William Henderson / Profile

- Information

|

11+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

I am a Trader/Writer/Pilot and have traded currencies and stock options for over a decade.

You will need to use a VPS close to Wall Street. https://www.interserver.net/vps/?id=194648

You will need to use a VPS close to Wall Street. https://www.interserver.net/vps/?id=194648

Friends

1968

Requests

Outgoing

William Henderson

Published post VPS by one the largest companies in the world.

...

Share on social networks

114

1

William Henderson

The growing risk that President #Trump could soon face possible #impeachment charges is deeply troubling for #dollar confidence and pushing investors into perceived safer havens like the #euro and #yen

http://www.scmp.com/business/companies/article/2130983/were-back-currency-wars-and-heres-why-bad-markets

http://www.scmp.com/business/companies/article/2130983/were-back-currency-wars-and-heres-why-bad-markets

William Henderson

The yen and Swiss franc are often used as funding currencies. In effect, this means the currency is borrowed and then sold, and the proceeds are used to buy a higher yielding or better-performing assets like European or emerging market equities, for example. As the heightened geopolitical tensions encouraging liquidating the assets, the funding has to be unwound, and this involves buying the previously slow yen and/or franc.

http://www.marctomarket.com/2017/08/grokking-yen.html

http://www.marctomarket.com/2017/08/grokking-yen.html

William Henderson

Dear MyForexVPS.ru customer,

According to numerous requests of our valued customers to establish presence in the USA, we are very glad to announce the opening of US based VPS location. According to the best practices, our new VPS location is in direct proximity to Wall Street, where the majority of Forex brokers' servers are located - hence we are targeting the lowest latency of one-two milliseconds.

For the time being one VPS plan is available - XPERT USA. We are going to expand our VPS plans in the nearest future.

We wish you profitable trading now on US platforms.

Best regards,

Team MyForexVPS.ru

English website: https://www.myforexvps.ru/billing/aff_en.php?aff=704

Уважаемый клиент MyForexVPS.ru

По многочисленным просьбам наших клиентов, мы рады вам сообщить о запуске новой площадки в США. Как и полагается, данная площадка расположена максимальнао близко к Wall Street, где расположена большая часть американских Форекс брокеров - соответственно пинг до серверов этих брокеров должен быть в приделах одной-двух миллисекунд.

В данный момент, и на первое время будет доступен один тариф XPERT USA. В недалёком будущем появится больше тарифов.

Желаем вам удачной торговли теперь и на американских площадках.

С уважением,

Команда MyForexVPS.ru

русский сайт: https://www.myforexvps.ru/billing/aff.php?aff=704

According to numerous requests of our valued customers to establish presence in the USA, we are very glad to announce the opening of US based VPS location. According to the best practices, our new VPS location is in direct proximity to Wall Street, where the majority of Forex brokers' servers are located - hence we are targeting the lowest latency of one-two milliseconds.

For the time being one VPS plan is available - XPERT USA. We are going to expand our VPS plans in the nearest future.

We wish you profitable trading now on US platforms.

Best regards,

Team MyForexVPS.ru

English website: https://www.myforexvps.ru/billing/aff_en.php?aff=704

Уважаемый клиент MyForexVPS.ru

По многочисленным просьбам наших клиентов, мы рады вам сообщить о запуске новой площадки в США. Как и полагается, данная площадка расположена максимальнао близко к Wall Street, где расположена большая часть американских Форекс брокеров - соответственно пинг до серверов этих брокеров должен быть в приделах одной-двух миллисекунд.

В данный момент, и на первое время будет доступен один тариф XPERT USA. В недалёком будущем появится больше тарифов.

Желаем вам удачной торговли теперь и на американских площадках.

С уважением,

Команда MyForexVPS.ru

русский сайт: https://www.myforexvps.ru/billing/aff.php?aff=704

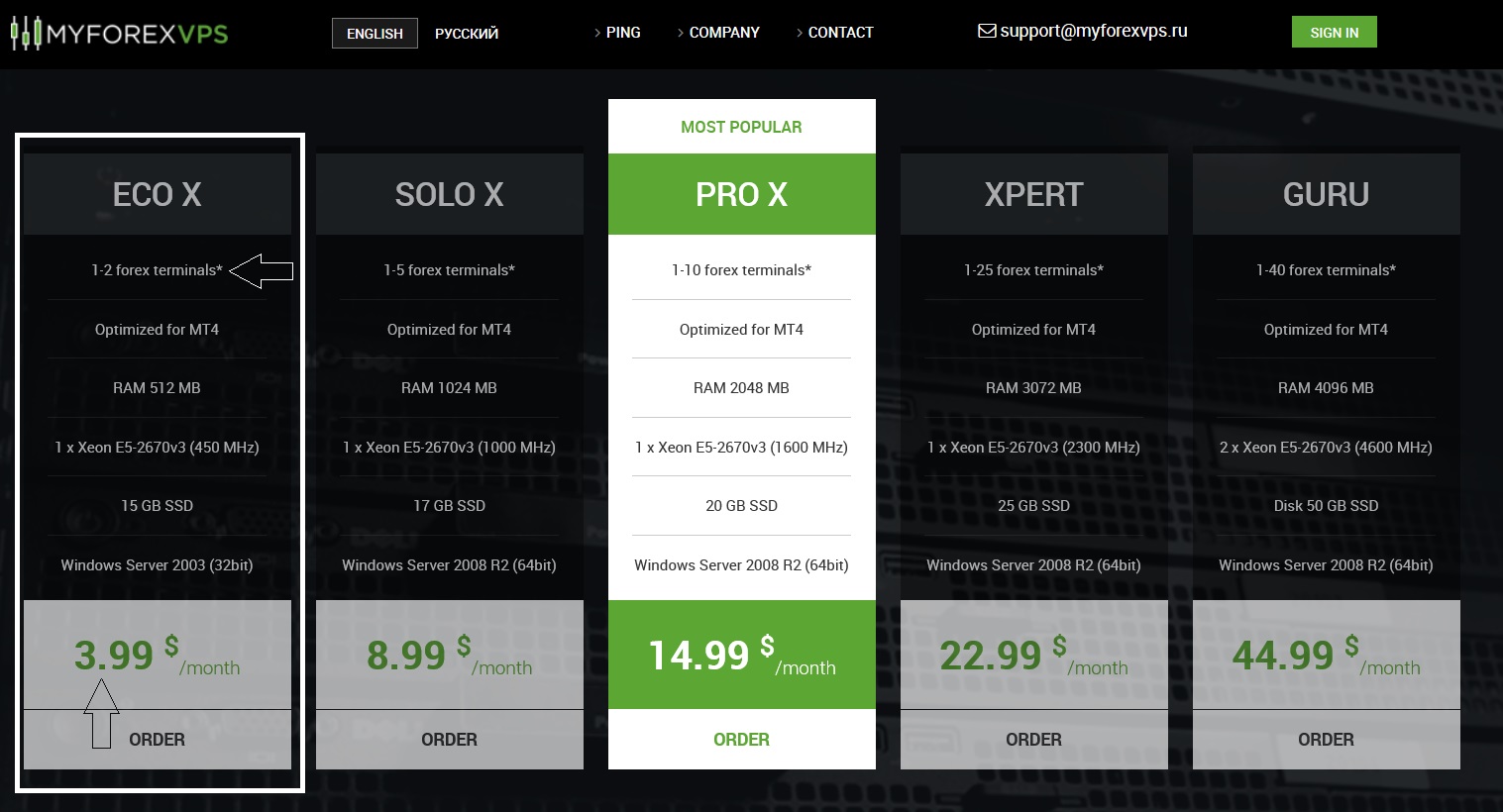

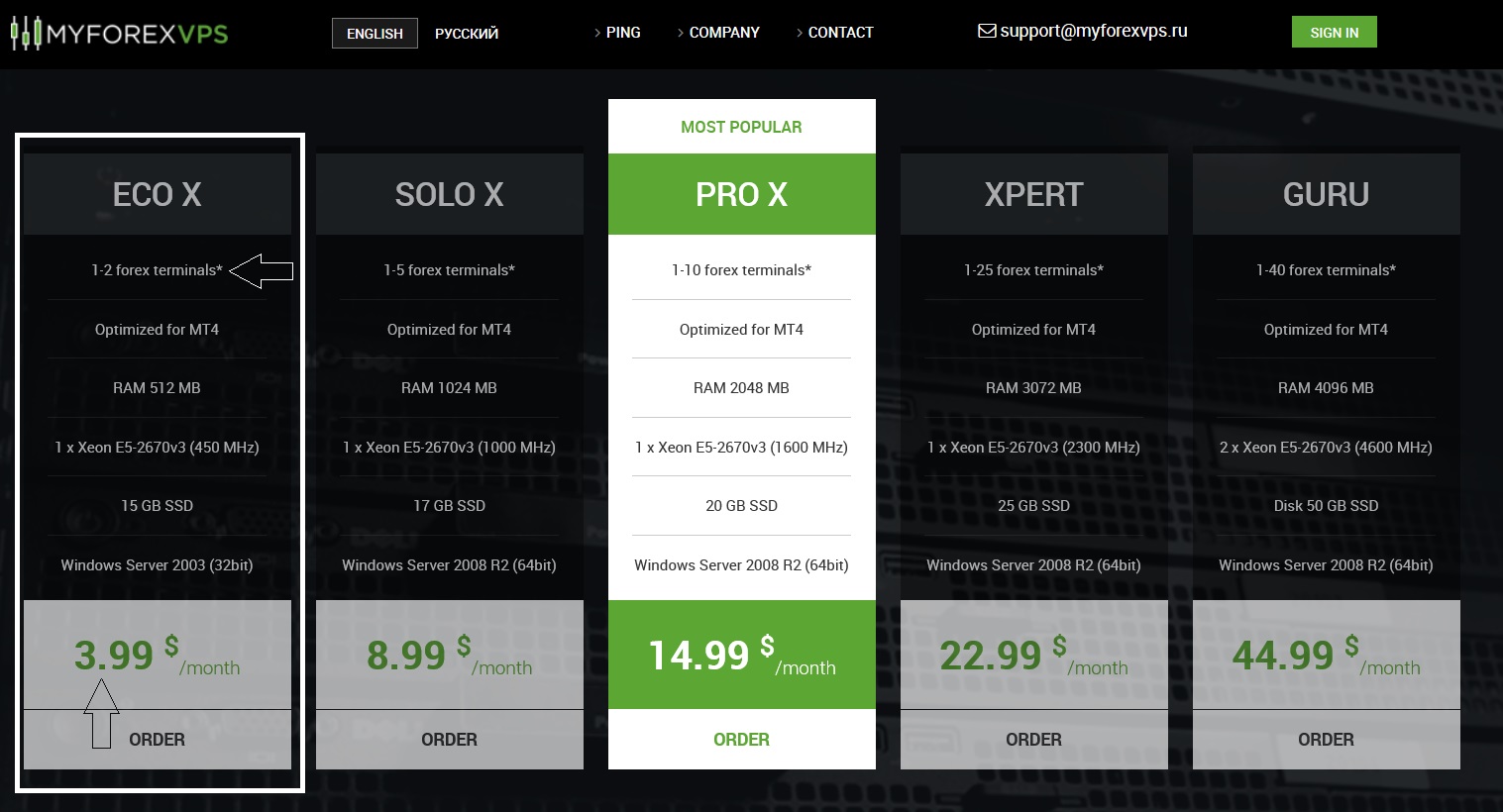

William Henderson

You will need to use a VPS to reliably receive a signal.

I use myforexvps, AAA+. Prices start $3.99/month (for 1 -2 forex terminals). RU https://www.myforexvps.ru/billing/aff.php?aff=704

English website: https://www.myforexvps.ru/billing/aff_en.php?aff=704

I use myforexvps, AAA+. Prices start $3.99/month (for 1 -2 forex terminals). RU https://www.myforexvps.ru/billing/aff.php?aff=704

English website: https://www.myforexvps.ru/billing/aff_en.php?aff=704

William Henderson

I notice some brokers are ripping people off with their swap like FortFS-Real taking negative swap for EURUSD sells. EURUSD sells should be positive swap. Be careful with your choice of broker.

William Henderson

Trump and the USD can't defy gravity much longer.

The U.S. dollar fell this week against a basket of currencies, weakening to its lowest level since mid-November on Thursday. But despite this near-term weakness, some strategists say the longer-term trend is a bullish one

http://www.cnbc.com/2017/02/03/why-the-dollars-bull-run-could-be-alive-and-kicking.html

The U.S. dollar fell this week against a basket of currencies, weakening to its lowest level since mid-November on Thursday. But despite this near-term weakness, some strategists say the longer-term trend is a bullish one

http://www.cnbc.com/2017/02/03/why-the-dollars-bull-run-could-be-alive-and-kicking.html

William Henderson

Currently no one (country / economy) is interested to have a strong currency. But USA will have difficulties getting the US dollar weak enough so that EUR/USD or GBP/USD can test any major resistances.

This, together with, more hawkish FED and more grexit, brexit and franxit talks will give us weak British pound and even weaker Euro.

Thus EUR/USD and GBP/USD down and testing major supports starting next week

This, together with, more hawkish FED and more grexit, brexit and franxit talks will give us weak British pound and even weaker Euro.

Thus EUR/USD and GBP/USD down and testing major supports starting next week

William Henderson

US policy uncertainty and Fed-ECB monetary policy divergence are likely to continue alternating as drivers of the EURUSD in the short term.

This week, the FOMC meeting could remind markets that risks are titled in the long-run towards a stronger dollar, through the possibility of more rate hikes, but the White House unpredictability has led investors to pare back short EURUSD positions since the beginning of the year.

https://www.efxnews.com/story/35215/eurusd-poor-performance-shorts-stay-some-more-weeks-barclays

This week, the FOMC meeting could remind markets that risks are titled in the long-run towards a stronger dollar, through the possibility of more rate hikes, but the White House unpredictability has led investors to pare back short EURUSD positions since the beginning of the year.

https://www.efxnews.com/story/35215/eurusd-poor-performance-shorts-stay-some-more-weeks-barclays

William Henderson

USD: USD To Recouple With US Yields. Bullish. We expect USD to recouple with rising yields and strengthen against low-yielding currencies. The reflation trade remains in tact. We don't expect President Trump's comments about USD strength to sustainably impact USD and think sustainable USD weakness would only come from disappointment on the policy front. If Trump moves towards protectionist policies, we still expect USD strength (particularly from border adjustment). However, these USD gains would be disproportionately against EM currencies. EUR: Driven by the USD. Bearish. We continue to be sellers of EURUSD*

CAD: Fade CAD Strength. Bearish.

https://www.efxnews.com/story/35206/usd-eur-jpy-gbp-chf-cad-nzd-weekly-outlook-morgan-stanley

CAD: Fade CAD Strength. Bearish.

https://www.efxnews.com/story/35206/usd-eur-jpy-gbp-chf-cad-nzd-weekly-outlook-morgan-stanley

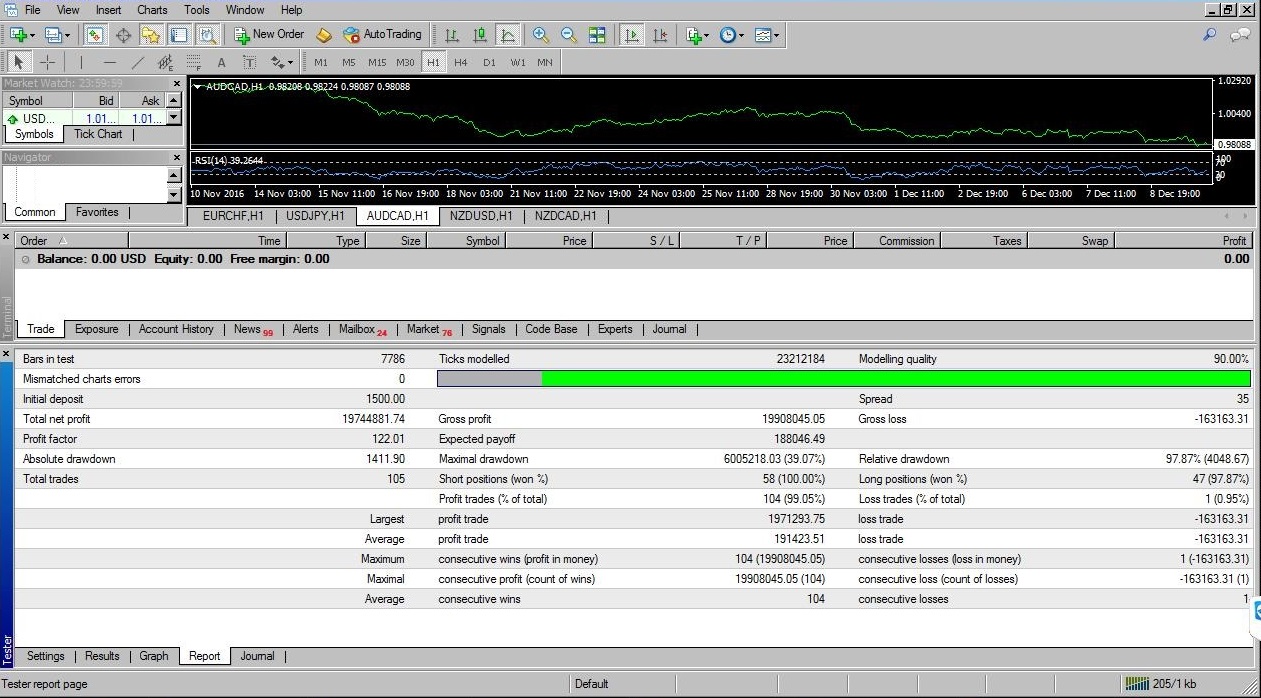

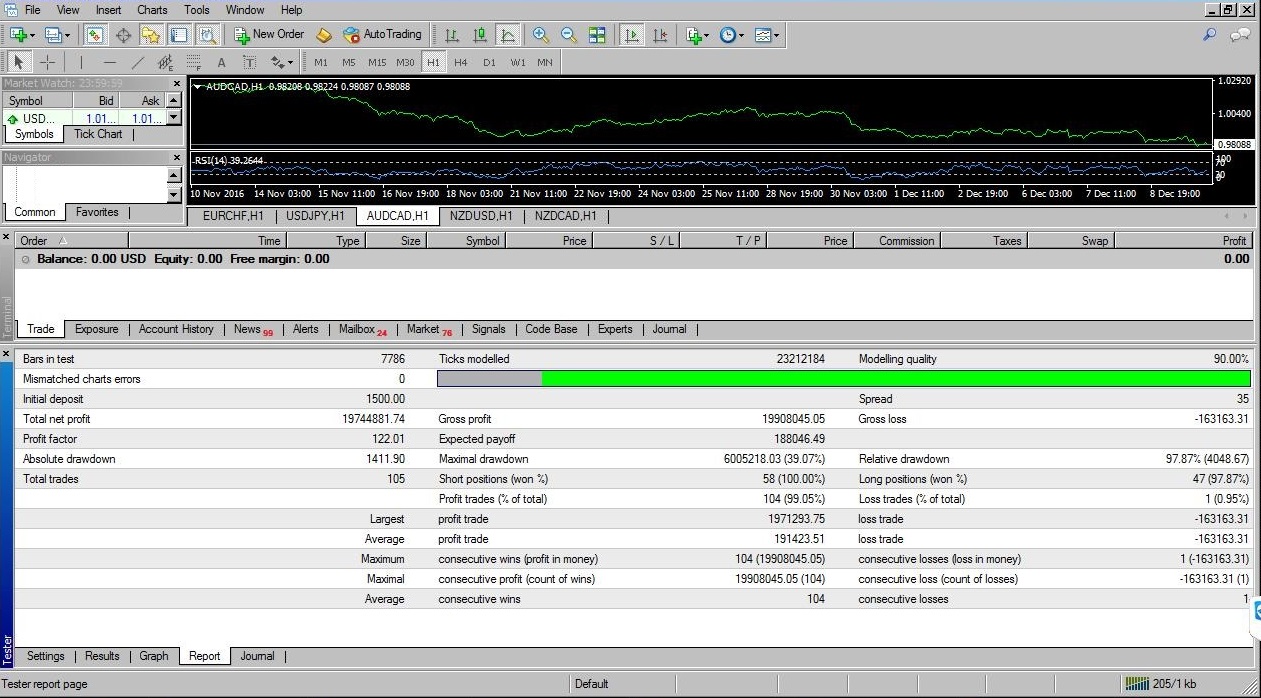

William Henderson

Posted a screen shot of my AUDCAD EA when it turned $1500 into over 19 million in one year on backtesting. The AUDCAD is usually a perfect sideways price action (both countries being commodity countries). But the drop in oil price has changed the limits of this action, meaning the EA can not do what it was designed to do. When oil price turns to normal, I will re-engage this EA and see if we can make around 20 million in one year.

William Henderson

Trading US election.

The most obvious reaction has been against the safe-haven currencies: first and foremost the yen, and also the Swiss franc returns to its role, despite the ever-present risk of an SNB intervention to weaken the franc. So, USD/JPY and USD/CHF rally with Clinton and plunge with Trump. This is a consistent reaction that has a very high probability of continuing on election night.

This response has been entirely consistent. Note that the SNB will be on high alert. Therefore a surge of the franc could be mitigated by the bankers in Switzerland.

I have decided not to hedge open CHF positions as the Swiss bank is likely to limit the downside, and the overwelming probability is upside with NZDCHF and EURCHF positions. However they will be volatile until the election is final.

Conclusion

Clinton wins: USD/JPY, USD/CHF rise; EUR/USD, GBP/USD mixed or a bit higher; AUD/USD, NZD/USD up, USD/CAD, USD/MXN down.

Trump wins: USD/JPY, USD/JPY fall; EUR/USD, GBP/USD, AUD/USD, NZD/USD down, USD/CAD, USD/MXN down

REF:

https://www.forexcrunch.com/trade-us-elections-currencies/

The most obvious reaction has been against the safe-haven currencies: first and foremost the yen, and also the Swiss franc returns to its role, despite the ever-present risk of an SNB intervention to weaken the franc. So, USD/JPY and USD/CHF rally with Clinton and plunge with Trump. This is a consistent reaction that has a very high probability of continuing on election night.

This response has been entirely consistent. Note that the SNB will be on high alert. Therefore a surge of the franc could be mitigated by the bankers in Switzerland.

I have decided not to hedge open CHF positions as the Swiss bank is likely to limit the downside, and the overwelming probability is upside with NZDCHF and EURCHF positions. However they will be volatile until the election is final.

Conclusion

Clinton wins: USD/JPY, USD/CHF rise; EUR/USD, GBP/USD mixed or a bit higher; AUD/USD, NZD/USD up, USD/CAD, USD/MXN down.

Trump wins: USD/JPY, USD/JPY fall; EUR/USD, GBP/USD, AUD/USD, NZD/USD down, USD/CAD, USD/MXN down

REF:

https://www.forexcrunch.com/trade-us-elections-currencies/

William Henderson

REDUNDANT SUPERFAST VPS FOR ONLY A PENNY!

LIMITED TIME SPECIAL, FIRST MONTH FOR ONLY $0.01!

https://www.interserver.net/dock/vps-194648.html

LIMITED TIME SPECIAL, FIRST MONTH FOR ONLY $0.01!

https://www.interserver.net/dock/vps-194648.html

William Henderson

2016.03.03

Been with them for over 5 years. Price has not gone up. No shutdown for maintenance like others I have used (annoying as have to get up early hours to restart all Mt4). In the 5 years only had about 3 or 4 times when the interface has run slow, but did not affect the MT4. I have run up to 8 MT4 with EA's. I like em. Find them better than the brokers VPS's I have used.

: