I think a better title for your topic would be "Are the days of high leverage over for US citizens" Certainly not affecting us down here at all.

Yes,

But the US does effect the decisions of other futures regulatory associations. I am Canadian myself but have clients from the US that I manage accounts for.

- forexmmm

You mean reducing leverage to 50:1 in 2010?

Yes, very true, but the Australian futures association is talking about this currently if you look up articles, and a few other countries.

This is something that is bound to effect retail Forex traders in the near future if other countries follow suit. The effects of the swiss bank closing still have brokers shaking at the knees.

It is in there best interest to lower leverage. Or at least to lower leverage over positions held on weekends when stop losses have no effect. (only one broker I know of lowers leverage over the weekends)

Two months after the CFTC made that a rule, Canada blindly followed suit and lowered leverage for Canadian brokers to the same amount.

I have friends that work for the CFTC that say they are strongly considering lowering leverage to 10:1.

- forexmmm

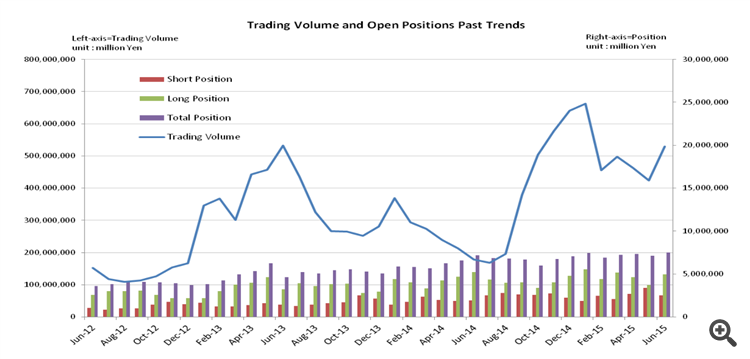

i think, if leverage drops, trading volume will also drop and will have impact on volatility in market.

Retail forex does not impact the forex market to any extent that would be noticeable in trading especially in regards to volatility.

Yeah I have read a few articles since January this year that have referred to the 10:1 drop. Can't say I've read anything about Australia following suit but yeah, that does worry me. Off to do some googling......

Considering stock trading (which I also trade on a daily basis) offers 2:1 leverage (maximum 8:1), the 10:1 leverage idea imposed by the CFTC does not seem out of reach.

This is something that can and will impact the Forex retail market greatly if put into effect. Not being a US citizen, but realizing the facts that whatever happens in the united states in regards to futures decisions, affects the rest of the world.

i think, if leverage drops, trading volume will also drop and will have impact on volatility in market.

Actually, I just read a few articles about when Japan dropped the leverage in 2011. 27% of retail traders said they would drop their volume but volume actually went up! As forexmmm said above, retail traders are a tiny part of the market.

To forexmmm: I've now now seen a few of the Oz articles you referred to which is a bit scary. However, I actually also found articles from back in 2011 when the FDIC proposed new legislation and even back then ASIC said that it was also looking at lowering leverage in Australia....but never did. Both fingers and toes now firmly crossed!

Yes. Both fingers and toes crossed as say! :P I couldn't agree more.

This is a growing concern as the retail Forex market continues to grow immensely on a daily basis.

Like I said before, I have many friends that work for both the NFA and CFHC that are all saying things are changing very soon, in regards to leverage.

Again, this is all a repercussions of what happened with the Swiss bank closing with no notice (putting many retail forex tradings in debt with brokers, and also brokers shutting down) and also due to retail Forex traders not fully understanding leverage.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

HI,

I have recently been reading that the CFTC is pushing to have US brokers lower leverage even further from 50:1 to 10:1.

This causes obvious problems for retail Forex traders in the US.

This is all caused from the aftermath of the Swiss bank closing at the beginning of the year and crashing the Swiss franc. (putting brokers out of business)

What this means is that any US resident that wants to trade retail Forex with an overseas broker has to have a broker that is governed by the CFTC which would limit there leverage to 50:1 anyways. (now maybe even 10:1)

As retail Forex gains in popularity the question is; AS the subject says. "Are the days of high leverage over?"

- Forexmmm