Fungkulo88 / Profile

Trading is my passion

at

Fbs

Friends

7

Requests

Outgoing

Fungkulo88

Trading tips:

Never put everyting into one basket.

Example 10,000 usd.

Split it into 10 accounts.

Never put everyting into one basket.

Example 10,000 usd.

Split it into 10 accounts.

Fungkulo88

Aud/ Usd

Short Trade Ideas

Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.6917 or 0.6940.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Long entry following bullish price action on the H1 time frame immediately upon the next touch of 0.6830 or 0.6800.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade Ideas

Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.6917 or 0.6940.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Long entry following bullish price action on the H1 time frame immediately upon the next touch of 0.6830 or 0.6800.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Fungkulo88

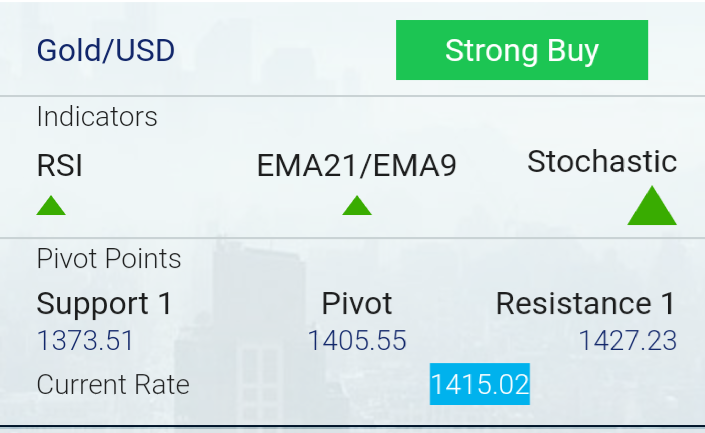

Gold has once declined after hitting a fresh 6-year high of $1452 as the chance of 50bpbs rate cut in Jul has diminished. According to the CME Fed watch tool, the probability of the 50bpbs rate cut has declined to 22.5% from 24% on Friday. US 10 year yield is trading steady and jumped more than 2% in the past two trading days.

On the flip side, near term support is around $1430 and any break below will drag the yellow metal to the next level till $1420/$1412/$1400. Major weakness only below $1380.

The near term minor resistance is around $1450 and any break above will take the yellow metal to the next level till $1465/$1500.

It is good to buy on dips around $1425-28 with SL around $1412 for the TP of $1465.

On the flip side, near term support is around $1430 and any break below will drag the yellow metal to the next level till $1420/$1412/$1400. Major weakness only below $1380.

The near term minor resistance is around $1450 and any break above will take the yellow metal to the next level till $1465/$1500.

It is good to buy on dips around $1425-28 with SL around $1412 for the TP of $1465.

Fungkulo88

My principle. ..

1 account

1 currency

1 way trade.

Clue.. Dont put everyting into one basket...

1 account

1 currency

1 way trade.

Clue.. Dont put everyting into one basket...

Fungkulo88

Holding above this area late Friday could trigger a short-covering rally into the close. The first target is an uptrending Gann angle at $1431.60.

If $1419.50 fails as support then look for a potential spike into the short-term Fibonacci level at $1411.30. If this fails then look for the late session selling to possibly extend into $1403.50 to $1403.30.

If $1419.50 fails as support then look for a potential spike into the short-term Fibonacci level at $1411.30. If this fails then look for the late session selling to possibly extend into $1403.50 to $1403.30.

Fungkulo88

Gold

The main trend is up according to the daily swing chart. However, Friday’s potentially bearish closing price reversal top may have shifted momentum to the downside. If confirmed on Monday, this could lead to the start of a 2 to 3 correction.

A trade through $1401.30 will change the main trend to down. A move through $1454.40 will signal a resumption of the uptrend.

The short-term range is $1384.70 to $1454.40. Its retracement zone at $1419.60 to $1411.30 is the first downside target.

The intermediate range is $1323.60 to $1454.40. If the trend changes to down then its retracement zone at $1389.00 to $1373.60 will become the next downside target.

The main range is $1274.60 to $1454.40. Its retracement zone at $1364.50 to $1343.30 is controlling the longer-term direction of the market.

The main trend is up according to the daily swing chart. However, Friday’s potentially bearish closing price reversal top may have shifted momentum to the downside. If confirmed on Monday, this could lead to the start of a 2 to 3 correction.

A trade through $1401.30 will change the main trend to down. A move through $1454.40 will signal a resumption of the uptrend.

The short-term range is $1384.70 to $1454.40. Its retracement zone at $1419.60 to $1411.30 is the first downside target.

The intermediate range is $1323.60 to $1454.40. If the trend changes to down then its retracement zone at $1389.00 to $1373.60 will become the next downside target.

The main range is $1274.60 to $1454.40. Its retracement zone at $1364.50 to $1343.30 is controlling the longer-term direction of the market.

Fungkulo88

Previous Cfd data for future references

Date Asset Position Entry Exit Profit Profit % Prof. % with 10x Leverage

Jun 10, 2019 USD/CHF Long 0.9914 0.9898 -0.0016 -0.16% -1.61%

Jun 10, 2019 EUR/USD Short 1.1299 1.1317 -0.0018 -0.16% -1.59%

May 29, 2019 USD/CHF Short 1.0053 1.0066 -0.0013 -0.13% -1.29%

May 24, 2019 Brent Long 68.90 68.25 -0.65 -0.94% -9.43%

May 24, 2019 Gold Short 1280.76 1285.40 -4.64 -0.36% -3.62%

May 24, 2019 USD/CAD Short 1.3442 1.3439 0.0003 0.02% 0.22%

May 22, 2019 S&P 500 Short 2855.64 2849.74 5.90 0.21% 2.07%

May 22, 2019 DJIA Short 25809.05 25755.21 53.84 0.21% 2.09%

May 22, 2019 EUR/JPY Short 123.04 122.77 0.27 0.22% 2.19%

May 22, 2019 USD/JPY Short 110.35 110.14 0.21 0.19% 1.90%

May 21, 2019 S&P 500 Long 2856.67 2856.67 0.00 0.00% 0.00%

May 21, 2019 DAX Long 12147.41 12205.35 57.94 0.48% 4.77%

May 17, 2019 Brent Short 72.57 72.28 0.29 0.40% 4.00%

May 17, 2019 S&P 500 Short 2864.31 2881.25 -16.94 -0.59% -5.91%

May 17, 2019 DJIA Short 25758.22 25646.42 111.8 0.43% 4.34%

May 15, 2019 DJIA Short 25471.64 25328.27 143.37 0.56% 5.63%

May 15, 2019 S&P 500 Short 2825.86 2848.21 -22.35 -0.79% -7.91%

May 15, 2019 DAX Short 11908.24 11868.74 39.5 0.33% 3.32%

May 15, 2019 Brent Short 70.96 71.59 -0.63 -0.89% -8.88%

May 14, 2019 DAX Long 11966.70 12039.00 72.3 0.60% 6.04%

May 14, 2019 S&P 500 Long 2830.87 2850.57 19.7 0.70% 6.96%

May 14, 2019 DJIA Long 25491.17 25672.85 181.68 0.71% 7.13%

May 13, 2019 GBP/USD Long 1.3018 1.3034 0.0016 0.12% 1.23%

May 08, 2019 USD/CAD Short 1.3453 1.3489 -0.0036 -0.27% -2.68%

May 07, 2019 Crude Short 61.53 60.75 0.78 1.27% 12.68%

May 07, 2019 Brent Short 70.72 70.10 0.62 0.88% 8.77%

May 06, 2019 GBP/USD Short 1.3104 1.3049 0.0055 0.42% 4.20%

Apr 26, 2019 USD/JPY Long 111.79 111.59 -0.2 -0.18% -1.79%

Apr 26, 2019 EUR/USD Long 1.1145 1.1128 -0.0017 -0.15% -1.53%

Apr 24, 2019 USD/CHF Short 1.01785 1.02145 -0.0036 -0.35% -3.54%

Apr 23, 2019 Crude Short 65.70 66.09 -0.39 -0.59% -5.94%

Apr 23, 2019 CAC40 Short 5565.13 5589.16 -24.03 -0.43% -4.32%

Apr 23, 2019 DAX Short 12183.87 12260.93 -77.06 -0.63% -6.32%

Apr 17, 2019 LTC/USD Short 78.67 80.83 -2.16 -2.75% -27.46%

Apr 16, 2019 USD/CAD Short 1.33445 1.33127 0.00318 0.24% 2.38%

Apr 16, 2019 Ethereum Long 164.05 167.31 3.26 1.99% 19.87%

Apr 16, 2019 Bitcoin Long 5097.21 5146.00 48.79 0.96% 9.57%

Apr 15, 2019 S&P 500 Short 2897.70 2910.85 -13.15 -0.45% -4.54%

Apr 11, 2019 DJIA Long 26204.67 26211.49 6.82 0.03% 0.26%

Apr 11, 2019 Gold Short 1305.98 1302.50 3.48 0.27% 2.66%

Apr 11, 2019 DAX Short 11875.00 11854.90 20.10 0.17% 1.69%

Apr 10, 2019 Crude Oil Long 64.25 64.58 0.33 0.51% 5.14%

Apr 10, 2019 Brent Oil Long 71.37 71.66 0.29 0.41% 4.06%

Apr 10, 2019 S&P 500 Long 2884.25 2891 6.75 0.23% 2.34%

Date Asset Position Entry Exit Profit Profit % Prof. % with 10x Leverage

Jun 10, 2019 USD/CHF Long 0.9914 0.9898 -0.0016 -0.16% -1.61%

Jun 10, 2019 EUR/USD Short 1.1299 1.1317 -0.0018 -0.16% -1.59%

May 29, 2019 USD/CHF Short 1.0053 1.0066 -0.0013 -0.13% -1.29%

May 24, 2019 Brent Long 68.90 68.25 -0.65 -0.94% -9.43%

May 24, 2019 Gold Short 1280.76 1285.40 -4.64 -0.36% -3.62%

May 24, 2019 USD/CAD Short 1.3442 1.3439 0.0003 0.02% 0.22%

May 22, 2019 S&P 500 Short 2855.64 2849.74 5.90 0.21% 2.07%

May 22, 2019 DJIA Short 25809.05 25755.21 53.84 0.21% 2.09%

May 22, 2019 EUR/JPY Short 123.04 122.77 0.27 0.22% 2.19%

May 22, 2019 USD/JPY Short 110.35 110.14 0.21 0.19% 1.90%

May 21, 2019 S&P 500 Long 2856.67 2856.67 0.00 0.00% 0.00%

May 21, 2019 DAX Long 12147.41 12205.35 57.94 0.48% 4.77%

May 17, 2019 Brent Short 72.57 72.28 0.29 0.40% 4.00%

May 17, 2019 S&P 500 Short 2864.31 2881.25 -16.94 -0.59% -5.91%

May 17, 2019 DJIA Short 25758.22 25646.42 111.8 0.43% 4.34%

May 15, 2019 DJIA Short 25471.64 25328.27 143.37 0.56% 5.63%

May 15, 2019 S&P 500 Short 2825.86 2848.21 -22.35 -0.79% -7.91%

May 15, 2019 DAX Short 11908.24 11868.74 39.5 0.33% 3.32%

May 15, 2019 Brent Short 70.96 71.59 -0.63 -0.89% -8.88%

May 14, 2019 DAX Long 11966.70 12039.00 72.3 0.60% 6.04%

May 14, 2019 S&P 500 Long 2830.87 2850.57 19.7 0.70% 6.96%

May 14, 2019 DJIA Long 25491.17 25672.85 181.68 0.71% 7.13%

May 13, 2019 GBP/USD Long 1.3018 1.3034 0.0016 0.12% 1.23%

May 08, 2019 USD/CAD Short 1.3453 1.3489 -0.0036 -0.27% -2.68%

May 07, 2019 Crude Short 61.53 60.75 0.78 1.27% 12.68%

May 07, 2019 Brent Short 70.72 70.10 0.62 0.88% 8.77%

May 06, 2019 GBP/USD Short 1.3104 1.3049 0.0055 0.42% 4.20%

Apr 26, 2019 USD/JPY Long 111.79 111.59 -0.2 -0.18% -1.79%

Apr 26, 2019 EUR/USD Long 1.1145 1.1128 -0.0017 -0.15% -1.53%

Apr 24, 2019 USD/CHF Short 1.01785 1.02145 -0.0036 -0.35% -3.54%

Apr 23, 2019 Crude Short 65.70 66.09 -0.39 -0.59% -5.94%

Apr 23, 2019 CAC40 Short 5565.13 5589.16 -24.03 -0.43% -4.32%

Apr 23, 2019 DAX Short 12183.87 12260.93 -77.06 -0.63% -6.32%

Apr 17, 2019 LTC/USD Short 78.67 80.83 -2.16 -2.75% -27.46%

Apr 16, 2019 USD/CAD Short 1.33445 1.33127 0.00318 0.24% 2.38%

Apr 16, 2019 Ethereum Long 164.05 167.31 3.26 1.99% 19.87%

Apr 16, 2019 Bitcoin Long 5097.21 5146.00 48.79 0.96% 9.57%

Apr 15, 2019 S&P 500 Short 2897.70 2910.85 -13.15 -0.45% -4.54%

Apr 11, 2019 DJIA Long 26204.67 26211.49 6.82 0.03% 0.26%

Apr 11, 2019 Gold Short 1305.98 1302.50 3.48 0.27% 2.66%

Apr 11, 2019 DAX Short 11875.00 11854.90 20.10 0.17% 1.69%

Apr 10, 2019 Crude Oil Long 64.25 64.58 0.33 0.51% 5.14%

Apr 10, 2019 Brent Oil Long 71.37 71.66 0.29 0.41% 4.06%

Apr 10, 2019 S&P 500 Long 2884.25 2891 6.75 0.23% 2.34%

Fungkulo88

USD / JPY

probably go down towards the 107 young level, perhaps even the 105 young level after that. Rallies more than likely are to be sold.

probably go down towards the 107 young level, perhaps even the 105 young level after that. Rallies more than likely are to be sold.

Fungkulo88

Gold today

is around $1387 and any break below will drag the yellow metal to the next level till $1380. Any break below$1380 will drag the yellow metal to $1374/$1360.

The near term minor resistance is around $1400 and any break above will take the yellow metal till $1412/$1422.

It is good to sell on rallies around $1400 with SL around $1410 for the TP of $1381.

is around $1387 and any break below will drag the yellow metal to the next level till $1380. Any break below$1380 will drag the yellow metal to $1374/$1360.

The near term minor resistance is around $1400 and any break above will take the yellow metal till $1412/$1422.

It is good to sell on rallies around $1400 with SL around $1410 for the TP of $1381.

: