Hans Raj Goswami / Profile

- Information

|

1 year

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

2

signals

|

0

subscribers

|

Hans Raj Goswami

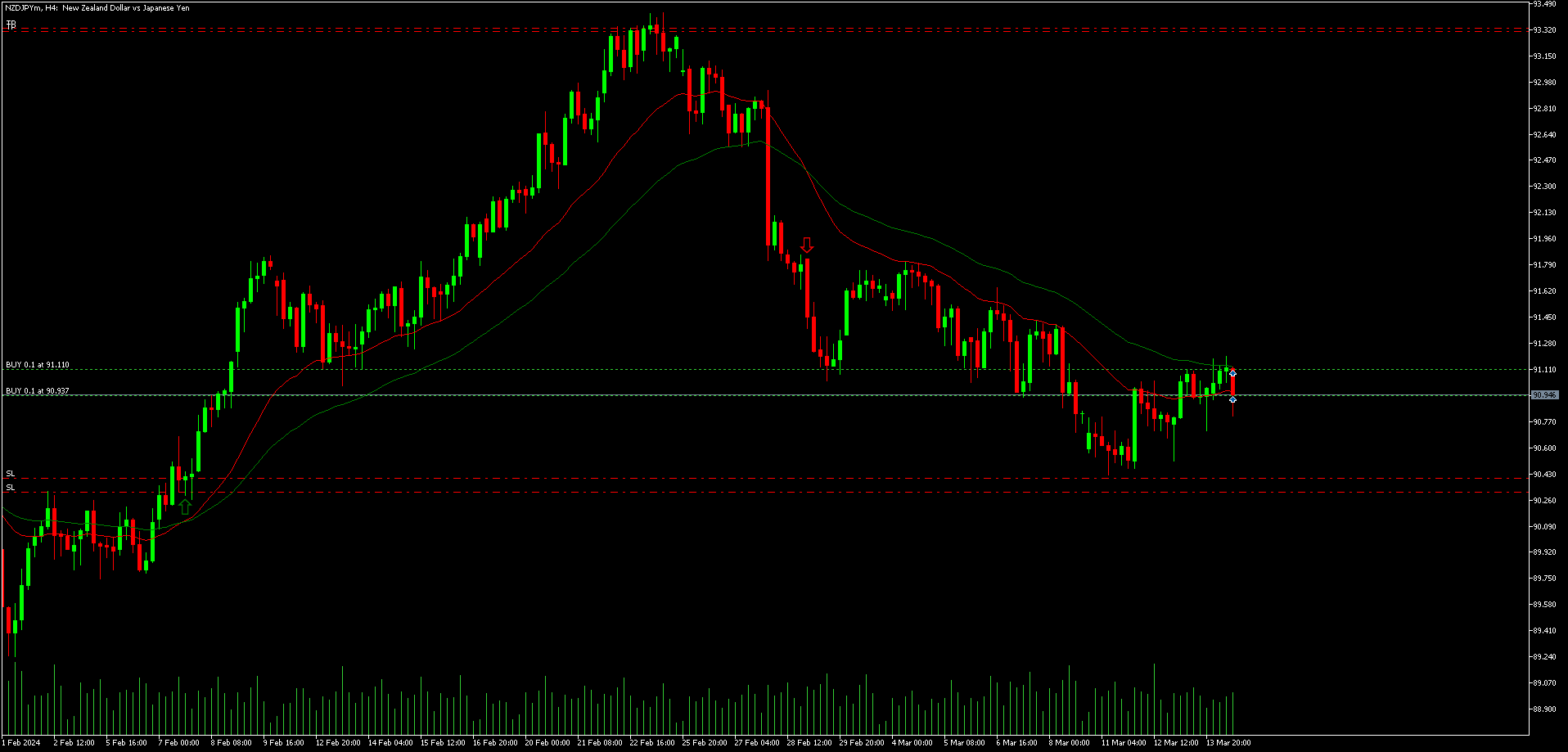

Current Price: 91.100 (as of your prompt, actual price may vary) (March 14, 2024, 18:20pm IST)

Target: 93.310

Stop Loss: 90.310

Analysis:

Since I cannot access live charts and historical data, this analysis is based on general technical indicators and should not be considered financial advice.

Moving Averages:

A 20-day or 50-day moving average crossing above a 100-day or 200-day moving average (golden crossover) could indicate an upward trend.

Check if the price is currently above its short-term moving averages (e.g., 20-day) and if there's recent upward momentum.

Relative Strength Index (RSI):

An RSI value below 30 suggests the currency might be oversold, potentially indicating a buying opportunity.

If the RSI is currently below 30 and has recently turned upward, it could signal a potential reversal towards the upside.

Support and Resistance:

Identify any support levels (areas where the price has bounced off previously) near the current price or below.

A break above a resistance level (areas where the price has struggled to surpass previously) could indicate a continuation of the uptrend.

Trade Justification:

If the above indicators suggest a potential uptrend (golden crossover, RSI below 30 and rising, break above resistance), the long trade from 91.100 with a target of 93.310 could be justified.

Risk Management:

The stop loss is placed at 90.310, maintaining a reasonable risk-reward ratio (ideally, at least 1:2).

Always place a stop loss to limit potential losses.

Additional Considerations:

This is a limited analysis based on basic indicators. Consider incorporating other technical indicators like MACD or Stochastic Oscillator for a more comprehensive view.

Fundamental factors like economic data, central bank policies, and risk sentiment can also impact the NZDJPY pair. Analyze these factors alongside technical indicators for a well-rounded trading decision.

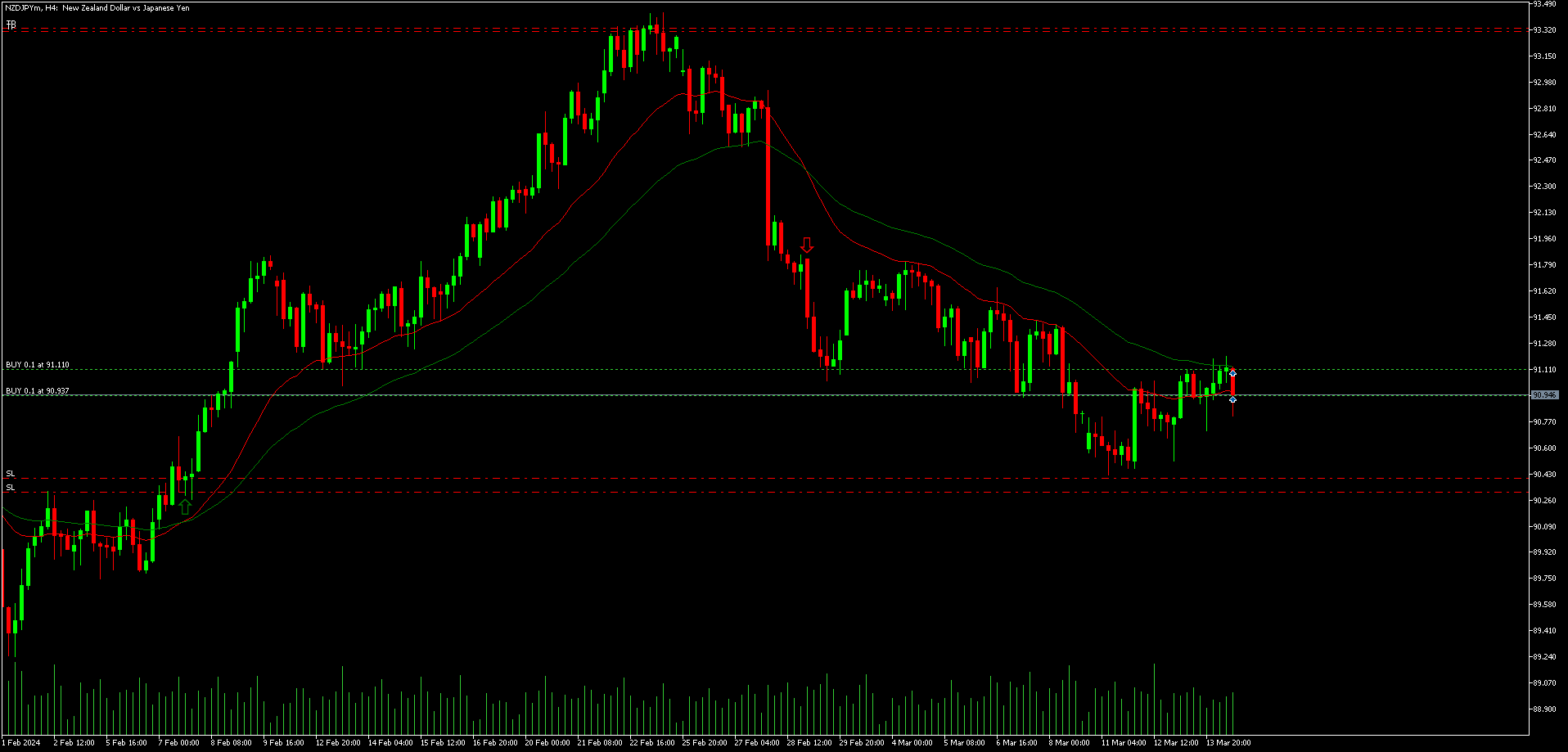

Target: 93.310

Stop Loss: 90.310

Analysis:

Since I cannot access live charts and historical data, this analysis is based on general technical indicators and should not be considered financial advice.

Moving Averages:

A 20-day or 50-day moving average crossing above a 100-day or 200-day moving average (golden crossover) could indicate an upward trend.

Check if the price is currently above its short-term moving averages (e.g., 20-day) and if there's recent upward momentum.

Relative Strength Index (RSI):

An RSI value below 30 suggests the currency might be oversold, potentially indicating a buying opportunity.

If the RSI is currently below 30 and has recently turned upward, it could signal a potential reversal towards the upside.

Support and Resistance:

Identify any support levels (areas where the price has bounced off previously) near the current price or below.

A break above a resistance level (areas where the price has struggled to surpass previously) could indicate a continuation of the uptrend.

Trade Justification:

If the above indicators suggest a potential uptrend (golden crossover, RSI below 30 and rising, break above resistance), the long trade from 91.100 with a target of 93.310 could be justified.

Risk Management:

The stop loss is placed at 90.310, maintaining a reasonable risk-reward ratio (ideally, at least 1:2).

Always place a stop loss to limit potential losses.

Additional Considerations:

This is a limited analysis based on basic indicators. Consider incorporating other technical indicators like MACD or Stochastic Oscillator for a more comprehensive view.

Fundamental factors like economic data, central bank policies, and risk sentiment can also impact the NZDJPY pair. Analyze these factors alongside technical indicators for a well-rounded trading decision.

: