Ahmad Fauzi / Profile

- Information

|

3 years

experience

|

2

products

|

6

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

Untuk menambah wawasan sebelum memulai trading forex Ikuti channel @RumahForexID dengan cara LIKE dan SUBSCRIBE 😘

Trading Tanpa Modal : " https://bit.ly/3wRrEEK "

Free Indicator & EA : " https://bit.ly/3xTelVi "

Copytrade Account : " https://bit.ly/justcopytrade "

Free Copytrade : " https://bit.ly/RumahforexID_Copytrading "

Trading Signal : " https://bit.ly/RumahForexID_Signal "

Hot Indicator : " https://bit.ly/hotnewsindicator "

WARNING:

DO YOUR DUE DILIGENCE AND DO NOT FOLLOW IT BLINDLY.

TRADING YOUR MONEY AT YOUR OWN RISK - FOREX TRADING IS HIGH RISK.

YOU HAVE BEEN WARNED.

Thank you for your support 😘

Trading Tanpa Modal : " https://bit.ly/3wRrEEK "

Free Indicator & EA : " https://bit.ly/3xTelVi "

Copytrade Account : " https://bit.ly/justcopytrade "

Free Copytrade : " https://bit.ly/RumahforexID_Copytrading "

Trading Signal : " https://bit.ly/RumahForexID_Signal "

Hot Indicator : " https://bit.ly/hotnewsindicator "

WARNING:

DO YOUR DUE DILIGENCE AND DO NOT FOLLOW IT BLINDLY.

TRADING YOUR MONEY AT YOUR OWN RISK - FOREX TRADING IS HIGH RISK.

YOU HAVE BEEN WARNED.

Thank you for your support 😘

Ahmad Fauzi

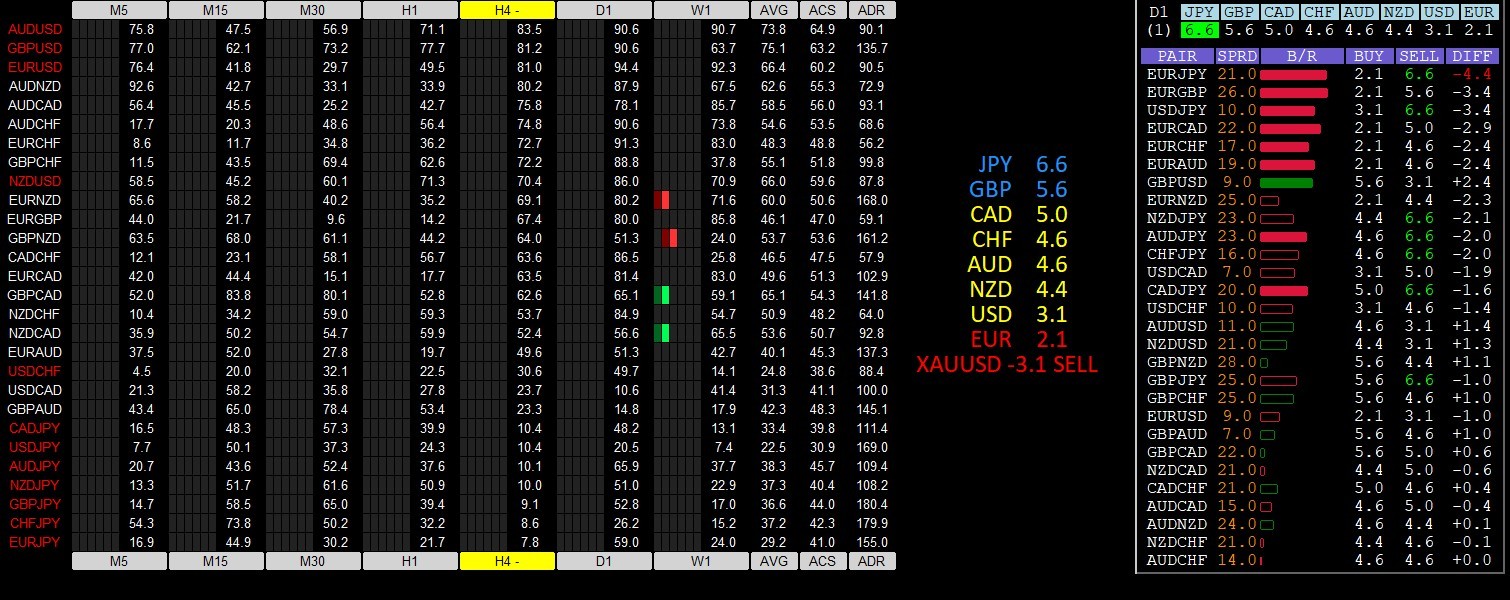

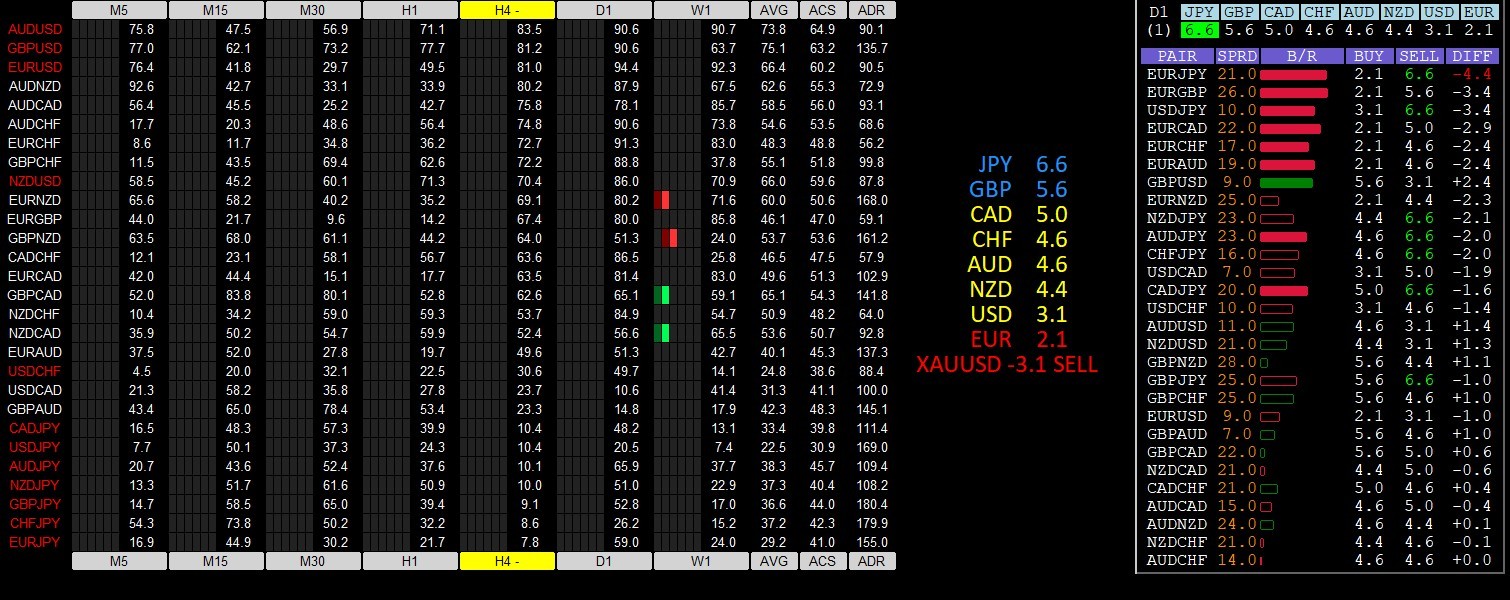

Currency Strength Index (4- Hour chart)- Currency pairs to watch (EURGBP)

Pair Value Recommendation

EURGBP 349.70 Strong Buy

Major resistance- 0.8830

Near-term support- 0.8760

Trend reversal level- 0.8900

Above (-150): Sell

Above (-300): Strong Sell

Above 150: Buy

Above 300: Strong Buy

Pair Value Recommendation

EURGBP 349.70 Strong Buy

Major resistance- 0.8830

Near-term support- 0.8760

Trend reversal level- 0.8900

Above (-150): Sell

Above (-300): Strong Sell

Above 150: Buy

Above 300: Strong Buy

Ahmad Fauzi

America’s Roundup: Dollar slides after U.S. inflation data, Wall Street ends up, Gold gains, Oil up more than 1% on U.S. inflation data, demand optimism-January 13th,2023

Market Roundup

•U.S. consumer prices fall in December

•US indexes: Dow up 0.6%, S&P 500 up 0.3%, Nasdaq up 0.6%

•US Dec CPI Index, n.s.a. 296.80,, 296.70forecast, 297.71 previous

•US Dec Jobless Claims 4-Week Avg 212.50K, 213.75K previous

• Continuing Jobless Claims 1,634K, 1,705K forecast, 1,694K previous

•US Initial Jobless Claims205K, 215K forecast, 204K previous

•US Dec CPI Index, s.a 298.11, 298.35 previous

•US Dec Core CPI Index 300.97, 300.07 previous

•US Dec CPI (YoY) 6.5%, 6.5% forecast,7.1% previous

• US Dec Core CPI (MoM) 0.3%,0.3% forecast,0.2% previous

• US Dec Core CPI (YoY) 5.7%,5.7% forecast,6.0% previous

• US Dec CPI (MoM) -0.1%,0.0% forecast,0.1% previous

•US Dec Real Earnings (MoM) 0.1%, 0.2% previous

•US Dec CPI, n.s.a (MoM) -0.31%, -0.10% previous

•US Natural Gas Storage 11B,-221B previous

•US Dec Cleveland CPI (MoM) 0.4%,0.5% previous

•US 4-Week Bill Auction 4.370%, 4.100% previous

•US 8-Week Bill Auction 4.465%,4.430% forecast,8.5% previous

Looking Ahead - Economic Data (GMT)

•00:30 Australia Home Loans (MoM)-3.0% forecast,-2.9% previous

•00:30 Australia Invest Housing Finance (MoM) -2.2% previous

•03:00 China Dec Trade Balance (USD) 76.20B forecast, 69.84B previous

•03:00 China Dec Exports (YoY) -10.0% forecast,-8.7% previous

•03:00 China Dec Imports (YoY) -9.8% forecast,-10.6% previous

Looking Ahead - Economic events and other releases (GMT)

•No events ahead

Currency Summaries

EUR/USD: The euro rose on Thursday as dollar fell after a reading of consumer prices fed expectations that Federal Reserve may have to scale back the size of future interest rate hikes. U.S consumer prices fell in December for the first time in more than 2-1/2 years as prices fell for gasoline and other goodseral Reserve may have leeway to scale back the size of future interest rate hikes. Following the CPI report, the dollar plunged as much as 1% against the euro, its weakest versus the common currency since April 21. Final euro zone inflation data for December is due next week. Readings so far from major economies such as Germany, Spain and Italy show a definite cooling in headline inflation, although the underlying core measures remain well above the ECBs 2% target rate. Immediate resistance can be seen at 1.0897(23.6%fib), an upside break can trigger rise towards 1.0914(Higher BB).On the downside, immediate support is seen at 1.07986 (5DMA), a break below could take the pair towards 1.0711(38.2%fib).

GBP/USD: The pound strengthened on Thursday as dollar dipped after data showed easing U.S. inflation strengthened bets that the Federal Reserve would switch to smaller rate hikes. U.S. data showed the consumer price index (CPI) dipped 0.1% last month, marking the first decline in the data since May 2020, when the economy was reeling from the first wave of COVID-19 infections. Risk appetite had taken a hit last year after aggressive interest rate hikes by the Fed had raised worries about a potential recession, diverting flows towards safer assets. Sterling was last trading at $1.2215, up 0.60% on the day. Immediate resistance can be seen at 1.2274 (23.6%fib), an upside break can trigger rise towards 1.2319(Higher BB),On the downside, immediate support is seen at 1.2173(5DMA), a break below could take the pair towards 1.2082 (Jan 9th low).

USD/CAD: The Canadian dollar strengthened to its highest level in nearly seven weeks against its U.S. counterpart on Thursday as oil prices rose and investors cheered data showing that U.S. inflation pressures are subsiding. The U.S. dollar fell against a basket of major currencies and equity markets globally rose as U.S consumer prices unexpectedly fell for the first time in more than 2-1/2 years in December. Canada’s inflation report for December is due for release next Tuesday, which could guide expectations for further tightening by the Bank of Canada. The loonie was trading 0.4% higher at 1.3365 to the greenback, or 74.82 U.S. cents, after touching its strongest since Nov. 25 at 1.3346.. Immediate resistance can be seen at 1.3397 (5DMA), an upside break can trigger rise towards 1.3450 (38.2%fib A).On the downside, immediate support is seen at 1.3345(23.6%fib), a break below could take the pair towards 1.3309(Lower BB).

USD/JPY: The dollar declined against Japanese yen on Thursday as yen was boosted by a Yomiuri report that the Bank of Japan (BOJ) will review the side effects of its monetary easing at next weeks policy meeting and may take additional steps to correct distortions in the yield curve. The news follows the BOJs surprise tweak in December to its bond yield curve control (YCC), though the move has failed to address distortions caused in the bond market by the central banks massive bond buying. The greenback slumped as much as 2.7% against the yen, hitting a 6-1/2-month low against the Japanese currency. Strong resistance can be seen at 130.00(Psychological level), an upside break can trigger rise towards 132.24(21DMA).On the downside, immediate support is seen at 128.69(23.6%fib), a break below could take the pair towards 128.28(Lower BB).

Equities Recap

European stocks closed higher on Thursday as soft U.S. inflation data helped outweigh concerns about interest rates. Optimism about economic growth following China reopening contributed as well to markets positive performance.

UKs benchmark FTSE 100 closed up by 0.89 percent, Germanys Dax ended up by 0.74 percent, France’s CAC finished the day up by 0.74 percent.

U.S. stocks closed higher on Thursday, extending recent gains as data showing a fall in consumer prices in December bolstered expectations of less aggressive interest rate hikes from the Federal Reserve.

Dow Jones closed up by 0.64% percent, S&P 500 closed up by 0.34% percent, Nasdaq settled up by 0.64% percent.

Treasuries Recap

U.S. Treasury yields were mixed in choppy trading, with the front end of the curve lower on Thursday, after data showing an unexpected fall in consumer prices in December, affirming expectations that the Federal Reserve will continue to slow the pace of rate increases.

U.S. benchmark Treasury 10-year yield was flat at 3.55% .U.S. two-year yield slid 5.6 bps to 4.171%.U.S. 30-year yields rose 2.1 bps to 3.70.

Commodities Recap

Gold prices rose over 1%, hovering near the $1,900 per ounce pivot on Thursday after data showing signs of cooling inflation in the United States boosted bets for slower rate hikes from the Federal Reserve.

Spot gold jumped 1.1% to $1,896.30 per ounce by 2:40 p.m. ET (1940 GMT). It earlier hit $1,901.4, its highest since May.

Oil prices gained about $1 a barrel on Thursday, supported by figures showing U.S consumer prices unexpectedly fell in December and by optimism over Chinas demand outlook.

Brent crude settled at $84.03 a barrel, rising $1.36, or 1.7%. U.S. West Texas Intermediate crude settled at $78.39 a barrel, gaining 98 cents, or 1.3%.

Regards

RumahForexID

Market Roundup

•U.S. consumer prices fall in December

•US indexes: Dow up 0.6%, S&P 500 up 0.3%, Nasdaq up 0.6%

•US Dec CPI Index, n.s.a. 296.80,, 296.70forecast, 297.71 previous

•US Dec Jobless Claims 4-Week Avg 212.50K, 213.75K previous

• Continuing Jobless Claims 1,634K, 1,705K forecast, 1,694K previous

•US Initial Jobless Claims205K, 215K forecast, 204K previous

•US Dec CPI Index, s.a 298.11, 298.35 previous

•US Dec Core CPI Index 300.97, 300.07 previous

•US Dec CPI (YoY) 6.5%, 6.5% forecast,7.1% previous

• US Dec Core CPI (MoM) 0.3%,0.3% forecast,0.2% previous

• US Dec Core CPI (YoY) 5.7%,5.7% forecast,6.0% previous

• US Dec CPI (MoM) -0.1%,0.0% forecast,0.1% previous

•US Dec Real Earnings (MoM) 0.1%, 0.2% previous

•US Dec CPI, n.s.a (MoM) -0.31%, -0.10% previous

•US Natural Gas Storage 11B,-221B previous

•US Dec Cleveland CPI (MoM) 0.4%,0.5% previous

•US 4-Week Bill Auction 4.370%, 4.100% previous

•US 8-Week Bill Auction 4.465%,4.430% forecast,8.5% previous

Looking Ahead - Economic Data (GMT)

•00:30 Australia Home Loans (MoM)-3.0% forecast,-2.9% previous

•00:30 Australia Invest Housing Finance (MoM) -2.2% previous

•03:00 China Dec Trade Balance (USD) 76.20B forecast, 69.84B previous

•03:00 China Dec Exports (YoY) -10.0% forecast,-8.7% previous

•03:00 China Dec Imports (YoY) -9.8% forecast,-10.6% previous

Looking Ahead - Economic events and other releases (GMT)

•No events ahead

Currency Summaries

EUR/USD: The euro rose on Thursday as dollar fell after a reading of consumer prices fed expectations that Federal Reserve may have to scale back the size of future interest rate hikes. U.S consumer prices fell in December for the first time in more than 2-1/2 years as prices fell for gasoline and other goodseral Reserve may have leeway to scale back the size of future interest rate hikes. Following the CPI report, the dollar plunged as much as 1% against the euro, its weakest versus the common currency since April 21. Final euro zone inflation data for December is due next week. Readings so far from major economies such as Germany, Spain and Italy show a definite cooling in headline inflation, although the underlying core measures remain well above the ECBs 2% target rate. Immediate resistance can be seen at 1.0897(23.6%fib), an upside break can trigger rise towards 1.0914(Higher BB).On the downside, immediate support is seen at 1.07986 (5DMA), a break below could take the pair towards 1.0711(38.2%fib).

GBP/USD: The pound strengthened on Thursday as dollar dipped after data showed easing U.S. inflation strengthened bets that the Federal Reserve would switch to smaller rate hikes. U.S. data showed the consumer price index (CPI) dipped 0.1% last month, marking the first decline in the data since May 2020, when the economy was reeling from the first wave of COVID-19 infections. Risk appetite had taken a hit last year after aggressive interest rate hikes by the Fed had raised worries about a potential recession, diverting flows towards safer assets. Sterling was last trading at $1.2215, up 0.60% on the day. Immediate resistance can be seen at 1.2274 (23.6%fib), an upside break can trigger rise towards 1.2319(Higher BB),On the downside, immediate support is seen at 1.2173(5DMA), a break below could take the pair towards 1.2082 (Jan 9th low).

USD/CAD: The Canadian dollar strengthened to its highest level in nearly seven weeks against its U.S. counterpart on Thursday as oil prices rose and investors cheered data showing that U.S. inflation pressures are subsiding. The U.S. dollar fell against a basket of major currencies and equity markets globally rose as U.S consumer prices unexpectedly fell for the first time in more than 2-1/2 years in December. Canada’s inflation report for December is due for release next Tuesday, which could guide expectations for further tightening by the Bank of Canada. The loonie was trading 0.4% higher at 1.3365 to the greenback, or 74.82 U.S. cents, after touching its strongest since Nov. 25 at 1.3346.. Immediate resistance can be seen at 1.3397 (5DMA), an upside break can trigger rise towards 1.3450 (38.2%fib A).On the downside, immediate support is seen at 1.3345(23.6%fib), a break below could take the pair towards 1.3309(Lower BB).

USD/JPY: The dollar declined against Japanese yen on Thursday as yen was boosted by a Yomiuri report that the Bank of Japan (BOJ) will review the side effects of its monetary easing at next weeks policy meeting and may take additional steps to correct distortions in the yield curve. The news follows the BOJs surprise tweak in December to its bond yield curve control (YCC), though the move has failed to address distortions caused in the bond market by the central banks massive bond buying. The greenback slumped as much as 2.7% against the yen, hitting a 6-1/2-month low against the Japanese currency. Strong resistance can be seen at 130.00(Psychological level), an upside break can trigger rise towards 132.24(21DMA).On the downside, immediate support is seen at 128.69(23.6%fib), a break below could take the pair towards 128.28(Lower BB).

Equities Recap

European stocks closed higher on Thursday as soft U.S. inflation data helped outweigh concerns about interest rates. Optimism about economic growth following China reopening contributed as well to markets positive performance.

UKs benchmark FTSE 100 closed up by 0.89 percent, Germanys Dax ended up by 0.74 percent, France’s CAC finished the day up by 0.74 percent.

U.S. stocks closed higher on Thursday, extending recent gains as data showing a fall in consumer prices in December bolstered expectations of less aggressive interest rate hikes from the Federal Reserve.

Dow Jones closed up by 0.64% percent, S&P 500 closed up by 0.34% percent, Nasdaq settled up by 0.64% percent.

Treasuries Recap

U.S. Treasury yields were mixed in choppy trading, with the front end of the curve lower on Thursday, after data showing an unexpected fall in consumer prices in December, affirming expectations that the Federal Reserve will continue to slow the pace of rate increases.

U.S. benchmark Treasury 10-year yield was flat at 3.55% .U.S. two-year yield slid 5.6 bps to 4.171%.U.S. 30-year yields rose 2.1 bps to 3.70.

Commodities Recap

Gold prices rose over 1%, hovering near the $1,900 per ounce pivot on Thursday after data showing signs of cooling inflation in the United States boosted bets for slower rate hikes from the Federal Reserve.

Spot gold jumped 1.1% to $1,896.30 per ounce by 2:40 p.m. ET (1940 GMT). It earlier hit $1,901.4, its highest since May.

Oil prices gained about $1 a barrel on Thursday, supported by figures showing U.S consumer prices unexpectedly fell in December and by optimism over Chinas demand outlook.

Brent crude settled at $84.03 a barrel, rising $1.36, or 1.7%. U.S. West Texas Intermediate crude settled at $78.39 a barrel, gaining 98 cents, or 1.3%.

Regards

RumahForexID

Ahmad Fauzi

Europe Roundup: Sterling edges up as markets await U.S. inflation data, European shares rise, Oil rises over 1% on China demand hopes, U.S. inflation in focus-January 12th,2023

Market Roundup

•Greek Dec HICP (YoY) 7.6%,8.8% previous

•Greek Nov Unemployment Rate 11.4%,11.6% previous

•Greek Dec CPI (YoY) 7.2% previous

Looking Ahead - Economic Data (GMT)

•12:30 US Dec CPI Index, n.s.a. 296.70forecast, 297.71 previous

•12:30 US Dec Jobless Claims 4-Week Avg. 213.75K previous

•12:30 US Continuing Jobless Claims 1,705K forecast, 1,694K previous

•12:30 US Initial Jobless Claims 215K forecast, 204K previous

•12:30 US Dec CPI Index, s.a 298.35 previous

•12:30 US Dec Core CPI Index 300.07 previous

•12:30 US Dec CPI (YoY) 6.5% forecast,7.1% previous

• 12:30 US Dec Core CPI (MoM) 0.3% forecast,0.2% previous

• 12:30 US Dec Core CPI (YoY) 5.7% forecast,6.0% previous

• 12:30 US Dec CPI (MoM) 0.0% forecast,0.1% previous

•12:30 US Dec Real Earnings (MoM) 0.2% previous

•12:30 US Dec CPI, n.s.a (MoM) -0.10% previous

•15:30 US Natural Gas Storage -221B previous

•16:00 US Dec Cleveland CPI (MoM) 0.5% previous

•16:30 US 4-Week Bill Auction 4.100% previous

•16:30 US 8-Week Bill Auction 4.430% forecast,8.5% previous

Looking Ahead - Economic events and other releases (GMT)

•No events ahead

Fxbeat

EUR/USD: The euro edged higher against the dollar on Thursday as investors awaited U.S. consumer price data later in US session . Markets will look towards U.S. inflation data due for cues on the likely path of rates this year after Federal Reserve Chairman Jerome Powell avoided speaking about rate hikes at a conference on Tuesday. The annual reading for U.S. CPI is expected to show a decline to 6.5% in December from 7.1% in the prior month. Immediate resistance can be seen at 1.0771(23.6%fib), an upside break can trigger rise towards 1.0787 (Higher BB).On the downside, immediate support is seen at 1.0643(9DMA), a break below could take the pair towards 1.0526(38.2%fib).

GBP/USD: Sterling made marginal gains on Thursday against the dollar as attention remained on U.S. inflation data due later in the session for clues on future rate hikes in the worlds largest economy.Britains murky economic backdrop remains in focus for traders, with a survey on Thursday showing its construction sector stagnated at the end of last year, with home-building particularly hard hit in the face of rising borrowing costs. The pound was up 0.18% to $1.21650 and was 0.11% higher against the euro, trading at 88.430 pence. Immediate resistance can be seen at 1.2173(23.6%fib), an upside break can trigger rise towards 1.2337(Higher BB),On the downside, immediate support is seen at 1.2091(14DMA), a break below could take the pair towards 1.2000 (Psychological level).

USD/CHF: The dollar steadied against the Swiss franc on Thursday as traders waited for this weeks U.S. consumer price data to see whether it will confirm that inflation is in retreat. Currency traders are looking to U.S. inflation data due for release on Thursday at 1330 GMT. It could give markets a glimpse into whether the Federal Reserve will slow the pace of rate hikes. The U.S. dollar index was last down 0.06% to 103.04, not far off its seven-month low of 102.93 hit earlier in the week. Immediate resistance can be seen at 0.9324 (38.2%fib), an upside break can trigger rise towards 0.9350(23.6%fib).On the downside, immediate support is seen at 0.9299(50%fib), a break below could take the pair towards 0.9276(61.8%fib).

USD/JPY: The dollar declined against Japanese yen on Thursday as traders positioned themselves for Thursday’s inflation data that could influence the U.S. Federal Reserve’s rate-hike stance. The focus is on U.S. inflation data due at 1330 GMT, after some Federal Reserve policymakers said this week the reading will help them decide if they can slow the pace of rate hikes.The much-anticipated report is expected to show U.S. consumer prices grew 6.5% year-on-year in December, moderating from a 7.1% rise in November, according to economists polled. Strong resistance can be seen at 131.00(Psychological level), an upside break can trigger rise towards 132.38(9DMA).On the downside, immediate support is seen at 130.60(Daily low), a break below could take the pair towards 130.00(Psychological level).

Equities Recap

European shares rose on Thursday ahead of U.S. inflation data that could sway the monetary policy direction at the worlds largest economy, while gains were capped by a drop in shares of Ubisoft and Logitech after the companies cut their forecasts.

At (GMT 13:15),UKs benchmark FTSE 100 was last trading up at 0.76 percent, Germanys Dax was up by 0.71 percent, France’s CAC was trading up by 0.91 percent.

Commodities Recap

Gold prices rose on Thursday, supported by a softer dollar, while market participants awaited U.S. inflation data that could influence the Federal Reserves policy path.

Oil rose more than 1% on Thursday supported by optimism over Chinas demand outlook and hopes that upcoming inflation data from the United States will point to a slower increase in interest rates.

Brent crude rose $1.18, or 1.4%, to $83.85 a barrel by 1250 GMT, while U.S. West Texas Intermediate crude gained $1.15, or 1.5%, to $78.56.

Regards

RumahForexID

Market Roundup

•Greek Dec HICP (YoY) 7.6%,8.8% previous

•Greek Nov Unemployment Rate 11.4%,11.6% previous

•Greek Dec CPI (YoY) 7.2% previous

Looking Ahead - Economic Data (GMT)

•12:30 US Dec CPI Index, n.s.a. 296.70forecast, 297.71 previous

•12:30 US Dec Jobless Claims 4-Week Avg. 213.75K previous

•12:30 US Continuing Jobless Claims 1,705K forecast, 1,694K previous

•12:30 US Initial Jobless Claims 215K forecast, 204K previous

•12:30 US Dec CPI Index, s.a 298.35 previous

•12:30 US Dec Core CPI Index 300.07 previous

•12:30 US Dec CPI (YoY) 6.5% forecast,7.1% previous

• 12:30 US Dec Core CPI (MoM) 0.3% forecast,0.2% previous

• 12:30 US Dec Core CPI (YoY) 5.7% forecast,6.0% previous

• 12:30 US Dec CPI (MoM) 0.0% forecast,0.1% previous

•12:30 US Dec Real Earnings (MoM) 0.2% previous

•12:30 US Dec CPI, n.s.a (MoM) -0.10% previous

•15:30 US Natural Gas Storage -221B previous

•16:00 US Dec Cleveland CPI (MoM) 0.5% previous

•16:30 US 4-Week Bill Auction 4.100% previous

•16:30 US 8-Week Bill Auction 4.430% forecast,8.5% previous

Looking Ahead - Economic events and other releases (GMT)

•No events ahead

Fxbeat

EUR/USD: The euro edged higher against the dollar on Thursday as investors awaited U.S. consumer price data later in US session . Markets will look towards U.S. inflation data due for cues on the likely path of rates this year after Federal Reserve Chairman Jerome Powell avoided speaking about rate hikes at a conference on Tuesday. The annual reading for U.S. CPI is expected to show a decline to 6.5% in December from 7.1% in the prior month. Immediate resistance can be seen at 1.0771(23.6%fib), an upside break can trigger rise towards 1.0787 (Higher BB).On the downside, immediate support is seen at 1.0643(9DMA), a break below could take the pair towards 1.0526(38.2%fib).

GBP/USD: Sterling made marginal gains on Thursday against the dollar as attention remained on U.S. inflation data due later in the session for clues on future rate hikes in the worlds largest economy.Britains murky economic backdrop remains in focus for traders, with a survey on Thursday showing its construction sector stagnated at the end of last year, with home-building particularly hard hit in the face of rising borrowing costs. The pound was up 0.18% to $1.21650 and was 0.11% higher against the euro, trading at 88.430 pence. Immediate resistance can be seen at 1.2173(23.6%fib), an upside break can trigger rise towards 1.2337(Higher BB),On the downside, immediate support is seen at 1.2091(14DMA), a break below could take the pair towards 1.2000 (Psychological level).

USD/CHF: The dollar steadied against the Swiss franc on Thursday as traders waited for this weeks U.S. consumer price data to see whether it will confirm that inflation is in retreat. Currency traders are looking to U.S. inflation data due for release on Thursday at 1330 GMT. It could give markets a glimpse into whether the Federal Reserve will slow the pace of rate hikes. The U.S. dollar index was last down 0.06% to 103.04, not far off its seven-month low of 102.93 hit earlier in the week. Immediate resistance can be seen at 0.9324 (38.2%fib), an upside break can trigger rise towards 0.9350(23.6%fib).On the downside, immediate support is seen at 0.9299(50%fib), a break below could take the pair towards 0.9276(61.8%fib).

USD/JPY: The dollar declined against Japanese yen on Thursday as traders positioned themselves for Thursday’s inflation data that could influence the U.S. Federal Reserve’s rate-hike stance. The focus is on U.S. inflation data due at 1330 GMT, after some Federal Reserve policymakers said this week the reading will help them decide if they can slow the pace of rate hikes.The much-anticipated report is expected to show U.S. consumer prices grew 6.5% year-on-year in December, moderating from a 7.1% rise in November, according to economists polled. Strong resistance can be seen at 131.00(Psychological level), an upside break can trigger rise towards 132.38(9DMA).On the downside, immediate support is seen at 130.60(Daily low), a break below could take the pair towards 130.00(Psychological level).

Equities Recap

European shares rose on Thursday ahead of U.S. inflation data that could sway the monetary policy direction at the worlds largest economy, while gains were capped by a drop in shares of Ubisoft and Logitech after the companies cut their forecasts.

At (GMT 13:15),UKs benchmark FTSE 100 was last trading up at 0.76 percent, Germanys Dax was up by 0.71 percent, France’s CAC was trading up by 0.91 percent.

Commodities Recap

Gold prices rose on Thursday, supported by a softer dollar, while market participants awaited U.S. inflation data that could influence the Federal Reserves policy path.

Oil rose more than 1% on Thursday supported by optimism over Chinas demand outlook and hopes that upcoming inflation data from the United States will point to a slower increase in interest rates.

Brent crude rose $1.18, or 1.4%, to $83.85 a barrel by 1250 GMT, while U.S. West Texas Intermediate crude gained $1.15, or 1.5%, to $78.56.

Regards

RumahForexID

Ahmad Fauzi

EUR/NZD range tightens as market looks to US CPI data

• EUR/NZD edged higher on Wednesday but gains were limited as traders held off from making big moves ahead of U.S. inflation data on Thursday .

• At GMT 17:07, the pair was trading up 0.48 percent at 1.6923 after reaching daily high at 1.6972.

• A rally towards 1.7000 zone is possible if EUR/NZD bulls overcome resistance at 38.2%fib.

• From a technical viewpoint, RSI is strongly bullish at 56, daily momentum studies, 5, 10 and 11 daily MAs are pointing higher.

• Immediate resistance is located at 1.6958 (38.2%fib), any close above will push the pair towards 1.7011 (Higher BB).

• Immediate support is seen at 1.6825 (50%fib) and break below could take the pair towards 1.6746(Jan 6th low).

Recommendation: Good to buy on dips around 1.6900, with stop loss of 1.6780 and target price of 1.6980

• EUR/NZD edged higher on Wednesday but gains were limited as traders held off from making big moves ahead of U.S. inflation data on Thursday .

• At GMT 17:07, the pair was trading up 0.48 percent at 1.6923 after reaching daily high at 1.6972.

• A rally towards 1.7000 zone is possible if EUR/NZD bulls overcome resistance at 38.2%fib.

• From a technical viewpoint, RSI is strongly bullish at 56, daily momentum studies, 5, 10 and 11 daily MAs are pointing higher.

• Immediate resistance is located at 1.6958 (38.2%fib), any close above will push the pair towards 1.7011 (Higher BB).

• Immediate support is seen at 1.6825 (50%fib) and break below could take the pair towards 1.6746(Jan 6th low).

Recommendation: Good to buy on dips around 1.6900, with stop loss of 1.6780 and target price of 1.6980

Ahmad Fauzi

Chart - Courtesy Trading View

Technical Analysis:

- EUR/JPY was trading 0.21% higher on the day at 141.74 at around 15:20 GMT

- The pair has broken above 21-EMA raising scope for further upside

- MACD confirms bullish crossover on signal line, Chikou span is biased higher

- Momentum has turned bullish, Stochs and RSI are biased higher

- Price action is above 200H MA, GMMA indicator has turned bullish on the intraday charts

Support levels - 140.95 (5-DMA), 140.40 (200H MA)

Resistance levels - 142.04 (110-EMA), 142.56 (55-EMA)

Summary: EUR/JPY has retraced dip below 200-DMA. Break above 21-EMA will fuel further upside. Test of daily cloud likely in the coming sessions.

Technical Analysis:

- EUR/JPY was trading 0.21% higher on the day at 141.74 at around 15:20 GMT

- The pair has broken above 21-EMA raising scope for further upside

- MACD confirms bullish crossover on signal line, Chikou span is biased higher

- Momentum has turned bullish, Stochs and RSI are biased higher

- Price action is above 200H MA, GMMA indicator has turned bullish on the intraday charts

Support levels - 140.95 (5-DMA), 140.40 (200H MA)

Resistance levels - 142.04 (110-EMA), 142.56 (55-EMA)

Summary: EUR/JPY has retraced dip below 200-DMA. Break above 21-EMA will fuel further upside. Test of daily cloud likely in the coming sessions.

: