Thanh Nguyen Huy / Profil

- Information

|

8+ Jahre

Erfahrung

|

0

Produkte

|

0

Demoversionen

|

|

0

Jobs

|

0

Signale

|

0

Abonnenten

|

Trader professor

in

Ha Noi

Technical Area Strategy

Freunde

78

Anfragen

Ausgehend

Thanh Nguyen Huy

Beitrag Forex strategy – SIAMESE TWINS veröffentlicht

How to trade forex with this forex strategy – SIAMESE TWINS In late 2007, China overtook Japan to become Australia’s largest trading partner. In 2009, China became Australia’s largest export market, consuming commodities such as iron ore, coal, gas, and wool in record amounts...

In sozialen Netzwerken teilen · 1

459

Thanh Nguyen Huy

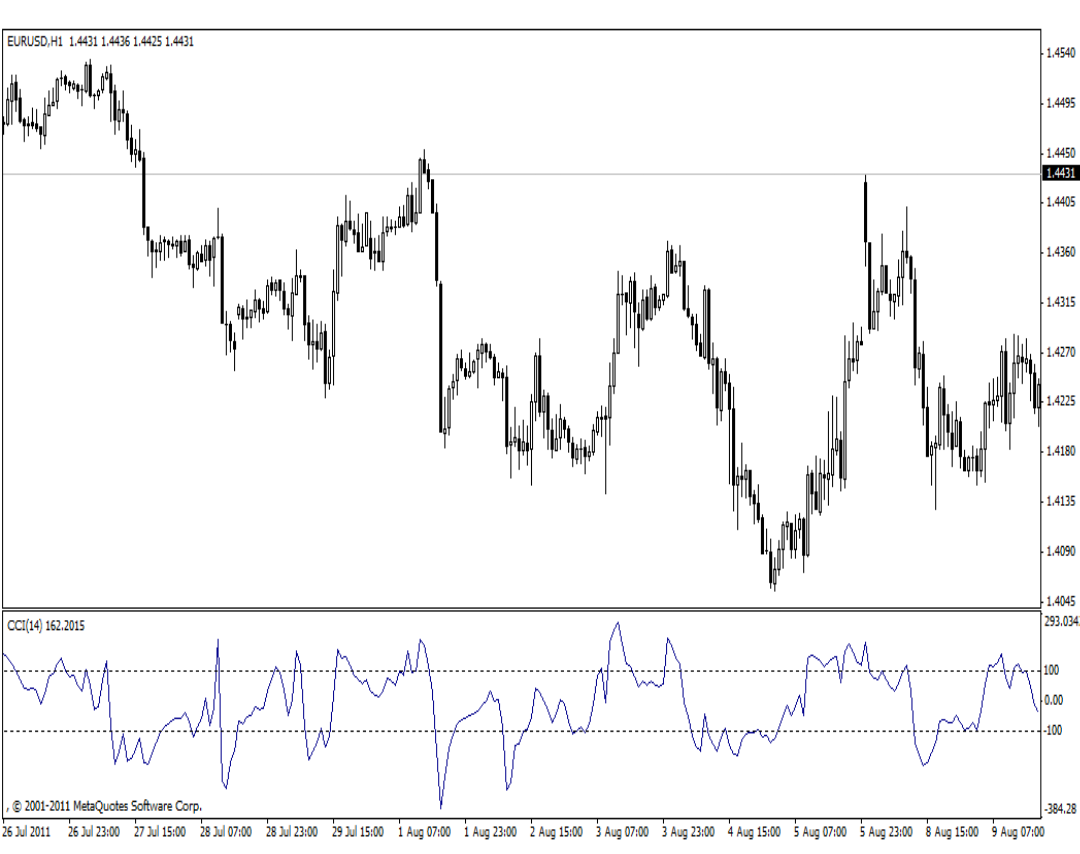

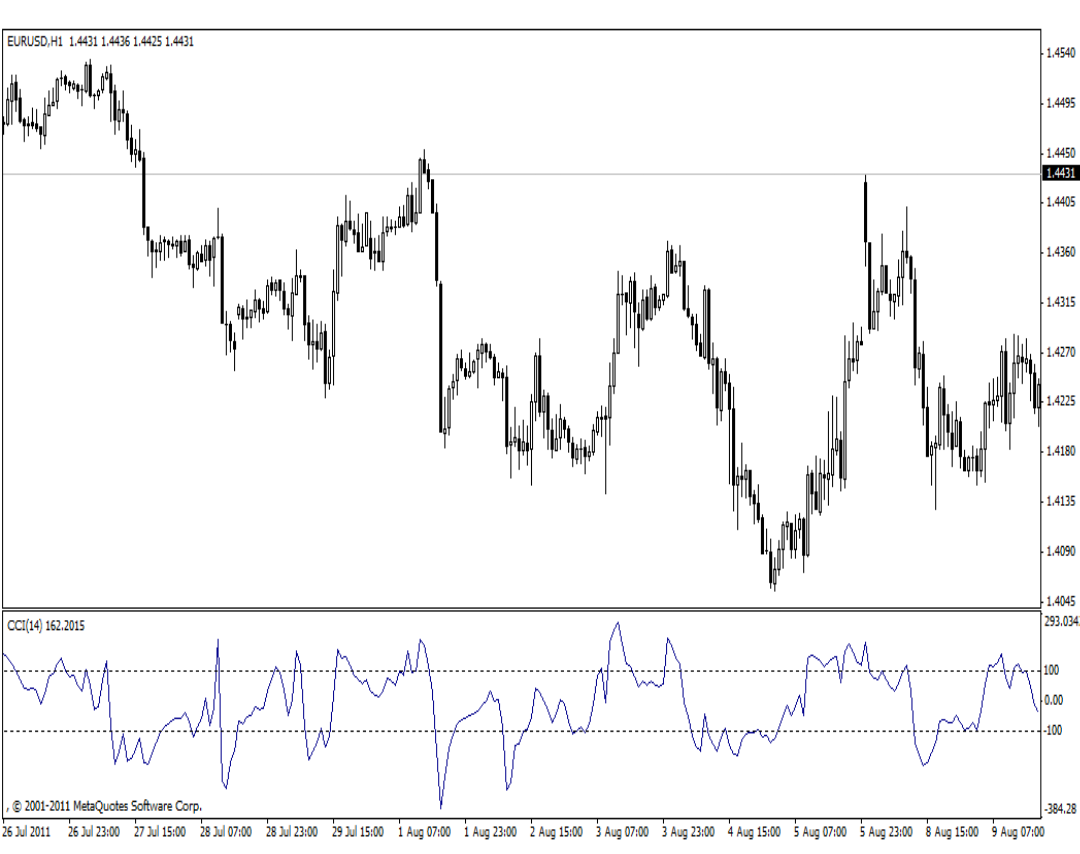

What is Commodity Channel Index (CCI)?

Commodity Channel Index Technical Indicator (CCI) measures the deviation of the commodity price from its average statistical price. High values of the index point out that the price is unusually high being compared with the average one, and low values show that the price is too low. In spite of its name, the Commodity Channel Index can be applied to any financial instrument, and not only for the wares.

2 basic techniques of using Commodity Channel Index:

a) Finding the divergences The divergence appears when the price reaches a new maximum, and Commodity Channel Index can not grow above the previous maximums. This classical divergence is normally followed by the price correction. b) As an indicator of overbuying/overselling Commodity Channel Index usually varies in the range of ±100. Values above +100 inform about an overbuying state (and about a probability of correcting decay), and the values below 100 inform about the overselling state (and about a probability of correcting increase).

Calculation

1. To find a Typical Price. You need to add the HIGH, the LOW, and the CLOSE prices of each bar and then divide the result by 3. TP = (HIGH + LOW +CLOSE)/3

2. To calculate then-period Simple Moving Average of typical prices. SMA(TP, N) = SUM[TP, N]/N

3. To subtract the received SMA(TP, N) from Typical Prices. D = TP — SMA(TP, N)

4. To calculate then-period Simple Moving Average of absolute D values. SMA(D, N) = SUM[D, N]/N

5. To multiply the received SMA(D, N) by 0,015. M = SMA(D, N) * 0,015

6. To divide M by D

CCI = M/D

Commodity Channel Index Technical Indicator (CCI) measures the deviation of the commodity price from its average statistical price. High values of the index point out that the price is unusually high being compared with the average one, and low values show that the price is too low. In spite of its name, the Commodity Channel Index can be applied to any financial instrument, and not only for the wares.

2 basic techniques of using Commodity Channel Index:

a) Finding the divergences The divergence appears when the price reaches a new maximum, and Commodity Channel Index can not grow above the previous maximums. This classical divergence is normally followed by the price correction. b) As an indicator of overbuying/overselling Commodity Channel Index usually varies in the range of ±100. Values above +100 inform about an overbuying state (and about a probability of correcting decay), and the values below 100 inform about the overselling state (and about a probability of correcting increase).

Calculation

1. To find a Typical Price. You need to add the HIGH, the LOW, and the CLOSE prices of each bar and then divide the result by 3. TP = (HIGH + LOW +CLOSE)/3

2. To calculate then-period Simple Moving Average of typical prices. SMA(TP, N) = SUM[TP, N]/N

3. To subtract the received SMA(TP, N) from Typical Prices. D = TP — SMA(TP, N)

4. To calculate then-period Simple Moving Average of absolute D values. SMA(D, N) = SUM[D, N]/N

5. To multiply the received SMA(D, N) by 0,015. M = SMA(D, N) * 0,015

6. To divide M by D

CCI = M/D

Thanh Nguyen Huy

What is a Triangle Formation?

Triangles can be visualized as pennants with no poles. There are four types of triangles: symmetrical, ascending, descending and expanding

A symmetrical triangle consists of two symmetrically converging support and resistance lines, defined by at least four significant points. (See Figure 5.25.)

The two symmetrically converging lines suggest that there is a balance between supply and demand in the foreign exchange market. Consequently, a break may occur on either side. In the case of a bullish symmetrical triangle, the breakout will occur in the same direction, qualifying the formation as a continuation pattern.

The descending triangle is simply a mirror image of the ascending triangle. It consists of a flat support line and a downward sloping resistance line. (See Figure below) This pattern suggests that supply is larger than demand. The currency is expected to break on the downside. The descending triangle also provides a price objective.

This objective is calculated by measuring the width of the triangle base and then transposing it to the breakpoint. As shown in Figure 5.29., the support line, defined by points A, C, E, and G, is flat. The converging top line, defined by points B, D, F, and H, is sloped downward. The price objective is the width of the base of the triangle (AA), measured above the support line from the breakout point I (IF.)

The expanding (broadening) triangle consists of a horizontal mirror image of a triangle, where the tip of the triangle is next to the original trend, rather than its base. (See Figure below) Volume of an expanding triangle also follows the horizontal mirror image as it increases steadily with the chart formation.

As shown in Figure 5.30, the bottom support line, defined by points B, D, and F, and the top line, defined by points A, C, and E, are divergent. The price objective should be the width of the base of the triangle (GG), measured from the breakout point G.

Chart pattern - Triangle Formation

Triangles can be visualized as pennants with no poles. There are four types of triangles: symmetrical, ascending, descending and expanding

A symmetrical triangle consists of two symmetrically converging support and resistance lines, defined by at least four significant points. (See Figure 5.25.)

The two symmetrically converging lines suggest that there is a balance between supply and demand in the foreign exchange market. Consequently, a break may occur on either side. In the case of a bullish symmetrical triangle, the breakout will occur in the same direction, qualifying the formation as a continuation pattern.

The descending triangle is simply a mirror image of the ascending triangle. It consists of a flat support line and a downward sloping resistance line. (See Figure below) This pattern suggests that supply is larger than demand. The currency is expected to break on the downside. The descending triangle also provides a price objective.

This objective is calculated by measuring the width of the triangle base and then transposing it to the breakpoint. As shown in Figure 5.29., the support line, defined by points A, C, E, and G, is flat. The converging top line, defined by points B, D, F, and H, is sloped downward. The price objective is the width of the base of the triangle (AA), measured above the support line from the breakout point I (IF.)

The expanding (broadening) triangle consists of a horizontal mirror image of a triangle, where the tip of the triangle is next to the original trend, rather than its base. (See Figure below) Volume of an expanding triangle also follows the horizontal mirror image as it increases steadily with the chart formation.

As shown in Figure 5.30, the bottom support line, defined by points B, D, and F, and the top line, defined by points A, C, and E, are divergent. The price objective should be the width of the base of the triangle (GG), measured from the breakout point G.

Chart pattern - Triangle Formation

Thanh Nguyen Huy

What are Bollinger Bands?

Bollinger Bands are a technical analysis tool invented by John Bollinger in the 1980s. Having evolved from the concept of trading bands, Bollinger Bands can be used to measure the highness or lowness of the price relative to previous trades.

http://oliforex.com/technical-indicator-bollinger-bands/

Bollinger Bands are a technical analysis tool invented by John Bollinger in the 1980s. Having evolved from the concept of trading bands, Bollinger Bands can be used to measure the highness or lowness of the price relative to previous trades.

http://oliforex.com/technical-indicator-bollinger-bands/

: