Developing a Replay System (Part 68): Getting the Time Right (I)

Today we will continue working on getting the mouse pointer to tell us how much time is left on a bar during periods of low liquidity. Although at first glance it seems simple, in reality this task is much more difficult. This involves some obstacles that we will have to overcome. Therefore, it is important that you have a good understanding of the material in this first part of this subseries in order to understand the following parts.

From Basic to Intermediate: Arrays and Strings (II)

In this article I will show that although we are still at a very basic stage of programming, we can already implement some interesting applications. In this case, we will create a fairly simple password generator. This way we will be able to apply some of the concepts that have been explained so far. In addition, we will look at how solutions can be developed for some specific problems.

Raw Code Optimization and Tweaking for Improving Back-Test Results

Enhance your MQL5 code by optimizing logic, refining calculations, and reducing execution time to improve back-test accuracy. Fine-tune parameters, optimize loops, and eliminate inefficiencies for better performance.

Developing a Replay System (Part 67): Refining the Control Indicator

In this article, we'll look at what can be achieved with a little code refinement. This refinement is aimed at simplifying our code, making more use of MQL5 library calls and, above all, making it much more stable, secure and easy to use in other projects that we may develop in the future.

Creating a Trading Administrator Panel in MQL5 (Part XI): Modern feature communications interface (I)

Today, we are focusing on the enhancement of the Communications Panel messaging interface to align with the standards of modern, high-performing communication applications. This improvement will be achieved by updating the CommunicationsDialog class. Join us in this article and discussion as we explore key insights and outline the next steps in advancing interface programming using MQL5.

Overcoming The Limitation of Machine Learning (Part 1): Lack of Interoperable Metrics

There is a powerful and pervasive force quietly corrupting the collective efforts of our community to build reliable trading strategies that employ AI in any shape or form. This article establishes that part of the problems we face, are rooted in blind adherence to "best practices". By furnishing the reader with simple real-world market-based evidence, we will reason to the reader why we must refrain from such conduct, and rather adopt domain-bound best practices if our community should stand any chance of recovering the latent potential of AI.

From Basic to Intermediate: Arrays and Strings (I)

In today's article, we'll start exploring some special data types. To begin, we'll define what a string is and explain how to use some basic procedures. This will allow us to work with this type of data, which can be interesting, although sometimes a little confusing for beginners. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

From Basic to Intermediate: Operator Precedence

This is definitely the most difficult question to be explained purely theoretically. That is why you need to practice everything that we're going to discuss here. While this may seem simple at first, the topic of operators can only be understood in practice combined with constant education.

Developing a Replay System (Part 66): Playing the service (VII)

In this article, we will implement the first solution that will allow us to determine when a new bar may appear on the chart. This solution is applicable in a wide variety of situations. Understanding its development will help you grasp several important aspects. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

DoEasy. Service functions (Part 3): Outside Bar pattern

In this article, we will develop the Outside Bar Price Action pattern in the DoEasy library and optimize the methods of access to price pattern management. In addition, we will fix errors and shortcomings identified during library tests.

From Basic to Intermediate: FOR Statement

In this article, we will look at the most basic concepts of the FOR statement. It is very important to understand everything that will be shown here. Unlike the other statements we've talked about so far, the FOR statement has some quirks that quickly make it very complex. So don't let stuff like this accumulate. Start studying and practicing as soon as possible.

Websockets for MetaTrader 5: Asynchronous client connections with the Windows API

This article details the development of a custom dynamically linked library designed to facilitate asynchronous websocket client connections for MetaTrader programs.

Creating a Trading Administrator Panel in MQL5 (Part X): External resource-based interface

Today, we are harnessing the capabilities of MQL5 to utilize external resources—such as images in the BMP format—to create a uniquely styled home interface for the Trading Administrator Panel. The strategy demonstrated here is particularly useful when packaging multiple resources, including images, sounds, and more, for streamlined distribution. Join us in this discussion as we explore how these features are implemented to deliver a modern and visually appealing interface for our New_Admin_Panel EA.

Developing a Replay System (Part 65): Playing the service (VI)

In this article, we will look at how to implement and solve the mouse pointer issue when using it in conjunction with a replay/simulation application. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Reimagining Classic Strategies (Part 14): High Probability Setups

High probability Setups are well known in our trading community, but regrettably they are not well-defined. In this article, we will aim to find an empirical and algorithmic way of defining exactly what is a high probability setup, identifying and exploiting them. By using Gradient Boosting Trees, we demonstrated how the reader can improve the performance of an arbitrary trading strategy and better communicate the exact job to be done to our computer in a more meaningful and explicit manner.

From Novice to Expert: Programming Candlesticks

In this article, we take the first step in MQL5 programming, even for complete beginners. We'll show you how to transform familiar candlestick patterns into a fully functional custom indicator. Candlestick patterns are valuable as they reflect real price action and signal market shifts. Instead of manually scanning charts—an approach prone to errors and inefficiencies—we'll discuss how to automate the process with an indicator that identifies and labels patterns for you. Along the way, we’ll explore key concepts like indexing, time series, Average True Range (for accuracy in varying market volatility), and the development of a custom reusable Candlestick Pattern library for use in future projects.

From Basic to Intermediate: SWITCH Statement

In this article, we will learn how to use the SWITCH statement in its simplest and most basic form. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Price Action Analysis Toolkit Development (Part 20): External Flow (IV) — Correlation Pathfinder

Correlation Pathfinder offers a fresh approach to understanding currency pair dynamics as part of the Price Action Analysis Toolkit Development Series. This tool automates data collection and analysis, providing insight into how pairs like EUR/USD and GBP/USD interact. Enhance your trading strategy with practical, real-time information that helps you manage risk and spot opportunities more effectively.

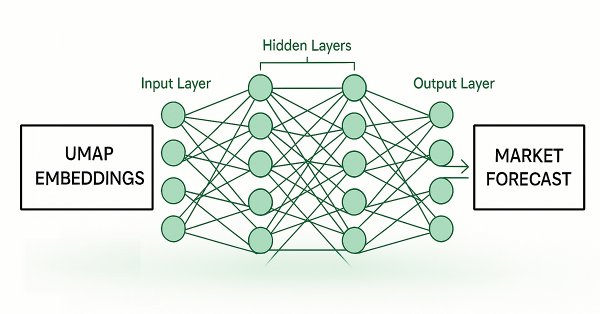

Feature Engineering With Python And MQL5 (Part IV): Candlestick Pattern Recognition With UMAP Regression

Dimension reduction techniques are widely used to improve the performance of machine learning models. Let us discuss a relatively new technique known as Uniform Manifold Approximation and Projection (UMAP). This new technique has been developed to explicitly overcome the limitations of legacy methods that create artifacts and distortions in the data. UMAP is a powerful dimension reduction technique, and it helps us group similar candle sticks in a novel and effective way that reduces our error rates on out of sample data and improves our trading performance.

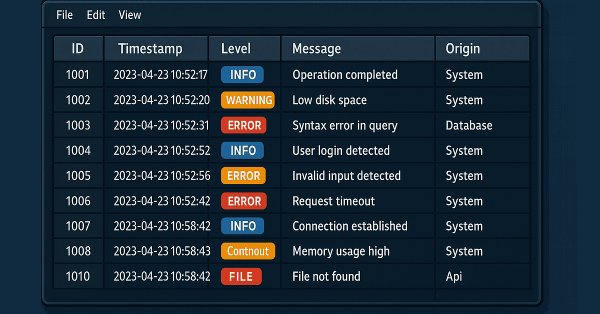

Mastering Log Records (Part 6): Saving logs to database

This article explores the use of databases to store logs in a structured and scalable way. It covers fundamental concepts, essential operations, configuration and implementation of a database handler in MQL5. Finally, it validates the results and highlights the benefits of this approach for optimization and efficient monitoring.

Developing a Replay System (Part 64): Playing the service (V)

In this article, we will look at how to fix two errors in the code. However, I will try to explain them in a way that will help you, beginner programmers, understand that things don't always go as you expect. Anyway, this is an opportunity to learn. The content presented here is intended solely for educational purposes. In no way should this application be considered as a final document with any purpose other than to explore the concepts presented.

Developing a Replay System (Part 63): Playing the service (IV)

In this article, we will finally solve the problems with the simulation of ticks on a one-minute bar so that they can coexist with real ticks. This will help us avoid problems in the future. The material presented here is for educational purposes only. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (V): AnalyticsPanel Class

In this discussion, we explore how to retrieve real-time market data and trading account information, perform various calculations, and display the results on a custom panel. To achieve this, we will dive deeper into developing an AnalyticsPanel class that encapsulates all these features, including panel creation. This effort is part of our ongoing expansion of the New Admin Panel EA, introducing advanced functionalities using modular design principles and best practices for code organization.

Developing a Trading System Based on the Order Book (Part I): Indicator

Depth of Market is undoubtedly a very important element for executing fast trades, especially in High Frequency Trading (HFT) algorithms. In this series of articles, we will look at this type of trading events that can be obtained through a broker on many tradable symbols. We will start with an indicator, where you can customize the color palette, position and size of the histogram displayed directly on the chart. We will also look at how to generate BookEvent events to test the indicator under certain conditions. Other possible topics for future articles include how to store price distribution data and how to use it in a strategy tester.

From Basic to Intermediate: The Include Directive

In today's article, we will discuss a compilation directive that is widely used in various codes that can be found in MQL5. Although this directive will be explained rather superficially here, it is important that you begin to understand how to use it, as it will soon become indispensable as you move to higher levels of programming. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

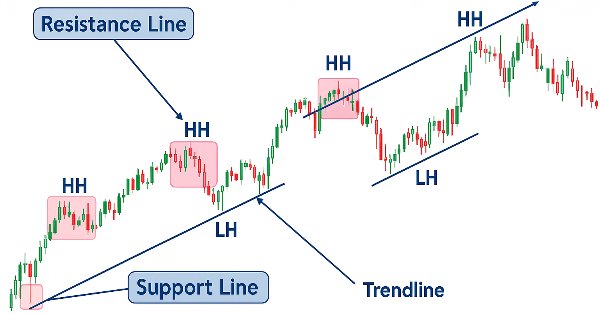

Price Action Analysis Toolkit Development (Part 19): ZigZag Analyzer

Every price action trader manually uses trendlines to confirm trends and spot potential turning or continuation levels. In this series on developing a price action analysis toolkit, we introduce a tool focused on drawing slanted trendlines for easy market analysis. This tool simplifies the process for traders by clearly outlining key trends and levels essential for effective price action evaluation.

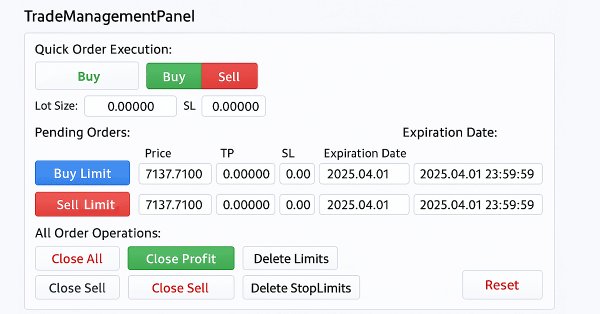

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (IV): Trade Management Panel class

This discussion covers the updated TradeManagementPanel in our New_Admin_Panel EA. The update enhances the panel by using built-in classes to offer a user-friendly trade management interface. It includes trading buttons for opening positions and controls for managing existing trades and pending orders. A key feature is the integrated risk management that allows setting stop loss and take profit values directly in the interface. This update improves code organization for large programs and simplifies access to order management tools, which are often complex in the terminal.

From Basic to Intermediate: BREAK and CONTINUE Statements

In this article, we will look at how to use the RETURN, BREAK, and CONTINUE statements in a loop. Understanding what each of these statements does in the loop execution flow is very important for working with more complex applications. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Simple solutions for handling indicators conveniently

In this article, I will describe how to make a simple panel to change the indicator settings directly from the chart, and what changes need to be made to the indicator to connect the panel. This article is intended for novice MQL5 users.

Day Trading Larry Connors RSI2 Mean-Reversion Strategies

Larry Connors is a renowned trader and author, best known for his work in quantitative trading and strategies like the 2-period RSI (RSI2), which helps identify short-term overbought and oversold market conditions. In this article, we’ll first explain the motivation behind our research, then recreate three of Connors’ most famous strategies in MQL5 and apply them to intraday trading of the S&P 500 index CFD.

Master MQL5 from beginner to pro (Part V): Fundamental control flow operators

This article explores the key operators used to modify the program's execution flow: conditional statements, loops, and switch statements. Utilizing these operators will allow the functions we create to behave more "intelligently".

Build Self Optimizing Expert Advisors in MQL5 (Part 6): Self Adapting Trading Rules (II)

This article explores optimizing RSI levels and periods for better trading signals. We introduce methods to estimate optimal RSI values and automate period selection using grid search and statistical models. Finally, we implement the solution in MQL5 while leveraging Python for analysis. Our approach aims to be pragmatic and straightforward to help you solve potentially complicated problems, with simplicity.

From Basic to Intermediate: WHILE and DO WHILE Statements

In this article, we will take a practical and very visual look at the first loop statement. Although many beginners feel intimidated when faced with the task of creating loops, knowing how to do it correctly and safely can only come with experience and practice. But who knows, maybe I can reduce your troubles and suffering by showing you the main issues and precautions to take when using loops in your code.

Developing a Replay System (Part 62): Playing the service (III)

In this article, we will begin to address the issue of tick excess that can impact application performance when using real data. This excess often interferes with the correct timing required to construct a one-minute bar in the appropriate window.

Bacterial Chemotaxis Optimization (BCO)

The article presents the original version of the Bacterial Chemotaxis Optimization (BCO) algorithm and its modified version. We will take a closer look at all the differences, with a special focus on the new version of BCOm, which simplifies the bacterial movement mechanism, reduces the dependence on positional history, and uses simpler math than the computationally heavy original version. We will also conduct the tests and summarize the results.

From Basic to Intermediate: IF ELSE

In this article we will discuss how to work with the IF operator and its companion ELSE. This statement is the most important and significant of those existing in any programming language. However, despite its ease of use, it can sometimes be confusing if we have no experience with its use and the concepts associated with it. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Developing a Replay System (Part 61): Playing the service (II)

In this article, we will look at changes that will allow the replay/simulation system to operate more efficiently and securely. I will also not leave without attention those who want to get the most out of using classes. In addition, we will consider a specific problem in MQL5 that reduces code performance when working with classes, and explain how to solve it.

Price Action Analysis Toolkit Development (Part 18): Introducing Quarters Theory (III) — Quarters Board

In this article, we enhance the original Quarters Script by introducing the Quarters Board, a tool that lets you toggle quarter levels directly on the chart without needing to revisit the code. You can easily activate or deactivate specific levels, and the EA also provides trend direction commentary to help you better understand market movements.

Resampling techniques for prediction and classification assessment in MQL5

In this article, we will explore and implement, methods for assessing model quality that utilize a single dataset as both training and validation sets.

From Novice to Expert: Support and Resistance Strength Indicator (SRSI)

In this article, we will share insights on how to leverage MQL5 programming to pinpoint market levels—differentiating between weaker and strongest price levels. We will fully develop a working, Support and Resistance Strength Indicator (SRSI).