Cameron Gill / 个人资料

- 信息

|

10+ 年

经验

|

0

产品

|

0

演示版

|

|

0

工作

|

0

信号

|

0

订阅者

|

黄金交易者更新:

截至2020年8月中旬,已部署了有关黄金交易者的新修订战略,其主要目的是防止在发生重大黄金抛售时防止交易的产生。

黄金交易者现在是手动的,可以交易多头和空头,并且可以交易XAUUSD,XAUEUR和XAUAUD。

修订后的战略的核心是在2个不同的时间范围内使用2个指标和趋势线楔形滤波器来确定交易方向。

交易主要在亚洲交易时段进行,周五交易有限。

外汇交易者概述:

FX Trader使用与Gold Trader相同的方法,并交易EURUSD,USDCHF,AUDUSD,USDCAD和GBPUSD。该策略在其他货币对上效果很好,但是优先考虑其他几种流动性货币。

交易通常在亚洲交易时段进行。

Huángjīn jiāoyì zhě gēngxīn:

Jiézhì 2020 nián 8 yuè zhōngxún, yǐ bùshǔle yǒuguān huángjīn jiāoyì zhě de xīn xiūdìng zhànlüè, qí zhǔyào mùdì shì fángzhǐ zài fāshēng zhòngdà huángjīn pāoshòu shí fángzhǐ jiāoyì de chǎnshēng.

Huángjīn jiāoyì zhě xiànzài shì shǒudòng de, kěyǐ jiāoyì duōtóu hé kōngtóu, bìngqiě kěyǐ jiāoyì XAUUSD,XAUEUR hé XAUAUD.

Xiūdìng hòu de zhànlüè de héxīn shì zài 2 gè bùtóng de shíjiān fànwéi nèi shǐyòng 2 gè zhǐbiāo hé qūshì xiàn xiēxíng lǜbō qì lái quèdìng jiāoyì fāngxiàng.

Jiāoyì zhǔyào zài yàzhōu jiāoyì shíduàn jìnxíng, zhōu wǔ jiāoyì yǒuxiàn.

Wàihuì jiāoyì zhě gàishù:

FX Trader shǐyòng yǔ Gold Trader xiāngtóng de fāngfǎ, bìng jiāoyì EURUSD,USDCHF,AUDUSD,USDCAD hé GBPUSD. Gāi cèlüè zài qítā huòbì duì shàng xiàoguǒ hěn hǎo, dànshì yōuxiān kǎolǜ qítā jǐ zhǒng liúdòng xìng huòbì.

Jiāoyì tōngcháng zài yàzhōu jiāoyì shíduàn jìnxíng.

截至2020年8月中旬,已部署了有关黄金交易者的新修订战略,其主要目的是防止在发生重大黄金抛售时防止交易的产生。

黄金交易者现在是手动的,可以交易多头和空头,并且可以交易XAUUSD,XAUEUR和XAUAUD。

修订后的战略的核心是在2个不同的时间范围内使用2个指标和趋势线楔形滤波器来确定交易方向。

交易主要在亚洲交易时段进行,周五交易有限。

外汇交易者概述:

FX Trader使用与Gold Trader相同的方法,并交易EURUSD,USDCHF,AUDUSD,USDCAD和GBPUSD。该策略在其他货币对上效果很好,但是优先考虑其他几种流动性货币。

交易通常在亚洲交易时段进行。

Huángjīn jiāoyì zhě gēngxīn:

Jiézhì 2020 nián 8 yuè zhōngxún, yǐ bùshǔle yǒuguān huángjīn jiāoyì zhě de xīn xiūdìng zhànlüè, qí zhǔyào mùdì shì fángzhǐ zài fāshēng zhòngdà huángjīn pāoshòu shí fángzhǐ jiāoyì de chǎnshēng.

Huángjīn jiāoyì zhě xiànzài shì shǒudòng de, kěyǐ jiāoyì duōtóu hé kōngtóu, bìngqiě kěyǐ jiāoyì XAUUSD,XAUEUR hé XAUAUD.

Xiūdìng hòu de zhànlüè de héxīn shì zài 2 gè bùtóng de shíjiān fànwéi nèi shǐyòng 2 gè zhǐbiāo hé qūshì xiàn xiēxíng lǜbō qì lái quèdìng jiāoyì fāngxiàng.

Jiāoyì zhǔyào zài yàzhōu jiāoyì shíduàn jìnxíng, zhōu wǔ jiāoyì yǒuxiàn.

Wàihuì jiāoyì zhě gàishù:

FX Trader shǐyòng yǔ Gold Trader xiāngtóng de fāngfǎ, bìng jiāoyì EURUSD,USDCHF,AUDUSD,USDCAD hé GBPUSD. Gāi cèlüè zài qítā huòbì duì shàng xiàoguǒ hěn hǎo, dànshì yōuxiān kǎolǜ qítā jǐ zhǒng liúdòng xìng huòbì.

Jiāoyì tōngcháng zài yàzhōu jiāoyì shíduàn jìnxíng.

Cameron Gill

Hello followers,

I am continually amazed how market psychology is displayed in technical analysis with mathematical rules.

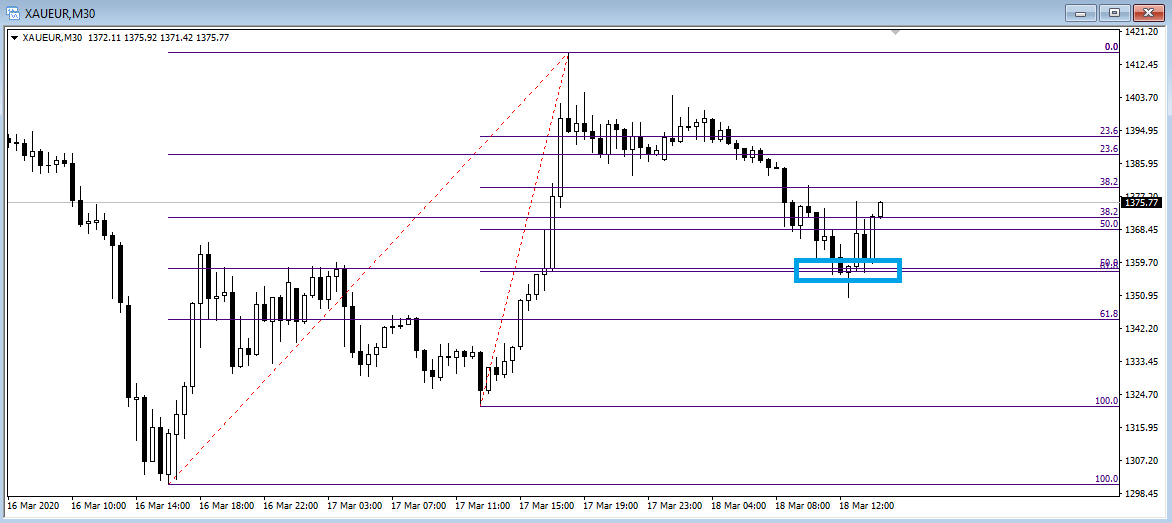

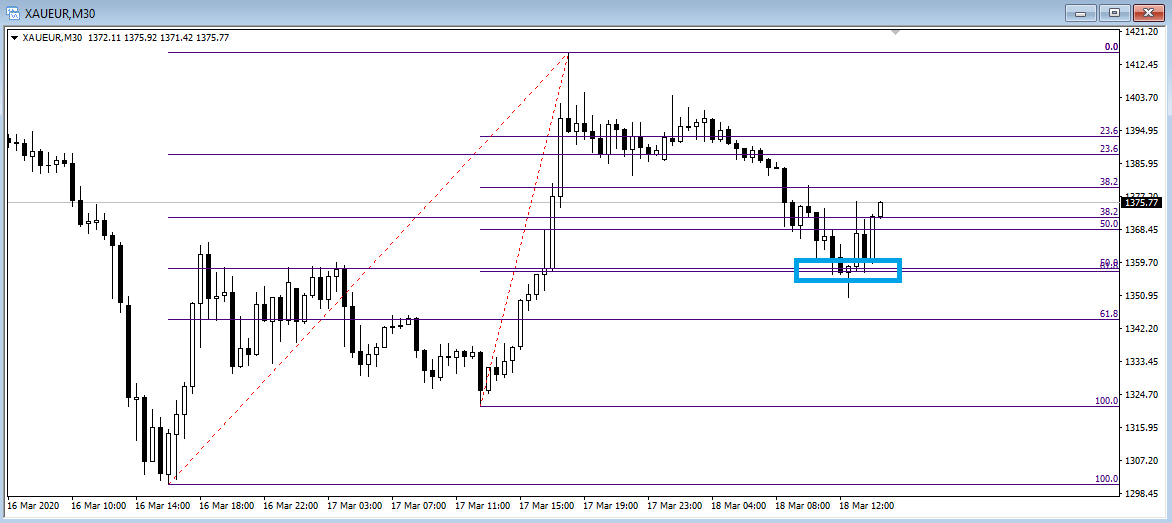

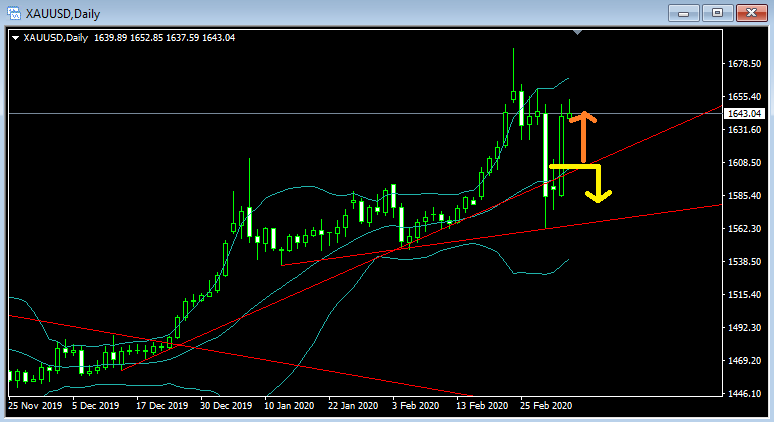

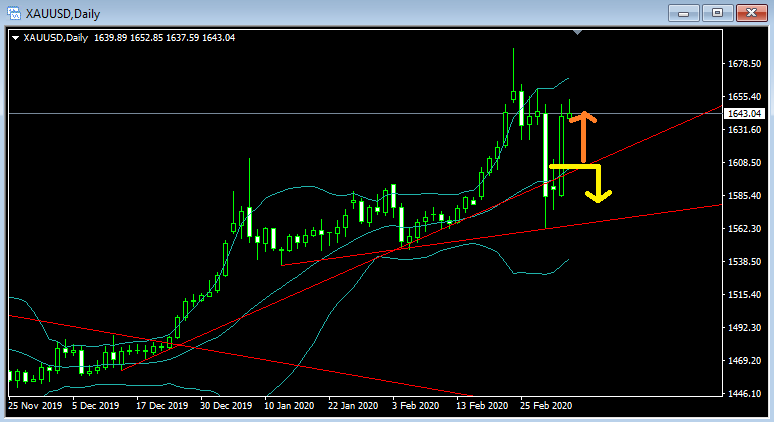

Look at the attached gold chart and how a Fibonacci retracement from two lows based on different times to a recent high to come back to a common 50% and 61.8% region before reversing.

I am continually amazed how market psychology is displayed in technical analysis with mathematical rules.

Look at the attached gold chart and how a Fibonacci retracement from two lows based on different times to a recent high to come back to a common 50% and 61.8% region before reversing.

分享社交网络 · 1

Cameron Gill

Zoo Wee Mama...

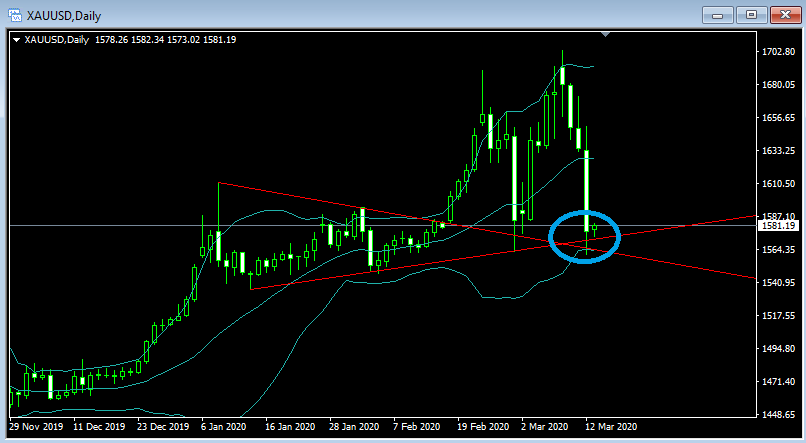

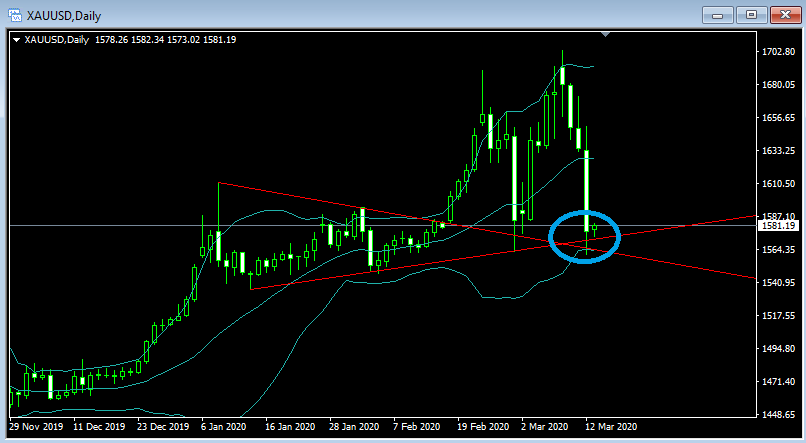

What a huge sell-off. The buyers are just not there.

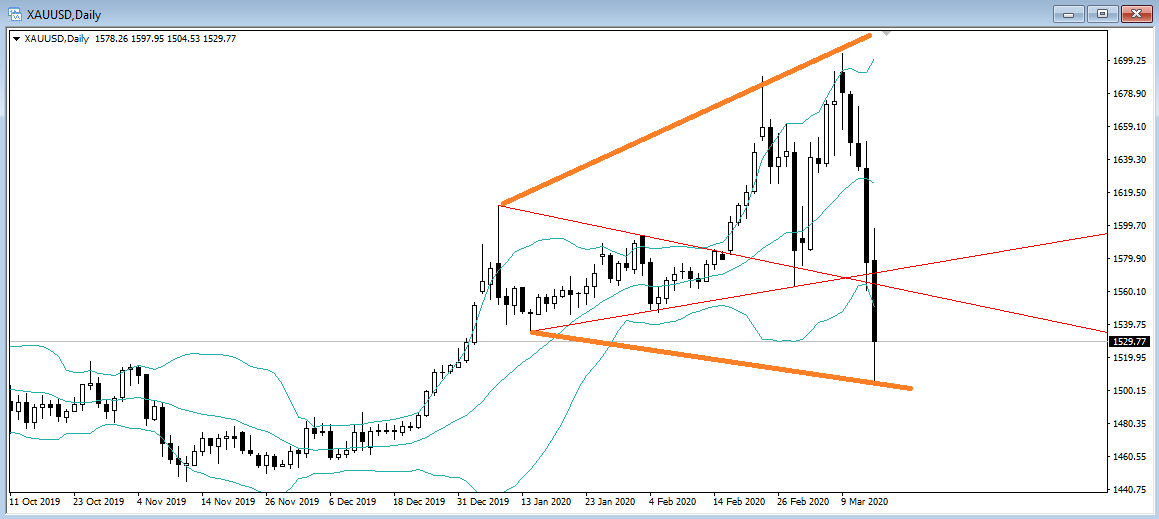

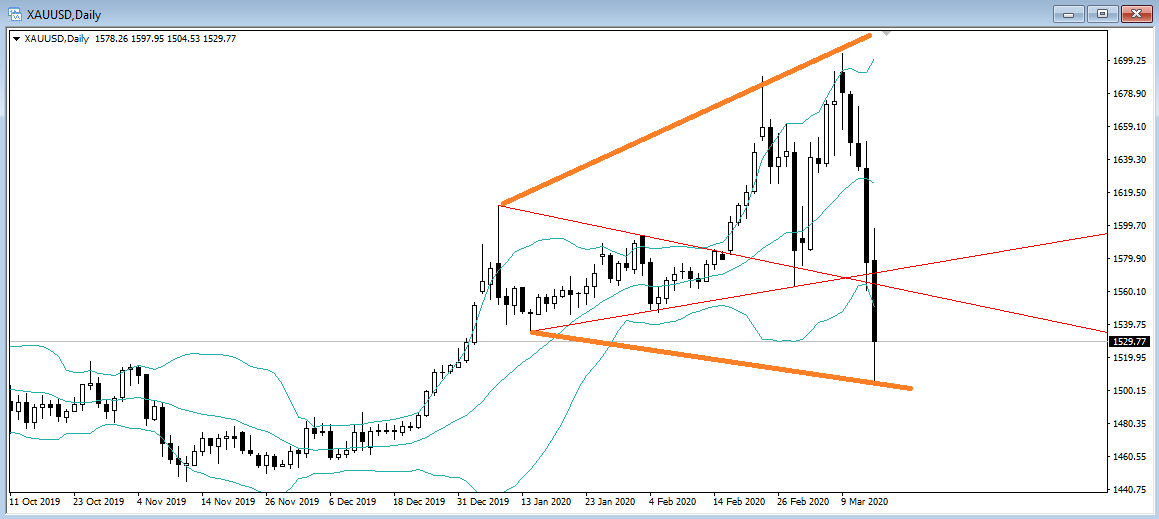

The previous daily channel did not hold and we now have higher highs and lower lows with the lows being dominant.

The reversal on DJIA is concerning, down 10% one day, up 10% the next. This is too volatile and am not expecting any normality in the markets next week. Part of me is saying to myself not to be surprised if the banks do not open next week and report an expended closing. I just do not believe the bounce on DJIA.

Looking at the daily gold chart it is hard to get a clear view of the next few days.

What a huge sell-off. The buyers are just not there.

The previous daily channel did not hold and we now have higher highs and lower lows with the lows being dominant.

The reversal on DJIA is concerning, down 10% one day, up 10% the next. This is too volatile and am not expecting any normality in the markets next week. Part of me is saying to myself not to be surprised if the banks do not open next week and report an expended closing. I just do not believe the bounce on DJIA.

Looking at the daily gold chart it is hard to get a clear view of the next few days.

分享社交网络 · 1

Cameron Gill

Hello followers,

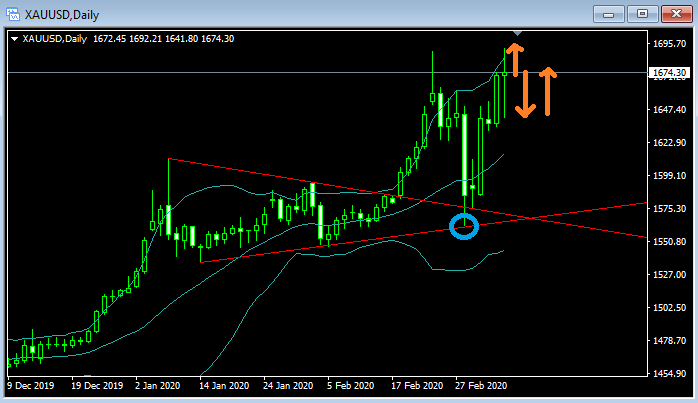

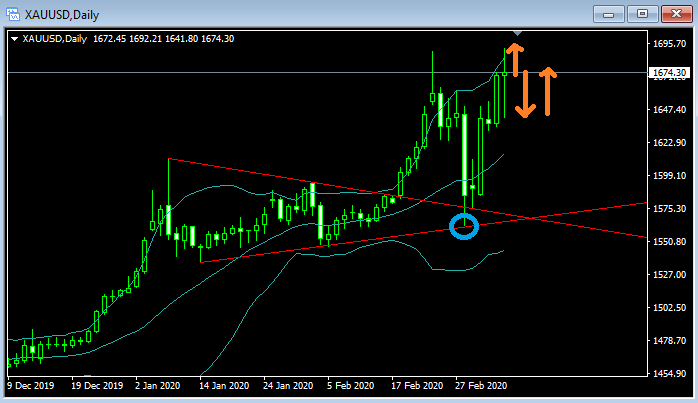

Wow, there was quite a sell-off on gold yesterday! Plus of course other markets crashing.

Many people look at the day in isolation and think it is the end of the world, however when you look at the charts over 2-5 years it is not that bad, it is more like a move back to the average longer term moving average.

My take on it was that the panic was about getting out of assets and back into USD.

Bitcoin took an early hammering, gold next and then when the US stock markets opened it was on for young and old! I noticed a trading halt and then a slight pull-back (indicating traders buying in) and then a close at a much lower level.

Of course the virus is a major concern on the markets, however this sort of correction was coming virus or not.

Are we over the worst of it? That is the question...(today will be interesting!!)

Looking at the gold chart we are at a cross-roads. Whilst gold did break the lower line, it did not close below and came back up. This indicates that the upper trend-line may hold. Today's close is important because if the close is below the upper line then it is not looking good for gold.

Honestly, I feel for those that have lost 'hard-earned' money in the markets yesterday and am sure that many people have profited from this correction.

The Gold Trader strategy was not impacted by the correction yesterday.

Wow, there was quite a sell-off on gold yesterday! Plus of course other markets crashing.

Many people look at the day in isolation and think it is the end of the world, however when you look at the charts over 2-5 years it is not that bad, it is more like a move back to the average longer term moving average.

My take on it was that the panic was about getting out of assets and back into USD.

Bitcoin took an early hammering, gold next and then when the US stock markets opened it was on for young and old! I noticed a trading halt and then a slight pull-back (indicating traders buying in) and then a close at a much lower level.

Of course the virus is a major concern on the markets, however this sort of correction was coming virus or not.

Are we over the worst of it? That is the question...(today will be interesting!!)

Looking at the gold chart we are at a cross-roads. Whilst gold did break the lower line, it did not close below and came back up. This indicates that the upper trend-line may hold. Today's close is important because if the close is below the upper line then it is not looking good for gold.

Honestly, I feel for those that have lost 'hard-earned' money in the markets yesterday and am sure that many people have profited from this correction.

The Gold Trader strategy was not impacted by the correction yesterday.

Cameron Gill

Hello Followers,

GOLD TO SILVER RATIO:

Keep an eye on the Gold to Silver ratio. It is a bit less than 100:1 and indicating that gold is over-valued and silver is way under-valued.

Silver has had a rough run recently and cannot explain why this would be the case. Silver has more industrial applications than gold and perhaps the recent closing of factories due to virus fears has been reflected in the price. However, fundamentally we have a dollar that is crashing and silver (and gold) are both solid commodities and stores of value.

The reason why Gold Trader is not Gold & Silver Trader is due to the fact that the correlations between the two are not accurate, silver chart tends to me way more volatile and it feels that silver is very jumpy whereas gold is more reliable for trend-lines and technical analysis. It is very clear that the volumes ($ not oz) on gold are higher than silver.

GOLD TO SILVER RATIO:

Keep an eye on the Gold to Silver ratio. It is a bit less than 100:1 and indicating that gold is over-valued and silver is way under-valued.

Silver has had a rough run recently and cannot explain why this would be the case. Silver has more industrial applications than gold and perhaps the recent closing of factories due to virus fears has been reflected in the price. However, fundamentally we have a dollar that is crashing and silver (and gold) are both solid commodities and stores of value.

The reason why Gold Trader is not Gold & Silver Trader is due to the fact that the correlations between the two are not accurate, silver chart tends to me way more volatile and it feels that silver is very jumpy whereas gold is more reliable for trend-lines and technical analysis. It is very clear that the volumes ($ not oz) on gold are higher than silver.

分享社交网络 · 1

Cameron Gill

Hello Followers,

We had quite a roller-coaster yesterday and in the last week we have seen further bullish momentum on gold.

Will be interesting to see what Gold and Silver Club analyst reports next week as he was talking short orders at 1609. We had a consequent move up to 1690.

Unfortunately for the Gold Trader strategy it does not pick up on those major moves, only ranging long trades. Fortunately for Gold Trader strategy it does not get caught up in major sell-offs (well hasn't to date anyway!).

Looking at the chart we can see that move on Friday where the Non Farm Payrolls reading was announced and was opposite to expectations. So we saw a move up prior in anticipation of a negative reading for USD, then the announcement which saw the move down, and then finally I think that traders thought that the announcement was fudged and bought back in to move back up.

Next week will be interesting and am hoping that Gold Trader picks up a few trades. Last week was an extremely quiet week.

We had quite a roller-coaster yesterday and in the last week we have seen further bullish momentum on gold.

Will be interesting to see what Gold and Silver Club analyst reports next week as he was talking short orders at 1609. We had a consequent move up to 1690.

Unfortunately for the Gold Trader strategy it does not pick up on those major moves, only ranging long trades. Fortunately for Gold Trader strategy it does not get caught up in major sell-offs (well hasn't to date anyway!).

Looking at the chart we can see that move on Friday where the Non Farm Payrolls reading was announced and was opposite to expectations. So we saw a move up prior in anticipation of a negative reading for USD, then the announcement which saw the move down, and then finally I think that traders thought that the announcement was fudged and bought back in to move back up.

Next week will be interesting and am hoping that Gold Trader picks up a few trades. Last week was an extremely quiet week.

Cameron Gill

Hello followers,

Have not had any trades come up so far this month.

I do not want to get into trades too early and the EA entries are just not being triggered.

What is interesting is that a gold/silver analyst that I check weekly was promoting sell orders at 1508. These would have been triggered and would now be in a decent draw-down.

The last few days demonstrate why Gold Trader is buy only as if it included shorts I would expect to have been caught in the recent move.

The obvious reason for the quick bullish move back to higher region is the lowering of interest rate and panic around virus. Many reserve banks are talking further stimulus, which is not good for fiat currencies.

We have NFP on Friday so will wait and see.

There is a chance no trades will be generated this week.

Have not had any trades come up so far this month.

I do not want to get into trades too early and the EA entries are just not being triggered.

What is interesting is that a gold/silver analyst that I check weekly was promoting sell orders at 1508. These would have been triggered and would now be in a decent draw-down.

The last few days demonstrate why Gold Trader is buy only as if it included shorts I would expect to have been caught in the recent move.

The obvious reason for the quick bullish move back to higher region is the lowering of interest rate and panic around virus. Many reserve banks are talking further stimulus, which is not good for fiat currencies.

We have NFP on Friday so will wait and see.

There is a chance no trades will be generated this week.

分享社交网络 · 1

Cameron Gill

2020.03.07

Hi there, yes Gold Trader is EA and manual. Around 60% of trade entries are EA, rest are manual. Majority of trades are closed manually and all trades are monitored.

: