Wall Street: Main bout debt limit, not shutdown

As fights go, Wall Street views the slugfest between Democrats and Republicans over the government shutdown as the undercard event. The main bout is the coming showdown over raising the debt ceiling and making sure the U.S. has enough cash to pay its bills and avoid the unthinkable: defaulting on its debt.

"The shutdown is a sideshow," says Brian Belski, chief investment strategist at BMO Capital Markets. "It's all about the debt ceiling and potential default."

There's a big difference between the hit to confidence and the economy due to the government temporarily closing for business, and the more serious threat of putting the full faith and credit of the USA at risk.

On Thursday, which marked Day 3 of the government's partial shutdown, volatility in the stock market began to rise. The Dow Jones industrial average fell more than 180 points before finishing down 137 points and below 15,000. Fears of a drawn-out fight over the shutdown have shifted to worries that Congress won't agree to bump up the nation's borrowing limit in time to avert disaster. The U.S. Treasury said it will be virtually out of cash on Oct. 17.

Still, there's a belief on Wall Street that the consequences of the U.S. not meeting its financial obligations would be so devastating to the economy and markets that there's virtually no way Congress will allow the first-ever U.S. default.

The U.S. not making timely interest and principal payments to holders of U.S. government debt is "the single most bearish scenario," says Adam Parker, chief U.S. equity strategist at Morgan Stanley. And Congress knows that.

The Doomsday scenario of a U.S. default

Debt fears mount

Call it the Doomsday scenario.

On the third day of the Washington shutdown, fears mounted on all fronts of what may lie ahead amid the political stalemate that has crippled the U.S. government.

The U.S. Treasury Department warned today that a default could be “catastrophic,” The Financial Times reported that two major American banks are putting extra money into ATMs, and market analysts warned of trouble on major exchanges already hit by concerns.

With no resolution in sight, Oct. 17 looms large for the issue of raising the debt ceiling. That’s when Treasury officials say the government will be tapped out.

“If Congress doesn’t reach an agreement to raise the debt ceiling before the U.S. Treasury runs out of ways to keep the ‘essential’ parts of the government running – sometime around the middle of the month – then the U.S. may not have enough cash to meet (among other requirements) a debt interest payment of about $30-billion on 15 November, potentially triggering a technical default,” warned Jessica Hinds of Capital Economics.

While a default seems unthinkable, the Treasury Department went so far today as to release a six-page report warning of the consequences.

Indeed, the department said, “political brinksmanship” that results in the prospect of a default can mean big trouble.

“A default would be unprecedented and has the potential to be catastrophic: Credit markets could freeze, the value of the dollar could plummet, U.S. interest rates could skyrocket, the negative spillovers could reverberate around the world, and there might be a financial crisis and recession that could echo the events of 2008 or worse,” the department said.

The report concludes by elaborating on “or worse” by noting that “the result then was a recession more severe than any seen since the Great Depression.”

According to reports in the United States, Speaker John Boehner told Republicans he would not allow things to go that far.

The Treasury department also recalled the events of the last fight over the debt ceiling, in 2011, when markets were stressed, job creation faltered, and S&P stripped the U.S. of its triple-A rating.

“To be sure, other forces also played a role, but the uncertainty surrounding whether or not the U.S. government would pay its bills took a toll on the economy,” the report said.

Catastrophic Consequences of a U.S. Default Explained

As we close out the first week of the government shutdown, a bigger and even more toxic disaster is creeping into the fray that could make the contentious budget battle look like a slap fight. The Treasury Department said Uncle Sam will be broke by October 17th unless something is done. Treasury secretary Jack Lew hammered home that point Thursday by releasing an unusually ominous statement that warned of catastrophic risks to the economy.

House Speaker John Boehner has said he won't let the government default on its debt, but until steps are taken to raise the nation's debt ceiling, the possibility of default is still theoretically alive.

"If they seriously default on the debt, what we're really talking about is a depression," says veteran financial sector analyst Richard Bove, VP of research at Rafferty Capital Markets. In the attached video he explains how the fallout would be a lot worse than the recession suffered in 2008 and the aftershocks would be felt for at least a decade.

"The first thing you have to do is look at who holds the debt," Bove says of the $16.7 trillion of bonds the U.S. currently has outstanding. "The first, biggest owner (of U.S. debt) is the social security fund, so you'd have all of these people who are receiving social security payments who now have to question whether they'll get their payments."

Clearly, that would cause a huge disruption to millions of Americans. But Bove says that is only the beginning since the second biggest holder of Treasuries (at about 12% of the total) is the Federal Reserve, which has "91% of its assets backed by U.S. government debt."

If the value of those assets were to decline, which they indisputably would in a default, Bove says the net effect would be that "we have nothing of value backing the dollar."

They're actually "Federal Reserve Notes" as well as the number one asset of choice held in the reserves of governments and businesses all over the world. A plunge in Treasuries would also devalue the dollar, which would instantly make everything we buy more expensive, and in turn destabilize countries and economies all over the world.

"Eleven-percent of all U.S. debt is owned by the Chinese," he says. "That $1.4 trillion represents about a third of the reserves of the People's Bank of China, so what we've now said to the PBOC is, 'Watch out, we may hit the value of a third of your assets and you can't do anything about it.'"

Investors bet on a U.S. default

Want to bet against the "full faith and credit" of the United States government?

A few financial institutions are doing just that -- betting the government will default on its debt if Congress can't agree to raise the debt ceiling this month.

If the U.S does default, they could reap a total payout of around $3.4 billion.

Sound like a lot? Actually, investors seem less convinced that a default will occur this time around than they were during the last big debt ceiling scare in the summer of 2011. Back then, they held contracts that would have paid out about $5.6 billion in the event of a default, according to the Depository Trust and Clearing Corporation.

Here's how it works: Financial institutions can buy what essentially amount to insurance contracts that protect against a government default.

These securities, called credit default swaps or CDS, cost a 0.34% premium to insure against the government defaulting in the next year. That means an investor pays about 34 cents for every $100 of potential payout they would receive in the event of default.

But it's not quite that simple.

First, these contracts are only available to institutional investors.

Second, credit default swaps on U.S. debt are usually priced in euros, because if the United States defaults, who wants to be paid back in dollars?

Treasuries Becalmed as Debt Cap Approaches With Gross Buying

The world’s biggest investors are finding U.S. government bonds becoming safer, not more risky, as the deadline to avoid the first American default approaches.

The yield on 10-year U.S. bonds dropped to a two-month low of 2.58 percent on Oct. 3, after Treasury Secretary Jacob J. Lew said the government won’t be able to pay its debts in 14 days unless Congress raises the $16.7 trillion borrowing ceiling. While short-term bill rates and the cost to insure against a default have risen, volatility in Treasuries has fallen, a sign that investor confidence in the Federal Reserve is outweighing worries over the budget battle among U.S. political leaders.

BlackRock Inc. (BLK) Chairman and Chief Executive Officer Laurence D. Fink and Pacific Investment Management Co. Co-Chief Investment Officer Bill Gross, who lead the world’s biggest bond firms, dismiss the possibility of a default after the first government shutdown in 17 years as House Republicans failed to agree on a budget with Senate Democrats and President Barack Obama. With the closures shaving at least 0.1 percent off economic growth each week, Fed policy makers said they will probably keep buying $85 billion a month of bonds.

“The dysfunction in Washington just makes the Fed more likely to be supportive of the market,” Mark MacQueen, a partner and money manager in Austin, Texas, at Sage Advisory Services Ltd., which oversees $11 billion, said in a telephone interview Oct. 1. “We should stick to the underlying economic fundamentals and not worry about 72 hours in Washington. The real fear of a major rate increase is diminishing as long as this nonsense continues.”

U.S. Congress enters crucial week in budget, debt limit battles

As the U.S. government moved into the second week of a shutdown on Monday with no end in sight, a deadlocked U.S. Congress also confronted an October 17 deadline to increase the nation's borrowing power or risk default.

Republican House of Representatives Speaker John Boehner vowed not to raise the U.S. debt ceiling without a "serious conversation" about what is driving the debt, while Democrats said it was irresponsible and reckless to raise the possibility of a U.S. default.

The last big confrontation over the debt ceiling, in August 2011, ended with an 11th-hour agreement under pressure from shaken markets and warnings of an economic catastrophe if there was a default.

A similar last-minute resolution remains a distinct possibility this time.

Equities investors were unnerved by the apparent hardening of stances over the weekend, with European shares falling to a four-month low on Monday. U.S. stock futures pointed to lower open, with S&P 500 futures down nearly 1 percent.

In comments on Sunday television political talk shows, neither Republicans nor Democrats offered any sign of impending agreement on either the shutdown or the debt ceiling, and both blamed the other side for the impasse.

"I'm willing to sit down and have a conversation with the president," said Boehner, speaking on ABC's "This Week." But, he added, U.S. President Barack Obama's "refusal to negotiate is putting our country at risk."

On CNN's "State of the Union" program, Treasury Secretary Jack Lew said: "Congress is playing with fire," adding that Obama would not negotiate until "Congress does its job" by reopening the government and raising the debt ceiling.

China, the biggest holder of U.S. Treasuries, urged Washington to take decisive steps to avoid a crisis and ensure the safety of Chinese investments.

China To U.S.: 'Clock Is Ticking' On Deal To Avoid Default

A top Chinese official chided Washington on Monday about the government shutdown and the debt-ceiling impasse, fretting that the political gridlock could leave the economy of America's top foreign creditor in a jam.

Vice Finance Minister Zhu Guangyao told reporters that he understands the White House is working to resolve the double-edged crisis, but expressed impatience with the lack of progress.

"We have to see that the clock is ticking," Zhu said, according to Agence France Presse.

"The executive branch of the U.S. government has to take decisive and credible steps to avoid a default on its Treasury bonds," he said.

China holds $1.2 trillion in U.S. Treasury bonds, more than any other country. It also wants to protect its U.S. investments — $54 billion last year alone, according to one estimate.

Meanwhile other world leaders Monday were also voicing concern over America's internal strife.

At the Asia Pacific Economic Cooperation meeting in Indonesia on Monday, some present took on the issue of the U.S. government shutdown — and President Barack Obama’s absence at the summit.

Russian President Vladimir Putin said Obama was justified to skip the event given the issues he faces domestically.

“We see what is happening in U.S. domestic politics and this is not an easy situation,” Putin said, adding, “If I was in his situation, I would not come, either.”

But others were not as gracious. Malaysian Prime Minister Najib Razak said Obama had missed “a golden opportunity” to show regional leadership by skipping the summit.

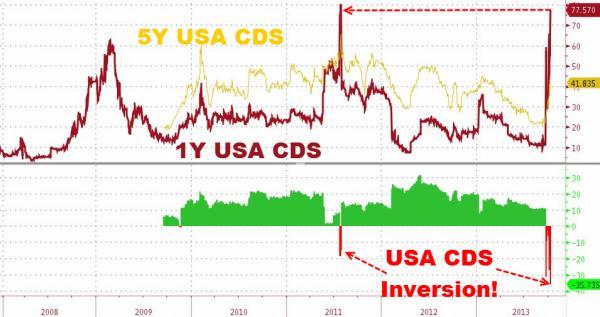

US Treasury Default Risk Hits 2011 Highs

Not much comment necessary on a topic we have beaten to horse pulp in the past 2 weeks aside to note thatthis time is ironically different from 2011 as the inversion in the CDS curve is considerably more biased to a piling up of short-term default risk than in 2011.

[Sure enough as we warned last night, we are seeing the longest-dated "Cheapest to deliver" Treasuries well bid as tradesr prepare for a potential CDS trigger in sovereigns - watch the 2.75s of Aug 2042 and the 2.75s of Nov 2042]

T-Bill rates exponentially rising (10/17 +20bps at 48bps!!) - no worries... Fidelity selling all its short-term Treasuries - not a problem... Repo markets starting to panic - have no fear... CDS markets signaling extreme short-term default concerns - baah humbug.... We have a solution for that - Janet Yellen's "buyback" plan.

Republicans push six-week debt limit hike

Proposal wouldn’t reopen government; White House calls debt plan ‘encouraging’

House Republican leaders on Thursday offered President Barack Obama what they called a “good faith” proposal to temporarily increase the nation’s debt ceiling and negotiate a budget deal, with the government remaining shuttered for a tenth straight day.

White House press secretary Jay Carney said the Republican debt-limit plan was “encouraging.” Obama would likely sign a short-term bill if it is “clean,” Carney said, meaning free of Republican policy prescriptions. But he added that the White House has seen no bill from House Republicans. He said that Obama “strongly prefers” a long-term increase in the borrowing limit.

Speaking to reporters after a meeting of the Republican caucus, House Speaker John Boehner said he hoped Obama would view the idea for a six-week extension as an attempt to meet him halfway.

The Republicans’ offer would not reopen the government. Boehner said that would be discussed at a White House meeting later Thursday.

“What we want to do is offer the president today the ability to move,” the Ohio Republican said. “A temporary increase in the debt ceiling [and] an agreement to go to conference on the budget, for his willingness to sit down and discuss with us a way forward to reopen the government.”

The plan would prohibit the Treasury from using so-called “extraordinary measures” to avoid default, The Wall Street Journal reported, citing aides. The Treasury has used such moves — such as temporarily halting issuance of securities to state and local governments — to stay under the borrowing limit. Treasury Secretary Jack Lew reiterated Thursday that the deadline for raising the borrowing limit is Oct. 17, when the government runs out of borrowing authority.

Republicans Enter Talks With Obama on Debt Limit Increase

President Barack Obama and House Republican leaders were moving toward an agreement to extend the nation’s borrowing authority even as they remained at odds over terms for ending the partial government shutdown.

They met for 90 minutes at the White House yesterday after House Speaker John Boehner of Ohio said he would offer a measure to postpone a potential U.S. default to Nov. 22 from Oct. 17, a step back from the brink that was enough to trigger the biggest rise in U.S. stocks in nine months.

The developments were the first sign that the president and House Republican leaders could resolve the fiscal impasse without negative economic consequences from a default as the halt in government operations moved into its 11th day.

Any prospective deal faces many questions, including whether Boehner can reach an agreement without losing the support of his members who are backed by the limited-government Tea Party. They’ve sought to use the debt ceiling and partial government shutdown to force curbs to Obamacare and federal spending cuts.

Obama didn’t accept or reject House Republicans’ plan for a short-term increase in the debt limit, and the two sides planned further talks among their staff members last night to address the president’s insistence that Republicans agree to fund the government before starting broader fiscal talks.

“No specific determination was made,” the White House said in a statement. The two sides talked about “potential paths forward.”

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

If Wall Street's high-frequency trading machines are capable of emotion, then they must be head over heels in love with the U.S. Congress and President Barack Obama. High-frequency-trading profits rise with market volatility because the lightning-fast machines can anticipate changes in investor behavior and front-run the crowd. The more panic in the street, the better. Congress and the president are giving the machines volatility aplenty by first shutting down the federal government and now risking a Treasury default on government obligations. The rest of us get heartburn.

The conventional wisdom was that Republicans and Democrats would bury their bombast and resolve the budget fight before moving on to resolving the debt-ceiling battle. Instead, the intractable battle of wills has gone on and on, conflating the budget fight and the debt-ceiling fight. That, in turn, has increased the odds of a debt default by the U.S. Treasury. The fanatical, small-government, free-market-loving Tea Party faction of the House Grand Old Party is engaged in a dangerous game of fiscal chicken with the equally fanatical big-government, welfare-state-loving Senate wing of the Democratic Party. Default looms, and neither side will blink.

A surviving piece of the conventional wisdom is that Congress will not allow the U.S. to default on its sovereign debt. Accept this notion at your peril. L. Douglas Lee, publisher of Economics From Washington, cautions that congressional fighting over the debt ceiling led to a temporary default on $120 million of T-bills in 1979. A 1989 study in the Financial Review—a publication of the Eastern Finance Association—by Terry Zivney, a finance professor at Ball State University, and Richard Marcus, a finance professor at the University of Wisconsin, says the Treasury was late in redeeming some securities. The Treasury blamed the problems on unprecedented participation by small investors, on the failure of Congress to act in a timely fashion on the debt-ceiling legislation, and on a failure of word-processing equipment used to prepare check schedules. T-bill rates spiked 60 basis points (0.6%) thereafter and remained elevated for at least six months.

Lee points out that today's credit markets are much larger and more complex. T-bills are employed as collateral on other transactions, for example. So the destruction wrought by a default today would be measured in kilotons.

CONGRESSIONAL LEADERS ARE NOT at all certain that their colleagues won't let the economy fall off the fiscal cliff. I was at the White House on Wednesday evening when Republican and Democratic leaders emerged from a powwow with the president. Both Republican House Speaker John Boehner and Democratic Senate Leader Harry Reid were grim-faced, and both groused that there had been no progress on resolving the impasse over either the budget or the debt ceiling. More telling, House Minority Leader Nancy Pelosi, who usually does not shy from tossing shrill, partisan tongue-bombs at the GOP, was soft-spoken and restrained, and was the only leader offering any hope. She obviously was trying to play down the political divide. When she described the meeting as productive, she elicited a surprised look from Reid.

Obama, on the other hand, tried to generate scary headlines. He released a Treasury report last Thursday that said an extended debt-ceiling battle would drive down stocks and drive up interest rates. The market immediately headed lower. Great for the machines; not so good for the rest of us.

read more ...