ADIKALARAJ / Profile

I love a good challenge and I'm as ambitious and dedicated as they come .I work in tandem toward a common goal of success.

Friends

1078

Requests

Outgoing

ADIKALARAJ

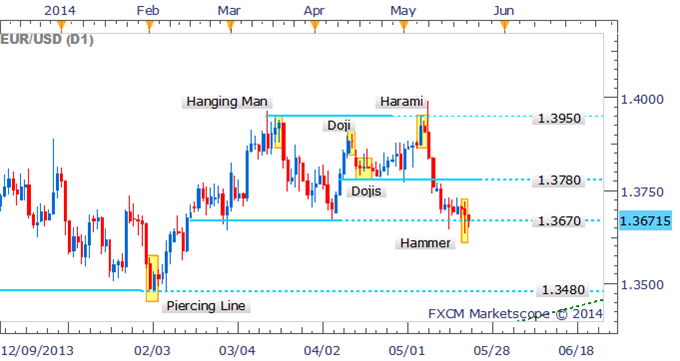

EUR/USD Technical Strategy:

Traders remain indecisive near the critical 1.3600 handle, as denoted by a Doji candlestick on the daily. However, with a bearish reversal pattern absent, a complete shift in sentiment looks doubtful. A correction is likely to be met by buying support at 1.3600.

Traders remain indecisive near the critical 1.3600 handle, as denoted by a Doji candlestick on the daily. However, with a bearish reversal pattern absent, a complete shift in sentiment looks doubtful. A correction is likely to be met by buying support at 1.3600.

ADIKALARAJ

EUR/USD Technical Strategy:

The Bullish Engulfing pattern on the EUR/USD daily chart is yet to find much follow-through as the common currency gives back gains above the 1.3600 handle. The pullback during yesterday’s session has prompted a Shooting Star candlestick, which suggests the bears may be looking to stage a return. However with support nearby, the extent of a correction may be limited. A daily close back below 1.3600 would signal enough conviction amongst traders to open the psychologically-significant 1.3500 level.

The Bullish Engulfing pattern on the EUR/USD daily chart is yet to find much follow-through as the common currency gives back gains above the 1.3600 handle. The pullback during yesterday’s session has prompted a Shooting Star candlestick, which suggests the bears may be looking to stage a return. However with support nearby, the extent of a correction may be limited. A daily close back below 1.3600 would signal enough conviction amongst traders to open the psychologically-significant 1.3500 level.

ADIKALARAJ

EUR/USD Technical Strategy:

As noted in yesterday’s candlesticks report the June FOMC Meeting offered the potential for significant US Dollar volatility. The price action resulting from the meeting has prompted the emergence of a Bullish Engulfing pattern, which suggests the potential for further gains. Sellers may look to emerge at the 1.3670 mark.

As noted in yesterday’s candlesticks report the June FOMC Meeting offered the potential for significant US Dollar volatility. The price action resulting from the meeting has prompted the emergence of a Bullish Engulfing pattern, which suggests the potential for further gains. Sellers may look to emerge at the 1.3670 mark.

ADIKALARAJ

ADIKALARAJ

EUR/USD Technical Strategy:

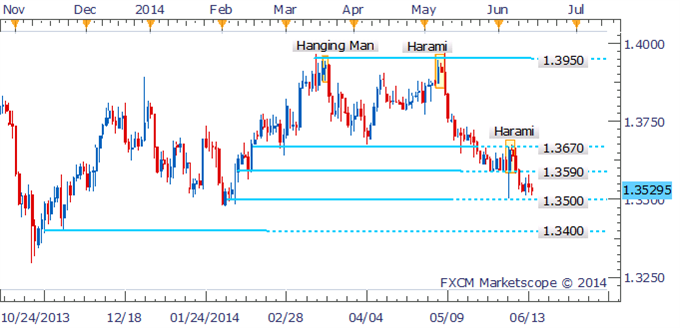

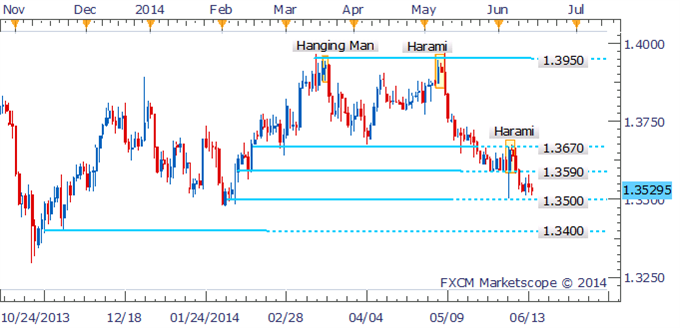

The Euro bulls appear unwilling to relinquish their grip on the pair as the common currency holds above the 1.3500 handle. While several short body candles are suggestive of indecision amongst traders, they do little to suggest a more meaningful bounce at this stage. A daily close below support at 1.3500 would help signal conviction amongst the bears and open up the next psychologically-significant level at 1.3400.

The Euro bulls appear unwilling to relinquish their grip on the pair as the common currency holds above the 1.3500 handle. While several short body candles are suggestive of indecision amongst traders, they do little to suggest a more meaningful bounce at this stage. A daily close below support at 1.3500 would help signal conviction amongst the bears and open up the next psychologically-significant level at 1.3400.

ADIKALARAJ

EUR/USD Technical Strategy:

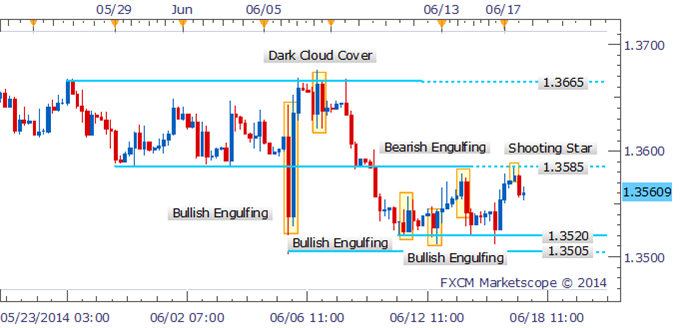

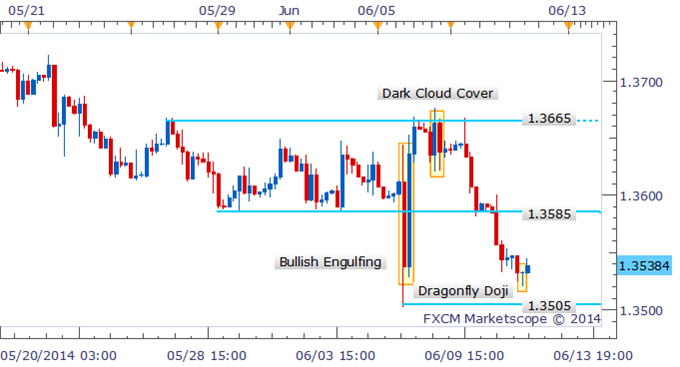

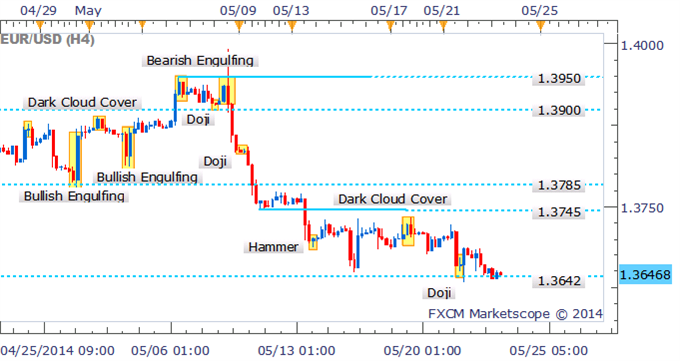

Examining the four hour chart, the appearance of a second Bullish Engulfing formation near 1.3520 was enough to stir buyers and send EUR/USD on a run towards 1.3585. The emergence of a bearish reversal pattern near the notable resistance level would be seen as a new opportunity to enter shorts.

Examining the four hour chart, the appearance of a second Bullish Engulfing formation near 1.3520 was enough to stir buyers and send EUR/USD on a run towards 1.3585. The emergence of a bearish reversal pattern near the notable resistance level would be seen as a new opportunity to enter shorts.

ADIKALARAJ

EUR/USD Technical Strategy:

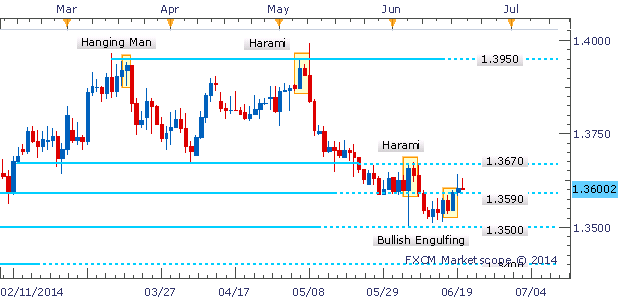

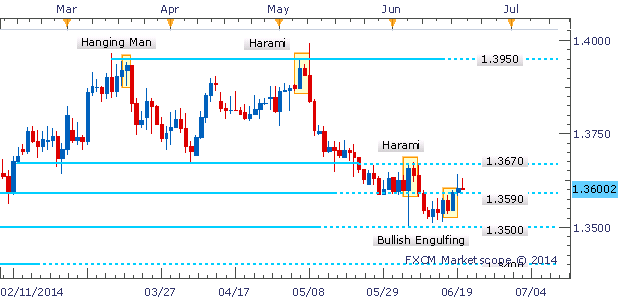

The Euro bulls are staging a return as the currency recovers some lost ground following a failure to break 1.3500. However, the extent of a bounce may prove limited, given resistance is hanging nearby at 1.3590 and bullish reversal candlesticks remain absent.

The Euro bulls are staging a return as the currency recovers some lost ground following a failure to break 1.3500. However, the extent of a bounce may prove limited, given resistance is hanging nearby at 1.3590 and bullish reversal candlesticks remain absent.

ADIKALARAJ

EUR/USD Technical Strategy:

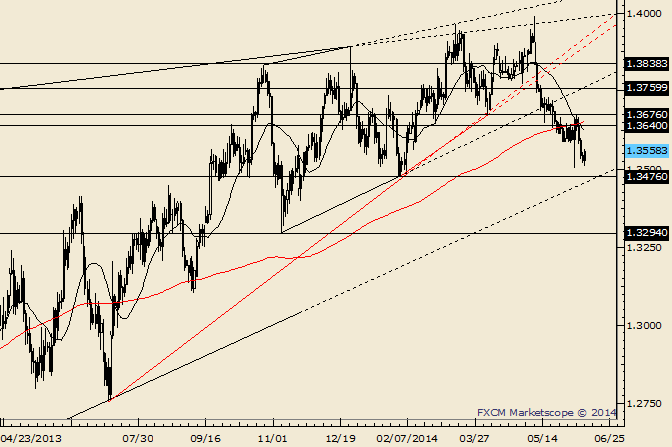

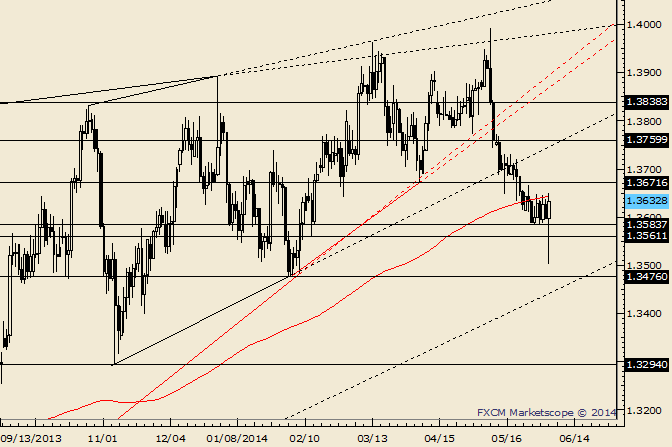

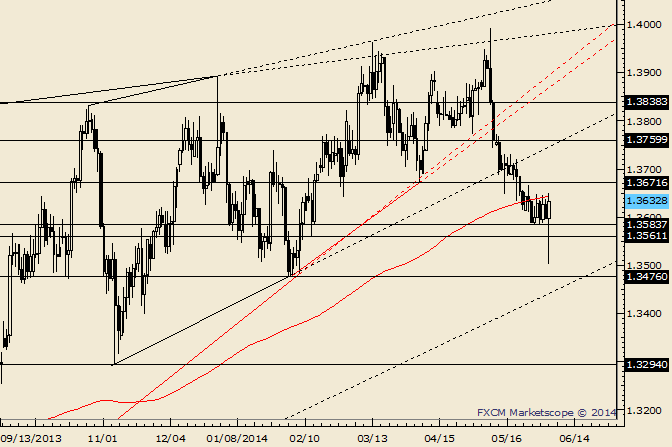

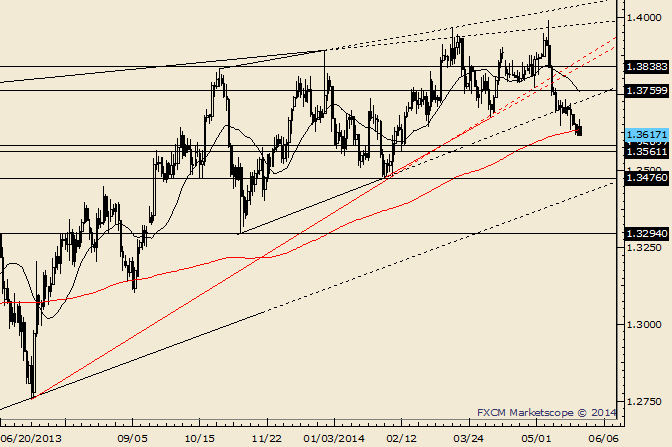

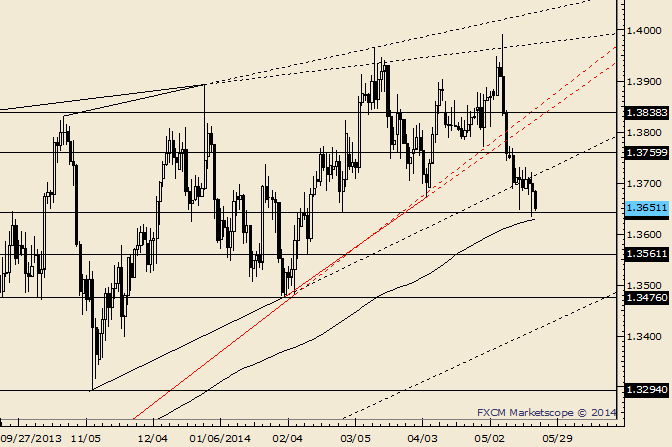

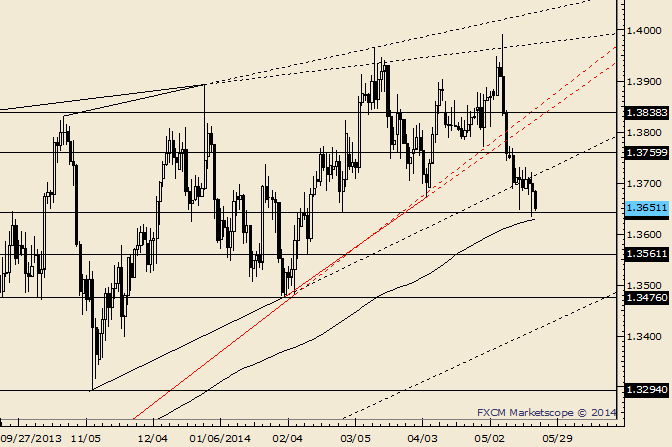

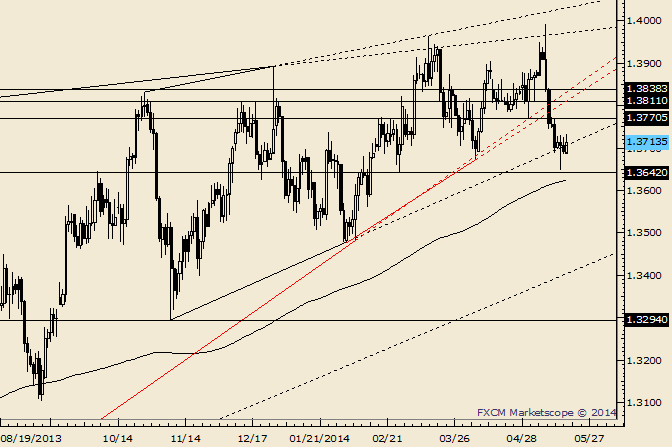

Respect potential for lower levels as long as EURUSD is below 1.3676. 1.3614/42 is resistance against that level. The line that extends off of the 2012 and 2013 lows is in line with the 2014 low at 1.3476 and could offer support. Today’s reversal shifts near term focus to 1.3635.

-Longer term implications from the ending diagonal that broke in May are bearish towards at least 1.3294.

LEVELS: 1.3419 1.34761.3538 | 1.3585 1.3635 1.367

Respect potential for lower levels as long as EURUSD is below 1.3676. 1.3614/42 is resistance against that level. The line that extends off of the 2012 and 2013 lows is in line with the 2014 low at 1.3476 and could offer support. Today’s reversal shifts near term focus to 1.3635.

-Longer term implications from the ending diagonal that broke in May are bearish towards at least 1.3294.

LEVELS: 1.3419 1.34761.3538 | 1.3585 1.3635 1.367

ADIKALARAJ

EUR/USD Technical Strategy:

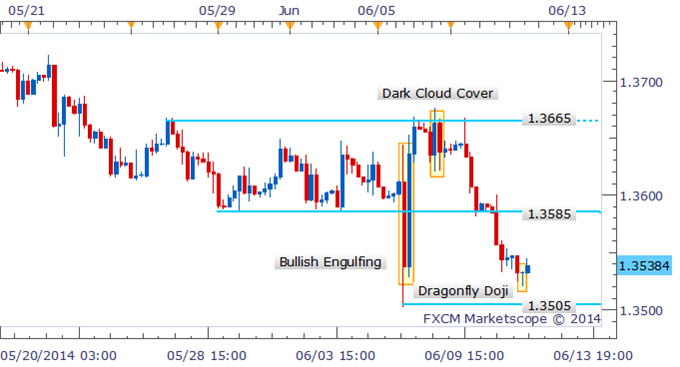

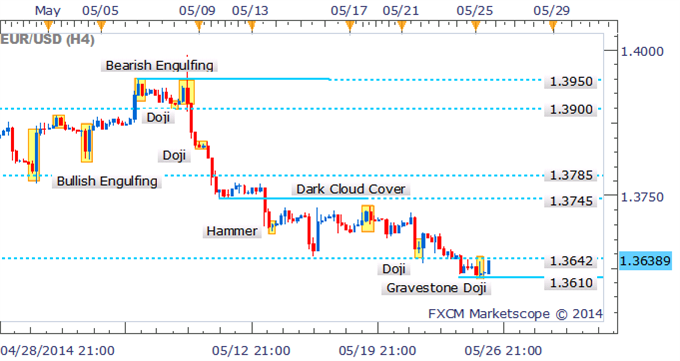

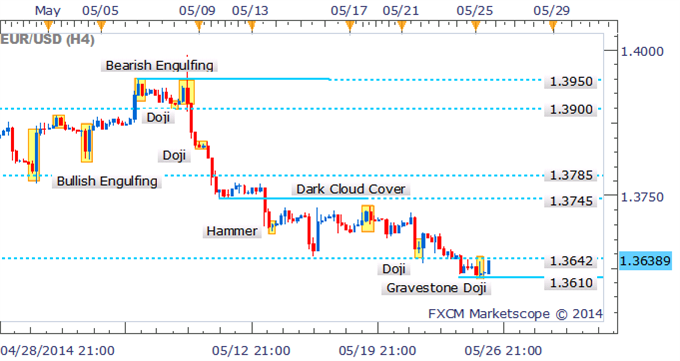

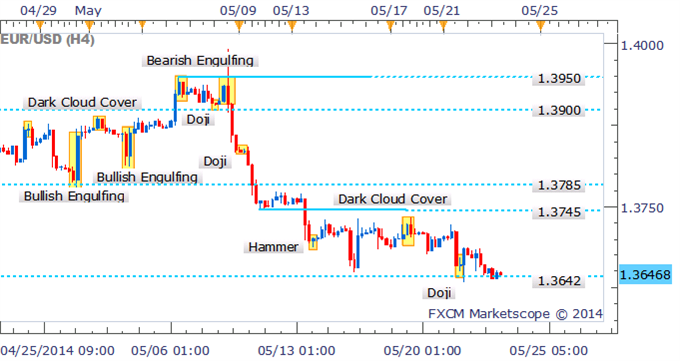

Drilling down to examine the four hour chart; a Dark Cloud Cover candlestick pattern indicated the bears were wrestling control of prices following a test of 1.3665. Now the appearance of a Dragonfly Doji suggests the bears may be hesitating near key support at 1.3500/5. With resistance hanging nearby at 1.3585, a recovery over the session ahead may prove limited

Drilling down to examine the four hour chart; a Dark Cloud Cover candlestick pattern indicated the bears were wrestling control of prices following a test of 1.3665. Now the appearance of a Dragonfly Doji suggests the bears may be hesitating near key support at 1.3500/5. With resistance hanging nearby at 1.3585, a recovery over the session ahead may prove limited

ADIKALARAJ

EUR/USD Technical Strategy:-

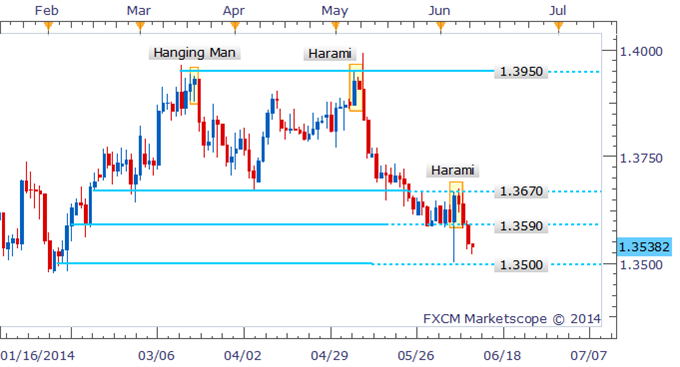

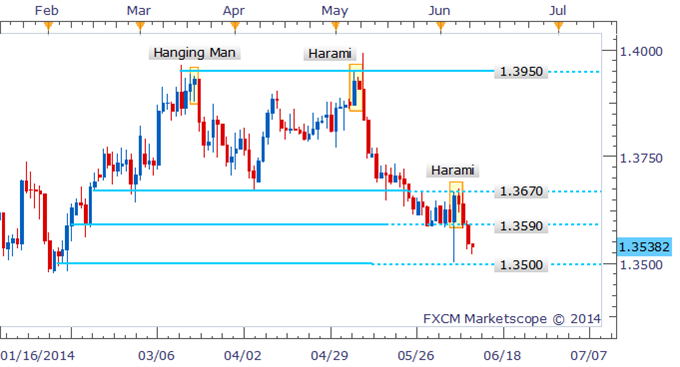

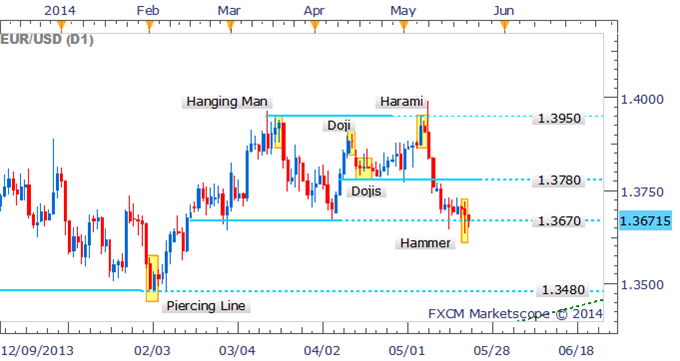

The Euro was set for further declines in the absence of a bullish reversal pattern. While the pair staged a small recovery to support-turned-resistance at 1.3670, the emergence of another Harami pattern suggests the bears have regained control of prices. Further falls may encounter buying support at the psychologically-significant 1.3500 handle.

The Euro was set for further declines in the absence of a bullish reversal pattern. While the pair staged a small recovery to support-turned-resistance at 1.3670, the emergence of another Harami pattern suggests the bears have regained control of prices. Further falls may encounter buying support at the psychologically-significant 1.3500 handle.

ADIKALARAJ

EUR/USD Technical Strategy:-

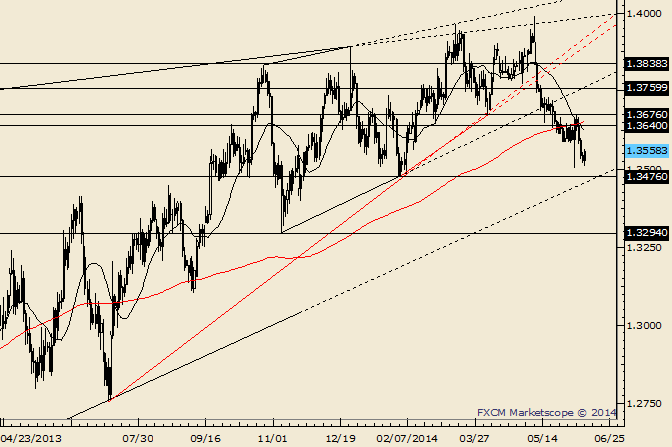

The implications are near term bullish towards 1.3750 but don’t forget the longer term implications from the ending diagonal that broke in May.

LEVELS: 1.3538 1.35931.3635 | 1.3686 1.3722 1.3757.

The implications are near term bullish towards 1.3750 but don’t forget the longer term implications from the ending diagonal that broke in May.

LEVELS: 1.3538 1.35931.3635 | 1.3686 1.3722 1.3757.

[Deleted]

2014.06.08

[Deleted]

ADIKALARAJ

EUR/USD Technical Strategy:-

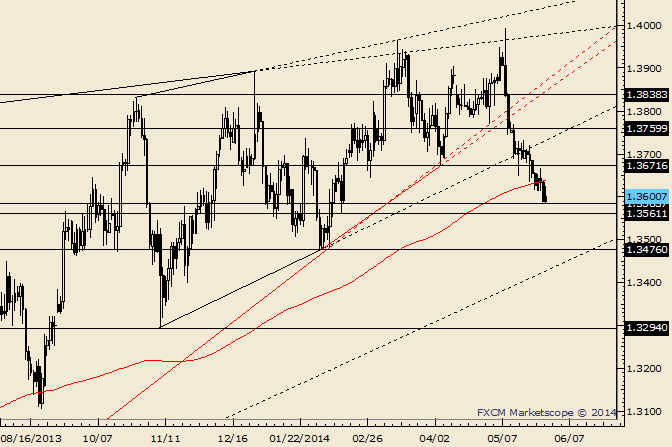

The sharp EURUSD reversal supports the long discussed ending diagonal (wedge) interpretation. Diagonals are often fully retraced (sometimes quickly), which yields a target of 1.3294.

-I mentioned previously to “beware a flush into 1.3560/90.” EURUSD has traded into the top of this zone. Beware a Friday low and early June recovery.

LEVELS: 1.3482 1.35601.3590 | 1.3634 1.3672 1.3704.

The sharp EURUSD reversal supports the long discussed ending diagonal (wedge) interpretation. Diagonals are often fully retraced (sometimes quickly), which yields a target of 1.3294.

-I mentioned previously to “beware a flush into 1.3560/90.” EURUSD has traded into the top of this zone. Beware a Friday low and early June recovery.

LEVELS: 1.3482 1.35601.3590 | 1.3634 1.3672 1.3704.

ADIKALARAJ

EUR/USD Technical Strategy:-

The sharp EURUSD reversal supports the long discussed ending diagonal (wedge) interpretation. Diagonals are often fully retraced (sometimes quickly), which yields a target of 1.3294.

-There is a lot to break through at these levels. The 200 day average, October high and 2/27 low continue to hold up but 2 reversal attempts since 5/15 have failed. As such, beware a flush into 1.3560/90.

LEVELS: 1.3482 1.35601.3590 | 1.3650 1.3686 1.3753

The sharp EURUSD reversal supports the long discussed ending diagonal (wedge) interpretation. Diagonals are often fully retraced (sometimes quickly), which yields a target of 1.3294.

-There is a lot to break through at these levels. The 200 day average, October high and 2/27 low continue to hold up but 2 reversal attempts since 5/15 have failed. As such, beware a flush into 1.3560/90.

LEVELS: 1.3482 1.35601.3590 | 1.3650 1.3686 1.3753

ADIKALARAJ

EUR/USD Technical Strategy:-

Drilling down to examine the four hour chart; a Gravestone Doji suggests the Euro bears may have run out of steam in intraday trade. While a sign of indecision from traders, it may be too early to suggest a shift in sentiment is on the cards for the common currency, given resistance looms nearby.

Drilling down to examine the four hour chart; a Gravestone Doji suggests the Euro bears may have run out of steam in intraday trade. While a sign of indecision from traders, it may be too early to suggest a shift in sentiment is on the cards for the common currency, given resistance looms nearby.

ADIKALARAJ

EUR/USD Technical Strategy:-

It may be set to extend its recent declines following a break below key support near 1.3670, and the absence of a bullish signal on the daily. Buyers are likely to step in to support the common currency at 1.3560.

It may be set to extend its recent declines following a break below key support near 1.3670, and the absence of a bullish signal on the daily. Buyers are likely to step in to support the common currency at 1.3560.

ADIKALARAJ

EUR/USD Technical Strategy:-

Drilling down to examine the four hour chart; there are few signs of a potential bounce over the session ahead, given a bullish signal remains absent.

Drilling down to examine the four hour chart; there are few signs of a potential bounce over the session ahead, given a bullish signal remains absent.

ADIKALARAJ

EUR/USD Technical Strategy:-

It has pushed below the 1.3670 mark which has failed to confirm the Hammer formation on the daily. With the Euro closing below the noteworthy level of support, further declines may be on the cards. Buyers are likely to step in to support the common currency at 1.3560.

It has pushed below the 1.3670 mark which has failed to confirm the Hammer formation on the daily. With the Euro closing below the noteworthy level of support, further declines may be on the cards. Buyers are likely to step in to support the common currency at 1.3560.

ADIKALARAJ

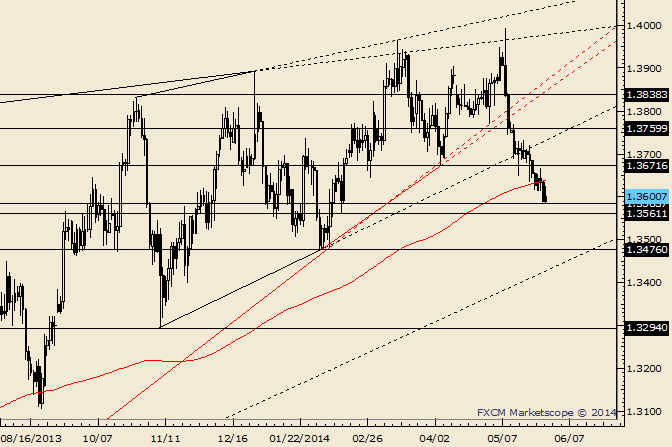

EUR/USD Technical Strategy:-

The sharp EUR/USD reversal supports the long discussed ending diagonal (wedge) interpretation. Diagonals are often fully retraced (sometimes quickly), which yields a target of 1.3294.

-There is a lot to break through at these levels. The 200 day average, October high and 2/27 low continue to hold up but 2 reversal attempts since 5/15 have failed. As such, beware a flush into 1.3560/90.

LEVELS: 1.3560 1.35901.3630 | 1.3717 1.3758 1.3774

The sharp EUR/USD reversal supports the long discussed ending diagonal (wedge) interpretation. Diagonals are often fully retraced (sometimes quickly), which yields a target of 1.3294.

-There is a lot to break through at these levels. The 200 day average, October high and 2/27 low continue to hold up but 2 reversal attempts since 5/15 have failed. As such, beware a flush into 1.3560/90.

LEVELS: 1.3560 1.35901.3630 | 1.3717 1.3758 1.3774

ADIKALARAJ

EUR/USD Technical Strategy:-

It continues to tease traders near critical support at 1.3670 with the Hammer formation on the daily suggesting the bulls are not prepared to relinquish their grip on the pair just yet. However, before suggesting a potential bounce back to 1.3780, the reversal signal needs to see confirmation from a successive up-day. A daily close below 1.3670 would signal strong conviction amongst the bears and open up the next noteworthy level of support at 1.3480.

It continues to tease traders near critical support at 1.3670 with the Hammer formation on the daily suggesting the bulls are not prepared to relinquish their grip on the pair just yet. However, before suggesting a potential bounce back to 1.3780, the reversal signal needs to see confirmation from a successive up-day. A daily close below 1.3670 would signal strong conviction amongst the bears and open up the next noteworthy level of support at 1.3480.

Ronnie Mansolillo

2014.05.22

Adikalaraj the indicator in charts writes the patterns in letters or you added them manually?

Sergey Golubev

2014.05.22

I think - it is not Metatrader - external image. But as I see - this is simple support/resistance indicator (or high/low indicator)

Ronnie Mansolillo

2014.05.22

thank you Sergey. as you know do we have here something similar. it could be an exit strategy some of those patterns.don't you think?

ADIKALARAJ

EUR/USD Technical Strategy:-

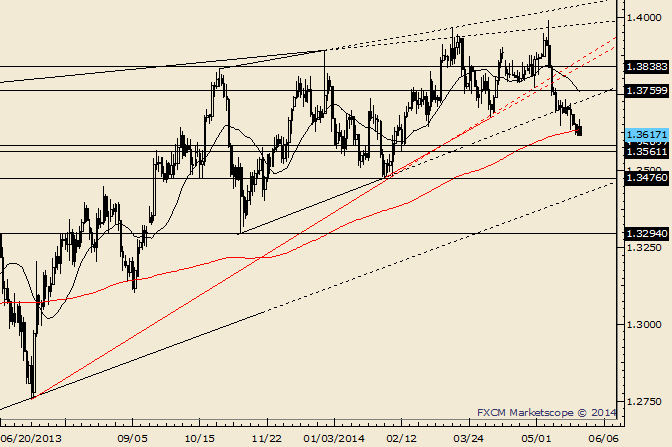

The sharp EUR/USD reversal supports the long discussed ending diagonal (wedge) interpretation. Diagonals are often fully retraced (sometimes quickly), which yields a target of 1.3294.

-Thursday’s reversal following the dip under 1.3672 gives scope to a rally attempt. 1.3758+- is resistance.

LEVELS: 1.3610 1.36571.3692 | 1.3745 1.3774 1.3810

The sharp EUR/USD reversal supports the long discussed ending diagonal (wedge) interpretation. Diagonals are often fully retraced (sometimes quickly), which yields a target of 1.3294.

-Thursday’s reversal following the dip under 1.3672 gives scope to a rally attempt. 1.3758+- is resistance.

LEVELS: 1.3610 1.36571.3692 | 1.3745 1.3774 1.3810

: