GTAS STrend

- Indicators

- Riviera Systems

- Version: 1.0

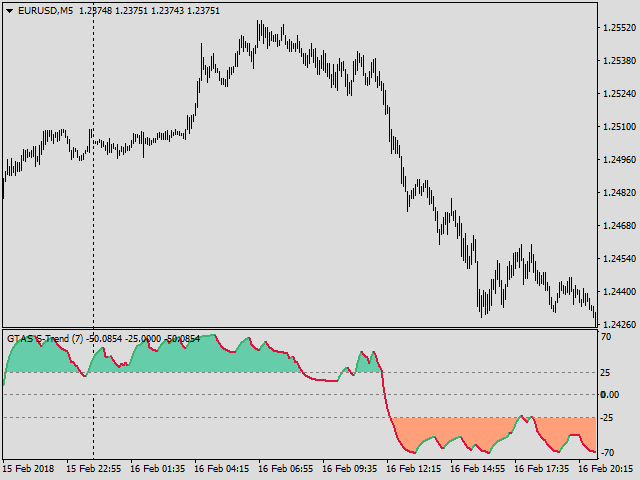

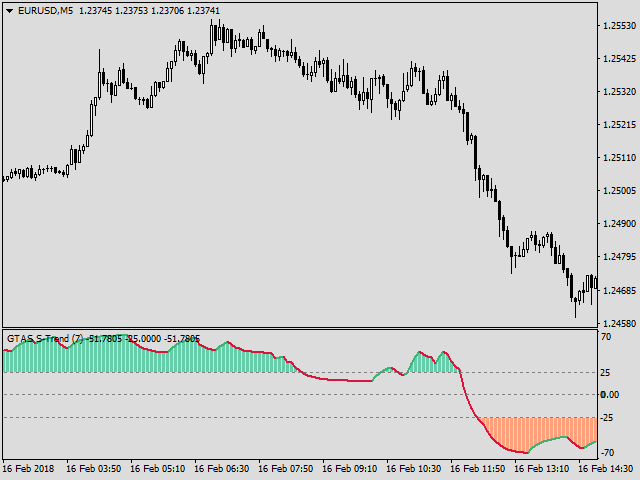

GTAS S-Trend is a momentum indicator that helps to determine trends using combination of MACD, RSI and moving averages.

This indicator was created by Bernard Prats Desclaux, proprietary trader and ex-hedge fund manager, founder of E-Winvest.

Description

The indicator oscillates between -65 and +65 with a neutral zone between -25 and +25 around a 0 equilibrium line.

S-Trend between -25 and +25 indicates congestion zones with a bullish bias between 0 and +25, and a bearish bias between 0 and -25.

Beyond +25, the uptrend is affirmed. Below -25, prices are downtrend.

How to use

Trend indicator

The indicator is all the more interesting as it will be used over several units of time.

Beyond + 25, and in the absence of a reversal pattern, it will simply be necessary to favor long trades.

Below -25, and in the absence of a reversal pattern, it will be necessary to favor short trades, or profit taking if you are long.

Between -25 and +25, it will be necessary to privilege the fast operations, with all the specificity of the congestion zones.

Timing indicator

In congestion zones, a confirmed break of the indicator beyond +25 or below -25, without the corresponding price action, is a sign of strength that can be used as a precursory break indicator.

It is then used as a timing signal, one of the rare cases where confirmation by prices is not necessary because the risk-reward ratio becomes very interesting.

Parameters

- Periods = 7 - the number of bars used to smooth the trend.

سلام وقت بخیر سالها من با اندیکاتور مکدی و ری سی کار کردم اما همیشه دقیق یاد نگرفتم از شما بخاطر این اندیکاتور ترکیبی دقیق و رایگان بسیار سپاس گذارم به همه پیشنهاد دارم که از این اندیکاتور خوب استفاه کنند