Valeriy Brusilovskyy / Profile

- Information

|

7+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

I have more than 18 years of trading experience. Except of forex trading also I worked with vanil options.

When I traded in divergences I had got 60-80% profit each year. Constantly I'm searching a new currency pairs that will be useful for my method of trading. I put currency pairs to demo-account only after their showing of good results (4-6 pips of expected value) in tester. I started to use pair in real account only after, at least, three months of successful trading (at least 3-4 pips of expected value). In the same time I don't stop to monitor the price movement of well-recommended currency pairs. Based on the results I change algorithm, time of trading and if it's necessary I change position size or even I can take of the pair from active trade.

In that moment I successfully drive a trade in six accounts.

If you are still not sure about me, please take a look on the indicators of all of my signals - https://www.mql5.com/en/signals/author/valera309

I can't wait to start working with you.

Please don't hesitate to address to me I always answer for all questions!

Sincerely yours, Valery!

When I traded in divergences I had got 60-80% profit each year. Constantly I'm searching a new currency pairs that will be useful for my method of trading. I put currency pairs to demo-account only after their showing of good results (4-6 pips of expected value) in tester. I started to use pair in real account only after, at least, three months of successful trading (at least 3-4 pips of expected value). In the same time I don't stop to monitor the price movement of well-recommended currency pairs. Based on the results I change algorithm, time of trading and if it's necessary I change position size or even I can take of the pair from active trade.

In that moment I successfully drive a trade in six accounts.

If you are still not sure about me, please take a look on the indicators of all of my signals - https://www.mql5.com/en/signals/author/valera309

I can't wait to start working with you.

Please don't hesitate to address to me I always answer for all questions!

Sincerely yours, Valery!

Friends

979

Requests

Outgoing

Valeriy Brusilovskyy

Citi: Дефицита нефти не будет никогда

С момента начала реализации соглашения ОПЕК+ еще не прошло и двух месяцев, но вопрос о необходимости продлить срок его действия почему-то в последние дни серьезно будоражит умы экспертов. Сегодня к ним присоединился и Citi.

Вполне возможно, что из-за роста добычи ОПЕК, имевшего место в период согласования условий соглашения, срок его действия придется продлить, считает глава товарных исследований банка Эд Морзе. Помимо этого в сегодняшнем интервью Bloomberg TV он заявил, что:

- главный вопрос заключается в том, какими именно будут условия его продления;

- в случае продления срока действия соглашения, ОПЕК не придется идти на новые масштабные сокращения объема добычи. Рынок и так придет в состояние баланса уже в этом году;

- если бы ОПЕК не увеличил объем добычи непосредственно перед заключением соглашения, баланс был бы уже достигнут;

- во время этих переговоров объем добычи ОПЕК вырос примерно на 1 млн б/д;

- рыночные ожидания того, что к 2020 году возникнет дефицит предложения, не сбудутся никогда из-за роста объемов добычи в США.

С момента начала реализации соглашения ОПЕК+ еще не прошло и двух месяцев, но вопрос о необходимости продлить срок его действия почему-то в последние дни серьезно будоражит умы экспертов. Сегодня к ним присоединился и Citi.

Вполне возможно, что из-за роста добычи ОПЕК, имевшего место в период согласования условий соглашения, срок его действия придется продлить, считает глава товарных исследований банка Эд Морзе. Помимо этого в сегодняшнем интервью Bloomberg TV он заявил, что:

- главный вопрос заключается в том, какими именно будут условия его продления;

- в случае продления срока действия соглашения, ОПЕК не придется идти на новые масштабные сокращения объема добычи. Рынок и так придет в состояние баланса уже в этом году;

- если бы ОПЕК не увеличил объем добычи непосредственно перед заключением соглашения, баланс был бы уже достигнут;

- во время этих переговоров объем добычи ОПЕК вырос примерно на 1 млн б/д;

- рыночные ожидания того, что к 2020 году возникнет дефицит предложения, не сбудутся никогда из-за роста объемов добычи в США.

Valeriy Brusilovskyy

Хранить нефть скоро станет невыгодно!!!

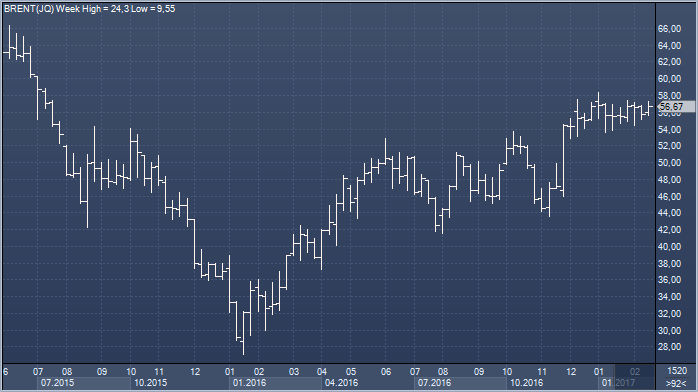

Крупнейшие в мире нефтепроизводители сокращают добычу, чтобы вернуть рынку равновесие, а инвесторы наращивают бычью позицию в расчете на то, что план ОПЕК+ сработает. Уместен ли этот оптимизм? Судя по динамике рынка фьючерсов - вполне. У финансовых управляющих сейчас больше фьючерсов и опционов на нефть Brent чем когда бы то ни было за всю историю ведения статистики - примерно 480 млн баррелей. Это почти в два раза больше, чем два месяца назад. Тогда цены на апрельские фьючерсы на Brent были росли не столь стремительно. Сейчас цены подошли к отметке 57 долларов за баррель, это на 15% выше, чем в начале года, однако не это главное. Впервые с апреля прошлого года контракты на поставку в следующем месяце могут оказаться дороже долгосрочных фьючерсов.

Это явление называется бэквордация, оно случается только в том случае, если инвесторы и трейдеры рассчитывают на то, что в скором времени спрос на нефть превысит предложение. По данным Международного энергетического агентства, в четвертом квартале 2016 года среднесуточный совокупный спрос достиг 97.3 млн баррелей; предложение было немногим выше - 97.9 млн баррелей в день. По нашим оценкам, на физическом рынке нефти уже сформировался дефицит, это значит, что объемы запасов должны сокращаться, - отмечает портфельный управляющий Том Нельсон из Investec Asset Management.

«Последний нисходящий тренд унес инвестиции на сумму около 1 трлн долларов и ограничил доступ к капиталу, поэтому мы считаем, что, структурно, на рынках будут сохраняться дефицитные условия на протяжении ближайших нескольких лет, что приведет к формированию позитивной ценовой динамики», - пояснил он. Почти три года мир купался в миллионах баррелей никому ненужной нефти, хлынувшей на рынок после сланцевой революции в США и стратегии ОПЕК с «девизом качай сколько сможешь», нацеленной на снижение уровня рентабельности на рынке.

Однако ноябрьское соглашение изменило угол зрения. Можно спорить о том, насколько добросовестно производители выполняют договоренности и придерживаются квот, но факт остается фактом: трейдеры поверили в изменение ключевых трендов. Сейчас апрельские контракты на нефть Brent продаются с премией 1.5 долларов относительно контрактов с поставкой в декабре 2018 года, и буквально на несколько центов дороже майских контрактов. Ничего подобного не случалось уже почти год (если не брать во внимание дни погашения этих контрактов, тогда цены бывают волатильны).

ОПЕК, главный поставщик жадной до нефти Азии, сократил добычу, зато поставки в регион из Северного моря в январе достигли исторических максимумов на уровне более 10 млн баррелей, экспорт из регионов Западной Африки в этом месяце немного сократился, но он все равно близок к 17-месячным максимумам. Когда рынок находится в состоянии контанго, контракты с близким сроком погашения стоят дешевле контрактов с поставкой в будущем, таким образом, трейдерам выгодно хранить нефть, а не продавать ее на рынке спот. Когда эта структура переворачивается с ног на голову, то есть, контанго превращается в бэквордацию, запасы начинают сокращаться, поскольку их владельцам выгоднее распродать их сейчас.

Сейчас развитые страны по-прежнему хранят рекордный объем нефти, но тенденция к сокращению уже наметилась. Об этом свидетельствуют данные МЭА о том, что мировые запасы в декабре спустились ниже 3 млрд баррелей, впервые за год. [IEA/M] Очевидно, что рынок увидел свет в конце туннеля. Наращивание производства в США вряд ли сможет компенсировать сокращение добычи со стороны ОПЕК, добавьте сюда прогнозы по устойчивому росту спроса, и станет ясно, что рынок движется к точке равновесия, хотя и неуверенным шагом.

Фонды делают ставку на то, что ОПЕК и другие страны сумеют выдавить нефть из хранилищ. Хотя, конечно, тут все еще вилами на воде писано, поскольку американские производители восстанавливаются, темпы роста спроса в этом году, вероятно, стабилизируются в районе 1.4 млн баррелей в день по сравнению с 1.6 млн баррелей в прошлом году. Между тем, обозревателей волнует не столько совокупный размер позиции финансовых управляющих, сколько процент всех фьючерсов и опционов на нефть Brent, сконцентрированных в руках у спекулятивных инвесторов, а не трейдеров, производителей или потребителей.

Сейчас инвесторам принадлежит 17% из общего объема фьючерсных и опционных контрактов на нефть Brent совокупным объемом 2.85 млн лотов по 1 тыс. баррелей каждый. Исторически этот процент не превышает 9%. Консалтинговая компания JBC Energy настроена менее оптимистично, полагая, что запасы продолжат расти. «Иными словами, всем быкам на рынке нефти остается только верить в то, что страны ОПЕК и другие производители продолжат сокращать добычу во втором полугодии, не снижая темп. В противном случае на всех ждет горькое разочарование».

Крупнейшие в мире нефтепроизводители сокращают добычу, чтобы вернуть рынку равновесие, а инвесторы наращивают бычью позицию в расчете на то, что план ОПЕК+ сработает. Уместен ли этот оптимизм? Судя по динамике рынка фьючерсов - вполне. У финансовых управляющих сейчас больше фьючерсов и опционов на нефть Brent чем когда бы то ни было за всю историю ведения статистики - примерно 480 млн баррелей. Это почти в два раза больше, чем два месяца назад. Тогда цены на апрельские фьючерсы на Brent были росли не столь стремительно. Сейчас цены подошли к отметке 57 долларов за баррель, это на 15% выше, чем в начале года, однако не это главное. Впервые с апреля прошлого года контракты на поставку в следующем месяце могут оказаться дороже долгосрочных фьючерсов.

Это явление называется бэквордация, оно случается только в том случае, если инвесторы и трейдеры рассчитывают на то, что в скором времени спрос на нефть превысит предложение. По данным Международного энергетического агентства, в четвертом квартале 2016 года среднесуточный совокупный спрос достиг 97.3 млн баррелей; предложение было немногим выше - 97.9 млн баррелей в день. По нашим оценкам, на физическом рынке нефти уже сформировался дефицит, это значит, что объемы запасов должны сокращаться, - отмечает портфельный управляющий Том Нельсон из Investec Asset Management.

«Последний нисходящий тренд унес инвестиции на сумму около 1 трлн долларов и ограничил доступ к капиталу, поэтому мы считаем, что, структурно, на рынках будут сохраняться дефицитные условия на протяжении ближайших нескольких лет, что приведет к формированию позитивной ценовой динамики», - пояснил он. Почти три года мир купался в миллионах баррелей никому ненужной нефти, хлынувшей на рынок после сланцевой революции в США и стратегии ОПЕК с «девизом качай сколько сможешь», нацеленной на снижение уровня рентабельности на рынке.

Однако ноябрьское соглашение изменило угол зрения. Можно спорить о том, насколько добросовестно производители выполняют договоренности и придерживаются квот, но факт остается фактом: трейдеры поверили в изменение ключевых трендов. Сейчас апрельские контракты на нефть Brent продаются с премией 1.5 долларов относительно контрактов с поставкой в декабре 2018 года, и буквально на несколько центов дороже майских контрактов. Ничего подобного не случалось уже почти год (если не брать во внимание дни погашения этих контрактов, тогда цены бывают волатильны).

ОПЕК, главный поставщик жадной до нефти Азии, сократил добычу, зато поставки в регион из Северного моря в январе достигли исторических максимумов на уровне более 10 млн баррелей, экспорт из регионов Западной Африки в этом месяце немного сократился, но он все равно близок к 17-месячным максимумам. Когда рынок находится в состоянии контанго, контракты с близким сроком погашения стоят дешевле контрактов с поставкой в будущем, таким образом, трейдерам выгодно хранить нефть, а не продавать ее на рынке спот. Когда эта структура переворачивается с ног на голову, то есть, контанго превращается в бэквордацию, запасы начинают сокращаться, поскольку их владельцам выгоднее распродать их сейчас.

Сейчас развитые страны по-прежнему хранят рекордный объем нефти, но тенденция к сокращению уже наметилась. Об этом свидетельствуют данные МЭА о том, что мировые запасы в декабре спустились ниже 3 млрд баррелей, впервые за год. [IEA/M] Очевидно, что рынок увидел свет в конце туннеля. Наращивание производства в США вряд ли сможет компенсировать сокращение добычи со стороны ОПЕК, добавьте сюда прогнозы по устойчивому росту спроса, и станет ясно, что рынок движется к точке равновесия, хотя и неуверенным шагом.

Фонды делают ставку на то, что ОПЕК и другие страны сумеют выдавить нефть из хранилищ. Хотя, конечно, тут все еще вилами на воде писано, поскольку американские производители восстанавливаются, темпы роста спроса в этом году, вероятно, стабилизируются в районе 1.4 млн баррелей в день по сравнению с 1.6 млн баррелей в прошлом году. Между тем, обозревателей волнует не столько совокупный размер позиции финансовых управляющих, сколько процент всех фьючерсов и опционов на нефть Brent, сконцентрированных в руках у спекулятивных инвесторов, а не трейдеров, производителей или потребителей.

Сейчас инвесторам принадлежит 17% из общего объема фьючерсных и опционных контрактов на нефть Brent совокупным объемом 2.85 млн лотов по 1 тыс. баррелей каждый. Исторически этот процент не превышает 9%. Консалтинговая компания JBC Energy настроена менее оптимистично, полагая, что запасы продолжат расти. «Иными словами, всем быкам на рынке нефти остается только верить в то, что страны ОПЕК и другие производители продолжат сокращать добычу во втором полугодии, не снижая темп. В противном случае на всех ждет горькое разочарование».

Valeriy Brusilovskyy

Market Overview

Finally, things are moving at a normal pace again and the directionless period that we've seen since Trump's confusing conference seems to be over. Hooray!!

Here are the main contributing factors...

1. Trump has picked himself a new National Security Advisor to replace the shady one that had alleged ties to Russia. Overall, the markets see this as a good thing.

2. Hawkish comments from the Federal Reserve are boosting the Buck.

3. The Greek Debt crisis has once again been swept under the rug, which is hurting the Euro.

For these three reasons and more, the US Dollar is king of the markets again. Here's a chart that shows the entire sequence of the last few days. This is the USDJPY 10 minutes per candle.

USDJPY

You can tell that Gold wants to go up but is having some trouble against the stronger Dollar. Right now we're looking at support at $1232 an ounce. If it falls below that we could be looking at $1220 before not too long.

Gold

The cherry on the top of this action packed market morning is Bitcoin with a rise of almost $40 a coin and reaching as high as $1095. If it passes $1100 today it's sure to get some very welcome love and attention.

BTC

The Fed (cont)

Fed member Harker stated that he "won't take March off the table" for a rate hike and has further reiterated the plan of three rate rises this year.

Currently, the market is pricing in a 36% chance of a rate hike in March and a 26% chance of three hikes this year.

We have an additional three fed members speaking today. Let's see if they can get those numbers up.

Greece (cont)

The Greek debt crisis is unsustainable. At the moment, the country owes more money than they can feasibly pay back.

Many were hoping for a swift resolution in Brussels before the elections in France blow the issue wide open. However, at this point, a swift resolution seems impossible and negotiations will again go down to the wire and will most likely be drawn out until July when their next payments are due.

For a full explanation of the Greek Debt Crisis, there's an excellent series on YouTube featuring Yanis Varoufakis. The former Greek finance minister who spat in the faces of the eurocrats and the only one man enough to tell them the truth to their faces.

What about the Pound?

The first item, the Brexit debates continue in the House of Lords. It's becoming clearer that even the Lords will have trouble shooting down the proposition of Brexit or calling for a second referendum. The people have spoken and though the vote was close, it is final.

The only question now is if they want to make any minor changes or stipulations to the way the negotiations are handled.

We'll also be getting some economic data from the UK this morning as well as a speech from Governor Carney so we can expect heavy volatility on the Pound today.

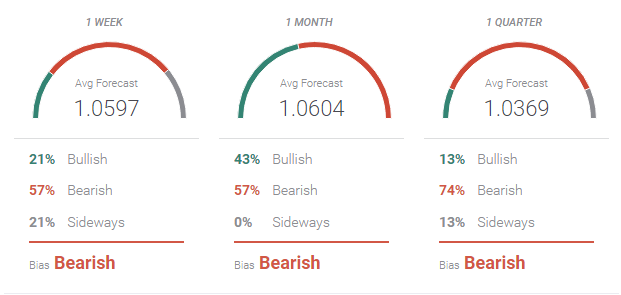

At the moment, the sentiment in eToro is showing 72% buying the GBPUSD and expecting it to go up from here.

https://www.fxstreet.com/analysis/bitcoin-on-the-move-again-201702211000

Finally, things are moving at a normal pace again and the directionless period that we've seen since Trump's confusing conference seems to be over. Hooray!!

Here are the main contributing factors...

1. Trump has picked himself a new National Security Advisor to replace the shady one that had alleged ties to Russia. Overall, the markets see this as a good thing.

2. Hawkish comments from the Federal Reserve are boosting the Buck.

3. The Greek Debt crisis has once again been swept under the rug, which is hurting the Euro.

For these three reasons and more, the US Dollar is king of the markets again. Here's a chart that shows the entire sequence of the last few days. This is the USDJPY 10 minutes per candle.

USDJPY

You can tell that Gold wants to go up but is having some trouble against the stronger Dollar. Right now we're looking at support at $1232 an ounce. If it falls below that we could be looking at $1220 before not too long.

Gold

The cherry on the top of this action packed market morning is Bitcoin with a rise of almost $40 a coin and reaching as high as $1095. If it passes $1100 today it's sure to get some very welcome love and attention.

BTC

The Fed (cont)

Fed member Harker stated that he "won't take March off the table" for a rate hike and has further reiterated the plan of three rate rises this year.

Currently, the market is pricing in a 36% chance of a rate hike in March and a 26% chance of three hikes this year.

We have an additional three fed members speaking today. Let's see if they can get those numbers up.

Greece (cont)

The Greek debt crisis is unsustainable. At the moment, the country owes more money than they can feasibly pay back.

Many were hoping for a swift resolution in Brussels before the elections in France blow the issue wide open. However, at this point, a swift resolution seems impossible and negotiations will again go down to the wire and will most likely be drawn out until July when their next payments are due.

For a full explanation of the Greek Debt Crisis, there's an excellent series on YouTube featuring Yanis Varoufakis. The former Greek finance minister who spat in the faces of the eurocrats and the only one man enough to tell them the truth to their faces.

What about the Pound?

The first item, the Brexit debates continue in the House of Lords. It's becoming clearer that even the Lords will have trouble shooting down the proposition of Brexit or calling for a second referendum. The people have spoken and though the vote was close, it is final.

The only question now is if they want to make any minor changes or stipulations to the way the negotiations are handled.

We'll also be getting some economic data from the UK this morning as well as a speech from Governor Carney so we can expect heavy volatility on the Pound today.

At the moment, the sentiment in eToro is showing 72% buying the GBPUSD and expecting it to go up from here.

https://www.fxstreet.com/analysis/bitcoin-on-the-move-again-201702211000

Valeriy Brusilovskyy

Le Pen shadow looms despite new highs

US markets are punching higher as they play catch up from yesterday’s holiday. With Le Pen’s support growing, will we continue to see a European-US divergence for stocks?

US outperforms European markets

Le Pen support drives European risk aversion

OPEC Sec.Gen sparks rally amid talk of rise to output cut

The bulls are back in charge in the US, with the divergence between US and European stock markets widening once more. Heightened political fears in Europe, ranging from Le Pen’s resurgence, to Brexit, stand in stark contrast to the overwhelming expectation of greater prosperity under Trump’s rule in the US. With US markets spiking to new all-time highs, it is simply a case of holding on for the ride as we seek to find out just how high US stocks can go.

The French elections are becoming an increasingly relevant risk to markets, with the chances of a victory for Le Pen rising with every month that passes. As the spread between French and German 10-year bond yields rises to a 4-year high, it is clear that the markets are increasingly factoring in a Le Pen victory as a distinct possibility. However, if there is anything we have learnt from polls in the UK and US, it is that the more controversial option can often be underrepresented up until the vote.

Crude prices have been a big mover today, following speculative comments from OPEC Secretary General Mohammad Barkindo, who expects the output cut compliance to not only be sustained, but built upon. Whilst the US has been gradually increasing output, the news that we could see further nations join in on trimming production has seen WTI rise to the second highest intraday price for 19-months.

US markets are punching higher as they play catch up from yesterday’s holiday. With Le Pen’s support growing, will we continue to see a European-US divergence for stocks?

US outperforms European markets

Le Pen support drives European risk aversion

OPEC Sec.Gen sparks rally amid talk of rise to output cut

The bulls are back in charge in the US, with the divergence between US and European stock markets widening once more. Heightened political fears in Europe, ranging from Le Pen’s resurgence, to Brexit, stand in stark contrast to the overwhelming expectation of greater prosperity under Trump’s rule in the US. With US markets spiking to new all-time highs, it is simply a case of holding on for the ride as we seek to find out just how high US stocks can go.

The French elections are becoming an increasingly relevant risk to markets, with the chances of a victory for Le Pen rising with every month that passes. As the spread between French and German 10-year bond yields rises to a 4-year high, it is clear that the markets are increasingly factoring in a Le Pen victory as a distinct possibility. However, if there is anything we have learnt from polls in the UK and US, it is that the more controversial option can often be underrepresented up until the vote.

Crude prices have been a big mover today, following speculative comments from OPEC Secretary General Mohammad Barkindo, who expects the output cut compliance to not only be sustained, but built upon. Whilst the US has been gradually increasing output, the news that we could see further nations join in on trimming production has seen WTI rise to the second highest intraday price for 19-months.

Valeriy Brusilovskyy

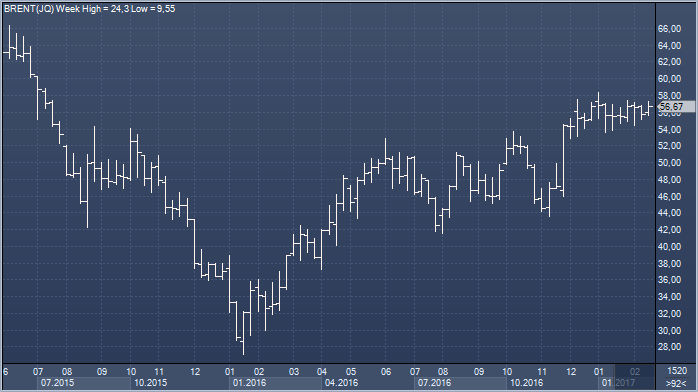

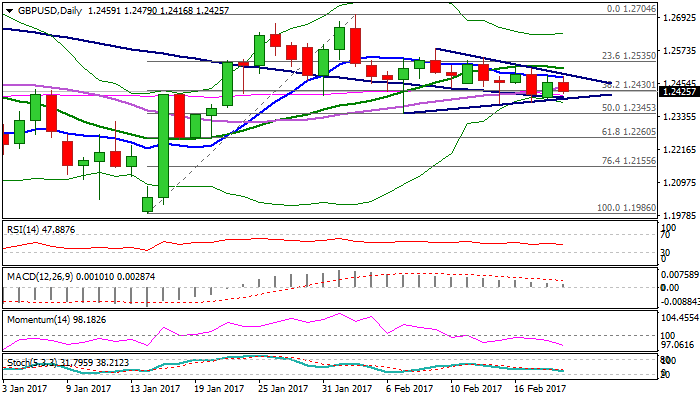

Cable is trading within near-term triangle, entrenched between daily 10 and 100SMA’s that mark key near-term levels.

The upside is limited by descending 10SMA (currently at 1.2474), while 100 SMA marks the lower pivot (currently at 1.2404).

Break of either side is needed to define fresh near-term direction, as daily studies are mixed. Extension below 100SMA would face immediate support at 1.2379 (top of descending daily cloud that so far contained downside attempts), break of which would trigger fresh weakness.

Conversely, lift above 10SMA (also upper triangle boundary) would shift near-term focus higher and expose 20SMA (1.2509), which guards upper pivots at 1.2550/80.

Res: 1.2474; 1.2509; 1.2550; 1.2580

Sup: 1.2404; 1.2379; 1.2345; 1.2300

The upside is limited by descending 10SMA (currently at 1.2474), while 100 SMA marks the lower pivot (currently at 1.2404).

Break of either side is needed to define fresh near-term direction, as daily studies are mixed. Extension below 100SMA would face immediate support at 1.2379 (top of descending daily cloud that so far contained downside attempts), break of which would trigger fresh weakness.

Conversely, lift above 10SMA (also upper triangle boundary) would shift near-term focus higher and expose 20SMA (1.2509), which guards upper pivots at 1.2550/80.

Res: 1.2474; 1.2509; 1.2550; 1.2580

Sup: 1.2404; 1.2379; 1.2345; 1.2300

Valeriy Brusilovskyy

EUR/USD Forecast 2017: politicians to displace Central bankers as market leaders

It took the FED a full year to raise rates for the second time in ten years, and the market almost two, to finally reflect in prices the imbalances between the FED and the rest of the world's Central Banks. The announcement came just a week after the ECB announced an extension of its QE program, which surpassed market's expectations, resulting in the EUR/USD pair suffering its longest losing streak since its inception in 1999: the pair is about to close in the red for a third consecutive year.

It was back in March 2014 when a debuting Janet Yellen said that the Federal Funds Rate could begin rising ‘around six months, that type of thing.‘ The EUR/USD pair opened that 2014 at 1.3760, and closed it at 1.2099, without the FED actually moving a finger. Enthusiasm over monetary policies' divergences faded during 2015, but the FOMC finally pulled the trigger, and the pair closed the year a 1.0857. Hopes for a second rate hike kept fading, all through this 2016, as despite strong, healthy growth in the jobs' sector, inflation has remained subdued. Still, a mild but steady improvement since mid-year backed the so long awaited second hike, resulting in the pair falling to fresh multi-year lows in the 1.0300 region.

But it was not just about the US and the FED. European slow growth, inflation holding close to deflationary levels and political woes, in the region, also affected the pair. Greece, Italy, Spain, Portugal, Ireland... Who would have thought that Great Britain was meant to be the first crack in the European Union? Greece was rescued again, and again, and again, but the UK held a referendum on its EU membership, won by Brexit supporters. PM Cameron resigned, and while the Pound suffered the most, the outcome dented further confidence in the Union.

Never-ending woes in Greece persists and while they hardly make it to center stage, the country's economic situation keeps worsening. Tsipras announced a Christmas bonus without its creditors' approval, who may refuse to keep on feeding the beast and could make the EUR tumble further. Same goes for Italy and its troubled banks, and government's intentions to rescue them against EU rules.

Ahh! and let's don't forget: Donald Trump won US elections and will be the 45th US President, taking over the office next January 20th, and with outrageous promises of boosting growth and inflation. Political risk in the Eurozone just keeps rising, while US inflation is picking up, getting closer to FED's 2% target for the first time in years.

In this scenario, how could the EUR do anything but fall? Indeed, is a tricky question, as the macroeconomic background is far larger than the above poor list of main 2016 events. And there's always two sides of a coin. The European situation can improve -German's data has been quite encouraging lately and is indeed the base of the region- while Trump can fail in its attempt to bring back the shine to the world's largest economy. The FED could once again falter to do as hinted in the dot-plot and stay on hold during 2017, while the ECB may beginning tapering.

Also, there are also hundreds of imponderables that we can't foresee right now, yet at this point, the EUR/USD pair is eminently bearish, and speculators are ready to give parity a test.

The pair has fallen too far, too fast following US election's peak of 1.1299, almost 1,000 pips in a month and a half. Considering the pair ranged within 1.0800 and 1.1400, measly 600 pips for almost two years, the sharp decline has left technical indicators in the daily and the weekly chart near oversold territory, but by no means the pair is giving signs of downward exhaustion and in fact, the largest one suggests that the ongoing bearish trend may continue developing, at least during the first quarter of 2017.

The first probable bearish target comes at 1.0206, July 2002 monthly high, while below it, parity comes next. By the time the common currency began circulating within much of Europe in 2002, the pair was trading around 0.8900, the next downward target should parity give up. Fall beyond this last level can only be triggered by financial and political chaos, which can result in the pair reaching its all-time low, posted in October 2000 at 0.8225.

1.0600 seems not that far away these days and it is the first critical resistance for this 2017, followed by the base of the 2015-16 range at 1.0840. A recovery above this last will confirm a bottom and favor additional gains in the common currency, with 1.1200 and 1.1460 as the next mid-term critical resistances to watch.

It took the FED a full year to raise rates for the second time in ten years, and the market almost two, to finally reflect in prices the imbalances between the FED and the rest of the world's Central Banks. The announcement came just a week after the ECB announced an extension of its QE program, which surpassed market's expectations, resulting in the EUR/USD pair suffering its longest losing streak since its inception in 1999: the pair is about to close in the red for a third consecutive year.

It was back in March 2014 when a debuting Janet Yellen said that the Federal Funds Rate could begin rising ‘around six months, that type of thing.‘ The EUR/USD pair opened that 2014 at 1.3760, and closed it at 1.2099, without the FED actually moving a finger. Enthusiasm over monetary policies' divergences faded during 2015, but the FOMC finally pulled the trigger, and the pair closed the year a 1.0857. Hopes for a second rate hike kept fading, all through this 2016, as despite strong, healthy growth in the jobs' sector, inflation has remained subdued. Still, a mild but steady improvement since mid-year backed the so long awaited second hike, resulting in the pair falling to fresh multi-year lows in the 1.0300 region.

But it was not just about the US and the FED. European slow growth, inflation holding close to deflationary levels and political woes, in the region, also affected the pair. Greece, Italy, Spain, Portugal, Ireland... Who would have thought that Great Britain was meant to be the first crack in the European Union? Greece was rescued again, and again, and again, but the UK held a referendum on its EU membership, won by Brexit supporters. PM Cameron resigned, and while the Pound suffered the most, the outcome dented further confidence in the Union.

Never-ending woes in Greece persists and while they hardly make it to center stage, the country's economic situation keeps worsening. Tsipras announced a Christmas bonus without its creditors' approval, who may refuse to keep on feeding the beast and could make the EUR tumble further. Same goes for Italy and its troubled banks, and government's intentions to rescue them against EU rules.

Ahh! and let's don't forget: Donald Trump won US elections and will be the 45th US President, taking over the office next January 20th, and with outrageous promises of boosting growth and inflation. Political risk in the Eurozone just keeps rising, while US inflation is picking up, getting closer to FED's 2% target for the first time in years.

In this scenario, how could the EUR do anything but fall? Indeed, is a tricky question, as the macroeconomic background is far larger than the above poor list of main 2016 events. And there's always two sides of a coin. The European situation can improve -German's data has been quite encouraging lately and is indeed the base of the region- while Trump can fail in its attempt to bring back the shine to the world's largest economy. The FED could once again falter to do as hinted in the dot-plot and stay on hold during 2017, while the ECB may beginning tapering.

Also, there are also hundreds of imponderables that we can't foresee right now, yet at this point, the EUR/USD pair is eminently bearish, and speculators are ready to give parity a test.

The pair has fallen too far, too fast following US election's peak of 1.1299, almost 1,000 pips in a month and a half. Considering the pair ranged within 1.0800 and 1.1400, measly 600 pips for almost two years, the sharp decline has left technical indicators in the daily and the weekly chart near oversold territory, but by no means the pair is giving signs of downward exhaustion and in fact, the largest one suggests that the ongoing bearish trend may continue developing, at least during the first quarter of 2017.

The first probable bearish target comes at 1.0206, July 2002 monthly high, while below it, parity comes next. By the time the common currency began circulating within much of Europe in 2002, the pair was trading around 0.8900, the next downward target should parity give up. Fall beyond this last level can only be triggered by financial and political chaos, which can result in the pair reaching its all-time low, posted in October 2000 at 0.8225.

1.0600 seems not that far away these days and it is the first critical resistance for this 2017, followed by the base of the 2015-16 range at 1.0840. A recovery above this last will confirm a bottom and favor additional gains in the common currency, with 1.1200 and 1.1460 as the next mid-term critical resistances to watch.

Valeriy Brusilovskyy

2017.02.21

It's a kind of important news by my opinion, I 'm happy that you agree with me!

Valeriy Brusilovskyy

Danske Bank: Трамп может вернуть рынки в состояние эйфории

После первоначальной эйфории от победы Трампа, обещавшего агрессивные фискальные и налоговые меры, а также ослабление регулирования, наступило затишье, связанное с тем, что рынки так и не получили больше информации о том, какие же меры, в конечном итоге, будут предложены новой администрацией. Последняя куда больше активности проявила в части иммиграционной политики и поддержания неопределенности в части будущих взаимоотношений США с основными торговыми партнерами.

В Danske Bank, однако, полагают, что вскоре затишье будет нарушено, и видят потенциал для восстановления оптимизма по поводу экономической политики 45 американского президента США. Во-первых, Трамп, наконец, получил утверждение (13 февраля) Стивена Мнучина на пост главы Казначейства США, а также обещал 28 февраля предоставить детали своей налоговой реформы. Таковая, вероятно, будет представлять собой некую комбинацию послаблений в налогах для корпораций и налога на доходы и корректировку налогов на импорт. Кроме того, Трамп движется в сторону отмены законодательного акта Додда — Франка и в прошлую пятницу подписал указ с требованием к главам регулирующих органов совместно с главой Казначейства США в течение 120 дней представить предложения по дерегулированию финансового сектора.

Конечно, масштабы реформы налогов и ее эффект полны неопределенности, но анонсирование налоговых послаблений произойдет на общем позитивном фоне — последние данные сигнализируют о том, что экономика США растет темпами выше трендовых. Ключевым вопросом для инвесторов является то, как повлияет прояснение планов новой администрации на инструменты с фиксированной доходностью. Пока доходность десятилетних американских облигаций, несмотря на продолжающийся рост рисковых активов, держится в узком диапазоне вблизи 2.40%. Одной из причин, по которой мы не наблюдаем роста доходностей, вероятно, является позиционирование участников рынка, однако возможно, что свою роль играет и рост спроса на американские гособлигации со стороны иностранных инвесторов — доходность по немецким и японским облигациям остается крайне низкой в свете политики ЕЦБ и Банка Японии, и в условиях растущей инфляции более высокая доходность в США привлекает долгосрочных инвесторов.

Стоит, однако, отметить, что прояснение перспектив экономической политики Трампа, вероятно, окажет влияние на оценку перспектив ставок ФРС — значительная часть членов FOMC не учитывает реализацию фискальных мер в своих прогнозах. Danske не думает, что у FOMC есть достаточно ясности относительно перспектив действий Белого Дома, чтобы повысить ставку на заседании 15 марта (вероятность, исходя из фьючерсов на ставку, составляет 40%), но риски, как считают в банке, смещены в пользу большего числа повышений ставки в этом году, нежели в данный момент учтено рынком.

Аналитики Danske Bank отмечают, что изменения в оценках перспектив ставок в США, как и в конце прошлого года, вероятно, повлияют на настрой в отношении немецких облигаций, и полагают, что доходностью по десятилетним бундесам к концу 2017 подымется до 0.90%, тогда как по аналогичным американским облигациям она достигнет 3.0%. Таким образом, возвращения темы рефляции не предполагает изменения в ожиданиях Danske относительно перспектив евро/доллара, тем более что долгосрочные модели справедливой стоимости говорят о значительной недооцененности евро. Аналитическая модель MEVA (Medium-Term Valuation*) предполагает, что справедливый курс евро к доллару составляет 1.27, модель, основанная на паритете покупательной способности, указывает на уровни в районе 1.29.

После первоначальной эйфории от победы Трампа, обещавшего агрессивные фискальные и налоговые меры, а также ослабление регулирования, наступило затишье, связанное с тем, что рынки так и не получили больше информации о том, какие же меры, в конечном итоге, будут предложены новой администрацией. Последняя куда больше активности проявила в части иммиграционной политики и поддержания неопределенности в части будущих взаимоотношений США с основными торговыми партнерами.

В Danske Bank, однако, полагают, что вскоре затишье будет нарушено, и видят потенциал для восстановления оптимизма по поводу экономической политики 45 американского президента США. Во-первых, Трамп, наконец, получил утверждение (13 февраля) Стивена Мнучина на пост главы Казначейства США, а также обещал 28 февраля предоставить детали своей налоговой реформы. Таковая, вероятно, будет представлять собой некую комбинацию послаблений в налогах для корпораций и налога на доходы и корректировку налогов на импорт. Кроме того, Трамп движется в сторону отмены законодательного акта Додда — Франка и в прошлую пятницу подписал указ с требованием к главам регулирующих органов совместно с главой Казначейства США в течение 120 дней представить предложения по дерегулированию финансового сектора.

Конечно, масштабы реформы налогов и ее эффект полны неопределенности, но анонсирование налоговых послаблений произойдет на общем позитивном фоне — последние данные сигнализируют о том, что экономика США растет темпами выше трендовых. Ключевым вопросом для инвесторов является то, как повлияет прояснение планов новой администрации на инструменты с фиксированной доходностью. Пока доходность десятилетних американских облигаций, несмотря на продолжающийся рост рисковых активов, держится в узком диапазоне вблизи 2.40%. Одной из причин, по которой мы не наблюдаем роста доходностей, вероятно, является позиционирование участников рынка, однако возможно, что свою роль играет и рост спроса на американские гособлигации со стороны иностранных инвесторов — доходность по немецким и японским облигациям остается крайне низкой в свете политики ЕЦБ и Банка Японии, и в условиях растущей инфляции более высокая доходность в США привлекает долгосрочных инвесторов.

Стоит, однако, отметить, что прояснение перспектив экономической политики Трампа, вероятно, окажет влияние на оценку перспектив ставок ФРС — значительная часть членов FOMC не учитывает реализацию фискальных мер в своих прогнозах. Danske не думает, что у FOMC есть достаточно ясности относительно перспектив действий Белого Дома, чтобы повысить ставку на заседании 15 марта (вероятность, исходя из фьючерсов на ставку, составляет 40%), но риски, как считают в банке, смещены в пользу большего числа повышений ставки в этом году, нежели в данный момент учтено рынком.

Аналитики Danske Bank отмечают, что изменения в оценках перспектив ставок в США, как и в конце прошлого года, вероятно, повлияют на настрой в отношении немецких облигаций, и полагают, что доходностью по десятилетним бундесам к концу 2017 подымется до 0.90%, тогда как по аналогичным американским облигациям она достигнет 3.0%. Таким образом, возвращения темы рефляции не предполагает изменения в ожиданиях Danske относительно перспектив евро/доллара, тем более что долгосрочные модели справедливой стоимости говорят о значительной недооцененности евро. Аналитическая модель MEVA (Medium-Term Valuation*) предполагает, что справедливый курс евро к доллару составляет 1.27, модель, основанная на паритете покупательной способности, указывает на уровни в районе 1.29.

Valeriy Brusilovskyy

Американский сланцевый бум может увязнуть в песке

За последние недели спрос на гранулированный песок для гидроразрыва резко повысился на фоне роста активности американских сланцевых производителей. Это вызвало беспокойство по поводу того, что предложение ключевого компонента для бурения может отстать от спроса в этом году. Растущий спрос на проппант объясняется резким увеличением числа активных буровых на сланцевых месторождениях США. На прошлой неделе количество установок достигло 591, максимального с октября 2015 года значения, почти вдвое восстановившись от уровней семимесячной давности. Аналитики Raymond James прогнозируют, что к концу 2018 года число буровых приблизится к 1 тыс.

Американские производители помещают проппант и другие материалы в скважины для разрыва сланцевой породы и добычи нефти. Скважины становятся все глубже и шире, что требует большего количества гранулированного песка. Индустрия проппанта оказалась под серьезным давлением в период недавнего обвала цен. Производители массово урезали расходы и расторгали (или пересматривали) контракты на поставку, подписанные в период бума. Акции некоторых крупных поставщиков проппантов резко обвалились на фоне скептицизма инвесторов. Но сейчас такие компании, как Fairmount Santrol Holdings и U.S. Silica Holdings, возвращаются к жизни и жаждут новых долгосрочных контрактов в условиях повсеместного оптимизма в отношении роста цен на черное золото.

В январе эксперты Raymond James предположили, что спрос на гранулированный песок достигнет рекордных уровней в этом году и составит 55 млн тонн, а к 2018 превысил 80 млн тонн, что на 60% выше, чем в 2014. По большей части этот прогноз основан на том, что производителям теперь требуется больше проппанта на каждую скважину. В начале прошлого года Tudor, Pickering, Holt & Co применил модель спроса, в рамках которой оценки на 2017 и 2018 годы оказались существенно недооцененными. В декабре банк пересмотрел свой прогноз и теперь ожидает рекордного роста спроса в 2018. Сокращение поставок и логистические трудности могут отправить цены на проппант к уровням 2014 года, когда в Штатах насчитывалось 1500 активных буровых.

Тейлор Робинсон, президент PLG Consulting, которая помогает компаниям решать проблемы с транспортировкой, отмечает, что спрос на гранулированный песок «существенно» повысился за последние шесть недель, и в ближайшие месяцы будет демонстрировать активный рост. «Полагаю, люди оценивают потенциальные показатели спроса и впервые обеспокоены тем, что песка может не хватить для удовлетворения спроса. Нефтепроизводители судорожно заключают долгосрочные контракты, чтобы не оказаться застигнутыми врасплох. Люди готовятся к новой волне», - поясняет Робинсон.

Рост спроса подтолкнет цены на песок вверх на 60%, и в течение ближайших 18 месяцев они достигнут $40 за тонну. На сегодняшний день затраты на проппанты составляют около $25 за тонну, а до обвала нефтяных котировок достигали $70. По мнению Криса Кина из Rangeland Energy LLC, реальный повод для беспокойства – это логистические трудности, возникающие при транспортировке больших объемов песка. Некоторые производители используют один грузовой состав (75 и более вагонов) на одну скважину. При таких объемах необходимы другие варианты транспортировки. Иначе эта проблема может подорвать рост добычи, считает Кин.

За последние недели спрос на гранулированный песок для гидроразрыва резко повысился на фоне роста активности американских сланцевых производителей. Это вызвало беспокойство по поводу того, что предложение ключевого компонента для бурения может отстать от спроса в этом году. Растущий спрос на проппант объясняется резким увеличением числа активных буровых на сланцевых месторождениях США. На прошлой неделе количество установок достигло 591, максимального с октября 2015 года значения, почти вдвое восстановившись от уровней семимесячной давности. Аналитики Raymond James прогнозируют, что к концу 2018 года число буровых приблизится к 1 тыс.

Американские производители помещают проппант и другие материалы в скважины для разрыва сланцевой породы и добычи нефти. Скважины становятся все глубже и шире, что требует большего количества гранулированного песка. Индустрия проппанта оказалась под серьезным давлением в период недавнего обвала цен. Производители массово урезали расходы и расторгали (или пересматривали) контракты на поставку, подписанные в период бума. Акции некоторых крупных поставщиков проппантов резко обвалились на фоне скептицизма инвесторов. Но сейчас такие компании, как Fairmount Santrol Holdings и U.S. Silica Holdings, возвращаются к жизни и жаждут новых долгосрочных контрактов в условиях повсеместного оптимизма в отношении роста цен на черное золото.

В январе эксперты Raymond James предположили, что спрос на гранулированный песок достигнет рекордных уровней в этом году и составит 55 млн тонн, а к 2018 превысил 80 млн тонн, что на 60% выше, чем в 2014. По большей части этот прогноз основан на том, что производителям теперь требуется больше проппанта на каждую скважину. В начале прошлого года Tudor, Pickering, Holt & Co применил модель спроса, в рамках которой оценки на 2017 и 2018 годы оказались существенно недооцененными. В декабре банк пересмотрел свой прогноз и теперь ожидает рекордного роста спроса в 2018. Сокращение поставок и логистические трудности могут отправить цены на проппант к уровням 2014 года, когда в Штатах насчитывалось 1500 активных буровых.

Тейлор Робинсон, президент PLG Consulting, которая помогает компаниям решать проблемы с транспортировкой, отмечает, что спрос на гранулированный песок «существенно» повысился за последние шесть недель, и в ближайшие месяцы будет демонстрировать активный рост. «Полагаю, люди оценивают потенциальные показатели спроса и впервые обеспокоены тем, что песка может не хватить для удовлетворения спроса. Нефтепроизводители судорожно заключают долгосрочные контракты, чтобы не оказаться застигнутыми врасплох. Люди готовятся к новой волне», - поясняет Робинсон.

Рост спроса подтолкнет цены на песок вверх на 60%, и в течение ближайших 18 месяцев они достигнут $40 за тонну. На сегодняшний день затраты на проппанты составляют около $25 за тонну, а до обвала нефтяных котировок достигали $70. По мнению Криса Кина из Rangeland Energy LLC, реальный повод для беспокойства – это логистические трудности, возникающие при транспортировке больших объемов песка. Некоторые производители используют один грузовой состав (75 и более вагонов) на одну скважину. При таких объемах необходимы другие варианты транспортировки. Иначе эта проблема может подорвать рост добычи, считает Кин.

Valeriy Brusilovskyy

United States: Reflation?

Data released this week point to a rebound in activity and inflation. Yet it is too early to interpret them as the first signs of the reflation that some are expecting. Granted, inflation has made an impressive rebound, retail sales are reassuringly robust, and the turnaround in surveys, notably in the manufacturing sector, is encouraging. Yet we shouldn’t over-interpret these results nor forget the risks.

Last summer, consumer price inflation was limited to about 1% yearon-year, whereas in January 2016, it surged to 2.5%, more or less in line with the Fed’s target. This target is not based on the consumer price index (CPI) but rather on the less volatile personal consumption expenditures price index (PCE). In the past, PCE inflation of 2% – the Fed’s target – has corresponded to CPI inflation of about 2.5%. As in the eurozone1 , the upturn in inflation must be seen above all as the result of the rebound in oil prices. The energy component of the CPI declined by about 10% year-on-year in summer 2016 but in January 2017, it rose by more than 11%. Last summer, energy was holding down inflation by roughly 0.7 percentage points, whereas today it is lifting inflation by about 0.8 pp. This perfectly explains the acceleration in prices. Core inflation, which excludes food and energy prices, has held at 2.3%, virtually the same level since last summer.

In February, the energy price base effect will be just as strong as in January, and it will not fade off until March, and then only gradually. If oil prices were to level off at current levels, the contribution of the energy component wouldn’t normalise until May, fluctuating between 0.2 and 0.4 pp through the end of the year. Inflation would continue to be driven upwards by energy, albeit to a lesser extent. As to core prices, they depend primarily on wages.

Despite its dynamic momentum, the job market has still failed to generate sustained wage growth. The US economy has been creating jobs since October 2010, more than 15 million overall in a little over six years. Yet wages have stuck to a soft trend. The average hourly wages of non-supervisory and production workers – our preferred measurement – only increased 2.4%. In 2006-2007, when the unemployment rate was as low as it is today (4.8%), wages were growing at a pace of nearly 4%. This is probably due to residual underemployment. Despite the job market’s impressive performance in recent years, there is still a large job gap. If from late 2007, job creation had been strong enough to absorb new entrants on the job market (net of those quitting it), non-farm payroll employment would be about 6.5 million higher than it is currently. Although this helps calm fears about an inflationary surge, it also calls for strong demand in order to normalise the labour market.

In this respect, recent retail sales trends are very encouraging. Reported in value terms, this data are volatile. To isolate volume effects from price effects, we have to focus only on “core” retail sales. The control group excludes vehicle and fuel sales as well as food services and building materials, and thus follows more closely the consumption of goods as defined in the national accounts. Those core sales have accelerated in recent months, rising to an annualised quarterly rate of 3.5% in January, from 1.2% in September 2016.

For the moment, manufacturing production has picked up, but not at such a robust pace. In January, output rose 2.2% (annualised 3- month rate) after a year of virtual stagnation. But prospects are definitely encouraging. First, the decline in inventory is bound to trigger a rebound in production. The inventory to sales ratio slipped from 1.40 in May to 1.35 in December. Second, surveys have picked up strongly since the beginning of the year. In January, manufacturing ISM rose to 56, a cumulative gain of 6.6 points in five months, driven by solid components for production (+12.1) and new orders (+11.5).

Surveys by the New York and Philadelphia Feds point to another upsurge in February. Our NEM composite index – using weighted data reconstructed according to the ISM calculation method – gained 1.6 points between January and February. This is a spectacular turnaround from last summer’s trough, and in February, the NEM index hit 55.3, the highest level since year-end 2014, when US industrial output began to feel the strains of the drop-off in oil prices and the dollar’s rebound.

Seen in this light, we can see the expected rebound as a catching-up movement after the sluggish growth reported by the US economy between year-end 2015 and mid-2016. A welcome performance, but nothing miraculous.

Since Donald Trump’s election, mortgage rates have increased by about 65 basis points, enough to raise fears of a slowdown in construction. So yes, we are witnessing a cyclical rally. Yet the main explanations might be nothing more than temporary factors. Moreover, the strong dollar does not leave much room for a rebound in the manufacturing sector, whose external competitiveness is also undermined by the upturn in unit labour costs. It is too early to begin popping the corks.

Data released this week point to a rebound in activity and inflation. Yet it is too early to interpret them as the first signs of the reflation that some are expecting. Granted, inflation has made an impressive rebound, retail sales are reassuringly robust, and the turnaround in surveys, notably in the manufacturing sector, is encouraging. Yet we shouldn’t over-interpret these results nor forget the risks.

Last summer, consumer price inflation was limited to about 1% yearon-year, whereas in January 2016, it surged to 2.5%, more or less in line with the Fed’s target. This target is not based on the consumer price index (CPI) but rather on the less volatile personal consumption expenditures price index (PCE). In the past, PCE inflation of 2% – the Fed’s target – has corresponded to CPI inflation of about 2.5%. As in the eurozone1 , the upturn in inflation must be seen above all as the result of the rebound in oil prices. The energy component of the CPI declined by about 10% year-on-year in summer 2016 but in January 2017, it rose by more than 11%. Last summer, energy was holding down inflation by roughly 0.7 percentage points, whereas today it is lifting inflation by about 0.8 pp. This perfectly explains the acceleration in prices. Core inflation, which excludes food and energy prices, has held at 2.3%, virtually the same level since last summer.

In February, the energy price base effect will be just as strong as in January, and it will not fade off until March, and then only gradually. If oil prices were to level off at current levels, the contribution of the energy component wouldn’t normalise until May, fluctuating between 0.2 and 0.4 pp through the end of the year. Inflation would continue to be driven upwards by energy, albeit to a lesser extent. As to core prices, they depend primarily on wages.

Despite its dynamic momentum, the job market has still failed to generate sustained wage growth. The US economy has been creating jobs since October 2010, more than 15 million overall in a little over six years. Yet wages have stuck to a soft trend. The average hourly wages of non-supervisory and production workers – our preferred measurement – only increased 2.4%. In 2006-2007, when the unemployment rate was as low as it is today (4.8%), wages were growing at a pace of nearly 4%. This is probably due to residual underemployment. Despite the job market’s impressive performance in recent years, there is still a large job gap. If from late 2007, job creation had been strong enough to absorb new entrants on the job market (net of those quitting it), non-farm payroll employment would be about 6.5 million higher than it is currently. Although this helps calm fears about an inflationary surge, it also calls for strong demand in order to normalise the labour market.

In this respect, recent retail sales trends are very encouraging. Reported in value terms, this data are volatile. To isolate volume effects from price effects, we have to focus only on “core” retail sales. The control group excludes vehicle and fuel sales as well as food services and building materials, and thus follows more closely the consumption of goods as defined in the national accounts. Those core sales have accelerated in recent months, rising to an annualised quarterly rate of 3.5% in January, from 1.2% in September 2016.

For the moment, manufacturing production has picked up, but not at such a robust pace. In January, output rose 2.2% (annualised 3- month rate) after a year of virtual stagnation. But prospects are definitely encouraging. First, the decline in inventory is bound to trigger a rebound in production. The inventory to sales ratio slipped from 1.40 in May to 1.35 in December. Second, surveys have picked up strongly since the beginning of the year. In January, manufacturing ISM rose to 56, a cumulative gain of 6.6 points in five months, driven by solid components for production (+12.1) and new orders (+11.5).

Surveys by the New York and Philadelphia Feds point to another upsurge in February. Our NEM composite index – using weighted data reconstructed according to the ISM calculation method – gained 1.6 points between January and February. This is a spectacular turnaround from last summer’s trough, and in February, the NEM index hit 55.3, the highest level since year-end 2014, when US industrial output began to feel the strains of the drop-off in oil prices and the dollar’s rebound.

Seen in this light, we can see the expected rebound as a catching-up movement after the sluggish growth reported by the US economy between year-end 2015 and mid-2016. A welcome performance, but nothing miraculous.

Since Donald Trump’s election, mortgage rates have increased by about 65 basis points, enough to raise fears of a slowdown in construction. So yes, we are witnessing a cyclical rally. Yet the main explanations might be nothing more than temporary factors. Moreover, the strong dollar does not leave much room for a rebound in the manufacturing sector, whose external competitiveness is also undermined by the upturn in unit labour costs. It is too early to begin popping the corks.

Valeriy Brusilovskyy

Added topic FIFTY TRADES OF GREY

Dear friends, I want to discuss with you interesting topic about trading rules. First of all I would like to tell you some of my rules and than interesting for me to know what rules help you to be successfull in trade. So let's start.... Rule No.1

Valeriy Brusilovskyy

Key Points:

A breakout is likely and this should be to the upside.

Long-term channel should remain intact.

The pair should reverse to the centre of the channel.

The Loonie is fast approaching a critical point where it must decide where exactly it wants to end up. On the one hand, it could finally break free of the ascending channel that has largely constrained its movements over the past months. On the other hand, a breakout from the near-term wedge could mean we see a rally back to the centre of this long-standing channel. As a result, it’s worth delving into some of the technicals to get a feel for what we can expect moving forward.

First and foremost, it’s quite clear on the daily chart that the narrowing price action of the falling wedge should lead to a breakout in one direction or the other in the very near-term. As a result of this particular wedge, the pair should be predisposed to breaking out on the upside which would also respect the downside constraint of the long-term channel. Due to this coincidence, a rally is looking much more likely than a downside breakout from a technical perspective at least.

Moreover, moving higher would, generally speaking, be inline with some of the other technical signals. Specifically, the MACD oscillator remains bullish and it wouldn’t take much in the way of buying pressure to invert the Parabolic SAR’s bias to follow suit. Additionally, both the RSI and stochastics are in neutral territory which means there is plenty of room to rally before fears that the Loonie is becoming overbought would arise.

The main deterrent that could prevent the bulls from staging a comeback is the EMA bias. As shown above, the 12, 20, and 100 day moving averages are all in a highly bearish configuration which would tend to indicate losses are set to extend moving ahead. However, on the balance of things, there seems to be more evidence suggestive of a reversal back to the centre of the channel rather than a breakout from the lower constraint of this objectively robust structure.

On the fundamental front, despite the USD’s rather baffling response to yesterday’s strong data, the outlook for the US economy is looking firmer than it has in some time. Combined with optimism over Trump’s tax policy and the jump in probability for a US rate hike to 44% in March, the market should continue to move backto the greenback which would be in line with the technical forecast.

Ultimately, keep an eye on this pair as the week draws to a close and early next week as there is likely to be at least one or two sessions remaining before a reversal is required. Furthermore, be alert for any update on that ‘phenomenal’ tax plan as it is likely to generate some waves.

https://www.fxstreet.com/analysis/whats-next-for-the-loonie-201702160510

A breakout is likely and this should be to the upside.

Long-term channel should remain intact.

The pair should reverse to the centre of the channel.

The Loonie is fast approaching a critical point where it must decide where exactly it wants to end up. On the one hand, it could finally break free of the ascending channel that has largely constrained its movements over the past months. On the other hand, a breakout from the near-term wedge could mean we see a rally back to the centre of this long-standing channel. As a result, it’s worth delving into some of the technicals to get a feel for what we can expect moving forward.

First and foremost, it’s quite clear on the daily chart that the narrowing price action of the falling wedge should lead to a breakout in one direction or the other in the very near-term. As a result of this particular wedge, the pair should be predisposed to breaking out on the upside which would also respect the downside constraint of the long-term channel. Due to this coincidence, a rally is looking much more likely than a downside breakout from a technical perspective at least.

Moreover, moving higher would, generally speaking, be inline with some of the other technical signals. Specifically, the MACD oscillator remains bullish and it wouldn’t take much in the way of buying pressure to invert the Parabolic SAR’s bias to follow suit. Additionally, both the RSI and stochastics are in neutral territory which means there is plenty of room to rally before fears that the Loonie is becoming overbought would arise.

The main deterrent that could prevent the bulls from staging a comeback is the EMA bias. As shown above, the 12, 20, and 100 day moving averages are all in a highly bearish configuration which would tend to indicate losses are set to extend moving ahead. However, on the balance of things, there seems to be more evidence suggestive of a reversal back to the centre of the channel rather than a breakout from the lower constraint of this objectively robust structure.

On the fundamental front, despite the USD’s rather baffling response to yesterday’s strong data, the outlook for the US economy is looking firmer than it has in some time. Combined with optimism over Trump’s tax policy and the jump in probability for a US rate hike to 44% in March, the market should continue to move backto the greenback which would be in line with the technical forecast.

Ultimately, keep an eye on this pair as the week draws to a close and early next week as there is likely to be at least one or two sessions remaining before a reversal is required. Furthermore, be alert for any update on that ‘phenomenal’ tax plan as it is likely to generate some waves.

https://www.fxstreet.com/analysis/whats-next-for-the-loonie-201702160510

Valeriy Brusilovskyy

Talking Points:

Asian stocks had a mixed session on Thursday

Toshiba continued to weigh on the Nikkei’s fortunes, but Chinese stocks gained

The Dollar slipped a little from one-month highs despite elevated rate-rise expectations

Thursday was a mixed session for Asian markets, with Wall Street’s enduring pep unable to prevent a slip for the Nikkei.

The Japanese benchmark was again hit by the woes of heavyweight Toshiba. It fell more than 8% on Wednesday and slipped by about half that amount on Thursday. This was thanks to reports that it may delay the sale of its flash-memory chip unit, chasing revenue following a huge hit at its US nuclear operations.

South Korea’s Kospi couldn’t hold early gains, although stocks in both Hong Kong and mainland China managed to stay up. Australia’s ASX ended a little higher. Regional data was sparse but what there was attracted interest.

Australia’s official employment stats for January beat forecasts again, but investors asked questions over the rise in part-time employment at the expense of full-time positions. Levels of foreign direct investment slid sharply in China. The statistics agency was quick to blame this on “one offs,” such as a high base of comparison and the timing of China’s New Year break. However, Beijing has been making strenuous efforts to try and attract investment this year.

Elsewhere Federal Reserve Chair Janet Yellen left the door to higher interest rates very much open in this week’s two-day testimony to Congress. Speaking on Wednesday her colleague William Dudley of the New York Fed indicated that a rise could come soon. None of this did the US Dollar much good in what was a pretty torpid Asia/Pacific foreign exchange session. It slipped a little against the Yen and the Australian Dollar, albeit from around one-month highs.

Gold prices ticked up despite the scent of higher US rates in market nostrils, probably gaining as the greenback slipped a little. Crude oil prices were steady, seemingly caught between ongoing confidence in production cuts from major producers and rising US inventory and supply.

The rest of the session will offer investors the official account of the last European Central Bank policy meeting. After that it’s all about the US, with housing starts, weekly jobless claims and the Philadelphia Fed’s business outlook all on the schedule.

Asian stocks had a mixed session on Thursday

Toshiba continued to weigh on the Nikkei’s fortunes, but Chinese stocks gained

The Dollar slipped a little from one-month highs despite elevated rate-rise expectations

Thursday was a mixed session for Asian markets, with Wall Street’s enduring pep unable to prevent a slip for the Nikkei.

The Japanese benchmark was again hit by the woes of heavyweight Toshiba. It fell more than 8% on Wednesday and slipped by about half that amount on Thursday. This was thanks to reports that it may delay the sale of its flash-memory chip unit, chasing revenue following a huge hit at its US nuclear operations.

South Korea’s Kospi couldn’t hold early gains, although stocks in both Hong Kong and mainland China managed to stay up. Australia’s ASX ended a little higher. Regional data was sparse but what there was attracted interest.

Australia’s official employment stats for January beat forecasts again, but investors asked questions over the rise in part-time employment at the expense of full-time positions. Levels of foreign direct investment slid sharply in China. The statistics agency was quick to blame this on “one offs,” such as a high base of comparison and the timing of China’s New Year break. However, Beijing has been making strenuous efforts to try and attract investment this year.

Elsewhere Federal Reserve Chair Janet Yellen left the door to higher interest rates very much open in this week’s two-day testimony to Congress. Speaking on Wednesday her colleague William Dudley of the New York Fed indicated that a rise could come soon. None of this did the US Dollar much good in what was a pretty torpid Asia/Pacific foreign exchange session. It slipped a little against the Yen and the Australian Dollar, albeit from around one-month highs.

Gold prices ticked up despite the scent of higher US rates in market nostrils, probably gaining as the greenback slipped a little. Crude oil prices were steady, seemingly caught between ongoing confidence in production cuts from major producers and rising US inventory and supply.

The rest of the session will offer investors the official account of the last European Central Bank policy meeting. After that it’s all about the US, with housing starts, weekly jobless claims and the Philadelphia Fed’s business outlook all on the schedule.

Valeriy Brusilovskyy

EUR/USD extends overnight recovery move further beyond 1.0600 handle

The EUR/USD pair extended overnight recovery move from nearly 5-week lows and held on to its strength back above 1.0600 handle.

Currently trading around 1.0620-25 region, the pair on Wednesday ended four days of losing streak and was primarily driven by a sharp pull-back in the greenback led by cautious comments from the Fed Chair Janet Yellen, who said “economic performance has been quite disappointing". The comments prompted investors to trim their long-dollar positions despite of upbeat US economic reports released on Wednesday, which dragged the pair to 1.0520 region, its lowest level since Jan. 11.

On Thursday, a mild retracement in the US treasury bond yields further weighed on the greenback and is now helping the pair to hold comfortably above 1.0600 handle.

Today's economic docket features the release of ECB monetary policy meeting minutes, while from the US initial jobless claims, building permits, housing starts and Philly Fed manufacturing index would be looked upon for fresh impetus.

Technical levels to watch

Immediate resistance on the upside is pegged near 1.0635-40 region above which the pair is likely to aim towards 1.0675-80 horizontal resistance ahead of 1.0700 round figure mark. On the flip side, weakness back below 1.0600 handle now seems to find support near 1.0575 area, which if broken seems to drag the pair back towards 1.0525-20 support area (yesterday’s lows).

The EUR/USD pair extended overnight recovery move from nearly 5-week lows and held on to its strength back above 1.0600 handle.

Currently trading around 1.0620-25 region, the pair on Wednesday ended four days of losing streak and was primarily driven by a sharp pull-back in the greenback led by cautious comments from the Fed Chair Janet Yellen, who said “economic performance has been quite disappointing". The comments prompted investors to trim their long-dollar positions despite of upbeat US economic reports released on Wednesday, which dragged the pair to 1.0520 region, its lowest level since Jan. 11.

On Thursday, a mild retracement in the US treasury bond yields further weighed on the greenback and is now helping the pair to hold comfortably above 1.0600 handle.

Today's economic docket features the release of ECB monetary policy meeting minutes, while from the US initial jobless claims, building permits, housing starts and Philly Fed manufacturing index would be looked upon for fresh impetus.

Technical levels to watch

Immediate resistance on the upside is pegged near 1.0635-40 region above which the pair is likely to aim towards 1.0675-80 horizontal resistance ahead of 1.0700 round figure mark. On the flip side, weakness back below 1.0600 handle now seems to find support near 1.0575 area, which if broken seems to drag the pair back towards 1.0525-20 support area (yesterday’s lows).

Valeriy Brusilovskyy

EUR/USD продолжает восстановление над 1.0600

EUR/USD продолжает восстанавливаться от почти 5-недельных минимумов и по-прежнему уверенно держится над отметкой 1.0600.

Сейчас пара торгуется в районе 1.0620-25 после того, как вчера прервала 4-дневную полосу снижения на фоне резкого отката доллара в ответ на осторожные комментарии главы ФРС Йеллен о том, что «экономические показатели несколько разочаровывают».

Это замечание побудило инвесторов сократить длинную позицию по USD, несмотря на позитивную статистику США, опубликованную вчера, и в итоге пара оказалась в районе минимальных с 11 января значений на 1.0520.

Еще одним фактором давления на доллар стало небольшое снижение доходности трежерис.

Сопротивление отмечено на 1.0635-40, 1.0675-80 и 1.0700 (психологический уровень). Поддержка проходит на 1.0600, 1.0575 и 1.0525-20 (вчерашние минимумы).

EUR/USD продолжает восстанавливаться от почти 5-недельных минимумов и по-прежнему уверенно держится над отметкой 1.0600.

Сейчас пара торгуется в районе 1.0620-25 после того, как вчера прервала 4-дневную полосу снижения на фоне резкого отката доллара в ответ на осторожные комментарии главы ФРС Йеллен о том, что «экономические показатели несколько разочаровывают».

Это замечание побудило инвесторов сократить длинную позицию по USD, несмотря на позитивную статистику США, опубликованную вчера, и в итоге пара оказалась в районе минимальных с 11 января значений на 1.0520.

Еще одним фактором давления на доллар стало небольшое снижение доходности трежерис.

Сопротивление отмечено на 1.0635-40, 1.0675-80 и 1.0700 (психологический уровень). Поддержка проходит на 1.0600, 1.0575 и 1.0525-20 (вчерашние минимумы).

Valeriy Brusilovskyy

China inflation rises to new multi-month highs

Asia Mid-Session Market Update: China inflation rises to new multi-month highs; Risk trade dented by NSA Flynn resignation

US Session Highlights

- (US) NY Fed Jan Survey of Consumer Expectations: inflation expectations highest since summer 2015; household spending expectations lowest since Jan 2016 - OPEC Sec Gen Barkindo: prelim numbers show a very high level of compliance with supply cut agreement - press

- (US) Pres Trump: US will be seeking to “tweak” the terms of its trade relationship with Canada.

US markets on close: Dow +0.7%, S&P500 +0.5%, Nasdaq +0.5%

- Best Sector in S&P500: Financials

- Worst Sector in S&P500: Telecom

- Biggest gainers: GT +5.9%, REGN +4.4%, NUE +4.3%, CCI +3.0%, STX +2.9%

- Biggest losers: NVDA -4.6%, ATVI -3.2%, GPS -3.0%, EQT -2.8%, EXPE -2.6%

- At the close: VIX 11.1 (+0.2pts); Treasuries: 2-yr 1.21% (flat), 10-yr 2.43% (+3bps), 30-yr 3.03% (+2bps)

US movers afterhours

- GUID: Reports Q4 $0.09 v $0.06e, R$29.5M v $28.7Me; Guides initial FY17 $0.28-0.36 to $ v $0.29e, R$112-118M v $115Me; +3.9% afterhours

- CSOD: Reports Q4 $0.00 v -$0.03e, R$109.9M v $109Me; Guides Q1 R$109-111M v $112Me; +3.9% afterhours

- BKD: Reports Q4 -$1.45 (unclear if comp) v $0.47e, R$1.21B v $1.22Be (2 est); -5.3% afterhours

- HIBB: Guides Q4 $0.53-0.55 v $0.68e, R$247M v $255Me; SSS - 2.2%; -5.4% afterhours

- AMKR: Reports Q4 $0.42 v $0.27e, R$1.02B v $1.03Be (1 est)- Guides Q1 -$0.11 to 0.05 v $0.11e, R$860-940M v $970Me, gross margin 13-17%; -10.9% afterhours

Politics

- (US) President Trump's National Security Adviser Michael Flynn resigned; Keith Kellogg is now acting National Security Adviser - financial press

- (US) Federal judge in Virginia also rules against upholding President Trump's executive order on immigration - press

- (US) Steven Mnuchin confirmed by US Senate as the next US Treasury Secretary in 53-47 vote

Asia Key economic data:

- (CN) CHINA JAN CPI M/M: 1.0% (11-month high) V 0.2% PRIOR; Y/Y: 2.5% (32-month high) V 2.4%E

- (CN) CHINA JAN PPI Y/Y: 6.9% V 6.5%E (5th straight increase and highest since Aug 2011)

- (JP) JAPAN DEC FINAL INDUSTRIAL PRODUCTION M/M: 0.7% V 0.5% PRELIM; Y/Y: 3.2% V 3.0% PRELIM

- (AU) AUSTRALIA JAN NAB BUSINESS CONFIDENCE: 10 (19-month high) V 6 PRIOR; CONDITIONS: 16 (9-year high) V 10 PRIOR

- (NZ) New Zealand Jan Food Prices M/M: +2.8% v -0.8% prior (First rise in 5 months)

- (NZ) New Zealand Jan REINZ median home price y/y: +9.4% v +11% prior; Home sales y/y: -14.7% v -10.7% prior

Asia Session Notable Observations, Speakers and Press

- "Re-flation Trump trade" sent US equities to record highs on Monday, but risk is on the back foot in the latter part of the Asia session. After days of DOJ investigations, National Security Advisor Michael Flynn has submitted his resignation after acknowledging he gave "incomplete information regarding phone calls with the Russian ambassador" about US sanctions prior to inauguration, potentially sending the US administration into damage control mode. White House press Sec Spicer will hold a press conference on Tuesday and may be faced with questions about the timing when the cabinet became aware of compromising intel on Flynn, particularly in light of Pres Trump stating Flynn had his confidence as recently as Monday. S&P futures are down slightly, Gold is up $5 from the lows above $1,330, and USD/JPY is off by 40pips below 113.30.

- China released its January CPI and PPI numbers that topped expectations while hitting multi-year highs. PPI remained especially notable as it rose for the 4th month and reached the highs not seen since 2011. CPI increase was more heavily skewed to food inflation (2.7% v 2.4% prior) as non-food component slowed to 0.7% v 2.0% prior. China Stats Bureau noted the CPI was skewed by the Lunar New Year effect, since it came in January this year as opposed to February of last year. Also of note in China, US financial press report indicating US Commerce Sec may not choose to name the country a currency manipulator, but rather designate the practice of currency manipulation as an unfair subsidy when employed by any state.

- AUD benefited from strong NAB Business Conditions reaching multi-year highs. NAB economist noted the employment index improvement was expecially notable since it had previously "stubbornly muted". Comments from UBS economist said the NAB data puts RBA into "rate hike territory".