From Basic to Intermediate: Union (I)

In this article we will look at what a union is. Here, through experiments, we will analyze the first constructions in which union can be used. However, what will be shown here is only a core part of a set of concepts and information that will be covered in subsequent articles. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

From Novice to Expert: Animated News Headline Using MQL5 (IV) — Locally hosted AI model market insights

In today's discussion, we explore how to self-host open-source AI models and use them to generate market insights. This forms part of our ongoing effort to expand the News Headline EA, introducing an AI Insights Lane that transforms it into a multi-integration assistive tool. The upgraded EA aims to keep traders informed through calendar events, financial breaking news, technical indicators, and now AI-generated market perspectives—offering timely, diverse, and intelligent support to trading decisions. Join the conversation as we explore practical integration strategies and how MQL5 can collaborate with external resources to build a powerful and intelligent trading work terminal.

From Novice to Expert: Animated News Headline Using MQL5 (III) — Indicator Insights

In this article, we’ll advance the News Headline EA by introducing a dedicated indicator insights lane—a compact, on-chart display of key technical signals generated from popular indicators such as RSI, MACD, Stochastic, and CCI. This approach eliminates the need for multiple indicator subwindows on the MetaTrader 5 terminal, keeping your workspace clean and efficient. By leveraging the MQL5 API to access indicator data in the background, we can process and visualize market insights in real-time using custom logic. Join us as we explore how to manipulate indicator data in MQL5 to create an intelligent and space-saving scrolling insights system, all within a single horizontal lane on your trading chart.

Moving Average in MQL5 from scratch: Plain and simple

Using simple examples, we will examine the principles of calculating moving averages, as well as learn about the ways to optimize indicator calculations, including moving averages.

Price Action Analysis Toolkit Development (Part 29): Boom and Crash Interceptor EA

Discover how the Boom & Crash Interceptor EA transforms your charts into a proactive alert system-spotting explosive moves with lightning-fast velocity scans, volatility surge checks, trend confirmation, and pivot-zone filters. With crisp green “Boom” and red “Crash” arrows guiding your every decision, this tool cuts through the noise and lets you capitalize on market spikes like never before. Dive in to see how it works and why it can become your next essential edge.

Mastering Log Records (Part 9): Implementing the builder pattern and adding default configurations

This article shows how to drastically simplify the use of the Logify library with the Builder pattern and automatic default configurations. It explains the structure of the specialized builders, how to use them with smart auto-completion, and how to ensure a functional log even without manual configuration. It also covers tweaks for MetaTrader 5 build 5100.

Self Optimizing Expert Advisors in MQL5 (Part 8): Multiple Strategy Analysis (2)

Join us for our follow-up discussion, where we will merge our first two trading strategies into an ensemble trading strategy. We shall demonstrate the different schemes possible for combining multiple strategies and also how to exercise control over the parameter space, to ensure that effective optimization remains possible even as our parameter size grows.

Developing a Replay System (Part 73): An Unusual Communication (II)

In this article, we will look at how to transmit information in real time between the indicator and the service, and also understand why problems may arise when changing the timeframe and how to solve them. As a bonus, you will get access to the latest version of the replay /simulation app.

Developing Advanced ICT Trading Systems: Implementing Order Blocks in an Indicator

In this article, we will learn how to create an indicator that detects, draws, and alerts on the mitigation of order blocks. We will also take a detailed look at how to identify these blocks on the chart, set accurate alerts, and visualize their position using rectangles to better understand the price action. This indicator will serve as a key tool for traders who follow the Smart Money Concepts and the Inner Circle Trader methodology.

Atomic Orbital Search (AOS) algorithm

The article considers the Atomic Orbital Search (AOS) algorithm, which uses the concepts of the atomic orbital model to simulate the search for solutions. The algorithm is based on probability distributions and the dynamics of interactions in the atom. The article discusses in detail the mathematical aspects of AOS, including updating the positions of candidate solutions and the mechanisms of energy absorption and release. AOS opens new horizons for applying quantum principles to computing problems by offering an innovative approach to optimization.

Price Action Analysis Toolkit Development (Part 28): Opening Range Breakout Tool

At the start of each trading session, the market’s directional bias often becomes clear only after price moves beyond the opening range. In this article, we explore how to build an MQL5 Expert Advisor that automatically detects and analyzes Opening Range Breakouts, providing you with timely, data‑driven signals for confident intraday entries.

From Novice to Expert: Animated News Headline Using MQL5 (II)

Today, we take another step forward by integrating an external news API as the source of headlines for our News Headline EA. In this phase, we’ll explore various news sources—both established and emerging—and learn how to access their APIs effectively. We'll also cover methods for parsing the retrieved data into a format optimized for display within our Expert Advisor. Join the discussion as we explore the benefits of accessing news headlines and the economic calendar directly on the chart, all within a compact, non-intrusive interface.

Reimagining Classic Strategies (Part 13): Taking Our Crossover Strategy to New Dimensions (Part 2)

Join us in our discussion as we look for additional improvements to make to our moving-average cross over strategy to reduce the lag in our trading strategy to more reliable levels by leveraging our skills in data science. It is a well-studied fact that projecting your data to higher dimensions can at times improve the performance of your machine learning models. We will demonstrate what this practically means for you as a trader, and illustrate how you can weaponize this powerful principle using your MetaTrader 5 Terminal.

Mastering Log Records (Part 8): Error Records That Translate Themselves

In this eighth installment of the Mastering Log Records series, we explore the implementation of multilingual error messages in Logify, a powerful logging library for MQL5. You’ll learn how to structure errors with context, translate messages into multiple languages, and dynamically format logs by severity level. All of this with a clean, extensible, and production-ready design.

From Novice to Expert: Animated News Headline Using MQL5 (I)

News accessibility is a critical factor when trading on the MetaTrader 5 terminal. While numerous news APIs are available, many traders face challenges in accessing and integrating them effectively into their trading environment. In this discussion, we aim to develop a streamlined solution that brings news directly onto the chart—where it’s most needed. We'll accomplish this by building a News Headline Expert Advisor that monitors and displays real-time news updates from API sources.

From Basic to Intermediate: Array (IV)

In this article, we'll look at how you can do something very similar to what's implemented in languages like C, C++, and Java. I am talking about passing a virtually infinite number of parameters inside a function or procedure. While this may seem like a fairly advanced topic, in my opinion, what will be shown here can be easily implemented by anyone who has understood the previous concepts. Provided that they were really properly understood.

Developing a Replay System (Part 72): An Unusual Communication (I)

What we create today will be difficult to understand. Therefore, in this article I will only talk about the initial stage. Please read this article carefully, it is an important prerequisite before we proceed to the next step. The purpose of this material is purely didactic as we will only study and master the presented concepts, without practical application.

Build Self Optimizing Expert Advisors in MQL5 (Part 8): Multiple Strategy Analysis

How best can we combine multiple strategies to create a powerful ensemble strategy? Join us in this discussion as we look to fit together three different strategies into our trading application. Traders often employ specialized strategies for opening and closing positions, and we want to know if our machines can perform this task better. For our opening discussion, we will get familiar with the faculties of the strategy tester and the principles of OOP we will need for this task.

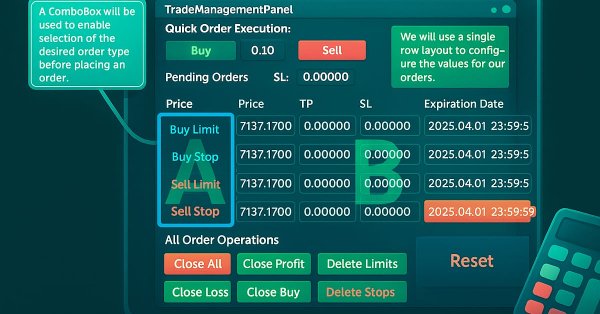

Creating a Trading Administrator Panel in MQL5 (Part XII): Integration of a Forex Values Calculator

Accurate calculation of key trading values is an indispensable part of every trader’s workflow. In this article, we will discuss, the integration of a powerful utility—the Forex Calculator—into the Trade Management Panel, further extending the functionality of our multi-panel Trading Administrator system. Efficiently determining risk, position size, and potential profit is essential when placing trades, and this new feature is designed to make that process faster and more intuitive within the panel. Join us as we explore the practical application of MQL5 in building advanced, trading panels.

SQLite capabilities in MQL5: Example of a dashboard with trading statistics by symbols and magic numbers

In this article, we will consider creating an indicator that displays trading statistics on a dashboard by account and by symbols and trading strategies. We will implement the code based on examples from the Documentation and the article on working with databases.

Price Action Analysis Toolkit Development (Part 27): Liquidity Sweep With MA Filter Tool

Understanding the subtle dynamics behind price movements can give you a critical edge. One such phenomenon is the liquidity sweep, a deliberate strategy that large traders, especially institutions, use to push prices through key support or resistance levels. These levels often coincide with clusters of retail stop-loss orders, creating pockets of liquidity that big players can exploit to enter or exit sizeable positions with minimal slippage.

Price Action Analysis Toolkit Development (Part 26): Pin Bar, Engulfing Patterns and RSI Divergence (Multi-Pattern) Tool

Aligned with our goal of developing practical price-action tools, this article explores the creation of an EA that detects pin bar and engulfing patterns, using RSI divergence as a confirmation trigger before generating any trading signals.

Developing a Replay System (Part 71): Getting the Time Right (IV)

In this article, we will look at how to implement what was shown in the previous article related to our replay/simulation service. As in many other things in life, problems are bound to arise. And this case was no exception. In this article, we continue to improve things. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

From Basic to Intermediate: Array (III)

In this article, we will look at how to work with arrays in MQL5, including how to pass information between functions and procedures using arrays. The purpose is to prepare you for what will be demonstrated and explained in future materials in the series. Therefore, I strongly recommend that you carefully study what will be shown in this article.

Build Self Optimizing Expert Advisors in MQL5 (Part 7): Trading With Multiple Periods At Once

In this series of articles, we have considered multiple different ways of identifying the best period to use our technical indicators with. Today, we shall demonstrate to the reader how they can instead perform the opposite logic, that is to say, instead of picking the single best period to use, we will demonstrate to the reader how to employ all available periods effectively. This approach reduces the amount of data discarded, and offers alternative use cases for machine learning algorithms beyond ordinary price prediction.

Mastering Log Records (Part 7): How to Show Logs on Chart

Learn how to display logs directly on the MetaTrader chart in an organized way, with frames, titles and automatic scrolling. In this article, we show you how to create a visual log system using MQL5, ideal for monitoring what your robot is doing in real time.

Developing a Replay System (Part 70): Getting the Time Right (III)

In this article, we will look at how to use the CustomBookAdd function correctly and effectively. Despite its apparent simplicity, it has many nuances. For example, it allows you to tell the mouse indicator whether a custom symbol is on auction, being traded, or the market is closed. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

From Basic to Intermediate: Array (II)

In this article, we will look at what a dynamic array and a static array are. Is there a difference between using one or the other? Or are they always the same? When should you use one and when the other type? And what about constant arrays? We will try to understand what they are designed for and consider the risks of not initializing all the values in the array.

From Novice to Expert: Auto-Geometric Analysis System

Geometric patterns offer traders a concise way to interpret price action. Many analysts draw trend lines, rectangles, and other shapes by hand, and then base trading decisions on the formations they see. In this article, we explore an automated alternative: harnessing MQL5 to detect and analyze the most popular geometric patterns. We’ll break down the methodology, discuss implementation details, and highlight how automated pattern recognition can sharpen a trader's market insights.

From Basic to Intermediate: Array (I)

This article is a transition between what has been discussed so far and a new stage of research. To understand this article, you need to read the previous ones. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Introduction to MQL5 (Part 16): Building Expert Advisors Using Technical Chart Patterns

This article introduces beginners to building an MQL5 Expert Advisor that identifies and trades a classic technical chart pattern — the Head and Shoulders. It covers how to detect the pattern using price action, draw it on the chart, set entry, stop loss, and take profit levels, and automate trade execution based on the pattern.

Developing a Replay System (Part 69): Getting the Time Right (II)

Today we will look at why we need the iSpread feature. At the same time, we will understand how the system informs us about the remaining time of the bar when there is not a single tick available for it. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Overcoming The Limitation of Machine Learning (Part 2): Lack of Reproducibility

The article explores why trading results can differ significantly between brokers, even when using the same strategy and financial symbol, due to decentralized pricing and data discrepancies. The piece helps MQL5 developers understand why their products may receive mixed reviews on the MQL5 Marketplace, and urges developers to tailor their approaches to specific brokers to ensure transparent and reproducible outcomes. This could grow to become an important domain-bound best practice that will serve our community well if the practice were to be widely adopted.

From Basic to Intermediate: Arrays and Strings (III)

This article considers two aspects. First, how the standard library can convert binary values to other representations such as octal, decimal, and hexadecimal. Second, we will talk about how we can determine the width of our password based on the secret phrase, using the knowledge we have already acquired.

Developing a Replay System (Part 68): Getting the Time Right (I)

Today we will continue working on getting the mouse pointer to tell us how much time is left on a bar during periods of low liquidity. Although at first glance it seems simple, in reality this task is much more difficult. This involves some obstacles that we will have to overcome. Therefore, it is important that you have a good understanding of the material in this first part of this subseries in order to understand the following parts.

From Basic to Intermediate: Arrays and Strings (II)

In this article I will show that although we are still at a very basic stage of programming, we can already implement some interesting applications. In this case, we will create a fairly simple password generator. This way we will be able to apply some of the concepts that have been explained so far. In addition, we will look at how solutions can be developed for some specific problems.

Raw Code Optimization and Tweaking for Improving Back-Test Results

Enhance your MQL5 code by optimizing logic, refining calculations, and reducing execution time to improve back-test accuracy. Fine-tune parameters, optimize loops, and eliminate inefficiencies for better performance.

Developing a Replay System (Part 67): Refining the Control Indicator

In this article, we'll look at what can be achieved with a little code refinement. This refinement is aimed at simplifying our code, making more use of MQL5 library calls and, above all, making it much more stable, secure and easy to use in other projects that we may develop in the future.

Creating a Trading Administrator Panel in MQL5 (Part XI): Modern feature communications interface (I)

Today, we are focusing on the enhancement of the Communications Panel messaging interface to align with the standards of modern, high-performing communication applications. This improvement will be achieved by updating the CommunicationsDialog class. Join us in this article and discussion as we explore key insights and outline the next steps in advancing interface programming using MQL5.

Overcoming The Limitation of Machine Learning (Part 1): Lack of Interoperable Metrics

There is a powerful and pervasive force quietly corrupting the collective efforts of our community to build reliable trading strategies that employ AI in any shape or form. This article establishes that part of the problems we face, are rooted in blind adherence to "best practices". By furnishing the reader with simple real-world market-based evidence, we will reason to the reader why we must refrain from such conduct, and rather adopt domain-bound best practices if our community should stand any chance of recovering the latent potential of AI.