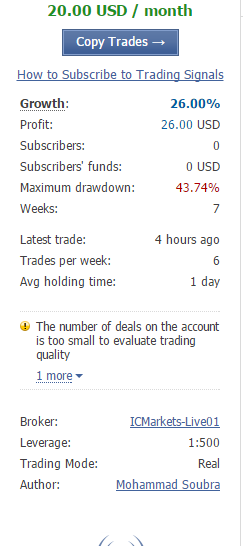

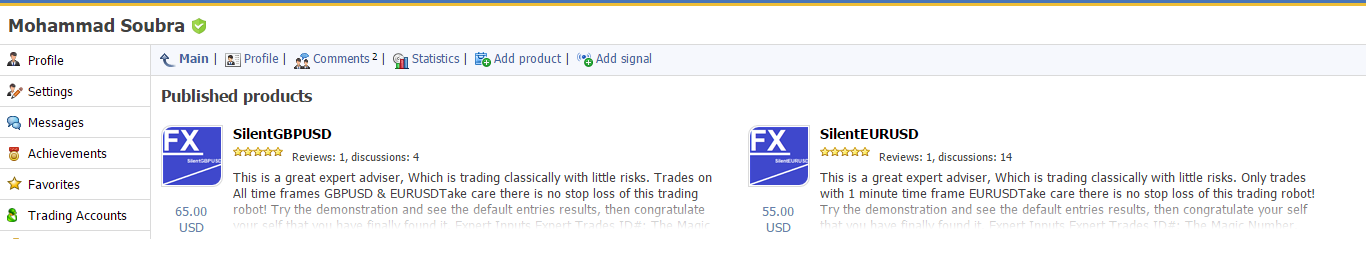

Mohammed Abdulwadud Soubra / Profile

- Information

|

8+ years

experience

|

1

products

|

7606

demo versions

|

|

134

jobs

|

0

signals

|

0

subscribers

|

"Я в форексе с 2005 года.

Ознакомьтесь с этим продуктом:

https://www.mql5.com/en/users/soubra2003/seller

Многообещающие торговые сигналы по US30 и американским акциям:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Для мгновенной поддержки, присоединяйтесь к этой группе в WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W "

Ознакомьтесь с этим продуктом:

https://www.mql5.com/en/users/soubra2003/seller

Многообещающие торговые сигналы по US30 и американским акциям:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Для мгновенной поддержки, присоединяйтесь к этой группе в WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W "

Friends

8600

Requests

Outgoing

Mohammed Abdulwadud Soubra

Added topic detect the London opening sission

Hello I am looking for the way that I can detect the London opening sission .. How to detect the opening of markets? Could I call then the Hour() function ? //--- void OnTick () { if ( Hour () == 10 ) .... //London

Share on social networks · 1

3

Mohammed Abdulwadud Soubra

Latest News

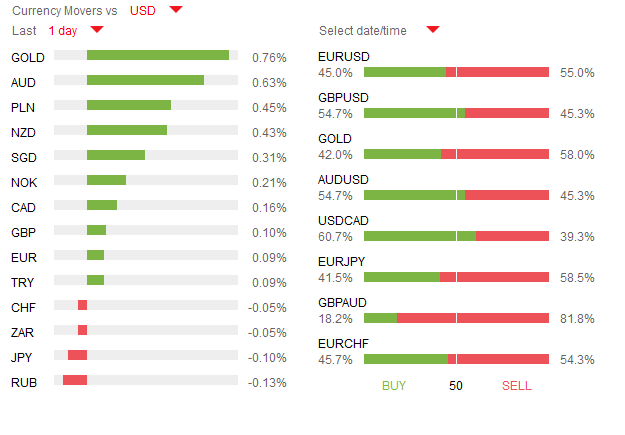

The USD surged yesterday following the release of the FOMC meeting in which it explicitly stated that most FED members were leaning towards a June rate hike if economic data improves from Q1. EURUSD, AUDUSD & NZDUSD all dropped 0.8%, 1.2% and 0.8% respectively on the day while USDJPY rose 0.9%. The options markets is now pricing in a 34% probability for the FED to hike in June, from yesterday’s 15% and 4% from a week ago. The Pound meanwhile rose 1% vs. the USD, as recent “Brexit” polls have mostly been coming in favor of the stay camp. It is important to note that FED members did mention the possibility of the UK leaving the EU as one of the near-term risks and a reason to hold off on from raising interest rates.

Today we will get retail sales from the UK, expected to have risen from last month’s figure of -1.3% to 0.6%. The ECB will publish its monetary policy meeting minutes just before noon while the US is scheduled to publish unemployment claims and the Philly FED manufacturing index which is forecasted to improve to 3.2. More importantly perhaps will be the two FED speeches scheduled for later this evening, beginning with Stanley Fischer and followed by William Dudely. Expect strength in USD in case both of these FED members repeat the language published in the FOMC minutes.

The USD surged yesterday following the release of the FOMC meeting in which it explicitly stated that most FED members were leaning towards a June rate hike if economic data improves from Q1. EURUSD, AUDUSD & NZDUSD all dropped 0.8%, 1.2% and 0.8% respectively on the day while USDJPY rose 0.9%. The options markets is now pricing in a 34% probability for the FED to hike in June, from yesterday’s 15% and 4% from a week ago. The Pound meanwhile rose 1% vs. the USD, as recent “Brexit” polls have mostly been coming in favor of the stay camp. It is important to note that FED members did mention the possibility of the UK leaving the EU as one of the near-term risks and a reason to hold off on from raising interest rates.

Today we will get retail sales from the UK, expected to have risen from last month’s figure of -1.3% to 0.6%. The ECB will publish its monetary policy meeting minutes just before noon while the US is scheduled to publish unemployment claims and the Philly FED manufacturing index which is forecasted to improve to 3.2. More importantly perhaps will be the two FED speeches scheduled for later this evening, beginning with Stanley Fischer and followed by William Dudely. Expect strength in USD in case both of these FED members repeat the language published in the FOMC minutes.

Mohammed Abdulwadud Soubra

The dollar finds itself firmer during the Asia session, with gains most pronounced against the Aussie and Kiwi, those currencies still with positive interest rates and generally higher beta vs. the US dollar. This came about partly on the back of comments from regional Fed Presidents Lockhart and Williams, both of whom were pushing the prospect of two “possibly three” rate moves this year. But don’t forget that they have been consistently wrong over the past year in their predictions for the Fed Funds rate. The prospect of a June move remains weak in my opinion and although the dollar is firmer, it’s difficult to see such gains sustained unless the data starts to consistently push a change in the anticipated rate path. The firmer than expected data has only played a minority role in the recent recovery of the dollar from the lows. The Fed meeting minutes this evening will naturally be in focus later today.

Overnight, we’ve seen firmer than expected GDP data in Japan, but this was tempered by downward revisions to the previous quarter. So in summary, these numbers are not anything to get excited about and the price action on the yen reflected that, standing only modestly weaker after the initial volatility. After yesterday’s weaker CPI data was largely brushed aside in the UK, the focus today is with the labour market numbers today. The skew of expectations in sterling interest rate markets is towards a loosening of interest rates, but this only being a risk priced for later in the year (around 25% chance). As such, it’s hard to see sterling reacting strongly to the numbers given the limited chance of a change in policy this year. The pound continues to hold up well, despite the impending EU referendum next month.

Overnight, we’ve seen firmer than expected GDP data in Japan, but this was tempered by downward revisions to the previous quarter. So in summary, these numbers are not anything to get excited about and the price action on the yen reflected that, standing only modestly weaker after the initial volatility. After yesterday’s weaker CPI data was largely brushed aside in the UK, the focus today is with the labour market numbers today. The skew of expectations in sterling interest rate markets is towards a loosening of interest rates, but this only being a risk priced for later in the year (around 25% chance). As such, it’s hard to see sterling reacting strongly to the numbers given the limited chance of a change in policy this year. The pound continues to hold up well, despite the impending EU referendum next month.

Mohammed Abdulwadud Soubra

Latest News

Equity markets sold off yesterday following comments by San Francisco FED President John Williams and Atlanta FED President Dennis Lockhart both stating that the FOMC committee could still raise interest rates 2-3 times this year. GBPUSD appreciated marginally yesterday despite inflation in the UK dropping to 0.3% year-on-year versus estimates of 0.5%. Meanwhile, the USD ended the day relatively changed even though most macro-economic indicators including inflation, housing starts, industrial production & capacity utilization rate coming in positive. During the overnight session, Japan released quarterly GDP figures which beat estimates at 0.4% q/q versus forecasts of 0.1%. Despite the Yen initially appreciating, USDJPY has reversed and is currently slightly positive on the day.

The UK will be in today’s spotlight during the European session as they get set to publish employment data which includes average earnings and claimant count change. The UK’s unemployment rate is expected to remain unchanged at 5.1%. Europe is expected to show that deflation has returned on year-on-year basis when they publish inflation data this morning. Lastly, later this evening the FOMC will release its FED minutes from their April meeting - it is interesting to note that the markets are only pricing in a 23% chance for the FED to raise interest rates at either of their next two meetings (June & July).

Equity markets sold off yesterday following comments by San Francisco FED President John Williams and Atlanta FED President Dennis Lockhart both stating that the FOMC committee could still raise interest rates 2-3 times this year. GBPUSD appreciated marginally yesterday despite inflation in the UK dropping to 0.3% year-on-year versus estimates of 0.5%. Meanwhile, the USD ended the day relatively changed even though most macro-economic indicators including inflation, housing starts, industrial production & capacity utilization rate coming in positive. During the overnight session, Japan released quarterly GDP figures which beat estimates at 0.4% q/q versus forecasts of 0.1%. Despite the Yen initially appreciating, USDJPY has reversed and is currently slightly positive on the day.

The UK will be in today’s spotlight during the European session as they get set to publish employment data which includes average earnings and claimant count change. The UK’s unemployment rate is expected to remain unchanged at 5.1%. Europe is expected to show that deflation has returned on year-on-year basis when they publish inflation data this morning. Lastly, later this evening the FOMC will release its FED minutes from their April meeting - it is interesting to note that the markets are only pricing in a 23% chance for the FED to raise interest rates at either of their next two meetings (June & July).

Mohammed Abdulwadud Soubra

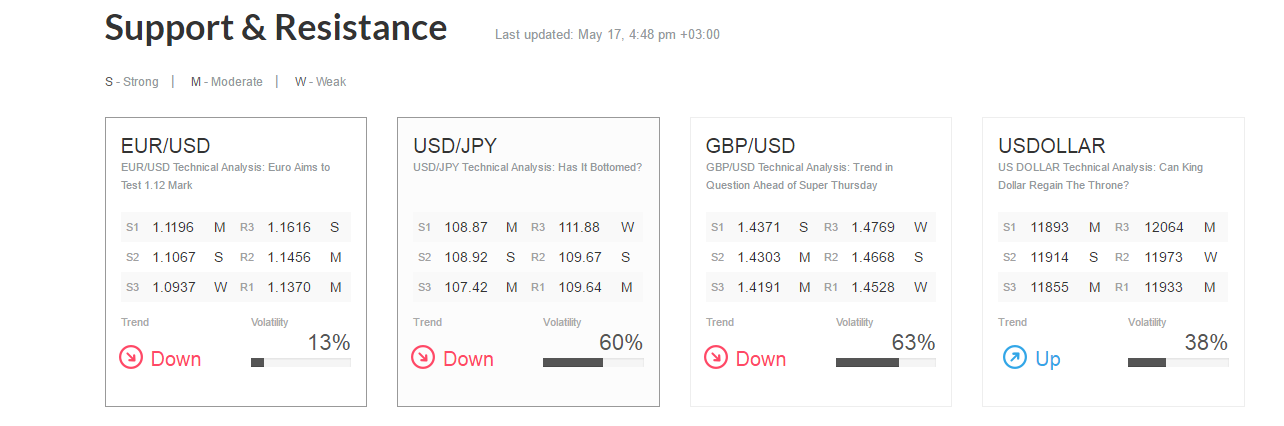

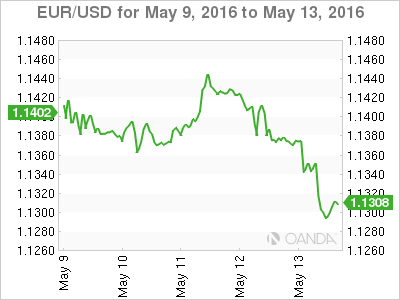

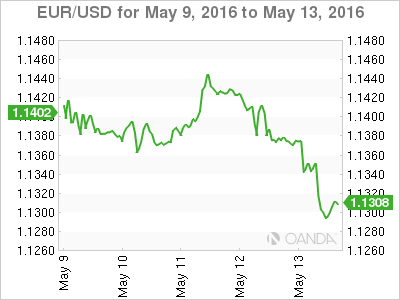

EUR/USD Technical Analysis: Euro Aims to Test 1.1200 Talking Points: EUR/USD Technical Strategy: Short at 1.1317 Euro vulnerable to deeper losses after largest 2-day drop in a month Short position entered, aiming for descent to challenge the 1.12 figure...

Share on social networks · 1

63

Mohammed Abdulwadud Soubra

GBP/USD: UK Employment Game Plan- Constructive Above 1.44 Talking Points GBPUSD 1.44-1.4530 key range in focus ahead of UK Jobs Report Updated targets & invalidation levels Check out FXCM’s Forex Trading Contest...

Share on social networks · 1

68

Mohammed Abdulwadud Soubra

No major central bank decisions this week, but plenty of indications of their thinking with minutes from the FOMC, ECB and the RBA overnight from Australia. The rate cut earlier this month was not fully expected by the market, so it should not be a surprise that the minutes were suggesting that the RBA is taking a cautious approach to the outlook. Perhaps it is not surprising was that it was the “broad based softness in prices and costs” was the main factor behind the decision to cut rates to 1.75%. They also noted the impact of “supervisory measures” on the housing market, which had tightening lending standards and taken some of the heat from the housing market, reducing the risks of lowering rates. The Aussie jumped around 1% on the back of the release, brining it above the 2.5 month lows recorded yesterday on AUDUSD at 0.7237. The focus remains with New Zealand and Canada, the other commodity bloc currencies, as the next major central banks to cut rates, with New Zealand likely to cut rates early June. AUDNZD was also marking 2.5 month lows yesterday, but the policy backdrop does argue for a more sustained correction into June.

Sterling has been on a firmer footing for the past couple of sessions, something which could be challenged by today’s inflation data. The headline rate is seen steady at 0.5%, with core prices falling from 1.5% to 1.4%. PPI data is also seen at the same time, so volatility risks are increased. Sterling has 5 weeks to go to the ‘Brexit’ referendum in June, which still has the potential to weakness the currency should the polls continue to show only a slight margin for the ‘remain’ camp. US CPI data is also seen this afternoon. The dollar has settled into a range (dollar index) after the recent recovery from the early May lows. Meanwhile, ahead of the G7 meeting at the end of the week, the pressure is reduced on the Bank of Japan in terms of the strength of the yen vs. the USD, the yen 2.6% weaker vs. the dollar from the USDJPY lows.

Sterling has been on a firmer footing for the past couple of sessions, something which could be challenged by today’s inflation data. The headline rate is seen steady at 0.5%, with core prices falling from 1.5% to 1.4%. PPI data is also seen at the same time, so volatility risks are increased. Sterling has 5 weeks to go to the ‘Brexit’ referendum in June, which still has the potential to weakness the currency should the polls continue to show only a slight margin for the ‘remain’ camp. US CPI data is also seen this afternoon. The dollar has settled into a range (dollar index) after the recent recovery from the early May lows. Meanwhile, ahead of the G7 meeting at the end of the week, the pressure is reduced on the Bank of Japan in terms of the strength of the yen vs. the USD, the yen 2.6% weaker vs. the dollar from the USDJPY lows.

Mohammed Abdulwadud Soubra

AFTER LUCKY FRIDAY 13 THE USD EXPECTED TO COOL WITH DOVISH FOMC MINUTES AND LOW INFLATION

Friday the 13 is usually considered an unlucky day but the USD rally was given a boost by the retail sales data coming in above expectations. Core retail sales (minus auto) was 0.8 percent in April and the headline retail sales number expected at a loss of 0.3 percent came in at a gain of 1.3 percent. The American consumer appears to be coming back with purchases marking yearly highs. The University of Michigan consumer sentiment survey came in at 95.8 a 12 month high. The previous gap between sentiment and spending is shrinking to the benefit of the greenback.

Inflation data will guide the forex market on the week of May 16 to 20. The United Kingdom will release its inflation report on Tuesday, May 17 at 4:30 am EDT. The United States will release on the same day at 8:30 am EDT. Canada will publish its consumer price index on Friday, May 20 at 8:30 am EDT. Inflation data in the U.S. is the most widely anticipated as it could provide insight into the path of future rate hikes.

The minutes of the Federal Open Market Committee (FOMC) meeting in April will be published on Wednesday, May 18 at 2:00 pm EDT. In their meeting on April 27 the Fed released a statement that downgraded some overseas risks, but admitted to a slowdown in the U.S. economy. The strong U.S. employment and retail sales data is showing the first quarter slowdown could be temporary. Putting the June FOMC back on the table is still premature but positive inflation growth would make the case for a summer U.S. interest rate hike more compelling.

Friday the 13 is usually considered an unlucky day but the USD rally was given a boost by the retail sales data coming in above expectations. Core retail sales (minus auto) was 0.8 percent in April and the headline retail sales number expected at a loss of 0.3 percent came in at a gain of 1.3 percent. The American consumer appears to be coming back with purchases marking yearly highs. The University of Michigan consumer sentiment survey came in at 95.8 a 12 month high. The previous gap between sentiment and spending is shrinking to the benefit of the greenback.

Inflation data will guide the forex market on the week of May 16 to 20. The United Kingdom will release its inflation report on Tuesday, May 17 at 4:30 am EDT. The United States will release on the same day at 8:30 am EDT. Canada will publish its consumer price index on Friday, May 20 at 8:30 am EDT. Inflation data in the U.S. is the most widely anticipated as it could provide insight into the path of future rate hikes.

The minutes of the Federal Open Market Committee (FOMC) meeting in April will be published on Wednesday, May 18 at 2:00 pm EDT. In their meeting on April 27 the Fed released a statement that downgraded some overseas risks, but admitted to a slowdown in the U.S. economy. The strong U.S. employment and retail sales data is showing the first quarter slowdown could be temporary. Putting the June FOMC back on the table is still premature but positive inflation growth would make the case for a summer U.S. interest rate hike more compelling.

Mohammed Abdulwadud Soubra

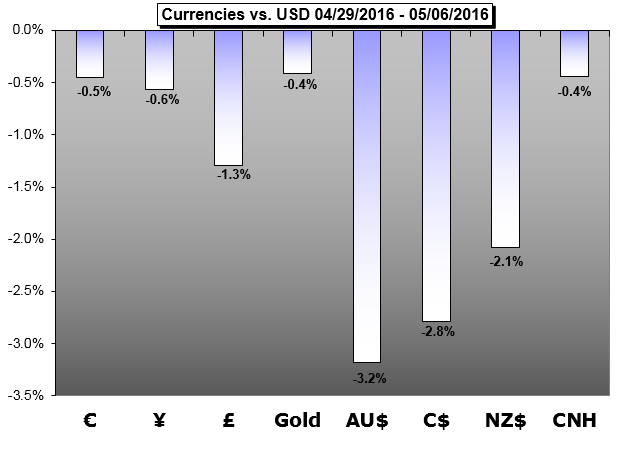

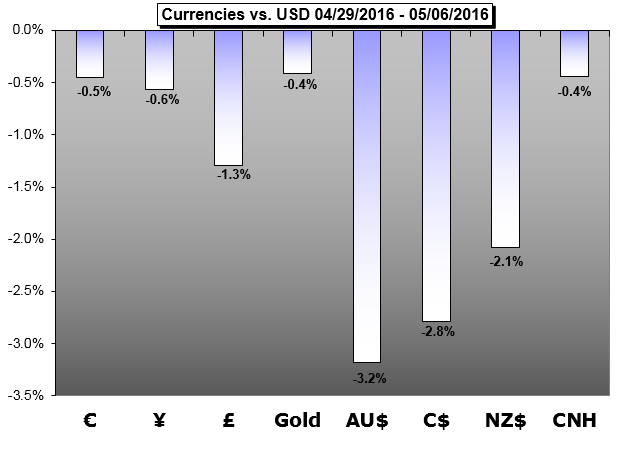

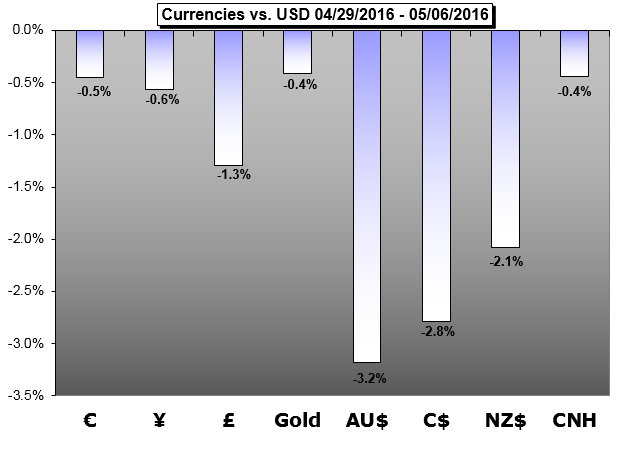

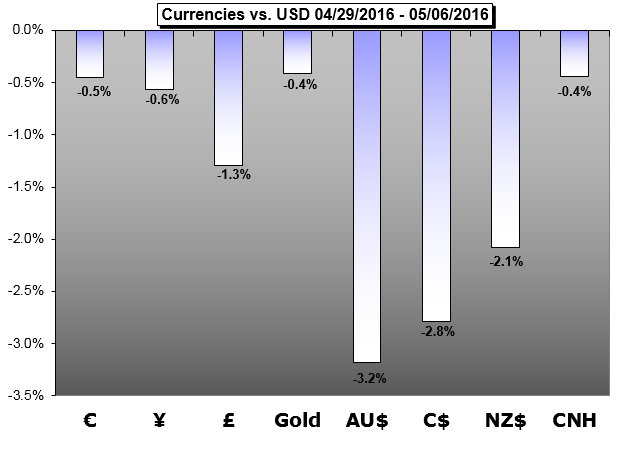

The Dollar has mounted a recover and risk trends have lost traction this past week. Will these themes carry through to the week ahead, and what will the G-7 meeting elicit from speculators?

US Dollar Forecast – Dollar Forges Bullish Reversal but May Struggle to Maintain Lift

The Greenback advanced against all of its major counterparts this past week, and the USDollar secured its strongest two-week rally since the May 2015 climb forestalled a bearish reversal.

British Pound Forecast - Mixed U.K./U.S. Data to Foster Range-Bound Conditions for GBP/USD

Mixed data prints coming out of the U.S. & U.K. may foster range-bound prices in GBP/USD especially as the Federal Reserve and the Bank of England (BoE) retain a wait-and-see approach for monetary policy.

Chinese Yuan (CNH) Forecast – Eco Policies, Commodity Volatility Add Mixed Moves to the Yuan

The onshore Yuan (CNY) extended losses against the US Dollar on Friday after PBOC fixed the daily reference rate to the weakest level in two months, to 6.5246.

Australian Dollar Forecast - Australian Dollar Torn Between RBA Bets, Sentiment TrendsTitle

The Australian Dollar may find itself torn between the influence of RBA monetary policy expectations and market-wide risk sentiment trends in the week ahead.

Gold Forecast – Gold Bulls Look to CPI, Fed Minutes for Solace

Gold prices are lower for a second consecutive week with the previous metal off 1.26% to trade at 1272 ahead of the New York close on Friday.

US Dollar Forecast – Dollar Forges Bullish Reversal but May Struggle to Maintain Lift

The Greenback advanced against all of its major counterparts this past week, and the USDollar secured its strongest two-week rally since the May 2015 climb forestalled a bearish reversal.

British Pound Forecast - Mixed U.K./U.S. Data to Foster Range-Bound Conditions for GBP/USD

Mixed data prints coming out of the U.S. & U.K. may foster range-bound prices in GBP/USD especially as the Federal Reserve and the Bank of England (BoE) retain a wait-and-see approach for monetary policy.

Chinese Yuan (CNH) Forecast – Eco Policies, Commodity Volatility Add Mixed Moves to the Yuan

The onshore Yuan (CNY) extended losses against the US Dollar on Friday after PBOC fixed the daily reference rate to the weakest level in two months, to 6.5246.

Australian Dollar Forecast - Australian Dollar Torn Between RBA Bets, Sentiment TrendsTitle

The Australian Dollar may find itself torn between the influence of RBA monetary policy expectations and market-wide risk sentiment trends in the week ahead.

Gold Forecast – Gold Bulls Look to CPI, Fed Minutes for Solace

Gold prices are lower for a second consecutive week with the previous metal off 1.26% to trade at 1272 ahead of the New York close on Friday.

Mohammed Abdulwadud Soubra

Weekly Trading Forecast: Will FX Policy and Global Risk Come Up at G-7 The Dollar has mounted a recover and risk trends have lost traction this past week. Will these themes carry through to the week ahead, and what will the G-7 meeting elicit from speculators...

Share on social networks · 1

79

Mohammed Abdulwadud Soubra

The Dollar has mounted a recover and risk trends have lost traction this past week. Will these themes carry through to the week ahead, and what will the G-7 meeting elicit from speculators?

US Dollar Forecast – Dollar Forges Bullish Reversal but May Struggle to Maintain Lift

The Greenback advanced against all of its major counterparts this past week, and the USDollar secured its strongest two-week rally since the May 2015 climb forestalled a bearish reversal.

British Pound Forecast - Mixed U.K./U.S. Data to Foster Range-Bound Conditions for GBP/USD

Mixed data prints coming out of the U.S. & U.K. may foster range-bound prices in GBP/USD especially as the Federal Reserve and the Bank of England (BoE) retain a wait-and-see approach for monetary policy.

Chinese Yuan (CNH) Forecast – Eco Policies, Commodity Volatility Add Mixed Moves to the Yuan

The onshore Yuan (CNY) extended losses against the US Dollar on Friday after PBOC fixed the daily reference rate to the weakest level in two months, to 6.5246.

Australian Dollar Forecast - Australian Dollar Torn Between RBA Bets, Sentiment TrendsTitle

The Australian Dollar may find itself torn between the influence of RBA monetary policy expectations and market-wide risk sentiment trends in the week ahead.

Gold Forecast – Gold Bulls Look to CPI, Fed Minutes for Solace

Gold prices are lower for a second consecutive week with the previous metal off 1.26% to trade at 1272 ahead of the New York close on Friday.

US Dollar Forecast – Dollar Forges Bullish Reversal but May Struggle to Maintain Lift

The Greenback advanced against all of its major counterparts this past week, and the USDollar secured its strongest two-week rally since the May 2015 climb forestalled a bearish reversal.

British Pound Forecast - Mixed U.K./U.S. Data to Foster Range-Bound Conditions for GBP/USD

Mixed data prints coming out of the U.S. & U.K. may foster range-bound prices in GBP/USD especially as the Federal Reserve and the Bank of England (BoE) retain a wait-and-see approach for monetary policy.

Chinese Yuan (CNH) Forecast – Eco Policies, Commodity Volatility Add Mixed Moves to the Yuan

The onshore Yuan (CNY) extended losses against the US Dollar on Friday after PBOC fixed the daily reference rate to the weakest level in two months, to 6.5246.

Australian Dollar Forecast - Australian Dollar Torn Between RBA Bets, Sentiment TrendsTitle

The Australian Dollar may find itself torn between the influence of RBA monetary policy expectations and market-wide risk sentiment trends in the week ahead.

Gold Forecast – Gold Bulls Look to CPI, Fed Minutes for Solace

Gold prices are lower for a second consecutive week with the previous metal off 1.26% to trade at 1272 ahead of the New York close on Friday.

: