sathish kumar / Profile

HAI, I AM TRADER. I HOPE YOU ALL DOING WELL.

I USE FIBONACCI RETRACEMENT, SUPPORT AND RESISTANCE

I USE FIBONACCI RETRACEMENT, SUPPORT AND RESISTANCE

Friends

549

Requests

Outgoing

sathish kumar

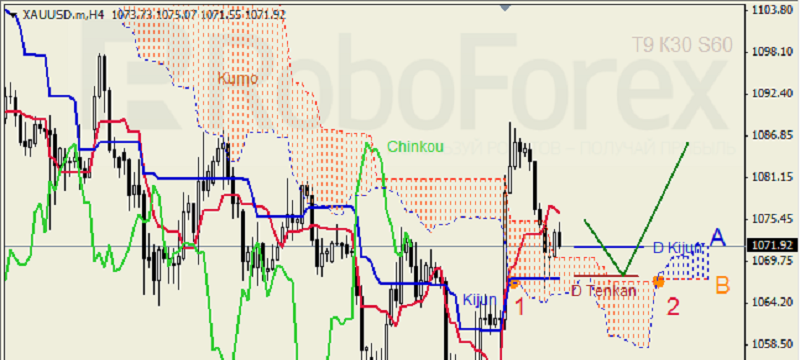

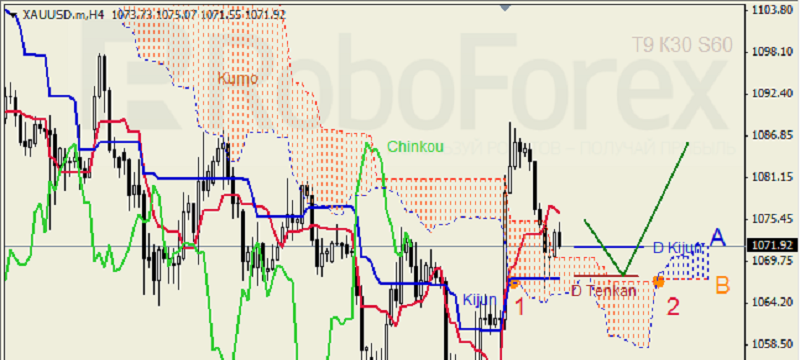

XAU USD, Time Frame H4. Indicator signals: Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1). Chinkou Lagging Span is on the chart, Ichimoku Cloud is moving upwards (2), and the price is between Tenkan-Sen and Kijun-Sen...

sathish kumar

GBP USD, Time Frame H1. Indicator signals: Tenkan-Sen and Kijun-Sen are influenced by “Dead Cross” (1); all lines are directed downwards. Ichimoku Cloud is going down (2); Chinkou Lagging Span is below the chart...

sathish kumar

GBP USD, Time Frame H4. Indicator signals: Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1), but the lines are getting closer to each other again. Ichimoku Cloud is heading up (2); Chinkou Lagging Span is below the chart...

sathish kumar

Published post Oil at multi-year low as OPEC retains market share strategy

Oil has plunged to multi year lows after OPEC in its meeting on Friday decided to stick to its policy of pumping record volumes, disregarding the global oil glut concerns. OPEC decided to produce closer to 31...

sathish kumar

Published post Treasury yields drop on flight to safety

A weak China trade data, coupled with a sharp drop in crude prices to lowest since 2009 triggered a risk-off in the markets and led to a flight to safety. The US treasuries, one of the traditional safe haven assets, advanced today, pushing the yields lower. The benchmark 10-yr yield lost 1...

sathish kumar

Published post USD/CAD off highs, back below 1.3600

The offered tone is not giving up on the Canadian dollar on Tuesday, now allowing USD/CAD to test fresh cycle highs near 1.3630 albeit easing some ground afterwards. USD/CAD boosted by oil slump The current drop of the West Texas Intermediate to multi-year lows in sub-$37...

sathish kumar

Published post Gold is the weakest safe haven today

Gold, a traditional safe haven asset, is the weakest today, despite the china-led risk-off in the European equities and US equity index futures. Gold ignores risk-off and weak USD index The metal currently trades 0.25% lower at USD 1073/Oz levels even though the USD index is down 0.27% at 98.47...

sathish kumar

Published post GBP/USD under pressure below 1.5000

GBP/USD has extended losses below the 1.50 mark and hit fresh 5-day lows ahead of the NY opening as the pound faces renewed weakness following mixed results from UK’s manufacturing and industrial production. GBP/USD accelerated the fall and hit a low of 1.4955 before finding support...

sathish kumar

Published post EUR/USD hit fresh session highs, S&P 500 futures drop 1%

The EUR/USD hit a fresh session high of 1.0890 as the S&P 500 futures dropped 1%, pointing to heightened China-led risk aversion ahead. Safe haven/funding currencies on the rise The risk-off is supporting gains in the safe haven/funding currencies like JPY, EUR. Both currencies are up 0...

sathish kumar

Published post ECB's Weidmann didn’t see easing as necessary

ECB member Jens Weidmann said that he does not believe that further easing is necessary, adding that the Eurozone is far away from a deflationary spiral, Bloomberg reports...

sathish kumar

Published post EUR/JPY could test 136.15 – Commerzbank

According to Karen Jones, Head of FICC Technical Analysis at Commerzbank, the door could be open for a test of the 136.15 level. Key Quotes “EUR/JPY has eased back from the 4 month resistance line at 134.58 and very near term we would allow for some slippage to 132...

sathish kumar

Published post AUD/USD dips below 0.7200, tests support at 100-day SMA

The Australian dollar has deepened losses versus a stronger greenback, with AUD/USD sliding below the 0.72 mark, also weighed by renewed softness in the commodity complex. AUD/USD has continued to back away from the 0...

sathish kumar

Published post USD/CAD at fresh 11-year high, as oil drops

The offered tone around CAD gathered pace in the early US session, pushing the USD/CAD to a fresh session high of 1.3606 as oil prices fell into losses...

sathish kumar

Published post EUR/CHF bid above 1.0800 – Commerzbank

In the view of Karen Jones, Head of FICC Technical Analyst at Commerzbank, the cross remains bid while above the 1.0800/12 area. Key Quotes “EUR/CHF continues to hold upside potential near term and while above 1.0800/12 we will consider that the market is bid. Initial resistance is 1...

sathish kumar

Published post OECD sees firming growth in India, stable growth in Eurozone

The leading indicators released today by the Organization for Economic Cooperation and Development (OECD) showed the growth is firming up in India and the Eurozone economy is showing signs of stabilization...

sathish kumar

Published post EUR/USD finds support in EUR/GBP rally

The uptick in the EUR/GBP cross is ensuring the EUR/USD pair remains around 1.0865 levels in the early US session. Weak US index futures support EUR The Cable fell below 1.50 levels and pushed the EUR/GBP pair higher, which is lending support the EUR/USD pair...

sathish kumar

Published post EUR/USD finds support in EUR/GBP rally

The uptick in the EUR/GBP cross is ensuring the EUR/USD pair remains around 1.0865 levels in the early US session. Weak US index futures support EUR The Cable fell below 1.50 levels and pushed the EUR/GBP pair higher, which is lending support the EUR/USD pair...

sathish kumar

Published post CAD: Stephen Poloz and Housing starts in focus - TDS

Research Team at TDS, suggests that the Canada’s November housing starts report is it today, TD’s on-consensus expectation is for the pace of new residential construction activity to remain largely unchanged at 200K. Key Quotes “Permits are expected to rebound at a respectable 2...

sathish kumar

Published post Brent oil up 1% on short covering

Brent oil futures advanced 1% following a sharp sell-off on Monday that took prices to 6-1/2 year low of USD 40.60/barrel. At the time of writing, Brent Jan futures were up 1.5% or 61 cents at USD 41.34/barrel. Prices are still well below the previous 2015 low of USD 42.22/barrel...

sathish kumar

EUR/GBP (H4): Increases after short correction Forecast: Rebound from 0.7170 support and further increases Alternative Scenario: Another test of previous resistance from the top...

: