One Of Janet Yellen's Favorite Monetary Policy Models Points To A Rate Hike This Year

Federal Reserve Chair Janet Yellen has said the tenor of economic data will decide when the U.S. central bank raises interest rates. Surprisingly, a data analysis based on Yellen's own priorities points to a rate increase by the end of this year.

Yellen has cautioned that the economic models built for policymakers amount to mere guideposts in a complicated decision-making process.

But she also has placed special emphasis on a set of equations for what she dubbed in a November 2012 speech as "optimal policy" or "optimal control." The equations mimic the churning of a vast economy and project a rate path that gives equal importance to meeting the Fed's twin goals of maximum employment and stable prices.

Last Friday, Fed economists said in a note that they had updated the model, and the new version suggests the central bank should tighten policy enough to have the federal funds rate average 0.33 percent in the October-December period of this year.

The Fed has kept the rate, which governs overnight lending between banks, in a zero to 0.25 percent range since late-2008.

However, it's clear the Fed is not following this model.

Several top officials have said they are not likely to bump rates up until the middle of next year, and to meet the 0.33 percent average would require an extremely sharp hike at the Fed's next and last meeting of the year on Dec. 16-17.

Even the note's authors are wary of policymakers leaning too heavily on their calculation because economic models by nature oversimplify a complex world. The assumptions that go into them can easily prove to be wrong.

"(Optimal control) paths should be treated with appropriate caution as a guide to actual policy," Fed economists Flint Brayton, Thomas Laubach and David Reifschneider wrote. ((FRB: FEDS Notes: Optimal-Control Monetary Policy in the FRB/US Model))

Yellen made waves in the 2012 speech by describing a computer simulation of optimal policy that suggested waiting to raise the fed funds rate until around the first half of 2016 to more quickly push down unemployment. Under this plan, inflation would be allowed to run above target for several years.

But as it turned out, the jobless rate came down more quickly than Yellen or most anyone else anticipated, while inflation has persisted well below the Fed's 2 percent target.

That has puzzled economists as tightening labor markets are supposed to push prices higher. In a second note, another group of Fed economists said they had tweaked the Fed's flagship economic model to make inflation less sensitive to changes in labor market slack.

Brayton, Laubach and Reifschneider re-ran Yellen's 2012 computer simulation with minor changes and using the updated flagship model, which spit out an earlier liftoff for rates.

While they did not release a full methodology of the simulation, earlier this month the Fed responded to a Freedom of Information Act request from Reuters by releasing the computer programs Yellen used to calculate optimal policy in her 2012 speech, which was made when she was the Fed's vice chair.

FORGET GDP: Here's the new way Wall Street is measuring the US economy

Move over GDP, GDI is the new and improved way everyone is measuring the economy.

GDP, or gross domestic product, is the most widely cited measure for the economy's overall health and trajectory. On Friday, we found out that the second estimate of GDP in the first quarter showed that the economy actually contracted 0.7% to start 2015.

But a number of Wall Street economists pointed to GDI, or gross domestic income, as giving us a better picture of what's really going on out there.

In the first quarter, GDI rose 1.4%.

The basic difference between the two is that GDP measures what the economy produces — goods, services, technology, intellectual property — while GDI measures what the economy makes, tracking things like wages, profits, and taxes.

In a note to clients following Friday's report, Kris Dawsey, an economist at Goldman Sachs, called GDI a "useful cross-check on the often-noisy quarterly GDP figures." Over the prior year, real GDI — which is adjusted for inflation — rose 3.6% in the first quarter, which Dawsey noted is near the top end of the range seen during the post-crisis recovery.

Paul Ashworth at Capital Economics wrote that, "We would view [GDI] as a much more accurate gauge of the economy's true performance over the [first] three months of this year."

And in comments following Friday's report, Jason Furman, Chairman of the White House's Council of Economics Advisors, also highlighted the solid GDI print and noted that starting in July, the Bureau of Economic Analysis will publish an average of GDP and GDI.

This measure showed the economy grew 0.3% to start the year.

There is a question, of course, surrounding why GDI has become en vogue now, given that GDP has been the relied-upon measure of economic growth over many years by politicians and economic policymakers alike.

Skeptics would likely cite a desire by those (read: the government) who simply won't acknowledge that the economy actually stinks to "move the goalposts," changing the conversation to fit a narrative that is simply untrue.

But there are actual, substantive reasons for economists and market participants to focus on GDI rather than the traditional GDP number. In theory, the two numbers should be the same, as both are designed to measure the aggregate growth of the economy. GDP measures what the economy produces, GDI measures what it takes in.

But because they use different data sources, these readings are subject to measurement error, though the BEA notes they tend to follow similar paths over time.

A main difference in their inputs is tax receipts, with GDI taking into account taxes on production and imports, as well as subsidies, net interest, and miscellaneous payments.

(The first estimate of Q1 GDP was released on April 29; that reading showed the economy grew by just 0.1% to start the year.)

In the first quarter, US federal tax receipts increased by 8.6% over the prior year, which does not point to an economy heading for a recession or even a serious slowdown. In comparison, year-over-year tax receipts declined for eight quarters during the financial crisis and were down on an annual basis for years after the 2001 recession.

If GDI rose, why did they push the Euro up?

June Fed hike still off the table, but get ready for autumn move

The strong jobs report released Friday does not put a June move by the Federal Reserve back on the table, economists said, but it does make an autumn move much more likely.

The U.S. economy added 280,000 jobs in May, above expectations of a gain of 210,000. The unemployment rate ticked higher to 5.5% as more people entered the labor force in search of work.

John Canally, chief economist strategist for LPL Financial, noted that the three-month average for job gains is 207,000, still below the average job gains of 260,000 in 2014.

“There is no way they are going to tighten in June,” Canally said in an interview.

But get prepared for a rate hike as the leaves start to turn, and maybe earlier. The Fed fund futures contract is now signaling the first rate hike occurring in October, two months ahead of what had been expected prior to the release of the jobs report.

The report does ease some fears that the economy might remain soft following the weak first quarter, said Thomas Simons, economist at Jefferies, in a note to clients.

Paul Ashworth, chief U.S. economist at Capital Economics, said he thought a move would come before December.

“Overall, at this stage this evident strength in the labor market probably isn’t enough to persuade the Fed to hike rates by July, but it definitely makes a rate cut by September probable,” Ashworth said in a note to clients.

Rob Carnell, chief international economist at ING, said that a third quarter rate hike “still looks a decent bet, and could be either July or September.”

Chris Williamson, chief economist at Markit, said that a September rate hike is “firmly on the table.”

Canally was in disagreement, saying his best guess for a rate increase is still December.

Economists said the Fed was unlikely to follow the advice of the International Monetary Fund, which just that week counseled that the U.S. central bank wait until 2016 to move.

Fed's Yellen Stands Firm in Pledge to Hike by Year-End

The Chair of the Federal Reserve Janet Yellen reiterated on Thursday that the first increase of benchmark short-term rates is likely to come before the end of the year and will be followed by a very gradual tightening of monetary policy over the next few years.

Speaking at the University of Massachusetts's annual Philip Gamble Memorial Lecture, she said in her prepared remarks that most FOMC participants, including herself, are anticipating the economic picture "will likely entail an initial increase in the federal funds rate later this year, followed by a gradual pace of tightening thereafter."

Yellen spoke a week after she and her colleagues on the Fed's main rate-setting committee decided to keep monetary policy unchanged due to heightened risk to the economic outlook. Policymakers wanted to study how macro-data will behave following the spike in financial market volatility seen after the Chinese currency devaluation.

In particular, they were concerned that further drops in prices of raw materials such as crude oil in reaction to weaker global growth forecasts would result in further disinflationary pressures.

Price growth has been below the Fed's 2% target for quite some time and has fallen even further after last year's oil price shock and dollar appreciation.

Again : a war of the words  and nothing else

and nothing else

Why US Rates Can Never Rise: In 1 Awkward Chart

Just before the FOMC decided to not decide last Thursday, we asked if the scuffle depicted below was Japanese lawmakers’ attempt to act out what they imagined might go on in the Eccles Building during what was billed as the most important Fed decision in recent history:

We went on to note that Japan - which, you're reminded, is the poster child for Keynesian insanity with a debt load that now totals ¥1,057,224,000,000,000 - tried to raise rates at one point, only to reverse course within seven months.

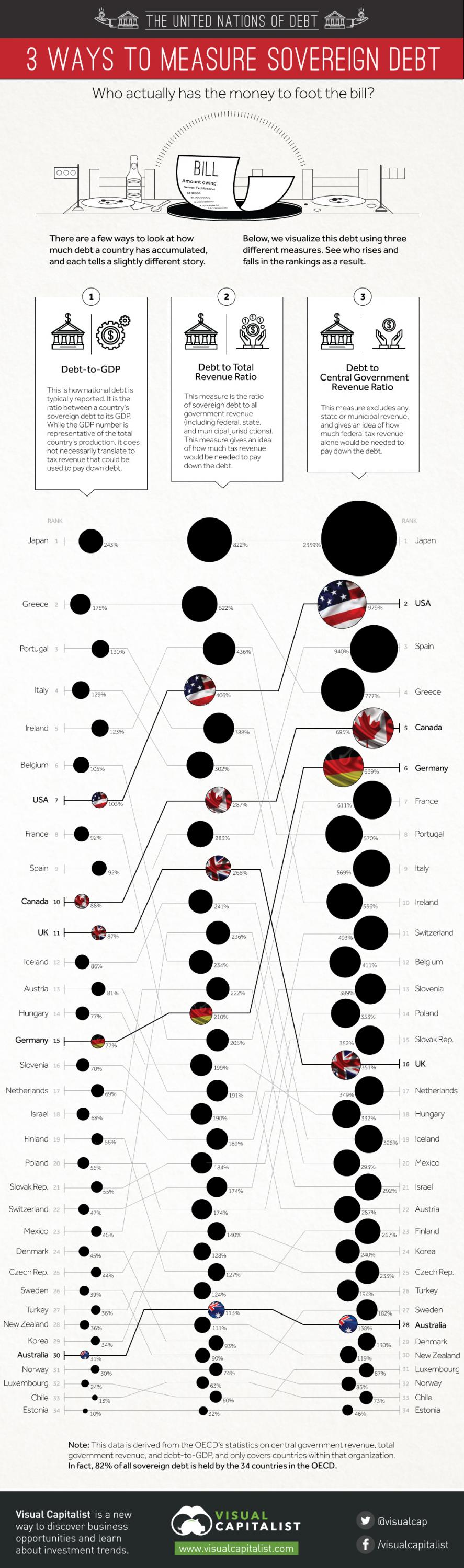

Now that the Fed is allegedly set to hike at some point in the not-entirely-distant future, and now that Japan has completely lost its mind and declared that despite Abenomics' abysmal and demonstrable failure, the economy will somehow expand at a 20% clip going forward, we thought this an oppotune time to demonstrate, with one helpful infographic, why the US can never raise rates. Put simply: the US is second only to Japan on the list of countries with the worst debt to central government revenue ratios.

Whatever Yellen and Bullard tell, the story ended long time ago. Again : Ben Bernanke told that FED will not turn back to normal rates while he is alive (and he is not a too old man)

Latest forecast (by Citibank) : not before march 2016 (and that is optimistic)

Fed Presidents Set to Hit Hike Button in 2015

The Federal Reserve's (Fed) regional presidents have stepped up their verbal activity in the weeks following the Federal Open Market Committee's (FOMC) September meeting. While there was great debate whether the Fed would begin its interest rates normalization at the September meeting, the decision in the end was pretty straight forward. All but one FOMC member voted in favor of keeping the rates unchanged, pointing to various risks including China.

In the weeks after the September FOMC meeting, the verbal activity from Fed members now seems to be pointing to a rise in rates this year, although various risks cloud the outlook.

With some Fed regional presidents and/or Board of Governors members favoring immediate lift-off, while others favor the so called "wait-and-see" attitude, let's sum up the views in the post September FOMC meeting period to see whether it is hawks, procrastinators or doves that will prevail during the year's two final meetings in October and December.

Hawks

The hawks see economic conditions justifying an immediate rate hike, with Jeffrey Lacker (FOMC voting member), James Bullard (FOMC voting member in 2016) being the most active promoters of tighter monetary conditions so far this year.

In the post-September FOMC world, both Lacker and Bullard stand clearly in favor of an immediate interest rates hike.

Richmond Federal Reserve president, and the only dissenter voting in favor of rate hike at September FOMC meeting, Jeffrey Lacker explained his views soon after reasoning that labor market conditions have steadily improved and the negative real short-term interest rates support consumption and spending.

Jeffrey Lacker was joined in view by St. Louis Federal Reserve Bank President James Bullard who said that the FOMC should not react to financial market volatility, keeping October or December rate hike expectations alive.

"There's a powerful case to be made that it's time to raise interest rates. And the case is not complicated ... policy settings are an emergency. The economy itself, the goals of the committee, have essentially been met," Bullard said on September 21.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The economy added to its jobs streak today.

Nonfarm payrolls were up 214,000 in October, according to the Bureau of Labor Statistics. The unemployment rate dropped to 5.8%, the lowest it has been since the summer of 2008.

While the headline numbers are good, wage growth is still stagnant, rising only 2% year-over-year. As a result, Wall Street thinks this means the Fed won't feel too much pressure to raise interest rates sooner than anticipated.

From a note to BNP clients: "Today’s employment report is likely to keep the FOMC on track to hike rates around Q2 2015 – with risks for earlier or later roughly balanced."

Captial Economics' Paul Ashworth shared the same sentiment: "Admittedly, the Fed doves could still cling to the news that, despite the decline in the unemployment rate, there is still no sign of a pick -up in average hourly earnings, which increased by a muted 0.1% m/m last month."

read more