Brexit Likely to Boost UK Inflation, Keep BoE Cautious on Rates Inflation in Britain has been stuck below the official target of 2% since January 2014 and even dipped into deflationary territory on three occasions over the course of 2015. The largest downward pressured has come from sharp drops in oil and food prices. The pass-through effect on inflation from sterling’s 2013 strong appreciation has also fueled notable disinflationary pressures.

But sterling's foreign exchange rate reversed the trend in late 2014 and its depreciation has been accelerating even more since late 2015, mainly on the back of mounting Brexit concerns and the monetary divergence seen between the Bank of England (BoE) and the US Federal Reserve (Fed).

If the British currency continues this downward trend, which the majority of analysts expect it will ahead of the June 23 EU referendum, more expensive imports could push up on consumer prices in the UK.

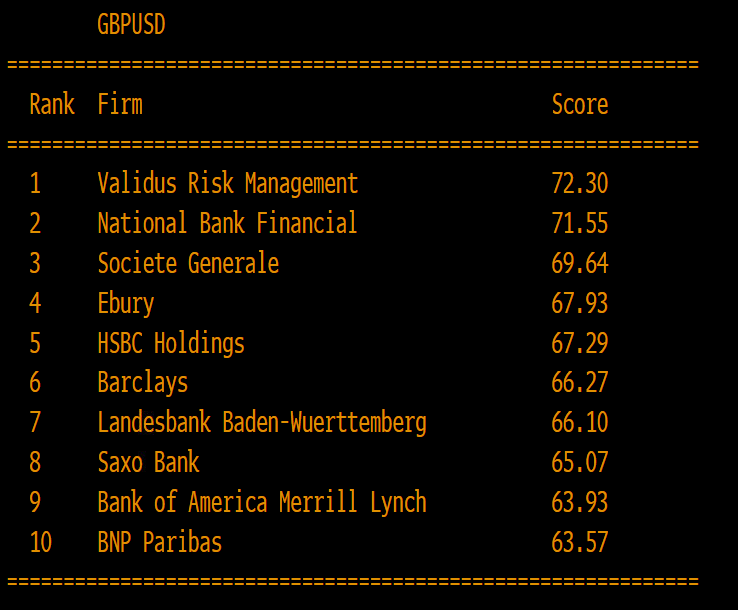

GBPUSD to drop 4% ahead of the Brexit vote says top pound forecaster Kevin Lester of Validus Risk Management is the best of the best when it comes to GBPUSD predictions, according to Bloomberg 1.3500 is where the pound could be ahead of the UK's EU referendum, according to a top pound forecaster. The 4% call was based on the price at 1.41.

If the UK votes out the quid could drop to 1.20, which would only be the starting point for further weakness.

Even if the UK votes to stay, that would be a good moment to short the pound as the BOE would still not be raising rates this year and are unlikely to be hawkish in any messages during the year.

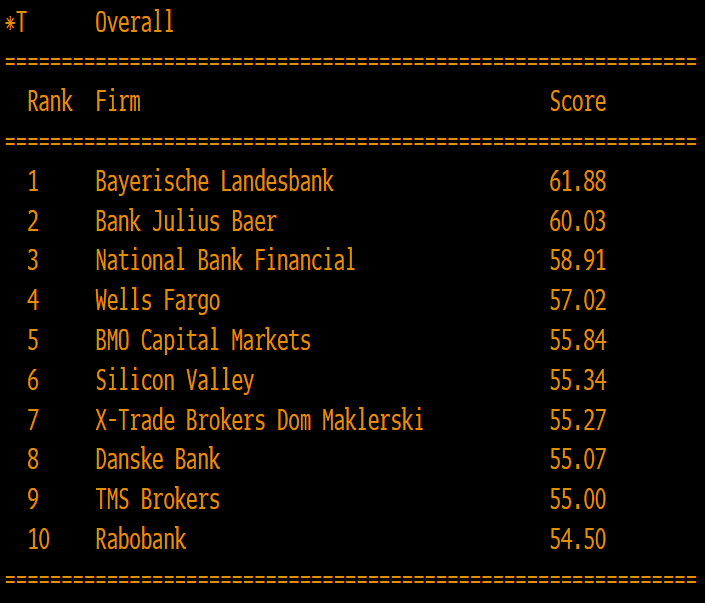

Bloomberg ranks forecasters on three categories, Margin of error, timing and directional accuracy. FYI here is the score card for GBPUSD and forecasting overall;

Cable has survived one test of 1.40 just now and it will need to reclaim 1.4050/55 pretty quickly if it's to sustain this bounce.

GBP/USD Weekly Outlook: Brexit Concerns to Hold Sterling in Vice-Like Grip The next week is expected to bring some bigger movements again and the pound might decline back below the psychological level of $1.40.

The UK macroeconomic calendar starts on Tuesday when inflation figures for March will be released, including CPI, PPI and RPI numbers. Inflation is expected to improve marginally and the data will be of a major importance for sterling traders.

On Thursday, the Bank of England is projected to leave monetary policy unchanged and the main rate should stay at 0.5%, with the annual pace of QE expected to stay at £375 billion. Moreover, all nine monetary policy committee members should vote unanimously for these measures to stay unchanged.

The pair remains extremely volatile and has been jumping up and down in the previous weeks as the uncertainty surrounding Brexit haunts the pound, but on the other hand, the unexpected dovishness by the Federal Reserve (Fed) has undermined the greenback. This trend will most likely continue in the days ahead.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

BMG poll Another poll puts the Brexit side with a slight lead. It was an online poll so it doesn't carry much weight.