Cahyo Basuko / Profil

Freunde

18

Anfragen

Ausgehend

Cahyo Basuko

MetaQuotes

MetaTrader 4 - теперь с магазином торговых роботов!

Выпуск MetaTrader 4 build 600 заметно расширил возможности трейдеров - в платформе появился магазин торговых приложений . И уже сейчас, на старте, в MetaTrader Market опубликованы более 200 торговых роботов, технических индикаторов и других

Cahyo Basuko

MetaQuotes

Обновление платформы MetaTrader 4 build 710: Активы, новая витрина сигналов и ручная торговля при подписке

В пятницу 26 сентября 2014 года будет опубликовано обновление платформы MetaTrader 4. Обновление содержит следующие изменения: Прекращена поддержка MetaTrader 4 для Windows Mobile и Windows Mobile SE Данные терминалы не смогут подключаться к новым

Cahyo Basuko

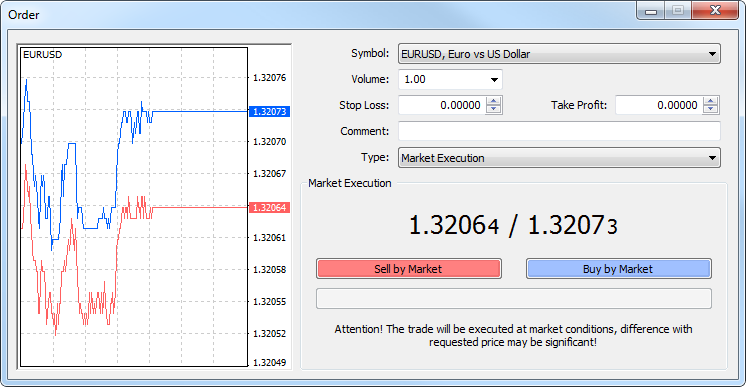

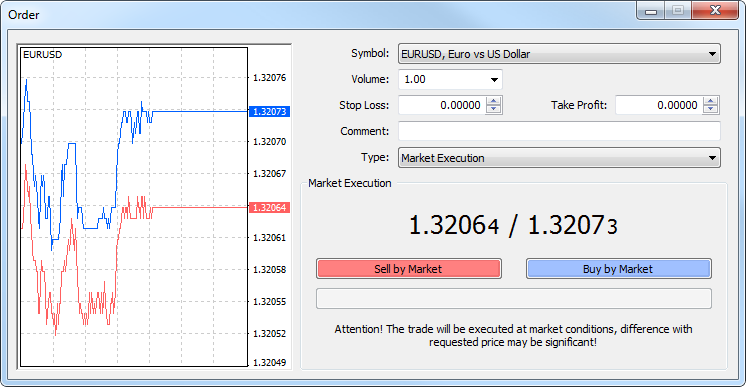

HADGINF LOCKING STRATEGI

Hedging is protecting his meaning according to value. In forex trading, hedging action means we open two opposite positions, so even if prices rise or fall of its floating rate remains the same.

Hedging is usually done when positions open that we suffered no loss. In order not to be larger losses, we key with this hedging technique..

So next Hedging also known as Locking (lock) because when we use these hedging techniques we locked position which makes the value of gains and losses always move in tandem.

For example:

Current value of the GBP / USD is 1.5600.

I predict GBP / USD will rise towards 1.5700, so I open a buy position.

A few minutes later it turns GBP / USD moves opposite to my prediction, which is down to 1.5580. That is my long positions lose 20 points.

In order for this loss does not increase in size, I open a new position that is opposite to the first position, ie open sell position at the level of 1.5580.

If then the market fell again to the level of 1.5550 then my losses remain 20 points, as the first loss position of 50 points (1.5600 - 1.5580) and a second position gain 30 points (1.5580-1.5550).

Likewise if the market rises to the level of 1.5620, I still lose 20 points for the first position gain of 20 points and second place 40 points loss (1.5620-1.5580).

Thus wherever the next market move, because it uses hedging strategies remain locked my losses by 20 points.

So what can the locked condition and loss of 20 points above turned into profit?

Course. As long as we can unlock it in the right conditions.

And the best conditions for closing positions using the hedging strategy is when we believe that the market will move next to a strong one-way, for example when there convergent or divergent.

example:

I open a buy position at 1.5550 and sell at 1.5500 open.

Then, when the market was at 1.5450 occurs convergent.

What to do is close my short positions which profit was 50 points. So I got a profit of 50 points.

Because convergent, then a few moments later the market bounced rise above 1.5500 level, for example, to the level of 1.5525.

At that moment I closed my long positions being 25 point.Sehingga loss 25 point loss.

After the second position is closed, its accumulation is profit = 50 pips (short positions) + 25-point loss (long position)

Total = 25 points profit.

That forex hedging strategy, the strategy most commonly used by traders frequently to minimize the risk of loss.

The hedging strategies we can use in our day to day trading. But the advice is:

- If the market is moving erratically, and we are not sure of the direction of the trend further, then you should close both positions being done hedging.

- But if we believe further market moves in either direction with strong, then we close one of the positions that are erlawanan with the direction of our predictions. With the expectation that the open positions can achieve greater gains than losses position has been closed.

Hedging is protecting his meaning according to value. In forex trading, hedging action means we open two opposite positions, so even if prices rise or fall of its floating rate remains the same.

Hedging is usually done when positions open that we suffered no loss. In order not to be larger losses, we key with this hedging technique..

So next Hedging also known as Locking (lock) because when we use these hedging techniques we locked position which makes the value of gains and losses always move in tandem.

For example:

Current value of the GBP / USD is 1.5600.

I predict GBP / USD will rise towards 1.5700, so I open a buy position.

A few minutes later it turns GBP / USD moves opposite to my prediction, which is down to 1.5580. That is my long positions lose 20 points.

In order for this loss does not increase in size, I open a new position that is opposite to the first position, ie open sell position at the level of 1.5580.

If then the market fell again to the level of 1.5550 then my losses remain 20 points, as the first loss position of 50 points (1.5600 - 1.5580) and a second position gain 30 points (1.5580-1.5550).

Likewise if the market rises to the level of 1.5620, I still lose 20 points for the first position gain of 20 points and second place 40 points loss (1.5620-1.5580).

Thus wherever the next market move, because it uses hedging strategies remain locked my losses by 20 points.

So what can the locked condition and loss of 20 points above turned into profit?

Course. As long as we can unlock it in the right conditions.

And the best conditions for closing positions using the hedging strategy is when we believe that the market will move next to a strong one-way, for example when there convergent or divergent.

example:

I open a buy position at 1.5550 and sell at 1.5500 open.

Then, when the market was at 1.5450 occurs convergent.

What to do is close my short positions which profit was 50 points. So I got a profit of 50 points.

Because convergent, then a few moments later the market bounced rise above 1.5500 level, for example, to the level of 1.5525.

At that moment I closed my long positions being 25 point.Sehingga loss 25 point loss.

After the second position is closed, its accumulation is profit = 50 pips (short positions) + 25-point loss (long position)

Total = 25 points profit.

That forex hedging strategy, the strategy most commonly used by traders frequently to minimize the risk of loss.

The hedging strategies we can use in our day to day trading. But the advice is:

- If the market is moving erratically, and we are not sure of the direction of the trend further, then you should close both positions being done hedging.

- But if we believe further market moves in either direction with strong, then we close one of the positions that are erlawanan with the direction of our predictions. With the expectation that the open positions can achieve greater gains than losses position has been closed.

: