Bollinger Bands strategy

- Experts

- Aleksandr Prishenko

- Version: 9.20

- Updated: 22 November 2021

- Activations: 5

Bollinger Bands strategy

An EA to help traders using Bollinger Bands in trading provides an opportunity to evaluate the effectiveness and optimize the three trading methods (strategies) described in John Bollinger’s book BOLLINGER ON BOLLINGER BANDS, with some additions. I do not recommend using in the forex market.

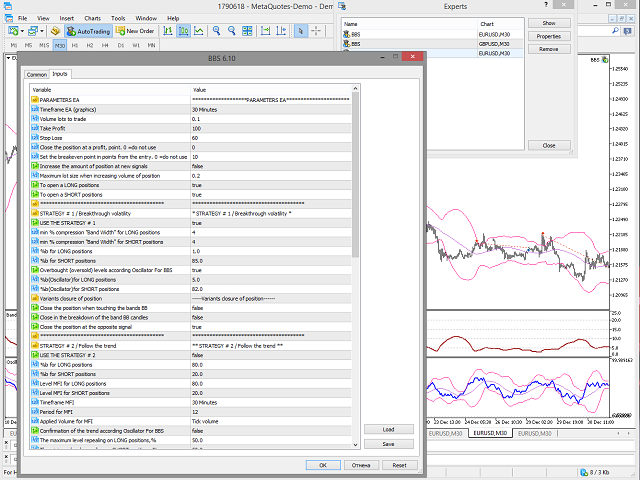

EA Parameters:

Stop Loss, in pips

Take Profit, in pips

Trailing Stop

Trailing Step

Money management: Lot OR Risk

Step trailing stop

The value for "Money management"

Deviation, in points

Print log

STRATEGY # 1 - Breakthrough volatility

The method uses low volatility (compression of Bollinger tapes) as a precursor of high volatility (expansion of tapes). The percentage of relative compression is determined by the Band Width indicator. The indicator% b (price position relative to the ribbons) is displayed in the upper left corner of the chart. The Oscillator For BBS indicator (oscillator normalized to bands) is used to guide the direction.

USE THE STRATEGY # 1

Min.% Compression of the "Band Width" indicator for long positions

Min.% Compression of the "Band Width" indicator for short positions

max %b value to which opening LONG positions are allowed

min %b value above which opening SHORT positions is allowed

Overbought (oversold) according "Oscillator For BBS" indicator

max %b(Osc)value to which opening LONG positions are allowed

min %b(Osc)value above which opening SHORT positions is allowed

Сlose the position at the opposite signal

Use trailing

Only one positions

STRATEGY # 2 - Follow the trend

The method predicts the birth of trends, considering the price strength confirmed by the power of the Money Flow Index indicator.

USE THE STRATEGY # 2

min %b value above which opening LONG positions is allowed

min MFI value above which opening LONG positions is allowed

max %b value to which opening SHORT positions are allowed

max MFI value to which opening SHORT positions are allowed

Use trailing

Only one positions

STRATEGY # 3 - Reversals

The method is based on touch of bands accompanied at by overbought (oversold) indicators. The EA implemented the condition:

- price touching the top tape, the indicator falls (sell),

- price touching the lower tape, the indicator growing (buy).

Trade transactions take place after passing the line

indicator the level (% b (Oscillator) for LONG positions or % b (Oscillator) for SHORT positions)

USE THE STRATEGY # 3

max %b value to which opening LONG positions are allowed

%b(Oscillator)for LONG positions

Check the indicator growing

min %b value above which opening SHORT positions is allowed

%b(Oscillator)for SHORT positions

Check the indicator falling

Close the position on the opposite signal

Use trailing

Only one positions

THE INDICATORS USED:

The indicator "Bollinger New" is used by three methods, https://www.mql5.com/ru/market/product/21976

The "Band Width" indicator is used by method 1, calculated according to the "Bollinger New" indicator.

The Oscillator For BBS indicator is used by methods 1 and 3, https://www.mql5.com/en/market/product/22061

The MFI indicator (Money Flow Index) is a technical indicator used by method 2

The indicators "Bollinger New", "Band Width", "Oscillator For BBS" can be added to the chart, after optimization

F OR EXPERIENCED USERS

Timeframe EA

Timeframe Band_Width

Timeframe Oscillator For BBS

Timeframe MFI (Money Flow Index)

Timeframe Trailing

Chart Indicators(BBNew & Band Width) Add

Chart Indicator(Oscillator For BBS) Add

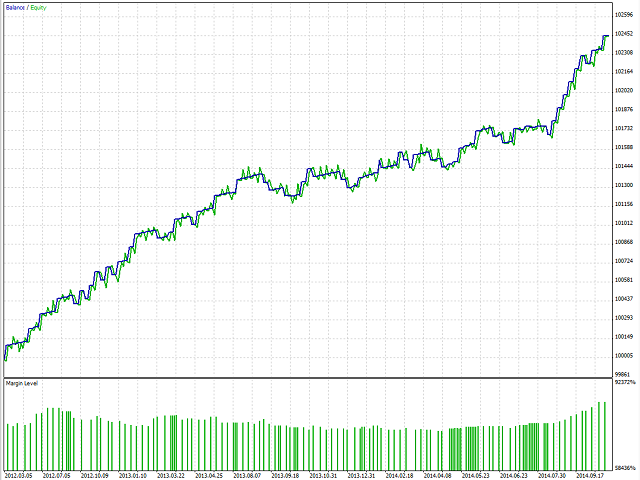

Optimization should be carried out on the history of the last two years or more, on any period . Optimization can be carried out on the "opening prices", but then double-check the result on "OHLC on M1".

After optimization, the advisor should open long and short positions, otherwise the optimization is incorrect.

You can use all 3 strategies simultaneously (but the first and the second or the second and the third are logical). I recommend installing the adviser on several currency pairs, having previously optimized the parameters for each pair.

You can drag stops, place orders and close trades manually when the advisor is working without any restrictions, the adviser assigns a magic number to each position, each pair has its own.

Use the strategies of real traders.