Md. Shah Emran / Profile

- Information

|

11+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

I have been trading in Forex market about 3 Years. I usually trade manually. I follow Chart Pattern & candle stick Pattern. I like to Sewing trade Price Action and some time scalping of a pair.

I strictly follow money management with 5% risk level.

I enjoy Forex very much.

Best wishes.

Candlesticks: The most popular method of viewing currency charts as traders can very quickly get a lot of information about the currency pair, including highs, lows, open and close prices. Generally candlesticks are two colors with one color meaning it is a bullish candlestick (close price is above its open price) and the other color a bearish candlestick (close price is below its open price).

If you think about what a candlestick is – the visual representation of where hundreds or even millions of traders think the currency pair is headed – entire trading systems have been developed that study the meanings of various candlestick patterns and what they mean for forecasting the direction of markets. Candlestick signals are used by traders to predict price movement, entry/exit points, trend reversals and more.

Consolidation pattern: Certain chart patterns (examples are the pennant, the flag and the broadening formations) that indicate a market is consolidating its position. Consolidation periods are thought to indicate periods of indecision among traders for the direction of a pair as traders take profit more often on shorter ranges. Consolidation patterns are important to recognize because frequently a pair can explosively leave a pattern, leading to solid profits for the well-positioned trader with good money management.

channel:Two parallel lines on a chart that contain current price action. The channel top should connect at least two highs on the currency charts and the channel bottom should connect at least two lows on the charts. Channel tops are used as resistance (areas where a bearish reversal might take place) and channel bottoms are used as support (areas where a bullish reversal might take place) by traders. Generally speaking the larger the time frame the more reliable channel support/resistance are. Also it is generally considered less-risky to trade in the direction of the overall trend of a channel (so if overall trend is bullish you would only look for buying opportunities at channel bottom and ignore channel tops).

Long Squeeze: A “long squeeze” is a bearish scenario where a high percentage of traders are long in a currency pair when the market begins to move against them.

Since most traders use stop-loss entry orders to limit losses or will close out positions if they move against them too much long squeezes can accelerate as stops are tripped to cover losses. Also since most of the traders are already long their buying power may be limited as the pair moves against them, further accelerating the bearish move. For example, lets say 80% of speculative traders are long the EUR/USD pair. If the pair starts moving downward on heavy bank selling then two things happen: a) traders are unable to buy further as they are already long, and b) as their stop-loss orders get tripped the pair will accelerate downward.

Short Squeeze: A “short-squeeze” is a bullish scenario where a high percentage of traders are short in a currency pair when the market begins to move against them (by rising).

Since most traders use stop-loss entry orders to limit losses or will close out positions if they move against them too much short squeezes can accelerate as stops are tripped to cover losses. Also since most of the traders are already short their selling power may be limited as the pair moves against them, further accelerating the bullish move. For example, lets say 80% of speculative traders are short the AUD/USD pair. If the pair starts moving upward on heavy bank buying then two things happen: a) traders are unable to sell further as they are already short, and b) as their stop-loss orders get tripped the pair will accelerate upward.

https://www.mql5.com/en/signals/39732

I strictly follow money management with 5% risk level.

I enjoy Forex very much.

Best wishes.

Candlesticks: The most popular method of viewing currency charts as traders can very quickly get a lot of information about the currency pair, including highs, lows, open and close prices. Generally candlesticks are two colors with one color meaning it is a bullish candlestick (close price is above its open price) and the other color a bearish candlestick (close price is below its open price).

If you think about what a candlestick is – the visual representation of where hundreds or even millions of traders think the currency pair is headed – entire trading systems have been developed that study the meanings of various candlestick patterns and what they mean for forecasting the direction of markets. Candlestick signals are used by traders to predict price movement, entry/exit points, trend reversals and more.

Consolidation pattern: Certain chart patterns (examples are the pennant, the flag and the broadening formations) that indicate a market is consolidating its position. Consolidation periods are thought to indicate periods of indecision among traders for the direction of a pair as traders take profit more often on shorter ranges. Consolidation patterns are important to recognize because frequently a pair can explosively leave a pattern, leading to solid profits for the well-positioned trader with good money management.

channel:Two parallel lines on a chart that contain current price action. The channel top should connect at least two highs on the currency charts and the channel bottom should connect at least two lows on the charts. Channel tops are used as resistance (areas where a bearish reversal might take place) and channel bottoms are used as support (areas where a bullish reversal might take place) by traders. Generally speaking the larger the time frame the more reliable channel support/resistance are. Also it is generally considered less-risky to trade in the direction of the overall trend of a channel (so if overall trend is bullish you would only look for buying opportunities at channel bottom and ignore channel tops).

Long Squeeze: A “long squeeze” is a bearish scenario where a high percentage of traders are long in a currency pair when the market begins to move against them.

Since most traders use stop-loss entry orders to limit losses or will close out positions if they move against them too much long squeezes can accelerate as stops are tripped to cover losses. Also since most of the traders are already long their buying power may be limited as the pair moves against them, further accelerating the bearish move. For example, lets say 80% of speculative traders are long the EUR/USD pair. If the pair starts moving downward on heavy bank selling then two things happen: a) traders are unable to buy further as they are already long, and b) as their stop-loss orders get tripped the pair will accelerate downward.

Short Squeeze: A “short-squeeze” is a bullish scenario where a high percentage of traders are short in a currency pair when the market begins to move against them (by rising).

Since most traders use stop-loss entry orders to limit losses or will close out positions if they move against them too much short squeezes can accelerate as stops are tripped to cover losses. Also since most of the traders are already short their selling power may be limited as the pair moves against them, further accelerating the bullish move. For example, lets say 80% of speculative traders are short the AUD/USD pair. If the pair starts moving upward on heavy bank buying then two things happen: a) traders are unable to sell further as they are already short, and b) as their stop-loss orders get tripped the pair will accelerate upward.

https://www.mql5.com/en/signals/39732

Friends

560

Requests

Outgoing

Md. Shah Emran

13

Imtiaz Ahmed

2014.06.18

woow is this real?? where is it??

Md. Shah Emran

2014.06.21

it is in Greek Epirus Region,Parga Boat Heaven. The Island of Panagia off the coast of Parga

Md. Shah Emran

2014.06.21

I don't think Greece has 5000 Billion debt

Md. Shah Emran

MetaQuotes

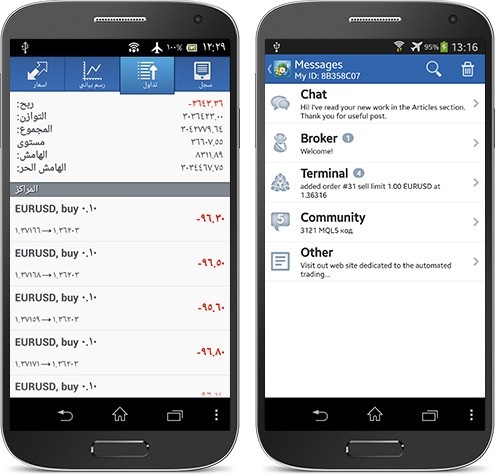

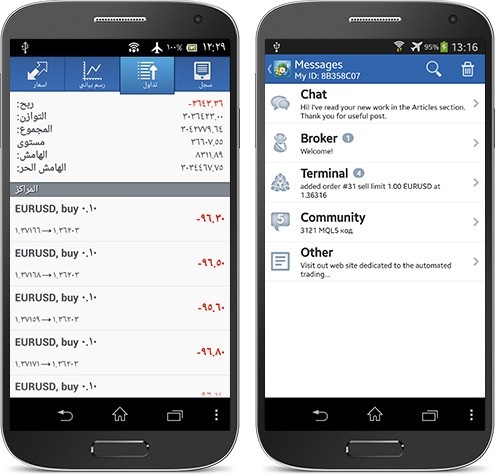

We continue to develop the MetaTrader 4 application for Android and keep adding more features. One technical innovation implemented in the latest build is the classification of messages.

All messages received from the system are divided into 5 types according to their senders: Chat (conversations with MQL5.com users), Broker (broker's messages), Terminal (alerts and notifications from launched Expert Advisors), Community (various messages from MQL5.com, including depositing funds on the account or execution of any ordered work) and Other (anything that is not related to the previous 4 types). This feature first appeared in the MetaTrader iOS mobile platforms and is now available to Android users.

Download MetaTrader 4 in Google Play for Free: https://download.mql5.com/cdn/mobile/mt4/android?utm_campaign=MQL5.community

All messages received from the system are divided into 5 types according to their senders: Chat (conversations with MQL5.com users), Broker (broker's messages), Terminal (alerts and notifications from launched Expert Advisors), Community (various messages from MQL5.com, including depositing funds on the account or execution of any ordered work) and Other (anything that is not related to the previous 4 types). This feature first appeared in the MetaTrader iOS mobile platforms and is now available to Android users.

Download MetaTrader 4 in Google Play for Free: https://download.mql5.com/cdn/mobile/mt4/android?utm_campaign=MQL5.community

4

Md. Shah Emran

Tamer Soliman

In Forex Market ,your heart should be as brave as this girl :-)

https://www.facebook.com/photo.php?v=708571192522380&set=vb.444491188930383&type=2&theater

https://www.facebook.com/photo.php?v=708571192522380&set=vb.444491188930383&type=2&theater

4

Md. Shah Emran

[Deleted]

2014.06.08

[Deleted]

Md. Shah Emran

Trading British Pound with BoE Rate Decision

by Alex Nekritin |

Whereas in the US the Central Bank is the Federal Reserve, in the UK the prevailing Central Bank is called the Bank of England (BOE). Since 1997, when the BOE gained complete independence from the government, the BOE has had full control over UK monetary policy.

For two days each month the BOE’s Monetary Policy Committee (MPC) meets in an effort to keep inflation at a target level of 2%. The meetings are held to set the overnight interest rate, and the future course of this rate.

The Monetary Policy Committee is made up of the following members:

The Governor

The Deputy Governor

Bank's Chief Economist

Executive Director of the Markets

4 external members appointed by the Chancellor of Exchequer

Regardless of whether the Bank of England decides to raise, lower, or maintain the interest rate; the decision always has an effect on the British Pound. Here’s why:

When the interest rates is increased the Bank of England is literally selling government securities to large financial firms. In turn, the financial organizations are paying in Pounds for these securities. This effectively decreased the amount of currency circulating in the economy. A decreasing supply leads to higher demand, and therefore causes the value of the Sterling to appreciate.

When the interest rates are decreased, the BOE floods the market with British Pounds. This is down by the BOE purchasing government securities from financial organizations. In return for the securities, these banks and financial deals are paid in Pounds, therefore increasing the supply of pounds in the economy. As supply increases, the value of the Sterling depreciates.

How to Trade the Sterling on the BOE Rate Decision

Prior to the Rate Decision:

Many traders buy the rumors and square their positions shortly after the decision is made. For instance, if the market believes that the BOE will hike the rate; traders buy the Pound and close the position shortly after the announcement. On the other hand, if the expectation is a rate decrease, traders will short the Pound and square the position after the announcement.

After the Rate Decision:

If the market’s expectations differ from the actual rate decision there can be some excellent trading opportunities.

If the market is expecting a rate hike, but the Bank of England ends up cutting the interest rate, a short 1-2 hour trade selling the Pound may prove successful.

If the market expects a rate cut, but the BOE comes in with an increase in the rate, a trader may want to place a short long position on the Pound for 1-2 hours.

by Alex Nekritin |

Whereas in the US the Central Bank is the Federal Reserve, in the UK the prevailing Central Bank is called the Bank of England (BOE). Since 1997, when the BOE gained complete independence from the government, the BOE has had full control over UK monetary policy.

For two days each month the BOE’s Monetary Policy Committee (MPC) meets in an effort to keep inflation at a target level of 2%. The meetings are held to set the overnight interest rate, and the future course of this rate.

The Monetary Policy Committee is made up of the following members:

The Governor

The Deputy Governor

Bank's Chief Economist

Executive Director of the Markets

4 external members appointed by the Chancellor of Exchequer

Regardless of whether the Bank of England decides to raise, lower, or maintain the interest rate; the decision always has an effect on the British Pound. Here’s why:

When the interest rates is increased the Bank of England is literally selling government securities to large financial firms. In turn, the financial organizations are paying in Pounds for these securities. This effectively decreased the amount of currency circulating in the economy. A decreasing supply leads to higher demand, and therefore causes the value of the Sterling to appreciate.

When the interest rates are decreased, the BOE floods the market with British Pounds. This is down by the BOE purchasing government securities from financial organizations. In return for the securities, these banks and financial deals are paid in Pounds, therefore increasing the supply of pounds in the economy. As supply increases, the value of the Sterling depreciates.

How to Trade the Sterling on the BOE Rate Decision

Prior to the Rate Decision:

Many traders buy the rumors and square their positions shortly after the decision is made. For instance, if the market believes that the BOE will hike the rate; traders buy the Pound and close the position shortly after the announcement. On the other hand, if the expectation is a rate decrease, traders will short the Pound and square the position after the announcement.

After the Rate Decision:

If the market’s expectations differ from the actual rate decision there can be some excellent trading opportunities.

If the market is expecting a rate hike, but the Bank of England ends up cutting the interest rate, a short 1-2 hour trade selling the Pound may prove successful.

If the market expects a rate cut, but the BOE comes in with an increase in the rate, a trader may want to place a short long position on the Pound for 1-2 hours.

Md. Shah Emran

Very hard to earn pips from Crocodile's mouth!

Tamer Soliman

2014.06.05

It's so easy to earn pips at Forex ,but much more easier to loose them , so always be aware.

Icham Aidibe

2014.06.05

hey tamer! stopped the experience, needed cores for optimization. how's on your side ?

Md. Shah Emran

Sergey Golubev

Comment to topic Something Interesting in Financial Video June 2014

New And Advanced Ways To Trade With Bollinger Bands Steven Primo Steven Primo has been actively involved in trading the markets for over 32 years. His trading tenure began in 1977 when he was hired to

Md. Shah Emran

[Deleted]

2014.06.03

Sei più bella te di Avril Lavinge

: