Version 9.6

2021.03.19

fixed small bug that could cause "divide by zero" error

Version 9.3

2021.03.01

- fixed balance issue with accountcredits

Version 9.2

2021.02.19

added parameter to manually set the maximum number of trades that the broker allows. This was not functioning correctly.

Version 9.1

2020.11.03

removed repeating message in expert tab about spread

Version 9.0

2020.11.02

- Added extra protection of closing grid in loss when big spreads occur

- some small improvements on some pairs

Version 8.99

2020.10.12

small change to GBPNZD

Version 8.98

2020.10.09

improved GBPNZD

Version 8.94

2020.04.16

added the support for PLN and SGD stocks

Version 8.93

2020.04.09

fixed small bug regarding balance allocation algo

Version 8.92

2020.03.30

Version 8.92

- fixed option to remove SL/TP "after" the hedge trade is succesful, instead of before

Version 8.91

2020.03.26

Version 8.91

- Fixed rollover-filter bug

- fixed bug for manual settings

Version 8.90

2020.03.19

added option to remove SL/TP "after" the hedge trade is succesful, instead of before

Version 8.80

2020.03.11

- added extra control to prohibit double hedging

Version 8.70

2020.03.02

Version 8.7

- Fixed bug that could lead to double hedging

Version 8.60

2020.02.26

Version 8.6

- Fixed small bug regarding end of year/start of year filter

Version 8.50

2020.02.25

- fixed bug that could potentially lead to wrong calculation of max loss value

Version 8.40

2020.02.04

improved performance for 15K set (new set available for download)

Version 8.31

2020.01.06

Version 8.31

- Fixed small bug for infopanel when using manual settings

Version 8.3

2019.12.11

fixed normalization issue with Fast Recovery

Version 8.2

2019.12.10

Version 8.2

- Adjusted default parameters

- Added Fast Recovery option (more risky)

- Adjusted predefined risk settings. very conservative is now at "5%" instead of "10%" Others adjusted as well

Version 8.1

2019.12.06

Version 8.1

- slightly adjusted default parameters

Version 8.0

2019.11.19

Version 8.0

- Fixed regarding Max Lotsize parameters

Version 7.9

2019.11.15

Version 7.9

- Fixed bug that could display wrong info on infopanel when only running 1 strategy

Version 7.8

2019.11.12

Version 7.7

- Added algorithms to make the EA handle manual closing of hedge-trades

Version 7.8

- Fixed bug regarding potential double first trades

Version 7.6

2019.10.25

Version 7.6

- Added Balance Allocation mode that takes in account the hedged equity

- Fixed bug that could lead to double "first trades" when using the ReverseGrid parameter

Version 7.5

2019.10.17

Version 7.5

- Added Quick Close S.E.A.

- Added Reverse Grid at X trades

Version 7.4

2019.09.25

Added support for crypto based accounts

Version 7.3

2019.09.09

Version 7.3

- Fixed bug that could lead to hedge breakdown closing only at 0.01lots

Version 7.2

2019.09.05

Version 7.2

- Fixed potential early closing of the grid when using the GlobabSL set when pairs are trading at different lotsizes

Version 7.0

2019.08.27

Version 7.0

- Fixed hedge breakdown for accounts that have minimum lotsize of 0.1lots

- Added "Continue Trading" for the hedging algorithm. It replaces the Recovery Mode

Important information:

- The "continue trading the hedged pairs" option replaces the Recovery Mode so it can all run from 1 chart

- BUT: if you were running the recovery mode BEFORE the update, and you have trades open in the recovery mode, you MUST let the EA finish those trades in Recovery Mode (the new version will NOT pick up those trades unless you also put it in recovery mode). So this means you must keep running the recovery mode on the second chart like before, but set the parameter "Maximum pairs allowed to trade simultanuously=-1". this will make sure the Recovery mode will continue the monitoring of those trades, but will not start new ones. On the 1st chart, you simply run the new EA with continue hedging enabled.

Version 6.99

2019.08.20

Version 6.99

- fixed the "close all trades at maximum allowed equity DD"

Version 6.98

2019.08.15

updated default settings

Version 6.97

2019.08.13

Version 6.97

- Fixed potential bug that could cause same trade to be set multiple times after failing

Version 6.96

2019.07.25

Version 6.94

- Added option to minimize grid before hedging

- Added option to show "Margin Used" to infopanel

Version 6.95

- Changed the "Maximum total equity drawdown allowed before closing all trades (per 0.01lots)" to "closing biggest grids" (those with Open Profit > Max Loss)

- Infopanel update: pair is also showing status "TrailingTP" in the OneChartSetup

- Added "recovery" setup when using hedging. Must be used on seperate chart with different magic numbers! This is so that hedged pairs will continue trading;

Version 6.96

- Improved some coding

Version 6.93

2019.06.27

Version 6.93

- Fixed small bug regarding Hedge Breakdown algo using Max Closing of day profit when multiple pairs are hedged

- added "Hedge" button for single chart setup

- Fixed StrictDirection-filter for single chart setup

Version 6.92

2019.06.26

Version 6.92

- Added HedgeButton for OneChartSetup infopanel. It allows the user to quickly hedge a pair when needed.

Version 6.91

2019.06.20

Version 6.91

- Quickfix for the last update

Version 6.90

2019.06.19

Version 6.90

- Added option to add extra pips to TP and FlashTP

Version 6.89

2019.06.15

Version 6.88

- Added Hedgebreakdown - Max % of Daily Profit closing - algorithm. When enabled, the EA will try to limit the hedge breakdown closing to a certain % of the profit of that day

Version 6.89

- Added "Hedge At Trail_TP level" when using Trailing TP

Version 6.87

2019.06.10

- Added option to add Swapcosts into grid closing calculations

Version 6.86

2019.05.06

Version 6.86

- Fixed possible wrong pair "hedged" at re-initialization of EA

Version 6.85

2019.05.06

Version 6.85

- Quickfix for Hedge closing size too small after restart of the EA

Version 6.84

2019.05.06

Version 6.84

- Added option to adjust maximum attempts to close or modify trades each tick (to prevent MT4 overload)

- Added extra info about Trailing TP setup on infopanel

- Fixed bug where Failed Hedgetrade is not retried

Version 6.83

2019.05.02

Version 6.83

- Fixed the "Maximum number of trades...." parameter

- Fixed potential problem with trailing TP when TP is hit during rollover time (market closed)

Version 6.82

2019.04.18

Version 6.82

- fixed wrong "total open profit" on the infopanel when grid is hedged

- Adjusted Xauusd strategy B minimum lotsize to 0.02 instead of 0.03

- fixed bug in hedging breakdown! important fix!!

Version 6.81

2019.04.12

fixed but that could cause the EA to crash if the setup of the EA is not done correctly

Version 6.8

2019.04.10

- Added "Rollover filter" to skip trading during rollover period

Version 6.7

2019.04.07

Version 6.7

- Fixed bug with smallest possible hedge closing size

Version 6.6

2019.04.02

- Improved Hedging technique, including splitting up of hedge trades for big accounts

- Fixed Infopanel wrong information when starting up in the weekend

Version 6.4

2019.03.29

Version 6.2

- Added INFORMATION MODE: only show info, but don't trade

- Added Hedge-Breakdown mode

Version 6.3

- Add TrailTP mode

- Added Withdrawal mode for strategy tester

Version 6.4

- Added option to Hedge the Max loss SL when using the TrailingTP mode

Version 6.1

2019.03.18

- fixed some things for those who have a "zero divide" problem sometimes. It will also show more information about the problem with the setup

Version 6.0

2019.03.15

Version 6.0

- Added GBPAUD

- added GBPNZD

- added EURNZD

- added NZDJPY

- added NZDCHF

- Fixed bug in Failed Trade recovery

- Added "Close Trades" buttons for OneChartSetup

Version 5.5

2019.02.25

Version 5.4

- Added Max Equity DD parameters based on $/0.01lots

Version 5.5

- Improved "Max Pairs Open" algorithm for OneChartSetup

Version 5.3

2019.02.21

- Really fixed the infopanel for XAUUSD this time, also for OneChartSetup

Version 5.1

2019.02.21

Version 5.1

- Fixed infopanel showing wrong Max Loss for XAUUSD

Version 5.0

2019.02.21

Version 5.0

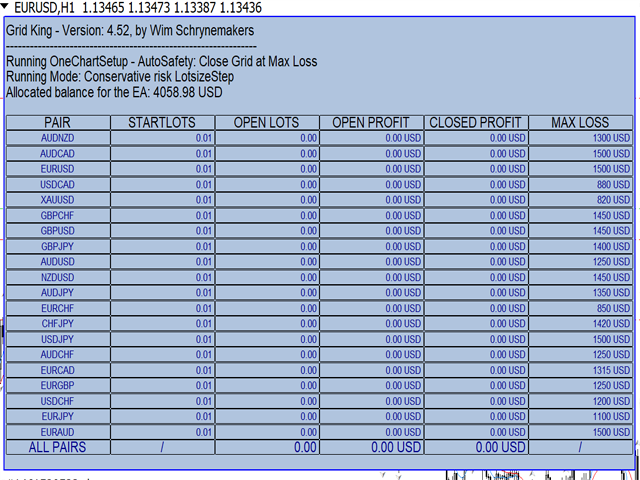

- Improved OneChartSetup info panel a bit more

- improved many pairs and overal risk vs reward

- fixed small bug

Version 4.52

2019.02.08

Version 4.52

- More improvements on infopanel

- changed Autosafety parameters -> Now there is a choice of 4 options: A) do not use autosafety; B) Close the grid when Max Loss is hit. C) Hedge grid when max loss is hit and stop trading the pair. D) don't close or hedge, but show a warning to the user

- fixed hedging option for onechartsetup

- changed Maxloss way of working -> it is now part of the autosafety settings. When you leave it to "0", the autosafety will use my optimized Max Loss based on historical max DD. When you fill in a value (like "1000") it will discard my optimized value and use this one instead;

Version 4.51

2019.02.07

Version 4.51

- Major improvements to the infopanel

Version 4.50

2019.02.05

added NZDUSD

Version 4.41

2019.02.02

Version 4.41

- Adjusted the info parameters + OneChartSetup for CHFJPY

Version 4.4

2019.02.02

Version 4.3

- fixed historical profits not calculated at initialization when using OneChartSetup

Version 4.4

- Added CHFJPY

Version 4.2

2019.01.30

fixed bug causing the slow backtesting

Version 4.1

2019.01.29

fixed small bug that caused the SEA virtual grid to be filled in empty at initialization when there are existing trades open

Version 4.0

2019.01.29

Version 4.0

- Introducing the OneChartSetup!

- Adjusted safety parameters "minimum equity" and "minimum free margin" to more safe settings

- eurcad and audcad improved stability

Version 3.50

2019.01.22

Version 3.5

- Added Usdcad

- fixed bug for "GOLD" pairs!

Version 3.42

2019.01.19

Version 3.40

- improved stability for euraud

Version 3.41

- improved stability for usdchf and audnzd

Version 3.42

- improved stability xauusd for different pricefeeds

- Added Audchf

Version 3.31

2019.01.15

fixed XAUUSD for brokers that use "GOLD" instead of "XAUUSD"

Version 3.3

2019.01.15

- Added XAUUSD -> LOW DRAWDOWN PAIR! Can be run on 1000$ account!

Version 3.2

2019.01.14

Version 3.2

- Improved Audjpy for S.E.A.

- Improved audnzd for S.E.A.

- Improved audcad for S.E.A.

- improved euraud for S.E.A.

- Fixed bug for S.E.A. when running lotsize bigger than 0.01

Version 3.1

2019.01.10

Version 3.1

- Fixed some bugs

- Improved S.E.A. -> better and more stable performance!

- general improvements

- improved usdchf

Version 3.0

2019.01.09

Version 3.0

- Implemented S.E.A. (Spread Equalizer Algorithm). This will greatly improve performance for different spreads and slippage.

- Added GBPCHF, the new number 1 pair!

Version 2.80

2018.12.22

improved eurcad

Version 2.71

2018.12.18

forgot to adjust EURGBP values internally for the new DD... now it is fixed. You only need to update the EURGBP chart with this one.

Version 2.7

2018.12.18

Version 2.7

- Adjusted EURGBP Max Loss

- Major improvement gbpjpy

- Fixed bug preventing audjpy trades

Version 2.6

2018.12.14

Version 2.6

- Improved eurusd with lower DD

- Added AUDJPY

- Re-arranged the parameters for a more clear and logical interface

Version 2.5

2018.12.12

Version 2.5

- Added option to NOT trade in same direction between the 2 strategies

- Added new parameters to control maximum risk

- Improved EURAUD

Version 2.4

2018.12.04

Version 2.3

- Added option for setting trading hours

- Added 'Very Low Risk LotsizeStep'

Version 2.4

- Added Audcad

Version 2.2

2018.11.29

Version 2.2

- Corrected the text (added AUDNZD) in the parameter information section

- changed some text in the information section of the parameters, to be more clear for users

- Fixed some small things

- Added EURCHF pair!

Version 2.1

2018.11.23

Version 2.1

- fixed Maxloss bug on accounts with minimum lotsize = 0.1 (this happened on some cent accounts with 0.1minimum lotsize...)

- added color option for buy/sell arrows

- Added AUDNZD pair

Version 2.0

2018.11.21

Version 2.0

- Added option to select trade direction (for strong trending markets)

- Added Max Loss Allowed value and next lotsize increase information in the information panel

- rearranged information panel

- Added manual trading option

- Improved trailingSL and hard TP algorithms

Version 1.9

2018.11.21

Version 1.9

- Added 'total historical profit' information for the pair on the information panel

- Changed "correlated pairs safety" to only work when they are in the same trade direction

- Fixed small bug with Hard TP

- Added option for trailing SL on Flash TP instead of closing the trade

Version 1.8

2018.11.19

Version 1.8

- fixed buttonsize (can be manually set now)

- added option to use only portion of balance

- added 2 new safeties: correlated pairs and max number of pairs.

- improved on chart visuals and information

Version 1.7

2018.11.16

Version 1.7

- Added button on chart to force close of all buy trades or sell trades

- Added option to set hard TP on FlashTP levels (+extra pips)

- Added Gbpjpy

- fixed bug concerning lotsize calculation

Version 1.6

2018.11.15

Version 1.6

- added new autosafety parameter for extra control on the function

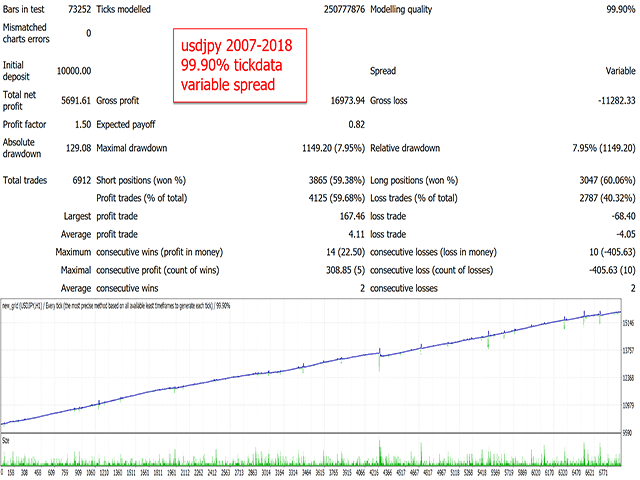

- reviewed autosafety's historical max equity DD based on 99.90% tickdata

- improved grid closing technique

Version 1.5

2018.11.13

Version 1.4

- Added an option to close all trades should "total" equity drawdown exceed a certain percentage.

- Adjusted eurusd to lower risk grids

Version 1.5

- Add trade retry algorithm if trade should fail

Version 1.3

2018.11.11

Version 1.3:

- improved gbpusd stability

- improved usdjpy stability

- fixed bug regarding portfolio trading

Version 1.2

2018.11.11

- improved eurusd stability

Version 1.1

2018.11.10

Version 1.1:

- Added "hedge" option -< instead of closing grid when exceeding max historical DD, the trades will be hedged so the user can manual manage the hedged trades.

- added security for MT4 restart.

- added warning when using to high lotsize or too small balance for your setup.

Bravo!