Job finished

Specification

Hello,

I would like 2 separate trading robots, one on the SELL SIDE and one on the BUY SIDE, that can execute (on most time frames, details below) the following strategy:

SELL SIDE

- When the spot price (close) goes above 2.5 Standard Deviation Channel (shown below) &

- When the spot price (close) goes above an RSI of 70 (standard 14 bar length) &

- When the spot price (close) goes above a Stochastic of 80 (%K period 5, %D period 3, slowing 3)

Below is a picture of the desired outcome – SELL SIDE

I do have this system running as an alert function in Think or Swim (TD Ameritrade) and the optimal lengthfor the Standard Deviation channel for each time frame is below:

15 Minutes - 480

1 Hour - 480

4 Hour - 1000

1 Day - 750

These are the ones that matter for my strategy. Please disregard other time frames. The above numbers are the number of bars that should be used for the Standard Deviation Channel.

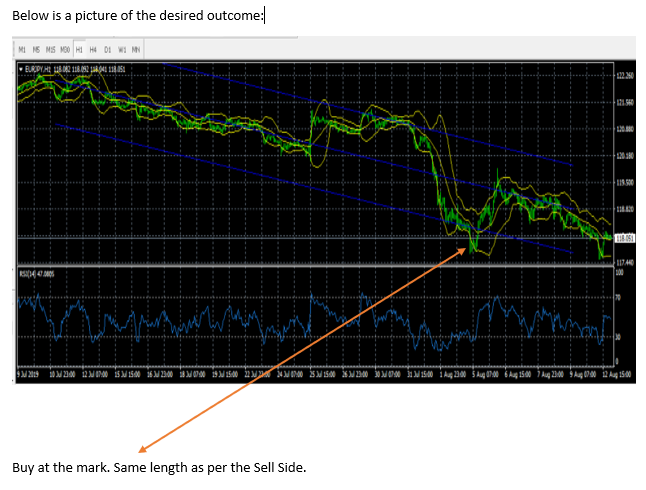

Please see below specifications for the BUY SIDE robot, which is similar in scope.

- When the spot price (close) goes below 2.5 Standard Deviations (shown below) &

- When the spot price (close) goes below an RSI of 30 (standard 14 bar length)

- When the spot price (close) goes below 2.0 on the Bollinger Bands

The idea here is to have an automated Standard Deviation Channel that readjusts the length with each moving tick going forward and executes the trades, buy and sell, once the price closes at the specified levels and meets the other conditions.

Other Specs

- Max of 2 Trades open at any time.

- Next Trade opening after 5 bars

- Trades Cannot be of the same LOT sizes, ideally, the first trade can be 0.1 Lot and second 0.2 Lot with the third trade going back down to 0.1.

- Take Profit of 50 PIPS (to test)

- Trailing STOP of 30 PIPS above break even

- No STOP LOSS