Zaimi Yazid / Profil

- Information

|

12+ Jahre

Erfahrung

|

0

Produkte

|

0

Demoversionen

|

|

0

Jobs

|

0

Signale

|

0

Abonnenten

|

Freunde

1061

Anfragen

Ausgehend

Zaimi Yazid

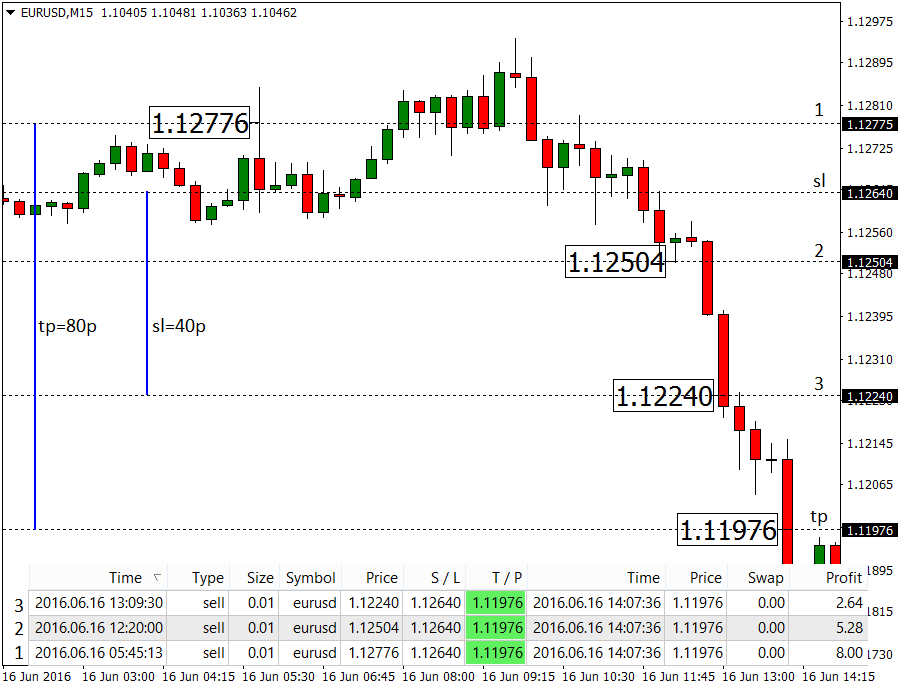

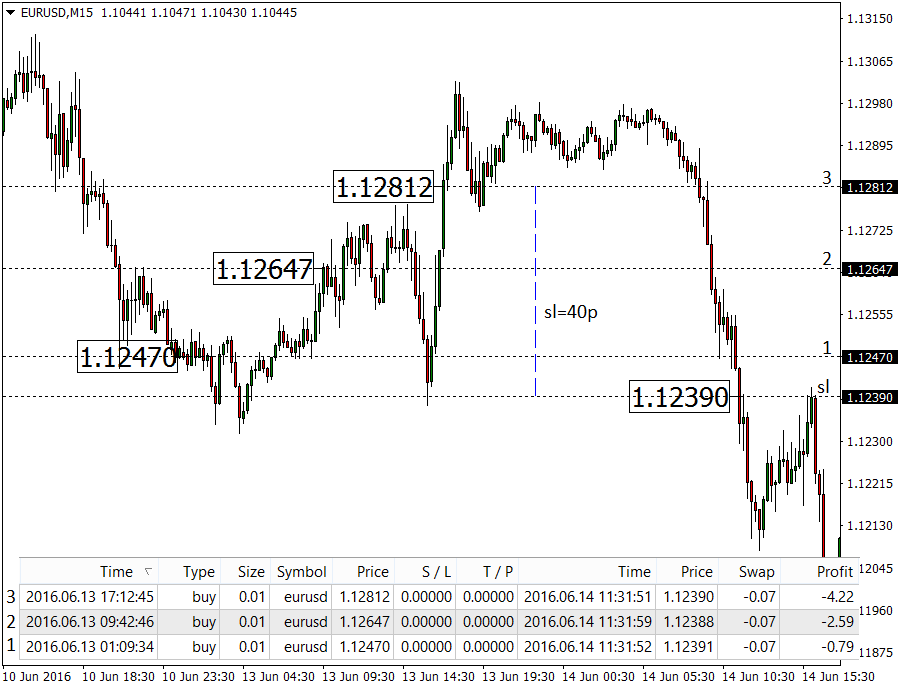

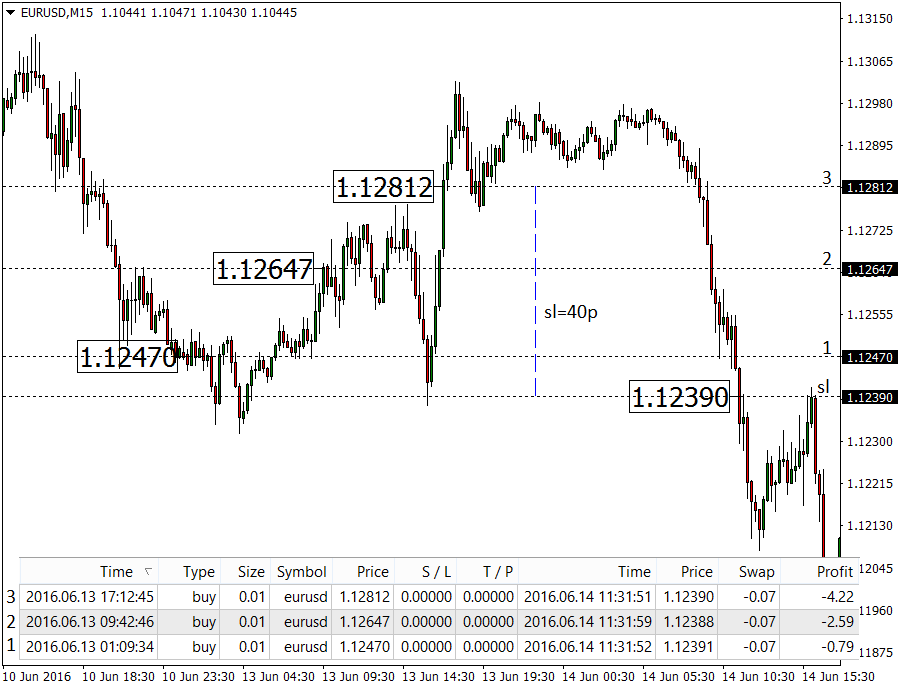

3rd trade giving a loss of 76p

1st position is in profit before opening 2nd position and so for 3rd position. All 3 position were in floating profit before market reversed and hit stop loss.

1st position is in profit before opening 2nd position and so for 3rd position. All 3 position were in floating profit before market reversed and hit stop loss.

Zaimi Yazid

https://www.mql5.com/en/signals/199160

My entry method/trade management are explained.

--max open positions are 3 in one trade.

--only open next position when initial/previous position in profit.

--take profit are 80p from the initial position.

--stop loss are 40p from the last position.

1st trade giving a profit of 172.5p

My entry method/trade management are explained.

--max open positions are 3 in one trade.

--only open next position when initial/previous position in profit.

--take profit are 80p from the initial position.

--stop loss are 40p from the last position.

1st trade giving a profit of 172.5p

Zaimi Yazid

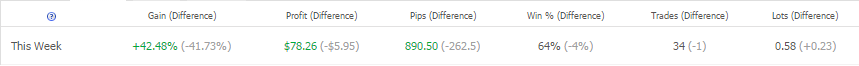

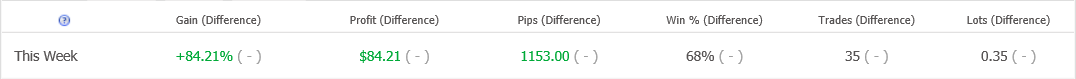

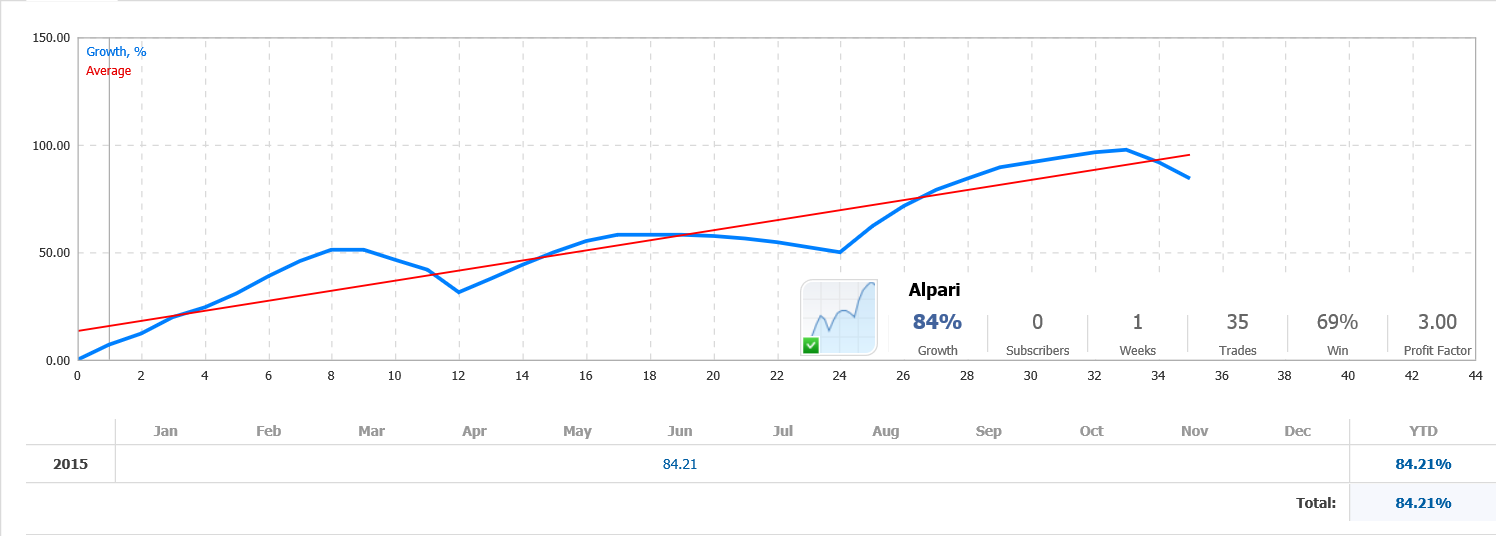

for some reason, I will start trading on a new account next week. still using the same broker Alpari Limited (alpari.com) and with usd350 amount of capital I will trade lot 0.02. assume my stop loss are ~70p, I will risk 3% per trade. if you wish to follow me from the beginning, you are most welcomed.

Alle Kommentare anzeigen (4)

Zaimi Yazid

2015.03.14

yes, i with them since nov 1, 2011 until now. switch to alpari after 2 years using easy-forex in 2009.

Zaimi Yazid

2015.03.14

it's Alpari (UK) Ltd. applied for insolvency not Alpari Ltd.

http://alpari.com/en/for_alpari_uk_clients/

http://alpari.com/en/for_alpari_uk_clients/

Zaimi Yazid

due to last night high impacted of usd news, one of my trade has been took out due to hit stop loss. both trades are using same risk, 55 pips stop loss. i sure many of you had this experienced, price took your stop loss, very frust if only one pip then move back to your favor direction.

usdcad: price came down, took my stop loss and move further 12 pips down before going up.

usdjpy: price came down and only 11 pips from my stop loss, before going up.

usdcad: price came down, took my stop loss and move further 12 pips down before going up.

usdjpy: price came down and only 11 pips from my stop loss, before going up.

Zaimi Yazid

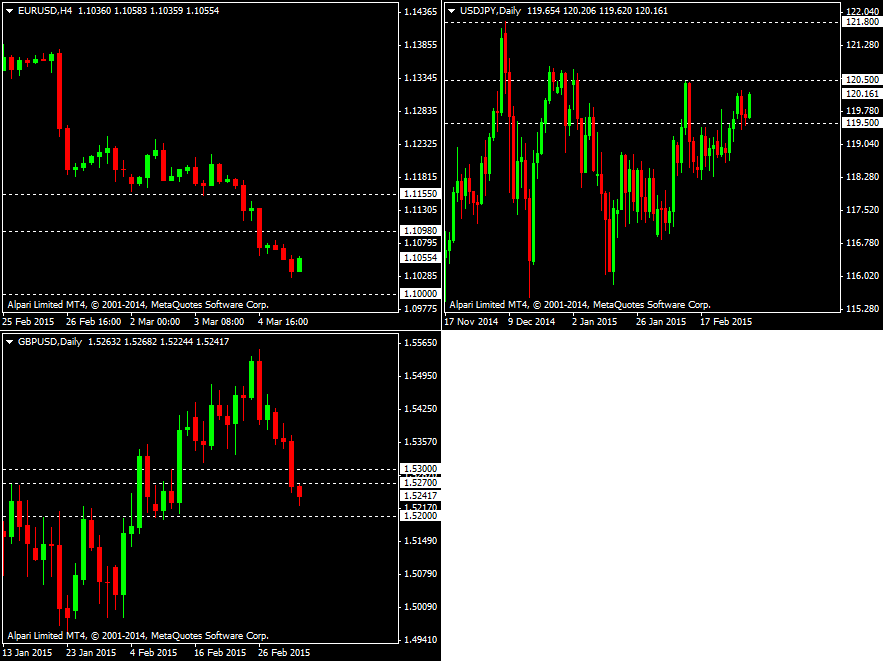

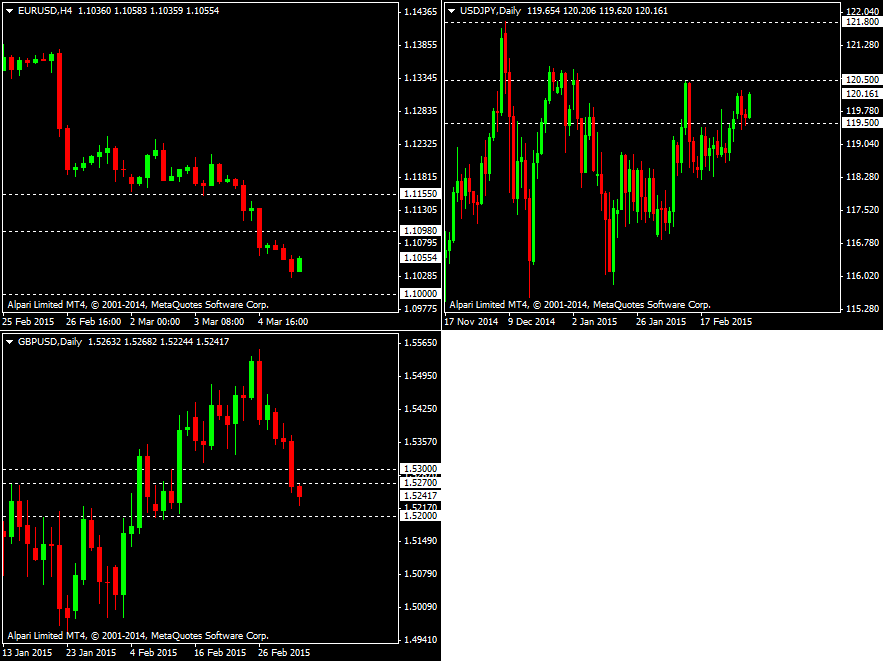

The following are latest short-term (mostly intraday) trading strategies for EURUSD, USDJPY, and GBPUSD.

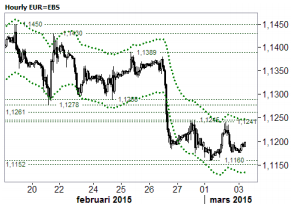

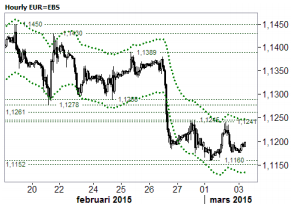

EURUSD: Softness continues, and there's still no reason to fight the trend. Still like being short, adding on any recovery near the 1.1098 previous low, with a 1.1155 stop. Would expect to see some demand around 1.1000, but overall it looks like the first real support is the 1.0765 low from September 2003.

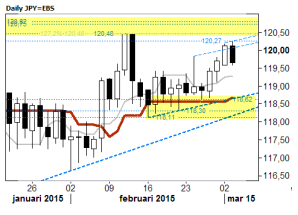

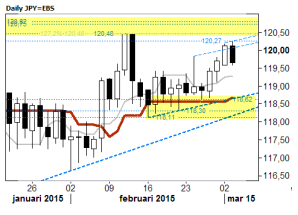

USDJPY: Buy USDJPY dips towards 119.50 with a stop below the week's low of 119.38. Resistance is 120.50 ahead of 121.80

GBPUSD: Would sell on rallies to 1.5270/80, targeting a test of 1.5200, with a stop above 1.5300.

EURUSD: Softness continues, and there's still no reason to fight the trend. Still like being short, adding on any recovery near the 1.1098 previous low, with a 1.1155 stop. Would expect to see some demand around 1.1000, but overall it looks like the first real support is the 1.0765 low from September 2003.

USDJPY: Buy USDJPY dips towards 119.50 with a stop below the week's low of 119.38. Resistance is 120.50 ahead of 121.80

GBPUSD: Would sell on rallies to 1.5270/80, targeting a test of 1.5200, with a stop above 1.5300.

Zaimi Yazid

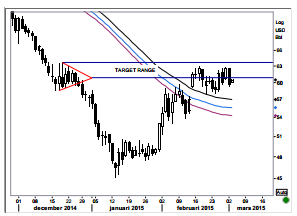

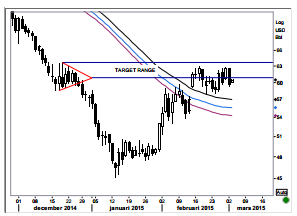

Brent Crude: Double top? With the black gold rejected from the secondary (primary was the 55d ma band) correction target range (apex point of the triangle - top of the triangle) the question must be raised of whether we now have a double top in place or not? A move below 57.80 will confirm the double top and hence the resumption of the still underlying bear trend.

Zaimi Yazid

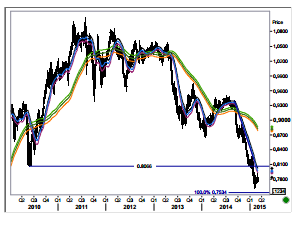

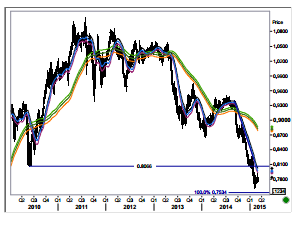

AUDUSD: Rechecking the downside break? Short covering after the RBA left rates on hold has pushed prices up in close proximity to the short term important 0.785 resistance. A break above this point will confirm that the past days selling (that didn't reach a new low) was merely a downside correction hence more upside potential should be penciled in near term. Potential targets for this correction are 0.7925 (an equality point) and 0.8040/66 (a Fibo projection point and the former key support that gave way early this year).

Zaimi Yazid

USDJPY: Sellers above 120. The bold move over a prior 119.84 high risks being negated today. So far the daily print looks bearish, but there is plenty of time for closing the bell to ring. But should local support at 119.54/50 not attract meaningful buying, the risk increases for a bearish print to be added toady and this would once more expose the key short-term 118.62/11 support zone. Key resistance above is located at 120.48/82 and the current intraday stretches are located at 119.3 & 120.5.

Zaimi Yazid

EURUSD: In range with downside bias. The 1.116-1.1246 box remains in place. Backdrop tools remain in keeps disfavoring the euro and thus a lower break is more likely once it happens than a move a back up through resistance (1.1246/1.1288). Current intraday stretches are located at 1.1135 & 1.125.

: