PZ Day Trading

- Indicators

- PZ TRADING SLU

- Version: 8.0

- Updated: 17 July 2024

- Activations: 20

Effortless trading: non-repainting indicator for accurate price reversals

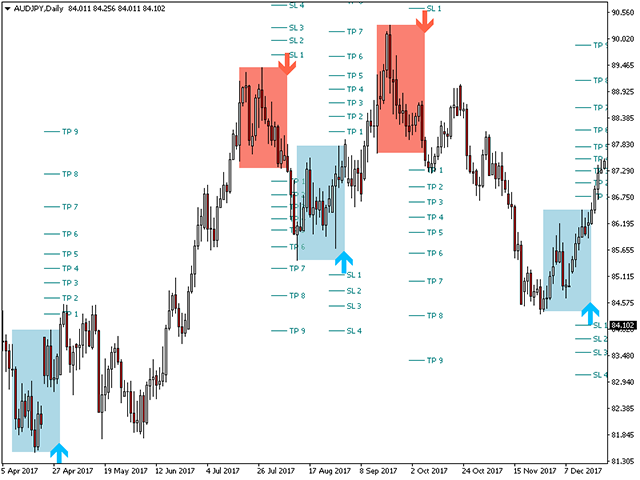

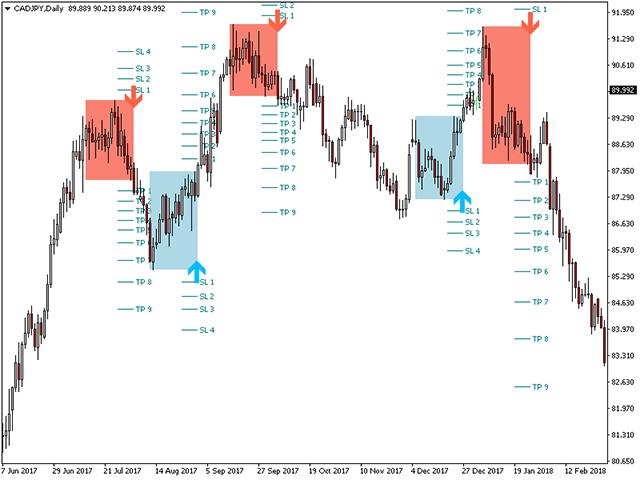

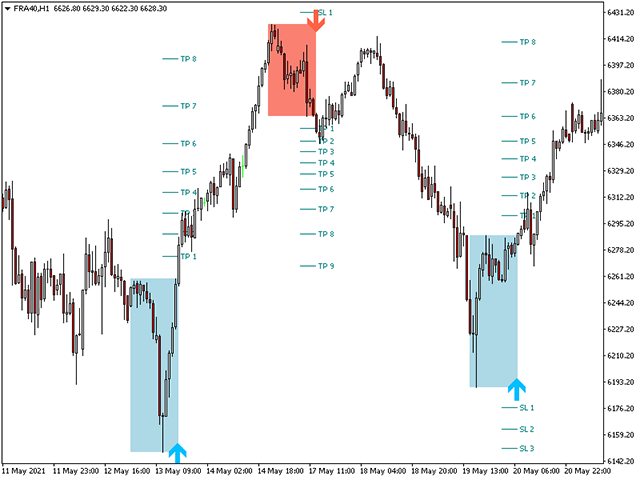

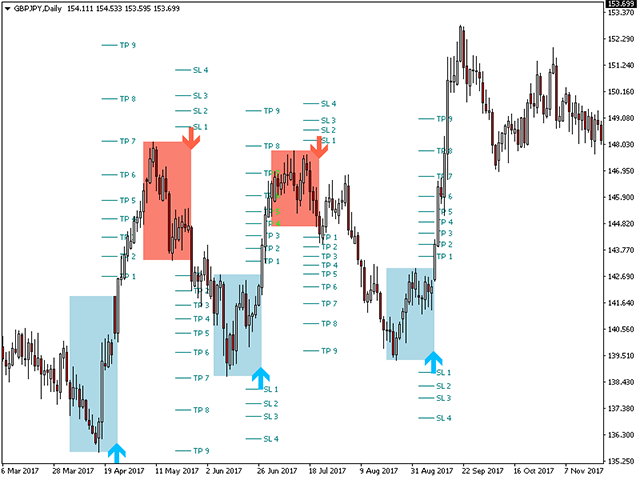

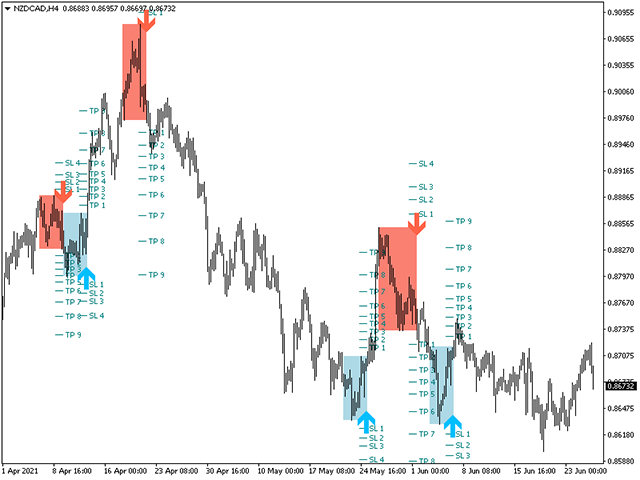

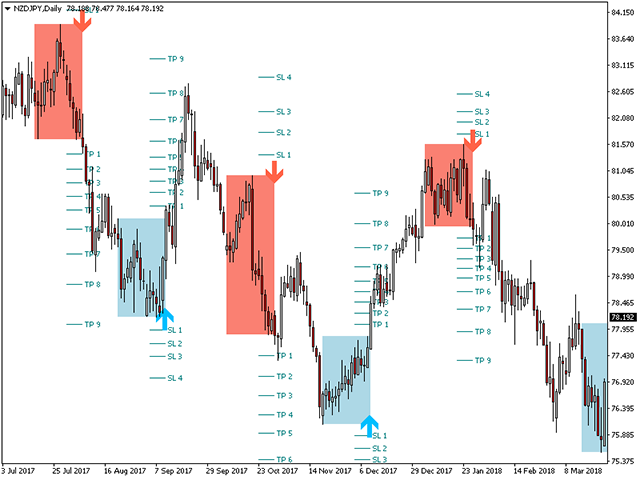

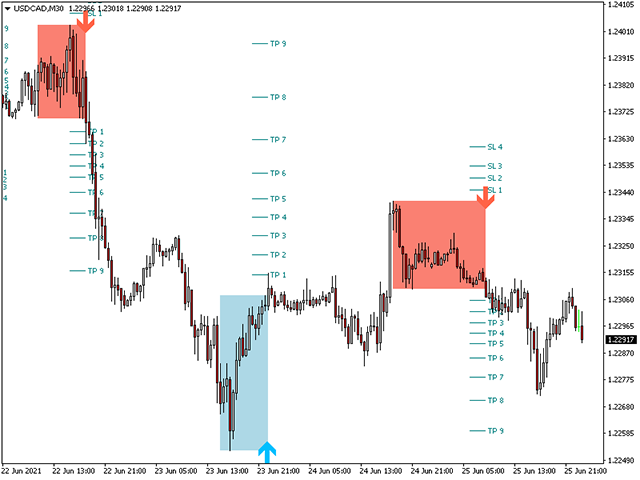

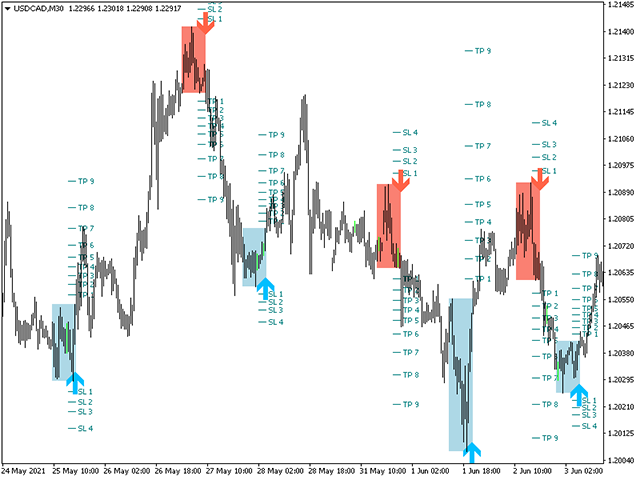

This indicator detects price reversals in a zig-zag fashion, using only price action analysis and a donchian channel. It has been specifically designed for short-term trading, without repainting or backpainting at all. It is a fantastic tool for shrewd traders aiming to increase the timing of their operations.

[ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ]

- Amazingly easy to trade

- It provides value on every timeframe

- It provides suitable SL and TP levels

- It implements self-analysis statistics

- It implements email/sound/visual alerts

Based on breakouts and congestion zones of variable lengths, the indicator uses only price action to pick trades and reacts to what the market is doing very fast.

- The potential profit of past signals is displayed

- The indicator analyzes its own quality and performance

- Losing breakouts are highlighted and accounted for

- The indicator is non-backpainting and non-repainting

This indicator will help intraday traders not to miss a single price reversal. However, not all price reversals are created equal nor have the same actionable quality. Deciding which breakouts to trade and which to ignore depends on the good judgement of the trader.

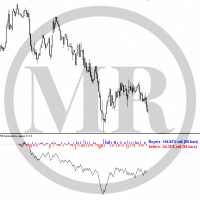

How to interpret the stats

The indicator studies the quality of its own signals and plots the relative information on the chart. Every trade is analyzed and the overall historic results displayed at the top-left corner of the chart, which allows you to optimize the indicator parameters by yourself, for any given instrument and timeframe. Each instrument and timeframe will have its own optimal settings, which you can find by yourself.

- Maximum Favorable Excursion: The MFE is the best possible outcome for any given trade.

- Maximum Adverse Excursion: The MAE is the worst possible outcome for any given trade.

- Average Absolute Expectancy: The AAE is the absolute excursion you can expect for any given trade, obtained by subtracting the MAE from the MFE, which reflects the true quality of the entry strategy. In other words, the entry strategy is measured by the relationship between the average best possible outcome and the average worst possible outcome for all the trades displayed.

- Losing Trades: Looking at the losing trades in the chart will help you to avoid losing patterns in the future.

The indicator displays the best possible outcome and the worst possible outcome for every trade using two dotted lines and two price labels, and account every single one of them into the statistics you can find at the top-left corner of the chart. You can use those statistics to optimize the indicator parameters by yourself, for any given instrument and timeframe.

Input Parameters

- Range: The range is the minimum amount of bars broken to consider a breakout valid and draw a signal. As you go down in timeframes, you need to increase this parameter. For example, to trade monthly charts a range of five is good, but to trade H1 charts you would need a range of at least 20-25 bars.

- Filter: The function of the filter is to separate alternative signals from each other, using a donchian channel and a multiplier of the price range it creates. A higher filter will decrease the amount of signals in the chart but, in average, increase the maximum favorable excursion.

- Max History Bars: The amount of past bars to evaluate when the indicator loads. Decrease this value to speed up loading of the indicator.

- Dashboard: Enable or disable the multi-timeframe dashboard widget.

- Statistics: Enable or disable the statistics widget. Use the stats to find the best parameters for each symbol and timeframe. Incrementally change the input parameters of the indicator until you find the higher accuracy and expectancy possible.

- Display boxes: Display or hide the colored boxes around the breakout price range.

- Fill boxes: Choose wether the inside of the breakout box is filled with color.

- Trade Analysis: Enable or disable the individual trade analysis in the chart.

- Alerts: Enable display/email/push/sound alerts for breakouts.

Author

Arturo López Pérez, private investor and speculator, software engineer and founder of Point Zero Trading Solutions.

All PZ tools are very well done.