Sergey Golubev / Profile

Newdigital

Friends

3916

Requests

Outgoing

Sergey Golubev

Sergey Golubev

Comment to topic 报刊评论

美国避免违约,美股期货"卖事实" 星期四, 十月 17 2013, 12:07 GMT 在美国债限来临的最后一刻,美国民共两党最终均通过了新的法案,该法案将使政府在明年1月15日之前处于开门状态,并提高债务上限期限直至明年2月7日, 之后奥巴马签署法案,宣告两党驴象状态结束。奥巴马将于北京时间周四22:35及周五08:25就财政问题发表讲话。目前美股期货小幅回落。

Sergey Golubev

james brown

how do you post to a wall of a signal provider

i can see the reviews but cant see how to reply to others leaving a review or how to place a review any ideas

Sergey Golubev

it’s time to execute the old adage — sell the highs and buy the lows

Sergey Golubev

Comment to topic Press review

Time To Take Profits In Some Hot Stocks As The Market Again Hits New Highs Now that the stock market is again close to hitting new all-time record highs, it's time for investors to reajdust portfolios

Sergey Golubev

Paramon Trading system

Sergey Golubev

Comment to topic Market Condition Evaluation based on standard indicators in Metatrader 5

Some people asked : what is Paramon Trading system ? indicators? template? well ... ============ Please find 2 indicators and 1 template in zip attachment (see the attachment on this post). How to

Sergey Golubev

If Provider decides to make a free Signal paid, then all existing subscriptions remain active and free until the end of subscription period. After subscription is expired, you will be offered to pay to renew this subscription, which you can accept or reject. Thus, converting free subscription to paid one will not charge your account if you have previously subscribed to free signal.

Sergey Golubev

Comment to topic Could Someone Become Rich By Forex Trading? - Lets Discuss

From this thread : Frequently Asked Questions about the Signals service ============= How paid subscriptions are charged? What will happen if a free subscription becomes paid? When subscribing to a

Sergey Golubev

Sergey Golubev

Comment to topic Press review

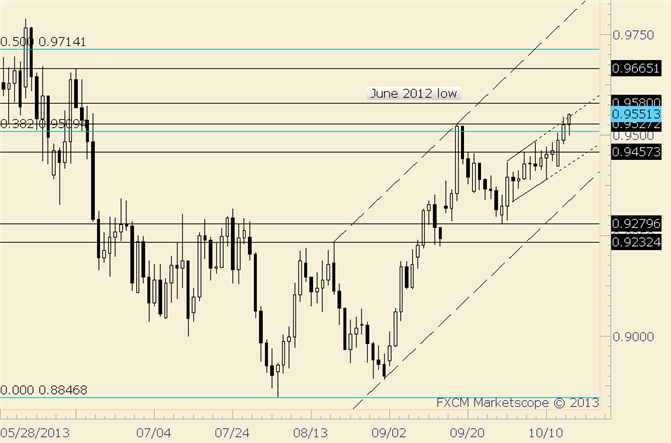

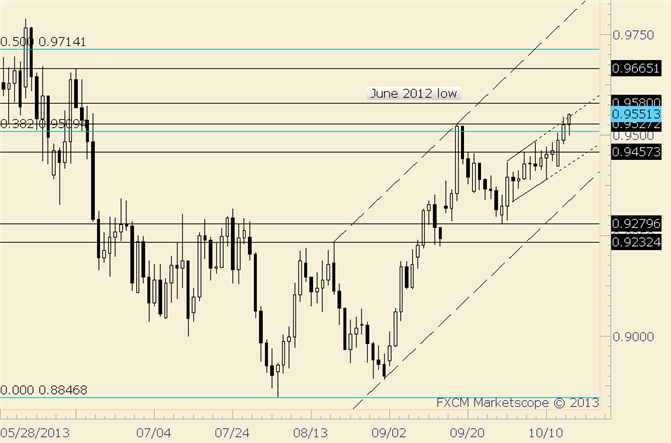

AUD/USD Grind Higher Continues; 2012 Low is at .9580 AUDUSD has extended gains following the 10/10 outside day. Price exceeded the Sep high of .9528 but failed to close above. Be aware of the 2012 low

Sergey Golubev

Sergey Golubev

Comment to topic 如何开始学习MQL5

MetaTrader 5 中进行测试的原理 进行自动化交易的想法源自交易机器人能够不间断地每天 24 小时、每周 7 天工作。机器人不会疲劳、疑惑或恐惧,它完全不会出现任何心理问题。它足以清晰地对交易规则进行规范化,以各种算法实施它们,机器人已经准备好不知疲倦地 工作。但是,首先您必须确信满足以下两个重要条件: EA 程序依据交易系统的规则执行 交易操作 ; , 在 EA

Sergey Golubev

Sergey Golubev

Comment to topic Indicators: Relative Strength Index (RSI)

RSI Indicator Forex Trading Strategy Summary

Sergey Golubev

Sergey Golubev

Comment to topic 报刊评论

外汇进阶学习∶新手三问 2013年10月16日 15:15 * 外汇新手容易把注意力放在错误的位置 * 找寻“最佳指标”,追求盈利水平,或者找寻“最佳时间框架”都是交易歧路 * 寻找持久有效的交易模式,理解关键策略的构建原理,找到适合自己的交易策略才是正途

Sergey Golubev

Sergey Golubev

Comment to topic 报刊评论

人民币即期汇率突破6.1 连续三日创新高 星期三, 十月 16 2013, 04:46 GMT 10月16日银行间询价市场美元兑人民币即期汇率开盘迅速下跌至6.0983,突破前期低点6.1007。人民币兑美元即期汇率已经连续三个交易日刷新汇改以来高点。 美元对人民币中间价报6.1408,逼近历史高点6.1406。

Sergey Golubev

Fitch Places United States' 'AAA' on Rating Watch Negative 15 October 2013

Sergey Golubev

Comment to topic Press review

Fitch Places United States' 'AAA' on Rating Watch Negative 15 October 2013: Fitch Ratings has placed the United States of America's (U.S.) 'AAA' Long-term foreign and local currency Issuer Default

Sergey Golubev

Sergey Golubev

Comment to topic 报刊评论

美股期货高位整理,油价低位震荡 星期二, 十月 15 2013, 12:16 GMT 美国民主党领袖里德和共和党领袖麦康奈尔周一的谈判进展积极,报道称两党就让政府开门持续至2014年1月15日,延长债务上限至2月7日的新提案接近达成一致协议,提振市场风险偏好情绪,推动美股迅速反弹并收高。周二美股期货高位整理。三大股指上涨0.1%左右。 里

Sergey Golubev

Mehrdad Shiri

Comment to topic Reversal Candle (best body analysis for using in a code) - part 2 : Engulfing

expert_abe_be_mfi.mq5 expert_abe_be_rsi.mq5 expert_abe_be_cci.mq5 expert_abe_be_stoch.mq5 expert_abe_be_cci.mq5 expert_abe_be_mfi.mq5 expert_abe_be_rsi.mq5 expert_abe_be_stoch.mq5

Sergey Golubev

Sergey Golubev

Comment to topic Something Interesting in Financial Video October 2013

Warren Buffett Interview on How to Read Stocks A Quick review on how Warren Buffett pick and review stocks he buys. Read more about here : =========== The Warren Buffett Way by Robert Hagstrom This

Sergey Golubev

Mehrdad Shiri

Reversal Candle (best body analysis for using in a code) - part 2 : Engulfing

hi, if you have information about : best setting for identify Engulfing pattern Candle & The relative percentage of body components & other nessecary condition for it's body or Adjacent candle, can use it in a code , can you please talk about

Sergey Golubev

Sergey Golubev

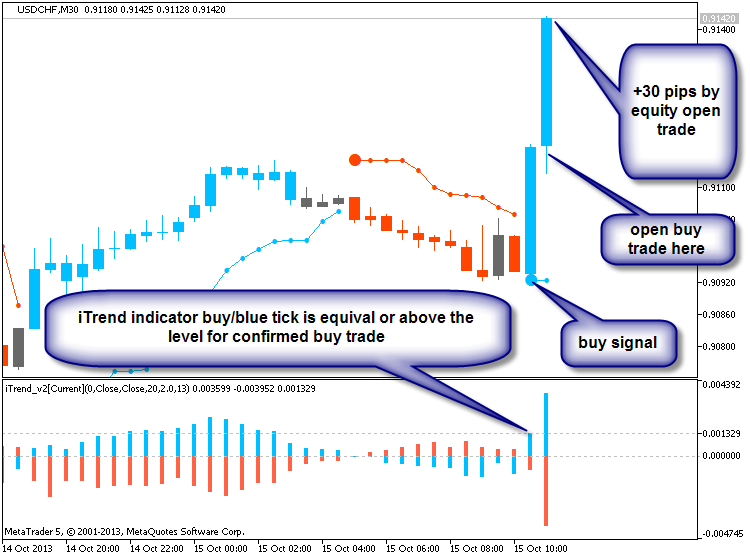

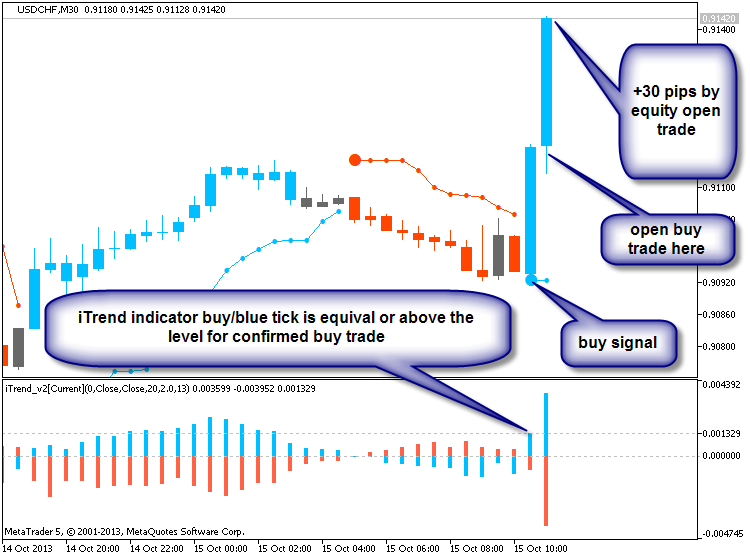

Comment to topic Brainwashing System / Asctrend System

It's going good price movement for now for USDCHF and EURUSD so it is the example about how to use this Brainwashing system in manual trading : If we are having good signal for buy or sell (on close

Sergey Golubev

Sergey Golubev

Comment to topic 报刊评论

美两党谈判显曙光 黄金周一小涨8.40美元 星期二, 十月 15 2013, 05:48 GMT 昨日回顾 金价昨日原本于3 个月低点反弹,然欧巴马总统会见两党国会领袖对谈消息传出,有望突破目前债限和政府关门等困顿局面,回拉部份黄金涨势。黄金价格小涨8.40 美元或0.7%,报每盎司1276.60 美元,约为将近3 个月低点。金价周线跌幅达3.2%。晚间电子盘交易价格上触1290

Sergey Golubev

Sergey Golubev

Comment to topic Press review

Americans Fama, Hansen, Shiller Win Nobel Prize In Economics For Stock Price Analysis This year's Nobel laureates in economics have fundamentally altered the way investors analyze, buy and sell

Sergey Golubev

Mehrdad Shiri

Comment to topic Reversal Candle (best body analysis for using in a code) - part 1 : Pinbar

summary : with use this fig. -------------------------------------------------- 1) S >= 2B -------------------------------------------------- 2) B <= 0.33 C 3) The body is in the first 33 percent of

: