Om Prakash Arora / Profile

- Information

|

5+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

Om Prakash Arora

Euro to US Dollar (EUR/USD) Exchange Rate Falls as Eurozone Faces Uncertainty as Covid-19 Cases Rise

The Euro to US Dollar (EUR/USD) exchange rate fell by -0.3% today, with the pairing currently trading around $1.22.

The Euro (EUR) struggled today following the release of the flash Eurozone Consumer Confidence data, which fell by -13.9.

As a result, EUR traders are becoming concerned for the Eurozone’s economy as several key economies in the bloc – included the largest, Germany – have re-entered national lockdowns.

The Euro to US Dollar (EUR/USD) exchange rate fell by -0.3% today, with the pairing currently trading around $1.22.

The Euro (EUR) struggled today following the release of the flash Eurozone Consumer Confidence data, which fell by -13.9.

As a result, EUR traders are becoming concerned for the Eurozone’s economy as several key economies in the bloc – included the largest, Germany – have re-entered national lockdowns.

alirezador

2020.12.22

you are the best

Om Prakash Arora

https://www.mql5.com/en/signals/849167

Subscribe Us!!

13.5% this month profit.

Followers reviews: Most consistent and reliable performer in MQL

Subscribe Us!!

13.5% this month profit.

Followers reviews: Most consistent and reliable performer in MQL

احمد فاطمی

2020.12.21

hi . your trades not syncing in my metatrader . also i agreed with terms and other staff in my mt5 . can you please help me that whats wrong?

Om Prakash Arora

Market Outlook: Balancing Near-Term Fears With Medium-Term Optimism

The lighter activity could make for either subdued price action or volatile activity. Brexit is a gift that keeps giving, and despite posturing to the contrary, neither side appears to want to be seen as the party that walked away. After much teeth-gnashing and finger-pointing, the US still appears set to provide modest fiscal stimulus that will help overcome the cliff of expiring income support programs. The scaled-down initiative keeps the door open to a larger package next year, depending on the two Senate races in Georgia. Early in-person voting for the January 5 election has already begun, and the polls and betting markets show both are tight races.

The lighter activity could make for either subdued price action or volatile activity. Brexit is a gift that keeps giving, and despite posturing to the contrary, neither side appears to want to be seen as the party that walked away. After much teeth-gnashing and finger-pointing, the US still appears set to provide modest fiscal stimulus that will help overcome the cliff of expiring income support programs. The scaled-down initiative keeps the door open to a larger package next year, depending on the two Senate races in Georgia. Early in-person voting for the January 5 election has already begun, and the polls and betting markets show both are tight races.

Om Prakash Arora

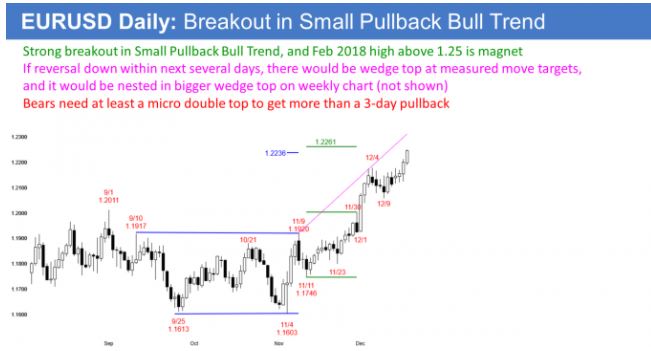

EUR/USD Rallies Again. What's Next?

The EUR/USD on the daily chart is rallying again, for the 2nd consecutive day in a Small Pullback Bull Trend that began on November 4. They want the rally to continue up to the February 2018 major lower high above 1.25, without more than a 3-day pullback.

The EUR/USD on the daily chart is rallying again, for the 2nd consecutive day in a Small Pullback Bull Trend that began on November 4. They want the rally to continue up to the February 2018 major lower high above 1.25, without more than a 3-day pullback.

Om Prakash Arora

Dollar Down Over U.S. Stimulus Hopes, Market’s “Feel-Good Momentum”

The dollar was down on Wednesday morning in Asia, after progress towards passing the latest U.S. stimulus measures increased risk appetite and turned investors away from the safe-haven dollar.

The dollar was down on Wednesday morning in Asia, after progress towards passing the latest U.S. stimulus measures increased risk appetite and turned investors away from the safe-haven dollar.

Om Prakash Arora

Chart Of The Day: AUD/NZD

AUD/NZD was our chart of the day last week, on Dec. 8, before the inverted head-and-shoulder pattern played out. But today, we are capped by the 200-day moving average for the second day in a row. This means dips back to the neckline at 1.0570 should find buyers now. The target for the inverted head-and-shoulder pattern still should target the 1.0725 level eventually.

AUD/NZD was our chart of the day last week, on Dec. 8, before the inverted head-and-shoulder pattern played out. But today, we are capped by the 200-day moving average for the second day in a row. This means dips back to the neckline at 1.0570 should find buyers now. The target for the inverted head-and-shoulder pattern still should target the 1.0725 level eventually.

Om Prakash Arora

Silence Mthusi

2020.12.31

I'm interested to subscribe u bat u don't know how do I work if I'm still new on Trader

Om Prakash Arora

EURJPY Price: $126 Resistance Level Holds, Consolidation May Continue

The bulls are struggling to break up the resistance level of $126; the ability to break it up will expose the price to $127 which may eventually place the price at the $130 price level. Should the bulls defend the $126 price level, it may reverse and decline to the support level of $124, $123, and $122.

The bulls are struggling to break up the resistance level of $126; the ability to break it up will expose the price to $127 which may eventually place the price at the $130 price level. Should the bulls defend the $126 price level, it may reverse and decline to the support level of $124, $123, and $122.

Om Prakash Arora

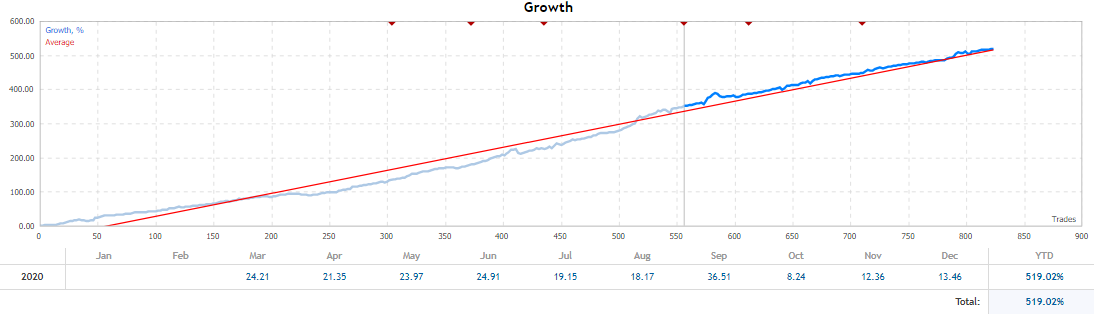

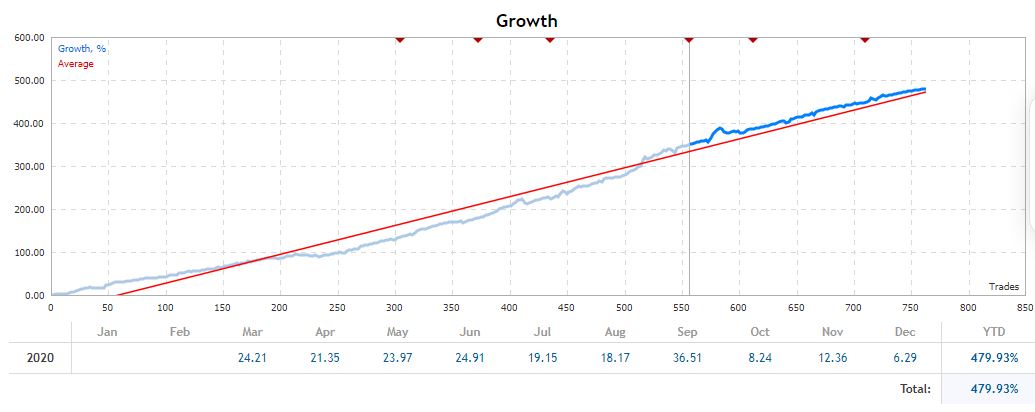

Another profitable week.

This month more than 6% done. More to go.

https://www.mql5.com/en/signals/849167

This month more than 6% done. More to go.

https://www.mql5.com/en/signals/849167

Om Prakash Arora

Serious Risk Of Post-ECB Euro Rally

Thursday’s European Central Bank monetary policy announcement is the most important event risk this week. The ECB is widely expected to ease monetary policy, making it one of the few central banks actively fighting COVID-19’s economic impact with fresh stimulus. Normally, the prospect of new easing should be negative for a currency, but investors bid EUR/USD sharply higher last month and there’s serious risk of a post-ECB euro rally.

Thursday’s European Central Bank monetary policy announcement is the most important event risk this week. The ECB is widely expected to ease monetary policy, making it one of the few central banks actively fighting COVID-19’s economic impact with fresh stimulus. Normally, the prospect of new easing should be negative for a currency, but investors bid EUR/USD sharply higher last month and there’s serious risk of a post-ECB euro rally.

Om Prakash Arora

https://www.mql5.com/en/signals/849167

Subscribe us!!

TIP: First, go to MT5->TOOLS->OPTIONS->SIGNALS (enable 1,2 and 4) + 3.0 slippage, then migrate the signal to your VPS via Navigator and check 'environment'. There you should see ''enabled'' and ''connected''.

Subscribe us!!

TIP: First, go to MT5->TOOLS->OPTIONS->SIGNALS (enable 1,2 and 4) + 3.0 slippage, then migrate the signal to your VPS via Navigator and check 'environment'. There you should see ''enabled'' and ''connected''.

Markus Christer Ekengren

2020.12.16

Hey... very good signal! :) Why just enable 1,2 and 4 and not 3?

Om Prakash Arora

https://www.mql5.com/en/signals/849167

Subscribe us!!

We believe in results and here our results for our followers. 5.7% in 1st week of December - 3 Weeks more to go.

Subscribe us!!

We believe in results and here our results for our followers. 5.7% in 1st week of December - 3 Weeks more to go.

Om Prakash Arora

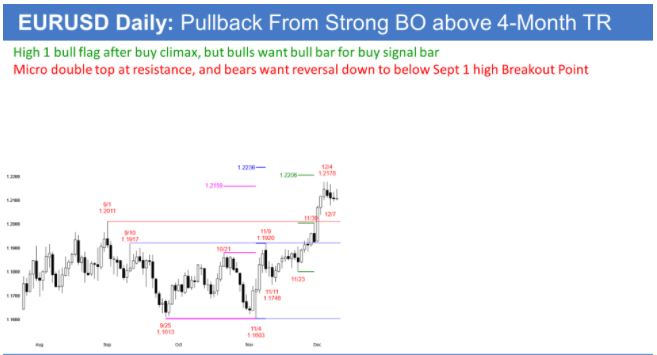

EUR/USD: Trading Range Day Likely

The EUR/USD forex market on the daily chart has gone sideways for 4 days, after a climactic breakout above a 4-month trading range. It is at the bottom of a cluster of measured move targets, which are resistance.

The EUR/USD forex market on the daily chart has gone sideways for 4 days, after a climactic breakout above a 4-month trading range. It is at the bottom of a cluster of measured move targets, which are resistance.

Om Prakash Arora

Currency Markets Remain Range Bound

Currency markets remain range-bound, with volatility being led by sterling as it bounces around on Brexit trade talk developments and rumours. The dollar index was barely changed overnight, rising just 0.19% to 90.96. The US dollar has retreated this morning in Asia though, after the Mnuchin stimulus proposal, the dollar index falling to 90.86. The December low of 90.50 remains the critical support level for the index.

With Brexit trade talks coming to a head this week—for the umpteenth time—sterling will continue to trade in a volatile 1.3200 to 1.3500 range. British Prime Minister Johnson is scheduled to hold a meeting with European Commission President Ursula von der Leyen in an attempt to break the logjam. Depending on the Boris-Brussels outcome, GBP/USD could well start with a 1.2 or a 1.4 by this time next week. I will not second-guess the road to that outcome though.

Currency markets remain range-bound, with volatility being led by sterling as it bounces around on Brexit trade talk developments and rumours. The dollar index was barely changed overnight, rising just 0.19% to 90.96. The US dollar has retreated this morning in Asia though, after the Mnuchin stimulus proposal, the dollar index falling to 90.86. The December low of 90.50 remains the critical support level for the index.

With Brexit trade talks coming to a head this week—for the umpteenth time—sterling will continue to trade in a volatile 1.3200 to 1.3500 range. British Prime Minister Johnson is scheduled to hold a meeting with European Commission President Ursula von der Leyen in an attempt to break the logjam. Depending on the Boris-Brussels outcome, GBP/USD could well start with a 1.2 or a 1.4 by this time next week. I will not second-guess the road to that outcome though.

Om Prakash Arora

Pound Erases Losses as U.K.-EU Set for Final Showdown Talks

The pound pared losses on Tuesday as the U.K. dropped parts of its controversial internal market bill, paving the way for both sides to meet in Brussels on Wednesday to clinch an agreement.

GBP/USD fell 0.09% to $1.3364, but had slumped to a session low of $1.3291 earlier in the day.

Both sides on Monday admitted that significant differences remain on three critical issues: level playing field, governance, and fisheries.

Britain reiterated hat talks would not be dragged on into the new year.

The U.K. and EU have until the end of the year to reach a deal, or run the risk of having to impose taxes on each other's goods.

The pound pared losses on Tuesday as the U.K. dropped parts of its controversial internal market bill, paving the way for both sides to meet in Brussels on Wednesday to clinch an agreement.

GBP/USD fell 0.09% to $1.3364, but had slumped to a session low of $1.3291 earlier in the day.

Both sides on Monday admitted that significant differences remain on three critical issues: level playing field, governance, and fisheries.

Britain reiterated hat talks would not be dragged on into the new year.

The U.K. and EU have until the end of the year to reach a deal, or run the risk of having to impose taxes on each other's goods.

Om Prakash Arora

https://www.mql5.com/en/signals/849167

Subscribe us

December Returns : 4.77% in 1st Week. Towards ending of a successful trading Year 2020.

Subscribe us

December Returns : 4.77% in 1st Week. Towards ending of a successful trading Year 2020.

Om Prakash Arora

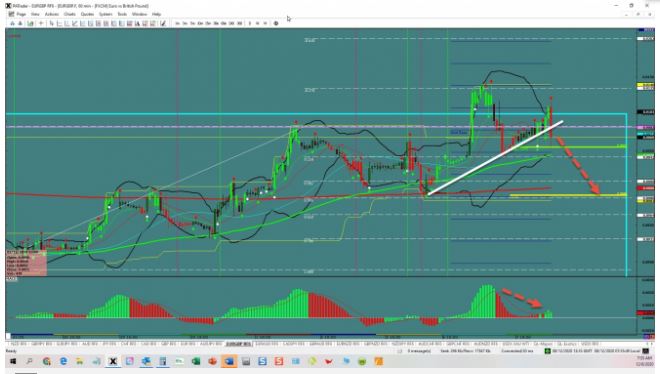

EUR/GBP Reversal EUR/GBP is currently at 0.9069 in a breakout. We are looking for the continuation to the ATR Target at 0.8990 area with a further target (0.618 Fibo) at 0.8964. Watch the USDX for any change in direction. The ATR for the pair currently is 65 pips per day

Om Prakash Arora

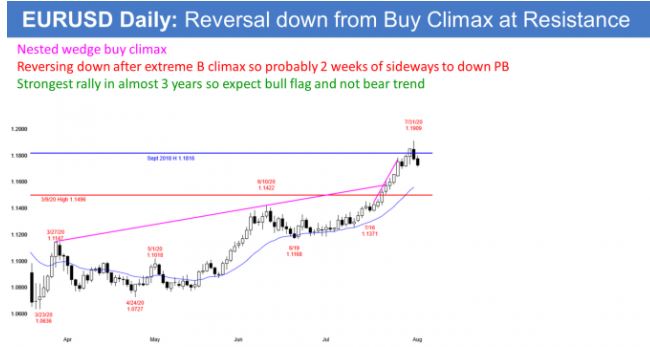

EUR/USD Bulls: Unlikely To See A Close Above The Open

The EUR/USD on the daily chart reversed down on Friday from just above the resistance of the September 2018 high. There was a parabolic wedge rally over the past several weeks and it was nested within a 4 month wedge rally.

The EUR/USD on the daily chart reversed down on Friday from just above the resistance of the September 2018 high. There was a parabolic wedge rally over the past several weeks and it was nested within a 4 month wedge rally.

Om Prakash Arora

Dollar Edges Higher as Rising Covid Cases Prompts Lockdowns

The dollar pushed higher in early European trade Monday, rebounding from multi-year lows as Covid-19 cases continue to mount and lockdowns expand, weighing on the U.S. economic recovery.

Elsewhere, GBP/USD dropped 0.9% to 1.3314, retreating from the two-and-a-half year high of $1.3540 seen on Friday, after talks over the weekend stalled over issues such as fishing rights waters around the U.K., fair competition and ways to solve future disputes.

The dollar pushed higher in early European trade Monday, rebounding from multi-year lows as Covid-19 cases continue to mount and lockdowns expand, weighing on the U.S. economic recovery.

Elsewhere, GBP/USD dropped 0.9% to 1.3314, retreating from the two-and-a-half year high of $1.3540 seen on Friday, after talks over the weekend stalled over issues such as fishing rights waters around the U.K., fair competition and ways to solve future disputes.

: