Sergey Golubev / Profilo

Newdigital

Amici

3895

Richieste

In uscita

Sergey Golubev

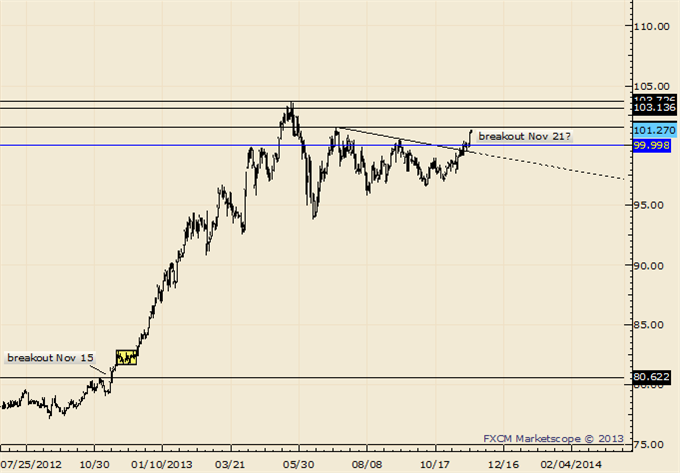

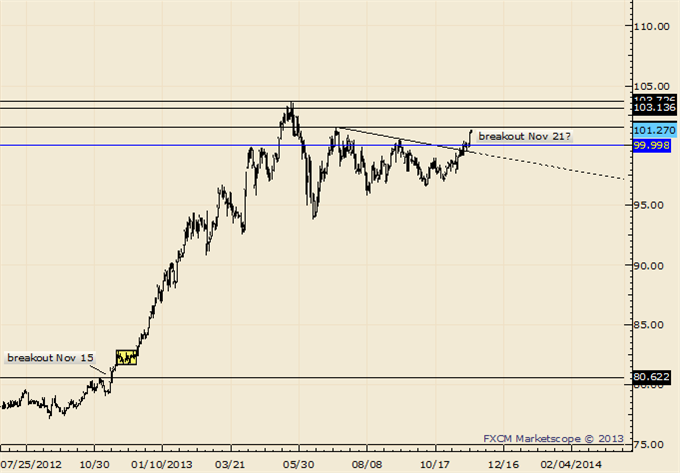

USDJPY Tachnical Analysis

Sergey Golubev

Commento all'argomento Market Condition Evaluation based on standard indicators in Metatrader 5

USDJPY (based on AUD/USD and NZD/USD Breakdown; Here are Trading Tactics article) USDJPY has broken above the trendline that extends off of the Jul and Sep highs and re-tested the line as support on

Sergey Golubev

Sergey Golubev

Commento all'argomento Market Condition Evaluation based on standard indicators in Metatrader 5

AUDUSD (based on AUD/USD and NZD/USD Breakdown; Here are Trading Tactics article) AUDUSD covered the 9/13 close (.9243) this week and confirmed a head and shoulders top. The weak right shoulder

Sergey Golubev

Sergey Golubev

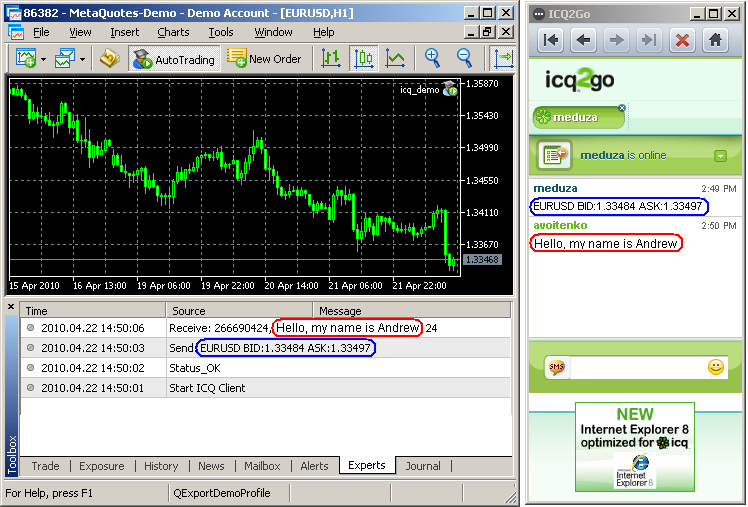

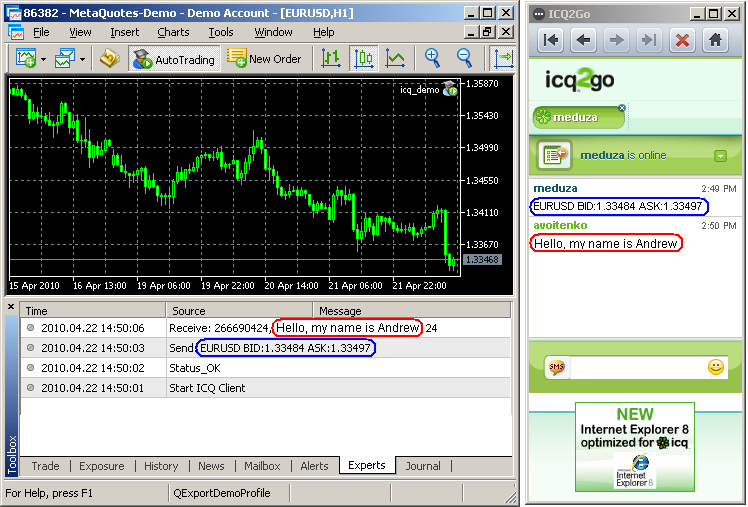

Commento all'argomento 如何开始学习MQL5

用 MQL5 连接 EA 交易程序和 ICQ ICQ 是一项文本信息即时交换中央服务,具有离线模式,采用 OSCAR 协议。对于交易者而言,ICQ 能够担当一个及时显示信息及控制面板的终端。本文将介绍一个例子,说明如何在一个 EA 交易程序内实施一个具有最少功能集的 ICQ 客户端。 IcqMod 项目的草稿包含一个开源代码,是本文的使用和处理基础。在 DLL 模块 icq_mql5.dll

Sergey Golubev

Sergey Golubev

Commento all'argomento Press review

Algorithmic Trading System (based on When To Trade? My Algorithmic Trading System Shows You article) Pre Algorithmic Trading System Analysis: This week has been a little wild as stocks pulled back due

Sergey Golubev

Bigger than Libor? Forex probe hangs over banks

A global investigation into forex trading abuses is the latest legal headache for the banking industry.

The [forex and Libor] benchmarks have a knock-on effect to all of these other markets," Kovel said. Assistant professor of law at Wake Forest University Andrew Verstein agrees.

A global investigation into forex trading abuses is the latest legal headache for the banking industry.

The [forex and Libor] benchmarks have a knock-on effect to all of these other markets," Kovel said. Assistant professor of law at Wake Forest University Andrew Verstein agrees.

Sergey Golubev

Commento all'argomento Press review

Bigger than Libor? Forex probe hangs over banks A global investigation into forex trading abuses is the latest legal headache for the banking industry. The [forex and Libor] benchmarks have a knock-on

Sergey Golubev

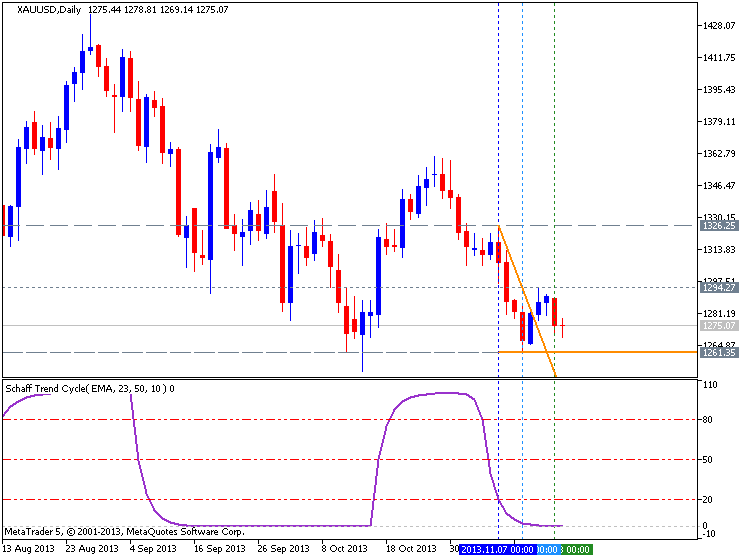

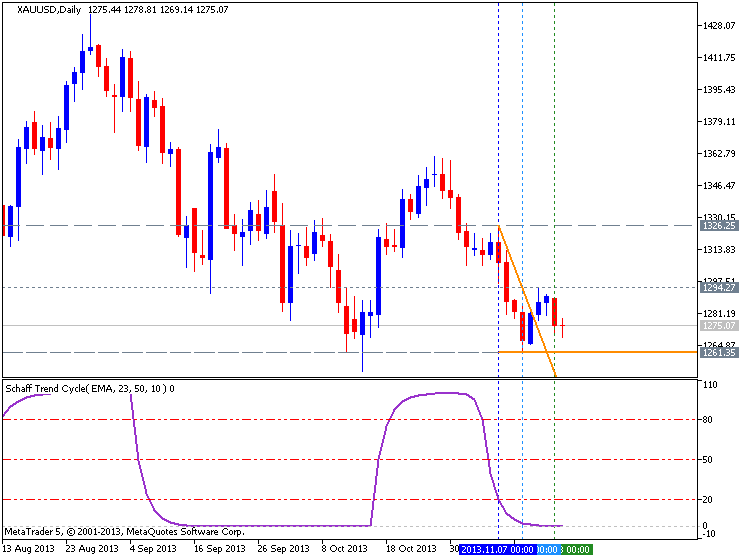

Gold is NOW at our price level (based on forexminute.com article)

We argue for you to consider buying a small position in Gold at this panic low.

If you don’t know by now, panic lows in Gold do not last long.

==============

Good morning

We argue for you to consider buying a small position in Gold at this panic low.

If you don’t know by now, panic lows in Gold do not last long.

==============

Good morning

Sergey Golubev

The European Central Bank is considering a smaller-than-normal cut in the deposit rate if officials decide to take it negative for the first time, according to two people with knowledge of the debate.

read more here http://www.bloomberg.com/news/2013-11-20/ecb-said-to-consider-mini-deposit-rate-cut-if-more-easing-needed.html

read more here http://www.bloomberg.com/news/2013-11-20/ecb-said-to-consider-mini-deposit-rate-cut-if-more-easing-needed.html

Sergey Golubev

Forex Brokers (adapted from "Is Switching Brokers Ever a Good Idea?" article by dailyforex.com)

1. Most Forex brokers are not actually exchanging any currency on the market. They are simply providing a price feed, the movements of which their clients are allowed to bet on in exchange for two effective fees: the spread or commission, and a small overnight charge that is incurred every night any position is left open. These brokers are in adversarial relationships with their clients: they make money when their clients lose, and lose money when their clients win.

2. The remaining Forex brokers tend to monitor the trades of their clients that have records of trading profitably, and cover the aggregate positions of these traders with a bank. These brokers have a less adversarial relationship with their clients, but still can face problems in adequately covering themselves in fast-moving markets.

3. The real Forex market is dominated by four large banks that together make up about 85% of the market’s volume.

4. Much of the Forex industry has a bad reputation and is poorly regulated.

1. Most Forex brokers are not actually exchanging any currency on the market. They are simply providing a price feed, the movements of which their clients are allowed to bet on in exchange for two effective fees: the spread or commission, and a small overnight charge that is incurred every night any position is left open. These brokers are in adversarial relationships with their clients: they make money when their clients lose, and lose money when their clients win.

2. The remaining Forex brokers tend to monitor the trades of their clients that have records of trading profitably, and cover the aggregate positions of these traders with a bank. These brokers have a less adversarial relationship with their clients, but still can face problems in adequately covering themselves in fast-moving markets.

3. The real Forex market is dominated by four large banks that together make up about 85% of the market’s volume.

4. Much of the Forex industry has a bad reputation and is poorly regulated.

Sergey Golubev

Sergey Golubev

Commento all'argomento 如何开始学习MQL5

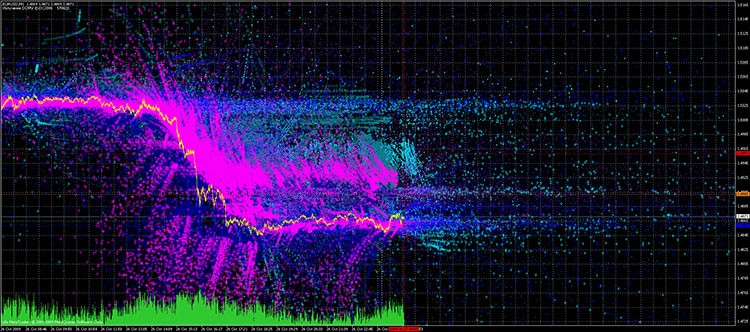

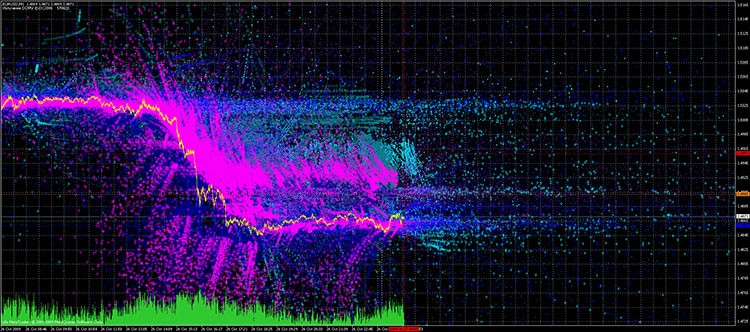

用 MQL5 绘制指标的喷发 毫无疑问,许多交易人员和交易策略的开发人员会对下面这些问题感兴趣: 大规模的市场运动是如何出现的? , 如何确定即将到来的变化的正确方向?, 如何为交易建立盈利仓位?, 如何平仓方可获取最大收益?

Sergey Golubev

Sergey Golubev

Commento all'argomento 如何开始学习MQL5

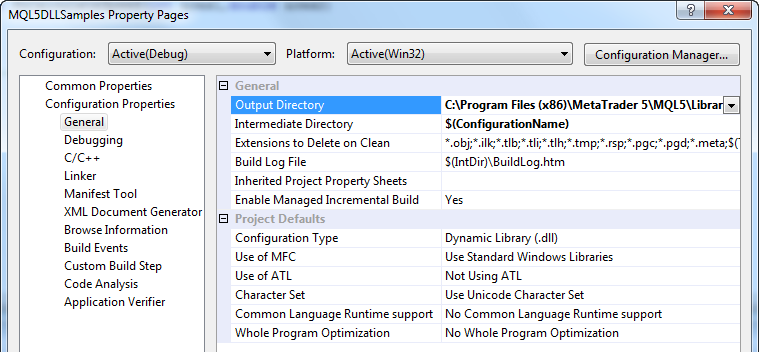

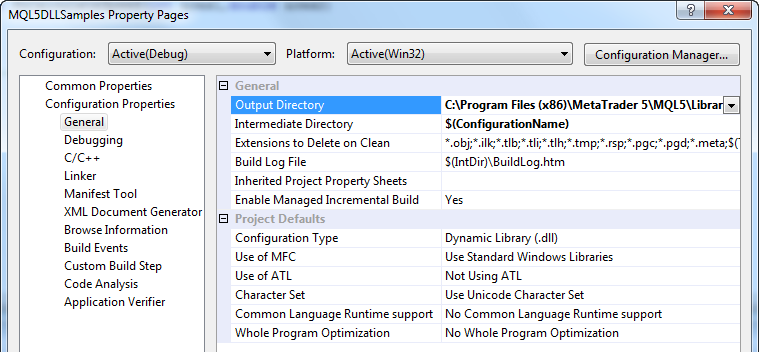

如何交换数据:10 分钟为 MQL5 创建 DLL 事实上,很少有开发人员确切知道如何编写简单的 DLL 库,他们也不清楚绑定不同系统的特性。 通过多个示例,我将展示在 10 分钟内创建简单 DLL 的整个过程,并讨论我们绑定实施的一些技术细节。我们将使用 Visual Studio 2005/2008;其 Express 版本可免费从 Microsoft 的网站 上下载。

Sergey Golubev

Sergey Golubev

Commento all'argomento 如何开始学习MQL5

价格直方图(市场概况)及其在 MQL5 中的实施 很久以前,我在浏览杂志订阅信息时在一份俄国杂志 "Valutny Spekulant"(现名 "Active Trader") 上读过一篇文章“市场概况和理解市场语言”(2002 年 10 月刊)。原文出处如下: "New Thinking in Technical Analysis:Trading Models from the Masters"

Sergey Golubev

上证指数周三收盘上涨0.62%,深成指数上涨0.58%

Sergey Golubev

Commento all'argomento 报刊评论

上证指数周三收盘上涨0.62%,深成指数上涨0.58%

Sergey Golubev

Sergey Golubev

Commento all'argomento Press review

Gold Technical Analysis (based on Where are the Stops? Tuesday, November 19: Gold and Silver article) Below are today’s likely price locations of buy and sell stop orders for the active Comex gold and

Sergey Golubev

codice Alexander Puzikov condiviso dell'autore

EA_CCIT3

L'Expert Advisor si basa su CCIT3_Simple e CCIT3_noReCalc. Il trading si basa sull'attraversamento del prezzo zero dell'indicatore.

Sergey Golubev

Sergey Golubev

Commento all'argomento Press review

Based on How Fundamentals Move Prices in the FX Market article Why Currency Values Matter Currency prices matter because of cross-border trade. The concept of Fundamental Analysis in the Forex Market

Sergey Golubev

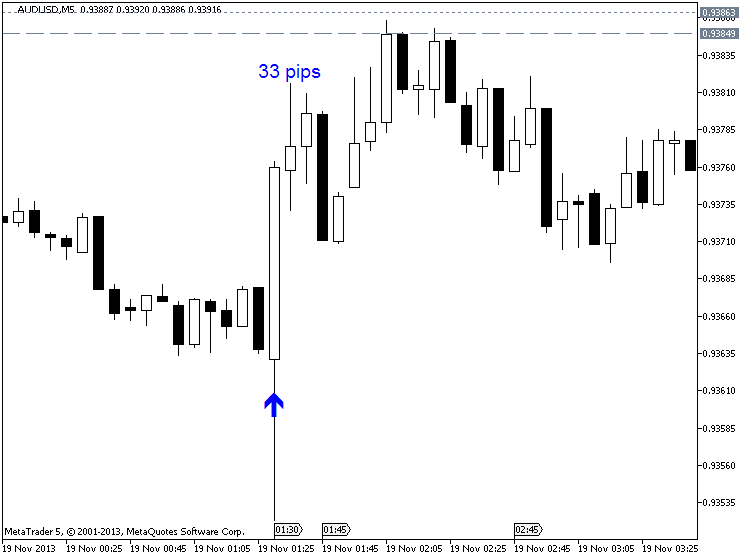

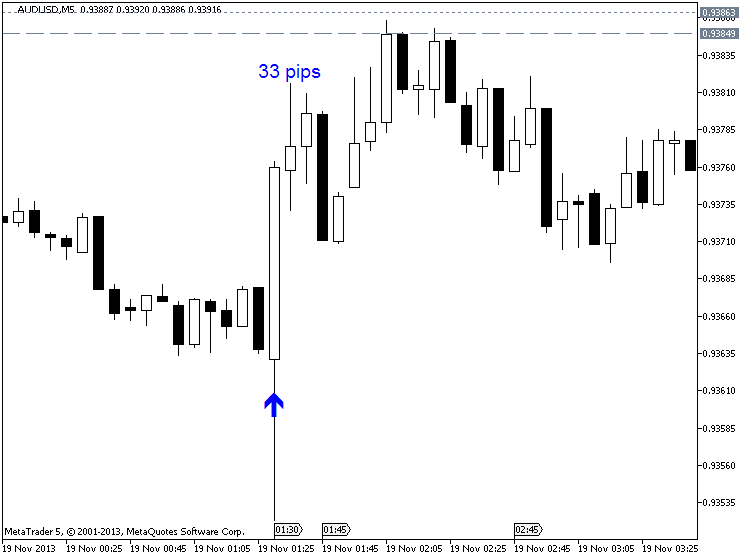

33 pips price movement by RBA Meeting Minutes

Sergey Golubev

Commento all'argomento Press review

2013-11-19 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - RBA Meeting Minutes] past data is n/a , forecast data is n/a, actual data is n/a according to the latest press release ========== Dollar up on

Sergey Golubev

Sergey Golubev

Commento all'argomento Press review

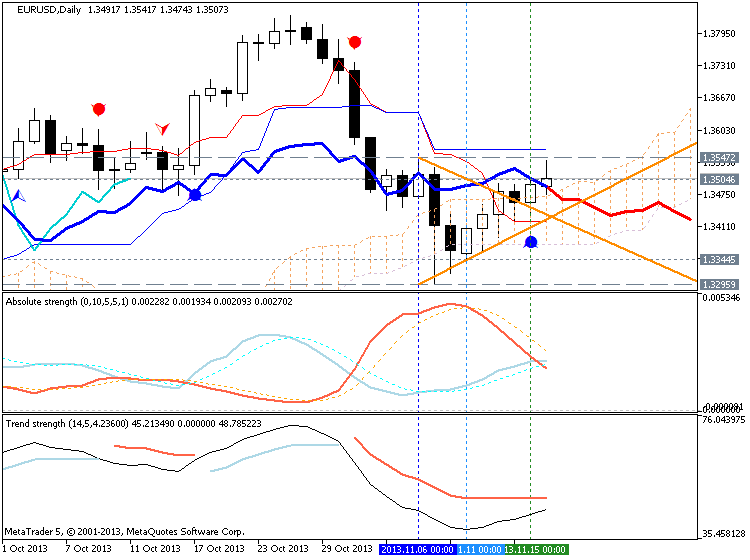

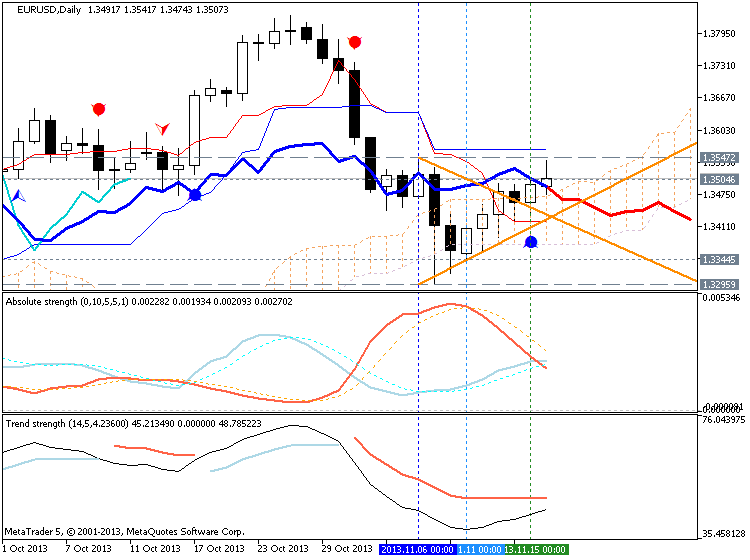

EURUSD Technical Analysis (based on EUR/USD weekly outlook: November 18 - 22 article) Monday, November 18 The euro zone is to release data on the current account balance. The U.S. is to release

Sergey Golubev

Increasing Your Probabilities in Break-Out Trades (source - dailyforex.com)

If you are new to day trading or have been in these markets for a long period of time, one this is clear: You have been exposed to the term “break-out” as a major market occurrence and a potential opportunity to see significant market gains. Break-outs signify important changes in market sentiment, and this could happen for a variety of reasons. Perhaps an important news release of piece of economic data has changed the market’s perceived value of an asset. This can be represented visually on a price chart, as the underlying activity literally “breaks through” important levels of support or resistance. A break of support would be a bearish break-out. A break of resistance would signify a bullish break-out is in place.

Watching Market Volumes

“Once we have an understanding of the mechanics of a forex trading breakout,” said Haris Constantinou, currency analyst at TeleTrade, “we next need to learn how to increase the probabilities in these trades so that we can maximize gains relative to the market majority.” One way of doing this is to look at market volumes as these support or resistance breaks occur. If trading volumes are low, it is a signal that a majority of the market is not behind the breakout move and that there is a possibility of a false break. Because of this, it is generally prudent to wait for breakouts that are accompanied by higher trading volumes. Higher trading volumes will show you that a majority of the investment community is in favor of the direction in which prices are moving. This is a better indication that prices will continue in this direction in the future. Without this confirmation, the probabilities for a successful trade are lower.

Watching for Follow-through

In addition to this, forex breakout traders that tend to be successful will also be looking increased volatility (follow-through) after the breakout occurs. After a significant break of support or resistance, follow through will depend on increases in volatility which are usually generated by stop losses that were put in place by traders on the wrong side of the break. So, for example, traders that were bearish when an upside break-out occurs will ultimately be forced to exit those positions. These bearish trades then, in effect, become new buy order that propel prices even higher. The reverse scenario would be true for a bearish break-out. Always remember, without these price extensions and increases in volatility, break-out traders will be vulnerable to a “false break-out” scenario that can quickly result in losses if not managed properly.

So, when we are looking to employ a well-structured break-out trading strategy, all of these factors need to be taken into consideration. It is not enough to simply look at breaks of support or resistance by themselves. Watching volume and follow-through can help to greatly improve trading probabilities.

If you are new to day trading or have been in these markets for a long period of time, one this is clear: You have been exposed to the term “break-out” as a major market occurrence and a potential opportunity to see significant market gains. Break-outs signify important changes in market sentiment, and this could happen for a variety of reasons. Perhaps an important news release of piece of economic data has changed the market’s perceived value of an asset. This can be represented visually on a price chart, as the underlying activity literally “breaks through” important levels of support or resistance. A break of support would be a bearish break-out. A break of resistance would signify a bullish break-out is in place.

Watching Market Volumes

“Once we have an understanding of the mechanics of a forex trading breakout,” said Haris Constantinou, currency analyst at TeleTrade, “we next need to learn how to increase the probabilities in these trades so that we can maximize gains relative to the market majority.” One way of doing this is to look at market volumes as these support or resistance breaks occur. If trading volumes are low, it is a signal that a majority of the market is not behind the breakout move and that there is a possibility of a false break. Because of this, it is generally prudent to wait for breakouts that are accompanied by higher trading volumes. Higher trading volumes will show you that a majority of the investment community is in favor of the direction in which prices are moving. This is a better indication that prices will continue in this direction in the future. Without this confirmation, the probabilities for a successful trade are lower.

Watching for Follow-through

In addition to this, forex breakout traders that tend to be successful will also be looking increased volatility (follow-through) after the breakout occurs. After a significant break of support or resistance, follow through will depend on increases in volatility which are usually generated by stop losses that were put in place by traders on the wrong side of the break. So, for example, traders that were bearish when an upside break-out occurs will ultimately be forced to exit those positions. These bearish trades then, in effect, become new buy order that propel prices even higher. The reverse scenario would be true for a bearish break-out. Always remember, without these price extensions and increases in volatility, break-out traders will be vulnerable to a “false break-out” scenario that can quickly result in losses if not managed properly.

So, when we are looking to employ a well-structured break-out trading strategy, all of these factors need to be taken into consideration. It is not enough to simply look at breaks of support or resistance by themselves. Watching volume and follow-through can help to greatly improve trading probabilities.

: