Tâche terminée

Temps d'exécution 28 jours

Commentaires du client

I require an which will trade based on a combination of Fibo levels and Hull 20 period MA. Confirmation should be based on a positive return from a neural network examination of detrended price action over at least the last 100 bars.

Buy signal:

1. price is currently below the 38.2 Fib level

2. Hull 20 period MA changes from down to up signal on previous bar and is still up on bar open

3. Neural network confirms price likely to move up based on detrended average price over previous 100 bars

Sell signal:

1. price is currently above the 38.2 Fib level

2. Hull 20 period MA changes from up to down signal on previous bar and is still down on bar open

3. Neural network confirms price likely to move down based on detrended average price over previous 100 bars

Note: "average price" should be an entry parameter selection of either "Price Typical" or "Price Weighted"

The EA should have additional parameters as follows:

1. Trade on NFP Friday

2. Traded permitted start/end times

3. % of account balance to risk

4. Fibonacci profit target (e.g. 50%, 61.8% etc)

5. Stop loss method:

5a. Auto - 1.5 times the point distance between the order open price and the TP price

5b. Manual - in points

Lot size should be calculated based on the account balance and %risk

The EA should provide the detrended price data to the neural net.

The NN should forecast the price using the Fourier Fit function

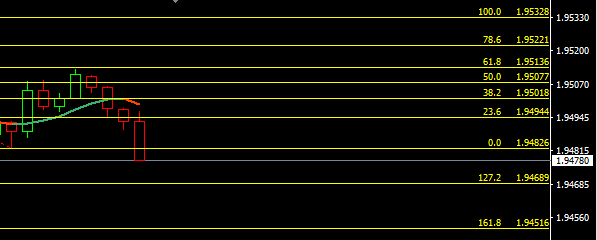

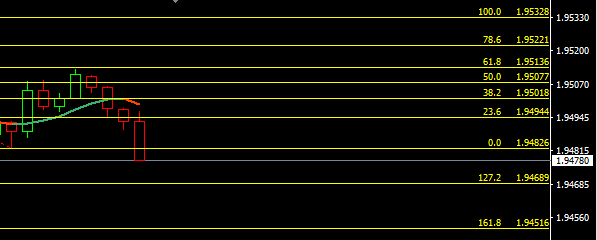

Example screen showing Hull 20 period MA and auto-calculated Fibonacci levels:

Apologies - I forgot to include that the TP and SL should be hidden from the market.

Commandes similaires

I would like to have a strategy in pinescript that I can backtest for several other stocks and shares. I was wondering if you could help me program the strategy. So the strategy is for only dividend paying companies. The basic is quite simple: The strategy buys the particular stock x days before the ex-dividend day and sells it the day before. E.g.: buys CVX stock 9 days before the ex dividend date and sells it the

Hello I have a EA and Custom Indicator That Someone Made for Me But I need to fix it up and get it to function properly using the customer indicator I want to fix the bug's and add a water mark to it that is all if someone could do this work asap that would be even better. EA is 3771 Lines Of Code Indicator Is 918 Lines Of Code list of things I need fixed (More then half of this is already coded in) #.1 I need the EA

I need smart, professional, and fast programmer for doing this project quickly, that have experience in EA with minimum 500 projects finish, and have good review and reputation from their client Share your link review, if you not qualified, dont apply! I will bidding the programmer from experience, review, reputation, price, and days working My EA using Moving Average, Average True Range, and using consecutives

==Strategy Outline== This strategy is a mean reversion strategy which uses 3 Indicators. · RSI with Overbought and Oversold Levels (Length 4, OB=10, OS=90) o The RSI gives us short term momentum signals against the trend · 3 Exponential Moving Averages (Length 50, 90, 230) o The 3x EMA provide a clear view of the prevailing longer-term trend · Damiani Volatmeter (Standard settings) o The

CAPSTONE EA We are in need of an experienced programmer that could help us create Forex Expert Advisor. SPECIFIC REQUIREMENT: Draw two horizontal line at the high and low of the 6th and 7th candle from the day session line using the one hour chat. ENTRY CONDITION ONE: The EA should wait for the break of the upper or lower horizontal line by 2 pips. i. BUY ENTRY: If the break of the horizontal line

The following items need to be included in the EA a) Include MA filter: Buy trades can only happen if the candles are closing above the MA and Sell trades can only happen if the candles are closing below it (filter can be turned on/off in the settings) b) Fix Orders without TP: Currently the EA (while live trading only) sometimes fails to include/modify the take profit value in the current orders, the error is not a

Hello I have a EA and Custom Indicator That Someone Made for Me But I need to fix it up and get it to function properly using the customer indicator I want to fix the bug's and add a water mark to it that is all if someone could do this work asap that would be even better. EA is 3771 Lines Of Code Indicator Is 918 Lines Of Code list of things I need fixed (More then half of this is already coded in) #.1 I need the EA

Am lebza fede from ivory park lusaka i work at BSG, Got my on music, am a Producer & a Dj, if i get a job i wanna cover up all my Debts. I Have so many things in life were i need money but its hard to find one, Everytime i hustle things go side ways

I want to build an EA that give me bias Longs only OR Shorts Only, and recommends Buy or Sell If conditions are met. I want to have the right and the original code for the EA. Conditions: Longs Only 1) 1 hour chat EMA 50 above EMA200, AND Price above 200 EMA (Must meet this criteria ) 2) Previous 4H candle closed Bullish? (Must meet this criteria ) 3) Calculate the Average Daily range, have price

MT4 EA to be backtested using Dukascopy data. 1. 10 currency pairs to be tested and optimized. 2. Period Time frame - H1 . Test with $10,000 account. 3. Test to be run in 10 years Dukascopy historic data 4. Parameter optimisation in 2 phases . Initially larger range and later detailed small range Parameters to be optimized same for all pairs Parameter / Start / Step /Stop Grid Size / 15 / 10 / 75 (7