Mochamad Briend Mega Bayu Angkasa / Profilo

- Informazioni

|

2 anni

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

1

segnali

|

0

iscritti

|

Mochamad Briend Mega Bayu Angkasa

The Dollar Index on the 4H timeframe is moving within a clear ascending channel structure showing a strong bullish momentum after breaking above a key resistance zone that now acts as support. The recent breakout confirms the continuation of the uptrend suggesting that buyers are in control and aiming for a higher swing within the channel. Each corrective wave has been followed by a strong impulsive leg maintaining market structure and validating the channel’s reliability. As long as price holds above the breakout zone the bullish outlook remains valid with potential for further upside movement toward the upper boundary of the channel completing the fifth wave of the sequence.

Mochamad Briend Mega Bayu Angkasa

Price continued its move lower to complete the final leg of this corrective phase.

Right now, we’re tracking the last wave of a (w)-(x)-(y) complex correction, likely finishing soon near the lower trendline support.

Once Wave (c) of (y) is complete, the next move should be impulsive and that’s where opportunity exists. ✅

Here’s what to focus on:

🔹 Corrections are designed to shake traders out

🔹 Impulsive moves follow when sentiment is weakest

🔹 Patience here is your real weapon

Most traders panic at the end of Wave 4…

…but disciplined traders prepare for Wave 5. 🚀

Don’t force trades during the correction.

Let the structure finish then execute with a plan.

Right now, we’re tracking the last wave of a (w)-(x)-(y) complex correction, likely finishing soon near the lower trendline support.

Once Wave (c) of (y) is complete, the next move should be impulsive and that’s where opportunity exists. ✅

Here’s what to focus on:

🔹 Corrections are designed to shake traders out

🔹 Impulsive moves follow when sentiment is weakest

🔹 Patience here is your real weapon

Most traders panic at the end of Wave 4…

…but disciplined traders prepare for Wave 5. 🚀

Don’t force trades during the correction.

Let the structure finish then execute with a plan.

Mochamad Briend Mega Bayu Angkasa

#xauusd #xᴀᴜᴜsᴅ

Gold on the 4H chart shows that the market completed a five wave bullish structure and after reaching the top it started a corrective phase that moved down in three clear waves labeled a b and c the price is reacting around the horizontal support zone where buyers are trying to regain control the descending trend line marks the limit of the corrective phase and a breakout above it may indicate the start of a fresh upward movement the pattern suggests that gold might build strength around this area before targeting higher levels again showing a possible shift from correction to continuation of the overall bullish trend

Gold on the 4H chart shows that the market completed a five wave bullish structure and after reaching the top it started a corrective phase that moved down in three clear waves labeled a b and c the price is reacting around the horizontal support zone where buyers are trying to regain control the descending trend line marks the limit of the corrective phase and a breakout above it may indicate the start of a fresh upward movement the pattern suggests that gold might build strength around this area before targeting higher levels again showing a possible shift from correction to continuation of the overall bullish trend

Mochamad Briend Mega Bayu Angkasa

#xauusd🔥🔥🔥🔥💰💸 #xauusd

Read below 👇

Gold 50% and 61% level are Golden level for the End of Corrections phase... remember if price doing corrections not crashing then these are ideal level for the reverseal. In crashing scenario no Technical Analysis will be applied just see the Fundemntal. To me Price correction will end near these level will start it's Bullish journey towards the resistance area as mentioned on the chart.

Read below 👇

Gold 50% and 61% level are Golden level for the End of Corrections phase... remember if price doing corrections not crashing then these are ideal level for the reverseal. In crashing scenario no Technical Analysis will be applied just see the Fundemntal. To me Price correction will end near these level will start it's Bullish journey towards the resistance area as mentioned on the chart.

Mochamad Briend Mega Bayu Angkasa

BTCUSD on the 4H chart shows a strong bullish breakout after the market successfully broke the descending channel structure that had been holding price for several sessions this confirms a shift in market sentiment as buyers step in with strong momentum the breakout above the previous resistance zone signals a possible continuation toward the next major target area marked as point C this movement reflects a clear end of the corrective phase and the beginning of a potential impulsive wave traders who identified the break early are now watching for sustained strength and possible retests of the breakout zone before the next leg higher the overall outlook remains bullish as long as price holds above the breakout structure zone.

Mochamad Briend Mega Bayu Angkasa

USDJPY shows a bearish setup on the daily chart as the pair has reached the golden Fibonacci resistance level and started to face strong rejection from that zone the structure forms an ending diagonal pattern suggesting potential downside pressure the highlighted red arrows indicate a possible drop as price completes the final wave E of the pattern momentum is losing strength near the upper trendline confirming the likelihood of reversal sellers may take control soon leading to a downward correction toward the lower boundary of the channel this setup reflects a shift from bullish exhaustion to bearish momentum in the coming sessions

Mochamad Briend Mega Bayu Angkasa

#eurchf #eur #chf

EUR/CHF daily chart shows that the price is approaching a crucial support level around 0.92200, which has been tested four times before, each time resulting in a bounce. This repetitive testing makes it a high-probability zone for potential support. Additionally the price is forming a falling channel a common reversal from the descending support further suggesting that a bullish move could be on the horizon. From an Elliott Wave perspective, the pair may be completing a corrective ABC pattern, with wave C likely near completion at this support

EUR/CHF daily chart shows that the price is approaching a crucial support level around 0.92200, which has been tested four times before, each time resulting in a bounce. This repetitive testing makes it a high-probability zone for potential support. Additionally the price is forming a falling channel a common reversal from the descending support further suggesting that a bullish move could be on the horizon. From an Elliott Wave perspective, the pair may be completing a corrective ABC pattern, with wave C likely near completion at this support

Mochamad Briend Mega Bayu Angkasa

Setup Failed.

From a technical perspective, gold’s surge on October 20, 2025, was supported by a strong bullish breakout above the previous resistance zone near $4,150 per ounce, confirming a continuation of the uptrend that had been forming since early Q3 2025. The move was accompanied by high trading volume and a bullish crossover on major momentum indicators such as the MACD and RSI, signaling strong buying pressure. The price also remained well above key moving averages particularly the 50-day and 200-day EMAs which acted as dynamic support levels. In addition, a weakening U.S. dollar index (DXY) and falling bond yields further reinforced the bullish technical setup. Together, these factors created a confluence of technical signals that drove gold to a new all-time high around $4,300 per ounce during that week.

From a technical perspective, gold’s surge on October 20, 2025, was supported by a strong bullish breakout above the previous resistance zone near $4,150 per ounce, confirming a continuation of the uptrend that had been forming since early Q3 2025. The move was accompanied by high trading volume and a bullish crossover on major momentum indicators such as the MACD and RSI, signaling strong buying pressure. The price also remained well above key moving averages particularly the 50-day and 200-day EMAs which acted as dynamic support levels. In addition, a weakening U.S. dollar index (DXY) and falling bond yields further reinforced the bullish technical setup. Together, these factors created a confluence of technical signals that drove gold to a new all-time high around $4,300 per ounce during that week.

Mochamad Briend Mega Bayu Angkasa

#gbpusd #eurusd

The GBPUSD on the 4H chart is forming a contracting triangle pattern with clear waves labeled from A to D showing a corrective structure that reflects consolidation before a potential bullish breakout. The market recently completed the D wave and is now preparing for an upward movement toward the E wave which suggests the pair may continue rising as momentum builds. The current structure indicates buyers are gaining strength while the lower support line remains intact signaling that the market is still respecting the triangle boundaries and could move higher once the breakout confirms continuation toward the next resistance zone.

The GBPUSD on the 4H chart is forming a contracting triangle pattern with clear waves labeled from A to D showing a corrective structure that reflects consolidation before a potential bullish breakout. The market recently completed the D wave and is now preparing for an upward movement toward the E wave which suggests the pair may continue rising as momentum builds. The current structure indicates buyers are gaining strength while the lower support line remains intact signaling that the market is still respecting the triangle boundaries and could move higher once the breakout confirms continuation toward the next resistance zone.

Mochamad Briend Mega Bayu Angkasa

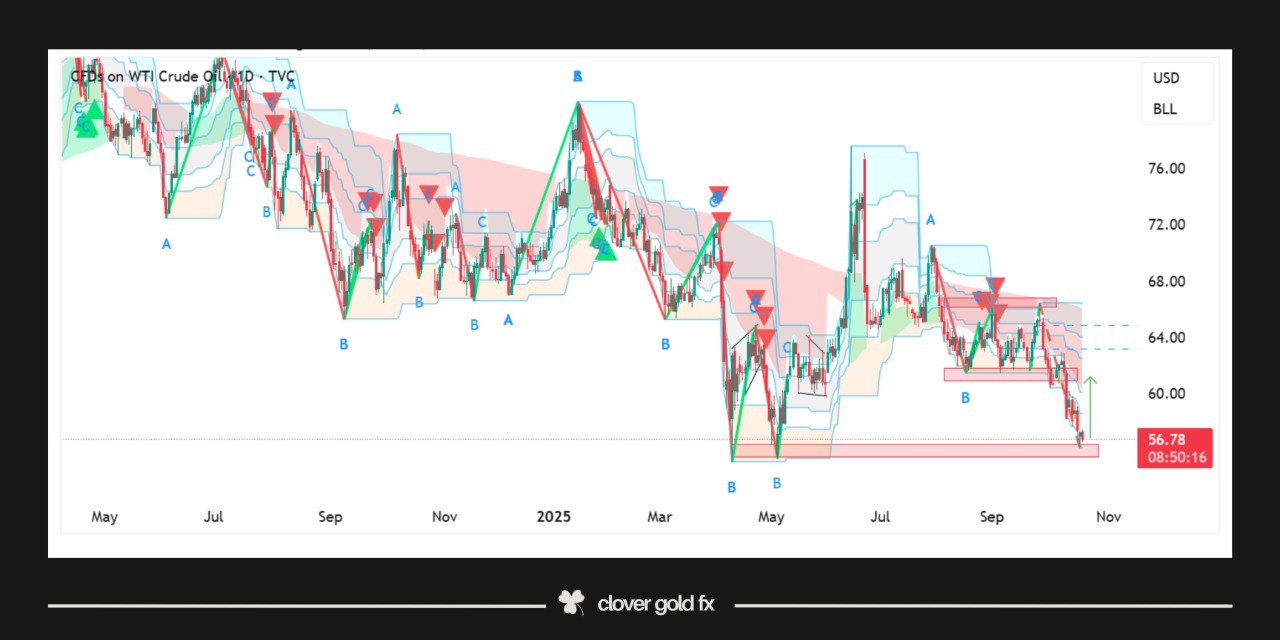

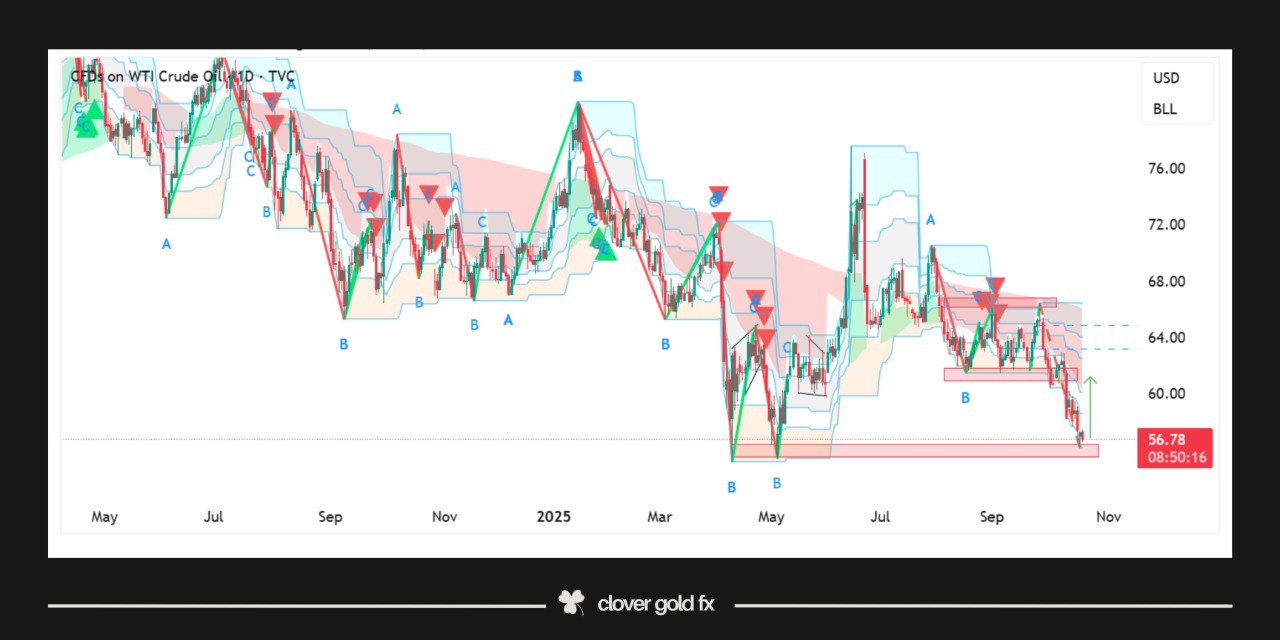

#usoil

The daily chart of US Oil shows a clear technical structure indicating potential bullish momentum ahead. After an extended downtrend the market has formed a triple bottom pattern which often signals exhaustion of selling pressure and a possible reversal. The appearance of a bullish hammer at this key support zone further strengthens the idea that buyers are stepping in to defend the area. Following the earlier range breakout and rejection from horizontal resistance the price has now returned to a major demand region where previous reactions have occurred. This combination of patterns suggests that the market could soon experience upward movement as sentiment shifts from bearish to bullish with traders watching closely for confirmation of continued strength in the coming sessions.

The daily chart of US Oil shows a clear technical structure indicating potential bullish momentum ahead. After an extended downtrend the market has formed a triple bottom pattern which often signals exhaustion of selling pressure and a possible reversal. The appearance of a bullish hammer at this key support zone further strengthens the idea that buyers are stepping in to defend the area. Following the earlier range breakout and rejection from horizontal resistance the price has now returned to a major demand region where previous reactions have occurred. This combination of patterns suggests that the market could soon experience upward movement as sentiment shifts from bearish to bullish with traders watching closely for confirmation of continued strength in the coming sessions.

Mochamad Briend Mega Bayu Angkasa

#EURUSD 🇪🇺🇺🇸

👉🏻 Since the beginning of 2025, #EURUSD has continued its upward trend, perfectly aligning with Elliott Wave expectations. Following the completion of a clean wave (iv) triangle, #EURUSD will continue its upside movement with the next impulsive wave.

Wave structure tells its story before market movements; all you need to do is read it correctly. With the completion of the 4th wave, the path remains open towards the 1.20+ level.

👉🏻 Since the beginning of 2025, #EURUSD has continued its upward trend, perfectly aligning with Elliott Wave expectations. Following the completion of a clean wave (iv) triangle, #EURUSD will continue its upside movement with the next impulsive wave.

Wave structure tells its story before market movements; all you need to do is read it correctly. With the completion of the 4th wave, the path remains open towards the 1.20+ level.

Mochamad Briend Mega Bayu Angkasa

#USDCHF 🇺🇸🇨🇭

You don’t control the market; you control your reaction to it. Let the trend lead, and your job is simply to follow with patience.

You don’t control the market; you control your reaction to it. Let the trend lead, and your job is simply to follow with patience.

Mochamad Briend Mega Bayu Angkasa

The EURNZD pair is moving within an ascending channel showing strong bullish momentum as each wave forms higher highs and higher lows. The structure highlights an Elliott wave pattern where the market completed a corrective phase and started a fresh impulsive move. The recent breakout from the ascending triangle confirms the strength of buyers suggesting continuation toward the upper boundary of the channel. Wave four acted as a retest area providing strong support for the next bullish leg. As long as price holds above this support zone the pair is expected to extend higher completing the fifth wave within the current upward structure which aligns with the broader bullish trend.

Mochamad Briend Mega Bayu Angkasa

USDJPY is forming a clear contracting wedge pattern which suggests that the market is reaching the final stage of its long term corrective structure after completing the fifth wave at the upper boundary near the trendline marked as point E the pair shows potential exhaustion indicating a possible reversal phase ahead the overall wave structure from one to five shows how the market expanded impulsively followed by an ABCDE correction pattern within the wedge formation now the reaction around point E becomes critical as it represents the final leg before a potential bearish correction begins the market may seek to fill the previous gap zone near the lower boundary where demand might reappear confirming a larger degree corrective move traders should monitor rejection patterns and momentum weakening around the top resistance as these signals could mark the start of a deeper retracement aligning with the technical symmetry of the Elliott wave and wedge breakout expectation

Mochamad Briend Mega Bayu Angkasa

Gold in the 4Htimeframe is showing strong bullish momentum after forming a clear bullish hammer near the mid support zone this candle pattern indicated that buyers have regained control and pushed the market upward after testing lower levels the price has broken above the previous resistance zone turning it into new support which confirms continuation of the uptrend the bullish structure with higher highs and higher lows supports the idea of strength from buyers the breakout above the key level signals that market sentiment is highly positive and the next target area lies near the projected Fibonacci extension suggesting that gold may continue its rise with strong momentum as long as it stays above the breakout level and maintains bullish volume

Mochamad Briend Mega Bayu Angkasa

GBPJPY For the Next Week .....

On the daily chart is moving inside a clear ascending channel where price recently touched the upper boundary and showed rejection. The structure indicates the completion of the fourth wave within the overall cycle suggesting that a larger corrective move may follow. The pattern shows exhaustion near the top and the red arrow highlights a potential bearish move toward the lower boundary of the channel. As long as the structure stays within this formation the pair is likely to respect the channel dynamics and continue following the wave count toward the fifth target area.

On the daily chart is moving inside a clear ascending channel where price recently touched the upper boundary and showed rejection. The structure indicates the completion of the fourth wave within the overall cycle suggesting that a larger corrective move may follow. The pattern shows exhaustion near the top and the red arrow highlights a potential bearish move toward the lower boundary of the channel. As long as the structure stays within this formation the pair is likely to respect the channel dynamics and continue following the wave count toward the fifth target area.

Mochamad Briend Mega Bayu Angkasa

Brent crude oil is showing a contracting pattern on the daily timeframe suggesting the market is moving within a symmetrical triangle where each swing forms a sequence of corrective waves the structure indicates that wave four has likely completed near the lower boundary and a bullish wave five could soon start the price action is creating higher lows and lower highs reflecting a state of consolidation before a potential breakout the current market sentiment hints at renewed buying interest as traders expect momentum to shift upward with possible continuation toward the upper resistance line completing the larger wave structure

Mochamad Briend Mega Bayu Angkasa

EURAUD 4H chart reveals a clear descending channel pattern, indicating a sustained bearish trend. Price action continues to respect both the upper and lower boundaries of the channel, forming consistent lower highs and lower lows. Recently, the pair faced rejection from the upper boundary of the channel, confirming strong selling pressure from that resistance zone. This rejection suggests the potential for further downside movement as sellers maintain control within the channel. If bearish momentum persists, the pair could continue sliding toward the lower boundary of the formation, aligning with the prevailing downtrend. Overall, market sentiment remains negative unless a decisive breakout above the channel occurs which would signal a possible trend reversal.

: