mazen nafee / Profile

- Information

|

11+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

Friends

982

Requests

Outgoing

mazen nafee

EUR/GBP Intraday: the upside prevails.

Pivot: 0.79

Our preference: Long positions above 0.79 with targets @ 0.794 & 0.795 in extension.

Alternative scenario: Below 0.79 look for further downside with 0.7885 & 0.787 as targets.

Comment: The pair stands above its support and remains on the upside.

Supports and resistances:

0.7965

0.795

0.794

0.7916 Last

0.79

0.7885

0.787

Pivot: 0.79

Our preference: Long positions above 0.79 with targets @ 0.794 & 0.795 in extension.

Alternative scenario: Below 0.79 look for further downside with 0.7885 & 0.787 as targets.

Comment: The pair stands above its support and remains on the upside.

Supports and resistances:

0.7965

0.795

0.794

0.7916 Last

0.79

0.7885

0.787

mazen nafee

GBP/JPY Intraday: key resistance at 173.35.

Pivot: 173.35

Our preference: Short positions below 173.35 with targets @ 172.55 & 172.35 in extension.

Alternative scenario: Above 173.35 look for further upside with 173.75 & 174.1 as targets.

Comment: The pair remains within a bearish channel.

Supports and resistances:

174.1

173.75

173.35

172.955 Last

172.55

172.35

171.9

Pivot: 173.35

Our preference: Short positions below 173.35 with targets @ 172.55 & 172.35 in extension.

Alternative scenario: Above 173.35 look for further upside with 173.75 & 174.1 as targets.

Comment: The pair remains within a bearish channel.

Supports and resistances:

174.1

173.75

173.35

172.955 Last

172.55

172.35

171.9

mazen nafee

EUR/JPY Intraday: the upside prevails.

Pivot: 136.6

Our preference: Long positions above 136.6 with targets @ 137.1 & 137.35 in extension.

Alternative scenario: Below 136.6 look for further downside with 136.35 & 136 as targets.

Comment: The pair is rebounding above its support.

Supports and resistances:

137.6

137.35

137.1

136.9067 Last

136.6

136.35

136

Pivot: 136.6

Our preference: Long positions above 136.6 with targets @ 137.1 & 137.35 in extension.

Alternative scenario: Below 136.6 look for further downside with 136.35 & 136 as targets.

Comment: The pair is rebounding above its support.

Supports and resistances:

137.6

137.35

137.1

136.9067 Last

136.6

136.35

136

mazen nafee

GBP/USD Intraday: the downside prevails.

Pivot: 1.7

Our preference: Short positions below 1.7 with targets @ 1.692 & 1.6885 in extension.

Alternative scenario: Above 1.7 look for further upside with 1.702 & 1.705 as targets.

Comment: The pair has broken below its support and remains under pressure.

Supports and resistances:

1.705

1.702

1.7

1.6941 Last

1.692

1.6885

1.685

Pivot: 1.7

Our preference: Short positions below 1.7 with targets @ 1.692 & 1.6885 in extension.

Alternative scenario: Above 1.7 look for further upside with 1.702 & 1.705 as targets.

Comment: The pair has broken below its support and remains under pressure.

Supports and resistances:

1.705

1.702

1.7

1.6941 Last

1.692

1.6885

1.685

mazen nafee

shared product by seller Olawale Adenagbe

Overview A One-Cancels-the-Other Order (OCO) is a pair of orders stipulating that if one order is executed, then the other order is automatically cancelled. Verdure OCO EA brings this functionality to MT4. This EA is a robust implementation of the popular One-Cancels-the-Other Order (OCO) but with added benefits, features and options. It is an EA that helps with trade management and especially useful for traders who use stop and reverse trading systems, traders who look for opportunities around

mazen nafee

Pivot: 0.856

Our preference: Short positions below 0.856 with targets @ 0.8495 & 0.847 in extension.

Alternative scenario: Above 0.856 look for further upside with 0.8585 & 0.862 as targets.

Comment: As long as 0.856 is resistance, look for choppy price action with a bearish bias. Prices are trading in a bearish channel.

Supports and resistances:

0.862

0.8585

0.856

0.8516 Last

0.8495

0.847

0.843

Our preference: Short positions below 0.856 with targets @ 0.8495 & 0.847 in extension.

Alternative scenario: Above 0.856 look for further upside with 0.8585 & 0.862 as targets.

Comment: As long as 0.856 is resistance, look for choppy price action with a bearish bias. Prices are trading in a bearish channel.

Supports and resistances:

0.862

0.8585

0.856

0.8516 Last

0.8495

0.847

0.843

mazen nafee

Pivot: 1.216

Our preference: Short positions below 1.216 with targets @ 1.213 & 1.2115 in extension.

Alternative scenario: Above 1.216 look for further upside with 1.2175 & 1.219 as targets.

Comment: The upward potential is likely to be limited by the resistance at 1.216.

Supports and resistances:

1.219

1.2175

1.216

1.2152 Last

1.213

1.2115

1.21

Our preference: Short positions below 1.216 with targets @ 1.213 & 1.2115 in extension.

Alternative scenario: Above 1.216 look for further upside with 1.2175 & 1.219 as targets.

Comment: The upward potential is likely to be limited by the resistance at 1.216.

Supports and resistances:

1.219

1.2175

1.216

1.2152 Last

1.213

1.2115

1.21

mazen nafee

mazen nafee

Comment to topic Press review

STOXX 600 Telecom MT: the upside prevails 280 is our pivot point. Our preference: As long as 280 is not broken down, we favour an upmove with 360 and then 375 as next targets. Alternative scenario

mazen nafee

mazen nafee

Comment to topic Press review

STOXX 600 Construction MT: the upside prevails 310 is our pivot point. Our preference: As long as 310 is not broken down, we favour an upmove with 383 and then 418 as next targets. Alternative

mazen nafee

mazen nafee

Comment to topic Press review

STOXX 600 Basic Resource MT: bounce 369 is our pivot point. Our preference: As long as 369 is not broken down, we favour an upmove with 485 and then 543.5 as next targets. Alternative scenario

mazen nafee

mazen nafee

Comment to topic Press review

EURO STOXX Telecommunications MT: the upside prevails 270 is our pivot point. Our preference: as long as 270 is support, the upside prevails. Alternative scenario: below 270 expect a drop to 254

mazen nafee

Sergey Golubev

Comment to topic Press review

Forum on trading, automated trading systems and testing trading strategies Press review newdigital , 2014.03.31 09:42 For Bitcoin Lessons In The History Of Failed Currencies If someone were to

mazen nafee

mazen nafee

Comment to topic Press review

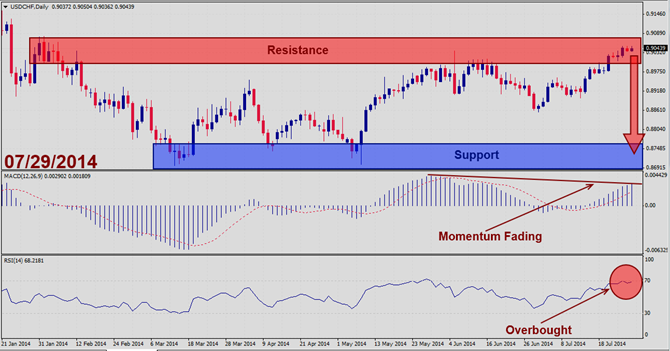

Pax Should price action for the USDCHF remain inside the 0.9020 to 0.9060 zone the following trade set-up is recommended: Timeframe: D1 Recommendation: Short Position Entry Level: Short Position @

mazen nafee

mazen nafee

Comment to topic Press review

EURO STOXX Retail MT: the upside prevails Our pivot point stands at 317. Our preference: As long as 317 is not broken down, we favour an upmove with 400 and then 420 as next targets. Alternative

mazen nafee

mazen nafee

Comment to topic Press review

STOXX 600 Retail MT: the upside prevails 268 is our pivot point. Our preference: As long as 268 is not broken down, we favour an upmove with 333.73 and then 360 as next targets. Alternative

mazen nafee

mazen nafee

Comment to topic Press review

Merlin Entertainments ST: the downside prevails as long as 358.25 is resistance 358.25 is our pivot point. Our preference: the downside prevails as long as 358.25 is resistance. Alternative scenario

mazen nafee

mazen nafee

Comment to topic Press review

Partnership Assurance Group ST: the downside prevails as long as 129 is resistance Our pivot point is at 129. Our preference: the downside prevails as long as 129 is resistance. Alternative scenario

mazen nafee

mazen nafee

Comment to topic Press review

Greencore Group ST: the upside prevails as long as 264.25 is support Our pivot point stands at 264.25. Our preference: the upside prevails as long as 264.25 is support. Alternative scenario: below

mazen nafee

mazen nafee

Comment to topic Press review

Opera Software ST: the RSI is oversold 78.7 is our pivot point. Our preference: the downside prevails as long as 78.7 is resistance. Alternative scenario: the upside breakout of 78.7 would call for

mazen nafee

mazen nafee

Comment to topic Press review

Genfit ST: the RSI is overbought Our pivot point is at 28.8. Our preference: the upside prevails as long as 28.8 is support. Alternative scenario: below 28.8, expect 25.5 and 23.6. Comment : the RSI

: