Alfred Charano / Profile

- Information

|

5+ years

experience

|

2

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

Full-Time Trader | Funded Trader | Algo Trader | EA Developer (Continuous Improvement)

Trading is a profession, not a game. For many, it is a primary source of income.

Everyone has a goal—mine is to achieve consistent, disciplined returns of 1–2% per day through proper risk management.

May we all be blessed in our journey, and when success comes, may we remember to give back and help others grow.

My Trading Journey

I started trading 7 years ago as a manual trader. Like most traders, the journey wasn’t smooth — there were good gains, painful losses, and many hard lessons along the way.

In 2020, I was introduced to EAs. That opened a new chapter for me. Automation brought consistency, but also new challenges. Some strategies worked, many failed. Still, I kept refining, testing, and learning.

Over the last two years, I’ve been deeply focused on coding EAs based on my own manual trading strategies. I’ve built many indicators and EAs — honestly, a lot of them ended up as “trash” 😄. But each failure taught me something. Step by step, the quality improved.

Today, several of the indicators and EAs I developed are used in my own trading and are able to generate income consistently. I haven’t published them publicly — most were for personal use and shared freely with close friends.

Now, I believe it’s the right time to monetize the knowledge and tools I’ve built over the years, and to offer the same indicators and EAs that I personally use — not experiments, but tools that have been tested through real market conditions.

Trading is a profession, not a game. For many, it is a primary source of income.

Everyone has a goal—mine is to achieve consistent, disciplined returns of 1–2% per day through proper risk management.

May we all be blessed in our journey, and when success comes, may we remember to give back and help others grow.

My Trading Journey

I started trading 7 years ago as a manual trader. Like most traders, the journey wasn’t smooth — there were good gains, painful losses, and many hard lessons along the way.

In 2020, I was introduced to EAs. That opened a new chapter for me. Automation brought consistency, but also new challenges. Some strategies worked, many failed. Still, I kept refining, testing, and learning.

Over the last two years, I’ve been deeply focused on coding EAs based on my own manual trading strategies. I’ve built many indicators and EAs — honestly, a lot of them ended up as “trash” 😄. But each failure taught me something. Step by step, the quality improved.

Today, several of the indicators and EAs I developed are used in my own trading and are able to generate income consistently. I haven’t published them publicly — most were for personal use and shared freely with close friends.

Now, I believe it’s the right time to monetize the knowledge and tools I’ve built over the years, and to offer the same indicators and EAs that I personally use — not experiments, but tools that have been tested through real market conditions.

Alfred Charano

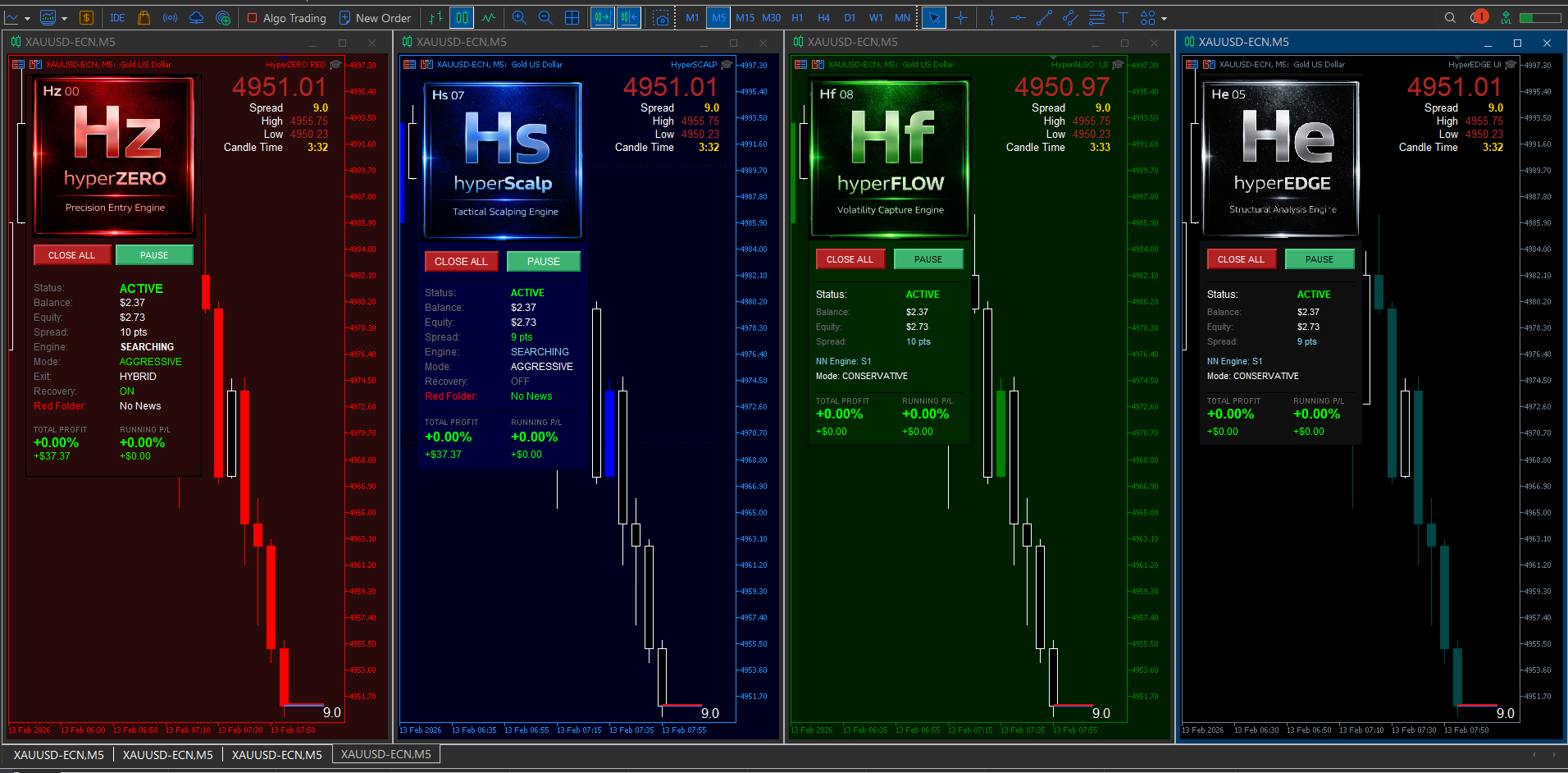

Launching Soon: The HyperALGO Gold Series — HyperZERO, HyperSCALP, HyperEDGE, and HyperFLOW. Precision-engineered for XAUUSD

Alfred Charano

Another great profitable week for HyperZERO! Now upgraded with a new logo, chart theme, and UI as part of our HyperEA series.

Alfred Charano

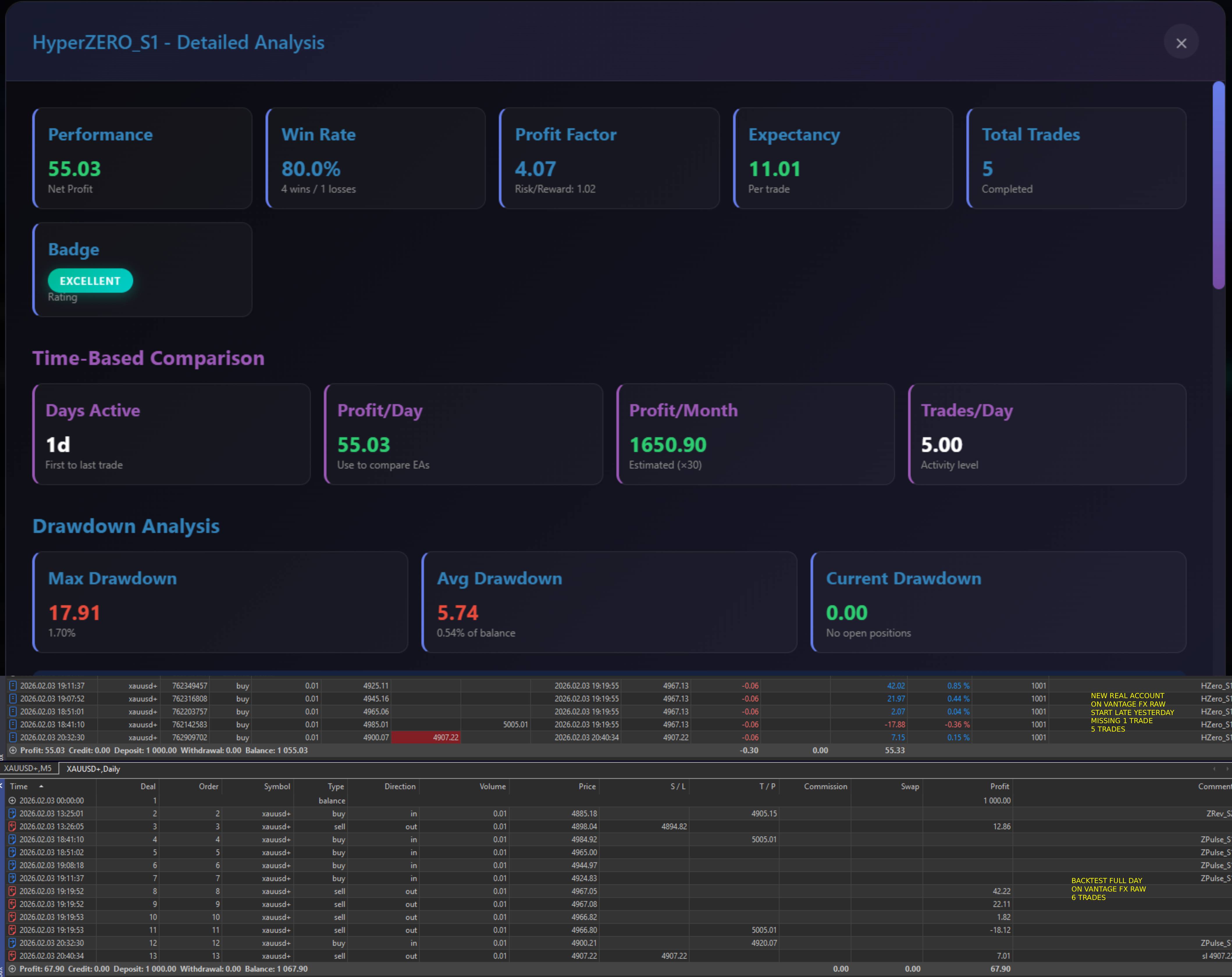

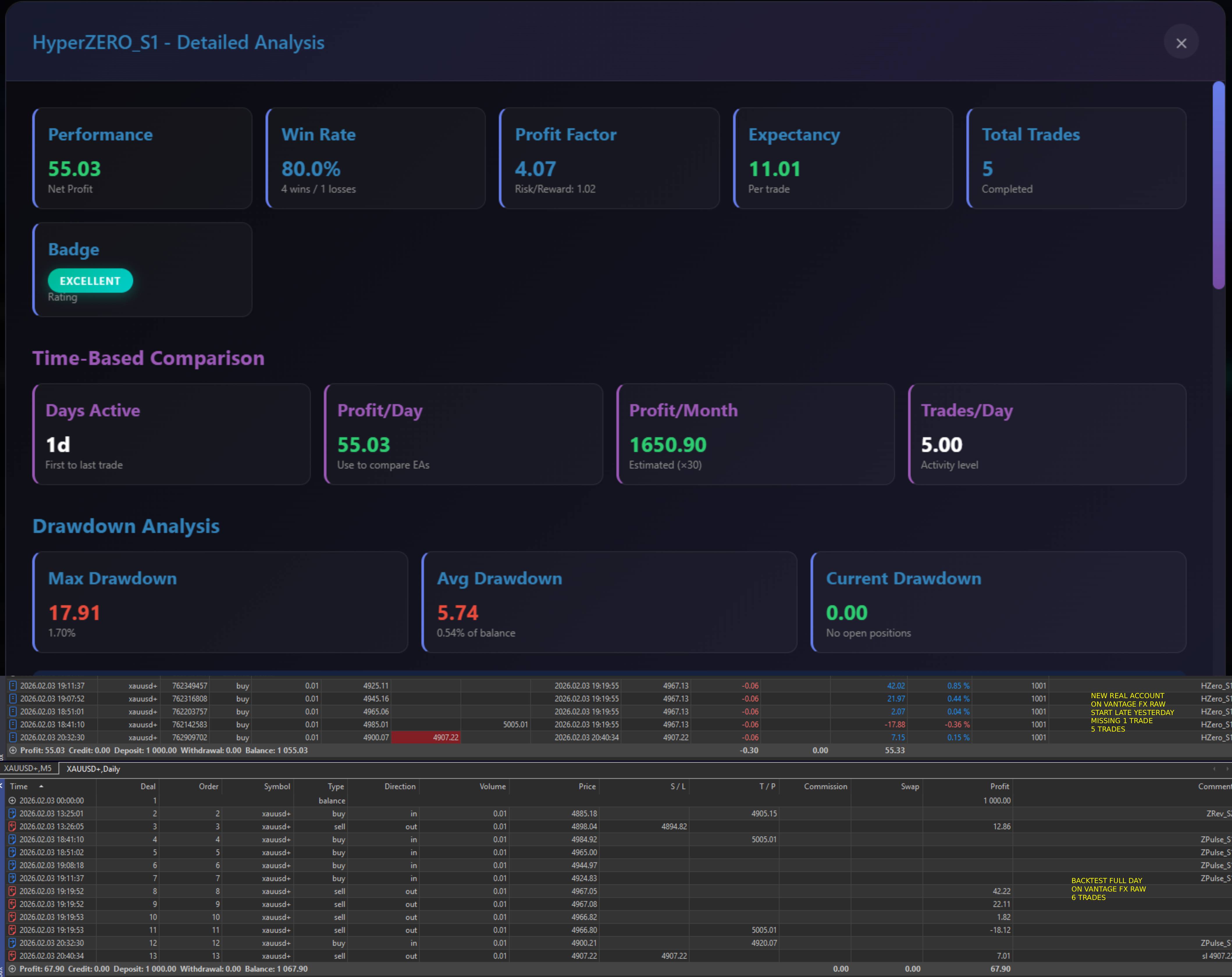

HyperZERO 😎 another profitable day—7 trades, $64.

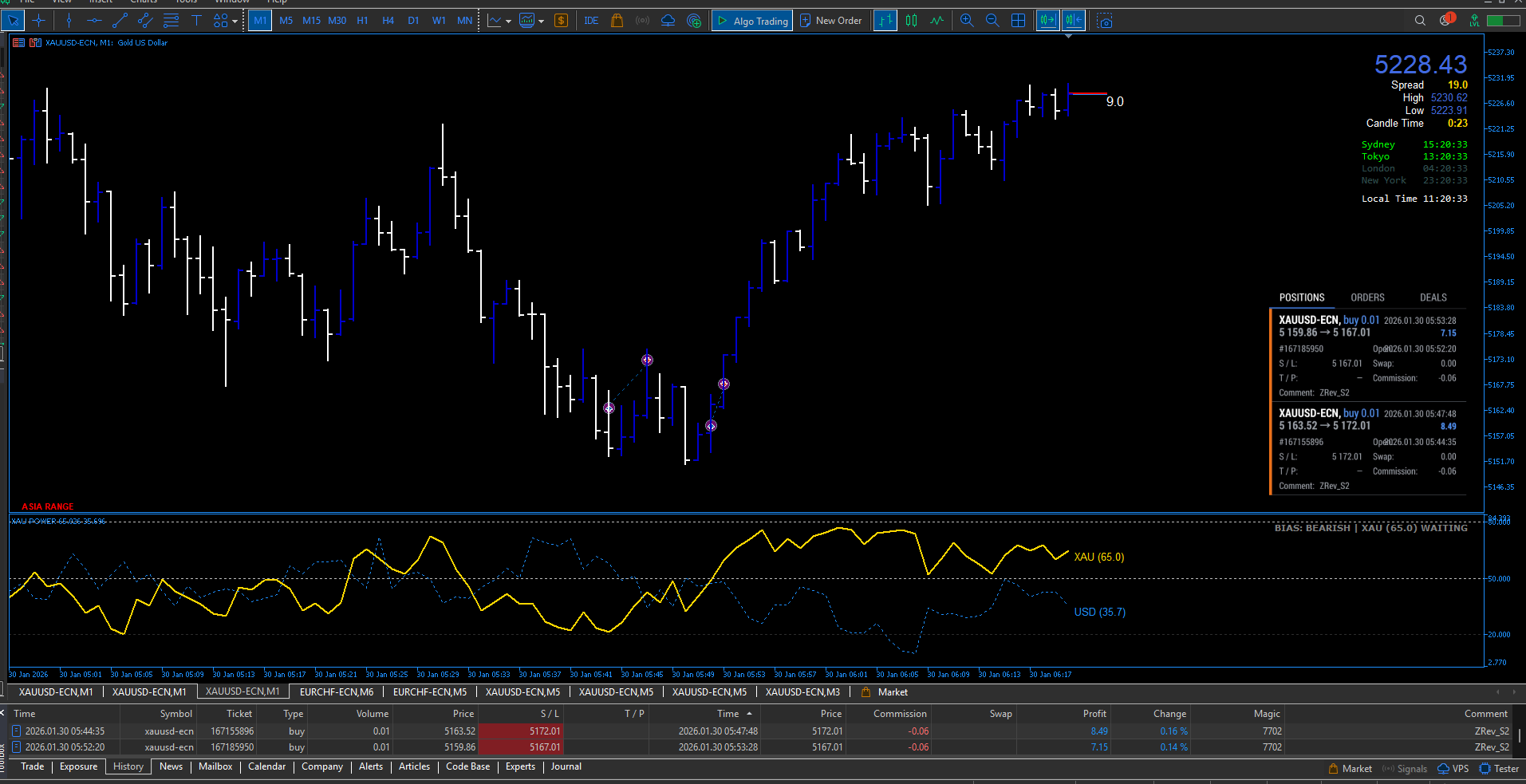

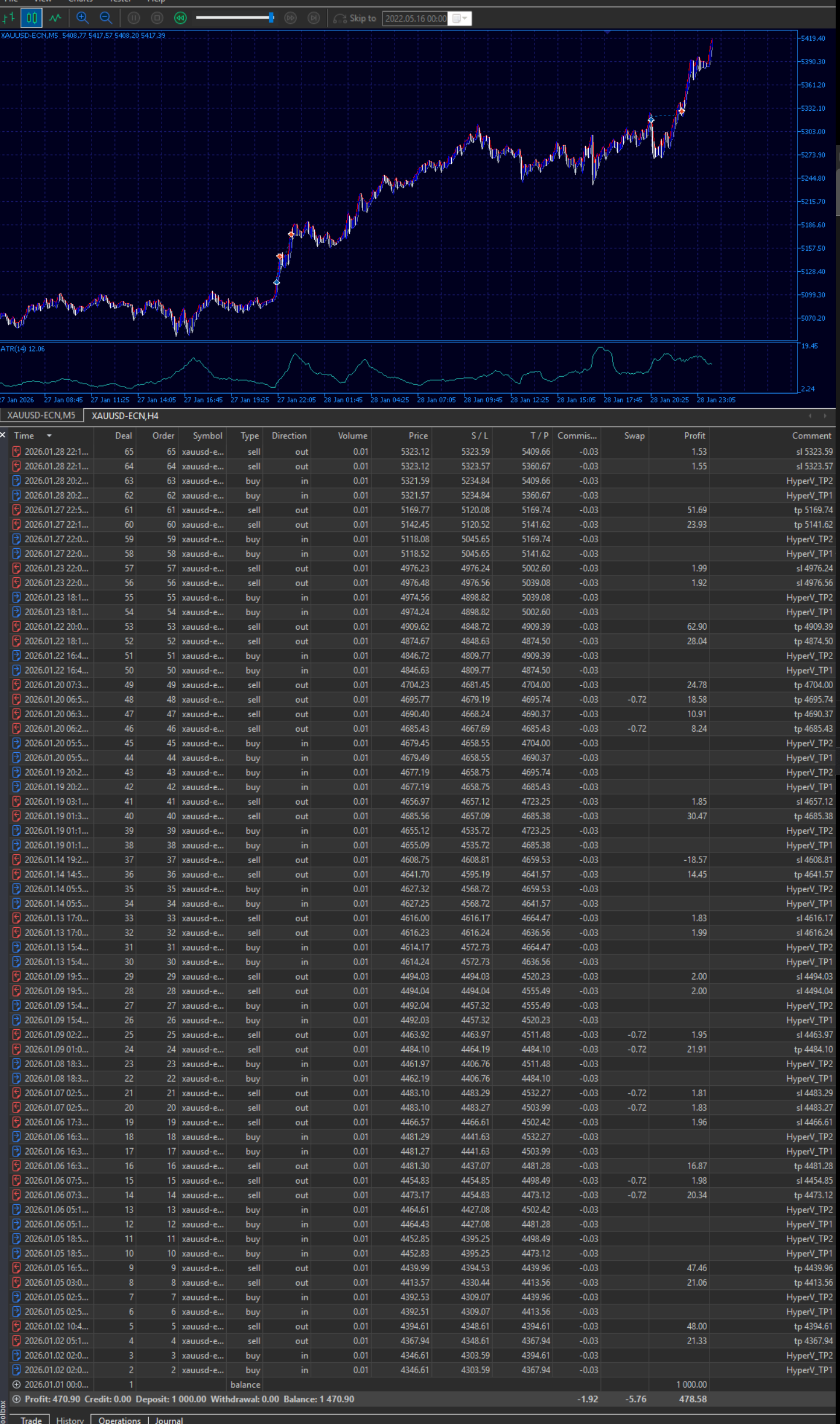

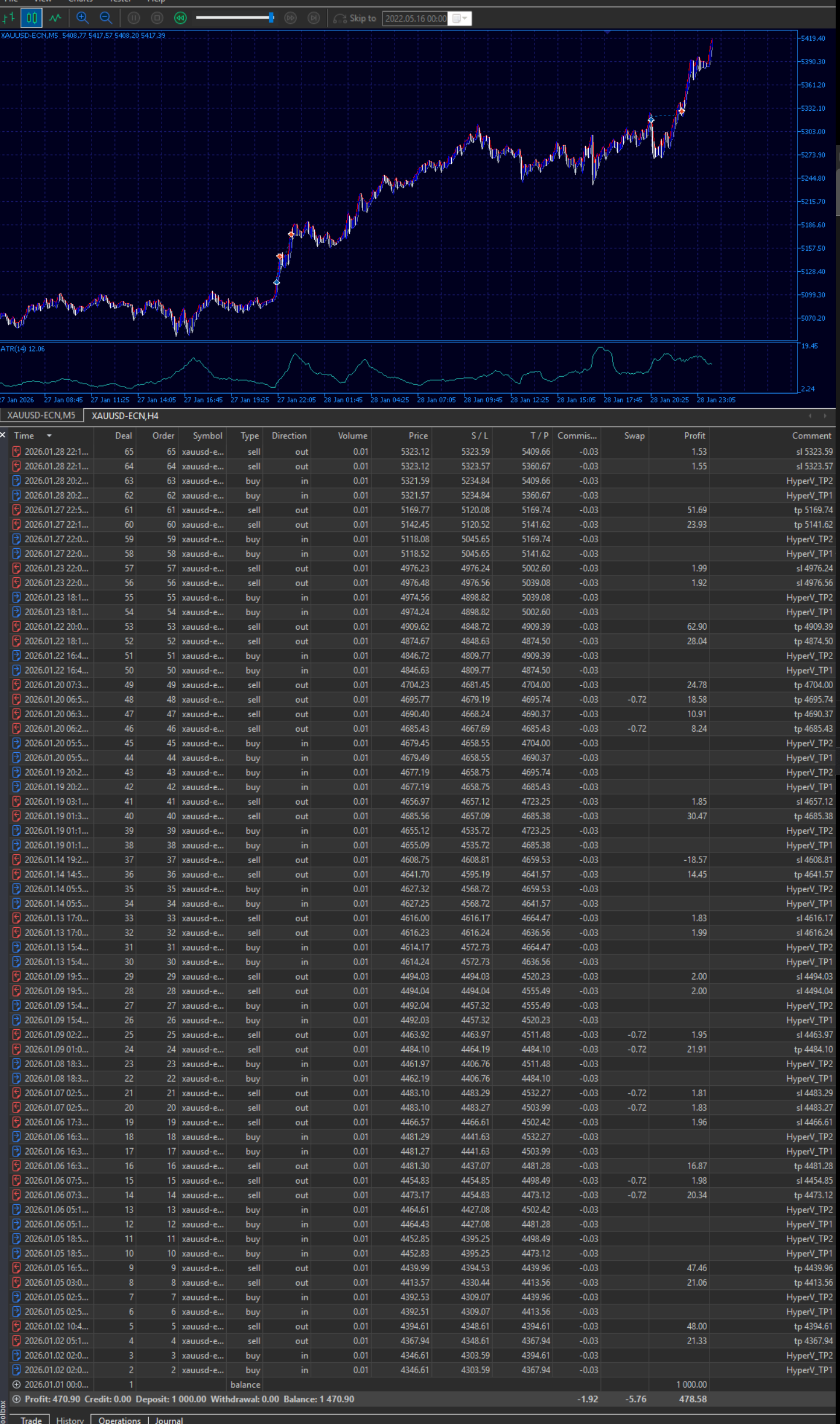

S1 and S2 are both active, generating $119 in profit over 2 days on a $1,000 account with a 0.01 lot size.

Backtest and live trades are identical; the only difference is the profit amount, with the live account making slightly more.

S1 and S2 are both active, generating $119 in profit over 2 days on a $1,000 account with a 0.01 lot size.

Backtest and live trades are identical; the only difference is the profit amount, with the live account making slightly more.

Alfred Charano

HyperZERO 😍 Another profitable day.

This run started on a new account ($1000, 0.01 lot) with a different broker (Vantage FX RAW vs. previous VT Markets ECN).

Backtest and live results are nearly identical, with one live trade missing due to a later start compared to the full-day backtest.

I’m sharing this as historical proof, so when the EA launches, it’s clear the trades are real and not manipulated

This run started on a new account ($1000, 0.01 lot) with a different broker (Vantage FX RAW vs. previous VT Markets ECN).

Backtest and live results are nearly identical, with one live trade missing due to a later start compared to the full-day backtest.

I’m sharing this as historical proof, so when the EA launches, it’s clear the trades are real and not manipulated

Alfred Charano

HyperZERO delivered another profitable day ( with 0.01 lot $159 profits yesterday only on real account ). I’m happy with the results—not only because of the profit, but also because the backtest and real trades are almost identical, below pic the comparison between BT & Real Trades.

Alfred Charano

HyperZERO S1 & S2 performance 😎 $1000 / 0.01 lot ( $178 profits ) on real account using VT Markets Broker

Alfred Charano

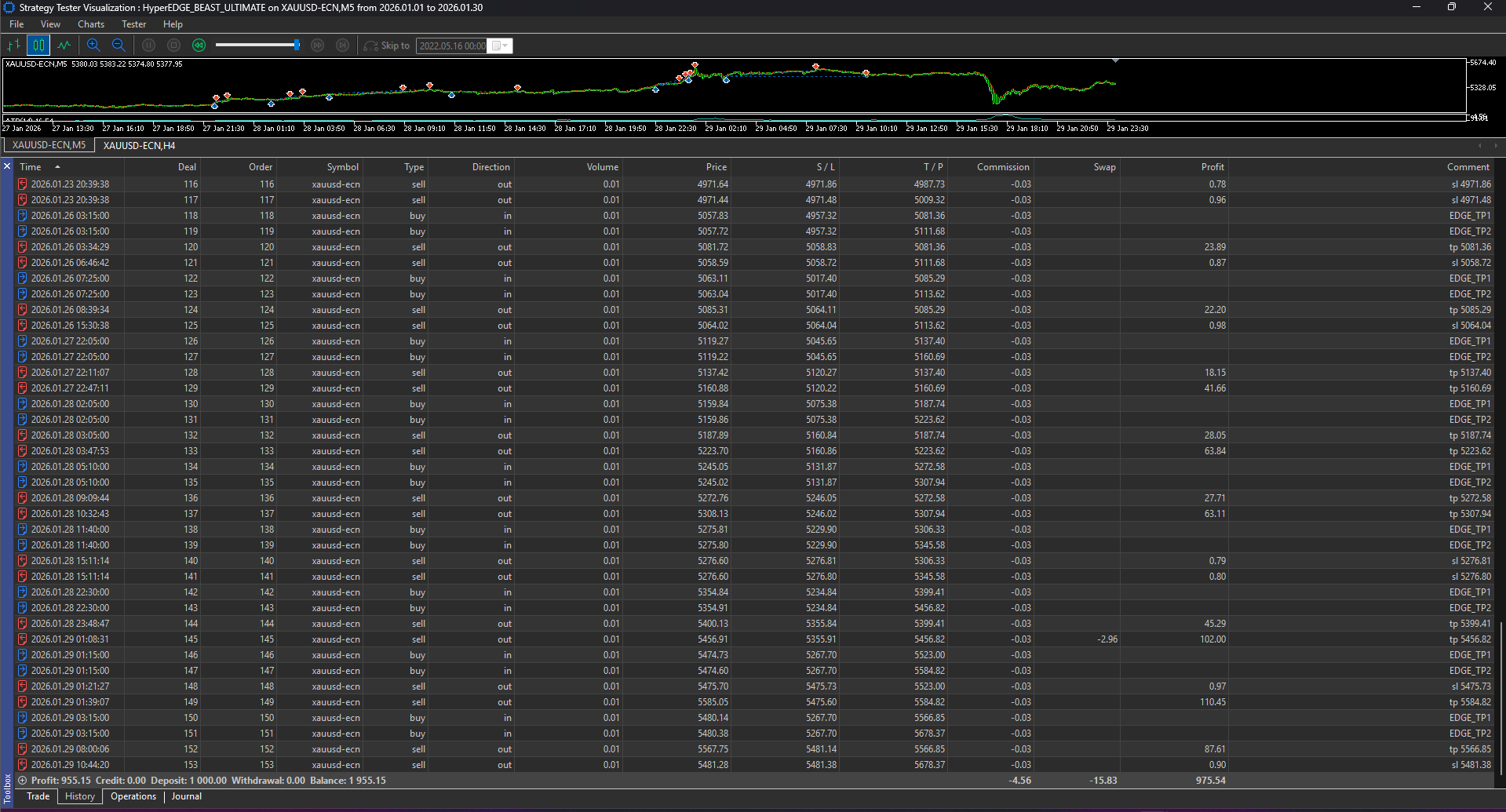

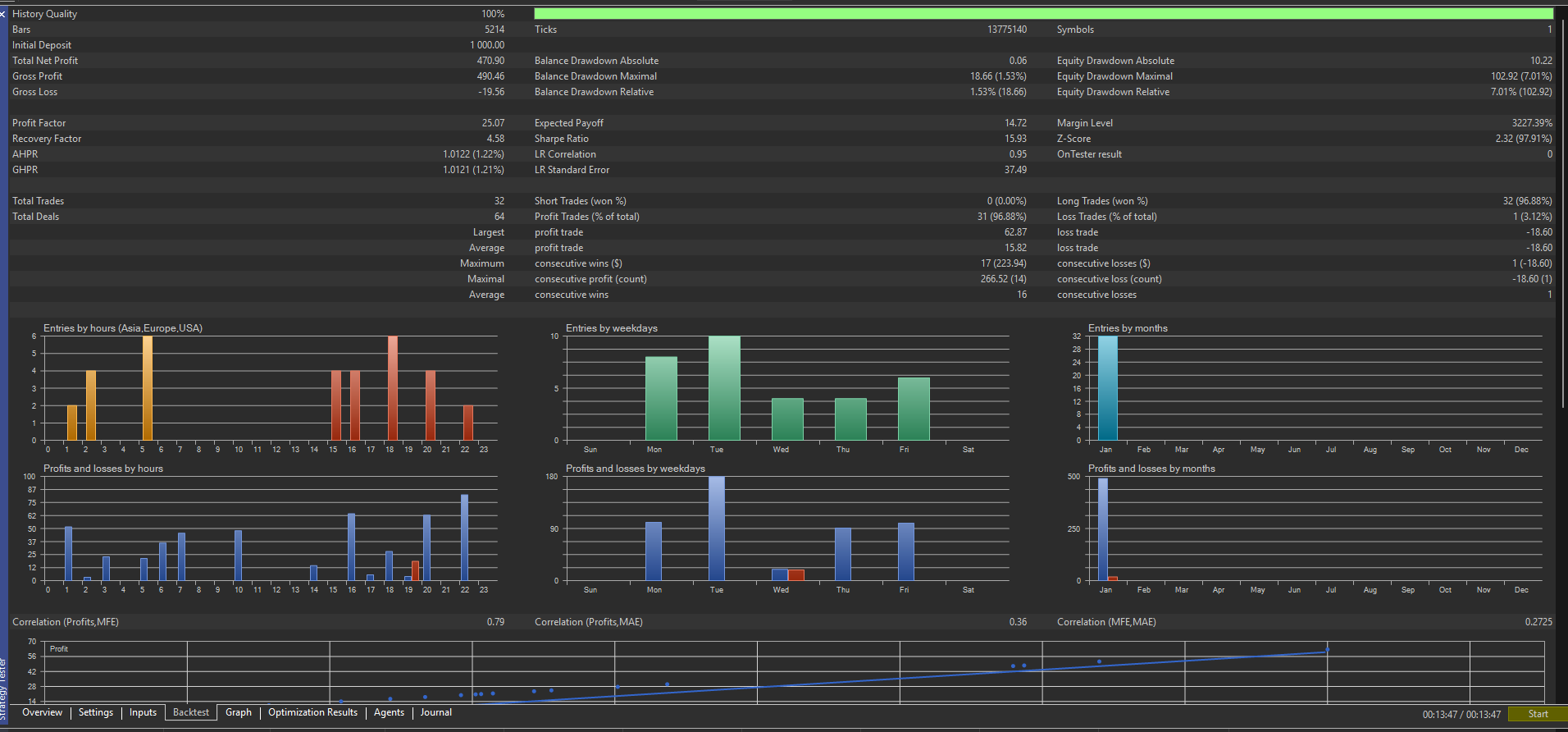

I honestly think HyperEDGE is the best EA I’ve ever coded. It trades gold using ATR-based TP, SL, and trailing stop. With just a 0.01 lot size, it delivered results like this in only one month. I’m literally speechless. This EA needs to be finalized ASAP — it truly looks ready for launch.

Alfred Charano

I can’t wait to run today’s backtest on HyperZERO. The results are almost identical to live trading (5 live trades vs. 5 backtest trades). Of course, there are slight differences due to real-market slippage, but overall the results are truly very close. While many EAs struggled yesterday, HyperZERO booked solid profits. I’m excited to further optimize this EA to make it more robust and profitable across different market conditions, both in live trading and backtesting. No manipulated backtests — the close match between real and BT trades speaks for itself.

Alfred Charano

While other EAs are crashing, HyperZERO running the ZPulse_S1 strategy is booking solid profits. only with 0.01 lot 😎

Alfred Charano

The new TP/SL logic on this EA looks insane. It runs with just 2 entries at a 0.01 lot size. Tested only in January 2026, and the results were amazing. SL and TP are ATR-based, so the risk stays under control — no crazy big stop losses. HyperEDGE sounds like the perfect name for it.

Alfred Charano

Published product

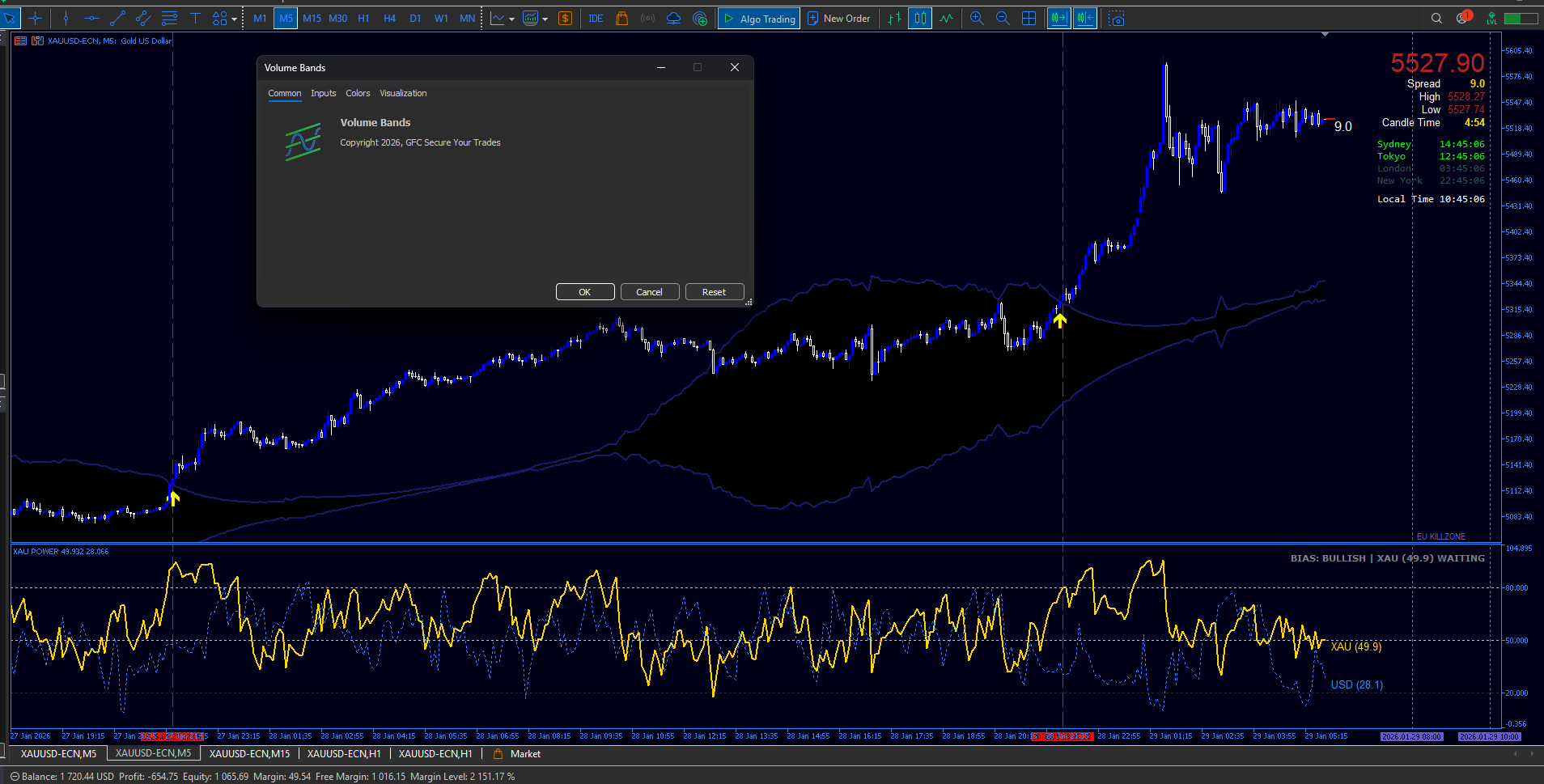

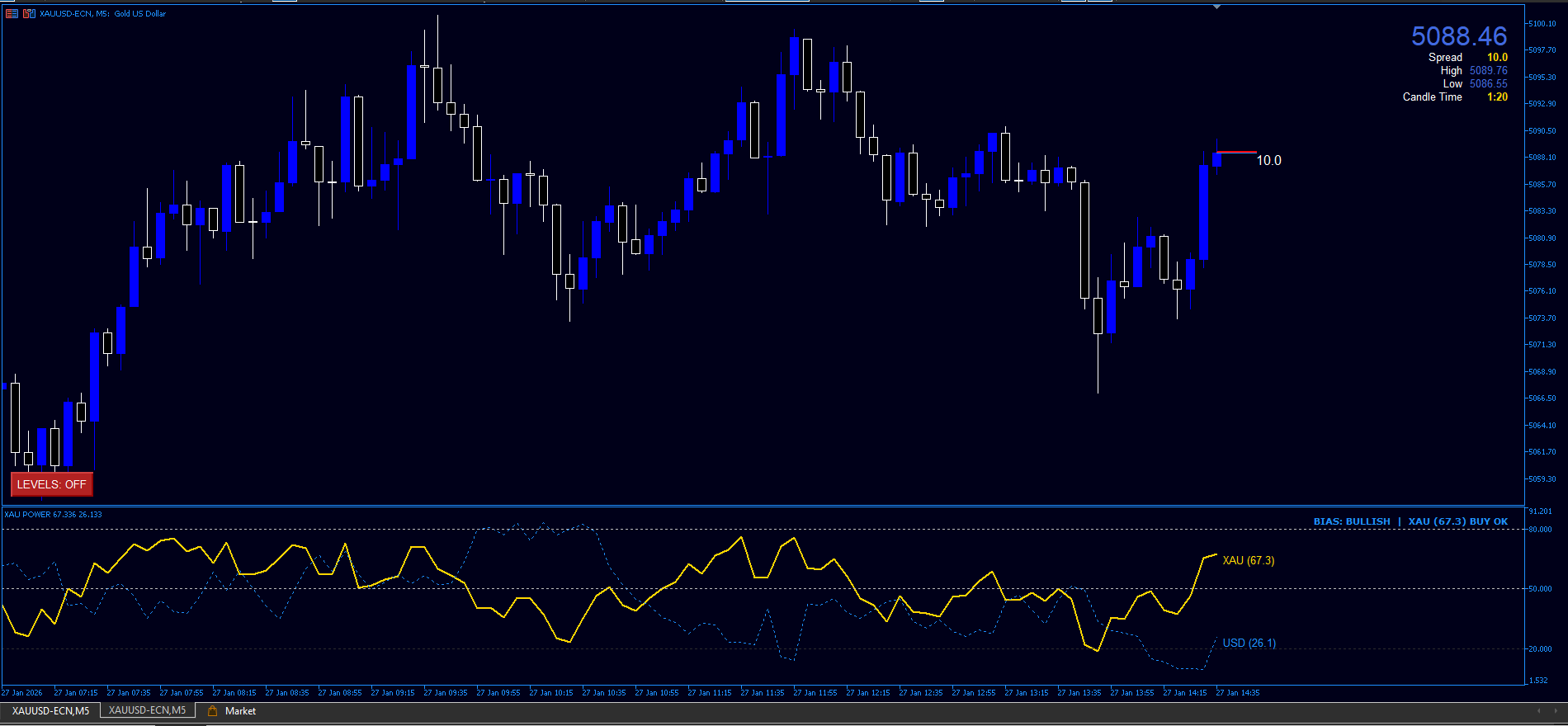

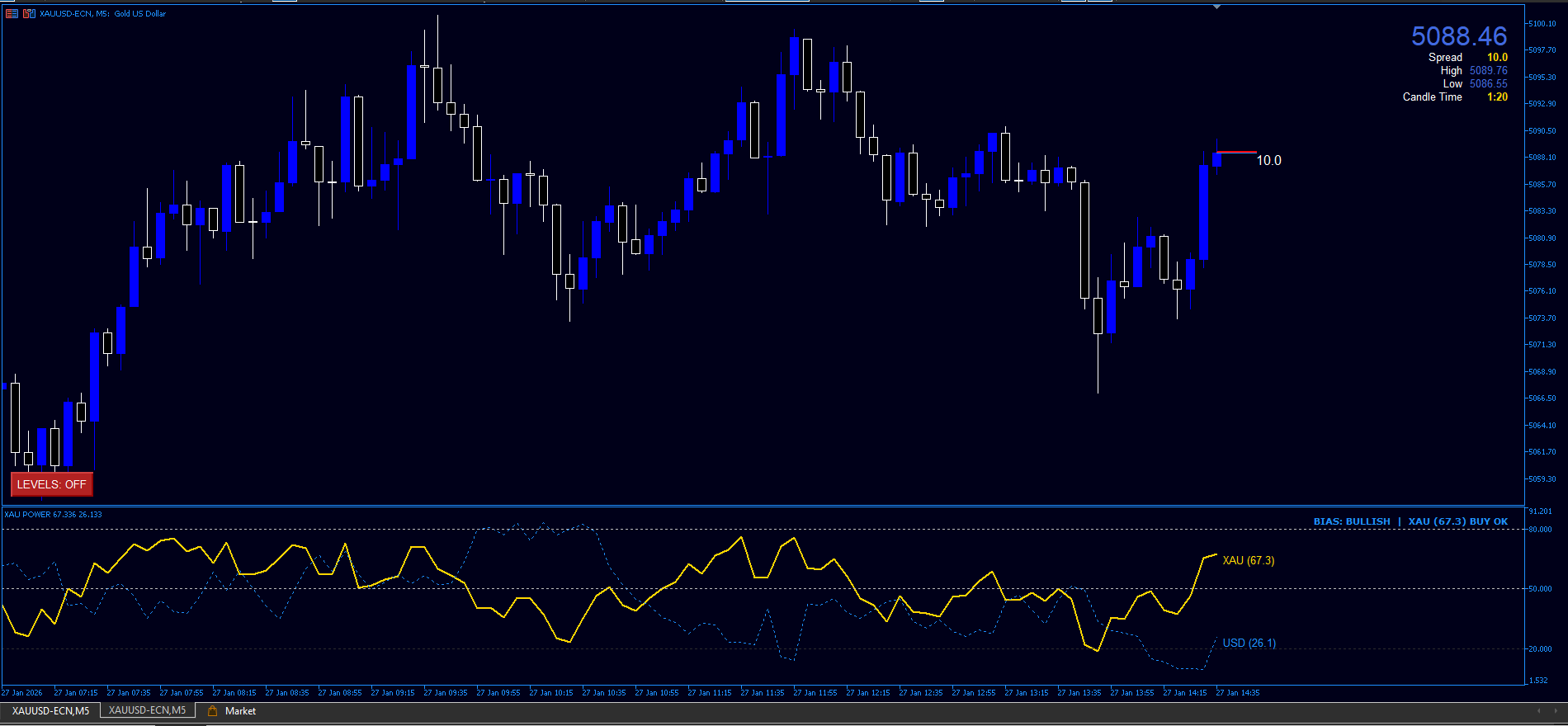

XAU POWER : The Gold Velocity Matrix XAU Power is an analytical suite specifically designed for Gold (XAUUSD) traders. This tool moves beyond traditional lagging indicators by utilizing a proprietary Velocity Decoupling Algorithm to measure the hidden energy balance between Gold and the US Dollar. Engineered for precision, XAU Power PRO synchronizes market momentum with a high-level Structural Trend Engine, giving you a definitive edge in identifying high-probability entry zones while

Alfred Charano

XAU Power is an analytical tools specifically designed for Gold (XAUUSD) traders. This tool moves beyond traditional lagging indicators by utilizing a proprietary Velocity Decoupling Algorithm to measure the hidden energy balance between Gold and the US Dollar.

XAU Power synchronizes market momentum with a high-level Structural Trend Engine, giving you a definitive edge in identifying high-probability entry zones while avoiding market exhaustion.

XAU Power synchronizes market momentum with a high-level Structural Trend Engine, giving you a definitive edge in identifying high-probability entry zones while avoiding market exhaustion.

Alfred Charano

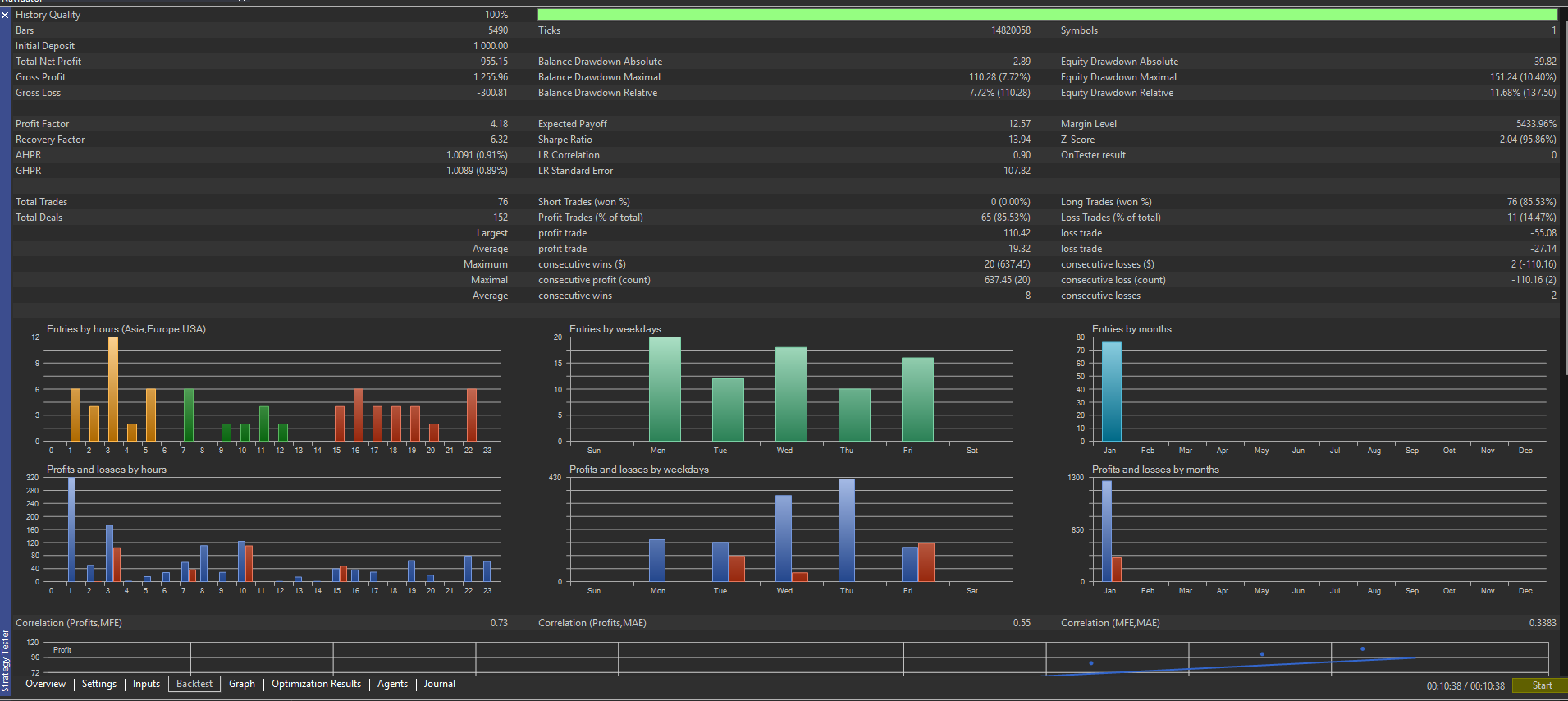

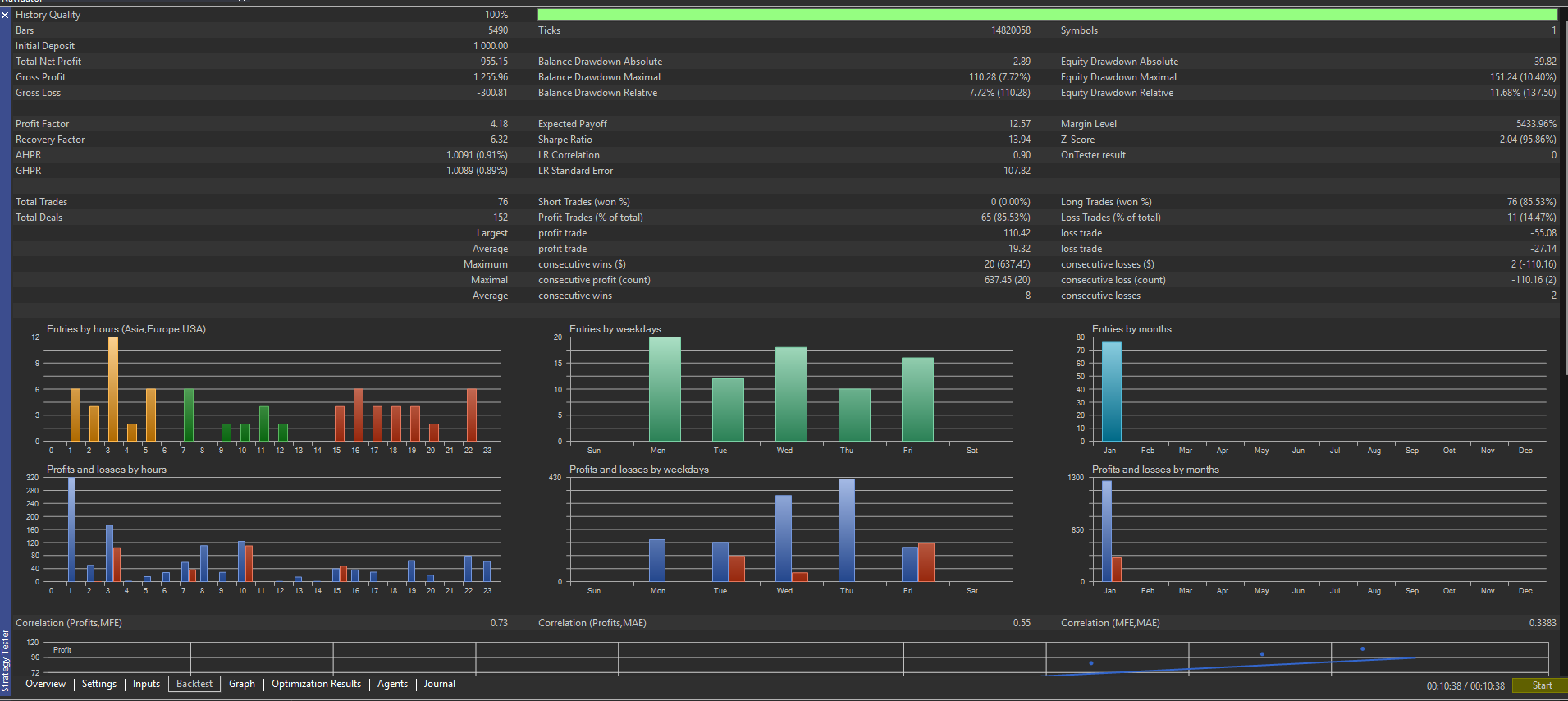

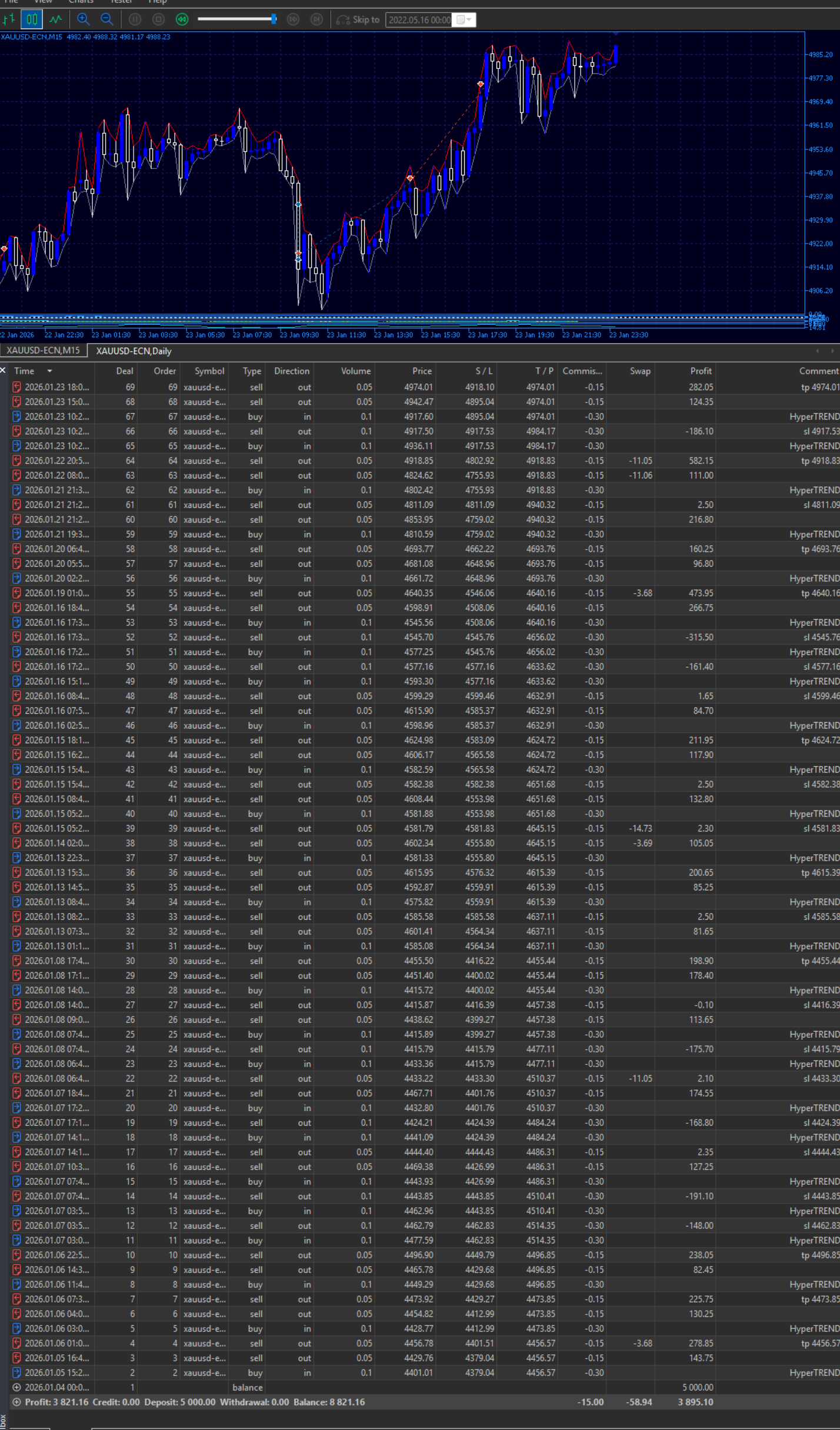

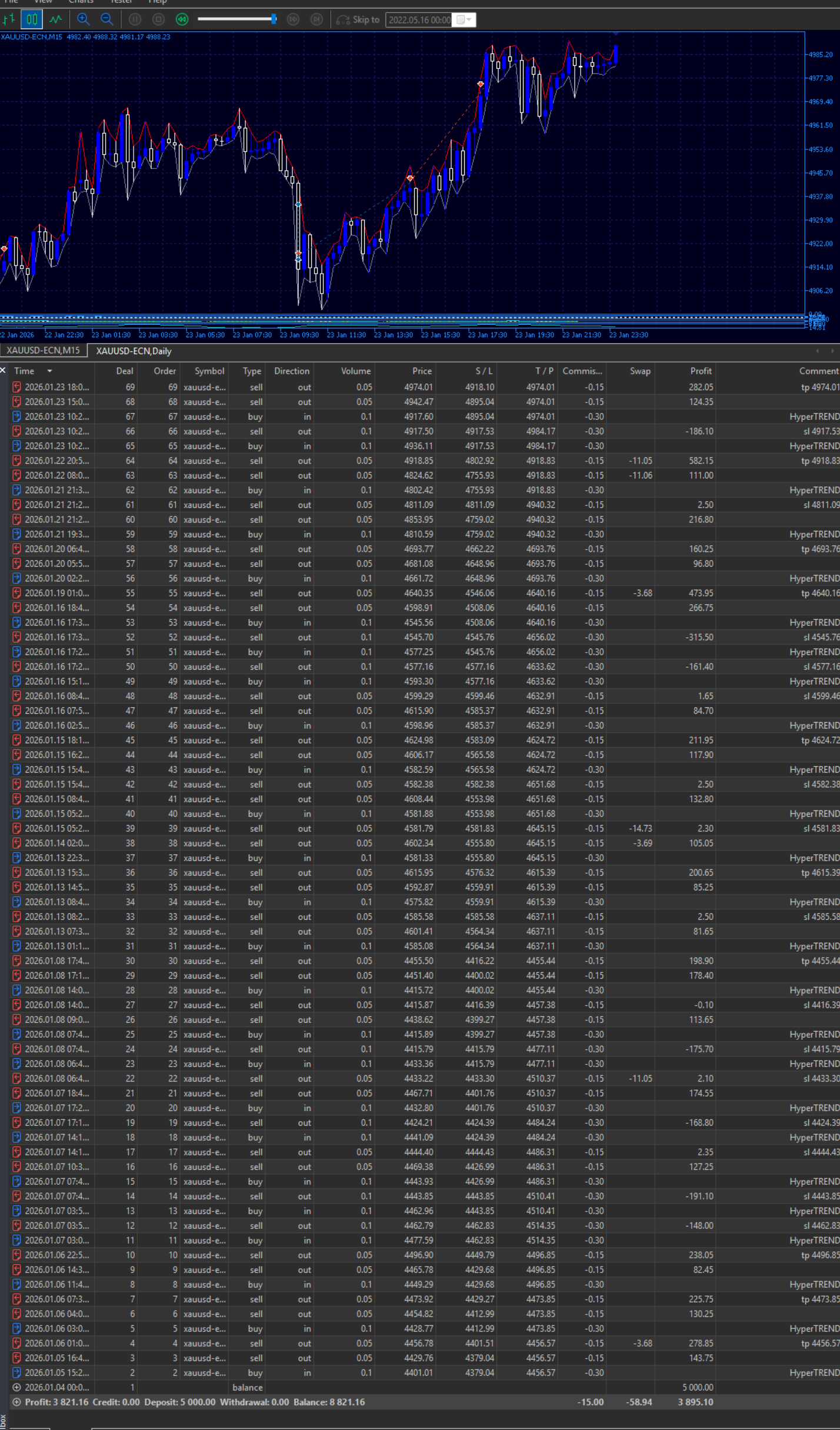

Just finished building the HyperTREND EA based on the HyperTREND indicator on TradingView.

The results are quite impressive — tests from 1 - 24 Januari 2026, using 0.1 lot size with partial closes (50%): TP1 = 0.05 lot, TP2 = 0.05 lot.

The performance is very close to the indicator’s results. Of course, it can never be 100% identical due to differences in programming language and other technical factors, but the EA’s output is already very close.

It just needs further tweaks and backtest optimization to ensure it can remain profitable in the long run.

The results are quite impressive — tests from 1 - 24 Januari 2026, using 0.1 lot size with partial closes (50%): TP1 = 0.05 lot, TP2 = 0.05 lot.

The performance is very close to the indicator’s results. Of course, it can never be 100% identical due to differences in programming language and other technical factors, but the EA’s output is already very close.

It just needs further tweaks and backtest optimization to ensure it can remain profitable in the long run.

: