Pitt Petruschke / 프로필

- 정보

|

1 년도

경험

|

1

제품

|

126

데몬 버전

|

|

0

작업

|

13

거래 신호

|

107

구독자

|

The Federal Reserve, led by Chair Jerome Powell, made its first rate cut since December 2024. The Fed reduced the federal funds rate by **25 basis points to a range of 4.00–4.25%**. Powell emphasized that monetary policy remains restrictive but is gradually moving toward a neutral stance.

### Key Messages

* **Labor Market**: Job growth is slowing, unemployment has edged up slightly, and wage gains are moderating but remain above inflation in many sectors.

* **Inflation**: Price pressures are still above the Fed’s 2% target. Tariffs are contributing to higher goods prices, though Powell described these increases as mostly one-time effects rather than a persistent inflationary trend.

* **Policy Path**: There was no support within the Fed for a larger 50 bps cut. Powell stressed that future decisions will depend on incoming data rather than a preset path.

* **Institutional Changes**: The Fed will reduce its staff by about 10%, bringing employment back to levels from roughly a decade ago.

### Market Implications

* **US Dollar**: At risk of weakening if the Fed eases while other central banks remain tight.

* **Bonds**: Yields, especially on the short end, are likely to move lower as policy shifts.

* **Equities**: Interest-rate-sensitive sectors such as real estate and utilities could benefit from lower borrowing costs.

* **Inflation Trades**: Traders should monitor whether tariff-driven price pressures fade or become more persistent.

### What to Watch Next

* Upcoming US labor market reports: job creation, unemployment, and wage growth.

* Core inflation data and the impact of tariffs on goods prices.

* Fed speeches and updates to the “dot plot” projections.

---

**Conclusion**

Powell’s message was cautious. Inflation risks remain, but a cooling labor market is now a major concern. The Fed is signaling flexibility, ready to adjust policy as needed. For traders, the balance between inflation and employment data will be the key driver of market direction in the months ahead.

In the past month we tracked every detail of our trading journey:

✅ Profits – consistent growth opportunities

✅ Drawdowns – fully visible, no hidden risks

✅ Overall Monthly Performance – clear, reliable, sustainable

We believe in transparency and real results. That’s why all numbers are public and updated live on our MQL5 profile.

💡 If you value honesty, risk-control and real performance – this is your chance to follow along and benefit.

The brand-new Yukon Gold EA is now available on MQL5!

Currently, it’s offered at a very low introductory price, but this will only last for a few days – the price will increase soon.

✅ Proven strong performance in past market conditions

✅ Fully automated trading system

✅ Available for free demo download so you can test it yourself before going live

Don’t miss the chance to secure Yukon Gold EA at the current price.

👉 EA Link: https://tinyurl.com/2t84cn5k

💬 Questions & community: https://tinyurl.com/Yukon-Gold-EA-Channel

The wait is over – the Yukon Gold EA is officially online.For the first movers, there’s a special launch opportunity:

💰 Get the EA for only $30 – but hurry, this offer is valid for the next 2 hours only.After that, the price will rise.

👉 Secure your copy here: https://tinyurl.com/2t84cn5k

Don’t miss out on this limited-time chance to trade with a powerful multi-strategy Expert Advisor!

Yukon Gold EA – 멀티 전략 자동매매 프로그램 Yukon Gold EA는 리버설과 돌파 전략이라는 두 가지 검증된 접근 방식을 결합한 현대적인 멀티 전략 자동매매 프로그램입니다. 수개월 동안 신중하게 개발·테스트·최적화되어 위험 관리와 수익 극대화 사이의 안정적인 균형을 달성했습니다. 이 EA는 손실을 일관되게 제한하면서 수익 구간에서는 포지션을 동적으로 확장하도록 설계되었습니다. 따라서 언제나 위험은 통제되며, 수익성 있는 장세를 최대로 활용할 수 있습니다. 여기 Yukon Gold EA 채널입니다: 여기를 클릭하세요 거래 로직 VWAP 기반 분석: Yukon Gold EA는 단순 가격 데이터가 아닌 주문장 데이터에서 직접 산출된 거래량 가중평균가격(VWAP)을 사용합니다. 이로써 모든 의사결정이 실제 유동성에 근거하며, 단순 캔들 움직임에만 의존하지 않습니다. 리버설 전략 : 가격이 VWAP에서 크게 벗어나면 과도한 움직임을 의미합니다. 시장 가격은 보통 VWAP

Gold trading needs precision and a real edge. Yukon Gold EA delivers both by using VWAP (Volume Weighted Average Price) from order book data – the same tool institutions rely on.

✅ Reversals: If price moves too far, Yukon Gold anticipates the snap back to VWAP.✅ Breakouts: If price consolidates near VWAP, Yukon Gold rides the breakout with momentum.

This is not just theory – performance already speaks for itself:

🚀 Official launch in the MQL5 Store within the next few days.👉 Be the first to join the Yukon Gold EA Channel and prepare for release:🔗 https://tinyurl.com/Yukon-Gold-EA-Channel

The gold rush is about to begin.

Built for strong performance and consistent growth. Launching soon on the MQL5 Marketplace.

We're currently in a phase where no suitable trade setups have appeared. Still, we're fully committed to the strategy and won’t interfere manually. Consistent profits only come by following the strategy 100%. So for now, we wait patiently for the next high-quality entry

The past few days have shown once again:

Markets move fast. News hits hard. Volatility rises.

But one thing didn’t change:

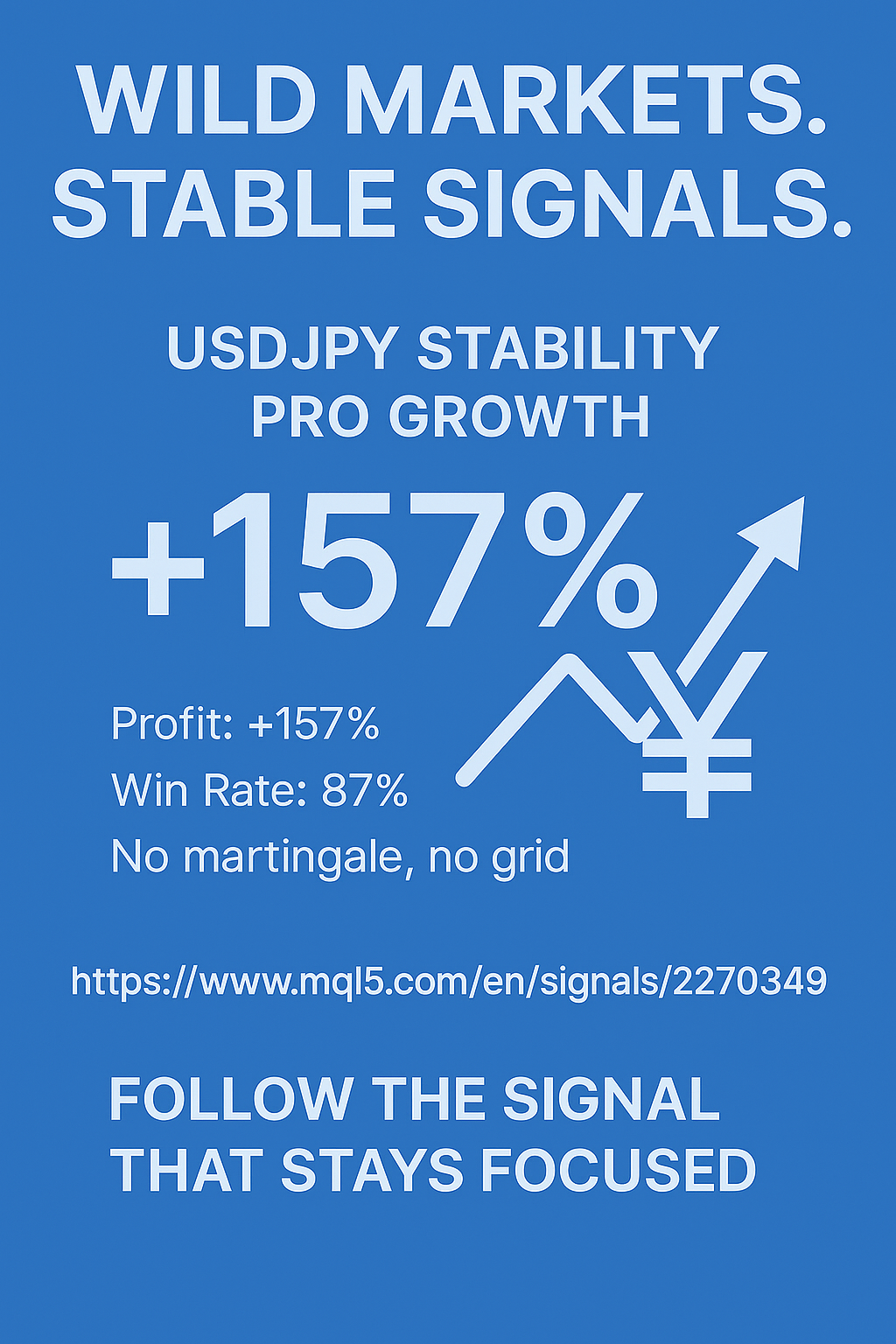

✅ USDJPY Stability Pro Growth kept running.

+157% profit, 87% win rate – and no martingale, no grid.

💼 Fully automated.

🔁 Trades USD/JPY only.

🧠 Precise. Disciplined. Long-term.

👉 https://www.mql5.com/en/signals/2270349

📌 When the market gets noisy, follow the signal that stays focused.

With over 10+ active signals, there's something for every investor type – whether you're a fan of steady growth, diversified strategies, or low-risk long-term gains.

📈 Top performers:

USDJPY Stability Pro Growth – +155%

MultiEA Stability Growth – +108%

Fusion Alpha FX – +93%

SouthEast FX 2K Precision Start – +86%

EURUSD Dynamic Pulse System – +58%

and many more!

💡 No matter if you're a beginner with small capital or a serious investor using a VPS – you’ll find the right setup here. And yes – support is always part of the deal. 🤝

👉 Check out my full signal list and pick your favorite!

Growth: +157.45%

Subscribers: 10

Profit Factor: 2.15

Win Rate: 87.6%

Trades: 129

Avg Holding Time: 7h

Max Drawdown: 22.17%

Monthly Growth: ~13.9%

Fee: $30/month

📈 A truly Automated USD/JPY strategy — no martingale, no grid, just precision and consistent long‑term results.

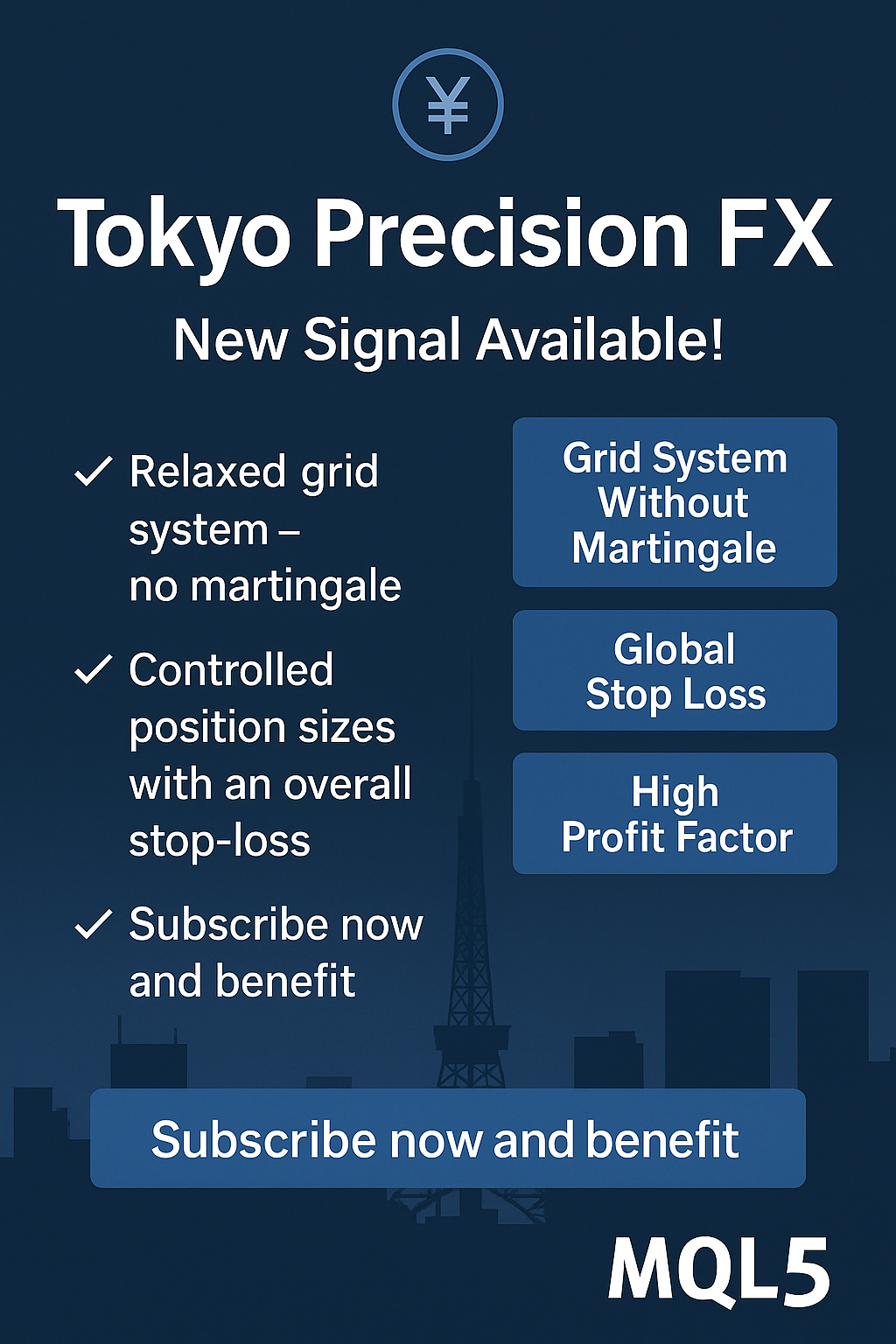

Fully automated. Relaxed grid strategy. No martingale.

All trades managed with an overall stop-loss – no risk of total loss.

✅ Grid trading with logic, not hope

✅ High profit factor, controlled position sizing

✅ Long-term performance with built-in safety

🔎 Want transparency? Check out my other signals on MQL5 and build confidence.

👉 Subscribe now and benefit!

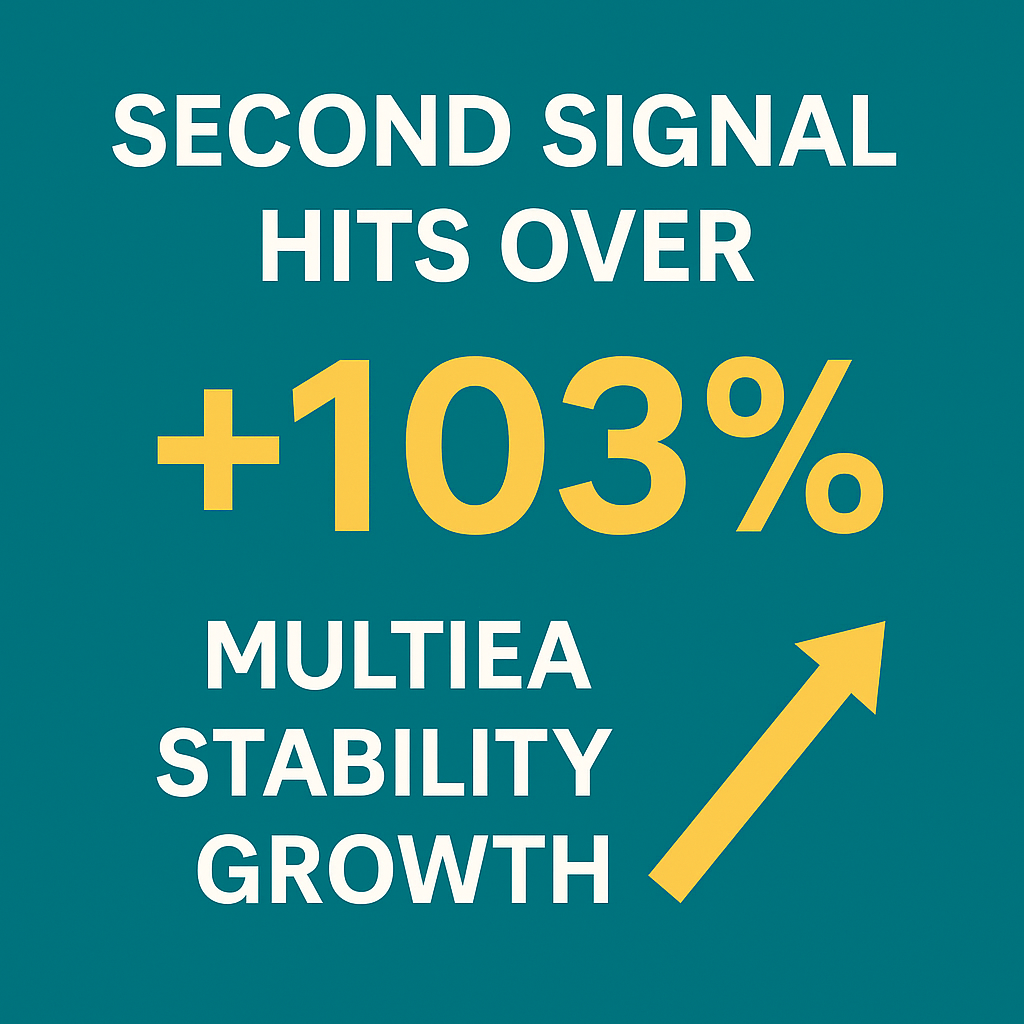

Following the success of USDJPY Stability Pro Growth, our second signal MultiEA Stability Growth has now also surpassed the 100% profit mark.

Another major milestone in our journey toward consistent, automated growth.

📊 Signal Overview:

Growth: +103%

Profit Factor: 1.29

Win Rate: 75%

Drawdown: approx. 22%

System: 5 Expert Advisors trading XAU/USD, US30, EURUSD and more

Subscription Fee: $30/month

💥 Get in early – before the first wave of followers!

👉 https://www.mql5.com/en/signals/2277332

The signal is on fire!

With 141% growth, 86% win rate, and Profit Factor 1.99, USDJPY Stability Pro Growth continues to deliver consistent results. No martingale, no grid – just solid, automated trading on USD/JPY.

💡 5 subscribers already joined – are you next?

https://www.mql5.com/en/signals/2270349?source=Unknown#!tab=account