Fifth dimension

- Indicators

- Gennadiy Stanilevych

- Version: 6.96

- Updated: 13 December 2021

- Activations: 13

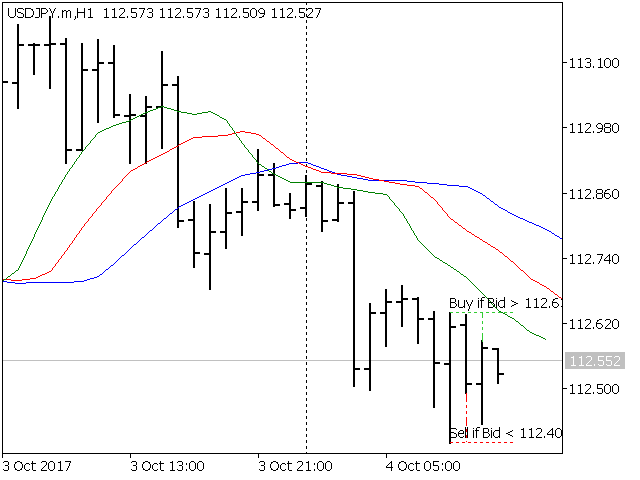

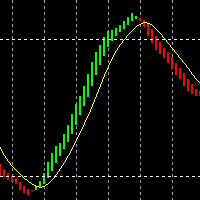

The indicator looks for the "Fifth dimension" trade signals and marks them on the chart. A detailed description of the chart patterns that generate the trade signals can be found in Chapter 8 "The Balance Line Trades" in the book Williams' "New Trading Dimensions". Signal levels with indication of the position entry or stop loss placement price are indicated directly on the chart. This feature creates additional convenience for the trader when placing pending orders. A solid horizontal line is displayed in case a signal level is broken. A dashed line on the chart indicates a level, the breakout of which may change the market trend. A vertical dashed line is drawn from the High (Low) of the basic bar to the signal level.

Settings

- bShowLine=true - show the signal lines, false - hide the signal lines.

- bShowLevel=true - show the prices of the signal levels, false - hide the prices of the signal levels.

- bAlert=true - show alerts about a breakout of the signal level, false - disable the signal block.

- bPush=false - send Push notifications about a breakout of the signal level, false - disable the signal block.

- bMail=false - send email notifications about a breakout of the signal level. false - disable the signal block.

- BuyLevel=clrLimeGreen - color of the buy level line.

- SellLevel=clrRed - color of the sell level line.

- BWZoneFilter=true - enable the AO and AC indicators based filter of zones.

- maPeriod=13 - parameter of the balance line, "Teeth" line of the Alligator indicator.

- maShift=8 - parameter of the balance line shift, "Teeth" line of the Alligator indicator.

- maMethod - smoothed method to draw the balance line (Alligator "jaw" line).

- maPrice - median price, price applied for the balance line.

- BWZoneFilter=true - enable consideration of signal zones based on the АО and АС indicators.

The Balance Line Trades ("The fifth market dimension")

The balance line shows the direction of the current path of least resistance for the movement of prices in the market. Therefore, buying is recommended when the price is located above the balance line and selling is advised if the current price is below the balance line. An opposite signal may serve as the stop loss level for the open deals. In addition, it is beneficial to look for the position entry points when the price is in the immediate vicinity of the balance line, while the histogram of the Awesome Oscillator is located near the zero line. Due to this, it is recommended to use the Alligator, Super AO and AC indicators in the template. An additional zoning filter available in the indicator should be used when trading. Works on all time frames. However, the author of the strategy recommends trading using the daily range.

Спасибо! Этого сигнала очень не хватало