Currency Strength Dynamic

- Indicators

- Ivan Butko

- Version: 1.0

- Activations: 20

Currency Strength Dynamic

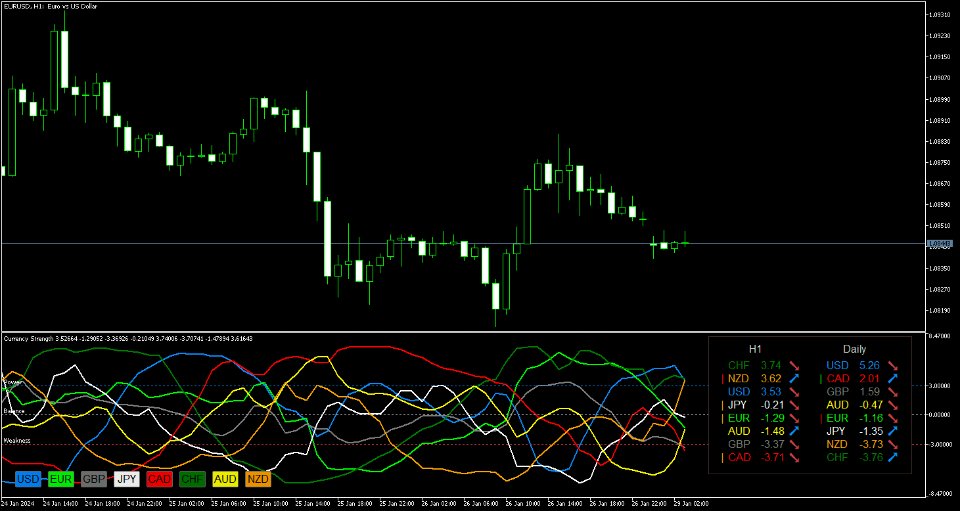

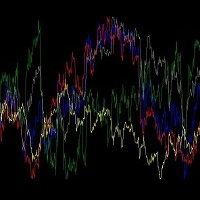

Currency Strength Dynamic is an indicator of currency strength. Currency strength refers to the trend direction of most or all currency pairs that a currency is a part of.

The indicator is based on readings of the difference between moving averages, similar to the MACD indicator, on the 28 most popular currency pairs: majors and minors.

Advantages

- Unique oscillatory calculation method

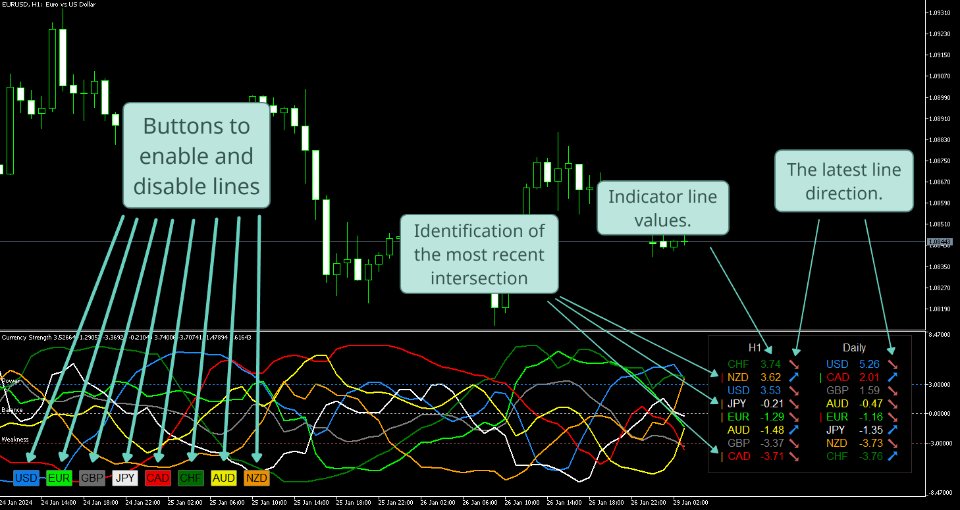

- Availability of buttons to disable or enable lines of specific currencies

- Information table

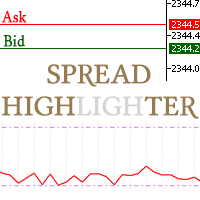

- 2 types of alerts: when indicator lines cross and when lines cross specified levels.

- The number of bars drawn is optional.

Let's look at each point in detail:

The unique oscillatory calculation method allows the indicator not to remain in maximum values for a long time, but to exit them in advance, similar to the familiar effects of divergences and convergences. This method also includes a specified calculation period and a level of smoothing of the readings, which makes them smoother. Calculations do not contain unnecessary clutter and unnecessary redundant formulas, so the load on the terminal is reduced.

Having buttons to disable or enable lines of specific currencies is one of the most convenient features, as it can free you from unused currencies, or simply visually improve your visibility.

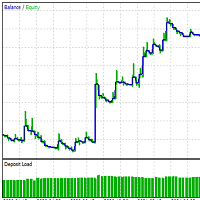

The information board is another convenient functionality of the indicator; it reflects not only the numerical readings of the lines, but also the readings of the senior TF. In addition, there are arrows in the direction of the last movement, and vertical paired signs indicating which lines of which currencies crossed. The last movement arrows are recorded movements on the penultimate bars - a very convenient function for visually identifying the beginning of a reversal at maximum or minimum values.

2 types of alerts are suitable for different cases: for some, the presence of intersections will be important, for others, they can monitor the position of lines relative to specified levels, and for others, both alerts will be useful. If they are not needed, they can be disabled optionally.

The number of bars drawn is a very useful feature not only for those who do not need to review the entire history, but also in order to save processor resources. In multi-currency indicators, calculations increase multiples due to the request for quotes not only for 28 currency pairs, but also for other financial instruments, if required. Therefore, limiting bars significantly saves time, resources and reduces the load on the terminal.

Use the Currency Strength Dynamic indicator as an addition to your trading system

Try also my other products in the market https://www.mql5.com/ru/users/capitalplus/seller