Naked Forex Tweezer Pro indicator for MT5 by ITC

- Indicators

- Renaud Herve Francois Candel

- Version: 3.10

- Updated: 4 July 2023

- Activations: 5

Naked Forex Tweezer Pro Indicator

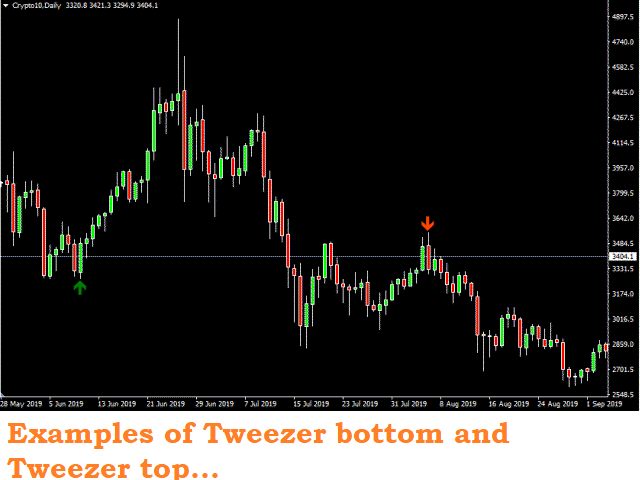

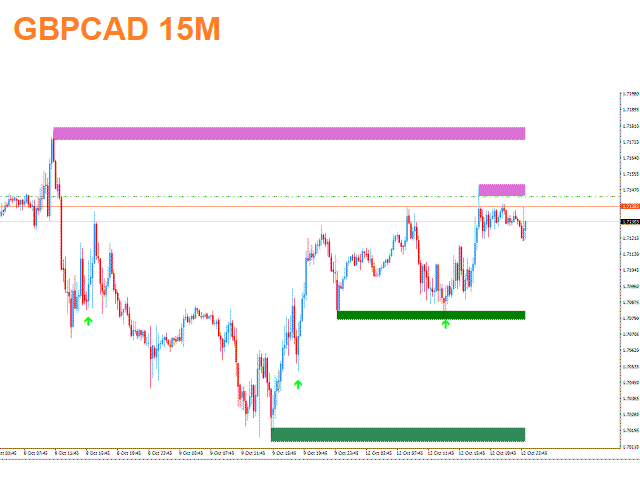

Tweezer Pro Indicator is a pattern recognition indicator for Forex, Stocks, Indices, Futures, Commodities and Cryptos.The standard Tweezer is a two bar pattern. Our enhanced version is a multi-bar pattern. We filter the patterns for you so that you only get the best and most effective patterns and ignore the noise.

The Tweezer pattern is a simple and effective pattern to trade.

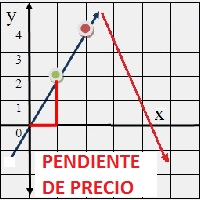

The strategy that comes with the Tweezer is based on price action.

The Tweezer Pro version lets users define their own pattern definition. This version is meant for expert traders who want to use their own optimized settings.

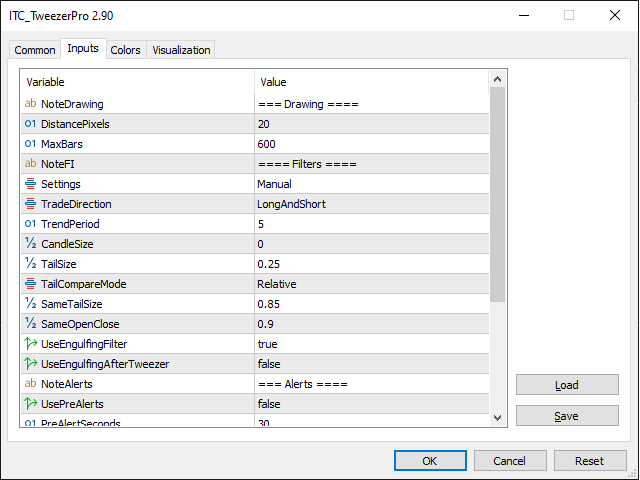

Inputs of the indicator are:

- Distance: distance in pixel relative to top or bottom of candle to display the arrow symbol

- MaxBars: maximum number of bars back to calculate searching for signals

- Settings (automatic/manual): you can either use the defaults settings optimized by Justin Mueller (automatic) or use your own settings (manual).

- TradeDirection (Long/Short/LongAndShort): you can filter signals and only show BUY signals (Long) or SELL signals (short). Default settings is LongAndShort (no filter).

- TrendPeriod (20 as default): number of candles the indicator should look back to determine current trend direction.

- CandleSize (0.5 as default): minimum size for candles to consider pattern as valid (0.0:no filter, 0.5:middle size candles, 1.0:big candles only).

- TailSize (0.0 as default): minimum size for the tails to consider pattern as valid (0.0:no filter, 0.2:middle size tails, 0.4:big tails only).

- TailCompareMode (Relative/Absolute): use size of candles (Relative) or size of tails themselves (Absolute) as a reference to compare tails sizes differences and valid the pattern.

- SameTailsSize (0.9 as default): check accuracy of same candle wicks size to validate pattern (0.0:ignore wick size criterion, 0.8:strict same size, 0.9:very strict same size).

- SameOpenClose (0.9 as default): check accuracy of same open and close for the candles (0.0:ignore criterion, 0.8:strict same open/close, 0.9:very strict same open/close).

- UseEngulfingFilter (true/false): if set to true then ignore patterns that do not include engulfing pattern.

- UseEngulfingAfterTweezer (true/false): if set to true then will also consider engulfing pattern with the next candle after the Tweezer formation.

- UsePreAlerts (true/false): to enable pre-alerts. It is required to set this value to true if you want to receive pre-alerts.

- PreAlertsSeconds (30): time in seconds before the close of the candle when pre-alerts will be activated (pre-alerts can disappear).

- UseConfirmedSignals (true/false): generate alerts for confirmed signals (at the close of the bar). It is required to set this value to true if you want to receive confirmed signals alerts.

- PopupAlerts (true/false): to enable alerts of type Popup window

- EmailAlerts (true/false): to enable alerts of type Email

- PushAlerts (true/false): to enable alerts of type Push Notification

- SoundAlerts (true/false): to enable alerts of type Sound

- SoundFile: file to be used for sound alerts

Trading rules:

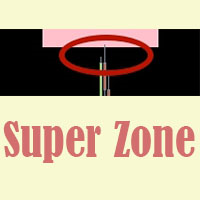

- For BUY: wait for a bullish Tweezer (Tweezer bottom) to print on a support zone after a down trend. Wait for price to break high of the Tweezer pattern (5 pips above the high for H1 and higher time frames). Immediately enter in the trade once high is broken. You also can use a BUY STOP order placed 5 pips above the high of the candle (plus spread). Stop Loss should be placed below the low of the Tweezer pattern. If order is not triggered in the next candle then trade is invalidated and should be canceled.

- For SELL: wait for a bearish Tweezer (Tweezer top) to print on resistance zone after an up trend. Wait for price to break the low of the Tweezer pattern (5 pips below the low for H1 and higher time frames). Immediately enter in the trade once low is broken. You also can use a SELL STOP order place 5 pips below the low of the candle. Stop Loss should be placed above the high of the Tweezer pattern. If order is not triggered in the next candle then trade is invalidated and should be canceled.

The Tweezer indicator can be used with any time frame.

The Tweezer indicator can be used with any class of assets: Forex, Stocks, Indices, Futures, Commodities and Cryptos.