Conor Mcnamara / Profilo

- Informazioni

|

2 anni

esperienza

|

8

prodotti

|

4

versioni demo

|

|

0

lavori

|

0

segnali

|

0

iscritti

|

I started learning C programming in 2010. From there I picked up many languages.

I have worked with MQL for just a year now. I pick up programming languages very quickly because I'm no stranger to programming.

I'm working on several indicator projects and EA concepts.

I'm currently studying epistemological degeneracy in financial markets.

I have worked with MQL for just a year now. I pick up programming languages very quickly because I'm no stranger to programming.

I'm working on several indicator projects and EA concepts.

I'm currently studying epistemological degeneracy in financial markets.

Conor Mcnamara

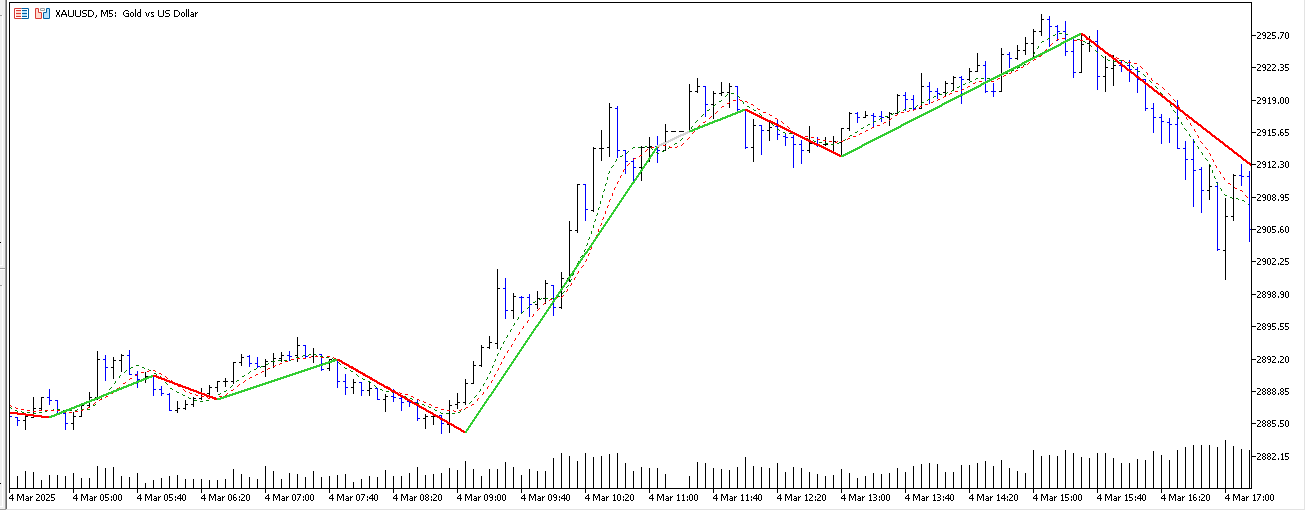

I'm building a brand new Zigzag which, once again, has instant trend detection and no delayed legs. No bar confirmations are needed in confirming the swings, and the legs always end at the current live bar.

How it works:

- It is guided by an MA trend, therefore there is no traditional ZigZag operation, as a moving average slope provides instant trend direction.

- The whipsaws and false signals you find in a moving average are completely ignored by two filters:

A traditional point deviation filter (comparing the previous swing to the current swing price).

An MA slope point confirmation filter, to bypass short, inconsequential moving average trends.

- A backstep is used so that the leg is constantly seeking the highest price (on a peak swing search) or lowest price (on a bottom swing search).

- If the moving average trend changes to mark a shift in the market, the leg does not need to alter the swing location at the point of the trend change if it already found a higher or lower price a few bars before.

- Keeping the backstep small keeps the swings in tune with the trend while never veering too far from the live moving average trend.

- A forward step is also implemented, but it's actually unnecessary as it would correct the Zigzag forward - and then it would be after the fact.

The zigzag I constructed here is very similar to the one I made for the Parabolic SAR indicator, but this one is more sophisticated, with both deviation and backstep logic.

It's definitely one of my more advanced codes. While it may not always capture the truest peaks and bottoms down to the end of candle wicks, it provides high-quality turning points, as can be seen in the screenshot.

How it works:

- It is guided by an MA trend, therefore there is no traditional ZigZag operation, as a moving average slope provides instant trend direction.

- The whipsaws and false signals you find in a moving average are completely ignored by two filters:

A traditional point deviation filter (comparing the previous swing to the current swing price).

An MA slope point confirmation filter, to bypass short, inconsequential moving average trends.

- A backstep is used so that the leg is constantly seeking the highest price (on a peak swing search) or lowest price (on a bottom swing search).

- If the moving average trend changes to mark a shift in the market, the leg does not need to alter the swing location at the point of the trend change if it already found a higher or lower price a few bars before.

- Keeping the backstep small keeps the swings in tune with the trend while never veering too far from the live moving average trend.

- A forward step is also implemented, but it's actually unnecessary as it would correct the Zigzag forward - and then it would be after the fact.

The zigzag I constructed here is very similar to the one I made for the Parabolic SAR indicator, but this one is more sophisticated, with both deviation and backstep logic.

It's definitely one of my more advanced codes. While it may not always capture the truest peaks and bottoms down to the end of candle wicks, it provides high-quality turning points, as can be seen in the screenshot.

Conor Mcnamara

last night I wanted to test mean reversion on the new VWAP indicator I published in the codebase. After noticing a support, I expected the market to move up and retreat to VWAP, so I set the TP to the VWAP price at that time. Both trades hit the TP at 4am GMT+3

Conor Mcnamara

Codice pubblicato Multi-Day Dynamic VWAP

Livello VWAP dinamico che può essere mediato su più giorni

Condividi sui social network · 1

222

1159

Conor Mcnamara

In this new indicator I built, I combined 3 worlds. I combine trend, volume, and tick trend into one indicator. The moving average is based on volume, the volume bars are colored by the heiken ashi trend, and the color of histogram bars are replaced by the tick trend during high volume events - to capture the trend of high bearish volume, and high bullish volume during the time that normal trend indicators would be lagging.

Conor Mcnamara

Codice pubblicato Volume MA with candle color tracking

Una media mobile del volume dei tick puri con barre istogramma che seguono il colore delle candele rialziste/ribassiste.

Condividi sui social network · 2

111

629

Conor Mcnamara

I automated my static zigzag based on macross. I did put this indicator on the codebase as well

backtest timelapse on the real ticks model- EURUSD H1- 8 months- Fast period length 2- Slow period length 30

Stop orders used in this simulation with 80 point offset

A different strategy will also be tested with limit orders

backtest timelapse on the real ticks model- EURUSD H1- 8 months- Fast period length 2- Slow period length 30

Stop orders used in this simulation with 80 point offset

A different strategy will also be tested with limit orders

Conor Mcnamara

The dilemma with EA ideas sometimes is that after you build the new idea, it could be no good. Experimental strategies sometimes end up as failures

Conor Mcnamara

2025.04.15

All the work counts for something. You learn what works and what doesn't, and you get a deeper understanding of the dangers in the market and why some things aren't safe enough

Conor Mcnamara

PSAR strategy:

Signal trade entry at the psar trend change

Confirm entry with MA slope trend

Trail stop loss with psar acceleration and a small offset

Filter signals with ranging market detection

Signal trade entry at the psar trend change

Confirm entry with MA slope trend

Trail stop loss with psar acceleration and a small offset

Filter signals with ranging market detection

Conor Mcnamara

2025.04.19

There are still caveats with this strategy. Psar will fail in thin markets. Will try a time filter and remove summer months.

Conor Mcnamara

It looks like there's a strong support at 3017 on Gold now, but it's hard to know if it will hold

Conor Mcnamara

xauusd is no longer for trading, it's a casino now, it looks like there will soon be a new normal

Conor Mcnamara

It's fascinating how different engineering backgrounds can shape someone's perspective on market behaviour.Wilder, the person who created the Parabolic sar - had a background in mechanical engineering and he viewed markets as a vehicle that drive with prices. John Ehlers, the person who created interesting smoother non lagging moving averages had a background in Electrical Engineering, and he viewed market prices as electrical signals.

Conor Mcnamara

Codice pubblicato PSAR Zigzag (Non lagging)

Uno zigzag basato sul cambio di tendenza della parabola sar

Condividi sui social network · 2

126

970

Conor Mcnamara

A zigzag sharper than your ex’s mood swings.

A zigzag that made hedge funds jealous and your neighbor reconsider Forex.

A zigzag that would make your granny yell ‘BUY!’

It's a zigzag coming soon to a codebase near you...

A zigzag that made hedge funds jealous and your neighbor reconsider Forex.

A zigzag that would make your granny yell ‘BUY!’

It's a zigzag coming soon to a codebase near you...

Mostra tutti i commenti (5)

Conor Mcnamara

2025.04.07

had this idea in my mind for a while, but didn't really know how to code it to get it working right. I nearly went as far as thinking that I need to do a linear regression calculation to get a straight leg to the current bar, but it was much easier than that

Conor Mcnamara

last night I was building a zigzag which is non lagging and continuous to the current bar. It's not so obvious to make this work correctly. The zigzag drawing should maintain straight legs, but if you don't delete previous leg values when new highs and lows come, then it will turn into a line chart... I have it working now and I base the zigzag trend this time on psar which is non lagging

Conor Mcnamara

Codice pubblicato Ranging Market Detector

Un indicatore che tenta di evidenziare un'area di mercato che oscilla

Condividi sui social network · 1

143

1022

Conor Mcnamara

Codice pubblicato Trend Zigzag (on ma cross)

Uno zigzag statico che collega le intersezioni di un crossover della media mobile

Condividi sui social network · 1

151

833

Conor Mcnamara

https://soundcloud.com/jonathanlesnick/oceanlab-vs-reflekt-sky-falls this is a wonderous mashup

Conor Mcnamara

I built a zigzag which connects the legs from two moving average crossover points. It's nothing to do with traditional zigzag and is fully about trend of the ma cross. It's more difficult than one may realize to make this good without noisy crossovers ruining the cycle. Moving averages are victim to market noise as you know, especially on short periods. The vertices also should also follow the cycle of LL - HL - LH - HH in sequence for each connecting leg to be in harmony. Invalid legs are inevitable in this one, and I colour them gray

Lorentzos Roussos

2025.03.13

what if you only accept crosses of "leaves" that have reached a minimum % of the atr in delta

Conor Mcnamara

2025.03.13

definitely possible..I mainly just wanted to make a new zigzag template which could be used for many things and not just a simple ma cross, all the cycles are organized by an enum, the code is nice and simple, maybe I should publish it

Conor Mcnamara

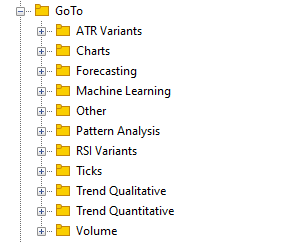

At some point you have a folder full of random indicators. I try to organize it like this in MetaEditor, and in turn, this also organizes the indicators in the software. It's a bit of work, but it's very annoying to have random indicators all within the examples folder

mapdonemap

2025.03.10

cool categorization. I tend to create 4 folders: mine (contains anything I add manually. also contains folders of course), stock (anything comes preinstalled with MT that is not going to be needed as a include), market (anything Ive downloaded from the official market OR from the internet that I dont have the source code for it), downloads (anything that I have source code for it AND I have got it from somewhere else AKA "not mine")

: