Abdul Barrud Darovi / Profile

- Information

|

3 years

experience

|

1

products

|

1

demo versions

|

|

0

jobs

|

1

signals

|

0

subscribers

|

Independent Traders

Abdul Barrud Darovi

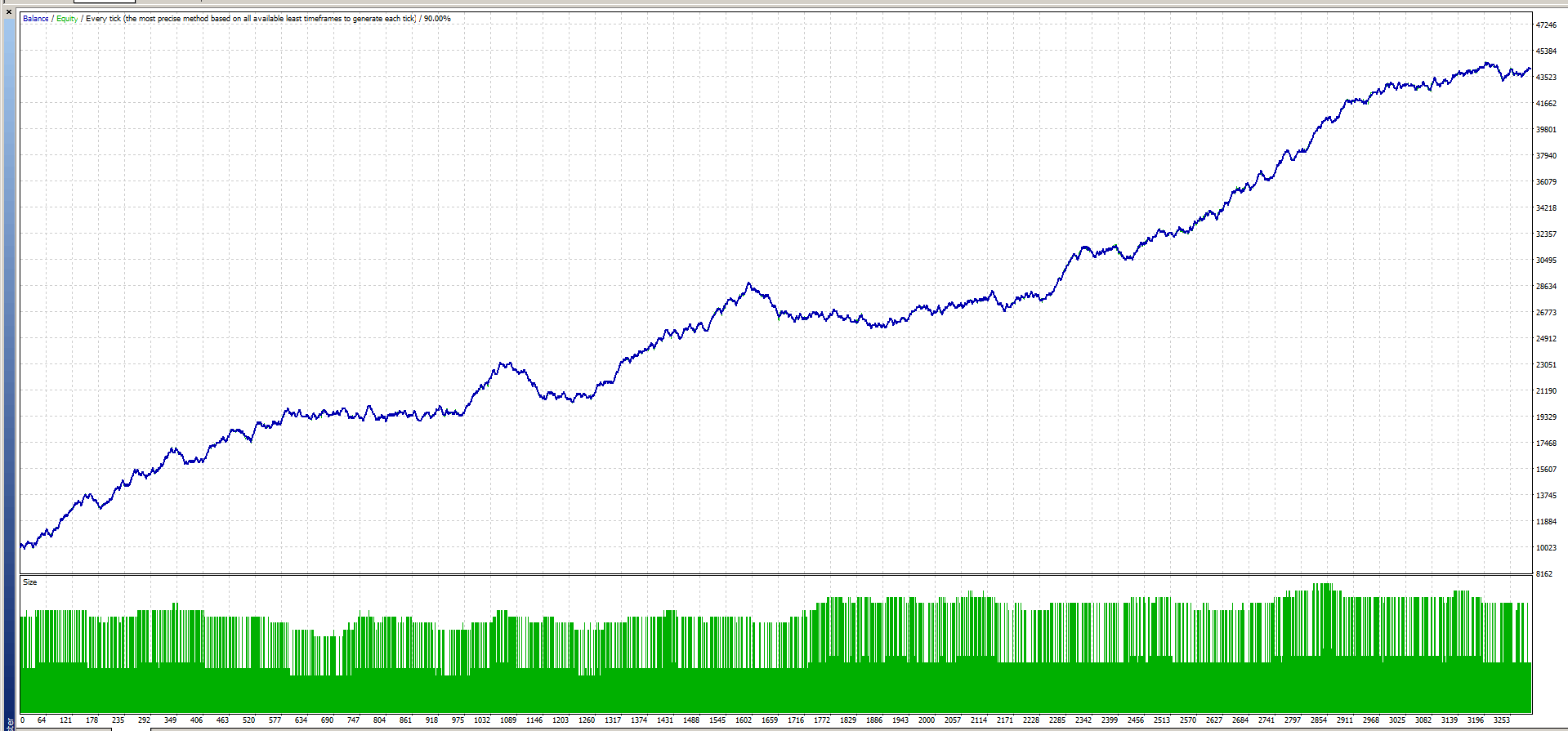

EURUSD Backtest Result

using 1% static RPT (Risk Per Trade)

backtest period : 2006 - 2025

I’m kinda disappointed with this backtest result.

People say EURUSD is the most liquid pair, but from what I saw during the backtest,

the probability distribution feels almost random. You need a pretty big move first before you can get a decent setup,

whether it’s a buy limit/stop or a sell limit/stop.

But yeah, it’s not too bad—profits are small, but at least it’s something.

Next backtest: GBPJPY, EURJPY, and GBPUSD.

using 1% static RPT (Risk Per Trade)

backtest period : 2006 - 2025

I’m kinda disappointed with this backtest result.

People say EURUSD is the most liquid pair, but from what I saw during the backtest,

the probability distribution feels almost random. You need a pretty big move first before you can get a decent setup,

whether it’s a buy limit/stop or a sell limit/stop.

But yeah, it’s not too bad—profits are small, but at least it’s something.

Next backtest: GBPJPY, EURJPY, and GBPUSD.

Abdul Barrud Darovi

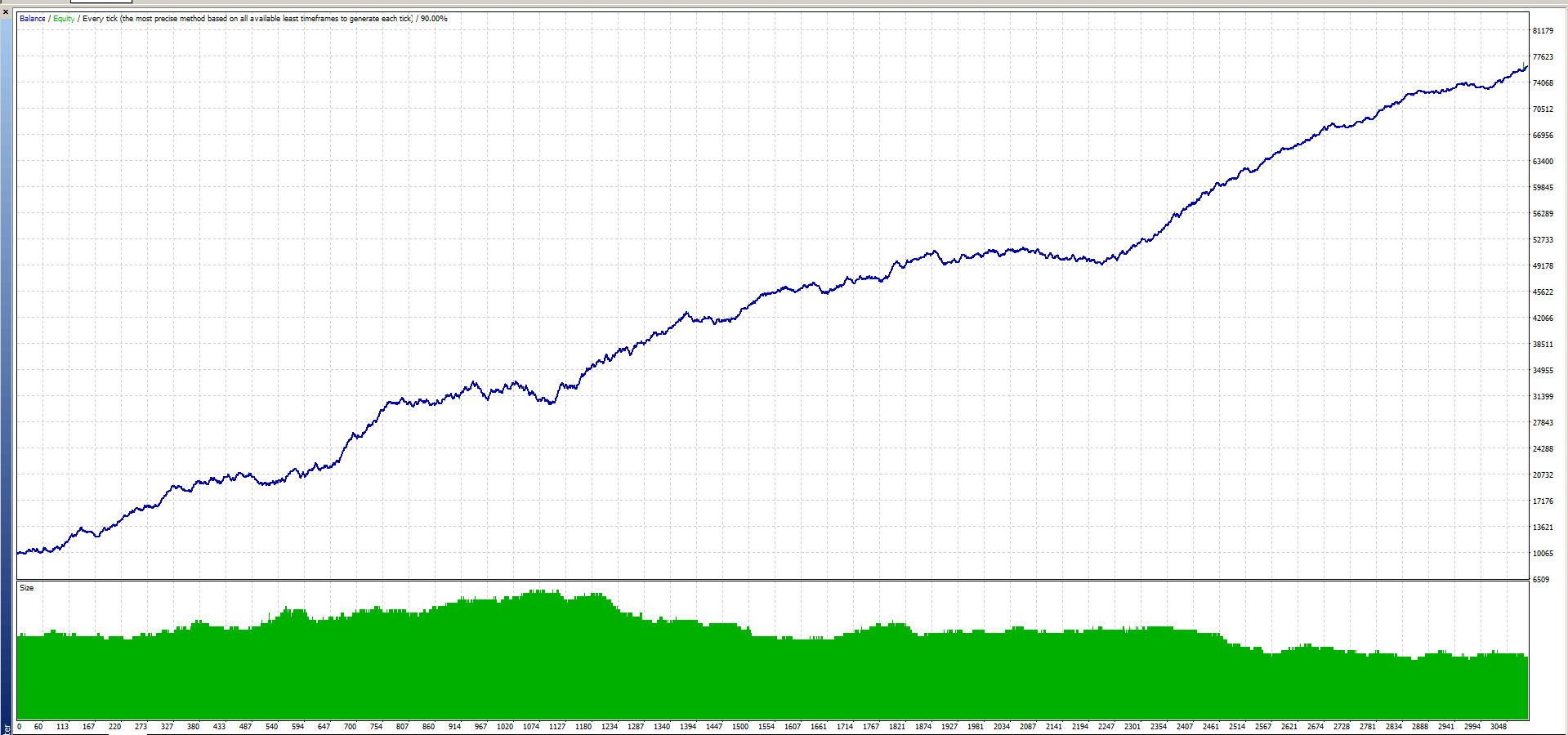

4 pairs left: GBPJPY, EURJPY, EURUSD, and GBPUSD.

At the beginning, backtesting was a nightmare 😅.

It took me almost 4 months because I was still trying to figure out the right blueprint for my method.

But once everything clicked, now it only takes about 3 weeks to backtest one pair.

The hardest part is definitely finding sell setups, especially on XAUUSD.

If you zoom out and look at the bigger picture, XAUUSD always feels like a buy. It just keeps going up.

But after digging a bit deeper, I realized something interesting. On a day-to-day basis,

XAUUSD actually has almost the same chance of going up or down.

The difference is how the moves play out.

When it goes up, the move usually lasts longer and runs further.

When it goes down, it tends to be quicker and shorter.

That’s why people say “XAUUSD always goes up.”

It looks bullish because of the structure of the moves, not because the probability is one-sided.

The distribution isn’t symmetric — it’s asymmetric.

At the beginning, backtesting was a nightmare 😅.

It took me almost 4 months because I was still trying to figure out the right blueprint for my method.

But once everything clicked, now it only takes about 3 weeks to backtest one pair.

The hardest part is definitely finding sell setups, especially on XAUUSD.

If you zoom out and look at the bigger picture, XAUUSD always feels like a buy. It just keeps going up.

But after digging a bit deeper, I realized something interesting. On a day-to-day basis,

XAUUSD actually has almost the same chance of going up or down.

The difference is how the moves play out.

When it goes up, the move usually lasts longer and runs further.

When it goes down, it tends to be quicker and shorter.

That’s why people say “XAUUSD always goes up.”

It looks bullish because of the structure of the moves, not because the probability is one-sided.

The distribution isn’t symmetric — it’s asymmetric.

Abdul Barrud Darovi

Published MetaTrader 4 signal

This strategy uses a multiple pending order daily, with a minimum of two pending orders per day . Each pending order is assigned a variable expiration time , from 23 to 69 hours . Minimum equity: $1,000 Risk per trade: 0.5% – 2% (adjusted to account equity) NOTE Most pending orders will expire without execution . This is an intentional filtering process designed to ensure that only high-probability setups are traded. Only setups with a win rate above 53%, based on 20 years of historical data

Abdul Barrud Darovi

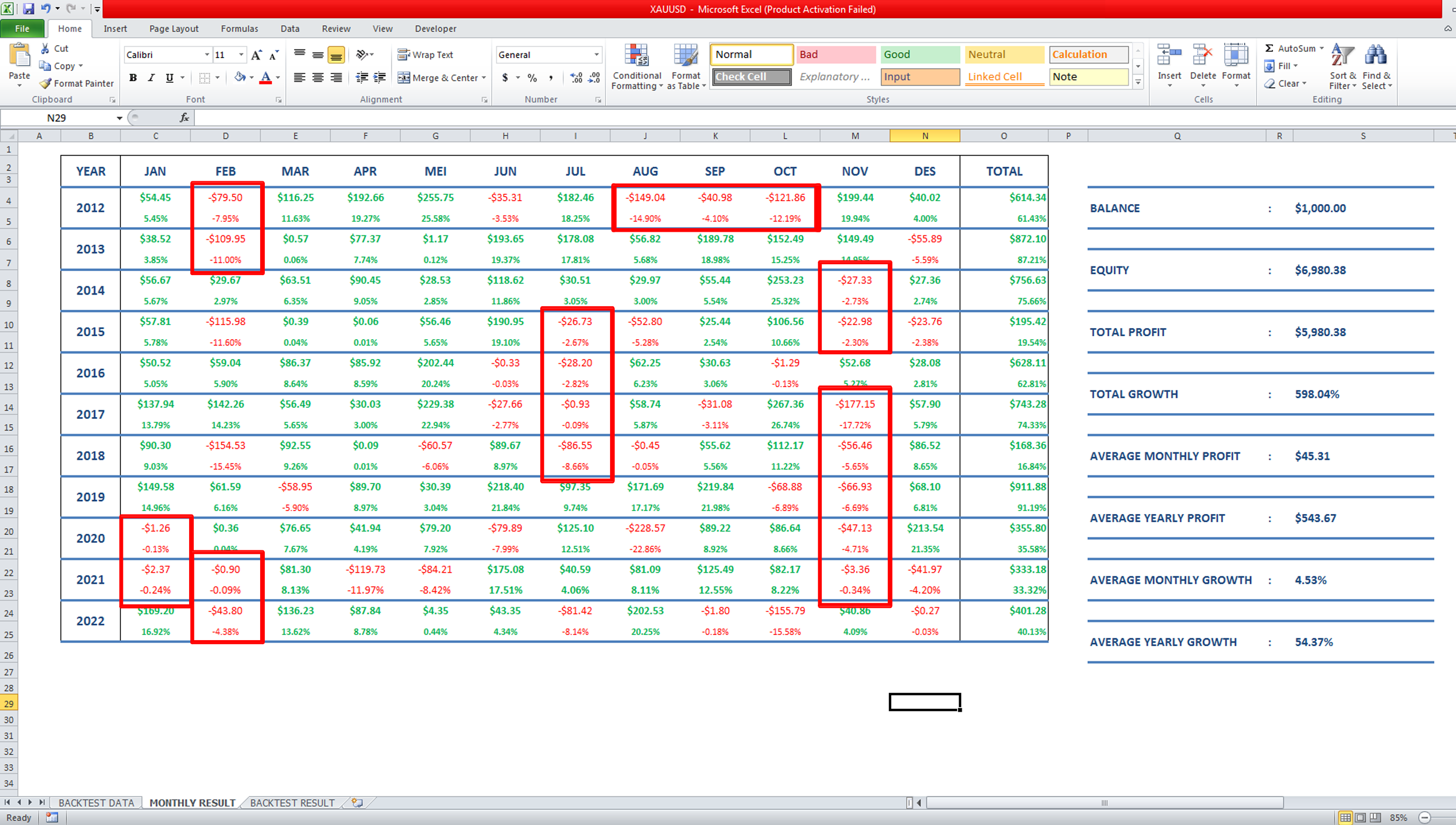

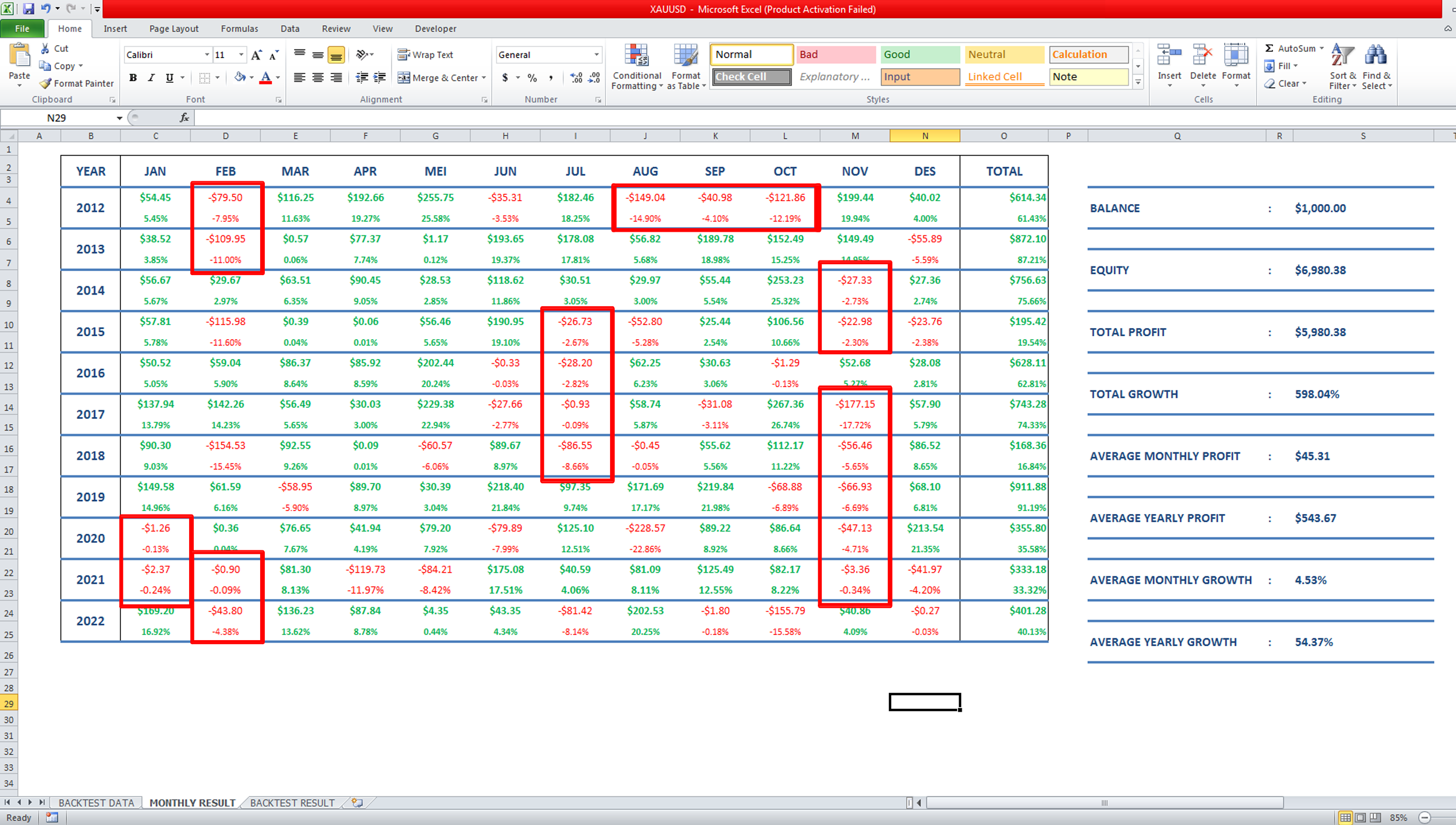

So far, I am still doing backtesting, dozens to hundreds of times, over a long period of historical data.

I don't trust robots or Expert Advisors (EAs), so the backtest I do is Manual.

You can imagine how exhausting this process is.

Am I searching for the holy grail? Yes. But not in the form of a high win rate.

I am satisfied with a 55% win rate. In theory, this should allow for a consistent 5% profit per month.

However, the backtest data still shows that there are some months of losses, even though the year-end book shows a profit.

The holy grail I am looking for is not a high win rate, nor a good risk-reward ratio.

Instead, it is consistent monthly profit, at least 3%, with no losing months.

I would be grateful with just 2% as long it is consistent.

Because once that happens, it’s just a matter of increasing the capital.

But since I haven't found it yet, I am still conducting backtests on various possibilities.

this is the journey of trader. i do enjoying this.

I don't trust robots or Expert Advisors (EAs), so the backtest I do is Manual.

You can imagine how exhausting this process is.

Am I searching for the holy grail? Yes. But not in the form of a high win rate.

I am satisfied with a 55% win rate. In theory, this should allow for a consistent 5% profit per month.

However, the backtest data still shows that there are some months of losses, even though the year-end book shows a profit.

The holy grail I am looking for is not a high win rate, nor a good risk-reward ratio.

Instead, it is consistent monthly profit, at least 3%, with no losing months.

I would be grateful with just 2% as long it is consistent.

Because once that happens, it’s just a matter of increasing the capital.

But since I haven't found it yet, I am still conducting backtests on various possibilities.

this is the journey of trader. i do enjoying this.

: