GOLDMAN: Here Are 3 Reasons Why The Fed Won't Taper Next Week

A slew of strong better-than-expected economic data has economists increasing the odds that the Federal Reserve will announce the tapering its $85 billion quantitative easing program at the conclusion of its FOMC meeting on Wednesday December 18."It's still a close call, but chances are now above 50 percent that the Federal Reserve will modestly reduce its asset purchases later this month," said Potomac Research Group's Greg Valliere who was communicating the analysis of former Fed Vice Chair Don Kohn. "There's a 60-40 chance that the FOMC will decide on Dec. 18 to begin tapering."

However, a December tapering announcement is not the consensus. Most economists don't expect a tapering announcement until January or March.

Goldman Sachs' David Mericle explains three reasons why in a new 9-page note to clients.

- Economic Data: "...the data since October is mixed at best. The strongest argument in favor is the improvement in the trend rate of payroll growth to the 200k level. However, we expect that Fed officials will also put considerable weight on inflation, which has fallen further in recent months."

- Communication: "...we continue to expect that tapering will be offset by a strengthening of the forward guidance, but we doubt the FOMC is ready to take this step. While some eventual strengthening or clarifying of the forward guidance is now a consensus expectation, the October minutes and recent Fed commentary suggest little agreement on what form this should take."

- Expectations: "...while consensus expectations now place greater probability on a December taper, it remains a minority view. We suspect that this makes a move less likely, as Fed officials will be reluctant to deliver a hawkish surprise that could tighten financial conditions and raise doubts about their commitment to the inflation target."

Why QE Isn't Working: Bridgewater Explains

In the past we have explained how QE continues to "fail upward" because instead of injecting credit that makes its way into the economy, what Bernanke is doing, is sequestering money-equivalent, high-quality collateral (not to mention market liquidity) - at last check the Fed owned 33% of all 10 Year equivalents - and by injecting reserves that end up on bank balance sheets, allows banks to chase risk higher in lieu of expanding loan creation. Alas it took a few thousands words, and tens of charts, to show this. Since we always enjoy simplification of complex concepts, we were happy to read the following 104-word blurb from Bridgewater's Co-CEO and Co-CIO Greg Jensen, on how QE should work... and why it doesn't.

The effectiveness of quantitative easing is a function of the dollars spent and what those people do with that money. If the dollars get spent on an asset that is very interchangeable with cash, then you don’t get much of an impact. You don’t get a multiplier from that. If the dollar is spent on an asset that’s risky and very different from cash, then that money goes into other assets and into the real economy. That’s really how you see the impact of quantitative easing. What do they buy? Who do they buy it from? What do those people do with that money?

Of course, this is why sooner or later the Fed will proceed to "monetize" increasingly more risky, and more non-cash equivalents assets, until "this time becomes different." Which it never is, but the Fed will still try, and try and try.

Why the Federal Reserve must taper quantitative easing before Christmas

Just do it. That's the message for the Federal Reserve as it decides this week whether its Christmas present to the American people should be to start scaling back on the $85bn (£52bn) in newly minted electronic money it is chucking at the American economy each month.

Wall Street thinks – and hopes – an announcement this week is unlikely. Financiers have enjoyed the Fed's gigantic monetary experiment. They have exchanged Treasury bills and mortgage-backed securities for cash, which they have used to play the global markets.

Main Street has not done so well out of the Fed's quantitative easing programme. Indeed, by helping to generate speculative increases in commodity prices QE has squeezed disposable incomes and done as much harm as good.

Back in September, the US central bank bottled a decision to wind down the programme and the markets believe the Fed will find an excuse for delaying again. March is now thought to be the time for tapering to begin. By that time, the new chairman of the Fed, Janet Yellen, will have her feet under the table. There may be stronger proof from the labour market by the spring that the world's biggest economy is on the mend.

In truth, this Wednesday is as good a time as any for the Fed to make a start on its taper. The US economy is recovering; QE has been of questionable use; there are long-term risks in keeping the programme in place for too long; the financial markets are calm. The reasons for further delay are not especially good ones.

The decision the Fed is making this week is not about whether to tighten policy. It is not even about removing the stimulus. It is about reducing the amount of stimulus, bit by bit. The Fed will probably start by cutting its asset-buying programme by $10bn a month. The difference will be imperceptible, not least because the judgment on QE will be that it was worth a try and helped initially to put a floor under the economy but has delivered less than promised.

Fed Taper Message Succeeds as Bonds Adjust to Economic Data

After misleading investors with a time line for tapering its unprecedented stimulus, the Federal Reserve now is stressing that any reduction in bond purchases will depend on the economic outlook -- and the message is sinking in.

Officials surprised traders and roiled markets across the globe on Sept. 18 by maintaining their $85 billion in monthly asset purchases. Investors had clung to Chairman Ben S. Bernanke’s May guidance that he might taper “in the next few meetings” of the policy-making Federal Open Market Committee, ignoring the weakest back-to-back months for payroll gains in a year and a jobless rate that was falling partly because workers were leaving the labor force.

The Fed since then has emphasized that changes are “not on a preset course” and hinge on the economy. The result: When unemployment dropped to a five-year low of 7 percent in November, the odds doubled that the central bank would begin tapering its bond buying this week, a Bloomberg survey showed.

“A lot of people, including myself, are now looking at the data and saying, ‘Okay, if that’s the way they want to go,’” said John Silvia, chief economist at Wells Fargo Securities LLC in Charlotte, North Carolina. Before September, “all of this talk about tapering without the context of the numbers threw the market off.”

FED will not taper. They are playing the same old game with us again

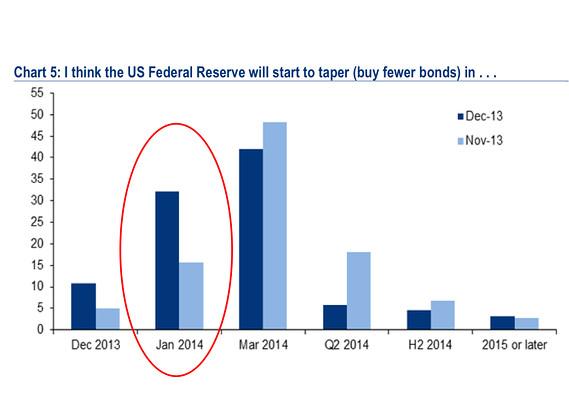

Only 11% of fund managers see a taper this week

Bank of America Merrill Lynch Fund managers are looking past Wednesday and into the new year for a Fed taper — all the way out to March. That’s the view of managers polled by Bank of America Merrill Lynch in its monthly survey.

Just 11% of fund managers are braced for a potential taper this week — 32% expect the move in January and 42% in March. Even so, tapering seems to be causing no alarm among managers as 71% expect a stronger economy.

(A Wall Street Journal poll of economists found that a quarter see a taper coming on Wednesday, while a Bloomberg poll found that 34% expect a tapering to come from the wrap of that Fed meeting.)

Marc Faber Warns The Fed "Will Never End Its Insane Policies"

"The Fed will never end QE for good..." blasts Marc Faber, "they may do some cosmetic adjustments, but within a few years, [Fed] asset purchases will be substantially higher than they are today." There will be another weakening in the US economy, Faber warns, and "the Fed will argue it hasn't done enough and will do more... they have been irresponsible for 20 years."

Noting that investors should "not buy stocks but be in cash", the stunned CNBC anchor exclaims "How could you sit in cash when th emarket is on fire and interest rates are so low?" to which Faber blasts, "The market is not on fire, look at IBM, Cisco, and Intel - all lower than 2011; it's on fire if you are in Facebook or Twitter and not everyone owns them."

Use rallies to reduce exposure, he warns, "we will go up until it is over; and when it is over the drop will be larger than 20%"

On The Fed

"They will never end QE for good... they may do some cosmetic adjustments, but within a few years, [Fed] asset purchases will be substantially higher than they are today""Do not forget, the stock market and the so-called economic recovery will be in its 5th year... and at some point the economy will weaken again. The Fed will argue it hasn't done enough and will do more"

On Money Printing

If money printing can truly enrich the world, we should all be on the beach! Money printing does not create wealth but that's what the Fed thinks.

On the Fed's ability to spot bubbles,

Faber analogizes the members sat on top of a barrel of dynamite covered in gasoline and lighting a cigar..."and still not notice any danger.""The members of the Fed have never worked a single day of their lives in business" and are blind to the real world impact of the policies.

"They have been irresponsible for at least 20 years," by creating one bubble after another and "bailing out institutions that should have failed

Fed Decision Day Guide From Tapering QE to Employment Thresholds

Here’s what to look for when the Federal Open Market Committee releases its statement today at 2 p.m. after a two-day meeting in Washington. The panel will also provide new economic forecasts, and Federal Reserve Chairman Ben S. Bernanke will hold a news conference at 2:30 p.m.

-- Taper on tap? Economists are divided over whether the Fed will decide today to reduce its $85 billion monthly pace of bond purchases, with some saying that recent economic data is strong enough to warrant a move, and others that policy makers need to see more evidence that growth is durable.

-- “There is little reason for the Fed to delay tapering,” Joseph Lavorgna, chief U.S. economist at Deutsche Bank Securities Inc. in New York, said yesterday in a note to clients. He cited better-than-expected employment data for October and November and “second-half output poised to average over 3 percent.”

-- Guy Berger, an economist at RBS Securities Inc. in Stamford, Connecticut, says March is a more likely date. “There’s no doubt that the doves feel more comfortable with tapering than they did three months ago, but certainly not enough that it makes you think tapering is imminent,” he said in an interview, referring to policy makers who favor pressing on with accommodation.

-- Any reduction today in monthly bond buying would probably be “gentle,” shaving as little as $5 billion from monthly purchases, according to Ward McCarthy, chief financial economist in New York at Jefferies LLC.

would these news reports not be better off in the Traders Joking thread ?

what the FED fails to realise - is no actually cares whether they taper or not

traders only care about price and what its says on the charts

but it is a source of amusement, and something to fill the financial news programs and financial New events

and helps keep the public and some traders bemused

the Central Bank talks and their opinions can only be viewed as massive over market manipulation and control, as there are far too many for it to be anything else and presumably the largest Market makers encourage the many speeches

especially as they get the notes in advance of the meetings

it could be worse i suppose, although not sure how, but it could be.....

would these news reports not be better off in the Traders Joking thread ?

what the FED fails to realise - is no actually cares whether they taper or not

traders only care about price and what its says on the charts

but it is a source of amusement, and something to fill the financial news programs and financial New events

and helps keep the public and some traders bemused

the Central Bank talks and their opinions can only be viewed as massive over market manipulation and control, as there are far too many for it to be anything else and presumably the largest Market makers encourage the many speeches

especially as they get the notes in advance of the meetings

it could be worse i suppose, although not sure how, but it could be.....I think that better name would be "FED joking" and that is why this is a separate thread. To keep all about taper by FED in one place

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The Federal Reserve, already exhausted after a year of missteps in the spotlight, has one last trick to pull off before it exits the stage — getting out of the controversial bond-buying business without causing long-term interest rates to soar.

“The Fed wants to gracefully exit [quantitative easing] while holding down bond yields for another year,” said Avery Shenfeld, chief economist of CIBC World Markets.

The Fed hasn’t settled on how to do this — several ideas seem to be under active consideration — and this could delay any taper of its $85 billion-a-month bond purchase program until next year, Shenfeld said.

Mark Gertler, a New York University economist who worked closely with Fed Chairman Ben Bernanke, agreed with Shenfeld.

He said U.S. central bankers already think long-term interest rates are higher than they should be at this stage of the recovery.

“They are trying to pick the right stage of the recovery” to taper, and where interest rates are is a big factor, Gertler said.

The labor market remains weak and inflation is well-below target, Gertler said.

The yield on 10-year Treasury notes spiked this summer when markets believed Bernanke was signalling an imminent tapering.

Although yields have come down since the initial alarm over tapering but have not returned to prior low levels.

Lou Crandall, chief economist at Wrightson ICAP, said the Fed is struggling to communicate because the bond-buying program is an experiment.

“They can’t provide more clarity,” he said.

read more