Zuzanna Slawinska / Profile

- Information

|

3 years

experience

|

1

products

|

6497

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

Hello & Welcome to our profile!

We're a trader-programmer duo who've joined forces to bring you the best of both worlds. With my extensive trading experience in metals, indices and major forex pairs, combined with my partner's programming expertise, we create trading solutions that actually work in real market conditions. We don't just develop tools - we actively trade them ourselves. Our systems blend sophisticated technical analysis with practical market knowledge, refined through years of real trading experience. We know what works and what doesn't, and we're committed to sharing that expertise with you. Whether you need automated trading solutions or want to discuss trading strategies, we're here to help. We believe in keeping things straightforward and effective, focusing on what really matters in today's markets. Feel free to reach out - we're always happy to chat about trading and help you achieve your goals.

Happy Trading!

We're a trader-programmer duo who've joined forces to bring you the best of both worlds. With my extensive trading experience in metals, indices and major forex pairs, combined with my partner's programming expertise, we create trading solutions that actually work in real market conditions. We don't just develop tools - we actively trade them ourselves. Our systems blend sophisticated technical analysis with practical market knowledge, refined through years of real trading experience. We know what works and what doesn't, and we're committed to sharing that expertise with you. Whether you need automated trading solutions or want to discuss trading strategies, we're here to help. We believe in keeping things straightforward and effective, focusing on what really matters in today's markets. Feel free to reach out - we're always happy to chat about trading and help you achieve your goals.

Happy Trading!

Friends

337

Requests

Outgoing

Zuzanna Slawinska

lcxnet

2025.06.30

This author is a liar. The backtesting of each of her EAs is inconsistent with the actual use. Don't be fooled by her.

Zuzanna Slawinska

lcxnet

2025.06.30

This author is a liar. The backtesting of each of her EAs is inconsistent with the actual use. Don't be fooled by her.

[Deleted]

2025.07.26

[Deleted]

Zuzanna Slawinska

Published product

Why trade silver when everyone's trading gold? Here's what most traders don't realize: silver isn't just a cheaper alternative to gold – it's a fundamentally different market with unique characteristics. While gold primarily serves as a safe-haven asset, silver lives a double life as both a precious metal and an industrial powerhouse. Approximately half of global silver demand comes from technology sectors including solar panels, electric vehicles and electronics manufacturing. This unique

lcxnet

2025.06.30

This author is a liar. The backtesting of each of her EAs is inconsistent with the actual use. Don't be fooled by her.

Zuzanna Slawinska

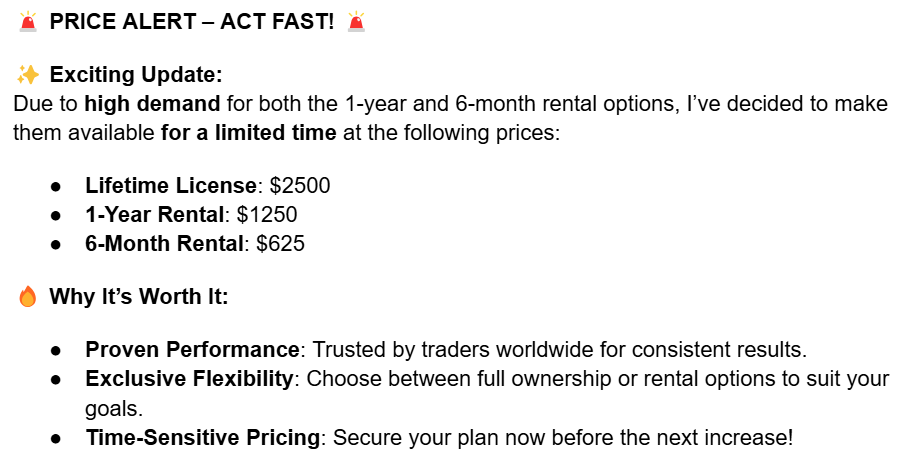

🔄 Monthly Option Now Available - Quick Update

I know some of you saw my recent "no more rentals" comment and might be wondering about this new monthly option. Let me clarify. When I said no more rentals, I meant the old 6-month model. That's done. The $625 lifetime option remains our main offering and the best value for existing customers. However, I've been getting messages from people who want to try the improved Goldenity but can't commit $625 right now. So I've introduced a $125 monthly option - which is actually higher than our old monthly rate ($625÷6 = $104). This serves a different customer segment without affecting our core pricing.

The new signal has been showing solid improvements and you can track our live performance on here. For existing customers with expiring licenses: Lifetime at $625 remains your best choice - it pays for itself and eliminates renewal stress.

For newcomers: The monthly option lets you test the improved system without major commitment. Same EA, same updates, different payment structures for different needs. The improvements speak for themselves in our live signal results.

DMs welcome as always in case of any questions

Best,

Zuzanna

PLEASE NOTE: 1 month rent option will be available only for a short period of time.

I know some of you saw my recent "no more rentals" comment and might be wondering about this new monthly option. Let me clarify. When I said no more rentals, I meant the old 6-month model. That's done. The $625 lifetime option remains our main offering and the best value for existing customers. However, I've been getting messages from people who want to try the improved Goldenity but can't commit $625 right now. So I've introduced a $125 monthly option - which is actually higher than our old monthly rate ($625÷6 = $104). This serves a different customer segment without affecting our core pricing.

The new signal has been showing solid improvements and you can track our live performance on here. For existing customers with expiring licenses: Lifetime at $625 remains your best choice - it pays for itself and eliminates renewal stress.

For newcomers: The monthly option lets you test the improved system without major commitment. Same EA, same updates, different payment structures for different needs. The improvements speak for themselves in our live signal results.

DMs welcome as always in case of any questions

Best,

Zuzanna

PLEASE NOTE: 1 month rent option will be available only for a short period of time.

Zuzanna Slawinska

Dear Goldenity Customers,

First, I want to thank every one of you for your patience, support and constructive feedback. Goldenity is not just a product to me - it’s my priority, my responsibility and something I care deeply about every single day. I know some of you have had concerns during the recent period and you deserve an open explanation. I needed to take a short break after the last update - not because I stopped believing in Goldenity, but because I am only human. Dealing with constant negativity, especially some absurd or hostile messages, took its toll. When I should have been focusing on refining Goldenity, I found myself spending too much time responding to things that had nothing to do with actual trading performance. Thank you to those who understood and supported me through this.

What’s New and What’s Next?

• Goldenity is back on track. With the latest update, the EA is returning to the consistent, high-quality performance you all expect. If you stick to the default settings (fixed lot 0.01, as I personally use), you are using the setup that has proven itself over and over again• A new IC Trading live signal is now available - something many of you requested. This makes it easier to verify results and follow along, regardless of your broker• No more rentals - only full license! By popular demand and to reward your loyalty, I’ve made the full Goldenity license available for $625 - the price that used to be for a 6-month rental. No more temporary rentals, just permanent access for a one-time fee• Silverity is coming. I know you’re eager. The final version is ready and is designed for today’s market. I’m holding back publication only until there’s enough live trading history to give you a fair, accurate comparison between the real signal and the backtest results. On Silverity, I’ll be running a 2% risk per trade model by default, which I believe gives the best results for most traders• Support: As always, if you have any questions, please reach out to me via DM. I am available and will personally help with any concerns, settings, or troubleshooting you need

On MQL5 and Integrity:

I remain firmly committed to MQL5 as the only trustworthy, regulated platform for EAs. This is where you are protected, where I am protected and where all updates and support are official. Please ignore any other channels or “copies” - they are not me, nor my products. Goldenity is still my main focus and your success is what matters most. I won’t be implementing further changes by request, because honestly, some of my past attempts to accommodate every wish led to decreased quality. My goal now is maximum consistency, reliability and transparency. Thank you for trusting me, for your patience and for allowing Goldenity to prove itself in this ever-changing market. I believe in this project and in you and together we will move forward

All the best,

Zuzanna

First, I want to thank every one of you for your patience, support and constructive feedback. Goldenity is not just a product to me - it’s my priority, my responsibility and something I care deeply about every single day. I know some of you have had concerns during the recent period and you deserve an open explanation. I needed to take a short break after the last update - not because I stopped believing in Goldenity, but because I am only human. Dealing with constant negativity, especially some absurd or hostile messages, took its toll. When I should have been focusing on refining Goldenity, I found myself spending too much time responding to things that had nothing to do with actual trading performance. Thank you to those who understood and supported me through this.

What’s New and What’s Next?

• Goldenity is back on track. With the latest update, the EA is returning to the consistent, high-quality performance you all expect. If you stick to the default settings (fixed lot 0.01, as I personally use), you are using the setup that has proven itself over and over again• A new IC Trading live signal is now available - something many of you requested. This makes it easier to verify results and follow along, regardless of your broker• No more rentals - only full license! By popular demand and to reward your loyalty, I’ve made the full Goldenity license available for $625 - the price that used to be for a 6-month rental. No more temporary rentals, just permanent access for a one-time fee• Silverity is coming. I know you’re eager. The final version is ready and is designed for today’s market. I’m holding back publication only until there’s enough live trading history to give you a fair, accurate comparison between the real signal and the backtest results. On Silverity, I’ll be running a 2% risk per trade model by default, which I believe gives the best results for most traders• Support: As always, if you have any questions, please reach out to me via DM. I am available and will personally help with any concerns, settings, or troubleshooting you need

On MQL5 and Integrity:

I remain firmly committed to MQL5 as the only trustworthy, regulated platform for EAs. This is where you are protected, where I am protected and where all updates and support are official. Please ignore any other channels or “copies” - they are not me, nor my products. Goldenity is still my main focus and your success is what matters most. I won’t be implementing further changes by request, because honestly, some of my past attempts to accommodate every wish led to decreased quality. My goal now is maximum consistency, reliability and transparency. Thank you for trusting me, for your patience and for allowing Goldenity to prove itself in this ever-changing market. I believe in this project and in you and together we will move forward

All the best,

Zuzanna

Zuzanna Slawinska

Hi everyone,

I just wanted to take a moment to thank you all for your recent messages and assure you that I carefully read and considered every single one. Your concerns and suggestions are always valuable, and each feedback helps me make Goldenity better. As many of you have noticed, the markets have been exceptionally volatile lately—far more than usual—and that’s precisely why I recently introduced some adjustments in Goldenity’s latest update. However, the work doesn’t stop here: I’m constantly monitoring its performance, reviewing data, and working behind the scenes to bring further improvements. You can expect another update very soon.

Given the upcoming Easter period, please be aware that market behavior typically becomes unpredictable and abnormal. Even though brokers might allow trading both on this upcoming Friday (Good Friday) and the following Monday (Easter Monday), my recommendation is to temporarily turn Goldenity off during these days and restart it on Tuesday, April 22nd. On that same day (Tuesday, April 22nd), I’ll also restart Goldenity’s live signal. I’d like to clarify again—the only reason I stopped running the live signal on Weltrade was because many of you expressed concerns about its legitimacy. To ensure absolute transparency and your peace of mind, I’m switching brokers for this signal.

Additionally, I’m pleased to announce that I’ll also launch the Silverity signal on that very same day. Once I accumulate enough verified trading history, I’ll officially publish it and let you all know.

Lastly, I can’t emphasize enough how important it is for me to support you. If you ever have questions, concerns, or need help with anything related to Goldenity, please don’t hesitate to contact me directly via DM. I’m always here and always happy to help.

Wishing you all the very best,

Zuzanna

I just wanted to take a moment to thank you all for your recent messages and assure you that I carefully read and considered every single one. Your concerns and suggestions are always valuable, and each feedback helps me make Goldenity better. As many of you have noticed, the markets have been exceptionally volatile lately—far more than usual—and that’s precisely why I recently introduced some adjustments in Goldenity’s latest update. However, the work doesn’t stop here: I’m constantly monitoring its performance, reviewing data, and working behind the scenes to bring further improvements. You can expect another update very soon.

Given the upcoming Easter period, please be aware that market behavior typically becomes unpredictable and abnormal. Even though brokers might allow trading both on this upcoming Friday (Good Friday) and the following Monday (Easter Monday), my recommendation is to temporarily turn Goldenity off during these days and restart it on Tuesday, April 22nd. On that same day (Tuesday, April 22nd), I’ll also restart Goldenity’s live signal. I’d like to clarify again—the only reason I stopped running the live signal on Weltrade was because many of you expressed concerns about its legitimacy. To ensure absolute transparency and your peace of mind, I’m switching brokers for this signal.

Additionally, I’m pleased to announce that I’ll also launch the Silverity signal on that very same day. Once I accumulate enough verified trading history, I’ll officially publish it and let you all know.

Lastly, I can’t emphasize enough how important it is for me to support you. If you ever have questions, concerns, or need help with anything related to Goldenity, please don’t hesitate to contact me directly via DM. I’m always here and always happy to help.

Wishing you all the very best,

Zuzanna

Zuzanna Slawinska

📘 Goldenity AI 2.64 – User Manual

Why did we update Goldenity AI?

Gold trading is more than just numbers—it's an art form. The gold market is known for its unique volatility, rapid changes, and frequent shifts in behavior. To stay ahead, trading algorithms must occasionally evolve to keep pace with these market dynamics. While Goldenity AI’s core logic remains unchanged, continuing to reflect years of trading expertise translated into algorithmic form, certain improvements and additional settings have been introduced. These updates allow greater flexibility, improved risk management, and more precise recovery mechanisms to keep Goldenity AI reliable and effective in current market conditions.

⚙️ General Setup

Set trading symbols:

Choose the symbol you want Goldenity AI to trade (e.g., XAUUSD for gold).

Set main magic number:

Unique identifier that helps Goldenity AI distinguish its trades from others (useful when multiple EAs are running).

Set order comment:

Optional custom comment for trade identification in your history.

⚙️ Risk Management

Lot calculation method:

Defines how Goldenity AI calculates trade sizes:

Risk by balance percent: Lot size is based on a percentage of your balance.

Fixed lot size: A fixed lot for every trade.

Fixed lot size based on x balance: Lot sizes adjusted based on balance increments.

Fixed lot size based on x currency amount: Lot sizes are determined by a fixed monetary risk amount.

Risk percentage for each trade:

Specifies the exact % of your balance risked if using "Risk by balance percent".

Fixed lot size:

Defines a constant lot size for each trade (if selected).

Fixed lot size based on x balance:

Adjusts lots when your balance reaches specific increments.

Fixed lot size based on x currency amount:

Sets lot sizes based on a chosen currency amount risk per trade.

⚙️ Trade Limits

Maximum number of trades allowed:

The maximum number of simultaneous open trades Goldenity AI is allowed.

⚙️ Splitting Orders (Multiple Take Profits)

Enable splitting orders into x orders with different TP levels:

When enabled, splits one main trade into multiple smaller ones, each with a unique take-profit (TP).

Number of orders to split:

Defines how many smaller trades a single trade should be divided into.

⚙️ Order Management

Open only one order per symbol:

If true, Goldenity AI limits itself to one open order per trading symbol at any given time.

Minimum distance between trades:

Minimum distance in points/pips between separate orders on the same pair.

Allow hedging:

Allows simultaneous buy and sell orders on the same symbol.

⚙️ News Filter

High/medium/low impact news filter:

When enabled, the robot avoids trading during specified economic news events.

Hours to avoid trading before/after news:

Time buffers before and after news events during which trading will be paused.

Please add: https://nfs.faireconomy.media into your trusted URLs

⚙️ Martingale (Recovery Mode)

Important:

Goldenity AI uses a modified Martingale approach. It does not close losing trades immediately. Instead, if a trade moves significantly into loss, it opens another trade in the same direction with a larger lot size. This repeats at intervals until the market returns in your favor. When the cumulative result of all these open trades reaches a specified profit level, the robot closes all trades in that sequence simultaneously.

Martingale Main Settings:

Enable Martingale:

Turns the recovery feature on or off.

Method for Martingale distances:

Determines the spacing of Martingale orders:

ATR (Average True Range): Based on market volatility.

Fixed points: User-defined fixed intervals.

Moving average: Based on moving average calculations.

Bollinger Bands: Based on standard deviation bands around price.

Method for calculating TP:

How the Take Profit for the Martingale series is determined (typically set as an average TP).

TP percentage of distance between orders:

Specifies the TP placement relative to the distance between Martingale orders.

Additional Martingale Settings (by method):

Fixed points distance:

Defines a fixed point distance between Martingale trades.

Moving Average Martingale Settings:

MA period: Number of bars to calculate the moving average.

MA type (simple, exponential): The calculation type.

Timeframe: Chart timeframe used.

ATR Martingale Settings:

ATR period: Bars used to calculate volatility.

ATR multiplier: How aggressively trade spacing adapts to volatility.

Timeframe: Chart timeframe for volatility calculation.

Bollinger Bands Martingale Settings:

Period: Number of bars for band calculation.

Deviations: Standard deviations from the price.

Timeframe: Chart timeframe for calculation.

⚙️ Advanced Martingale Controls

Smart recover percent:

Enables a partial recovery approach, recovering only a percentage of losses per sequence.

Percent of recovery per Martingale trade:

The percent of the total loss to recover per additional Martingale trade.

Maximum initial lot percent addition:

Limits how large each additional Martingale trade can be relative to the initial trade.

Only continue Martingale on new signal:

Opens new Martingale trades only when a fresh trading signal appears.

⚙️ RSI (Relative Strength Index) Settings for Martingale Signals

RSI Timeframe:

Timeframe for RSI indicator calculations.

RSI Period:

Bars used in RSI calculation.

RSI High/Low values:

Defines overbought (high) and oversold (low) thresholds used to confirm Martingale trades.

Reverse RSI:

Flips RSI logic for triggering trades.

⚙️ Martingale Profit Target

Profit calculation method:

Defines profit targets as a percentage of account balance or fixed monetary value.

Total profit (USD):

Fixed dollar target for closing Martingale series.

Total profit (% of balance):

Target profit as a percentage of the account balance.

Recommendations:

Always test on demo accounts to become familiar with new settings.

Begin conservatively, gradually adjusting risk levels.

Use a reliable VPS provider

Be cautious and monitor Martingale settings closely, as they significantly affect risk exposure.

Why did we update Goldenity AI?

Gold trading is more than just numbers—it's an art form. The gold market is known for its unique volatility, rapid changes, and frequent shifts in behavior. To stay ahead, trading algorithms must occasionally evolve to keep pace with these market dynamics. While Goldenity AI’s core logic remains unchanged, continuing to reflect years of trading expertise translated into algorithmic form, certain improvements and additional settings have been introduced. These updates allow greater flexibility, improved risk management, and more precise recovery mechanisms to keep Goldenity AI reliable and effective in current market conditions.

⚙️ General Setup

Set trading symbols:

Choose the symbol you want Goldenity AI to trade (e.g., XAUUSD for gold).

Set main magic number:

Unique identifier that helps Goldenity AI distinguish its trades from others (useful when multiple EAs are running).

Set order comment:

Optional custom comment for trade identification in your history.

⚙️ Risk Management

Lot calculation method:

Defines how Goldenity AI calculates trade sizes:

Risk by balance percent: Lot size is based on a percentage of your balance.

Fixed lot size: A fixed lot for every trade.

Fixed lot size based on x balance: Lot sizes adjusted based on balance increments.

Fixed lot size based on x currency amount: Lot sizes are determined by a fixed monetary risk amount.

Risk percentage for each trade:

Specifies the exact % of your balance risked if using "Risk by balance percent".

Fixed lot size:

Defines a constant lot size for each trade (if selected).

Fixed lot size based on x balance:

Adjusts lots when your balance reaches specific increments.

Fixed lot size based on x currency amount:

Sets lot sizes based on a chosen currency amount risk per trade.

⚙️ Trade Limits

Maximum number of trades allowed:

The maximum number of simultaneous open trades Goldenity AI is allowed.

⚙️ Splitting Orders (Multiple Take Profits)

Enable splitting orders into x orders with different TP levels:

When enabled, splits one main trade into multiple smaller ones, each with a unique take-profit (TP).

Number of orders to split:

Defines how many smaller trades a single trade should be divided into.

⚙️ Order Management

Open only one order per symbol:

If true, Goldenity AI limits itself to one open order per trading symbol at any given time.

Minimum distance between trades:

Minimum distance in points/pips between separate orders on the same pair.

Allow hedging:

Allows simultaneous buy and sell orders on the same symbol.

⚙️ News Filter

High/medium/low impact news filter:

When enabled, the robot avoids trading during specified economic news events.

Hours to avoid trading before/after news:

Time buffers before and after news events during which trading will be paused.

Please add: https://nfs.faireconomy.media into your trusted URLs

⚙️ Martingale (Recovery Mode)

Important:

Goldenity AI uses a modified Martingale approach. It does not close losing trades immediately. Instead, if a trade moves significantly into loss, it opens another trade in the same direction with a larger lot size. This repeats at intervals until the market returns in your favor. When the cumulative result of all these open trades reaches a specified profit level, the robot closes all trades in that sequence simultaneously.

Martingale Main Settings:

Enable Martingale:

Turns the recovery feature on or off.

Method for Martingale distances:

Determines the spacing of Martingale orders:

ATR (Average True Range): Based on market volatility.

Fixed points: User-defined fixed intervals.

Moving average: Based on moving average calculations.

Bollinger Bands: Based on standard deviation bands around price.

Method for calculating TP:

How the Take Profit for the Martingale series is determined (typically set as an average TP).

TP percentage of distance between orders:

Specifies the TP placement relative to the distance between Martingale orders.

Additional Martingale Settings (by method):

Fixed points distance:

Defines a fixed point distance between Martingale trades.

Moving Average Martingale Settings:

MA period: Number of bars to calculate the moving average.

MA type (simple, exponential): The calculation type.

Timeframe: Chart timeframe used.

ATR Martingale Settings:

ATR period: Bars used to calculate volatility.

ATR multiplier: How aggressively trade spacing adapts to volatility.

Timeframe: Chart timeframe for volatility calculation.

Bollinger Bands Martingale Settings:

Period: Number of bars for band calculation.

Deviations: Standard deviations from the price.

Timeframe: Chart timeframe for calculation.

⚙️ Advanced Martingale Controls

Smart recover percent:

Enables a partial recovery approach, recovering only a percentage of losses per sequence.

Percent of recovery per Martingale trade:

The percent of the total loss to recover per additional Martingale trade.

Maximum initial lot percent addition:

Limits how large each additional Martingale trade can be relative to the initial trade.

Only continue Martingale on new signal:

Opens new Martingale trades only when a fresh trading signal appears.

⚙️ RSI (Relative Strength Index) Settings for Martingale Signals

RSI Timeframe:

Timeframe for RSI indicator calculations.

RSI Period:

Bars used in RSI calculation.

RSI High/Low values:

Defines overbought (high) and oversold (low) thresholds used to confirm Martingale trades.

Reverse RSI:

Flips RSI logic for triggering trades.

⚙️ Martingale Profit Target

Profit calculation method:

Defines profit targets as a percentage of account balance or fixed monetary value.

Total profit (USD):

Fixed dollar target for closing Martingale series.

Total profit (% of balance):

Target profit as a percentage of the account balance.

Recommendations:

Always test on demo accounts to become familiar with new settings.

Begin conservatively, gradually adjusting risk levels.

Use a reliable VPS provider

Be cautious and monitor Martingale settings closely, as they significantly affect risk exposure.

Amit Mohan Sharma

2025.03.04

Have you addressed the 5:1 RR 150 point SL and 30 point profit issue Zuzanna or this is the logic being used in the EA? Occasional trades but consecutive loses with 5:1 RR is the main issue here. Please get that sorted.

Zuzanna Slawinska

Dear Traders,

I want to take a moment to address the recent surge of concern, frustration and skepticism that has appeared in the reviews and comment section. Many of you have been supportive from the very beginning and I appreciate that. But I also see that a portion of users have quickly lost faith after a couple of losses, leading to a drop in the rating. I understand emotions can run high when trading, but I want to be clear - Goldenity is performing exactly as designed and I stand by this system just as I always have.

Why don't we look at the actual numbers instead of reacting emotionally? The live signal has executed 42 trades, maintaining a strong 80.95% win rate. The worst trade recorded was -69.28 USD, while the best trade was 148.35 USD. This demonstrates a controlled risk approach, where losses are kept within reason while profits are allowed to run. The profit factor sits at 3.57, meaning for every dollar lost Goldenity generated 3.57 dollars in profit so far. The maximum consecutive wins recorded is 13, with a maximum consecutive loss streak of just 2 trades, which is statistically insignificant in a long-term trading system.

Despite short-term fluctuations, the monthly growth stands at a decent level, which, when compounded, results in consistent and stable account growth over time. The drawdown by balance is only 4.32%, meaning that the EA is trading responsibly while protecting capital. If this were a system with reckless risk management, we would be seeing significantly higher drawdowns.

Some have asked whether I am still trading Goldenity myself. The answer is yes, absolutely. In fact, I just launched a brand new live signal account with a top-tier broker to further demonstrate the EA’s strength in a premium trading environment. This should be proof that I believe in this system enough to trade it publicly under full transparency. I would never do that if I weren’t fully confident in Goldenity’s ability to perform long-term.

Now let’s talk about risk management. Losses will happen - that is a fact of trading. However, I emphasize controlled risk and a strategic approach. If you are experiencing excessive drawdowns, the issue is not Goldenity - it is likely an incorrect risk setting, unsuitable leverage or a poor broker environment. If you are unsure whether your settings are correct, I encourage you to reach out and I will personally help you check them.

Some of you may feel tempted to abandon the system after a couple of losing trades, but let me remind you - trading is a long-term game, not a sprint. If you are expecting an EA to win every trade, you have unrealistic expectations. Goldenity does not take random trades, it waits for optimal conditions. This is not a machine that trades just for the sake of trading. It is selective and that is what makes it effective. To those who are still here, still trading and still trusting the system - I appreciate you. This is why I always emphasize patience, the ability to handle losses and proper risk management. That is what separates profitable traders from those who fail. I assure you that everything is working as intended and I will continue to trade as I have been for the last couple of months.

For those panicking and leaving negative reviews based on a few trades, I ask you to take a step back and look at the full picture. The stats speak for themselves. If you still have concerns, I am here to address them, but I will always stand by Goldenity and the way it is designed to trade.

Stay focused on the bigger picture and let’s move forward with discipline and confidence.

Best regards,

Zuzanna

I want to take a moment to address the recent surge of concern, frustration and skepticism that has appeared in the reviews and comment section. Many of you have been supportive from the very beginning and I appreciate that. But I also see that a portion of users have quickly lost faith after a couple of losses, leading to a drop in the rating. I understand emotions can run high when trading, but I want to be clear - Goldenity is performing exactly as designed and I stand by this system just as I always have.

Why don't we look at the actual numbers instead of reacting emotionally? The live signal has executed 42 trades, maintaining a strong 80.95% win rate. The worst trade recorded was -69.28 USD, while the best trade was 148.35 USD. This demonstrates a controlled risk approach, where losses are kept within reason while profits are allowed to run. The profit factor sits at 3.57, meaning for every dollar lost Goldenity generated 3.57 dollars in profit so far. The maximum consecutive wins recorded is 13, with a maximum consecutive loss streak of just 2 trades, which is statistically insignificant in a long-term trading system.

Despite short-term fluctuations, the monthly growth stands at a decent level, which, when compounded, results in consistent and stable account growth over time. The drawdown by balance is only 4.32%, meaning that the EA is trading responsibly while protecting capital. If this were a system with reckless risk management, we would be seeing significantly higher drawdowns.

Some have asked whether I am still trading Goldenity myself. The answer is yes, absolutely. In fact, I just launched a brand new live signal account with a top-tier broker to further demonstrate the EA’s strength in a premium trading environment. This should be proof that I believe in this system enough to trade it publicly under full transparency. I would never do that if I weren’t fully confident in Goldenity’s ability to perform long-term.

Now let’s talk about risk management. Losses will happen - that is a fact of trading. However, I emphasize controlled risk and a strategic approach. If you are experiencing excessive drawdowns, the issue is not Goldenity - it is likely an incorrect risk setting, unsuitable leverage or a poor broker environment. If you are unsure whether your settings are correct, I encourage you to reach out and I will personally help you check them.

Some of you may feel tempted to abandon the system after a couple of losing trades, but let me remind you - trading is a long-term game, not a sprint. If you are expecting an EA to win every trade, you have unrealistic expectations. Goldenity does not take random trades, it waits for optimal conditions. This is not a machine that trades just for the sake of trading. It is selective and that is what makes it effective. To those who are still here, still trading and still trusting the system - I appreciate you. This is why I always emphasize patience, the ability to handle losses and proper risk management. That is what separates profitable traders from those who fail. I assure you that everything is working as intended and I will continue to trade as I have been for the last couple of months.

For those panicking and leaving negative reviews based on a few trades, I ask you to take a step back and look at the full picture. The stats speak for themselves. If you still have concerns, I am here to address them, but I will always stand by Goldenity and the way it is designed to trade.

Stay focused on the bigger picture and let’s move forward with discipline and confidence.

Best regards,

Zuzanna

Leonstevey20

2025.02.15

To be honest i think most people who left negative comments basing on 2 weeks results are unfair to this author, i have been trading with goldenity and observed its style of trading and found it to be one of the most intelligent and smart trading technics having dynamic T.P and S.L depending on how it has analysed the market. It is true that last week was tough and the EA made losses but come on, no EA can make pure 100% profits not even the best traders can do that, it is my opinion to let the EA run for couple of months and evaluate it's performance then rather than letting emotions control you in over a 2 weeks results. I will continue to run this EA as i believe it will recoup the losses it has made in no time and will give updates on it's performance as we go. I still trust the developer is honest and wishes well basing on how she responded professionally and in a polite manner despite being harshly bombarded with hatred comments. Well what happened happened and i trust the performance of the EA will go beyond proving all those who quickly panicked and left negative comments basing on emotions raised by few impatient individuals who caused the damage. I wish everyone the best and anxiously waiting to see what the EA will bring in the coming weeks and months. Best regards, Leon.

Amy Demi Morgendal

2025.02.15

I believe it's a ploy to get the price of Goldenity to drop. The same thing happened with Infinity EA and if you look at the dates of the comments and reviews, all the negativity happened very suddenly. Either people are impatient or it's a very strategically planned attack - the competition is rife. These popular bots also leak at the same time when these kind of reviews drop - not sure why, but just something that I noticed.

Michael John Malkinson

2025.02.20

I've been following the comments on Goldenity and honestly its nuts... 2 or 3 people literally have a screw loose I think. I purchased the MT4 version so I'm unable to comment in the MT5 conversation but I really don't understand where all the hates comes from. Goldenity is still in profit for me since purchasing (although admittedly only just right now... But I do beleive (hope) it will bounce back). Its still one of only 2 EA's that I really think have actual long term profit potential (and I've purchased aloottttt of EA's from this store). I will however just leave 2 points of opinion on it all. 1. Although my trades almost identically match the signal, there's no denying that the initial trades on the 27th of December are somehow faked/staged. Its clear after 2 months of using the EA that Goldenity doesnt trade in this way opening multiple trades and closing all together. I always hear negative things about Welltrade so I'm guessing they let you do things like this to hook people in - which is a little bit naughty. 2. Even though these people are pretty deluded, I do think you could have just given them their refund after they've kicked off so badly, simply just to quiet the noise. On the terms that they removed reviews/comments it wouldnt be harmful to have given their money back. Especially when, as they keep pointing out, you've sold alotttt of copies for an extremely large sum of money. But even with the above, I personally still use Goldenity and will continue for now. The only changes I WOULD like to see is the option to do trailing TP/SL. I know it reduces amount won in trades, but would also significantly reduce amount of lost trades for ones that get halfway to TP then go all the way to SL. Also wouldnt mind a feature being able to increase the EA's only stoploss by X amount of pips. for example, 2 or 3 of my goldenity trades ive slightly increased the SL when it was getting close and theyve come back round and won.

Zuzanna Slawinska

Understanding Algorithmic Trading and Working with Expert Advisors (EAs)

Let me share some essential insights about algorithmic trading and how EAs operate in today's markets. The foundation of any EA's success lies in understanding how these systems process and react to market data in real-time. Think of an EA as a sophisticated analysis engine that continuously evaluates incoming price data, volume patterns and market conditions to identify trading opportunities according to its programmed strategies.

The effectiveness of any EA depends heavily on the quality of data it receives and processes. This creates a crucial chain of dependencies between your broker's data feed, your execution environment (whether VPS or local machine) and the EA itself. When all these elements work in harmony, the EA can identify and execute trades precisely as designed. However, if there's any delay or disruption in this chain, it may affect trading performance.

Trading infrastructure plays a vital role in algorithmic trading success. The ideal setup involves a Windows-based VPS system with guaranteed 24/7 uptime and minimal latency, combined with a broker offering reliable data feeds and efficient execution. This foundation ensures faster data delivery and improved trade execution, significantly reducing the likelihood of missed opportunities.

One common challenge I observe is traders constantly monitoring their charts and analyzing every trade. While this level of engagement shows dedication, it often leads to unnecessary stress and emotional responses to normal market fluctuations. Remember that EAs are designed to handle analysis and execution automatically, allowing you to focus on other activities.

Let's discuss three fundamental principles that every trader should embrace:

First, patience is absolutely crucial. Markets move in natural cycles of volatility and calm periods. Not every day presents optimal trading conditions and attempting to force trades during unfavorable periods often leads to suboptimal results. Trust your EA's ability to identify genuine opportunities.

Second, managing losses effectively is essential. Trading inherently involves both winning and losing trades - this is simply the nature of markets. What truly matters is overall performance over time rather than individual trades. Even the most robust trading systems experience drawdowns occasionally.

Third, proper risk management forms the cornerstone of long-term trading success. This is why sophisticated EAs incorporate advanced risk management features that carefully calculate position sizes and implement protective measures to preserve capital during challenging market periods.

When experiencing technical issues, always start with the basics - perform a clean reinstallation of both your trading platform and EA. It's surprising how often this simple solution resolves apparent complications. Additionally, regularly check your VPS performance and broker connectivity to ensure optimal operating conditions.

Remember that successful trading is truly a marathon rather than a sprint. Maintaining emotional equilibrium during both winning and losing periods is crucial for long-term success. Focus on the bigger picture - overall statistics and performance metrics rather than individual trades.

Finally, understand that market volatility and challenging trades are normal parts of any trading journey. What distinguishes successful traders is their ability to stay calm during turbulent periods and trust their tested systems. With proper setup, patience and disciplined risk management, algorithmic trading can be a powerful tool in your trading arsenal.

I hope these insights help you better understand the world of algorithmic trading and working with EAs. Remember, your success as a trader depends not just on your tools but also on your approach to using them effectively.

Best regards and successful trading!

Let me share some essential insights about algorithmic trading and how EAs operate in today's markets. The foundation of any EA's success lies in understanding how these systems process and react to market data in real-time. Think of an EA as a sophisticated analysis engine that continuously evaluates incoming price data, volume patterns and market conditions to identify trading opportunities according to its programmed strategies.

The effectiveness of any EA depends heavily on the quality of data it receives and processes. This creates a crucial chain of dependencies between your broker's data feed, your execution environment (whether VPS or local machine) and the EA itself. When all these elements work in harmony, the EA can identify and execute trades precisely as designed. However, if there's any delay or disruption in this chain, it may affect trading performance.

Trading infrastructure plays a vital role in algorithmic trading success. The ideal setup involves a Windows-based VPS system with guaranteed 24/7 uptime and minimal latency, combined with a broker offering reliable data feeds and efficient execution. This foundation ensures faster data delivery and improved trade execution, significantly reducing the likelihood of missed opportunities.

One common challenge I observe is traders constantly monitoring their charts and analyzing every trade. While this level of engagement shows dedication, it often leads to unnecessary stress and emotional responses to normal market fluctuations. Remember that EAs are designed to handle analysis and execution automatically, allowing you to focus on other activities.

Let's discuss three fundamental principles that every trader should embrace:

First, patience is absolutely crucial. Markets move in natural cycles of volatility and calm periods. Not every day presents optimal trading conditions and attempting to force trades during unfavorable periods often leads to suboptimal results. Trust your EA's ability to identify genuine opportunities.

Second, managing losses effectively is essential. Trading inherently involves both winning and losing trades - this is simply the nature of markets. What truly matters is overall performance over time rather than individual trades. Even the most robust trading systems experience drawdowns occasionally.

Third, proper risk management forms the cornerstone of long-term trading success. This is why sophisticated EAs incorporate advanced risk management features that carefully calculate position sizes and implement protective measures to preserve capital during challenging market periods.

When experiencing technical issues, always start with the basics - perform a clean reinstallation of both your trading platform and EA. It's surprising how often this simple solution resolves apparent complications. Additionally, regularly check your VPS performance and broker connectivity to ensure optimal operating conditions.

Remember that successful trading is truly a marathon rather than a sprint. Maintaining emotional equilibrium during both winning and losing periods is crucial for long-term success. Focus on the bigger picture - overall statistics and performance metrics rather than individual trades.

Finally, understand that market volatility and challenging trades are normal parts of any trading journey. What distinguishes successful traders is their ability to stay calm during turbulent periods and trust their tested systems. With proper setup, patience and disciplined risk management, algorithmic trading can be a powerful tool in your trading arsenal.

I hope these insights help you better understand the world of algorithmic trading and working with EAs. Remember, your success as a trader depends not just on your tools but also on your approach to using them effectively.

Best regards and successful trading!

asad.74 alazemi

2025.01.31

I purchased the program and I recommend it, as I achieved great profits through it that I did not expect, and it works excellently, and I recommend using it.

Zuzanna Slawinska

Joe

2025.02.10

Maybe 1 month rental term for beginners? people with small capital need good EA's too :)

: