PinBar Indicator

- Indicators

- Kashif Hameed

- Version: 1.30

- Updated: 19 October 2022

- Activations: 5

PinBar indicator is an Indicator identifies price reversal, pattern and timely identifies that price trend is changed. The Trend change is immediately identified over the chart. Alert is send over the Chart and Email address. Indicator generated Signal Price is displayed over the chart near the PinBar.

Please make sure to use on Higher time frames if you are swing trader. for day traders who want to use M30 or M15 time frames, Take profit should be kept minimal. Lower than M15 is not recommended at all.

This Price Action indicator identifies profitable PinBar to be traded with a success rate of 85%. If you follow the proper strategy and trade on the pins as per above six conditions, you can eliminate chances of losing trades. Every pin if identified correctly as per H4 charts, gives you 50-150 pips in just one trade.

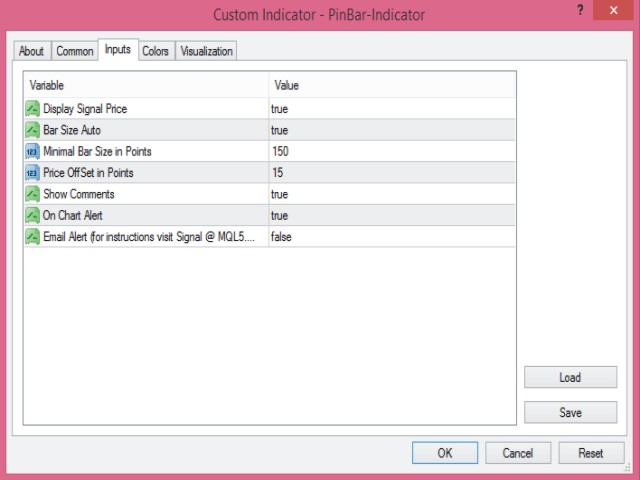

Inputs

- Display Signal Price: Set to true by default. If you don't want the price to be displayed over the PinBar use can change it to false.

- Auto Bar Size: if True, the indicator will calculate size of the candle based on a chart (H1, H4, D1, etc.).

- Min Bar Size: if AutoBarSize is False, you can manually enter a size of PinBar.

- PriceOffset: number of points (pips) to add (or minus) from High or Low of the PinBar to mention an entry price and a stop loss.

- Show Comments: Comments are actually guidelines displayed over the Top Left corner to guide the Trade Process.

- On Chart Alert: Alert will be shown over the chart when ever new PinBar is created.

- Email Alert: if true, email will be sent to provided email address(make sure to make necessary changes in Options>>Email in the terminal.

- A long nose (and a long nose relative to the open/close/low)

- a nose protruding a long way from the prices around it

- the open/close both near one end of the bar.

- Fibonacci levels (retracements of the previous move)

- Important pivot levels

- Moving averages

- Confluence (several MA or Fibo levels in the same general region)

- Swing high/swing low

- Retracement of the current move (must retrace a minimum of 23% Fibo retracement of the current move), which is a lower probability play.

For the BEST results, a trader may trade a pin bar on the swing high (or swing low) or a pin bar that is bouncing off confluence (Fibo levels). The PinBar is a very reliable setup under these circumstances, indicating that there is a high probability that prices will change direction – which is a very tradeable setup.