RODOLFO GIULIANA / Profile

- Information

|

5+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

Hello to all dear traders.

My name is Rodolfo, I am a young boy who has been operating on the markets for 5 years now. I have participated in numerous events of great importance on an Italian level on the Italian Stock Exchange and I have been a trainer for some banking institutions. For about 3 years I have focused on the Forex and Indices market, in fact I use metatraders as well as platforms with volumes, institutional order books and flow analysis. I studied statistics and economics in university and I finally decided to open my first Copy Trading. My trading is mainly intraday, I limit my risk a lot and I am very conservative, I only enter the market on the basis of FUTURE volumes. The risk is managed on the basis of the open position (1 maximum per day). I obtain the data externally and I use this secondary account as a TEST combined with my main account. The size will be kept on a very low level compared to the account. I currently want to take on this challenge by growing a € 100 account and adding one-off money only when there are no open positions.

I hope my service will give you a great benefit, together we can grow! a greeting to all from your MrRudiTrader!

My name is Rodolfo, I am a young boy who has been operating on the markets for 5 years now. I have participated in numerous events of great importance on an Italian level on the Italian Stock Exchange and I have been a trainer for some banking institutions. For about 3 years I have focused on the Forex and Indices market, in fact I use metatraders as well as platforms with volumes, institutional order books and flow analysis. I studied statistics and economics in university and I finally decided to open my first Copy Trading. My trading is mainly intraday, I limit my risk a lot and I am very conservative, I only enter the market on the basis of FUTURE volumes. The risk is managed on the basis of the open position (1 maximum per day). I obtain the data externally and I use this secondary account as a TEST combined with my main account. The size will be kept on a very low level compared to the account. I currently want to take on this challenge by growing a € 100 account and adding one-off money only when there are no open positions.

I hope my service will give you a great benefit, together we can grow! a greeting to all from your MrRudiTrader!

RODOLFO GIULIANA

Added topic Metaquotes data change BACKTEST!

Hello, In these weeks, I have carried out some backtests on Metatrader and fortunately everything went smoothly. However, a few days later, I tried another backtest using the same code, variables, and financial instrument. Now, the lots during the

RODOLFO GIULIANA

Good morning dear traders friends! Tonight the Dax tried a recovery in the 11,000 area (now become resistance). As I said last week, the supports have all been broken downwards, in fact the index has managed to touch the 10.500 area, even surpassing the 100 area of Fibonacci Weekly. For now, the main heating element is located in the area 11.090 - 11.300 (GAP closure), important supports are found in the area 10.550 - 10.500. I look forward to opening new positions on the market.

RODOLFO GIULIANA

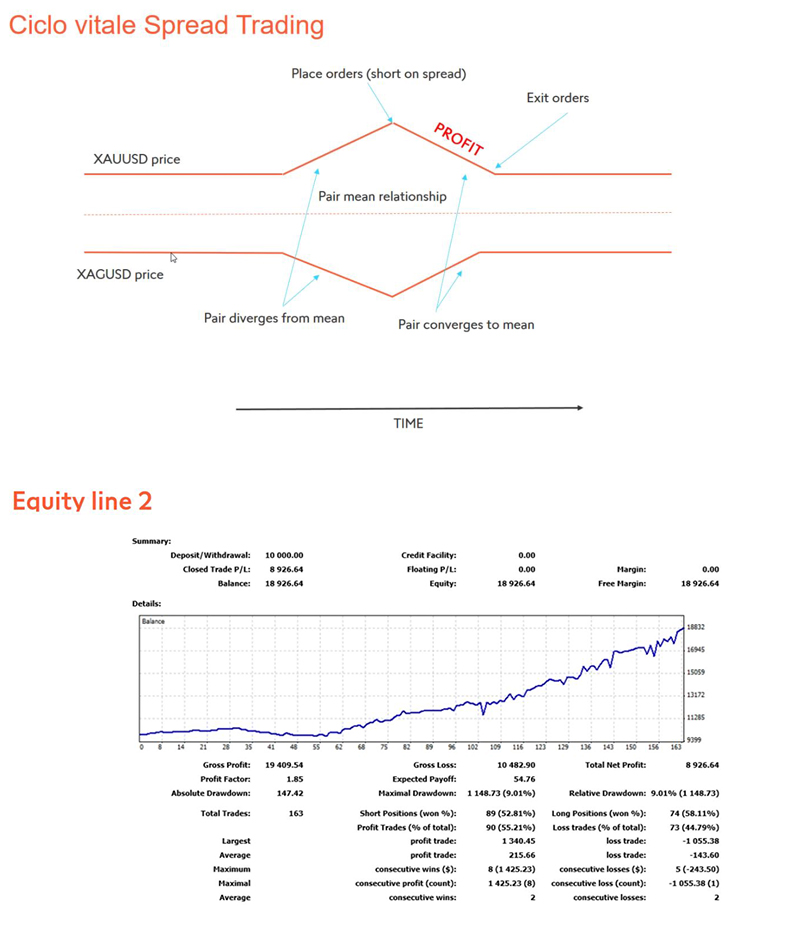

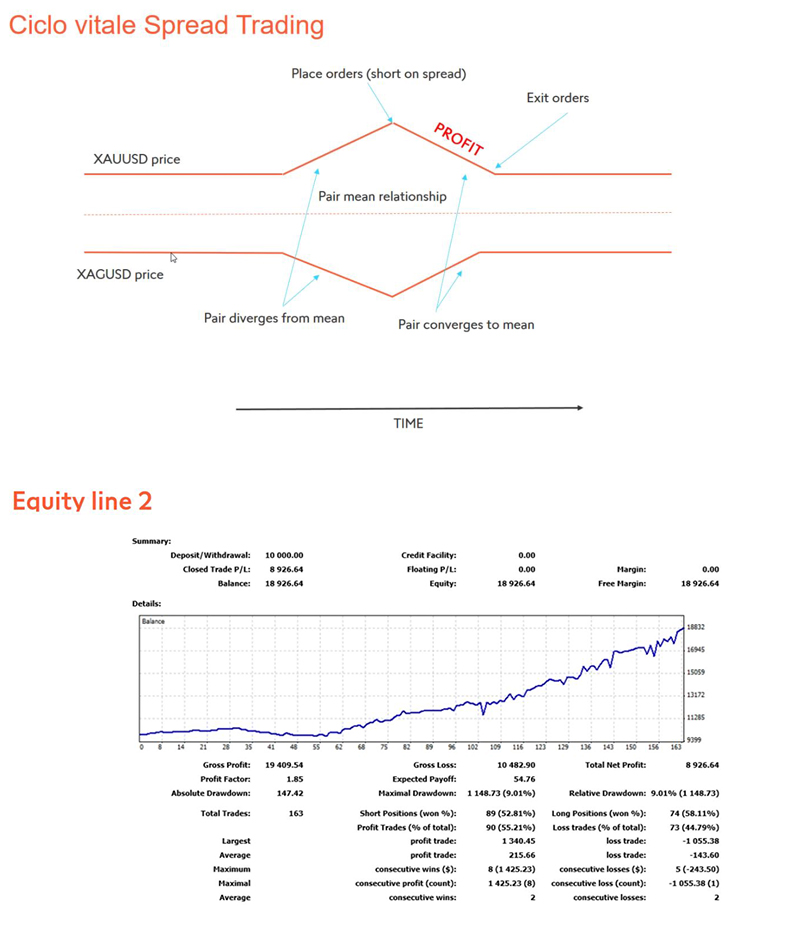

Many have asked me how commodity spread trading works. This is a small example of the inverse correlation on the spread of XAUUSD and XAGUSD, it is a technique that I will use on the new signal account which will be called spread trading. Result? That one operation will be negative, while the other will be positive + spread, in fact in the long term the equity line will be positive due to an overnight spread.

RODOLFO GIULIANA

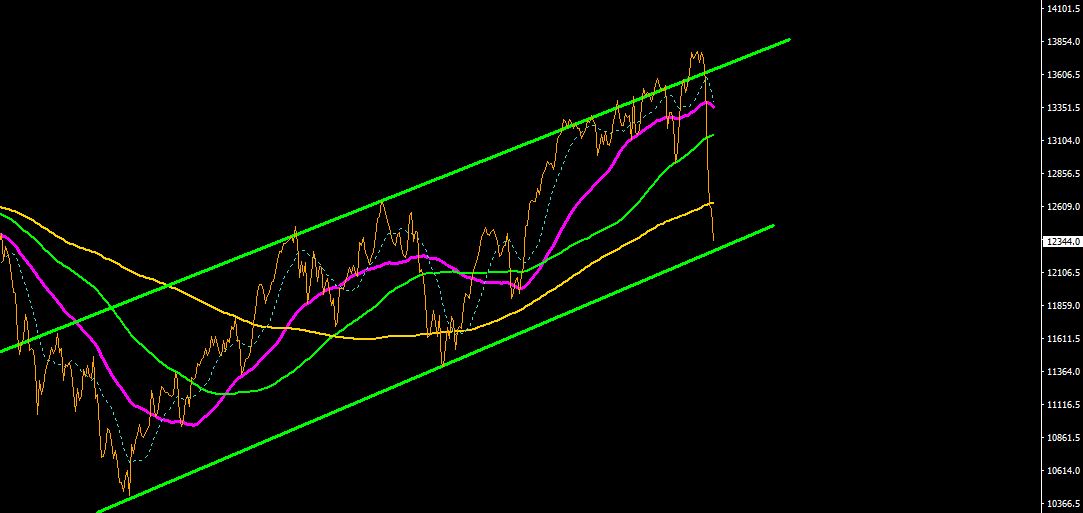

Good evening friends! the German index has reached a very interesting point, it has in fact passed the 61.8 zone of Fibonacci Weekly, we are close to the important support of 11.500. Exactly 1 year ago the DAX quoted 11.517, currently the quotations have stopped in the 11.550 area. As I said last week, 12,200 area did not hold, in fact the market has returned bearish. By March 20 there will be the end of the cycle at 11.000 on the German index and fundamental news permitting, the DAX could take some breath, also due to a possible refinancing and new liquidity by the central banks. We look forward to Monday's opening! In the screen I use my custom indicator that works on Bloomberg data.

RODOLFO GIULIANA

Hi! the Dax still remains on the side with a range between 12,250 and 11,750. Will the Fed and the ECB manage to fix the coronavirus situation?

RODOLFO GIULIANA

Goodmorning everyone! possible recovery on the DAX or false correction? until it opens the American market we won't know! Currently the volumes with a support base in the 11,850 area seem to want to keep.

RODOLFO GIULIANA

The DAX is now exhausted, in a week it has lost over 10% going from 13,800 to 12,300! America today opened negative together with Europe, in fact the German index opened at -2% only from this morning. The area of 12.100 - 12.200 is important for the maintenance at the level of supports, the volumes are still very bearish.

RODOLFO GIULIANA

Good morning to all guys! Today Europe wakes up laterally, an end-of-cycle rise on the DAX is expected. I remember that the account created on ava is a small account so as to make it accessible to all my signals, soon I will open an account from 15k up and from 50k up!

: