ADIKALARAJ / Profile

I love a good challenge and I'm as ambitious and dedicated as they come .I work in tandem toward a common goal of success.

Friends

1078

Requests

Outgoing

ADIKALARAJ

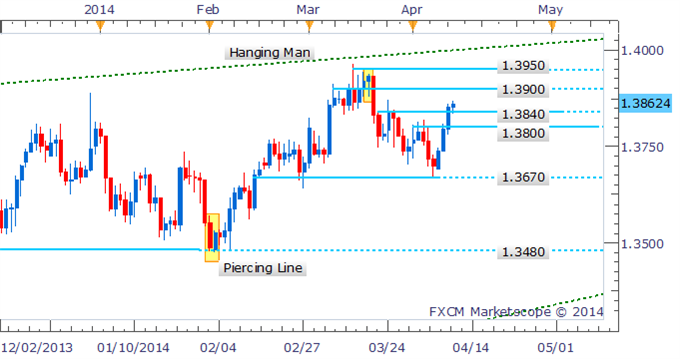

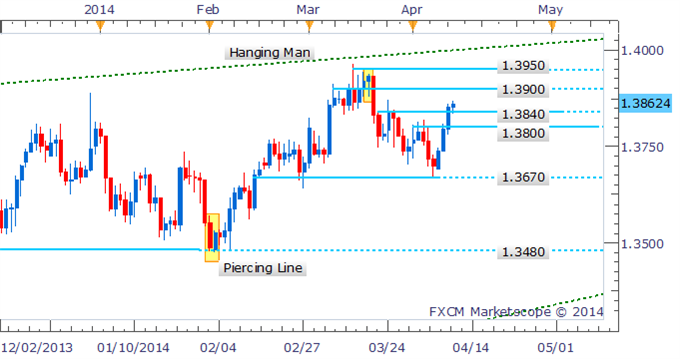

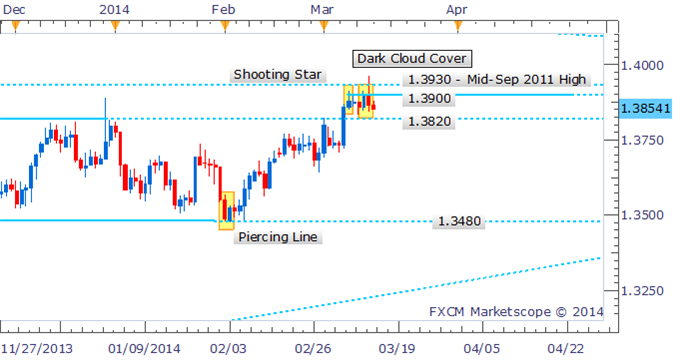

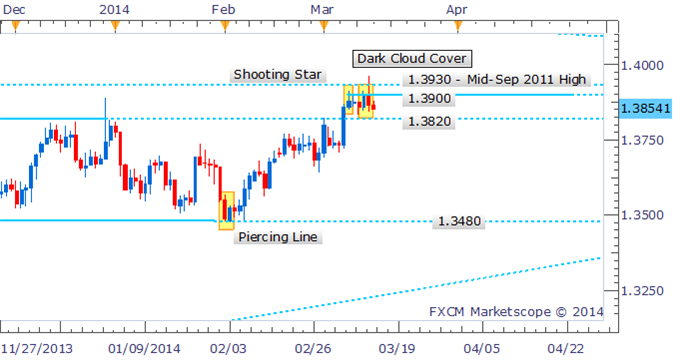

EUR/USD: Break above 1.3800 Opens Further Gains.

EUR/USD has powered through several key resistance levels in recent trading, which has likely caught the bears off-guard. With a reversal signal still missing on the daily, further gains may be possible with sellers likely to emerge the next psychological level at 1.3900.

EUR/USD has powered through several key resistance levels in recent trading, which has likely caught the bears off-guard. With a reversal signal still missing on the daily, further gains may be possible with sellers likely to emerge the next psychological level at 1.3900.

ADIKALARAJ

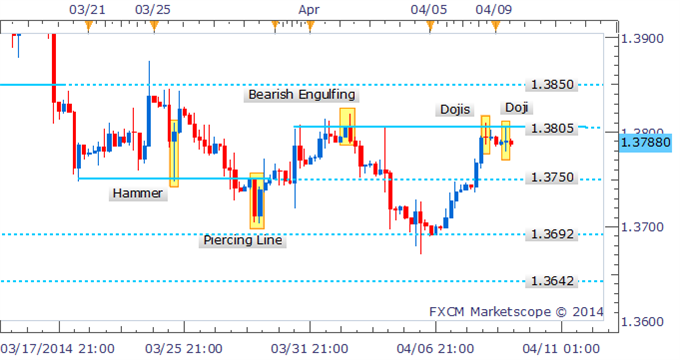

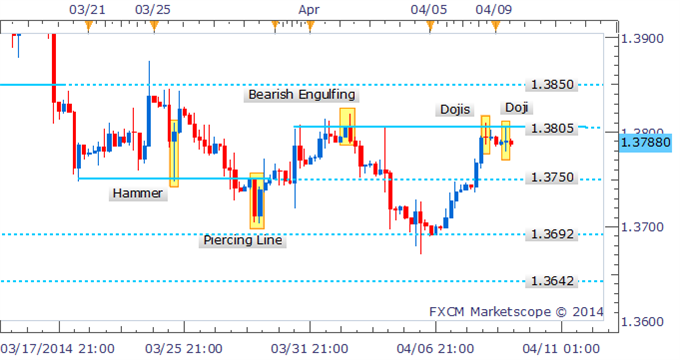

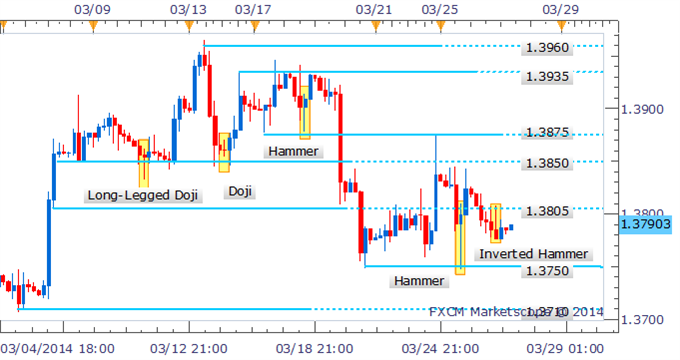

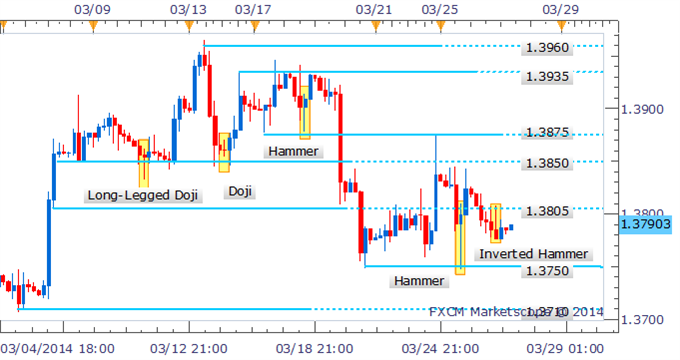

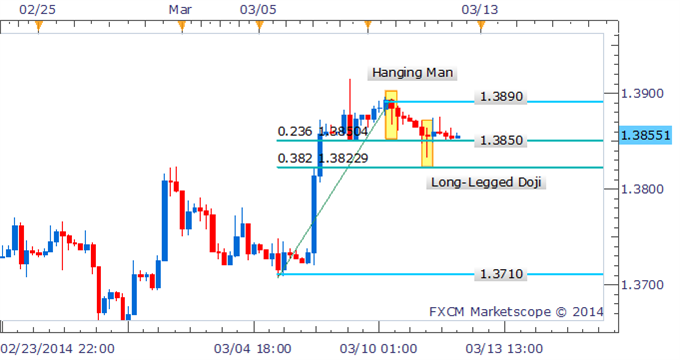

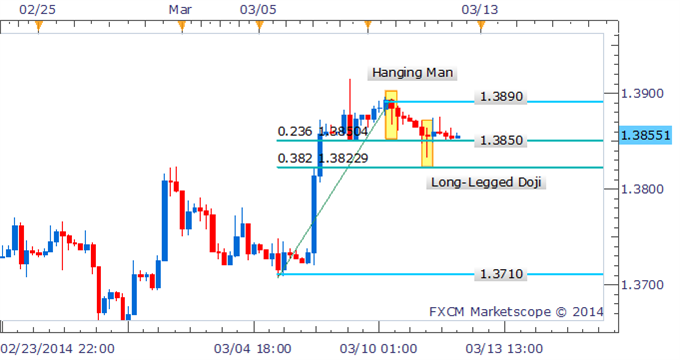

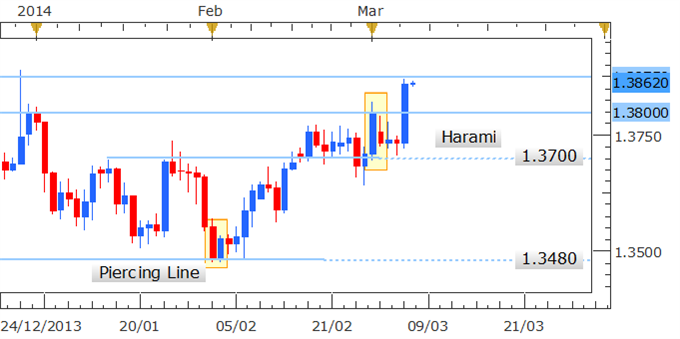

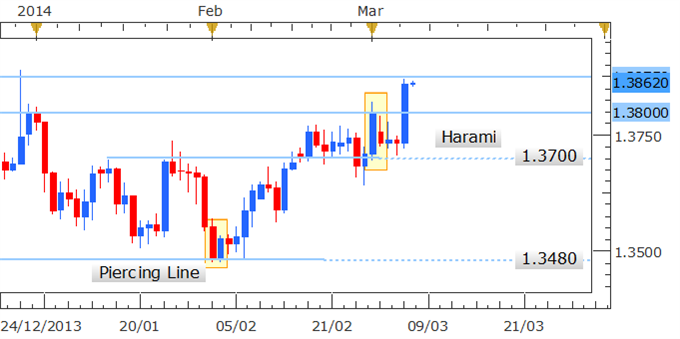

EUR/USD: Sellers Keep Gains Capped At 1.3800/5:

As noted in yesterday’s candlesticks report, the bulls’ run was likely to be met by selling pressure around the 1.3800 handle. With several Long-Legged Dojis having formed near the critical resistance level, the potential for an upside breakout is put in doubt. However, we’re yet to see a bearish reversal signal emerge, this leaves the pair at a critical juncture in the session ahead.

As noted in yesterday’s candlesticks report, the bulls’ run was likely to be met by selling pressure around the 1.3800 handle. With several Long-Legged Dojis having formed near the critical resistance level, the potential for an upside breakout is put in doubt. However, we’re yet to see a bearish reversal signal emerge, this leaves the pair at a critical juncture in the session ahead.

ADIKALARAJ

EUR/USD Technical Strategy:

EUR/USD continues to gain ground in early European trading as the pair advances towards the critical 1.3800 handle. However, traders should be wary of the potential for the recovery in the Euro to stall, given that prices remain in a short-term downtrend on the daily, and a bullish reversal signal is notably lacking

EUR/USD continues to gain ground in early European trading as the pair advances towards the critical 1.3800 handle. However, traders should be wary of the potential for the recovery in the Euro to stall, given that prices remain in a short-term downtrend on the daily, and a bullish reversal signal is notably lacking

ADIKALARAJ

EUR/USD Technical Strategy:

After hinting at a break below the 1.3700 handle in intraday trade, the bulls have managed to regain control of prices for the time-being. However, again a reversal signal is notably lacking on the four hour chart which calls into question the potential for further gains. Sellers are likely to emerge near former support-turned-resistance at 1.3750.

After hinting at a break below the 1.3700 handle in intraday trade, the bulls have managed to regain control of prices for the time-being. However, again a reversal signal is notably lacking on the four hour chart which calls into question the potential for further gains. Sellers are likely to emerge near former support-turned-resistance at 1.3750.

ADIKALARAJ

EUR/USD Technical Strategy:

Bearish Engulfing pattern helped foreshadow declines near 1.3800

EUR/USD: Eyes 1.3600 Following Break Below Key Support

Bearish Engulfing pattern helped foreshadow declines near 1.3800

EUR/USD: Eyes 1.3600 Following Break Below Key Support

ADIKALARAJ

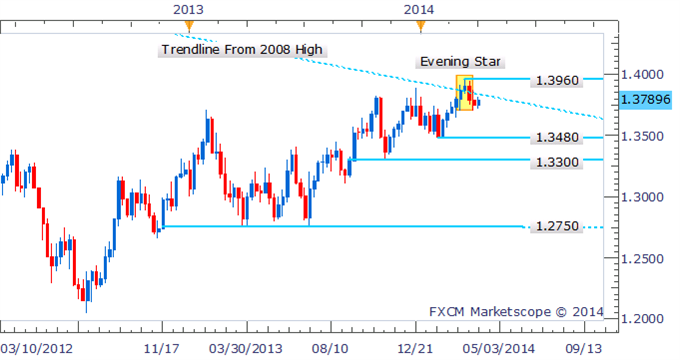

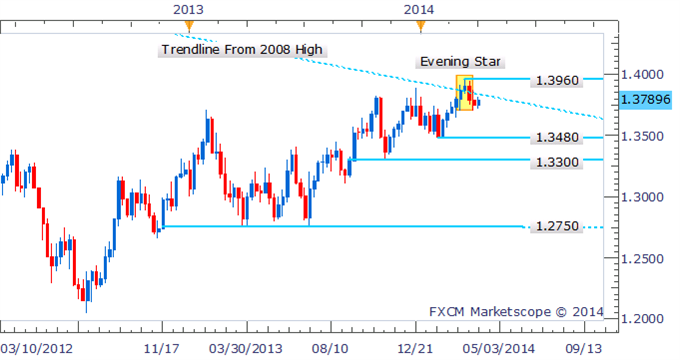

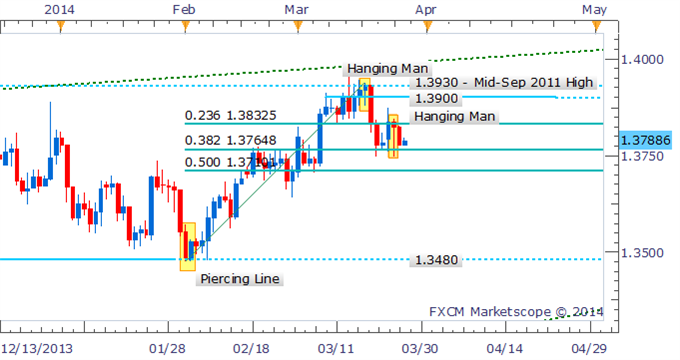

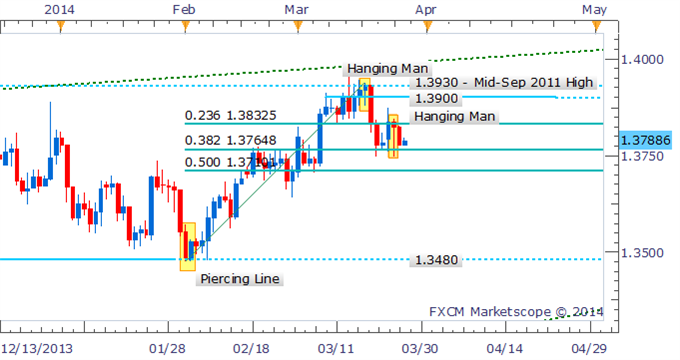

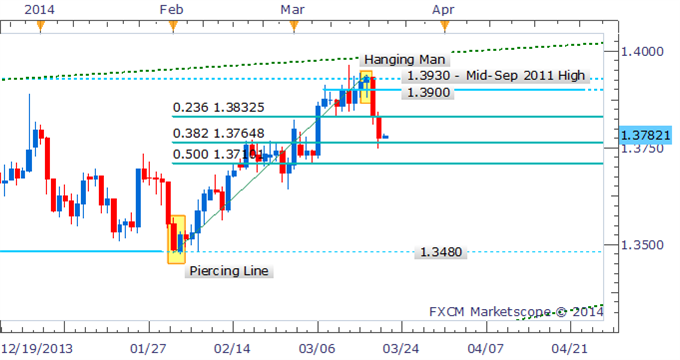

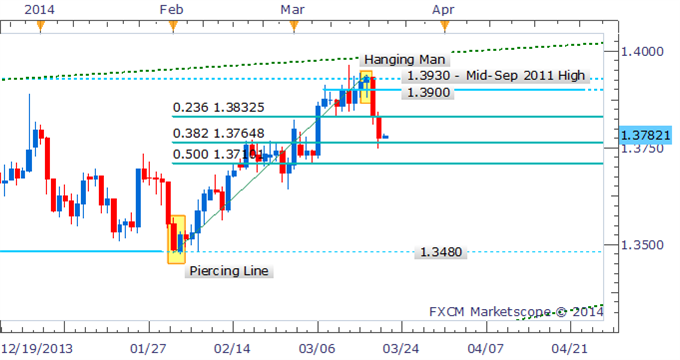

EUR/USD: Evening Star Receives Confirmation.

weekly chart;

The Evening Star formation that has emerged shy of the key 1.4000 is a notable warning signal of further declines ahead. The pattern has received confirmation from a successive down week which raises the likelihood of an eventual correction towards the 1.3480 support level.

weekly chart;

The Evening Star formation that has emerged shy of the key 1.4000 is a notable warning signal of further declines ahead. The pattern has received confirmation from a successive down week which raises the likelihood of an eventual correction towards the 1.3480 support level.

ADIKALARAJ

EUR/USD: 1.3800/5 In Focus During Intraday Trade.

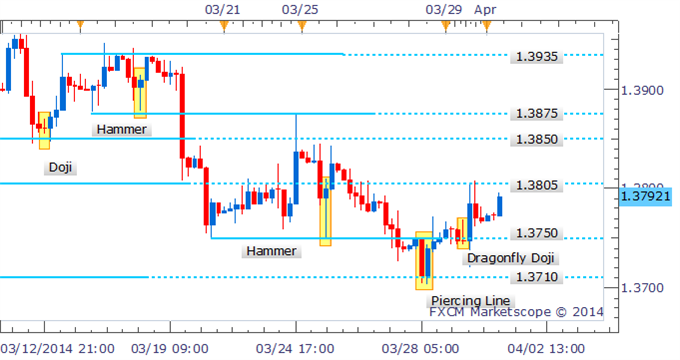

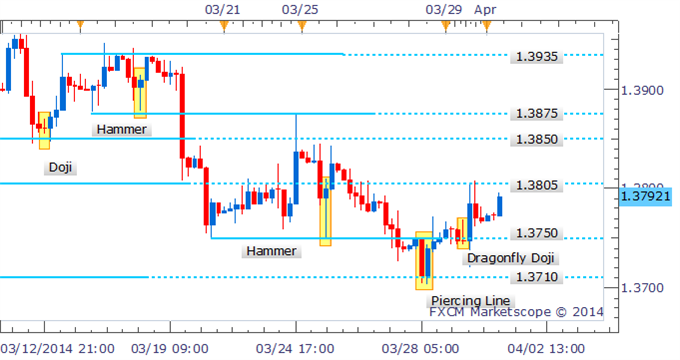

Drilling down to the four hour chart; the presence of a Dragonfly Doji near 1.3750 helped foreshadow the bounce towards 1.3805 in recent trading. A break above the notable resistance level coupled with the absence of a bearish reversal signal may open an advance towards 1.3840/50

Drilling down to the four hour chart; the presence of a Dragonfly Doji near 1.3750 helped foreshadow the bounce towards 1.3805 in recent trading. A break above the notable resistance level coupled with the absence of a bearish reversal signal may open an advance towards 1.3840/50

ADIKALARAJ

EUR/USD Technical Strategy:

Hammer formation may offer bullish reversal signal, but awaits confirmation.

Hammer formation may offer bullish reversal signal, but awaits confirmation.

ADIKALARAJ

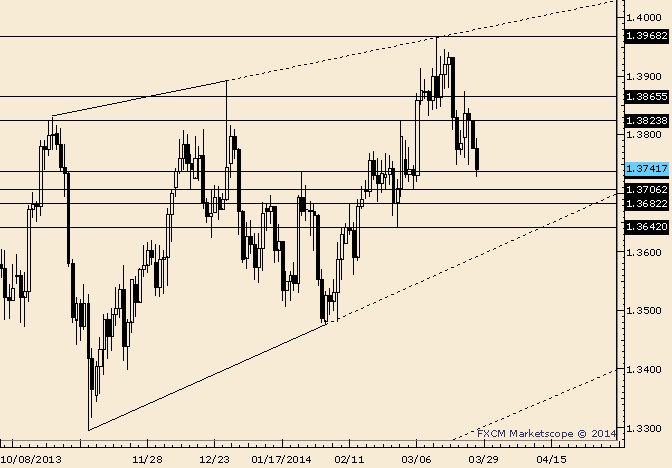

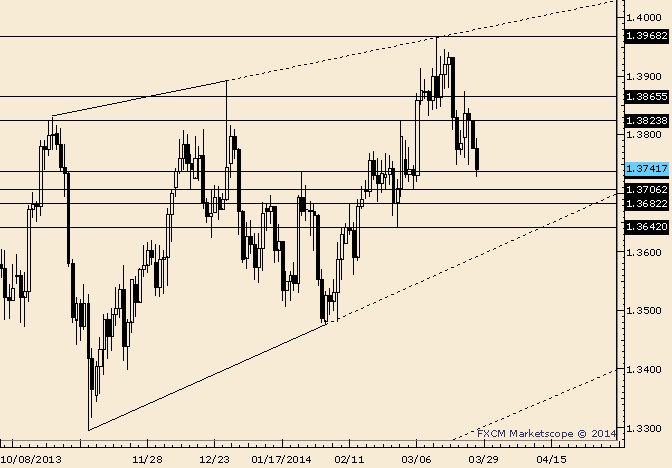

EUR/USD 1.3650-1.3700 is Support for a Rally Attempt.

1.3650-1.3700 is a support zone that could inspire a multiday rally back towards 1.3865.

-A 1.3475 break is needed in order to reverse the macro trend towards 1.2750.

LEVELS: 1.3642 1.36821.3707 | 1.3779 1.3820 1.3868.

1.3650-1.3700 is a support zone that could inspire a multiday rally back towards 1.3865.

-A 1.3475 break is needed in order to reverse the macro trend towards 1.2750.

LEVELS: 1.3642 1.36821.3707 | 1.3779 1.3820 1.3868.

ADIKALARAJ

Drilling down to the four hour chart:- an Inverted Hammer formation has warned of an intraday bounce for EUR/USD. However follow-through has been limited, which suggests the signal may have been overlooked by traders given noteworthy resistance at 1.3805 is hanging nearby

ADIKALARAJ

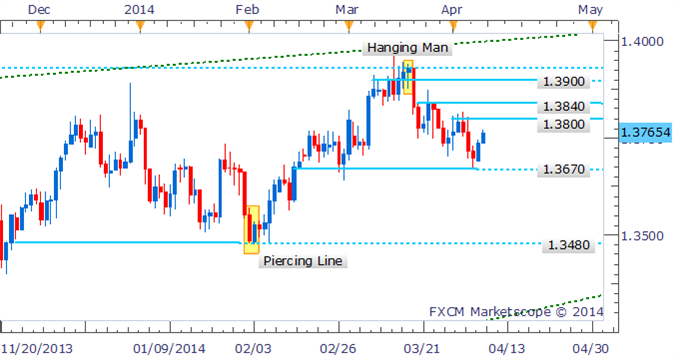

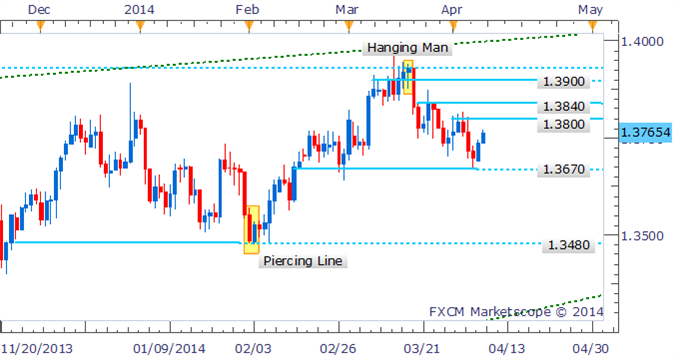

EUR/USD Technical Strategy:-

The emergence of a second Hanging Man candlestick formation on the daily suggests that EUR/USD may come under renewed selling pressure. The bearish reversal pattern is made more noteworthy by its appearance near former support-turned-resistance at 1.3832. Fresh declines for the pair are likely to be met by buying support near the 1.3765 mark.

The emergence of a second Hanging Man candlestick formation on the daily suggests that EUR/USD may come under renewed selling pressure. The bearish reversal pattern is made more noteworthy by its appearance near former support-turned-resistance at 1.3832. Fresh declines for the pair are likely to be met by buying support near the 1.3765 mark.

ADIKALARAJ

EUR-USD trend is best described as sideways in the near term with resistance at 1.3866 and in the 1.3920s. Stronger support is still seen near 1.3650.

-A 1.3475 break is needed in order to reverse the macro trend.

LEVELS: 1.3707 1.37391.3778 | 1.3868 1.3893 1.3924

-A 1.3475 break is needed in order to reverse the macro trend.

LEVELS: 1.3707 1.37391.3778 | 1.3868 1.3893 1.3924

ADIKALARAJ

EUR/USD Technical Strategy:

Hanging Man receives confirmation suggesting correction to continue

Short-term gains may be limited in absence of bullish reversal signal

Hanging Man receives confirmation suggesting correction to continue

Short-term gains may be limited in absence of bullish reversal signal

ADIKALARAJ

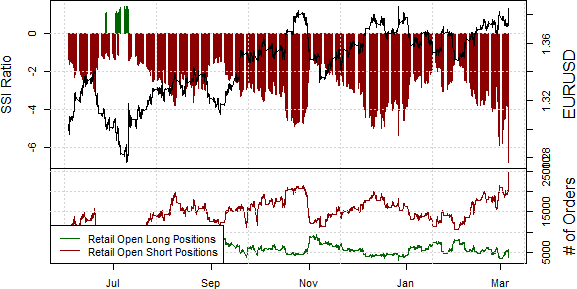

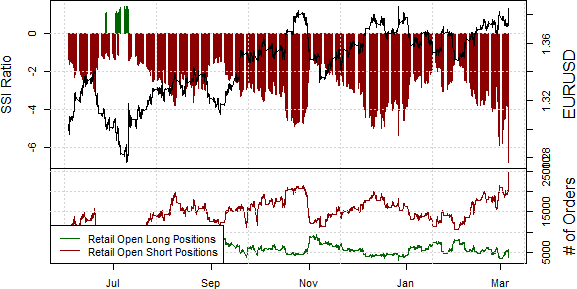

Trade Implications – EURUSD:

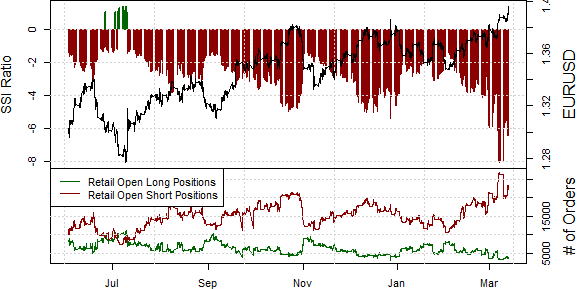

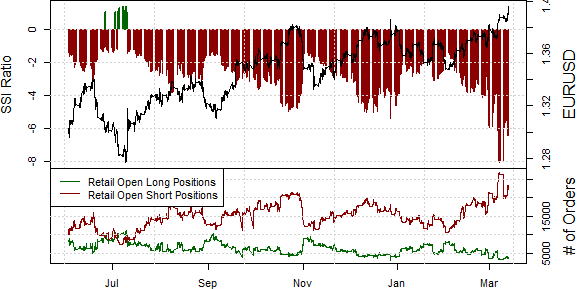

Selling interest in the Euro/USD is near an all-time high, and the fact that crowds continue selling into the most recent EUR bounce favors further strength.

Selling interest in the Euro/USD is near an all-time high, and the fact that crowds continue selling into the most recent EUR bounce favors further strength.

ADIKALARAJ

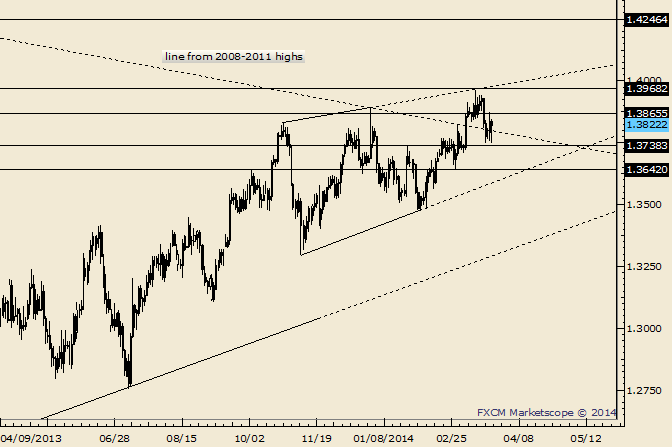

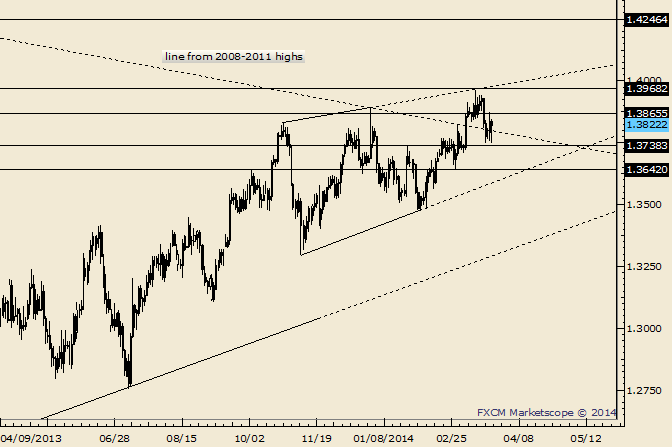

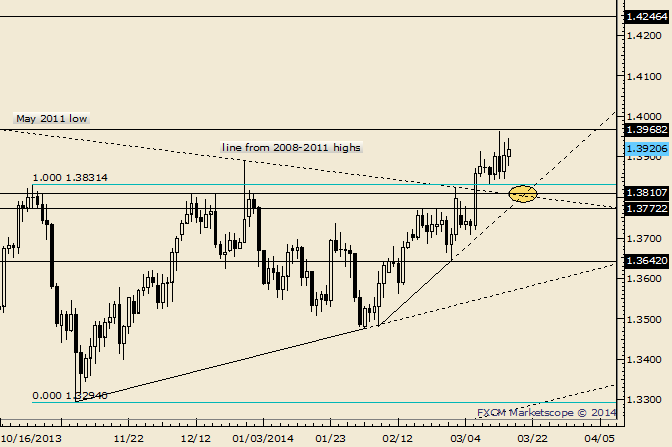

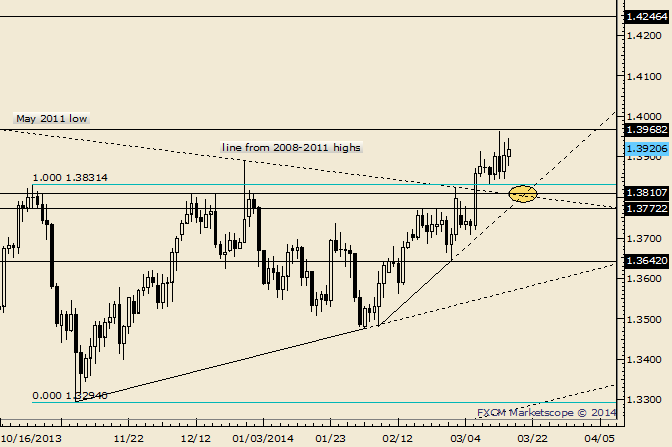

EUR/USD Trendline Confluence Near 1.3800 is Possible Support

The EURUSD has broken out of the 5 month triangle. 1.3720 is the new pivot. As long as price is above 1.3720, focus is on the triangle target of 1.4368. The October 2011 high at 1.4247 is a possible reaction level.

Former resistance is now estimated support at 1.3813.

LEVELS: 1.3781 1.38151.3868 | 1.3960 1.4000 1.4087.

The EURUSD has broken out of the 5 month triangle. 1.3720 is the new pivot. As long as price is above 1.3720, focus is on the triangle target of 1.4368. The October 2011 high at 1.4247 is a possible reaction level.

Former resistance is now estimated support at 1.3813.

LEVELS: 1.3781 1.38151.3868 | 1.3960 1.4000 1.4087.

ADIKALARAJ

EUR/USD Technical Strategy:

• Dark Cloud Cover warning of a bearish reversal

• Caution suggested when looking at trading a correction

• Dark Cloud Cover warning of a bearish reversal

• Caution suggested when looking at trading a correction

george1234

2014.03.14

hi friend i am george which broker you are using. which area can u give your number

ADIKALARAJ

EUR/USD Technical Strategy:

Bearish reversal signal on daily awaits further confirmation

Intraday support resting at 1.3850 (see four hour chart)

Bearish reversal signal on daily awaits further confirmation

Intraday support resting at 1.3850 (see four hour chart)

ADIKALARAJ

EUR/USD Technical Strategy:

Absent bearish reversal signal opens up further gains

Upcoming NFPs likely to spark break of Asian session range.

Absent bearish reversal signal opens up further gains

Upcoming NFPs likely to spark break of Asian session range.

ADIKALARAJ

Trade Implications – EURUSD: The fact that crowds continue selling into Euro strength suggests the EURUSD may continue higher. Yet the chart above will show that traders are often their most short at the top; how do we trade?

Two of our sentiment-based trading models are now long Euro from $1.3811 and $1.3745 as the pair trades to multi-year peaks. Those positions may work well if the pair continues higher. Yet our Senior Strategist emphasizes that we will need to see a EURUSD daily close above the critical $1.3800 level to confirm the new move. Continued failure at this level would negate our bullish forecast and favor a major USD reversal.

Two of our sentiment-based trading models are now long Euro from $1.3811 and $1.3745 as the pair trades to multi-year peaks. Those positions may work well if the pair continues higher. Yet our Senior Strategist emphasizes that we will need to see a EURUSD daily close above the critical $1.3800 level to confirm the new move. Continued failure at this level would negate our bullish forecast and favor a major USD reversal.

ADIKALARAJ

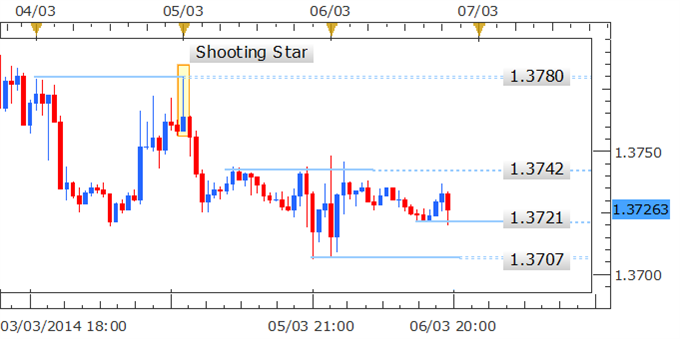

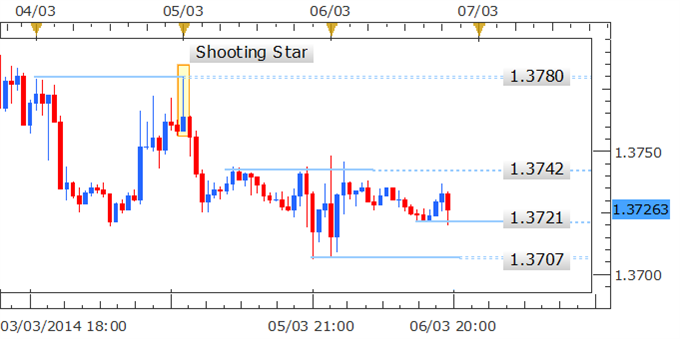

EUR/USD Technical Strategy: Shorts preferred on break below 1.3700

Shooting Star pattern hinted at declines after test of 1.3780

Upcoming ECB rate decision likely to offer volatility

Shooting Star pattern hinted at declines after test of 1.3780

Upcoming ECB rate decision likely to offer volatility

: