Claws and Horns / 个人资料

Claws and Horns

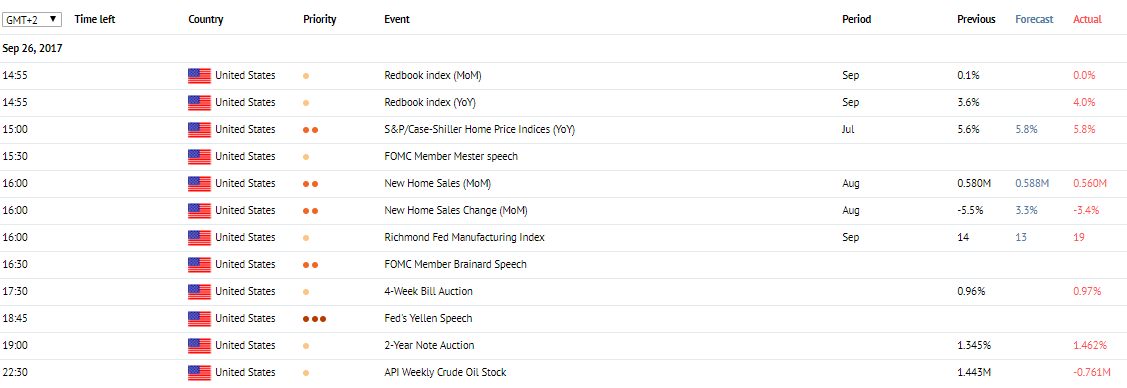

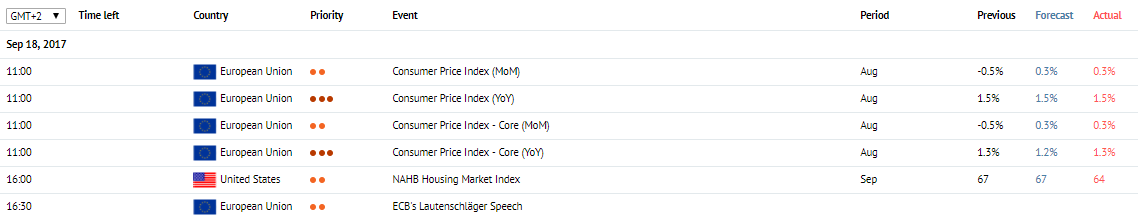

News of the day. 26.09.2017

BoJ Monetary Policy Meeting Minutes. Japan, 01:50 (GMT+2)

After the meeting the Bank of Japan releases an analytical report on the economic situation evaluating the prospects of its development.

S&P/CaseShiller Home Price Indices. USA, 15:00 (GMT+2)

S&P/CaseShiller Home Price Indices are due at 15:00 (GMT+2). The indicator is expected to grow to 5.8% in July from 5.7% a month earlier. It shows changes in housing prices in 20 major US regions. High results strengthen USD, and low ones weaken it.

New Home Sales. USA, 16:00 (GMT+2)

The data on new home sales is due at 16:00 (GMT+2). The indicator is expected to grow to 3.3% in August from -9.4% a month earlier. This is a very important indicator in terms of US real estate market. That is why the growth of the indicator is a signal about increased general well-being and the growth of the economy. High values of the indicator facilitate the growth of USD. Lower values have negative impact on the USD.

BoJ Monetary Policy Meeting Minutes. Japan, 01:50 (GMT+2)

After the meeting the Bank of Japan releases an analytical report on the economic situation evaluating the prospects of its development.

S&P/CaseShiller Home Price Indices. USA, 15:00 (GMT+2)

S&P/CaseShiller Home Price Indices are due at 15:00 (GMT+2). The indicator is expected to grow to 5.8% in July from 5.7% a month earlier. It shows changes in housing prices in 20 major US regions. High results strengthen USD, and low ones weaken it.

New Home Sales. USA, 16:00 (GMT+2)

The data on new home sales is due at 16:00 (GMT+2). The indicator is expected to grow to 3.3% in August from -9.4% a month earlier. This is a very important indicator in terms of US real estate market. That is why the growth of the indicator is a signal about increased general well-being and the growth of the economy. High values of the indicator facilitate the growth of USD. Lower values have negative impact on the USD.

Claws and Horns

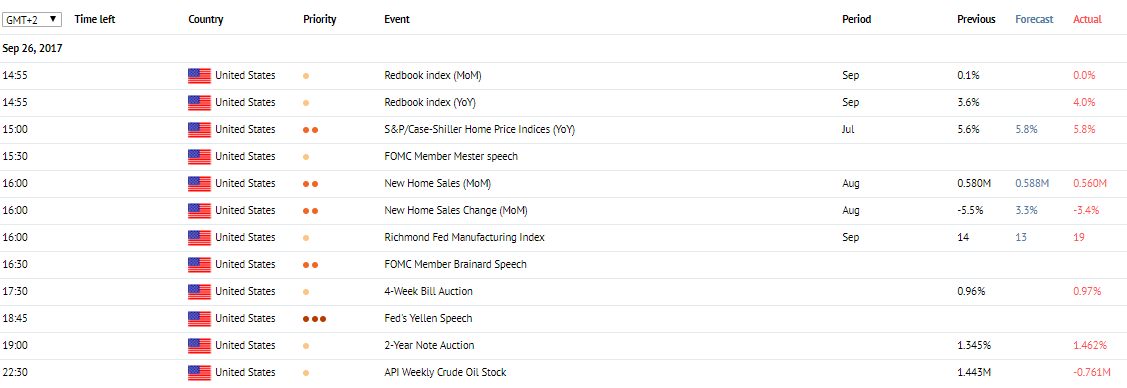

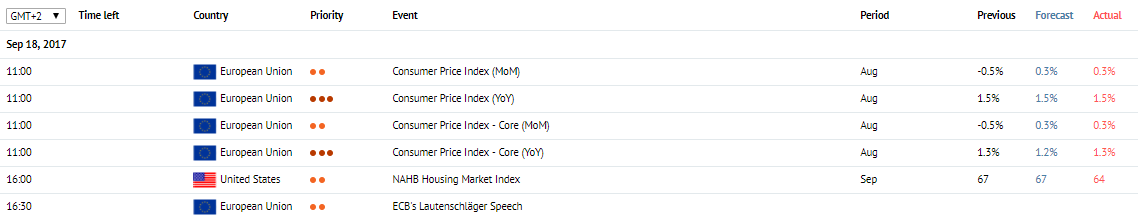

News of the day. 18.09.2017

Consumer Price Index. Eurozone, 11:00 (GMT+2)

Consumer Price Index is due at 11:00 (GMT+2) in the Eurozone. The YoY index is expected to stay on the same level of 1.5% in August. The MoM index is expected to be at the level of –0.2% in August against –0.5% in the previous month. It is the key indicator of inflation in the Eurozone and represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

NAHB Housing Market Index. USA, 16:00 (GMT+2

NAHB Housing Market Index is due at 16:00 (GMT+2) in the USA. It is based on the survey of house owners to estimate the market prices of houses. It represents home sales and expected home buildings in the nearest 6 months, indicating housing market trend in the United States. A high reading reflects favorable state of the housing market and is seen as positive for the USD, whereas a low reading is seen as negative.

Consumer Price Index. Eurozone, 11:00 (GMT+2)

Consumer Price Index is due at 11:00 (GMT+2) in the Eurozone. The YoY index is expected to stay on the same level of 1.5% in August. The MoM index is expected to be at the level of –0.2% in August against –0.5% in the previous month. It is the key indicator of inflation in the Eurozone and represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

NAHB Housing Market Index. USA, 16:00 (GMT+2

NAHB Housing Market Index is due at 16:00 (GMT+2) in the USA. It is based on the survey of house owners to estimate the market prices of houses. It represents home sales and expected home buildings in the nearest 6 months, indicating housing market trend in the United States. A high reading reflects favorable state of the housing market and is seen as positive for the USD, whereas a low reading is seen as negative.

Claws and Horns

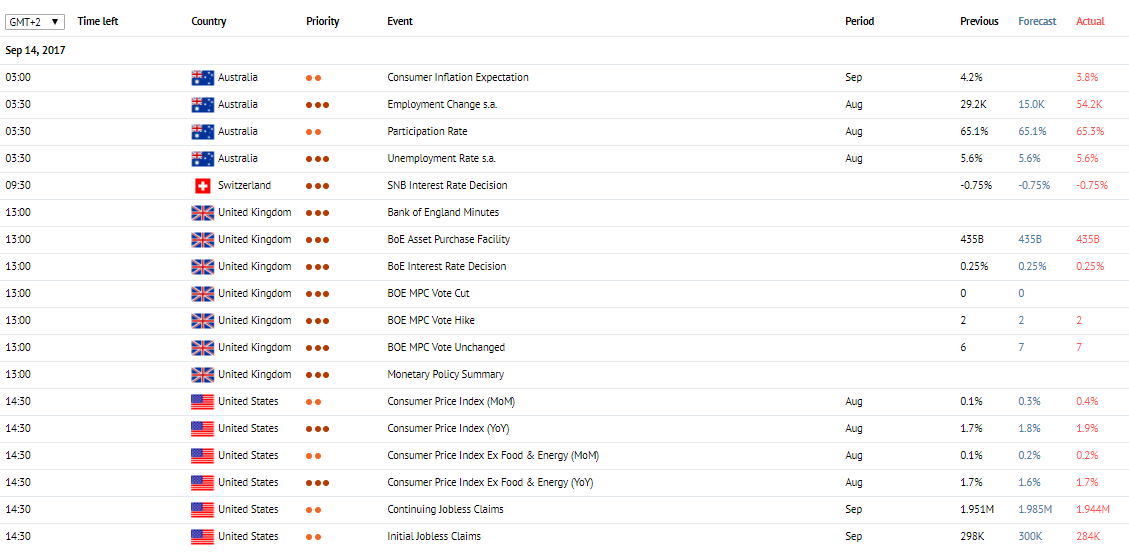

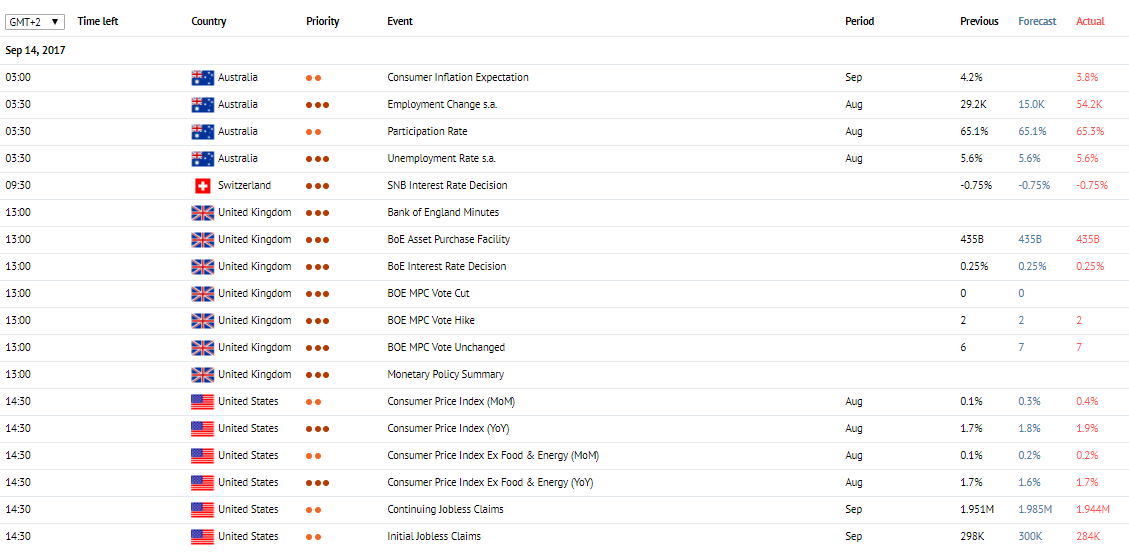

News of the day. 14.09.2017

Employment Rate. Australia, 03:30 (GMT+2)

The data on the employment rate in Australia is due at 03:30 (GMT+2). The indicator is to make 15K in August against 27.9K a month earlier. The index shows the number of recently employed Australian citizens. The growth of its value strengthens AUD, and reduction weakens it.

National Bank of Switzerland Decision on the Interest Rate. Switzerland, 10:30 (GMT+2)

The decision of National Bank of Switzerland on the interest rate is due today at 10:30 (GMT+2). The National Bank of Switzerland makes the decision based on current economic situation and inflation level. The growth of the indicator strengthens CHF. If the rate stays at the same level or goes down, CHF rate is decreased.

Bank of England Decision on the Interest Rate. UK, 13:00 (GMT+2)

The decision of the Bank of England on the interest rate will be released at 13:00 (GMT+2). The Bank of England makes its decision on the interest rate based on the current economic situation and the level of inflation. The growth of the indicator strengthens GBP. If the rate stays at the same level or goes down, the national currency rate is decreased.

Bank of England Minutes. UK, 13:00 (GMT+2)

After the decision is announced, the minutes of the Fiscal Policy Committee with comments about made decisions is published.

Consumer Prices Index. USA, 14:30 (GMT+2)

Consumer Price Index is due at 14:30 (GMT+2). The indicator is expected to grow to 1.8% YoY in August from 1.7% a month earlier. It is the key indicator of inflation in the country. Represents the change in the value of the basket of goods and services. Positive results strengthen USD, and negative ones weaken it.

Initial Jobless Claims. USA, 14:30 (GMT+2)

Initial Jobless Claims are due at 14:30 (GMT+2). The indicator is expected to grow to 300K a week from 298K a week earlier. The value indicates the number of new jobless claims. The index is published every Thursday and shows the value of nonfarm payrolls. Decreasing the amount of the claims influences the USA dollar in a positive way. Increased amount of claims, on the contrary, is considered to be a negative factor.

Employment Rate. Australia, 03:30 (GMT+2)

The data on the employment rate in Australia is due at 03:30 (GMT+2). The indicator is to make 15K in August against 27.9K a month earlier. The index shows the number of recently employed Australian citizens. The growth of its value strengthens AUD, and reduction weakens it.

National Bank of Switzerland Decision on the Interest Rate. Switzerland, 10:30 (GMT+2)

The decision of National Bank of Switzerland on the interest rate is due today at 10:30 (GMT+2). The National Bank of Switzerland makes the decision based on current economic situation and inflation level. The growth of the indicator strengthens CHF. If the rate stays at the same level or goes down, CHF rate is decreased.

Bank of England Decision on the Interest Rate. UK, 13:00 (GMT+2)

The decision of the Bank of England on the interest rate will be released at 13:00 (GMT+2). The Bank of England makes its decision on the interest rate based on the current economic situation and the level of inflation. The growth of the indicator strengthens GBP. If the rate stays at the same level or goes down, the national currency rate is decreased.

Bank of England Minutes. UK, 13:00 (GMT+2)

After the decision is announced, the minutes of the Fiscal Policy Committee with comments about made decisions is published.

Consumer Prices Index. USA, 14:30 (GMT+2)

Consumer Price Index is due at 14:30 (GMT+2). The indicator is expected to grow to 1.8% YoY in August from 1.7% a month earlier. It is the key indicator of inflation in the country. Represents the change in the value of the basket of goods and services. Positive results strengthen USD, and negative ones weaken it.

Initial Jobless Claims. USA, 14:30 (GMT+2)

Initial Jobless Claims are due at 14:30 (GMT+2). The indicator is expected to grow to 300K a week from 298K a week earlier. The value indicates the number of new jobless claims. The index is published every Thursday and shows the value of nonfarm payrolls. Decreasing the amount of the claims influences the USA dollar in a positive way. Increased amount of claims, on the contrary, is considered to be a negative factor.

Claws and Horns

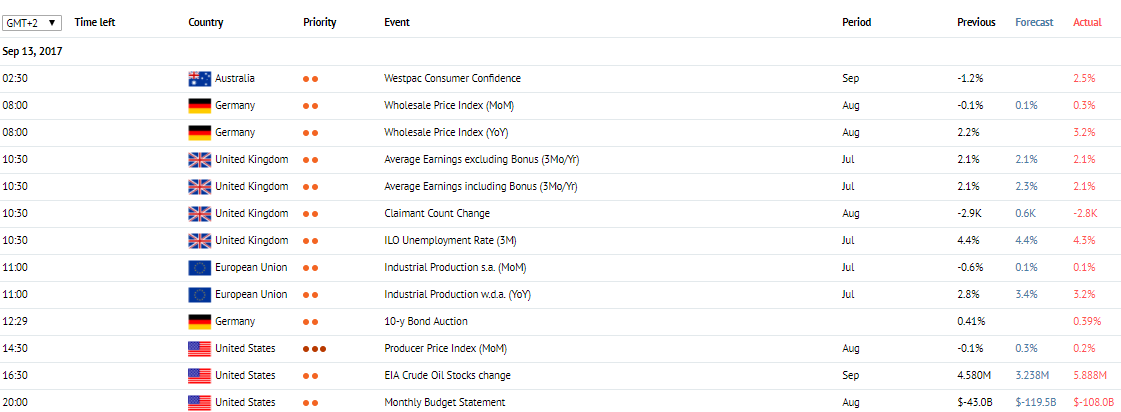

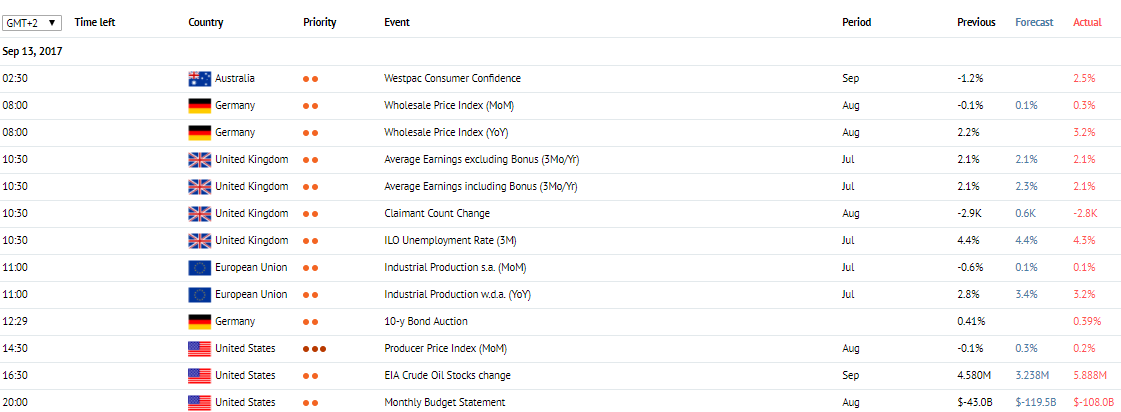

News of the day. 13.09.2017

Westpac Consumer Confidence. Australia, 02:30 (GMT+2)

Westpac Consumer Confidence publication is due at 02:30 (GMT+2) in Australia. The data on consumer confidence is based on survey responses from consumers regarding how confident they feel about current economic conditions and a short-term outlook for the economy. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

Consumer Price Index. Germany, 08:00 (GMT+2)

The Consumer Price Index is due at 08:00 (GMT+2) in Germany. The MoM indicator is expected to stay on the same level of 0.1% in August. The index represents the change in prices for goods and services for households and is considered the main inflation indicator. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Claimant Count Change. United Kingdom, 10:30 (GMT+2)

Claimant Count Change publication is due at 10:30 (GMT+2) in the UK. The index is expected to reach 0.6K in August against –4.2K in the previous month. The indicator represents the number of unemployed in the UK. A high reading weakens the GBP. A low reading strengthens the GBP.

Industrial Production. Eurozone, 12:00 (GMT+2)

The Industrial Production publication is due at 12:00 (GMT+2) in the EU. The YoY index is expected to grow to 3.4% in July from 2.6% in the previous month. The MoM index is expected to grow to 0.1% in July from –0.6% in the previous month. Data on industrial production represents changes in industrial output and is considered as one of the major indicators of the state of the economy. A high reading strengthens the EUR. A low reading weakens the EUR.

Producer Price Index. USA, 15:30 (GMT+2)

The Producer Price Index publication is due at 15:30 (GMT+2) in the USA. The index is expected to grow to 0.3% in August from –0.1% in the previous month. It represents the wholesale prices change from producers. A high reading strengthens the USD. A low reading weakens the USD.

Westpac Consumer Confidence. Australia, 02:30 (GMT+2)

Westpac Consumer Confidence publication is due at 02:30 (GMT+2) in Australia. The data on consumer confidence is based on survey responses from consumers regarding how confident they feel about current economic conditions and a short-term outlook for the economy. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

Consumer Price Index. Germany, 08:00 (GMT+2)

The Consumer Price Index is due at 08:00 (GMT+2) in Germany. The MoM indicator is expected to stay on the same level of 0.1% in August. The index represents the change in prices for goods and services for households and is considered the main inflation indicator. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Claimant Count Change. United Kingdom, 10:30 (GMT+2)

Claimant Count Change publication is due at 10:30 (GMT+2) in the UK. The index is expected to reach 0.6K in August against –4.2K in the previous month. The indicator represents the number of unemployed in the UK. A high reading weakens the GBP. A low reading strengthens the GBP.

Industrial Production. Eurozone, 12:00 (GMT+2)

The Industrial Production publication is due at 12:00 (GMT+2) in the EU. The YoY index is expected to grow to 3.4% in July from 2.6% in the previous month. The MoM index is expected to grow to 0.1% in July from –0.6% in the previous month. Data on industrial production represents changes in industrial output and is considered as one of the major indicators of the state of the economy. A high reading strengthens the EUR. A low reading weakens the EUR.

Producer Price Index. USA, 15:30 (GMT+2)

The Producer Price Index publication is due at 15:30 (GMT+2) in the USA. The index is expected to grow to 0.3% in August from –0.1% in the previous month. It represents the wholesale prices change from producers. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

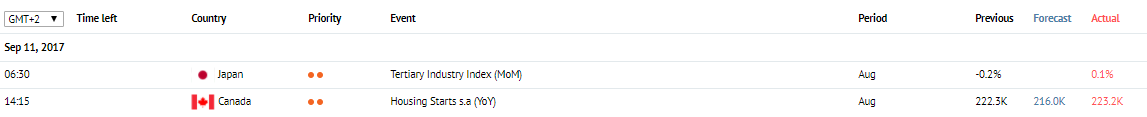

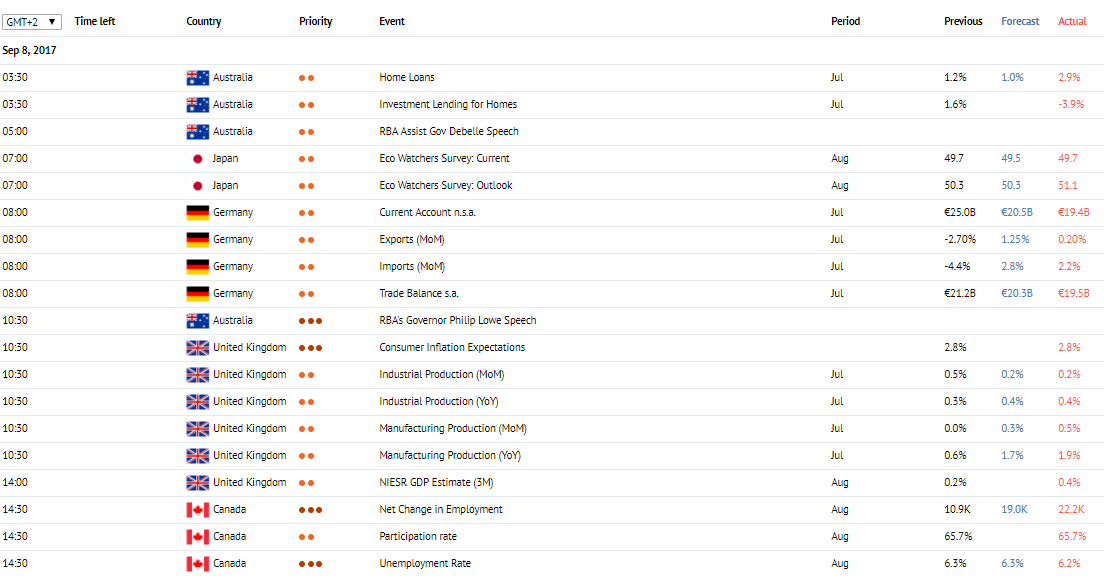

News of the day. 11.09.2017

Electronic Card Retail Sales. New Zealand, 00:45 (GMT+2)

The Electronic Card Retail Sales publications are due at 00:45 (GMT+2) in New Zealand. The indices measure purchases made in New Zealand on debit, credit and store cards. The figure gives hint of strength in the retail sector and influences interest rate decisions. A high number is generally positive for the New Zealand dollar, while a weak number is seen as negative.

Tertiary Industry Index. Japan, 06:30 (GMT+2)

The Tertiary Industry Index (MoM) is due at 06:30 (GMT+2) in Japan. It indicates the domestic service sector in Japan Generally, a high reading is positive for the JPY, while a low reading is negative.

Housing Starts s.a. Canada, 14:15 (GMT+2)

The Housing Starts s.a (YoY) publication is due at 14:15 (GMT+2) in Canada. The index released by the Canadian Mortgage and Housing Corporation captures how many new single-family homes or buildings were constructed. It shows the strength of the Canadian housing market, which can be considered as the economy as a whole due to Housing Starts' sensitivity to changes in the business cycle. A high reading is seen as positive for the CAD, while a low reading is seen as negative.

Electronic Card Retail Sales. New Zealand, 00:45 (GMT+2)

The Electronic Card Retail Sales publications are due at 00:45 (GMT+2) in New Zealand. The indices measure purchases made in New Zealand on debit, credit and store cards. The figure gives hint of strength in the retail sector and influences interest rate decisions. A high number is generally positive for the New Zealand dollar, while a weak number is seen as negative.

Tertiary Industry Index. Japan, 06:30 (GMT+2)

The Tertiary Industry Index (MoM) is due at 06:30 (GMT+2) in Japan. It indicates the domestic service sector in Japan Generally, a high reading is positive for the JPY, while a low reading is negative.

Housing Starts s.a. Canada, 14:15 (GMT+2)

The Housing Starts s.a (YoY) publication is due at 14:15 (GMT+2) in Canada. The index released by the Canadian Mortgage and Housing Corporation captures how many new single-family homes or buildings were constructed. It shows the strength of the Canadian housing market, which can be considered as the economy as a whole due to Housing Starts' sensitivity to changes in the business cycle. A high reading is seen as positive for the CAD, while a low reading is seen as negative.

Claws and Horns

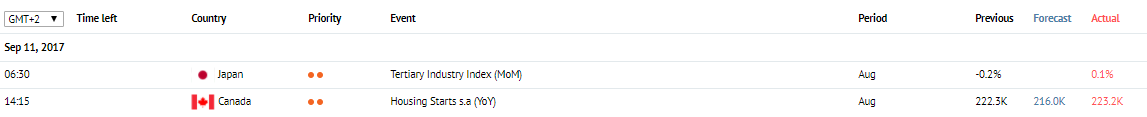

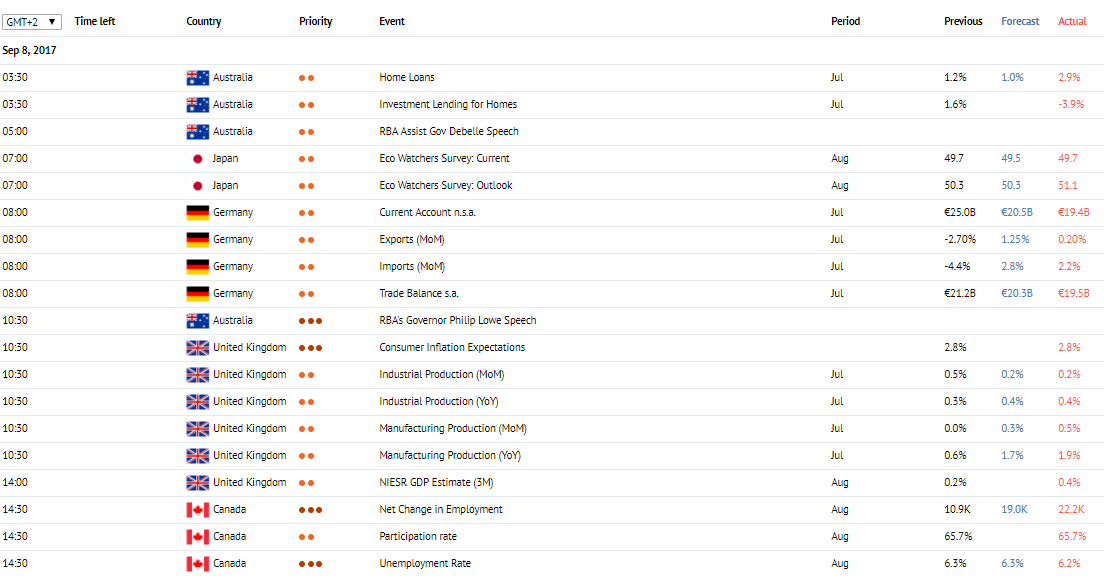

News of the day. 8.09.2017

Gross Domestic Product Annualized. Japan, 01:50 (GMT+2)

Gross Domestic Product Annualized publication is due at 01:50 (GMT+2) in Japan. The index is expected to fall to 2.9% in the second quarter from 4.0% in the previous period. The index shows the monetary value of all the goods, services and structures produced in Japan within a given period of time. A high reading or a better than expected number is seen as positive for the JPY, while a low reading is negative.

Home Loans. Australia, 03:30 (GMT+2)

Home Loans publication is due at 03:30 (GMT+2) in Australia. The index is expected to grow to 1.0% in July from 0.5% in the previous month. The data on home loans represents the number of recently extended home loans. It is one of the key indicators of the property market. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

RBA Assist Gov Debelle Speech. Australia, 05:00 (GMT+2)

RBA Assist Gov Debelle Speech is due at 05:00 (GMT+2). Guy Debelle is the Assistant Governor (Financial Markets) at the Reserve Bank of Australia. In that role, he has oversight of the Bank's operations in the domestic and global financial markets, including the management of Australia's foreign reserves.

Trade Balance s.a. Germany, 08:00 (GMT+2)

Trade Balance s.a. is due at 08:00 (GMT+2) in Germany. The decrease of surplus to 20.3 billion EUR in July from 21.2 billion in the previous month is expected. The Trade Balance is a balance between exports and imports of total goods and services. A positive value shows a trade surplus, while a negative value shows a trade deficit. It is an event that generates some volatility for the EUR. If a steady demand in exchange for German exports is seen, that would turn into a positive growth in the trade balance, and that should be positive for the EUR.

Industrial Production. United Kingdom, 10:30 (GMT+2)

The Industrial Production publication is due at 10:30 (GMT+2) in the UK. The YoY index is expected to grow to 0.4% in July from 0.3% in the previous month. It represents industrial output in the UK and is one of the major indicators of the state of the national economy. The index includes manufacturing, mining and utilities. A growth in the index supports the GBP. A fall in the index pressures the GBP.

NIESR GDP Estimate. United Kingdom, 14:00 (GMT+2)

NIESR GDP Estimate (3M) publication is due at 14:00 (GMT+2) in the UK. The GDP Estimate released by the National Institute of Economic and Social Research is an estimate of growth over the last 3 months up to the report which comes out a month before the official announcement. The report is highly reliable and would influence the UK monetary policy. A high reading is seen as positive for the GBP, whereas a low reading is seen as negative.

Net Change in Employment. Canada, 14:30 (GMT+2)

Net Change in Employment publication is due at 14:30 (GMT+2) in Canada. The index is expected to grow to 19.0K in August from 10.9K in the previous month. It is a measure of the change in the number of employed people in Canada. A high reading is seen as positive for the CAD and reflects an economy growth, while a low reading is seen as negative.

Gross Domestic Product Annualized. Japan, 01:50 (GMT+2)

Gross Domestic Product Annualized publication is due at 01:50 (GMT+2) in Japan. The index is expected to fall to 2.9% in the second quarter from 4.0% in the previous period. The index shows the monetary value of all the goods, services and structures produced in Japan within a given period of time. A high reading or a better than expected number is seen as positive for the JPY, while a low reading is negative.

Home Loans. Australia, 03:30 (GMT+2)

Home Loans publication is due at 03:30 (GMT+2) in Australia. The index is expected to grow to 1.0% in July from 0.5% in the previous month. The data on home loans represents the number of recently extended home loans. It is one of the key indicators of the property market. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

RBA Assist Gov Debelle Speech. Australia, 05:00 (GMT+2)

RBA Assist Gov Debelle Speech is due at 05:00 (GMT+2). Guy Debelle is the Assistant Governor (Financial Markets) at the Reserve Bank of Australia. In that role, he has oversight of the Bank's operations in the domestic and global financial markets, including the management of Australia's foreign reserves.

Trade Balance s.a. Germany, 08:00 (GMT+2)

Trade Balance s.a. is due at 08:00 (GMT+2) in Germany. The decrease of surplus to 20.3 billion EUR in July from 21.2 billion in the previous month is expected. The Trade Balance is a balance between exports and imports of total goods and services. A positive value shows a trade surplus, while a negative value shows a trade deficit. It is an event that generates some volatility for the EUR. If a steady demand in exchange for German exports is seen, that would turn into a positive growth in the trade balance, and that should be positive for the EUR.

Industrial Production. United Kingdom, 10:30 (GMT+2)

The Industrial Production publication is due at 10:30 (GMT+2) in the UK. The YoY index is expected to grow to 0.4% in July from 0.3% in the previous month. It represents industrial output in the UK and is one of the major indicators of the state of the national economy. The index includes manufacturing, mining and utilities. A growth in the index supports the GBP. A fall in the index pressures the GBP.

NIESR GDP Estimate. United Kingdom, 14:00 (GMT+2)

NIESR GDP Estimate (3M) publication is due at 14:00 (GMT+2) in the UK. The GDP Estimate released by the National Institute of Economic and Social Research is an estimate of growth over the last 3 months up to the report which comes out a month before the official announcement. The report is highly reliable and would influence the UK monetary policy. A high reading is seen as positive for the GBP, whereas a low reading is seen as negative.

Net Change in Employment. Canada, 14:30 (GMT+2)

Net Change in Employment publication is due at 14:30 (GMT+2) in Canada. The index is expected to grow to 19.0K in August from 10.9K in the previous month. It is a measure of the change in the number of employed people in Canada. A high reading is seen as positive for the CAD and reflects an economy growth, while a low reading is seen as negative.

Claws and Horns

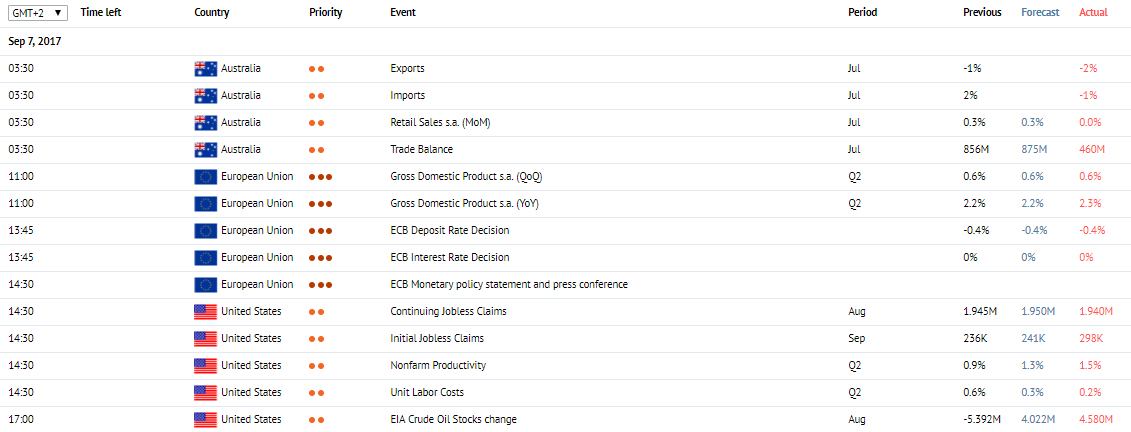

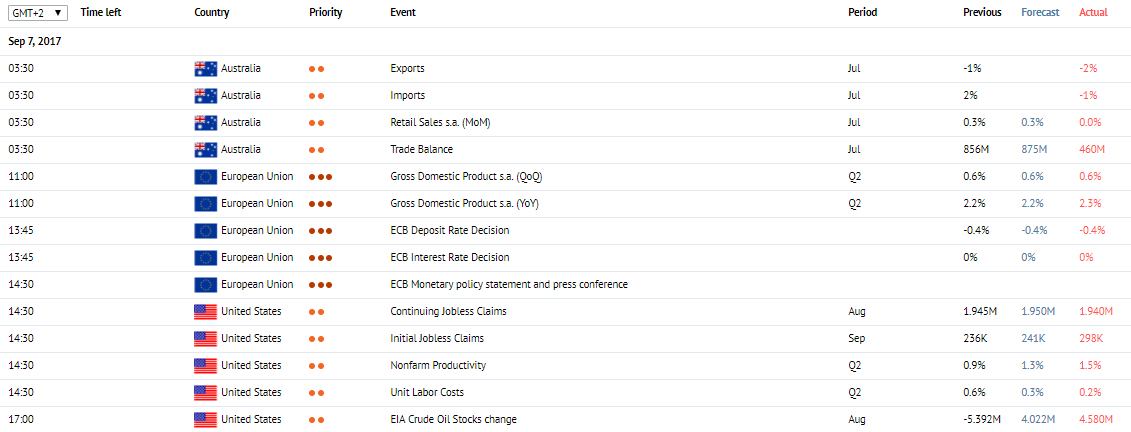

News of the day. 7.09.2017

AiG Performance of Construction Index. Australia, 01:30 (GMT+2)

AiG Performance of Construction Index is due at 01:30 (GMT+2) in Australia. The index is constructed from survey data collected from executives of 120 construction companies regarding their assessment of such criteria as sales, production, new orders, supplier deliveries and employment in the sector. A reading above 50 is perceived positive and strengthens the AUD. A reading below 50, on the contrary, is perceived negative and weakens the AUD.

Trade Balance. Australia, 03:30 (GMT+2)

Trade Balance publication is due at 03:30 (GMT+2) in Australia. The growth of the surplus to 875 million USD in July from 856 million in the previous month is expected. The data on trade balance represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the AUD. Negative values indicate the balance deficit and weaken the AUD.

Gross Domestic Product. EU, 11:00 (GMT+2)

Gross Domestic Product publication is due at 11:00 (GMT+2) in the EU. The YoY index is expected to stay on the same level of 2.2% in the second quarter. The Gross Domestic Product is a measure of the total value of all goods and services produced by the Eurozone. A rising trend has a positive effect on the EUR, while a falling trend is seen as negative.

ECB Interest Rate Decision. EU, 13:45 (GMT+2)

ECB Interest Rate Decision is due at 13:45 (GMT+2). The index is expected to stay on the same level of 0%. ECB decides upon the rate according to current economy and inflation state. A growth strengthens the EUR, if the rate stays on the same level or decreases, EUR is going down.

Initial Jobless Claims. USA, 14:30 (GMT+2)

Initial Jobless Claims publication is due at 14:30 (GMT+2) in the USA. The index is expected to grow to 241K in a week from 236K in the previous week. It measures the number of individuals who are unemployed and are currently receiving unemployment benefits and can predict the Nonfarm Payrolls value. A rise in this indicator has negative implications for consumer spending which discourage economic growth.

ECB Monetary policy statement and press conference. EU, 14:30 (GMT+2)

Following the ECB´s economic policy decision, the ECB President gives a press conference regarding monetary policy.

AiG Performance of Construction Index. Australia, 01:30 (GMT+2)

AiG Performance of Construction Index is due at 01:30 (GMT+2) in Australia. The index is constructed from survey data collected from executives of 120 construction companies regarding their assessment of such criteria as sales, production, new orders, supplier deliveries and employment in the sector. A reading above 50 is perceived positive and strengthens the AUD. A reading below 50, on the contrary, is perceived negative and weakens the AUD.

Trade Balance. Australia, 03:30 (GMT+2)

Trade Balance publication is due at 03:30 (GMT+2) in Australia. The growth of the surplus to 875 million USD in July from 856 million in the previous month is expected. The data on trade balance represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the AUD. Negative values indicate the balance deficit and weaken the AUD.

Gross Domestic Product. EU, 11:00 (GMT+2)

Gross Domestic Product publication is due at 11:00 (GMT+2) in the EU. The YoY index is expected to stay on the same level of 2.2% in the second quarter. The Gross Domestic Product is a measure of the total value of all goods and services produced by the Eurozone. A rising trend has a positive effect on the EUR, while a falling trend is seen as negative.

ECB Interest Rate Decision. EU, 13:45 (GMT+2)

ECB Interest Rate Decision is due at 13:45 (GMT+2). The index is expected to stay on the same level of 0%. ECB decides upon the rate according to current economy and inflation state. A growth strengthens the EUR, if the rate stays on the same level or decreases, EUR is going down.

Initial Jobless Claims. USA, 14:30 (GMT+2)

Initial Jobless Claims publication is due at 14:30 (GMT+2) in the USA. The index is expected to grow to 241K in a week from 236K in the previous week. It measures the number of individuals who are unemployed and are currently receiving unemployment benefits and can predict the Nonfarm Payrolls value. A rise in this indicator has negative implications for consumer spending which discourage economic growth.

ECB Monetary policy statement and press conference. EU, 14:30 (GMT+2)

Following the ECB´s economic policy decision, the ECB President gives a press conference regarding monetary policy.

Claws and Horns

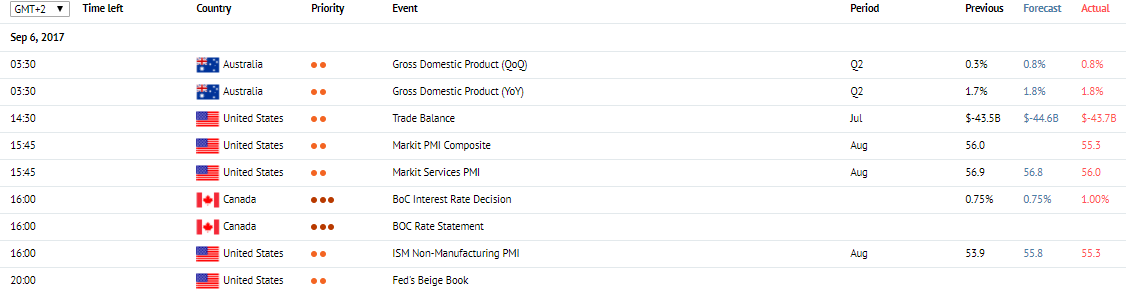

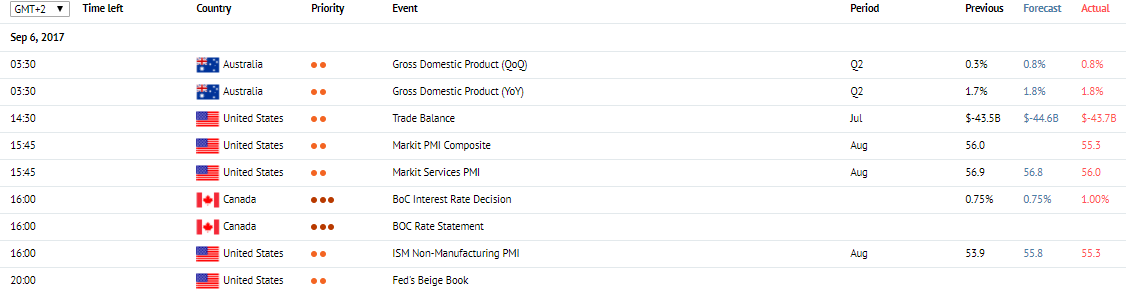

News of the day. 6.09.2017

Gross Domestic Product. Australia, 03:30 (GMT+2)

Gross Domestic Product publication is due at 03:30 (GMT+2) in Australia. The YoY index is expected to grow to 1.8% in the second quarter from 1.7% in the previous period. The index is a measure of the total value of all goods and services produced by Australia. A rising trend has a positive effect on the AUD, while a falling trend is seen as negative for the AUD.

Trade Balance. USA, 14:30 (GMT+2)

Trade Balance publications is due at 14:30 (GMT+2) in the USA. The growth of deficit to –44.6 billion USD in July from –43.6 billion in the previous month is expected. It represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the USD. Negative values represent the balance deficit and weaken the USD.

ISM Non-Manufacturing PMI. USA, 16:00 (GMT+2)

ISM Non-Manufacturing PMI publication is due at 16:00 (GMT+2) in the USA. The index is expected to fall to 53.3 points in August from 53.9 points in the previous month. It shows business conditions in the US non-manufacturing sector and estimates the economy state in the sector. A result above 45–50 is positive for the USD. A value below 45–50 reflects the slowing of the economic growth. The increase of index supports USD.

BoC Interest Rate Decision. Canada, 16:00 (GMT+2)

Bank of Canada Interest Rate Decision is due at 16:00 (GMT+2). The index is expected to stay on the same level of 0.75%. Estimating the current economy and inflation level, BoC determined the interest rate. The growth of rate strengthens CAD. If the rate stays on the same level or falls, CAD is going down.

Fed's Beige Book. USA, 20:00 (GMT+2)

Fed's Beige Book is due at 20:00 (GMT+2) in the USA. The Beige Book reports on the current US economic situation. Through interviews with key business contacts, economists, market experts, and other sources are gathered by each of the 12 Federal Reserve Districts. The survey gives a picture of the overall US economic growth. An optimistic view of those authorities is considered as positive, or bullish for the USD, whereas a pessimistic view is considered as negative for USD.

Gross Domestic Product. Australia, 03:30 (GMT+2)

Gross Domestic Product publication is due at 03:30 (GMT+2) in Australia. The YoY index is expected to grow to 1.8% in the second quarter from 1.7% in the previous period. The index is a measure of the total value of all goods and services produced by Australia. A rising trend has a positive effect on the AUD, while a falling trend is seen as negative for the AUD.

Trade Balance. USA, 14:30 (GMT+2)

Trade Balance publications is due at 14:30 (GMT+2) in the USA. The growth of deficit to –44.6 billion USD in July from –43.6 billion in the previous month is expected. It represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the USD. Negative values represent the balance deficit and weaken the USD.

ISM Non-Manufacturing PMI. USA, 16:00 (GMT+2)

ISM Non-Manufacturing PMI publication is due at 16:00 (GMT+2) in the USA. The index is expected to fall to 53.3 points in August from 53.9 points in the previous month. It shows business conditions in the US non-manufacturing sector and estimates the economy state in the sector. A result above 45–50 is positive for the USD. A value below 45–50 reflects the slowing of the economic growth. The increase of index supports USD.

BoC Interest Rate Decision. Canada, 16:00 (GMT+2)

Bank of Canada Interest Rate Decision is due at 16:00 (GMT+2). The index is expected to stay on the same level of 0.75%. Estimating the current economy and inflation level, BoC determined the interest rate. The growth of rate strengthens CAD. If the rate stays on the same level or falls, CAD is going down.

Fed's Beige Book. USA, 20:00 (GMT+2)

Fed's Beige Book is due at 20:00 (GMT+2) in the USA. The Beige Book reports on the current US economic situation. Through interviews with key business contacts, economists, market experts, and other sources are gathered by each of the 12 Federal Reserve Districts. The survey gives a picture of the overall US economic growth. An optimistic view of those authorities is considered as positive, or bullish for the USD, whereas a pessimistic view is considered as negative for USD.

Claws and Horns

News of the day. 1.09.2017

Markit Manufacturing PMI. Eurozone, 09:55 (GMT+2)

Eurozone Markit Manufacturing PMI is due at 09:55 (GMT+2). The indicator is expected to remain unchanged at the level of 57.4 points in August. The index shows economic conditions in manufacturing sector, and prospects for further development. It is one of the main indicators of the state of Eurozone economy. Values above 50 are perceived as a positive signal and strengthen EUR. Values below 50 are perceived as a negative signal and call for decreasing EUR rate.

Markit Manufacturing PMI. UK, 10:30 (GMT+2)

UK Markit Manufacturing PMI is due at 10:30 (GMT+2). The indicator is expected to decrease to 55.0 points in August from 55.1 a month earlier. The indicator shows the state of the industrial sphere and is based on the poll of managers of major industrial companies. Values above 50 indicate the growth of production and strengthen GBP. Values below 50 on the contrary indicate the reduction of growth rate and weaken GBP.

Nonfarm Payrolls. USA, 14:30 (GMT+2)

Nonfarm Payrolls data are due at 14:30 (GMT+2). The indicator is expected to decrease to 180K in August from 209K a month earlier. It is one of the most important indices of employment in USA, shows the number of salaried employees outside the agriculture sector, and makes a great influence on the market. High values indicate the growth of the employment rate and strengthen USD, and low ones weaken it.

Average Hourly Earnings. USA, 14:30 (GMT+2)

The data on average hourly salary from the USA are due at 14:30 (GMT+2). The indicator is expected to drop to 0.2% in August from 0.3% a month earlier. The indicator shows the cost of labor and changes in average hourly earnings. High values strengthen USD, and low ones weaken it.

Markit Manufacturing PMI. Eurozone, 09:55 (GMT+2)

Eurozone Markit Manufacturing PMI is due at 09:55 (GMT+2). The indicator is expected to remain unchanged at the level of 57.4 points in August. The index shows economic conditions in manufacturing sector, and prospects for further development. It is one of the main indicators of the state of Eurozone economy. Values above 50 are perceived as a positive signal and strengthen EUR. Values below 50 are perceived as a negative signal and call for decreasing EUR rate.

Markit Manufacturing PMI. UK, 10:30 (GMT+2)

UK Markit Manufacturing PMI is due at 10:30 (GMT+2). The indicator is expected to decrease to 55.0 points in August from 55.1 a month earlier. The indicator shows the state of the industrial sphere and is based on the poll of managers of major industrial companies. Values above 50 indicate the growth of production and strengthen GBP. Values below 50 on the contrary indicate the reduction of growth rate and weaken GBP.

Nonfarm Payrolls. USA, 14:30 (GMT+2)

Nonfarm Payrolls data are due at 14:30 (GMT+2). The indicator is expected to decrease to 180K in August from 209K a month earlier. It is one of the most important indices of employment in USA, shows the number of salaried employees outside the agriculture sector, and makes a great influence on the market. High values indicate the growth of the employment rate and strengthen USD, and low ones weaken it.

Average Hourly Earnings. USA, 14:30 (GMT+2)

The data on average hourly salary from the USA are due at 14:30 (GMT+2). The indicator is expected to drop to 0.2% in August from 0.3% a month earlier. The indicator shows the cost of labor and changes in average hourly earnings. High values strengthen USD, and low ones weaken it.

Claws and Horns

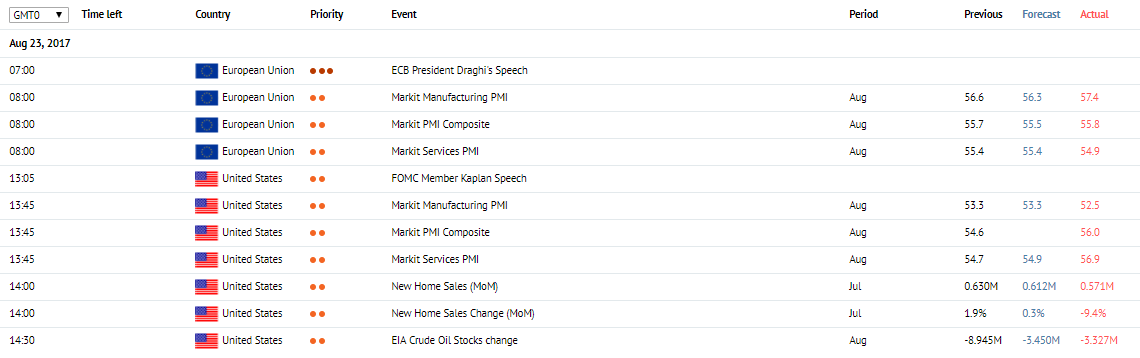

News of the day. 23.08.2017

Statement by ECB Head Draghi. Eurozone, 09:00 (GMT+2)

The statement by ECB head Mario Draghi is due at 09:00 (GMT+2). He will comment on the current economic situation in Eurozone. Positive comments may lead to the strengthening of EUR. Negative ones weaken it.

Markit Manufacturing PMI. Eurozone, 10:00 (GMT+2)

Markit Manufacturing PMI is due at 10:00 (GMT+2). The indicator is expected to drop to 56.3 points in August from 56.6 points in the previous month. The index shows economic conditions in manufacturing sector, and prospects for further development. Values above 50 are perceived as a positive signal and strengthen EUR. Values below 50 are perceived as a negative signal and call for decreasing EUR rate.

New Home Sales. USA, 16:00 (GMT+2)

The data on new home sales is due at 16:00 (GMT+2). The indicator is expected to grow to 0.613 mln in July from 0.610 mln a month earlier. This is a very important indicator in terms of US real estate market. That is why the growth of the indicator is a signal about increased general well-being and the growth of the economy. High values of the indicator influence the US dollar positively. Lower values have negative impact on the USD.

Statement by ECB Head Draghi. Eurozone, 09:00 (GMT+2)

The statement by ECB head Mario Draghi is due at 09:00 (GMT+2). He will comment on the current economic situation in Eurozone. Positive comments may lead to the strengthening of EUR. Negative ones weaken it.

Markit Manufacturing PMI. Eurozone, 10:00 (GMT+2)

Markit Manufacturing PMI is due at 10:00 (GMT+2). The indicator is expected to drop to 56.3 points in August from 56.6 points in the previous month. The index shows economic conditions in manufacturing sector, and prospects for further development. Values above 50 are perceived as a positive signal and strengthen EUR. Values below 50 are perceived as a negative signal and call for decreasing EUR rate.

New Home Sales. USA, 16:00 (GMT+2)

The data on new home sales is due at 16:00 (GMT+2). The indicator is expected to grow to 0.613 mln in July from 0.610 mln a month earlier. This is a very important indicator in terms of US real estate market. That is why the growth of the indicator is a signal about increased general well-being and the growth of the economy. High values of the indicator influence the US dollar positively. Lower values have negative impact on the USD.

Claws and Horns

News of the day. 22.08.2017

Net Public Sector Borrowings. UK, 10:30 (GMT+2)

The data on net public sector borrowings in the UK are due at 10:30 (GMT+2). The indicator is expected to make up 0.400 bln pounds in July against 6.278 bln a month earlier. The indicator describes net state indebtedness. Positive values indicate budget deficiency and weaken GBP. Negative ones show proficiency and strengthen the pound.

ZEW Survey - Current Situation. Germany, 11:00 (GMT+2)

The data on ZEW survey on the current economic situation is due at 11:00 (GMT+2). The indicator is expected to drop to 85.5 points in August from 86.4 points in the previous month. The indicator is calculated by the Economic Studies Center (ZEW) on the basis of poll of the leading European financial experts That assess the current economic situation in Europe. A positive result indicates that the experts are optimistic about the economy and strengthen EUR. Values below the expected level show that the economy is assessed in pessimistic terms and weaken euro.

ZEW Survey - Economic Sentiment Eurozone, 11:00 (GMT+2)

ZEW survey on economic sentiment will be released at 11:00 (GMT+2). The indicator is expected to drop to 34.2 points in August from 35.5 points in the previous month. The index is calculated on the basis of a poll taken among the consumers regarding their confidence in Eurozone economy. High values show optimistic views and strengthen EUR. Low ones, on the contrary, weaken EUR.

Retail Sales. Canada, 14:30 (GMT+2)

The data on Canadian retail sales are due at 14:30 (GMT+2). On a monthly basis the indicator is expected to drop to 0.3% in June from 0.6% a month earlier. The indicator shows changes in the volumes of sales in the retail sector. The growth of the indicator is a positive factor for the national economy and strengthens CAD. The fall of the indicator weakens CAD.

Net Public Sector Borrowings. UK, 10:30 (GMT+2)

The data on net public sector borrowings in the UK are due at 10:30 (GMT+2). The indicator is expected to make up 0.400 bln pounds in July against 6.278 bln a month earlier. The indicator describes net state indebtedness. Positive values indicate budget deficiency and weaken GBP. Negative ones show proficiency and strengthen the pound.

ZEW Survey - Current Situation. Germany, 11:00 (GMT+2)

The data on ZEW survey on the current economic situation is due at 11:00 (GMT+2). The indicator is expected to drop to 85.5 points in August from 86.4 points in the previous month. The indicator is calculated by the Economic Studies Center (ZEW) on the basis of poll of the leading European financial experts That assess the current economic situation in Europe. A positive result indicates that the experts are optimistic about the economy and strengthen EUR. Values below the expected level show that the economy is assessed in pessimistic terms and weaken euro.

ZEW Survey - Economic Sentiment Eurozone, 11:00 (GMT+2)

ZEW survey on economic sentiment will be released at 11:00 (GMT+2). The indicator is expected to drop to 34.2 points in August from 35.5 points in the previous month. The index is calculated on the basis of a poll taken among the consumers regarding their confidence in Eurozone economy. High values show optimistic views and strengthen EUR. Low ones, on the contrary, weaken EUR.

Retail Sales. Canada, 14:30 (GMT+2)

The data on Canadian retail sales are due at 14:30 (GMT+2). On a monthly basis the indicator is expected to drop to 0.3% in June from 0.6% a month earlier. The indicator shows changes in the volumes of sales in the retail sector. The growth of the indicator is a positive factor for the national economy and strengthens CAD. The fall of the indicator weakens CAD.

Claws and Horns

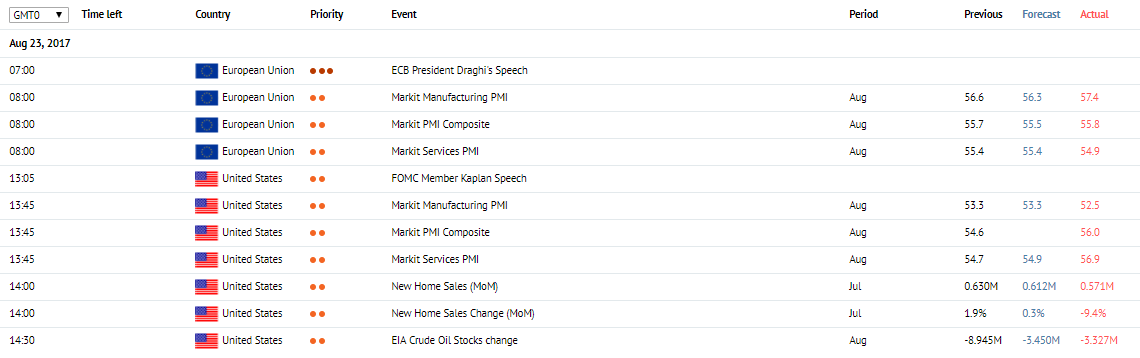

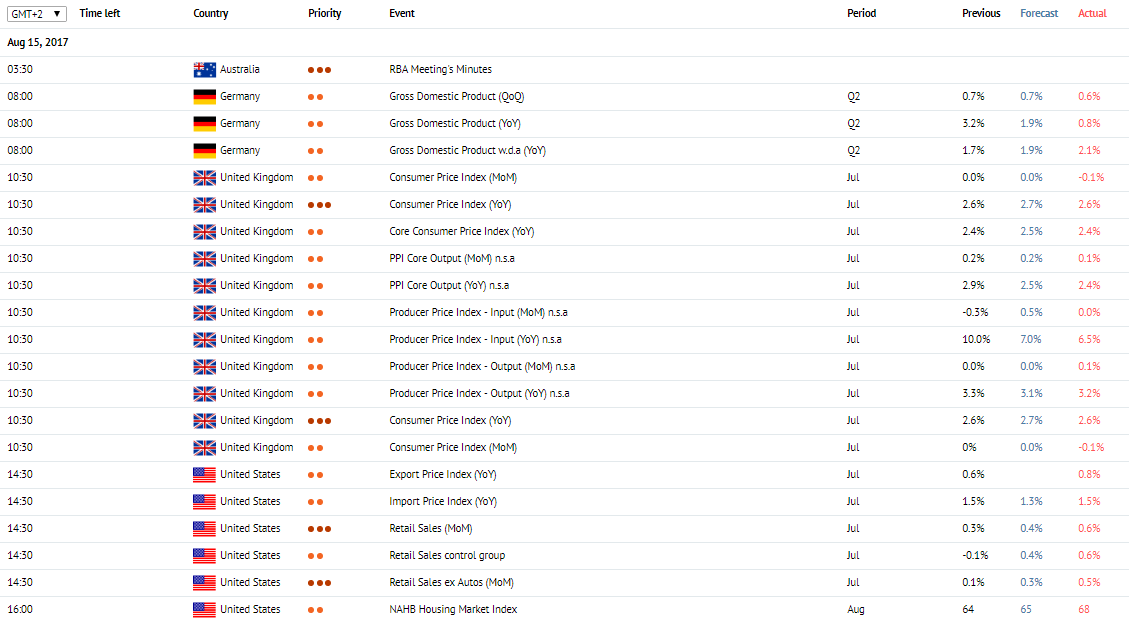

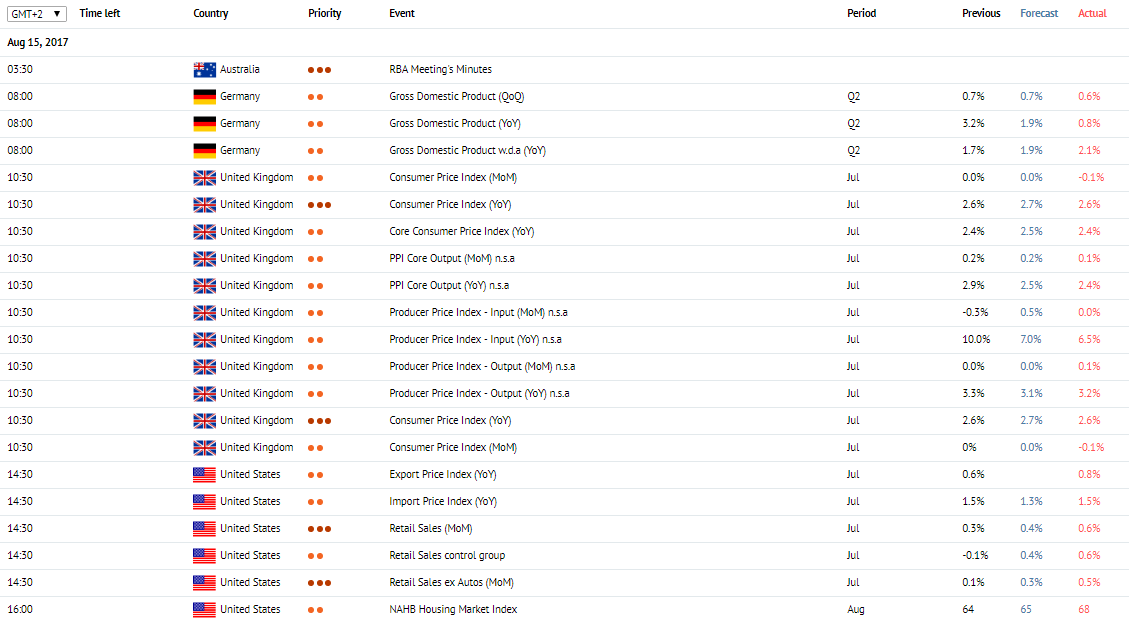

News of the day. 15.08.2017

RBA Meeting’s Minutes. Australia, 03:30 (GMT+2)

Minutes of the Meeting of Reserve Bank of Australia is due at 03:30 (GMT+2). The document is published two weeks after making a decision on the interest rate and contains comments on RBA decisions. The minutes also contains information about the votes of certain Monetary Policy Committee members.

Gross Domestic Product. Germany, 08:00 (GMT+2)

The data on Gross Domestic Product in Germany is due at 08:00 (GMT+2). The indicator is expected to drop to 0.6% in Q2 from 2.9% in the previous period YoY. In the quarterly terms it will grow to 0.7% in Q2 from 0.6% in the previous period. The indicator shows the cost of all goods and services produced in Germany during the year. A high result facilitates the growth of EUR. Low results, on the contrary, lead to the fall of euro.

Consumer Price Index. UK, 10:30 (GMT+2)

The data on the UK consumer price index are due at 10:30 (GMT+2). The indicator is expected to grow to 2.7% in July from 2.6% a month earlier YoY. MoM the indicator is expected to remain unchanged on the level of 0% in July. Consumer Price Index is one of the key indicators that characterizes the level of inflation and demonstrates the changes in commodity and service prices. A high value of the indicator strengthens GBP, and a low one weakens it.

Retail Sales. USA, 14:30 (GMT+2)

The data on the US retail sales are due at 14:30 (GMT+2). The indicator is expected to grow to 0.4% MoM in July from -0.2% a month earlier. This indicator reflects consumer spending and represents the change in the volume of retail sales. Growth of the index is a positive factor for the economy and strengthens USD. Fall of the index weakens USD.

RBA Meeting’s Minutes. Australia, 03:30 (GMT+2)

Minutes of the Meeting of Reserve Bank of Australia is due at 03:30 (GMT+2). The document is published two weeks after making a decision on the interest rate and contains comments on RBA decisions. The minutes also contains information about the votes of certain Monetary Policy Committee members.

Gross Domestic Product. Germany, 08:00 (GMT+2)

The data on Gross Domestic Product in Germany is due at 08:00 (GMT+2). The indicator is expected to drop to 0.6% in Q2 from 2.9% in the previous period YoY. In the quarterly terms it will grow to 0.7% in Q2 from 0.6% in the previous period. The indicator shows the cost of all goods and services produced in Germany during the year. A high result facilitates the growth of EUR. Low results, on the contrary, lead to the fall of euro.

Consumer Price Index. UK, 10:30 (GMT+2)

The data on the UK consumer price index are due at 10:30 (GMT+2). The indicator is expected to grow to 2.7% in July from 2.6% a month earlier YoY. MoM the indicator is expected to remain unchanged on the level of 0% in July. Consumer Price Index is one of the key indicators that characterizes the level of inflation and demonstrates the changes in commodity and service prices. A high value of the indicator strengthens GBP, and a low one weakens it.

Retail Sales. USA, 14:30 (GMT+2)

The data on the US retail sales are due at 14:30 (GMT+2). The indicator is expected to grow to 0.4% MoM in July from -0.2% a month earlier. This indicator reflects consumer spending and represents the change in the volume of retail sales. Growth of the index is a positive factor for the economy and strengthens USD. Fall of the index weakens USD.

Claws and Horns

News of the day. 07.08.2017

Consumer Price Index. Switzerland, 09:15 (GMT+2)

July Consumer Price Index is due at 09:15 (GMT+2) in Switzerland. The index represents changes in prices of goods and services for household consumption. The data is considered as the key indicator of inflation. A growth in the index strengthens the CHF, while a fall weakens the CHF.

Halifax House Prices. United Kingdom, 09:30 (GMT+2)

Halifax House Prices publication is due at 09:30 (GMT+2) in the UK. It represents the change in house prices. A high reading strengthens the GBP. A low reading weakens the GBP.

Consumer Price Index. Switzerland, 09:15 (GMT+2)

July Consumer Price Index is due at 09:15 (GMT+2) in Switzerland. The index represents changes in prices of goods and services for household consumption. The data is considered as the key indicator of inflation. A growth in the index strengthens the CHF, while a fall weakens the CHF.

Halifax House Prices. United Kingdom, 09:30 (GMT+2)

Halifax House Prices publication is due at 09:30 (GMT+2) in the UK. It represents the change in house prices. A high reading strengthens the GBP. A low reading weakens the GBP.

Claws and Horns

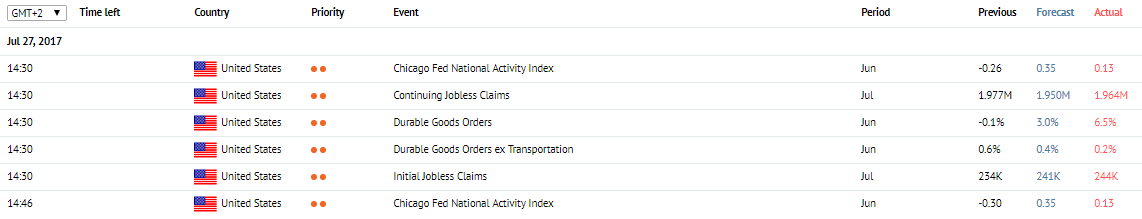

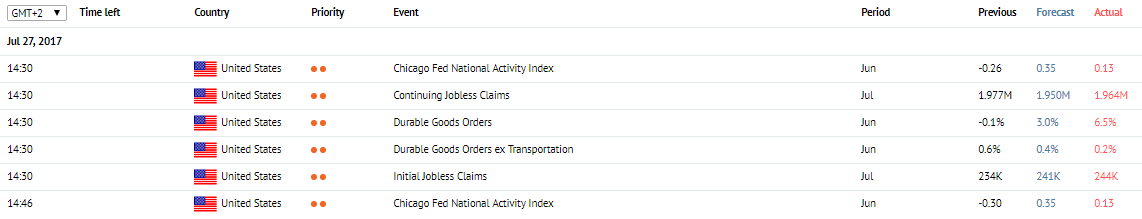

News of the day. 27.07.2017

Initial Jobless Claims. USA, 14:30 (GMT+2)

Weekly data on initial jobless claims from the USA will be released at 14:30 (GMT+2). This is an important indicator for analyzing the state of the US labor market that may be used as the leading index for nonfarm payrolls. However, due to its volatility 4-week or quarterly data are usually used. This week the number of claims is expected to grow from 233K to 241K.

Durable Goods Orders. USA, 14:30 (GMT+2)

June data on demand for durable goods are due at 14:30 (GMT+2). Durable goods are the goods with shelf life over three years. The indicator shows the confidence of the consumers in the state of economy and is a leading index for industrial activity. The index is expected to increase from -0.8% to 3.0%. The value without vehicles may grow from 0.3% to 0.4%. If the forecast proves to be true, this may support to the US currency.

Initial Jobless Claims. USA, 14:30 (GMT+2)

Weekly data on initial jobless claims from the USA will be released at 14:30 (GMT+2). This is an important indicator for analyzing the state of the US labor market that may be used as the leading index for nonfarm payrolls. However, due to its volatility 4-week or quarterly data are usually used. This week the number of claims is expected to grow from 233K to 241K.

Durable Goods Orders. USA, 14:30 (GMT+2)

June data on demand for durable goods are due at 14:30 (GMT+2). Durable goods are the goods with shelf life over three years. The indicator shows the confidence of the consumers in the state of economy and is a leading index for industrial activity. The index is expected to increase from -0.8% to 3.0%. The value without vehicles may grow from 0.3% to 0.4%. If the forecast proves to be true, this may support to the US currency.

Claws and Horns

News of the day. 21.07.2017

Consumer Price Index. Canada, 14:30 (GMT+2)

The June Consumer Price Index is due at 14:30 (GMT+2) in Canada. It is the main indicator of the national inflation and represents the change in the price for the basket of goods and services. Since this February the inflation in Canada in falling, and the development of the trend is expected in June: the YoY index can go down from 1.3% to 1.2%, and the MoM index — from 0.1% to 0.0%, which can affect the CAD negatively.

Retail Sales. Canada, 14:30 (GMT+2)

The May Retail Sales publication is due at 14:30 (GMT+2) in Canada. The index is used to estimate the GDP; it shows the change in the sales volume in the retail trade sphere and characterizes the level of the consumer spending and demand. In Canada the Retail Sales is highly volatile lately, and after the 2-month growth the fall to 0.2% is expected. The Retail Sales ex Autos index can decrease 1.5% до 0.0%, which will affect the CAD negatively.

Baker Hughes US Oil Rig Count. USA, 19:00 (GMT+2)

Baker Hughes US Oil Rig Count is due at 19:00 (GMT+2) in the USA. The indicator has been growing since the conclusion of the OPEC+ oil production limitation Agreement. The companies, producing the US shale oil, are trying to profit from the oil price growth, as they are not obliged to limit the production. The rig number is expected to grow next week, which will affect the oil prices negatively.

Consumer Price Index. Canada, 14:30 (GMT+2)

The June Consumer Price Index is due at 14:30 (GMT+2) in Canada. It is the main indicator of the national inflation and represents the change in the price for the basket of goods and services. Since this February the inflation in Canada in falling, and the development of the trend is expected in June: the YoY index can go down from 1.3% to 1.2%, and the MoM index — from 0.1% to 0.0%, which can affect the CAD negatively.

Retail Sales. Canada, 14:30 (GMT+2)

The May Retail Sales publication is due at 14:30 (GMT+2) in Canada. The index is used to estimate the GDP; it shows the change in the sales volume in the retail trade sphere and characterizes the level of the consumer spending and demand. In Canada the Retail Sales is highly volatile lately, and after the 2-month growth the fall to 0.2% is expected. The Retail Sales ex Autos index can decrease 1.5% до 0.0%, which will affect the CAD negatively.

Baker Hughes US Oil Rig Count. USA, 19:00 (GMT+2)

Baker Hughes US Oil Rig Count is due at 19:00 (GMT+2) in the USA. The indicator has been growing since the conclusion of the OPEC+ oil production limitation Agreement. The companies, producing the US shale oil, are trying to profit from the oil price growth, as they are not obliged to limit the production. The rig number is expected to grow next week, which will affect the oil prices negatively.

Claws and Horns

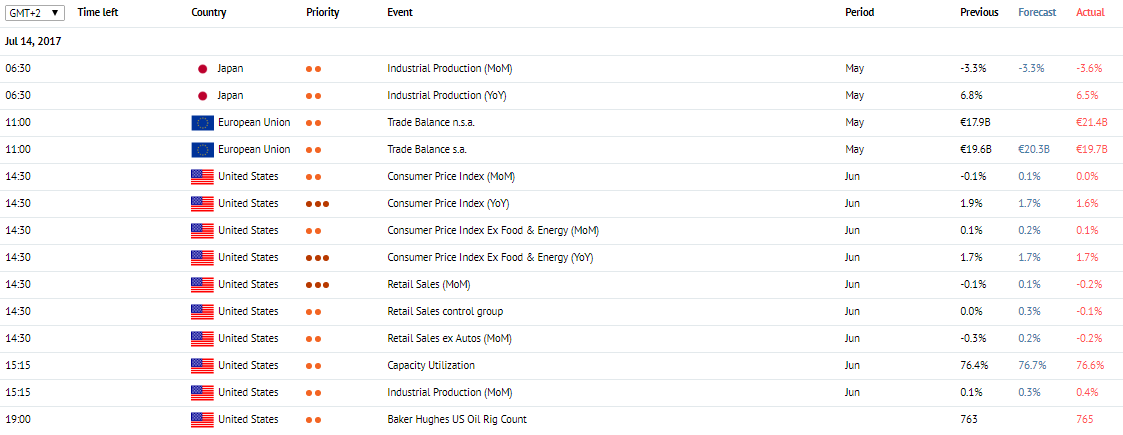

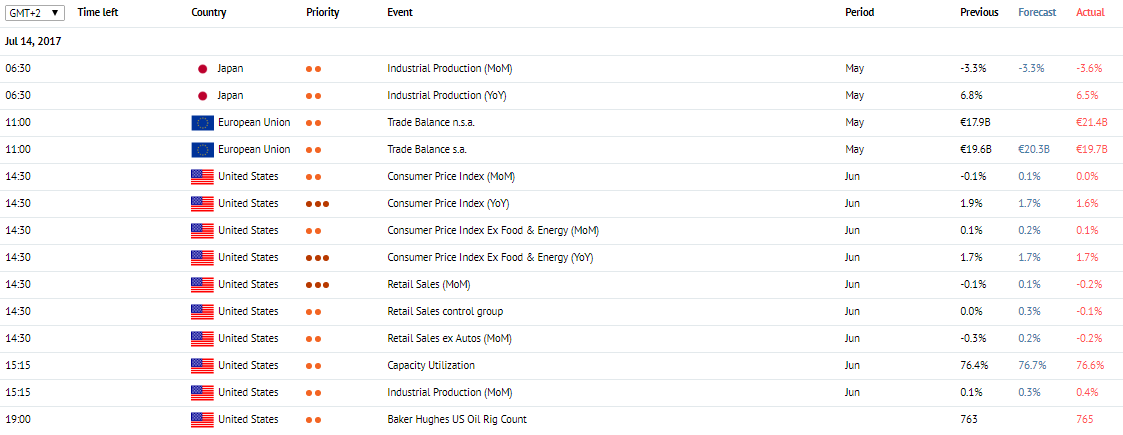

News of the day. 14.07.2017

Business NZ PMI. New Zealand, 00:30 (GMT+2)

Business NZ PMI is due at 00:30 (GMT+2). The index is based on survey responses from purchasing managers regarding their assessment of current economic conditions and economic growth prospects. A reading above 50 represents a generally optimistic assessment and strengthens the NZD. A reading below 50, on the contrary, represents a generally negative assessment and weakens the NZD.

Industrial Production. Japan, 06:30 (GMT+2)

The May Industrial Production publication is due at 06:30 (GMT+2) in Japan. The MoM index is expected to stay on the same level of 3.3%. The indicator represents changes in industrial output in Japan. Data on industrial production is one of the major indicators of the state of the national economy. A growth in the indicator supports the JPY. A fall in the indicator pressures the JPY.

Trade Balance. Eurozone, 12:00 (GMT+2)

The Trade Balance is due at 12:00 (GMT+2) in the Eurozone. The index is expected to grow to 20.3 billion EUR in May from 19.6 billion in the previous month. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the EUR. Negative values indicate the balance deficit and weaken the EUR.

Retail Sales. USA, 14:30 (GMT+2)

The Retail Sales data are due at 14:30 (GMT+2) in the USA. The MoM index is expected to grow to 0.1% in June –0.3% in the previous month. It indicates consumer spending and represents the change in the volume of retail sales. A growth in the index is the positive factor for the economy and strengthens the USD. A fall in the index weakens the USD.

Consumer Price Index. USA, 14:30 (GMT+2)

The Consumer Price Index is due at 14:30 (GMT+2) in the USA. The YoY index is expected to drop to 1.7% in June from 1.9% in the previous month. The MoM index is expected to grow to 0.1% in June –0.1% in the previous month. It is the key indicator of inflation in the country and represents the change in the value of the basket of goods and services. A positive reading strengthens the USD. A negative reading weakens the USD.

Industrial Production. USA, 15:15 (GMT+2)

The Industrial Production publication is due at 15:15 (GMT+2) in the USA. The index is expected to grow to 0.3% in June from 0.0% in the previous month. It represents industrial output in the US and is one of the major indicators of the state of the national economy. It has a high impact on the market. A growth in the index supports the USD. A fall in the index pressures the USD.

Business NZ PMI. New Zealand, 00:30 (GMT+2)

Business NZ PMI is due at 00:30 (GMT+2). The index is based on survey responses from purchasing managers regarding their assessment of current economic conditions and economic growth prospects. A reading above 50 represents a generally optimistic assessment and strengthens the NZD. A reading below 50, on the contrary, represents a generally negative assessment and weakens the NZD.

Industrial Production. Japan, 06:30 (GMT+2)

The May Industrial Production publication is due at 06:30 (GMT+2) in Japan. The MoM index is expected to stay on the same level of 3.3%. The indicator represents changes in industrial output in Japan. Data on industrial production is one of the major indicators of the state of the national economy. A growth in the indicator supports the JPY. A fall in the indicator pressures the JPY.

Trade Balance. Eurozone, 12:00 (GMT+2)

The Trade Balance is due at 12:00 (GMT+2) in the Eurozone. The index is expected to grow to 20.3 billion EUR in May from 19.6 billion in the previous month. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the EUR. Negative values indicate the balance deficit and weaken the EUR.

Retail Sales. USA, 14:30 (GMT+2)

The Retail Sales data are due at 14:30 (GMT+2) in the USA. The MoM index is expected to grow to 0.1% in June –0.3% in the previous month. It indicates consumer spending and represents the change in the volume of retail sales. A growth in the index is the positive factor for the economy and strengthens the USD. A fall in the index weakens the USD.

Consumer Price Index. USA, 14:30 (GMT+2)

The Consumer Price Index is due at 14:30 (GMT+2) in the USA. The YoY index is expected to drop to 1.7% in June from 1.9% in the previous month. The MoM index is expected to grow to 0.1% in June –0.1% in the previous month. It is the key indicator of inflation in the country and represents the change in the value of the basket of goods and services. A positive reading strengthens the USD. A negative reading weakens the USD.

Industrial Production. USA, 15:15 (GMT+2)

The Industrial Production publication is due at 15:15 (GMT+2) in the USA. The index is expected to grow to 0.3% in June from 0.0% in the previous month. It represents industrial output in the US and is one of the major indicators of the state of the national economy. It has a high impact on the market. A growth in the index supports the USD. A fall in the index pressures the USD.

Claws and Horns

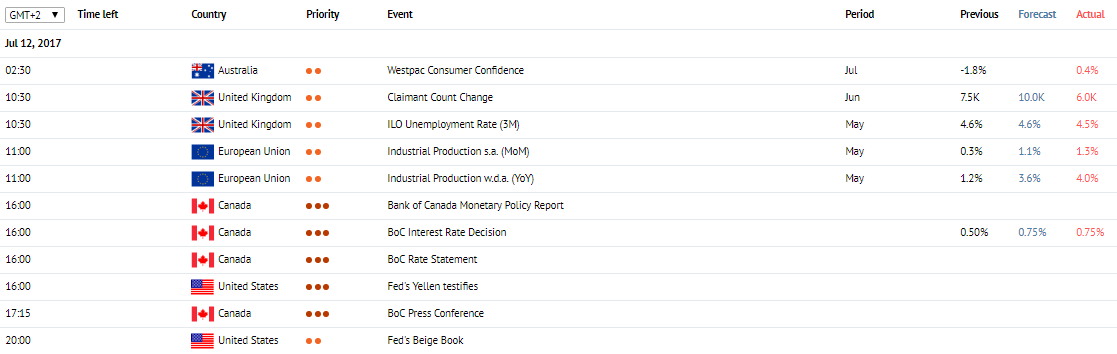

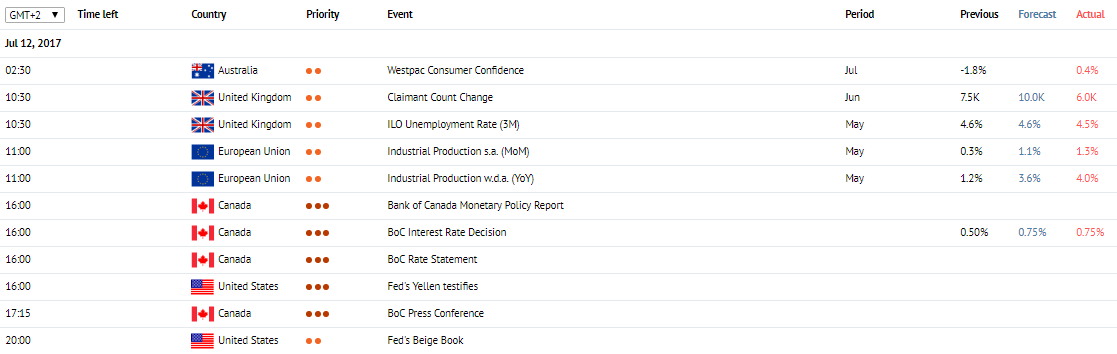

News of the day. 12.07.2017

Westpac Consumer Confidence Index. Australia, 02:30 (GMT+2)

The data on Westpac Consumer Confidence Index are due at 02:30 (GMT+2). The index is based on a poll aimed at evaluating the respondents' confidence in the economic situation and readiness for major purchases. High values of the indicator strengthen AUD, and low ones weaken it.

Jobless Claims. UK, 10:30 (GMT+2)

The data on the UK jobless claims is due at 10:30 (GMT+2). The indicator is expected to increase to 10.0K in June from 7.3K a month earlier. The indicator shows the amount of British citizens not having a job. High values of the indicator weaken GBP, and low ones strengthen it.

ILO Unemployment Rate. UK, 10:30 (GMT+2)

The data on ILO unemployment rate are due at 10:30 (GMT+2). The indicator is expected to remain unchanged on the level of 4.6% in May. ILO is one of the main indicators of the UK labor market. It demonstrates the shares of employable citizens of the country that have no jobs as of the moment. The growth of the indicator is a negative factor lowering the rate of GBP. Its reduction on the contrary is perceived as a positive factor and strengthens the pound.

Industrial output. Eurozone, 11:00 (GMT+2)

The data on the European industrial output is due at 11:00 (GMT+2). On a monthly basis the indicator is expected to grow to 1.1% in May from 0.5% a month earlier. On the annual basis the indicator is expected to increase to 1.1% in May from 0.5% a month earlier. The indicator shows changes in industrial output volume and is one of the most important indices of state of the economy. High results strengthen EUR, and low values weaken the European currency.

Statement by FOMC head Janet Yellen. USA, 16:00 (GMT+2)

Fed's Janet Yellen speech is due at 16:00 (GMT+2). The head of FOMC is to speak before the US Congress with a report on the current economic situation and to answer the questions of the Congressmen afterwards. Her comments may cause a surge of market volatility.

Bank of Canada Decision on the Interest Rate. Canada, 16:00 (GMT+2)

Bank of Canada Decision on the Interest Rate is due at 16:00 (GMT+2). The indicator is expected to remain unchanged on the level of 0.5%. The Bank of Canada makes the decision based on current economic situation and inflation level. The growth of the indicator strengthens CAD. If the rate stays at the same level or goes down, the national currency rate is decreased.

Follow-Up Statement of the Bank of Canada. Canada, 16:00 (GMT+2)

After announcing its decision on the interest rate the Bank of Canada is to make a follow-up statement containing comments on made decisions and monetary policy.

FOMC Beige Book Economic Review. USA, 20:00 (GMT+2)

FOMC Beige Book Economic Review is due at 20:00 (GMT+2). The review prepared by 12 US Federal Banks provides an assessment of current economic situation. Optimistic comments of experts are considered a positive signal and strengthen USD. Negative ones, on the contrary, put pressure on US dollar.

Westpac Consumer Confidence Index. Australia, 02:30 (GMT+2)

The data on Westpac Consumer Confidence Index are due at 02:30 (GMT+2). The index is based on a poll aimed at evaluating the respondents' confidence in the economic situation and readiness for major purchases. High values of the indicator strengthen AUD, and low ones weaken it.

Jobless Claims. UK, 10:30 (GMT+2)

The data on the UK jobless claims is due at 10:30 (GMT+2). The indicator is expected to increase to 10.0K in June from 7.3K a month earlier. The indicator shows the amount of British citizens not having a job. High values of the indicator weaken GBP, and low ones strengthen it.

ILO Unemployment Rate. UK, 10:30 (GMT+2)

The data on ILO unemployment rate are due at 10:30 (GMT+2). The indicator is expected to remain unchanged on the level of 4.6% in May. ILO is one of the main indicators of the UK labor market. It demonstrates the shares of employable citizens of the country that have no jobs as of the moment. The growth of the indicator is a negative factor lowering the rate of GBP. Its reduction on the contrary is perceived as a positive factor and strengthens the pound.

Industrial output. Eurozone, 11:00 (GMT+2)

The data on the European industrial output is due at 11:00 (GMT+2). On a monthly basis the indicator is expected to grow to 1.1% in May from 0.5% a month earlier. On the annual basis the indicator is expected to increase to 1.1% in May from 0.5% a month earlier. The indicator shows changes in industrial output volume and is one of the most important indices of state of the economy. High results strengthen EUR, and low values weaken the European currency.

Statement by FOMC head Janet Yellen. USA, 16:00 (GMT+2)

Fed's Janet Yellen speech is due at 16:00 (GMT+2). The head of FOMC is to speak before the US Congress with a report on the current economic situation and to answer the questions of the Congressmen afterwards. Her comments may cause a surge of market volatility.

Bank of Canada Decision on the Interest Rate. Canada, 16:00 (GMT+2)

Bank of Canada Decision on the Interest Rate is due at 16:00 (GMT+2). The indicator is expected to remain unchanged on the level of 0.5%. The Bank of Canada makes the decision based on current economic situation and inflation level. The growth of the indicator strengthens CAD. If the rate stays at the same level or goes down, the national currency rate is decreased.

Follow-Up Statement of the Bank of Canada. Canada, 16:00 (GMT+2)

After announcing its decision on the interest rate the Bank of Canada is to make a follow-up statement containing comments on made decisions and monetary policy.

FOMC Beige Book Economic Review. USA, 20:00 (GMT+2)

FOMC Beige Book Economic Review is due at 20:00 (GMT+2). The review prepared by 12 US Federal Banks provides an assessment of current economic situation. Optimistic comments of experts are considered a positive signal and strengthen USD. Negative ones, on the contrary, put pressure on US dollar.

Claws and Horns

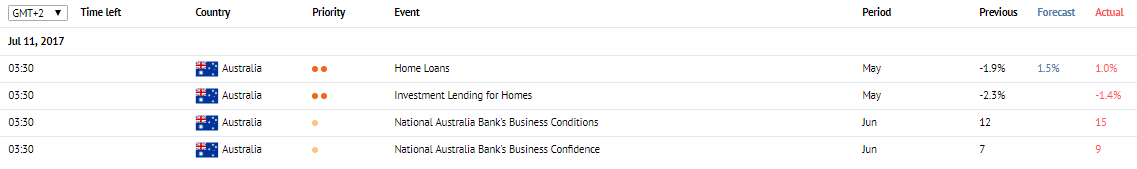

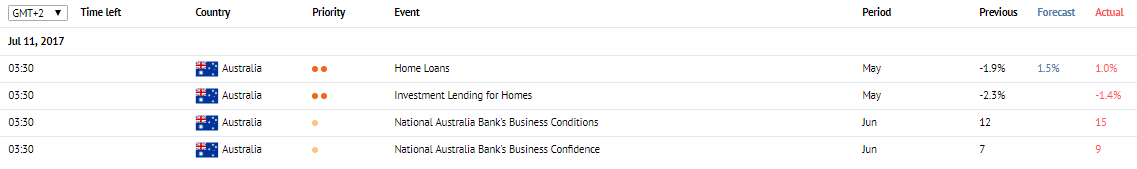

News of the day. 11.07.2017

Retail sales with the use of electronic payment cards. New Zealand, 00:45 (GMT+2)

The data on retail sales with the use of electronic payment cards will be released at 00:45 (GMT+2). The indicator shows the number of purchases made with the use of credit and debit cards and shows the state of the retail sector. High values are a positive factor for NZD, and low ones are considered negative.

Mortgages. Australia, 03:30 (GMT+2)

The data on mortgages in Australia are due at 03:30 (GMT+2). The indicator shows the number of new issued mortgages and is one of the main indexes in the real estate market. The growth of the indicator strengthens AUD, and its fall weakens the currency.

Retail sales with the use of electronic payment cards. New Zealand, 00:45 (GMT+2)

The data on retail sales with the use of electronic payment cards will be released at 00:45 (GMT+2). The indicator shows the number of purchases made with the use of credit and debit cards and shows the state of the retail sector. High values are a positive factor for NZD, and low ones are considered negative.

Mortgages. Australia, 03:30 (GMT+2)

The data on mortgages in Australia are due at 03:30 (GMT+2). The indicator shows the number of new issued mortgages and is one of the main indexes in the real estate market. The growth of the indicator strengthens AUD, and its fall weakens the currency.

Claws and Horns

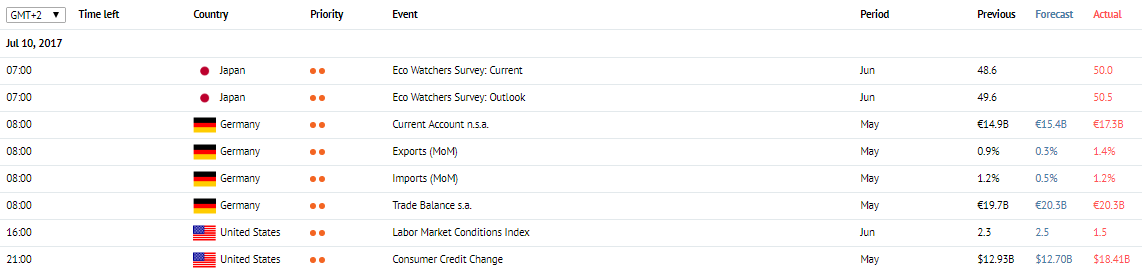

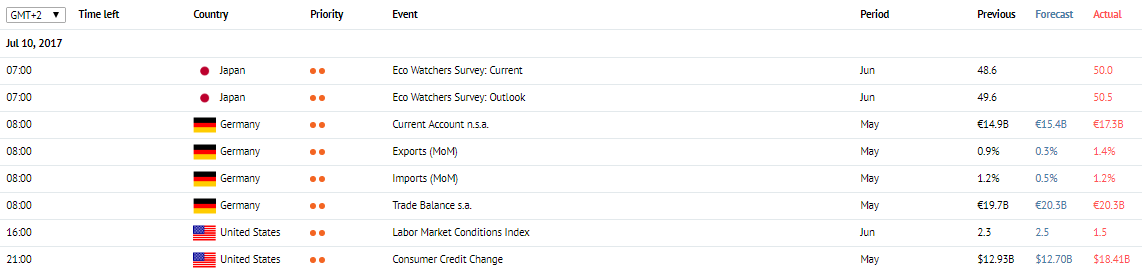

News of the day. 10.07.2017

Orders for Machine Building Products. Japan, 01:50 (GMT+2)

The data on orders for machine building products from Japan is due at 01:50 (GMT+2). The indicator is expected to grow to 7.7% in May from 2.7% a month earlier YoY. On the monthly basis the indicator should increase to 1.7% in May from -3.1% a month earlier. The index shows changes in the volume of orders for machine building products from major Japanese manufacturers and is a leading indicator of manufacturers' expenditure. The increase of the indicator shows economic growth and strengthens JPY. The fall of the indicator shows economic slowdown and puts pressure on yen.

Trading Balance. Germany, 08:00 (GMT+2)

The data on the German trading balance is due at 08:00 (GMT+2). The indicator shows the difference between import and exports of goods and services in monetary terms. A positive value means trading proficiency, i.e. the dominance of export over import. A negative value indicates trading balance deficiency. High values strengthen EUR, and low ones weaken it.

Labor Market Conditions Index. USA, 16:00 (GMT+2)

The Labor Market Conditions Index is due at 16:00 (GMT+2). The indicator has been developed by FOMC economists and consists of 19 elements describing the labor market. The index is a key indicator of US economic development. High values have a positive impact on the rate of USD, and low ones put pressure on the dollar.

Orders for Machine Building Products. Japan, 01:50 (GMT+2)

The data on orders for machine building products from Japan is due at 01:50 (GMT+2). The indicator is expected to grow to 7.7% in May from 2.7% a month earlier YoY. On the monthly basis the indicator should increase to 1.7% in May from -3.1% a month earlier. The index shows changes in the volume of orders for machine building products from major Japanese manufacturers and is a leading indicator of manufacturers' expenditure. The increase of the indicator shows economic growth and strengthens JPY. The fall of the indicator shows economic slowdown and puts pressure on yen.

Trading Balance. Germany, 08:00 (GMT+2)

The data on the German trading balance is due at 08:00 (GMT+2). The indicator shows the difference between import and exports of goods and services in monetary terms. A positive value means trading proficiency, i.e. the dominance of export over import. A negative value indicates trading balance deficiency. High values strengthen EUR, and low ones weaken it.

Labor Market Conditions Index. USA, 16:00 (GMT+2)

The Labor Market Conditions Index is due at 16:00 (GMT+2). The indicator has been developed by FOMC economists and consists of 19 elements describing the labor market. The index is a key indicator of US economic development. High values have a positive impact on the rate of USD, and low ones put pressure on the dollar.

Claws and Horns

News of the day. 06.07.2017

Trade Balance. Australia, 03:30 (GMT+2)

The Trade Balance publication is due at 03:30 (GMT+2) in Australia. The index is expected to grow to 1100 million dollars in May from 555 million in the previous month. The data on trade balance represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the AUD. Negative values indicate the balance deficit and weaken the AUD.

Factory Orders. Germany, 08:00 (GMT+2)

The Factory Orders data are due at 08:00 (GMT+2) in Germany. The MoM indicator is expected to grow to 2.0% in May from –2.1% in the previous month. The index is based on data on new and incomplete orders. Also includes information on inventories. A growth in the index generally strengthens the EUR.

ECB Monetary Policy Meeting Accounts. Eurozone, 13:30 (GMT+2)

The ECB Monetary Policy Meeting Accounts publication is due at 13:30 (GMT+2). Account of the monetary policy meeting contains an overview of the current economic situation, commentaries on the recent monetary policy decisions and macroeconomic forecasts.

ADP Employment Change. USA, 14:15 (GMT+2)

The ADP Employment Change data are due at 14:15 (GMT+2) in the USA. The index is expected to fall to 187K in June from 253K in the previous month. The index represents employment change in non-agricultural sectors. It is based on data from about 500 thousands companies in the US. A high reading strengthens the USD. A low reading and values below expectations weaken the USD.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The Initial Jobless Claims publication is due at 14:30 (GMT+2) in the USA. The index is expected to fall to 243K in a week against 244K in the previous period. It represents the number of new unemployment claims and is published weekly on Thursdays. It allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

ISM Non-Manufacturing PMI. USA, 16:00 (GMT+2)

The ISM Non-Manufacturing PMI publication is due at 16:00 (GMT+2) in the USA. The indicator is expected to fall to 56.5 points in June from 56.9 points in the previous month. The index is based on surveys of executives of the companies operating in the services sector regarding their opinion on current economic conditions in the sector. A reading above 45–50 represents economic growth. A reading below 45–50 represents economy slowdown. A growth in the index strengthens the USD.

Trade Balance. Australia, 03:30 (GMT+2)

The Trade Balance publication is due at 03:30 (GMT+2) in Australia. The index is expected to grow to 1100 million dollars in May from 555 million in the previous month. The data on trade balance represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the AUD. Negative values indicate the balance deficit and weaken the AUD.

Factory Orders. Germany, 08:00 (GMT+2)

The Factory Orders data are due at 08:00 (GMT+2) in Germany. The MoM indicator is expected to grow to 2.0% in May from –2.1% in the previous month. The index is based on data on new and incomplete orders. Also includes information on inventories. A growth in the index generally strengthens the EUR.

ECB Monetary Policy Meeting Accounts. Eurozone, 13:30 (GMT+2)

The ECB Monetary Policy Meeting Accounts publication is due at 13:30 (GMT+2). Account of the monetary policy meeting contains an overview of the current economic situation, commentaries on the recent monetary policy decisions and macroeconomic forecasts.

ADP Employment Change. USA, 14:15 (GMT+2)

The ADP Employment Change data are due at 14:15 (GMT+2) in the USA. The index is expected to fall to 187K in June from 253K in the previous month. The index represents employment change in non-agricultural sectors. It is based on data from about 500 thousands companies in the US. A high reading strengthens the USD. A low reading and values below expectations weaken the USD.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The Initial Jobless Claims publication is due at 14:30 (GMT+2) in the USA. The index is expected to fall to 243K in a week against 244K in the previous period. It represents the number of new unemployment claims and is published weekly on Thursdays. It allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

ISM Non-Manufacturing PMI. USA, 16:00 (GMT+2)

The ISM Non-Manufacturing PMI publication is due at 16:00 (GMT+2) in the USA. The indicator is expected to fall to 56.5 points in June from 56.9 points in the previous month. The index is based on surveys of executives of the companies operating in the services sector regarding their opinion on current economic conditions in the sector. A reading above 45–50 represents economic growth. A reading below 45–50 represents economy slowdown. A growth in the index strengthens the USD.

: