Adithyo Dewangga Wijaya / Profile

- Information

|

5+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

2

signals

|

50

subscribers

|

Senior Solutions Manager @ Singtel Singapore

at

Singapore

Strategy Type: Trader and Investor

Strategy Description: This account focuses exclusively on trading—engaging in the buying and selling of multiple asset classes to hedge risk, rather than adhering to a traditional buy-and-hold investment strategy. I employ both technical and fundamental analyses to pinpoint trading opportunities by identifying key support and resistance levels, as well as assessing the intrinsic value of assets.

Investment Period: I manage short, medium, and long-term trades.

Education: Computer Science - HardvardX

Professional Experience: Senior Solutions Manager @ Singtel Singapore

Personal Notes: I enjoy good food, travel, and sailing. If I can combine all these interests, even better.

https://t.me/tol_langit

Strategy Description: This account focuses exclusively on trading—engaging in the buying and selling of multiple asset classes to hedge risk, rather than adhering to a traditional buy-and-hold investment strategy. I employ both technical and fundamental analyses to pinpoint trading opportunities by identifying key support and resistance levels, as well as assessing the intrinsic value of assets.

Investment Period: I manage short, medium, and long-term trades.

Education: Computer Science - HardvardX

Professional Experience: Senior Solutions Manager @ Singtel Singapore

Personal Notes: I enjoy good food, travel, and sailing. If I can combine all these interests, even better.

https://t.me/tol_langit

Friends

304

Requests

Outgoing

Adithyo Dewangga Wijaya

Published MetaTrader 4 signal

Trading Parameters Maximum Lot Size: 0.03 per $1,000 equity Martingale Grid Distance: 100 pips, Fixed Lot Multiplier (1x) Take Profit (TP): Dynamic, trailing from 5 to 10 pips Supported Currency Pairs Major Pairs: EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD Cross Pairs: EUR/GBP, AUD/USD, EUR/CHF, AUD/CAD, AUD/NZD, NZD/CAD Strategy & Risk Management This automated Expert Advisor (EA) is engineered for consistent, low-risk growth, targeting a monthly return of 3-5% with a strict risk cap of

Adithyo Dewangga Wijaya

tol langit has a new tool for technical analysis — Trend smart algorithm detects the trend. This indicator combines the ratings of multiple different technical indicators to make it easier for traders and investors to find profitable trades.

The first consists of SMAs and EMAs with different lengths (MA lengths are 10, 20, 30, 50, 100 and 200), the Ichimoku Cloud, VWMA and HullMA. The second is calculated based on oscillators such as RSI, Stochastic, CCI, ADX, AO, Momentum, MACD, Stochastic RSI, Williams %R, Bulls and Bears Strength and UO.

The strategy relies on the recommendations of the indicator to Strong Buy or Strong Sell to determine the direction of entry into long or short positions, respectively.

you may use it freely!

The first consists of SMAs and EMAs with different lengths (MA lengths are 10, 20, 30, 50, 100 and 200), the Ichimoku Cloud, VWMA and HullMA. The second is calculated based on oscillators such as RSI, Stochastic, CCI, ADX, AO, Momentum, MACD, Stochastic RSI, Williams %R, Bulls and Bears Strength and UO.

The strategy relies on the recommendations of the indicator to Strong Buy or Strong Sell to determine the direction of entry into long or short positions, respectively.

you may use it freely!

Adithyo Dewangga Wijaya

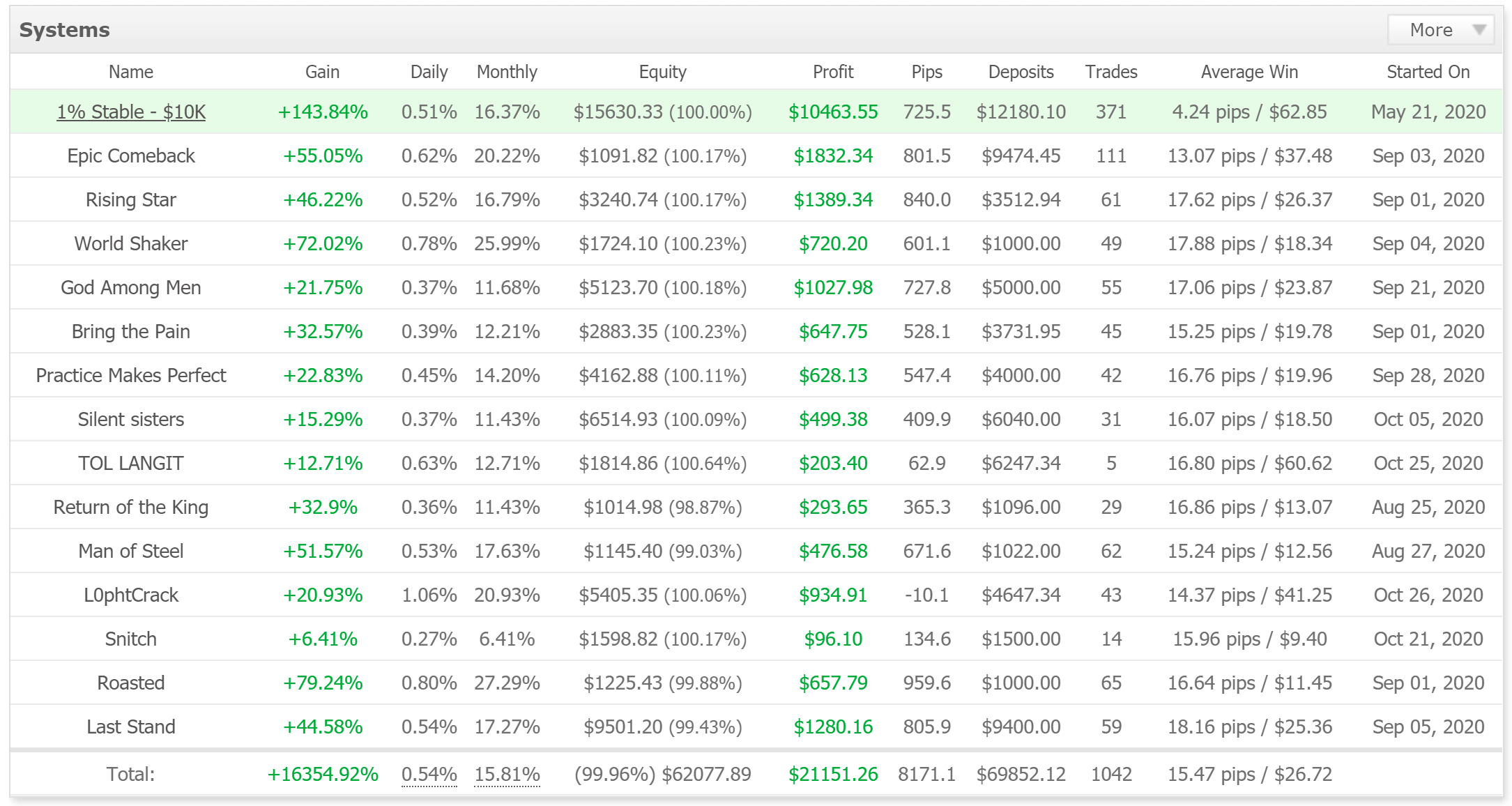

Whoever is interested in trading and following me, My portfolio gain 16354% in the past 3 months trading

Adithyo Dewangga Wijaya

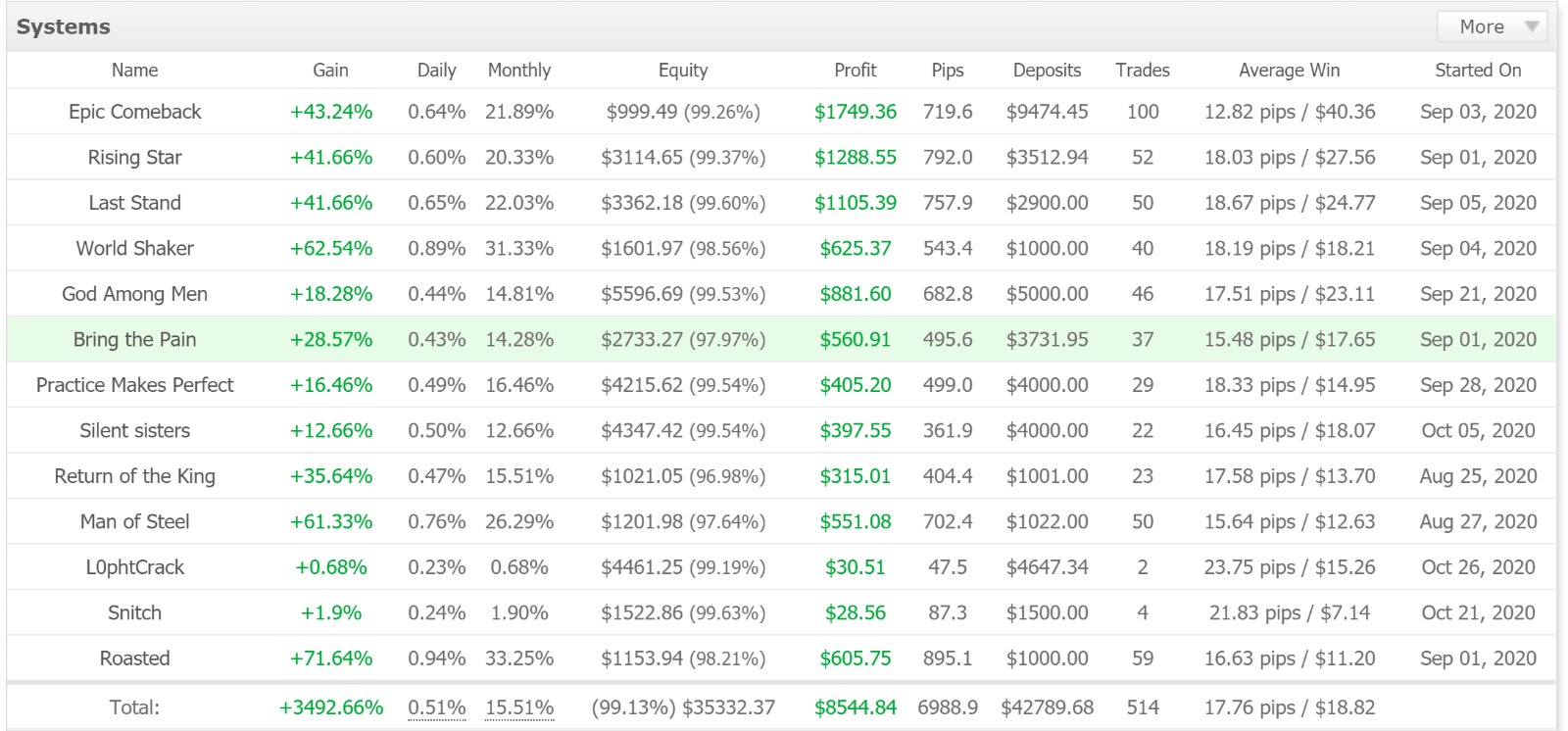

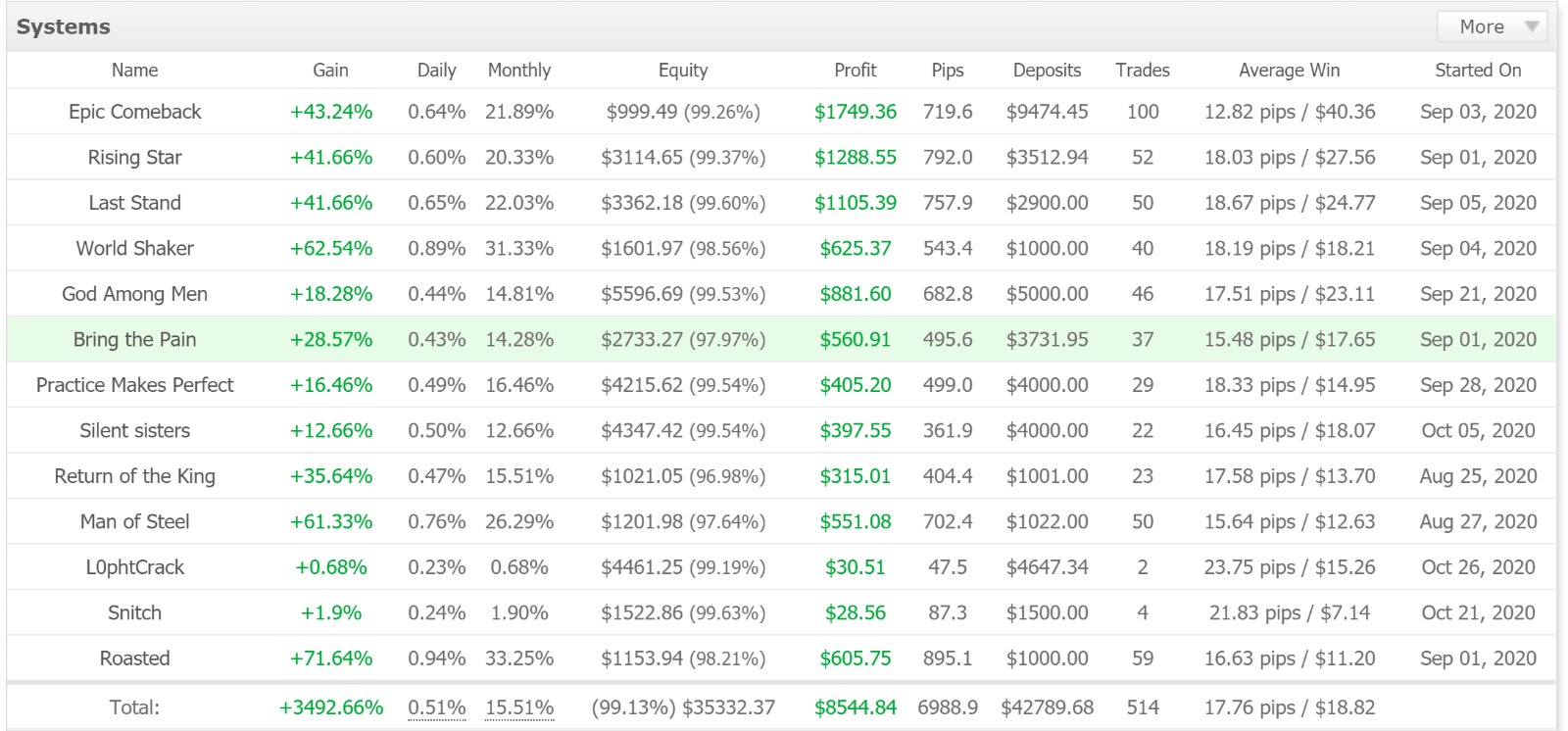

Whoever is interested in trading and following me, My portfolio is up 3492% in the past 2 months trading

: