Exness / 프로필

Exness Group은 온라인 트레이딩을 통해 트레이더에게 전 세계 금융 시장에 액세스할 수 있는 기회를 제공하는 글로벌 다중 규제 브로커입니다.

창립자 Igor Lychagov, Petr Valov가 2008년에 설립한 Exness는 현재 월간 트레이딩량 규모가 총 3조 USD에 달하는 500,000명의 활성 트레이더를 대상으로 서비스를 제공하고 있습니다. Exness는 투명한 고객 중심 트레이딩 환경을 제공함으로써, 고객이 신뢰할 수 있고 시장보다 좋은 조건으로 시장에 액세스할 수 있도록 최선을 다하고 있습니다.

고객은 Exness의 전용 단말 프로그램인 Exness 터미널과 Exness 트레이드 앱을 통해 Exness에서 트레이딩할 수 있으며, 모든 PC 및 모바일 기기에서 지원되는 MT4 및 MT5 플랫폼을 사용할 수도 있습니다. 본 소개 글을 작성하는 시점에 Exness는 100+종의 통화 쌍과 90+종의 주식, 11종의 지수, 34종의 암호화폐, 13종의 원자재 상품을 제공하고 있으며, 상품군을 지속적으로 확장해 가고 있습니다.

Exness는 선택하는 결제 수단 또는 고객의 국가에 따라 10 USD의 최소 입금 조건을 지원합니다. 다음은 Exness의 특징에 대한 간략한 설명입니다.

설명

계좌 유형에 따라 0.0핍에서 시작하는 최소 스프레드

숨은 수수료 없음

수동 검토 없이 즉시 처리되는 인출

0.25ms의 주문 거래 실행 속도

100+종의 통화 쌍

최대 레버리지 1:2000

트레이딩 플랫폼: MT4, MT5, Exness 터미널, Exness 트레이드 앱

무료 VPS 호스팅

다양한 현지 및 글로벌 결제 시스템

365일 24시간 고객 지원

소셜 트레이딩 애플리케이션

파트너 프로그램

규제 준수 및 라이선스 보유: FCA(영국), CySEC(키프로스), FSCA(남아프리카공화국), FSA(세이셸), CBCS(퀴라소 및 신트마르턴), FSC(영국령 버진아일랜드), CMA(케냐)

Exness는 오랜 역사와 검증된 실적을 보유한 신뢰할 수 있는 브로커이자 업계 리더입니다. Exness는 트레이더들이 포지션에 대한 스왑이나 롤오버 이자를 지불하지 않고 다양한 상품을 트레이딩할 수 있는 확장 스왑프리 트레이딩과 시장 변동성과 스톱 아웃에 대비한 특별한 보호 기능, 수수료 없는 즉시 입금 및 인출 처리와 같은 혁신적인 기능을 제공하므로 숙련도와 무관하게 모든 트레이더에게 적합합니다.

적용되는 조건 및 기능은 계좌 유형, 플랫폼, 금융 상품, 고객 국가, 결제 수단 등에 따라 상이할 수 있습니다. 또한 Exness는 다수 국가에서 라이선스를 보유한 다중 규제 브로커이므로 고객이 등록된 트레이딩 법인에 따라 적용되는 기능이 상이할 수 있습니다.

창립자 Igor Lychagov, Petr Valov가 2008년에 설립한 Exness는 현재 월간 트레이딩량 규모가 총 3조 USD에 달하는 500,000명의 활성 트레이더를 대상으로 서비스를 제공하고 있습니다. Exness는 투명한 고객 중심 트레이딩 환경을 제공함으로써, 고객이 신뢰할 수 있고 시장보다 좋은 조건으로 시장에 액세스할 수 있도록 최선을 다하고 있습니다.

고객은 Exness의 전용 단말 프로그램인 Exness 터미널과 Exness 트레이드 앱을 통해 Exness에서 트레이딩할 수 있으며, 모든 PC 및 모바일 기기에서 지원되는 MT4 및 MT5 플랫폼을 사용할 수도 있습니다. 본 소개 글을 작성하는 시점에 Exness는 100+종의 통화 쌍과 90+종의 주식, 11종의 지수, 34종의 암호화폐, 13종의 원자재 상품을 제공하고 있으며, 상품군을 지속적으로 확장해 가고 있습니다.

Exness는 선택하는 결제 수단 또는 고객의 국가에 따라 10 USD의 최소 입금 조건을 지원합니다. 다음은 Exness의 특징에 대한 간략한 설명입니다.

설명

계좌 유형에 따라 0.0핍에서 시작하는 최소 스프레드

숨은 수수료 없음

수동 검토 없이 즉시 처리되는 인출

0.25ms의 주문 거래 실행 속도

100+종의 통화 쌍

최대 레버리지 1:2000

트레이딩 플랫폼: MT4, MT5, Exness 터미널, Exness 트레이드 앱

무료 VPS 호스팅

다양한 현지 및 글로벌 결제 시스템

365일 24시간 고객 지원

소셜 트레이딩 애플리케이션

파트너 프로그램

규제 준수 및 라이선스 보유: FCA(영국), CySEC(키프로스), FSCA(남아프리카공화국), FSA(세이셸), CBCS(퀴라소 및 신트마르턴), FSC(영국령 버진아일랜드), CMA(케냐)

Exness는 오랜 역사와 검증된 실적을 보유한 신뢰할 수 있는 브로커이자 업계 리더입니다. Exness는 트레이더들이 포지션에 대한 스왑이나 롤오버 이자를 지불하지 않고 다양한 상품을 트레이딩할 수 있는 확장 스왑프리 트레이딩과 시장 변동성과 스톱 아웃에 대비한 특별한 보호 기능, 수수료 없는 즉시 입금 및 인출 처리와 같은 혁신적인 기능을 제공하므로 숙련도와 무관하게 모든 트레이더에게 적합합니다.

적용되는 조건 및 기능은 계좌 유형, 플랫폼, 금융 상품, 고객 국가, 결제 수단 등에 따라 상이할 수 있습니다. 또한 Exness는 다수 국가에서 라이선스를 보유한 다중 규제 브로커이므로 고객이 등록된 트레이딩 법인에 따라 적용되는 기능이 상이할 수 있습니다.

Exness

Trader psychology and the benefits of emotional intelligence

Developing self-awareness and the ability to identify and overcome personal biases should be at (or near) the top of your educational to-do list as a trader. Those born to trade share one powerful personal trait: they can look at their behaviors and practices with a critical eye. Emotions like fear, greed, and overconfidence can lead even the most experienced traders astray.

Meanwhile, cognitive biases hardwired into the human brain can cause us to make irrational decisions that sabotage our trading strategies. To truly excel in trader psychology, you must become a student of your own mind.

Follow this link for more: https://www.exness.com/blog/trader-psychology-emotional-intelligence/

Developing self-awareness and the ability to identify and overcome personal biases should be at (or near) the top of your educational to-do list as a trader. Those born to trade share one powerful personal trait: they can look at their behaviors and practices with a critical eye. Emotions like fear, greed, and overconfidence can lead even the most experienced traders astray.

Meanwhile, cognitive biases hardwired into the human brain can cause us to make irrational decisions that sabotage our trading strategies. To truly excel in trader psychology, you must become a student of your own mind.

Follow this link for more: https://www.exness.com/blog/trader-psychology-emotional-intelligence/

Exness

Exness Team Pro member, Nicolas Palacios: Charting his own course in the markets

Nicolas Palacios, a prominent figure in the Latin American trading scene and an Exness Team Pro member, has carved a unique path into the financial markets. Starting with a fascination for blockchain and a desire for financial freedom, Nicolas transformed his passion for trading into a career as a professional trader and financial markets influencer. In this interview, he shares his insights, strategies, and commitment to empowering others in the trading world.

You began trading at a young age. What initially sparked your interest in the financial markets, and how did you develop your skills so quickly?

My journey began with a fascination for blockchain technology and the potential offered by financial markets. I was captivated by the idea of achieving financial independence, even though I knew it was risky. Trading seemed like a great opportunity, even as a side hustle, so I immersed myself in learning everything I could about it. I attended seminars, devoured books, participated in workshops—you name it, I did it!

While I’ve had positive results in the beginning, the real key to my development and consistent trading was mastering risk management. For me, that’s the foundation upon which a career in the markets is built. I believe that to be a trader is a matter of discovering that potential and honing the necessary skills.

Are there any financial assets you favor?

Bitcoin and Ethereum have always held a special place in my portfolio. My journey actually began with a YouTube channel dedicated to blockchain technology. I was eager to share my knowledge and enthusiasm about its potential to revolutionize the world. Having a deep understanding of these cryptocurrencies gives me an edge when trading them, though it's crucial to remember that they are high-risk assets.

Tesla is another favorite. I've been an avid follower of the company for years, and believe in their long-term vision.

Your analysis is well respected. Do you regard yourself as part of "team technical" or "team fundamental?"

My trading methodology relies on a combination of fundamental and technical analysis. I use fundamentals to understand the mid- to long-term trends and overall market sentiment. This provides a solid foundation for my trading decisions. I then utilize technical analysis to pinpoint optimal entry and exit points, refining my strategy based on chart patterns and indicators.

I believe it's important to weigh in as many parameters as possible when trading for two key reasons: Firstly, the markets are incredibly interconnected; when one is impacted positively, another might be affected negatively. Look at gold and stocks, for example. Secondly, it is crucial to consider all aspects in order to make a decision that is as calculated as possible. This includes considering economic data, geopolitical events, and even social media sentiment alongside traditional fundamental and technical analysis. By incorporating a holistic view of the market, I can make more informed decisions and increase my chances of positive results.

You have a strong following on social media. In your opinion, what are the unique challenges and opportunities facing traders, and how do you address these in your content?

The trading community is experiencing rapid growth, which presents exciting opportunities and unique challenges. One of the biggest challenges is the need for greater financial literacy and education. Many aspiring traders lack access to reliable information and resources.

That's where I see my role as an educator and mentor. Through my content, I strive to bridge this knowledge gap and empower traders to make informed decisions. I focus on providing clear, concise explanations of trading concepts, risk management strategies, and ethical practices. It's incredibly rewarding to see how my content has helped traders in the region develop their skills and navigate the markets more confidently.

As a crypto enthusiast, do you believe there is a crypto summer on the horizon? What advice would you give to traders who want to navigate such a volatile market?

I'm passionate about cryptocurrencies but approach them with a balanced perspective. They offer the potential for high rewards but also come with significant risks. While I believe a crypto summer could be on the horizon, it's essential to trade these assets responsibly and manage risk effectively. I advise approaching crypto trading with a clear strategy, a disciplined mindset, and a focus on capital preservation.

You are a popular content creator and surely had several offers. Why did you choose to become an Exness Team Pro member? What is it about ETP that resonates with you?

Exness stands out for several reasons. Beyond its impressive size and global reach, Exness prioritizes ethics, technology, and client satisfaction—values that resonate deeply with my own. In the often turbulent world of trading, integrity and transparency are paramount.

Exness has built a solid reputation for upholding these principles, which is incredibly important to me. They're not just focused on profits; they genuinely care about creating a positive and supportive trading environment for their clients.

Being a member of Exness Team Pro is an honor. It allows me to align myself with a brand that I believe in and to contribute to a joint mission of empowering traders worldwide. It also provides me with a fantastic platform to expand my reach as an educator and mentor, sharing my knowledge and passion for trading with a larger audience.

In your opinion, what sets Exness apart from the competition, and what is the key to its success?

Exness has a unique approach, combining cutting-edge technology with a strong ethical foundation. Its frictionless trading experience, favorable trading conditions, seamless withdrawals, and customer-centric approach resonates not only with me but also with other seasoned traders.

Exness strikes a balance between providing powerful tools and maintaining a simple, intuitive interface. This, combined with their dedication to ethical practices and client support, is undoubtedly a contributing factor to its success and my trust in it.

You seem deeply committed to mentoring those who pursue trading. What inspires your passion, and what role do you see yourself playing in the development of trading in your region?

My passion for mentoring is fueled by my belief that financial literacy should be accessible to everyone. Trading has the potential to transform lives, and I'm driven to share my knowledge and experience to help others achieve their financial goals.

I've witnessed how trading can empower individuals, allowing them to create their own path and achieve a level of independence they may not have thought possible. It's incredibly fulfilling to guide aspiring traders, witness their progress, and celebrate their journey. By providing education, mentorship, and support, I hope to contribute to a more financially literate and empowered community of traders.

What piece of advice would you give someone starting their trading journey?

Master money and risk management. That's the key to a long-term trading journey. Focus on preserving your capital and making informed decisions.

Looking ahead, what are your personal goals and aspirations, and how does Exness Team Pro fit into your journey?

My primary goal is to continue educating and empowering traders of all levels to achieve their financial goals. Exness Team Pro provides me with a platform to reach a wider audience and make a greater impact.

I'm excited to continue this journey, collaborating with Exness to promote financial literacy and contribute to the growth of the trading community worldwide.

Nicolas Palacios, a prominent figure in the Latin American trading scene and an Exness Team Pro member, has carved a unique path into the financial markets. Starting with a fascination for blockchain and a desire for financial freedom, Nicolas transformed his passion for trading into a career as a professional trader and financial markets influencer. In this interview, he shares his insights, strategies, and commitment to empowering others in the trading world.

You began trading at a young age. What initially sparked your interest in the financial markets, and how did you develop your skills so quickly?

My journey began with a fascination for blockchain technology and the potential offered by financial markets. I was captivated by the idea of achieving financial independence, even though I knew it was risky. Trading seemed like a great opportunity, even as a side hustle, so I immersed myself in learning everything I could about it. I attended seminars, devoured books, participated in workshops—you name it, I did it!

While I’ve had positive results in the beginning, the real key to my development and consistent trading was mastering risk management. For me, that’s the foundation upon which a career in the markets is built. I believe that to be a trader is a matter of discovering that potential and honing the necessary skills.

Are there any financial assets you favor?

Bitcoin and Ethereum have always held a special place in my portfolio. My journey actually began with a YouTube channel dedicated to blockchain technology. I was eager to share my knowledge and enthusiasm about its potential to revolutionize the world. Having a deep understanding of these cryptocurrencies gives me an edge when trading them, though it's crucial to remember that they are high-risk assets.

Tesla is another favorite. I've been an avid follower of the company for years, and believe in their long-term vision.

Your analysis is well respected. Do you regard yourself as part of "team technical" or "team fundamental?"

My trading methodology relies on a combination of fundamental and technical analysis. I use fundamentals to understand the mid- to long-term trends and overall market sentiment. This provides a solid foundation for my trading decisions. I then utilize technical analysis to pinpoint optimal entry and exit points, refining my strategy based on chart patterns and indicators.

I believe it's important to weigh in as many parameters as possible when trading for two key reasons: Firstly, the markets are incredibly interconnected; when one is impacted positively, another might be affected negatively. Look at gold and stocks, for example. Secondly, it is crucial to consider all aspects in order to make a decision that is as calculated as possible. This includes considering economic data, geopolitical events, and even social media sentiment alongside traditional fundamental and technical analysis. By incorporating a holistic view of the market, I can make more informed decisions and increase my chances of positive results.

You have a strong following on social media. In your opinion, what are the unique challenges and opportunities facing traders, and how do you address these in your content?

The trading community is experiencing rapid growth, which presents exciting opportunities and unique challenges. One of the biggest challenges is the need for greater financial literacy and education. Many aspiring traders lack access to reliable information and resources.

That's where I see my role as an educator and mentor. Through my content, I strive to bridge this knowledge gap and empower traders to make informed decisions. I focus on providing clear, concise explanations of trading concepts, risk management strategies, and ethical practices. It's incredibly rewarding to see how my content has helped traders in the region develop their skills and navigate the markets more confidently.

As a crypto enthusiast, do you believe there is a crypto summer on the horizon? What advice would you give to traders who want to navigate such a volatile market?

I'm passionate about cryptocurrencies but approach them with a balanced perspective. They offer the potential for high rewards but also come with significant risks. While I believe a crypto summer could be on the horizon, it's essential to trade these assets responsibly and manage risk effectively. I advise approaching crypto trading with a clear strategy, a disciplined mindset, and a focus on capital preservation.

You are a popular content creator and surely had several offers. Why did you choose to become an Exness Team Pro member? What is it about ETP that resonates with you?

Exness stands out for several reasons. Beyond its impressive size and global reach, Exness prioritizes ethics, technology, and client satisfaction—values that resonate deeply with my own. In the often turbulent world of trading, integrity and transparency are paramount.

Exness has built a solid reputation for upholding these principles, which is incredibly important to me. They're not just focused on profits; they genuinely care about creating a positive and supportive trading environment for their clients.

Being a member of Exness Team Pro is an honor. It allows me to align myself with a brand that I believe in and to contribute to a joint mission of empowering traders worldwide. It also provides me with a fantastic platform to expand my reach as an educator and mentor, sharing my knowledge and passion for trading with a larger audience.

In your opinion, what sets Exness apart from the competition, and what is the key to its success?

Exness has a unique approach, combining cutting-edge technology with a strong ethical foundation. Its frictionless trading experience, favorable trading conditions, seamless withdrawals, and customer-centric approach resonates not only with me but also with other seasoned traders.

Exness strikes a balance between providing powerful tools and maintaining a simple, intuitive interface. This, combined with their dedication to ethical practices and client support, is undoubtedly a contributing factor to its success and my trust in it.

You seem deeply committed to mentoring those who pursue trading. What inspires your passion, and what role do you see yourself playing in the development of trading in your region?

My passion for mentoring is fueled by my belief that financial literacy should be accessible to everyone. Trading has the potential to transform lives, and I'm driven to share my knowledge and experience to help others achieve their financial goals.

I've witnessed how trading can empower individuals, allowing them to create their own path and achieve a level of independence they may not have thought possible. It's incredibly fulfilling to guide aspiring traders, witness their progress, and celebrate their journey. By providing education, mentorship, and support, I hope to contribute to a more financially literate and empowered community of traders.

What piece of advice would you give someone starting their trading journey?

Master money and risk management. That's the key to a long-term trading journey. Focus on preserving your capital and making informed decisions.

Looking ahead, what are your personal goals and aspirations, and how does Exness Team Pro fit into your journey?

My primary goal is to continue educating and empowering traders of all levels to achieve their financial goals. Exness Team Pro provides me with a platform to reach a wider audience and make a greater impact.

I'm excited to continue this journey, collaborating with Exness to promote financial literacy and contribute to the growth of the trading community worldwide.

Exness

Exness Team Pro Member, Kojo Forex's journey to success. Was he born to trade?

From trading in a tiny room to partnering with Exness Team Pro, Kojo Forex's story is one of grit, determination, and a relentless pursuit of knowledge. His commitment to empowering others has made him a leading force and inspiration for Ghana's new generation of traders.

Your technical analysis is very well–regarded. Does this mean you're team ‘technical’? What are your thoughts on fundamentals?

I'd say I'm about 80% technical, and the remaining 20% focusing on fundamentals. But my approach has evolved over time. Initially, I was a scalper chasing quick profits in short timeframes. Eventually, I realised that sustainable trading requires a broader perspective. That’s when I shifted my focus to day trading and swing trading, concentrating on the four-hour timeframe.

This change in perspective was a game-changer. I discovered that the markets are interconnected across different timeframes. The volatility I once chased on shorter timeframes now informs my analysis of the four-hour chart. It's like the market speaks the same language, just with varying degrees of detail.

Now, I leverage my day trading knowledge to refine my swing trading entries and exits. While I still keep an eye on the shorter timeframes, I don't get sucked into the noise anymore. I focus on the bigger picture, the overall trend of the market. It's a less stressful approach that’s more aligned with my long-term goals.

Are there any financial assets that you favor?

The Pound has always been my go-to asset, I’ve been trading it since day one. My first significant loss was GBPUSD due to a lack of risk management. I was doubling down on a long position while the market was headed south. It took a couple of days to blow the whole account.

That was a wake-up call, a harsh reminder that discipline and sticking to a strategy are crucial in trading. Through this experience, I also realised I needed to delve deeper into the fundamentals and technical aspects of the asset class. Luckily, this was during the Brexit saga, which was ideal for studying and trading it well.

But even after Brexit, I stuck with the pound. My success with it earned me nicknames like "GBP Legend" and "Emperor of the Pound."

You seem deeply committed to mentoring people who are pursuing trading. What inspires your passion, and what role do you see yourself playing in developing the rising trend of trading in your region?

Trading is becoming popular in Ghana, and I don’t want to be just another trader. I want to be someone who can inspire and guide the next generation. Trading can be a powerful tool for empowerment, but it requires knowledge, discipline, and the right mindset. By mentoring others, I can help them navigate the complexities of the market and develop the skills they need to succeed.

Personally, mentorship is about more than just teaching people how to read charts and place trades. It's about building real, personal connections with my community. Understanding their struggles, motivations, and dreams.

When I started trading, I never had a mentor, but I was lucky enough to have a group of friends who shared the same passion for trading. We learned together, supported each other, and pushed each other to grow. That experience taught me the value of community and the power of shared knowledge. It's why I'm so committed to giving back to the trading community in Ghana. I want to be the mentor that I never had, to guide and support others on their journey to financial freedom.

Mentorship is about knowing that I’ve played a part in their growth. I want to inspire and guide people, help them realise their potential, and make a real difference in their lives and communities.

If you could give one piece of advice to someone starting their trading journey now, what would it be?

Before you think about placing a trade, figure out what trading means to you. Are you looking for a side hustle, or do you see this as a potential career path? This distinction is crucial because it will determine the level of commitment and resources you need to invest.

If trading is a side hustle, it's not that big of a deal; you can experiment, learn, and see what works for you without too much pressure. But if you aim to make trading your main source of income, it's a whole different ball game. It's a huge responsibility, and you must be prepared for it. With trading as your full-time job, you have to treat it like a business. It means you’re the CEO, the accountant, the risk manager, all in one. It’s a huge responsibility, and you need to be prepared for that.

That doesn’t mean you can’t transition from a side hustle to a full-time gig. It’s totally doable, but it requires planning and dedication. Start by building a solid foundation of experience, developing your trading strategy, and aiming for consistency.

The key is to be realistic and honest with yourself. Don't get caught up in the hype of quick riches. Trading takes time, effort, and continuous learning. But if you're willing to put in the work, it can be an incredibly rewarding path.

From trading in a tiny room to partnering with Exness Team Pro, Kojo Forex's story is one of grit, determination, and a relentless pursuit of knowledge. His commitment to empowering others has made him a leading force and inspiration for Ghana's new generation of traders.

Your technical analysis is very well–regarded. Does this mean you're team ‘technical’? What are your thoughts on fundamentals?

I'd say I'm about 80% technical, and the remaining 20% focusing on fundamentals. But my approach has evolved over time. Initially, I was a scalper chasing quick profits in short timeframes. Eventually, I realised that sustainable trading requires a broader perspective. That’s when I shifted my focus to day trading and swing trading, concentrating on the four-hour timeframe.

This change in perspective was a game-changer. I discovered that the markets are interconnected across different timeframes. The volatility I once chased on shorter timeframes now informs my analysis of the four-hour chart. It's like the market speaks the same language, just with varying degrees of detail.

Now, I leverage my day trading knowledge to refine my swing trading entries and exits. While I still keep an eye on the shorter timeframes, I don't get sucked into the noise anymore. I focus on the bigger picture, the overall trend of the market. It's a less stressful approach that’s more aligned with my long-term goals.

Are there any financial assets that you favor?

The Pound has always been my go-to asset, I’ve been trading it since day one. My first significant loss was GBPUSD due to a lack of risk management. I was doubling down on a long position while the market was headed south. It took a couple of days to blow the whole account.

That was a wake-up call, a harsh reminder that discipline and sticking to a strategy are crucial in trading. Through this experience, I also realised I needed to delve deeper into the fundamentals and technical aspects of the asset class. Luckily, this was during the Brexit saga, which was ideal for studying and trading it well.

But even after Brexit, I stuck with the pound. My success with it earned me nicknames like "GBP Legend" and "Emperor of the Pound."

You seem deeply committed to mentoring people who are pursuing trading. What inspires your passion, and what role do you see yourself playing in developing the rising trend of trading in your region?

Trading is becoming popular in Ghana, and I don’t want to be just another trader. I want to be someone who can inspire and guide the next generation. Trading can be a powerful tool for empowerment, but it requires knowledge, discipline, and the right mindset. By mentoring others, I can help them navigate the complexities of the market and develop the skills they need to succeed.

Personally, mentorship is about more than just teaching people how to read charts and place trades. It's about building real, personal connections with my community. Understanding their struggles, motivations, and dreams.

When I started trading, I never had a mentor, but I was lucky enough to have a group of friends who shared the same passion for trading. We learned together, supported each other, and pushed each other to grow. That experience taught me the value of community and the power of shared knowledge. It's why I'm so committed to giving back to the trading community in Ghana. I want to be the mentor that I never had, to guide and support others on their journey to financial freedom.

Mentorship is about knowing that I’ve played a part in their growth. I want to inspire and guide people, help them realise their potential, and make a real difference in their lives and communities.

If you could give one piece of advice to someone starting their trading journey now, what would it be?

Before you think about placing a trade, figure out what trading means to you. Are you looking for a side hustle, or do you see this as a potential career path? This distinction is crucial because it will determine the level of commitment and resources you need to invest.

If trading is a side hustle, it's not that big of a deal; you can experiment, learn, and see what works for you without too much pressure. But if you aim to make trading your main source of income, it's a whole different ball game. It's a huge responsibility, and you must be prepared for it. With trading as your full-time job, you have to treat it like a business. It means you’re the CEO, the accountant, the risk manager, all in one. It’s a huge responsibility, and you need to be prepared for that.

That doesn’t mean you can’t transition from a side hustle to a full-time gig. It’s totally doable, but it requires planning and dedication. Start by building a solid foundation of experience, developing your trading strategy, and aiming for consistency.

The key is to be realistic and honest with yourself. Don't get caught up in the hype of quick riches. Trading takes time, effort, and continuous learning. But if you're willing to put in the work, it can be an incredibly rewarding path.

Exness

Born to trade? How Dennis Okari, an investigative journalist turned into professional trading

In this interview with Dennis Okari, we delve deeper into his partnership with Exness, his commitment to mentoring, and his vision for the future of trading in Kenya and beyond.

Being a journalist means that you have the knowledge to investigate how certain events affect the economy and the markets. Does this mean you're more interested in fundamental analysis?

While my journalism background is helpful, I'm primarily a technical trader. However, I strongly believe in a balanced approach. I use fundamentals to see the underlying factors. Fundamentals provide the context—the 'why' behind those movements. Technical analysis helps me spot patterns and trends in the market.

For me, it's like having a toolkit. Technical analysis gives me the tools to navigate the charts, while fundamentals help me understand the bigger picture. Together, they give me a comprehensive strategy and a deeper understanding of what drives the markets.

My experience as a journalist has given me a unique advantage in this regard. I've always had a knack for digging deeper and seeing beyond the headlines. This skill translates directly to trading. For example, during Brexit, my in-depth understanding of the political landscape in the UK gave me valuable insights into how the Pound might react. Similarly, my reporting on the COVID-19 pandemic and the Russia-Ukraine conflict helped me anticipate their impact on various assets.

This investigative mindset also informs my trading style. When I was a journalist, time constraints often dictated my trading approach. I focused on swing trading, identifying opportunities, and letting them pan out over longer periods. Now, with a full-time focus on trading, I can explore shorter-term opportunities through day trading. Technical analysis becomes even more critical in this context, allowing me to identify patterns and trends without relying solely on fundamental news.

Are there any financial assets you favor?

I began my trading journey with EURUSD, drawn to its volatility, which is ideal for day trading. As I gained experience and refined my strategies, I discovered that my approach could be adapted to various financial instruments.

I expanded my focus to include USDJPY, and now I trade a wide range of assets, from major currency pairs to indices and commodities. While my core trading philosophy remains consistent across these diverse markets, I tailor my specific strategies to suit the unique characteristics of each asset class. For instance, commodities often exhibit more pronounced trends than currencies, so my approach to trading oil might differ from my strategy for EURUSD.

What is your opinion on cryptocurrencies? Is there a crypto summer on the horizon? Most importantly, do you want to share your views with traders who want to navigate such a volatile asset class?

I'll be honest: I prefer to stick with what I know well. While I'm aware of cryptocurrencies' potential, their extreme volatility gives me pause. Sure, crypto is exciting, but it also comes with significant risks. I prefer to focus on more established markets where I have a deeper understanding of the underlying factors.

That said, I'm not an expert on cryptocurrencies, and I wouldn't want to advise without a full grasp of the intricacies involved. However, for those considering venturing into the crypto space, I'd emphasize the importance of thorough research, a keen eye for patterns, and meticulous risk management. The volatility of cryptocurrencies means that the potential for gains and losses is magnified compared to other markets. So, if you decide to trade crypto, proceed with caution and a well-informed strategy.

What differentiates Exness from other brokers, and what do you think is the key to its success?

The Exness terminal is a game-changer. It's designed to be an all-in-one hub where you can seamlessly manage your pending orders, view real-time calculations, and execute trades without ever leaving the platform. It's incredibly efficient and user-friendly, allowing me to focus on what matters most – making informed trading decisions.

This dedication to streamlining the trading process, combined with its robust technology and commitment to client satisfaction, is the key to Exness' success. Exness understands that traders need a reliable and intuitive platform to navigate the complexities of the financial markets. By continuously innovating and prioritizing its clients’ needs, Exness has created a trading environment that empowers traders to reach their full potential.

You seem deeply committed to mentoring people who are pursuing trading. What inspires your passion, and what role do you see yourself playing in developing the rise of trading in your region?

My passion for mentoring stems from my own journey and the transformative power of financial freedom. I vividly remember the joy and sense of accomplishment when I purchased my first washing machine and dining room table with my trading profits. It was a tangible reminder that I could achieve financial goals beyond my regular salary.

This experience ignited a desire to share my knowledge and empower others to achieve their dreams. I love seeing the spark in my students' eyes as they grasp new concepts and the pride they feel when they achieve their first profitable trade. It's immensely gratifying to guide them through the challenges and pitfalls I faced, helping them avoid unnecessary mistakes and accelerate their learning curve.

By fostering financial literacy and providing accessible education, I can help empower individuals to take control of their financial future. My ultimate goal is to cultivate a thriving community of traders who are not only knowledgeable but also confident and responsible in their approach to the markets.

What is the one piece of advice you could give someone who is beginning their trading journey?

Start now, but start with education. Knowledge is the cornerstone of any successful endeavor, and trading is no exception. No one is born with an innate understanding of the markets, so invest time learning the fundamentals.

Remember, success in trading isn't solely measured by profits. It's about personal growth, resilience, and the ability to bounce back from setbacks. Everyone's journey is unique. Focus on continuous learning, develop a solid strategy, and, most importantly, don't be afraid to start. The best time to begin your trading journey is now.

Disclaimer: The information in this material is provided for information purposes only and should not be construed as containing investment advice or an offer of solicitation for any transactions in financial instruments. Neither the presenter nor Exness takes into account your personal investment objectives or financial situation and assumes no liability to the accuracy, timeliness or completeness of the information provided, nor for any loss arising from any information supplied. Any opinions made throughout the presentation are strictly personal to the presenters and may not reflect the opinions of Exness. Past performance does not guarantee or predict future performance. Seek independent advice if necessary.

In this interview with Dennis Okari, we delve deeper into his partnership with Exness, his commitment to mentoring, and his vision for the future of trading in Kenya and beyond.

Being a journalist means that you have the knowledge to investigate how certain events affect the economy and the markets. Does this mean you're more interested in fundamental analysis?

While my journalism background is helpful, I'm primarily a technical trader. However, I strongly believe in a balanced approach. I use fundamentals to see the underlying factors. Fundamentals provide the context—the 'why' behind those movements. Technical analysis helps me spot patterns and trends in the market.

For me, it's like having a toolkit. Technical analysis gives me the tools to navigate the charts, while fundamentals help me understand the bigger picture. Together, they give me a comprehensive strategy and a deeper understanding of what drives the markets.

My experience as a journalist has given me a unique advantage in this regard. I've always had a knack for digging deeper and seeing beyond the headlines. This skill translates directly to trading. For example, during Brexit, my in-depth understanding of the political landscape in the UK gave me valuable insights into how the Pound might react. Similarly, my reporting on the COVID-19 pandemic and the Russia-Ukraine conflict helped me anticipate their impact on various assets.

This investigative mindset also informs my trading style. When I was a journalist, time constraints often dictated my trading approach. I focused on swing trading, identifying opportunities, and letting them pan out over longer periods. Now, with a full-time focus on trading, I can explore shorter-term opportunities through day trading. Technical analysis becomes even more critical in this context, allowing me to identify patterns and trends without relying solely on fundamental news.

Are there any financial assets you favor?

I began my trading journey with EURUSD, drawn to its volatility, which is ideal for day trading. As I gained experience and refined my strategies, I discovered that my approach could be adapted to various financial instruments.

I expanded my focus to include USDJPY, and now I trade a wide range of assets, from major currency pairs to indices and commodities. While my core trading philosophy remains consistent across these diverse markets, I tailor my specific strategies to suit the unique characteristics of each asset class. For instance, commodities often exhibit more pronounced trends than currencies, so my approach to trading oil might differ from my strategy for EURUSD.

What is your opinion on cryptocurrencies? Is there a crypto summer on the horizon? Most importantly, do you want to share your views with traders who want to navigate such a volatile asset class?

I'll be honest: I prefer to stick with what I know well. While I'm aware of cryptocurrencies' potential, their extreme volatility gives me pause. Sure, crypto is exciting, but it also comes with significant risks. I prefer to focus on more established markets where I have a deeper understanding of the underlying factors.

That said, I'm not an expert on cryptocurrencies, and I wouldn't want to advise without a full grasp of the intricacies involved. However, for those considering venturing into the crypto space, I'd emphasize the importance of thorough research, a keen eye for patterns, and meticulous risk management. The volatility of cryptocurrencies means that the potential for gains and losses is magnified compared to other markets. So, if you decide to trade crypto, proceed with caution and a well-informed strategy.

What differentiates Exness from other brokers, and what do you think is the key to its success?

The Exness terminal is a game-changer. It's designed to be an all-in-one hub where you can seamlessly manage your pending orders, view real-time calculations, and execute trades without ever leaving the platform. It's incredibly efficient and user-friendly, allowing me to focus on what matters most – making informed trading decisions.

This dedication to streamlining the trading process, combined with its robust technology and commitment to client satisfaction, is the key to Exness' success. Exness understands that traders need a reliable and intuitive platform to navigate the complexities of the financial markets. By continuously innovating and prioritizing its clients’ needs, Exness has created a trading environment that empowers traders to reach their full potential.

You seem deeply committed to mentoring people who are pursuing trading. What inspires your passion, and what role do you see yourself playing in developing the rise of trading in your region?

My passion for mentoring stems from my own journey and the transformative power of financial freedom. I vividly remember the joy and sense of accomplishment when I purchased my first washing machine and dining room table with my trading profits. It was a tangible reminder that I could achieve financial goals beyond my regular salary.

This experience ignited a desire to share my knowledge and empower others to achieve their dreams. I love seeing the spark in my students' eyes as they grasp new concepts and the pride they feel when they achieve their first profitable trade. It's immensely gratifying to guide them through the challenges and pitfalls I faced, helping them avoid unnecessary mistakes and accelerate their learning curve.

By fostering financial literacy and providing accessible education, I can help empower individuals to take control of their financial future. My ultimate goal is to cultivate a thriving community of traders who are not only knowledgeable but also confident and responsible in their approach to the markets.

What is the one piece of advice you could give someone who is beginning their trading journey?

Start now, but start with education. Knowledge is the cornerstone of any successful endeavor, and trading is no exception. No one is born with an innate understanding of the markets, so invest time learning the fundamentals.

Remember, success in trading isn't solely measured by profits. It's about personal growth, resilience, and the ability to bounce back from setbacks. Everyone's journey is unique. Focus on continuous learning, develop a solid strategy, and, most importantly, don't be afraid to start. The best time to begin your trading journey is now.

Disclaimer: The information in this material is provided for information purposes only and should not be construed as containing investment advice or an offer of solicitation for any transactions in financial instruments. Neither the presenter nor Exness takes into account your personal investment objectives or financial situation and assumes no liability to the accuracy, timeliness or completeness of the information provided, nor for any loss arising from any information supplied. Any opinions made throughout the presentation are strictly personal to the presenters and may not reflect the opinions of Exness. Past performance does not guarantee or predict future performance. Seek independent advice if necessary.

Exness

No Fine Print: Why transparency matters in the world of trading

Transparency - a given, not a nice-to-have

The global Contract for Difference (CFD) market has grown spectacularly over the past decades and shows no signs of slowing down, with an estimated annual compound growth rate of 4.3% from 2023 to 2028. CFD trading offers convenient, low-cost access to assets like oil, gold, currencies, and stocks, making it appealing to traders worldwide. Yet, with this convenience comes complexity—and that means risk.

CFDs are intricate financial instruments, and brokers often have flexibility in setting fees and spreads, which are not always fully disclosed. This is when transparency becomes critical for traders seeking fairness and clarity in their transactions. Transparency is no longer a “nice-to-have” but a foundational expectation in today’s trading landscape.

As traders’ preferences evolve, so does their expectation of transparency. The "Born to Trade" spirit calls for clarity and reliability, and Exness, one of the world’s largest brokers, leads by example, setting the standard for transparency and trustworthiness.

Why is it important?

In the complex world of trading, where markets can change in milliseconds, traders need clarity on fees, policies, and practices to make informed decisions and build trust with their brokers.

Transparency in trading is about more than disclosure; it’s about enabling traders to make empowered decisions based on clear, reliable information. Here’s how transparency plays out in practice:

Clarity on fees and costs: Transparent brokers offer straightforward information on fees, commissions, and spreads, ensuring traders know exactly what they’re paying and why. This transparency removes hidden charges and surprises.

Insight into execution practices: Transparency includes providing details on how orders are executed and what factors influence pricing. Brokers that clearly explain their execution practices give traders confidence in how their trades are handled.

Open communication channels: Reliable customer support and clear communication build trust by providing traders with timely responses to questions and concerns, enhancing their trading experience.

When brokers operate transparently, they build trust and confidence, allowing their clients to focus on what matters most: achieving their trading goals.

How technology exemplifies transparency

As the demand for transparency grows, technology has become a critical tool for brokers aiming to meet this expectation. Hidden fees and unclear terms can erode trust, instilling feelings of uncertainty.

Through advanced data analysis, algorithmic pricing, and high-speed execution systems, brokers can create a trading environment that offers real-time data and supports tight, predictable spreads and efficient transaction processing. These technological advancements allow brokers to maintain consistency, even during high volatility, by minimizing price deviations, ensuring that trades are executed with precision.

Exness: Fueling traders’ decision-making

Exness is a prime example of a broker leveraging technology to achieve transparency and build trust. The company ensures that all traders—regardless of experience level—can access accurate information on spreads, fast execution speeds, and risk management tools.

Through pricing algorithms and real-time data analysis, Exness maintains tight and stable spreads, even during volatility periods such as high-impact news*. This consistency ensures traders avoid unexpected price shifts, making costs predictable and transparent.

Exness’ infrastructure is also designed to offer better-than-market conditions with ultra-fast trade execution. With latency as low as a few milliseconds, slippage is minimized, focusing on bridging traders to the prices they expect. By reducing the time it takes to execute trades, Exness enhances transparency and gives traders more control over their transactions.

Seamless withdrawals are another result of Exness’s technological investment. Automated systems monitor trading activity around the clock, flagging any potentially suspicious actions. This setup enables Exness to streamline withdrawals, allowing 95% of requests to be processed in under 1 minute. This efficiency aligns with Exness’ commitment to transparency by ensuring that funds reach their rightful owners without delays (at least on the broker’s end), adding another layer of trust and reliability.

By providing full visibility on pricing and eliminating hidden fees, Exness fosters a trusting relationship with its traders. Exness’ approach to transparency means that all terms are clear, fees are straightforward, and policies are crafted for traders’ ease of understanding.

Whether it’s spreads, fees, or execution times, Exness provides traders with the complete picture, allowing them to make proactive, strategic decisions. This creates an environment where trust and accountability are no longer a matter of expectation. Exness' commitment to transparency and accountability as its core values, together with multiple regulatory licenses, has garnered the trust of hundreds of thousands of traders, transforming the company into one of the world's largest retail brokers.

*Spreads may fluctuate and widen due to factors including market volatility and liquidity, news releases, economic events, when markets open or close, and the type of instruments being traded

Transparency - a given, not a nice-to-have

The global Contract for Difference (CFD) market has grown spectacularly over the past decades and shows no signs of slowing down, with an estimated annual compound growth rate of 4.3% from 2023 to 2028. CFD trading offers convenient, low-cost access to assets like oil, gold, currencies, and stocks, making it appealing to traders worldwide. Yet, with this convenience comes complexity—and that means risk.

CFDs are intricate financial instruments, and brokers often have flexibility in setting fees and spreads, which are not always fully disclosed. This is when transparency becomes critical for traders seeking fairness and clarity in their transactions. Transparency is no longer a “nice-to-have” but a foundational expectation in today’s trading landscape.

As traders’ preferences evolve, so does their expectation of transparency. The "Born to Trade" spirit calls for clarity and reliability, and Exness, one of the world’s largest brokers, leads by example, setting the standard for transparency and trustworthiness.

Why is it important?

In the complex world of trading, where markets can change in milliseconds, traders need clarity on fees, policies, and practices to make informed decisions and build trust with their brokers.

Transparency in trading is about more than disclosure; it’s about enabling traders to make empowered decisions based on clear, reliable information. Here’s how transparency plays out in practice:

Clarity on fees and costs: Transparent brokers offer straightforward information on fees, commissions, and spreads, ensuring traders know exactly what they’re paying and why. This transparency removes hidden charges and surprises.

Insight into execution practices: Transparency includes providing details on how orders are executed and what factors influence pricing. Brokers that clearly explain their execution practices give traders confidence in how their trades are handled.

Open communication channels: Reliable customer support and clear communication build trust by providing traders with timely responses to questions and concerns, enhancing their trading experience.

When brokers operate transparently, they build trust and confidence, allowing their clients to focus on what matters most: achieving their trading goals.

How technology exemplifies transparency

As the demand for transparency grows, technology has become a critical tool for brokers aiming to meet this expectation. Hidden fees and unclear terms can erode trust, instilling feelings of uncertainty.

Through advanced data analysis, algorithmic pricing, and high-speed execution systems, brokers can create a trading environment that offers real-time data and supports tight, predictable spreads and efficient transaction processing. These technological advancements allow brokers to maintain consistency, even during high volatility, by minimizing price deviations, ensuring that trades are executed with precision.

Exness: Fueling traders’ decision-making

Exness is a prime example of a broker leveraging technology to achieve transparency and build trust. The company ensures that all traders—regardless of experience level—can access accurate information on spreads, fast execution speeds, and risk management tools.

Through pricing algorithms and real-time data analysis, Exness maintains tight and stable spreads, even during volatility periods such as high-impact news*. This consistency ensures traders avoid unexpected price shifts, making costs predictable and transparent.

Exness’ infrastructure is also designed to offer better-than-market conditions with ultra-fast trade execution. With latency as low as a few milliseconds, slippage is minimized, focusing on bridging traders to the prices they expect. By reducing the time it takes to execute trades, Exness enhances transparency and gives traders more control over their transactions.

Seamless withdrawals are another result of Exness’s technological investment. Automated systems monitor trading activity around the clock, flagging any potentially suspicious actions. This setup enables Exness to streamline withdrawals, allowing 95% of requests to be processed in under 1 minute. This efficiency aligns with Exness’ commitment to transparency by ensuring that funds reach their rightful owners without delays (at least on the broker’s end), adding another layer of trust and reliability.

By providing full visibility on pricing and eliminating hidden fees, Exness fosters a trusting relationship with its traders. Exness’ approach to transparency means that all terms are clear, fees are straightforward, and policies are crafted for traders’ ease of understanding.

Whether it’s spreads, fees, or execution times, Exness provides traders with the complete picture, allowing them to make proactive, strategic decisions. This creates an environment where trust and accountability are no longer a matter of expectation. Exness' commitment to transparency and accountability as its core values, together with multiple regulatory licenses, has garnered the trust of hundreds of thousands of traders, transforming the company into one of the world's largest retail brokers.

*Spreads may fluctuate and widen due to factors including market volatility and liquidity, news releases, economic events, when markets open or close, and the type of instruments being traded

Exness

The invisible enemy: Why your biggest trading challenge is lurking between your ears

An opinion article by Negin Sadat Negahdari, Exness Senior Business Development Manager

As traders, we often obsess over external factors, meticulously analyzing every market fluctuation, yet neglect the internal landscape that truly dictates our journey in the markets. In reality, the most formidable opponent traders face isn’t in the market; it's in their minds. Yes, trading psychology, often overshadowed by technical analysis and market strategies, is the hidden engine that powers traders’ consistency.

While many aspire to conquer the markets, few truly grasp the profound impact of their thoughts and feelings on their trading outcomes. Without emotional resilience and a disciplined mindset, even the most well-researched trading strategy can unravel the moment your trading activity is at stake. Developing a disciplined trader mindset isn’t just important; it’s essential.

Consider the seismic shift from demo to live trading. In the risk-free environment of a demo account, strategies feel clear, confidence is high, and there’s little fear of loss. But in the high-stakes world of live trading, clarity is often clouded by fears of loss or the tantalizing lure of quick gains. Suddenly, decisions that seemed straightforward become loaded with emotion.

The crucial takeaway here? Consistent trading isn’t just about predicting the markets but mastering oneself. The big disconnect is that an overwhelming majority of traders recognize the need for a concrete strategy yet struggle to consistently translate that strategy into disciplined action. Emotions like greed, regret, FOMO (fear of missing out), and ego insidiously creep in and hijack our rational minds, sabotaging even the best-laid plans.

Greed might compel a trader to hold a winning position for too long, ignoring warning signs in hopes of ever-higher profits. FOMO can lure traders into impulsive decisions, jumping into trades without solid analysis, undermining consistency. Regret—those nagging “What if?” thoughts—can lead traders to chase the market instead of assessing it objectively. Then there’s ego, driving traders to prove themselves right at the expense of rational analysis. Each of these emotions interferes with decision-making and often ends in regret.

Interestingly, experience plays a role in how traders handle these psychological challenges. Younger traders are often more susceptible to emotional decisions. But there is good news. As traders become more seasoned, they rely more on concrete strategies than gut feeling. This is the power of self-awareness at play.

This shift hints at trading psychology maturing over time – a skill honed by experience and reflection. Keeping a trading journal, for example, is like holding a mirror to our minds, allowing us to identify the emotional triggers that influence our trading decisions. Setting realistic profit targets, implementing risk management, and cultivating a disciplined approach to trading can help traders start eliminating self-defeating habits.

Consistency in trading isn’t about being right every time; it’s about managing risk well and using mistakes as stepping stones for improvement. As George Soros wisely said, “It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong.” This perspective teaches traders to view losses as part of the process, shifting the focus from individual trades to overall growth.

Ultimately, trading psychology is a skill that separates those who merely dabble in the markets from those who build resilience and endurance. For traders striving to achieve lasting results, mastering the mind is as crucial as mastering the charts. Emotional resilience, discipline, and self-reflection are the foundations of a consistent trading career. Without them, your financial gains will be as unpredictable as the markets themselves.

An opinion article by Negin Sadat Negahdari, Exness Senior Business Development Manager

As traders, we often obsess over external factors, meticulously analyzing every market fluctuation, yet neglect the internal landscape that truly dictates our journey in the markets. In reality, the most formidable opponent traders face isn’t in the market; it's in their minds. Yes, trading psychology, often overshadowed by technical analysis and market strategies, is the hidden engine that powers traders’ consistency.

While many aspire to conquer the markets, few truly grasp the profound impact of their thoughts and feelings on their trading outcomes. Without emotional resilience and a disciplined mindset, even the most well-researched trading strategy can unravel the moment your trading activity is at stake. Developing a disciplined trader mindset isn’t just important; it’s essential.

Consider the seismic shift from demo to live trading. In the risk-free environment of a demo account, strategies feel clear, confidence is high, and there’s little fear of loss. But in the high-stakes world of live trading, clarity is often clouded by fears of loss or the tantalizing lure of quick gains. Suddenly, decisions that seemed straightforward become loaded with emotion.

The crucial takeaway here? Consistent trading isn’t just about predicting the markets but mastering oneself. The big disconnect is that an overwhelming majority of traders recognize the need for a concrete strategy yet struggle to consistently translate that strategy into disciplined action. Emotions like greed, regret, FOMO (fear of missing out), and ego insidiously creep in and hijack our rational minds, sabotaging even the best-laid plans.

Greed might compel a trader to hold a winning position for too long, ignoring warning signs in hopes of ever-higher profits. FOMO can lure traders into impulsive decisions, jumping into trades without solid analysis, undermining consistency. Regret—those nagging “What if?” thoughts—can lead traders to chase the market instead of assessing it objectively. Then there’s ego, driving traders to prove themselves right at the expense of rational analysis. Each of these emotions interferes with decision-making and often ends in regret.

Interestingly, experience plays a role in how traders handle these psychological challenges. Younger traders are often more susceptible to emotional decisions. But there is good news. As traders become more seasoned, they rely more on concrete strategies than gut feeling. This is the power of self-awareness at play.

This shift hints at trading psychology maturing over time – a skill honed by experience and reflection. Keeping a trading journal, for example, is like holding a mirror to our minds, allowing us to identify the emotional triggers that influence our trading decisions. Setting realistic profit targets, implementing risk management, and cultivating a disciplined approach to trading can help traders start eliminating self-defeating habits.

Consistency in trading isn’t about being right every time; it’s about managing risk well and using mistakes as stepping stones for improvement. As George Soros wisely said, “It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong.” This perspective teaches traders to view losses as part of the process, shifting the focus from individual trades to overall growth.

Ultimately, trading psychology is a skill that separates those who merely dabble in the markets from those who build resilience and endurance. For traders striving to achieve lasting results, mastering the mind is as crucial as mastering the charts. Emotional resilience, discipline, and self-reflection are the foundations of a consistent trading career. Without them, your financial gains will be as unpredictable as the markets themselves.

Exness

The Oracle of Omaha is bracing for a market shake-up

Warren Buffett’s recent moves at Berkshire Hathaway are raising eyebrows across global markets. The “Oracle of Omaha” has offloaded nearly $10 billion in Bank of America stock, while steadily accumulating cash and buying back Berkshire shares. This shift has traders asking: what does Buffett see coming?

While Buffett has always championed long-term investing in quality businesses, his latest actions may indicate deeper concerns. With a growing cash reserve, he appears to be preparing Berkshire to weather potential storms. Investors may want to take note, as these decisions could offer insights into broader economic trends.

Cash is king—again

Buffett’s cash build-up suggests caution. His approach has always been conservative, but his remarks about “casino-like” markets last year hint at skepticism about today’s valuations. Holding more cash provides flexibility to take advantage of buying opportunities in downturns. For traders, this could mean that keeping an eye on cash-equivalent assets and the US dollar index (DXY) may reveal how markets react to perceived overvaluation.

Bank stocks and blue-chip shares

With Berkshire selling Bank of America shares, some might wonder if there are concerns about the banking sector. Although Berkshire has historically been a big player in financial stocks, Buffett’s latest moves imply he might see risks in the sector’s exposure to rising interest rates and economic fluctuations. Watching USD pairs like USD/JPY or USD/CHF could offer traders insight into how the dollar responds to shifts in the financial sector.

Meanwhile, Buffett’s buybacks signal confidence in Berkshire’s value. This focus on blue-chip stability could mean traders should consider monitoring indices tied to established, resilient companies. Despite cuts in tech holdings like Apple, Buffett’s actions point towards safer assets—ones that weather volatility well.

Follow this link for more: https://exness.social/3NKHx9b

Warren Buffett’s recent moves at Berkshire Hathaway are raising eyebrows across global markets. The “Oracle of Omaha” has offloaded nearly $10 billion in Bank of America stock, while steadily accumulating cash and buying back Berkshire shares. This shift has traders asking: what does Buffett see coming?

While Buffett has always championed long-term investing in quality businesses, his latest actions may indicate deeper concerns. With a growing cash reserve, he appears to be preparing Berkshire to weather potential storms. Investors may want to take note, as these decisions could offer insights into broader economic trends.

Cash is king—again

Buffett’s cash build-up suggests caution. His approach has always been conservative, but his remarks about “casino-like” markets last year hint at skepticism about today’s valuations. Holding more cash provides flexibility to take advantage of buying opportunities in downturns. For traders, this could mean that keeping an eye on cash-equivalent assets and the US dollar index (DXY) may reveal how markets react to perceived overvaluation.

Bank stocks and blue-chip shares

With Berkshire selling Bank of America shares, some might wonder if there are concerns about the banking sector. Although Berkshire has historically been a big player in financial stocks, Buffett’s latest moves imply he might see risks in the sector’s exposure to rising interest rates and economic fluctuations. Watching USD pairs like USD/JPY or USD/CHF could offer traders insight into how the dollar responds to shifts in the financial sector.

Meanwhile, Buffett’s buybacks signal confidence in Berkshire’s value. This focus on blue-chip stability could mean traders should consider monitoring indices tied to established, resilient companies. Despite cuts in tech holdings like Apple, Buffett’s actions point towards safer assets—ones that weather volatility well.

Follow this link for more: https://exness.social/3NKHx9b

Exness

The biggest economic events you shouldn’t ignore in week 41

On Monday, October 7, the EU Sentix Investor Confidence release will be the first to grab attention. Scheduled for 08:30 GMT, this survey measures investor sentiment across the Eurozone. The euro, European equities, and even global indices like the DAX are expected to feel the ripples from this report. The last reading showed declining confidence, and if this trend continues, it could signal further economic pessimism in the Eurozone. Euro traders might want to brace for either relief or disappointment.

Tuesday, October 8, brings the German Industrial Production numbers at 06:00 GMT. With Germany being the powerhouse of Europe, industrial production stats are always a key indicator of overall economic health. The euro and the DAX will be directly affected, but global markets could also react, depending on the data. Last month's numbers came in weaker than expected, so markets are anticipating either a rebound or continued contraction. A stronger-than-expected report could give the euro some upward momentum, while another weak release would reinforce recession fears.

Follow this link for more: https://exness.social/3TZtZKo

On Monday, October 7, the EU Sentix Investor Confidence release will be the first to grab attention. Scheduled for 08:30 GMT, this survey measures investor sentiment across the Eurozone. The euro, European equities, and even global indices like the DAX are expected to feel the ripples from this report. The last reading showed declining confidence, and if this trend continues, it could signal further economic pessimism in the Eurozone. Euro traders might want to brace for either relief or disappointment.

Tuesday, October 8, brings the German Industrial Production numbers at 06:00 GMT. With Germany being the powerhouse of Europe, industrial production stats are always a key indicator of overall economic health. The euro and the DAX will be directly affected, but global markets could also react, depending on the data. Last month's numbers came in weaker than expected, so markets are anticipating either a rebound or continued contraction. A stronger-than-expected report could give the euro some upward momentum, while another weak release would reinforce recession fears.

Follow this link for more: https://exness.social/3TZtZKo

Exness

The coming black swan hype: Is it legit?

You’ve probably seen or heard the term “Black Swan event” popping up in financial media recently. What exactly is a black swan event, and is one coming?

A true Black Swan event can’t be predicted—by definition. If someone is forecasting one, they either don’t understand the concept, or worse, they’re using it to generate fear and hype. Let's cut through the noise and talk about what a Black Swan really is and why traders should not let the term throw them off their strategy

.

What is a Black Swan event?

A Black Swan event, as popularized by Nassim Nicholas Taleb, refers to an event that is:

Extremely rare and outside the realm of regular expectations.

Unpredictable, meaning no existing models or data could have reasonably anticipated it.

Massively impactful, causing widespread consequences across markets, economies, or societies.

The key takeaway is that Black Swan events are so improbable that they can’t be foreseen, even by experts. This is where the current media usage of the term gets things wrong.

Follow this link for more: https://exness.social/3U19wou

You’ve probably seen or heard the term “Black Swan event” popping up in financial media recently. What exactly is a black swan event, and is one coming?

A true Black Swan event can’t be predicted—by definition. If someone is forecasting one, they either don’t understand the concept, or worse, they’re using it to generate fear and hype. Let's cut through the noise and talk about what a Black Swan really is and why traders should not let the term throw them off their strategy

.

What is a Black Swan event?

A Black Swan event, as popularized by Nassim Nicholas Taleb, refers to an event that is:

Extremely rare and outside the realm of regular expectations.

Unpredictable, meaning no existing models or data could have reasonably anticipated it.

Massively impactful, causing widespread consequences across markets, economies, or societies.

The key takeaway is that Black Swan events are so improbable that they can’t be foreseen, even by experts. This is where the current media usage of the term gets things wrong.

Follow this link for more: https://exness.social/3U19wou

Exness

Don’t fall for the growing oil crisis narrative yet

As tensions escalate between Israel and Iran, talks of supply disruptions are triggering sentiment shifts and market volatility, but what might really happen to USOIL prices in the coming weeks?

One of the oldest adages in trading is “buy the rumor, sell the news.” This approach or perspective suggests that prices often rise on speculation (or rumors) of a potential event but fall when the actual event comes and goes and the news is fully digested. Let’s break down the USOIL narrative forming right now.

The Rumor - Fear of a broader Middle East conflict has led to speculation about supply disruptions, driving oil prices up.

The News - As the conflict progresses and news confirms that oil supplies remain relatively unaffected, prices could fall back to previous levels, as the panic subsides and the market realizes the worst-case scenario has not materialized.

That’s one example of how investor sentiment alone can move markets without a real-world underlying mechanism or change. Those holding and refining crude oil prefer the prices to be high, but not too high, as it tends to trigger political tensions and even trade wars.

Follow this link for more: https://exness.social/3BtE3ou

As tensions escalate between Israel and Iran, talks of supply disruptions are triggering sentiment shifts and market volatility, but what might really happen to USOIL prices in the coming weeks?

One of the oldest adages in trading is “buy the rumor, sell the news.” This approach or perspective suggests that prices often rise on speculation (or rumors) of a potential event but fall when the actual event comes and goes and the news is fully digested. Let’s break down the USOIL narrative forming right now.

The Rumor - Fear of a broader Middle East conflict has led to speculation about supply disruptions, driving oil prices up.

The News - As the conflict progresses and news confirms that oil supplies remain relatively unaffected, prices could fall back to previous levels, as the panic subsides and the market realizes the worst-case scenario has not materialized.

That’s one example of how investor sentiment alone can move markets without a real-world underlying mechanism or change. Those holding and refining crude oil prefer the prices to be high, but not too high, as it tends to trigger political tensions and even trade wars.

Follow this link for more: https://exness.social/3BtE3ou

Exness

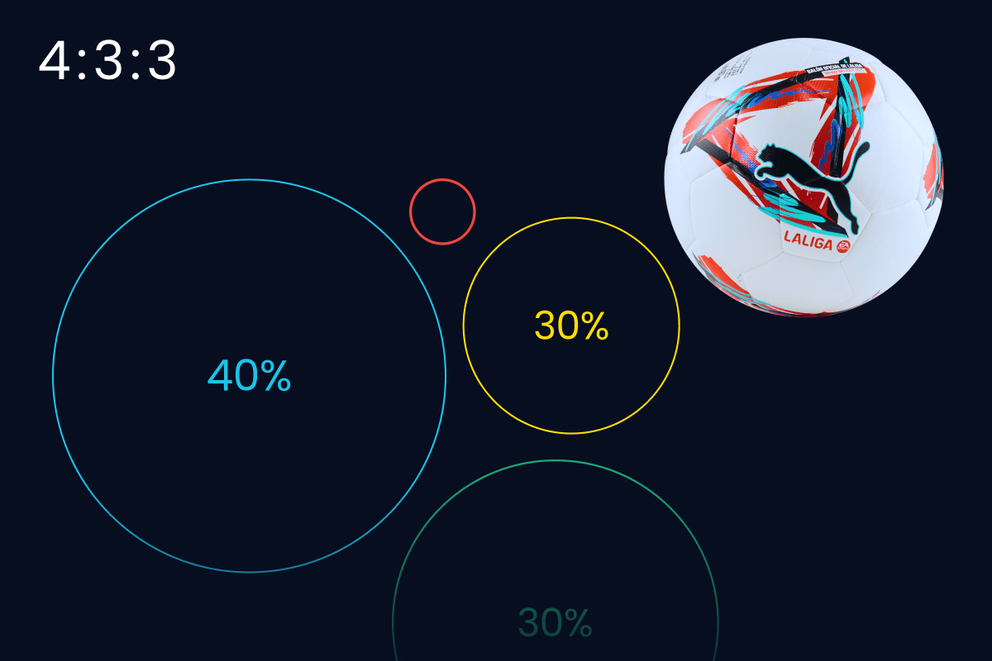

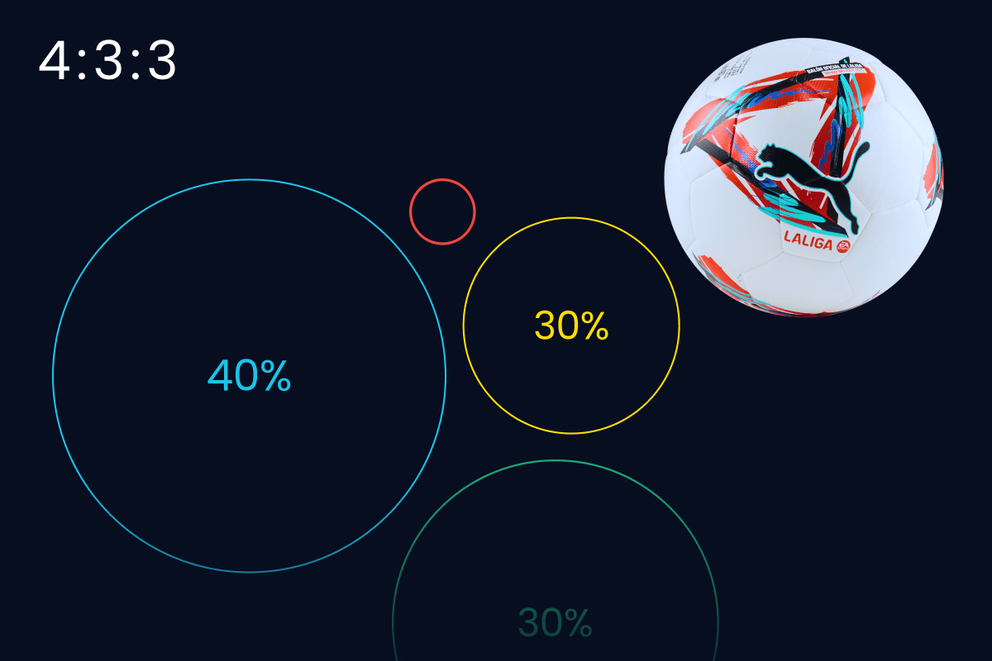

How football formations can help you find the perfect trading portfolio

Whether selecting a team formation for a particular match or selecting trading assets for a particular market, balancing aggression with risk management is a must.

Football formations

There are three common formations:

4-4-2: Four defenders, four midfielders, and two forwards.

4-3-3: Four defenders, three midfielders, and three forwards.

3-5-2: Three defenders, five midfielders, and two forwards.

Each formation has its strengths and weaknesses, and coaches choose the formation based on the team’s strategy and the opponent’s tactics.

Diversifying your portfolio

In trading, diversification means spreading your investments across different types of assets to reduce risk. Just like a balanced football team is important for winning, a diversified portfolio is key to trading. Here’s how you can relate football formations to your trading portfolio:

Follow this link for more: https://exness.social/3Y2NBzr

Whether selecting a team formation for a particular match or selecting trading assets for a particular market, balancing aggression with risk management is a must.

Football formations

There are three common formations:

4-4-2: Four defenders, four midfielders, and two forwards.

4-3-3: Four defenders, three midfielders, and three forwards.

3-5-2: Three defenders, five midfielders, and two forwards.

Each formation has its strengths and weaknesses, and coaches choose the formation based on the team’s strategy and the opponent’s tactics.

Diversifying your portfolio

In trading, diversification means spreading your investments across different types of assets to reduce risk. Just like a balanced football team is important for winning, a diversified portfolio is key to trading. Here’s how you can relate football formations to your trading portfolio:

Follow this link for more: https://exness.social/3Y2NBzr

Exness

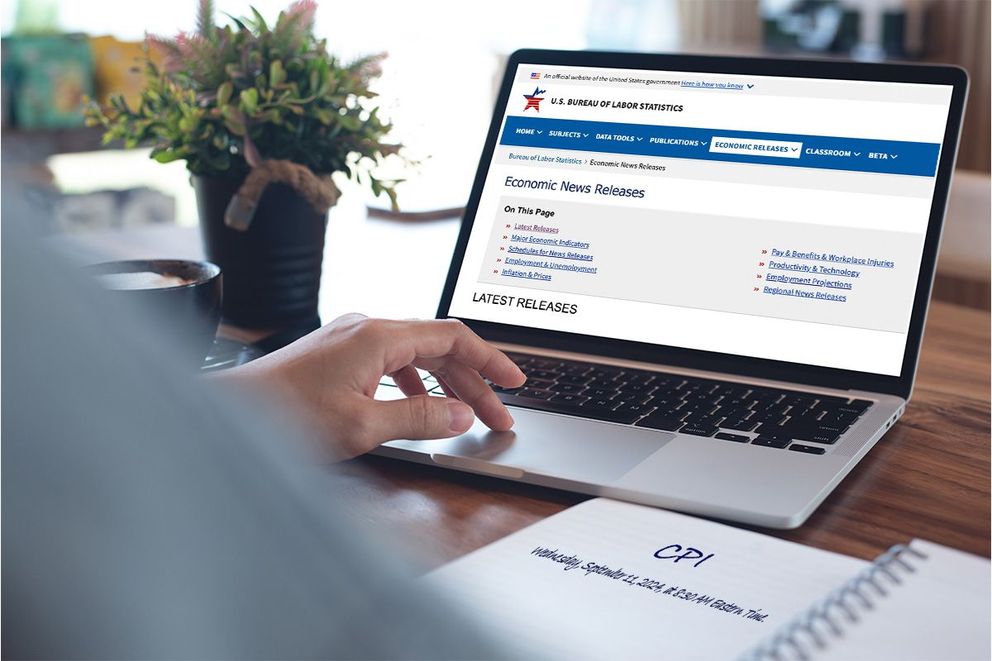

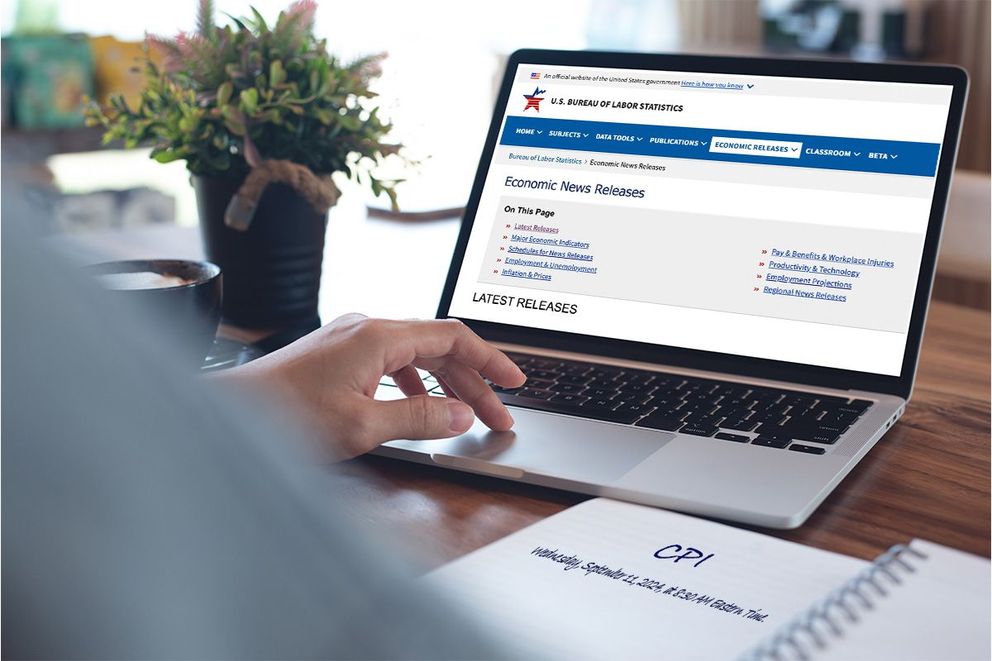

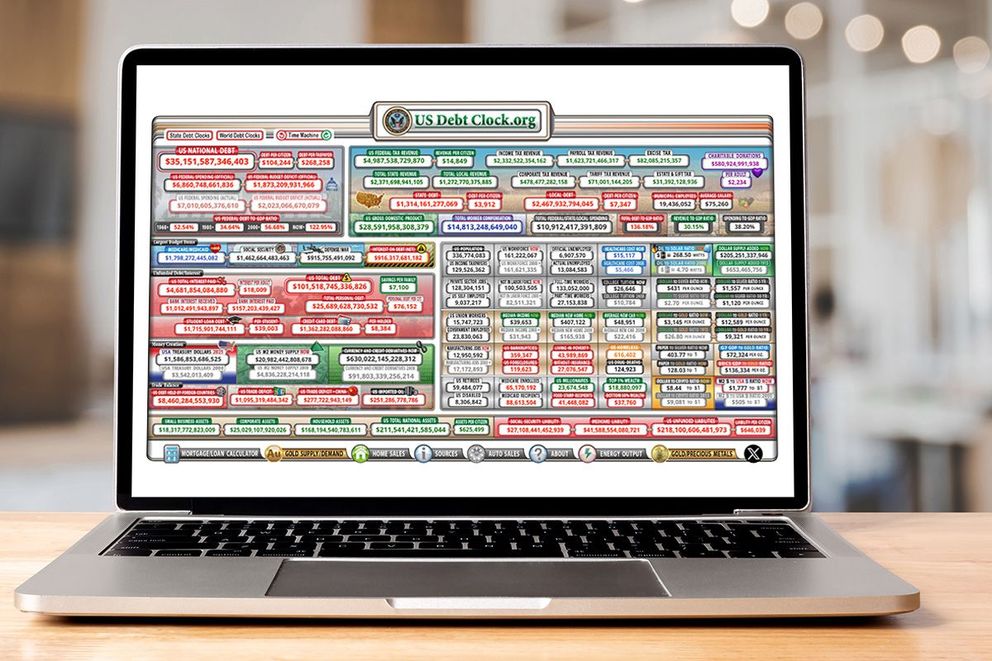

The upcoming release of the Consumer Price Index (CPI) data on Wednesday, September 11, 2024, has the attention of market participants across the globe, but will it reveal truth or another economic narrative?

This CPI economic indicator, which measures changes in the prices paid by consumers for a basket of goods and services, is widely watched for its potential implications on Federal Reserve policy and broader financial market trends.

Consensus expectations and potential impacts

The consensus points to a modest increase in the CPI for September, potentially similar to, or slightly lower than, the 0.6% increase seen in August. The focus is on the core CPI, which excludes volatile food and energy prices, as it is said to provide a clearer picture of underlying inflationary pressures.

Almost every statement suggests a positive near-term. Look at how optimistic the US Treasury gauges the US economy.

“Today, the global economy remains resilient—driven in large part by the United States’ remarkable economic performance. Instead of faltering, U.S. GDP grew by a robust 3.1 percent during 2023. And new data from just this morning shows growth of 2.8 percent in the second quarter of this year, affirming the path we’re on to steady growth and declining inflation.”

Janet Yellen - US Secretary of the Treasury (August 25, 2024)

But how grounded is the optimism? If the CPI figure aligns with market forecasts, the response may be relatively muted, as investors have already priced in the anticipated increase. However, a CPI reading exceeding expectations could trigger concerns about persistent inflation, potentially leading to a stock market decline, bond market sell-off, and US dollar appreciation as the Federal Reserve may be compelled to raise rates further.

Conversely, a CPI figure below expectations could suggest easing inflationary pressures, potentially resulting in a stock market rally, bond market rally, and US dollar depreciation as investors anticipate a less aggressive Fed policy.

Follow this link for more: https://exness.social/insights