Mohammadreza Esmaeili / Profil

Freunde

434

Anfragen

Ausgehend

Mohammadreza Esmaeili

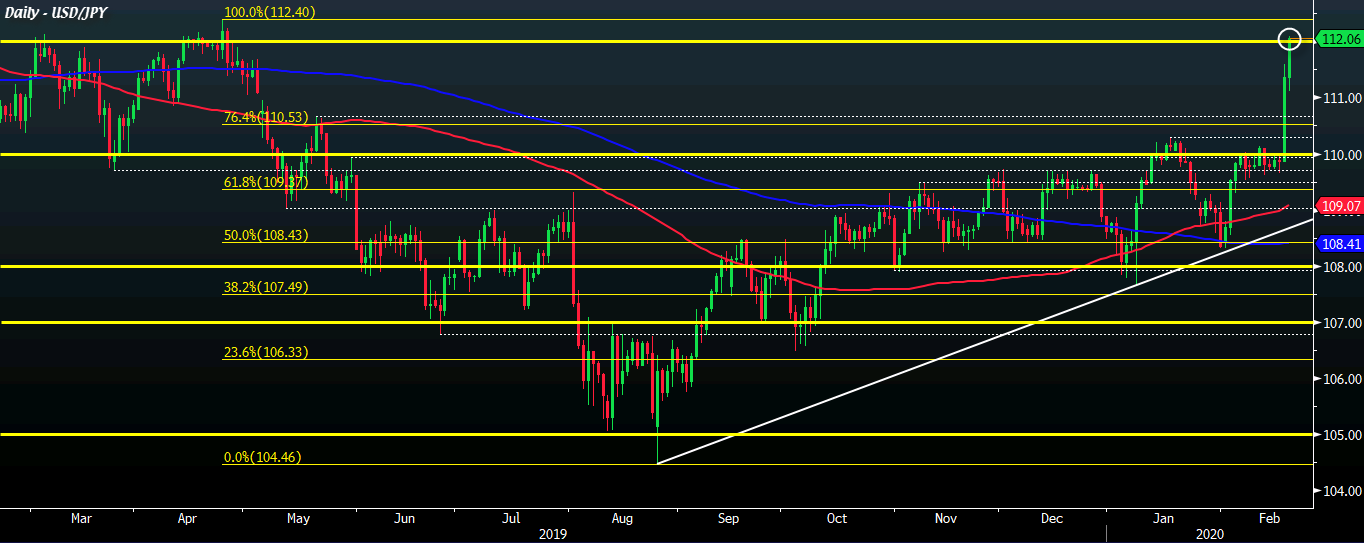

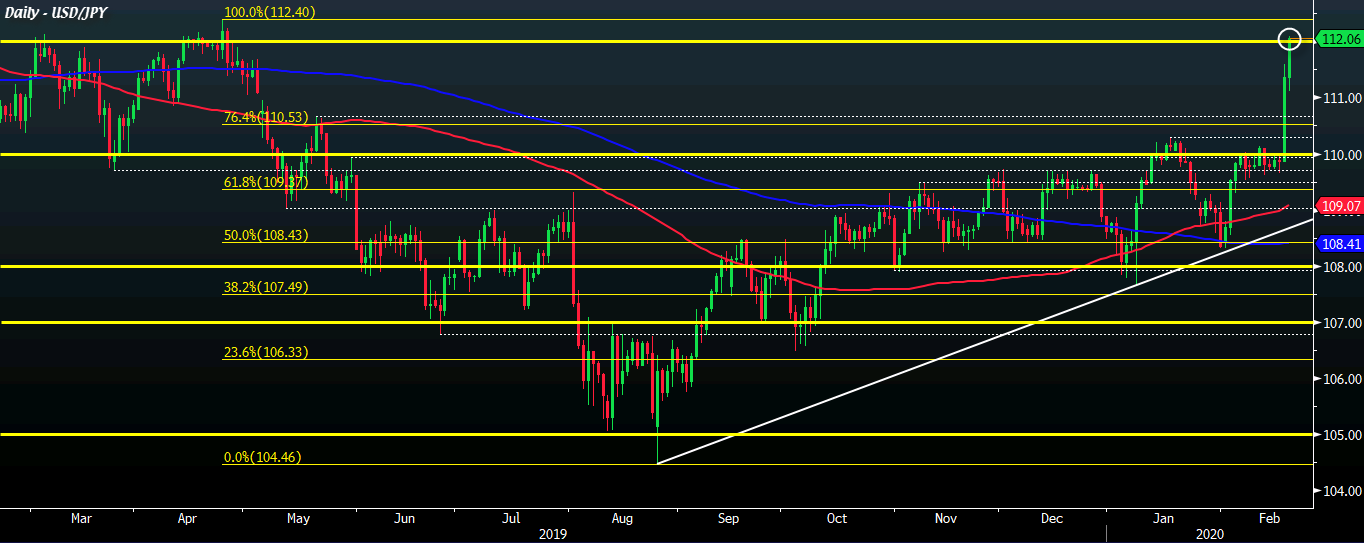

USD/JPY rises to its highest level since 25 April 2019

The pair is up by another 0.6% on the day currently as buyers now go in search of a firm break above the 112.00 handle. The high today touches 112.10, the highest level since 25 April 2019 - with further resistance now seen from the 24 April 2019 high @ 112.40.

Again, this comes amid the backdrop of a somewhat softer risk environment as the dollar continues to run rampant across the board. The greenback is posting solid gains against the yen, pound, loonie, aussie and kiwi today.

The pair is up by another 0.6% on the day currently as buyers now go in search of a firm break above the 112.00 handle. The high today touches 112.10, the highest level since 25 April 2019 - with further resistance now seen from the 24 April 2019 high @ 112.40.

Again, this comes amid the backdrop of a somewhat softer risk environment as the dollar continues to run rampant across the board. The greenback is posting solid gains against the yen, pound, loonie, aussie and kiwi today.

Mohammadreza Esmaeili

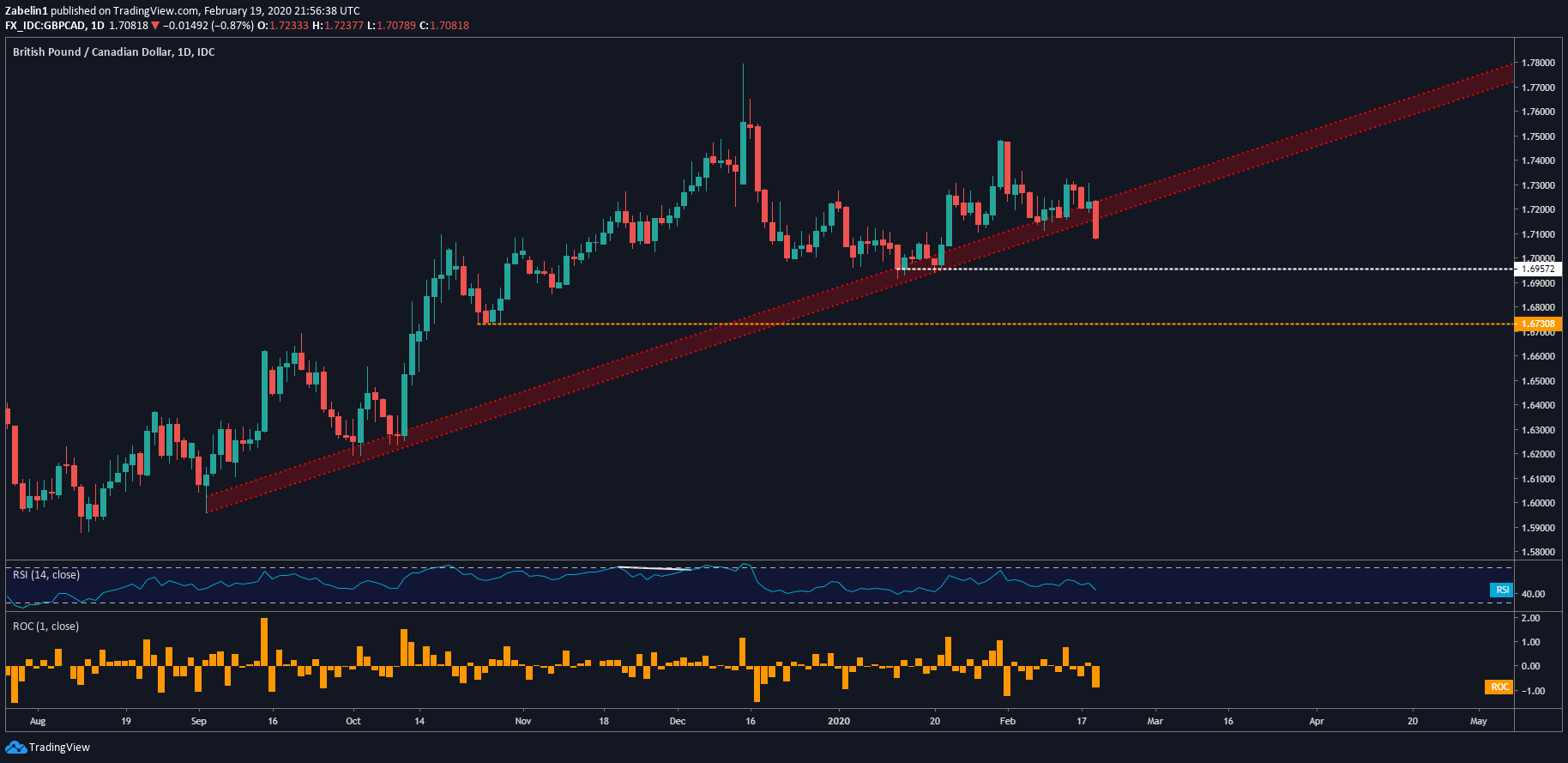

Forecast: GBP/CAD

GBP/CAD recently shattered the September 2019 uptrend and opened the door for a short-term bearish correction after it rose almost eight percent over five months. The pair’s decline may encounter some downside friction at 1.6957 but selling pressure may gain momentum if support is cleared. Beyond that, GBP/CAD traders will be eyeing the October swing-low at 1.6730. If it holds, it could limit the pair’s near-term losses.

GBP/CAD recently shattered the September 2019 uptrend and opened the door for a short-term bearish correction after it rose almost eight percent over five months. The pair’s decline may encounter some downside friction at 1.6957 but selling pressure may gain momentum if support is cleared. Beyond that, GBP/CAD traders will be eyeing the October swing-low at 1.6730. If it holds, it could limit the pair’s near-term losses.

Mohammadreza Esmaeili

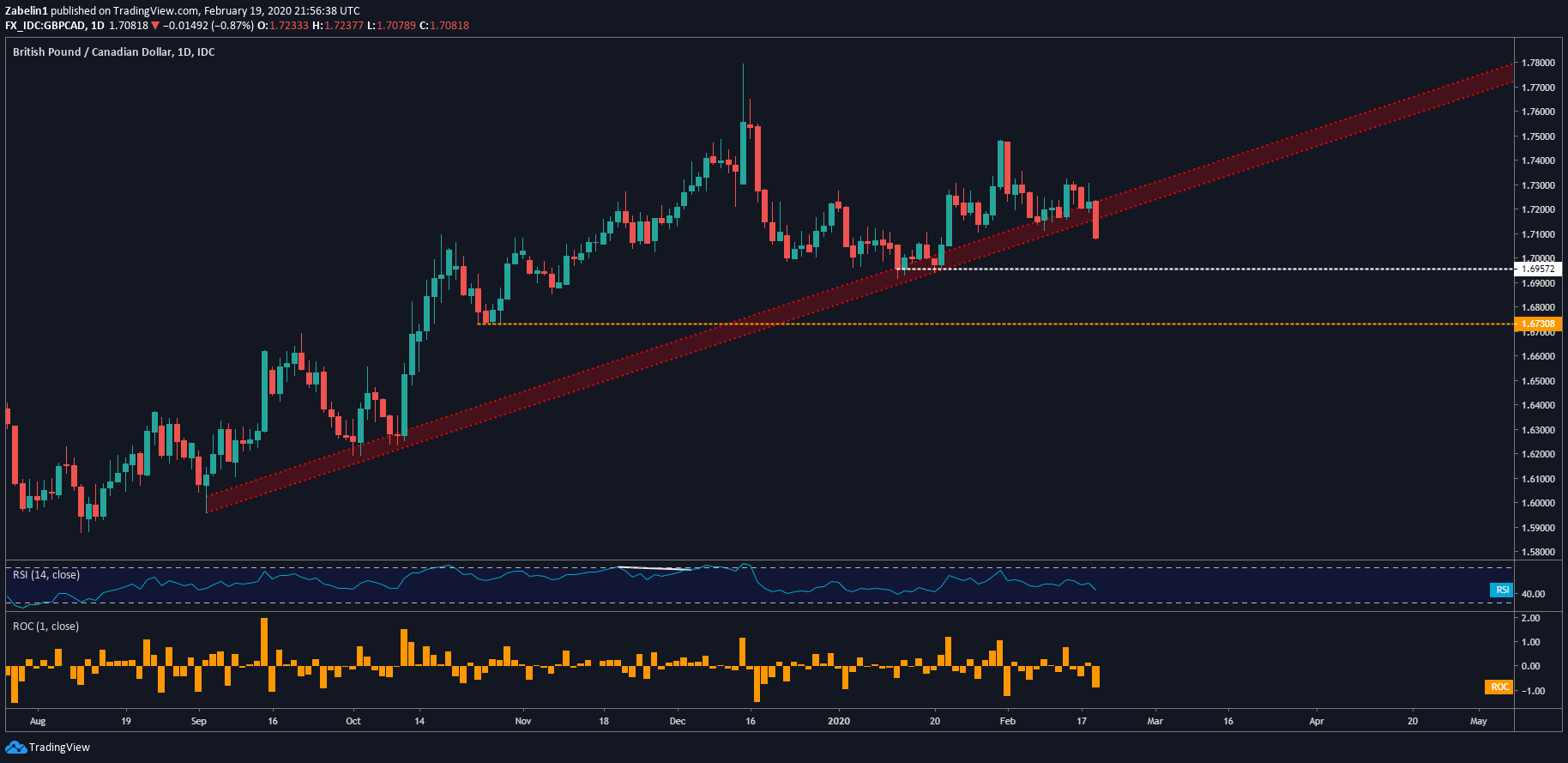

Why the USDJPY jumped 1.6% yesterday.

It was a strange one yesterday. Yes, we had risk on tones with equities green across the board and we were expecting JPY weakness, but it just seemed to keep going and going. The USDJPY put in a strong green candle with gains of around 1.6%.

The reason USDJPY jumped higher

According to Bloomberg's Market Live Blog there are a number of reasons circulating as to the reason for JPY weakness:

Japanese funds buying US dollar debt

CTA stopping out

Macro funds dumping long JPY/Asia risk hedges

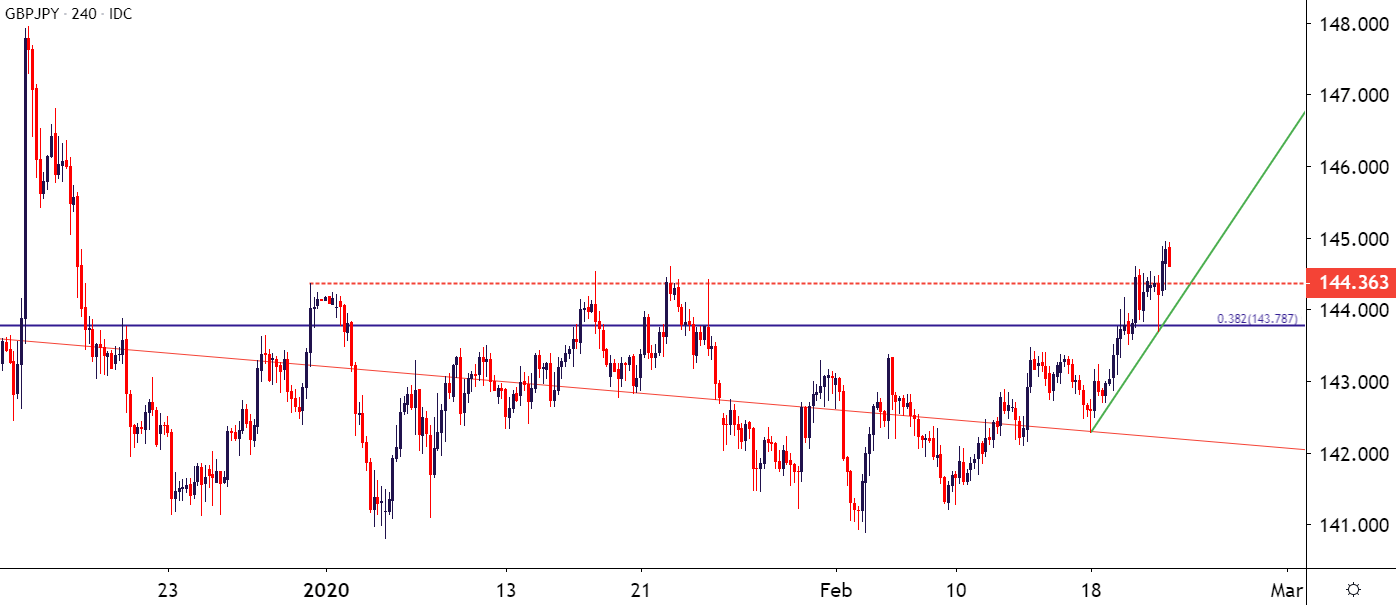

The move occurred during the European Session and trading yesterday felt like a game of two halves with Europe pushing the risk on tone and then the America session pushing it further. We saw steady JPY selling all day. I was looking at the USDJPY. CADJPY and GBPJPY pairs yesterday for longs and they just kept heading north all day. It struck me as steady JPY weakness all day without a sudden move.

It was a strange one yesterday. Yes, we had risk on tones with equities green across the board and we were expecting JPY weakness, but it just seemed to keep going and going. The USDJPY put in a strong green candle with gains of around 1.6%.

The reason USDJPY jumped higher

According to Bloomberg's Market Live Blog there are a number of reasons circulating as to the reason for JPY weakness:

Japanese funds buying US dollar debt

CTA stopping out

Macro funds dumping long JPY/Asia risk hedges

The move occurred during the European Session and trading yesterday felt like a game of two halves with Europe pushing the risk on tone and then the America session pushing it further. We saw steady JPY selling all day. I was looking at the USDJPY. CADJPY and GBPJPY pairs yesterday for longs and they just kept heading north all day. It struck me as steady JPY weakness all day without a sudden move.

: