62507511 Dimimu Odufote / Profile

I like to keep things simple and smooth for you to read. I love read charts and making new friends. I am deaf.

I like posting what I can see the market structure and I am firm believer to be happy and honest to everyone new and old.

Happy trading.

Bless your heart!

I like posting what I can see the market structure and I am firm believer to be happy and honest to everyone new and old.

Happy trading.

Bless your heart!

Friends

13

Requests

Outgoing

62507511 Dimimu Odufote

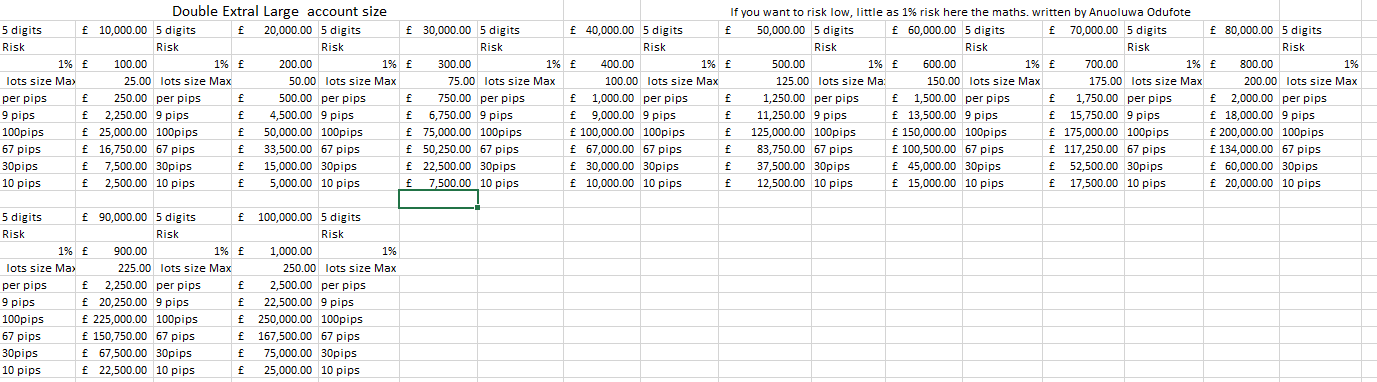

Risk management 101

(Please notes: Risk to rewards, losing streak rule book and Compounding ideas are not involved in this topic )

This is a simple guide on how to work out the money and treat it as a business. Feel free to add your thoughts.

It is about Double Extral Large account users here are the safety tips. If you wanted to risk more you simply change the %.

(Please notes: Risk to rewards, losing streak rule book and Compounding ideas are not involved in this topic )

This is a simple guide on how to work out the money and treat it as a business. Feel free to add your thoughts.

It is about Double Extral Large account users here are the safety tips. If you wanted to risk more you simply change the %.

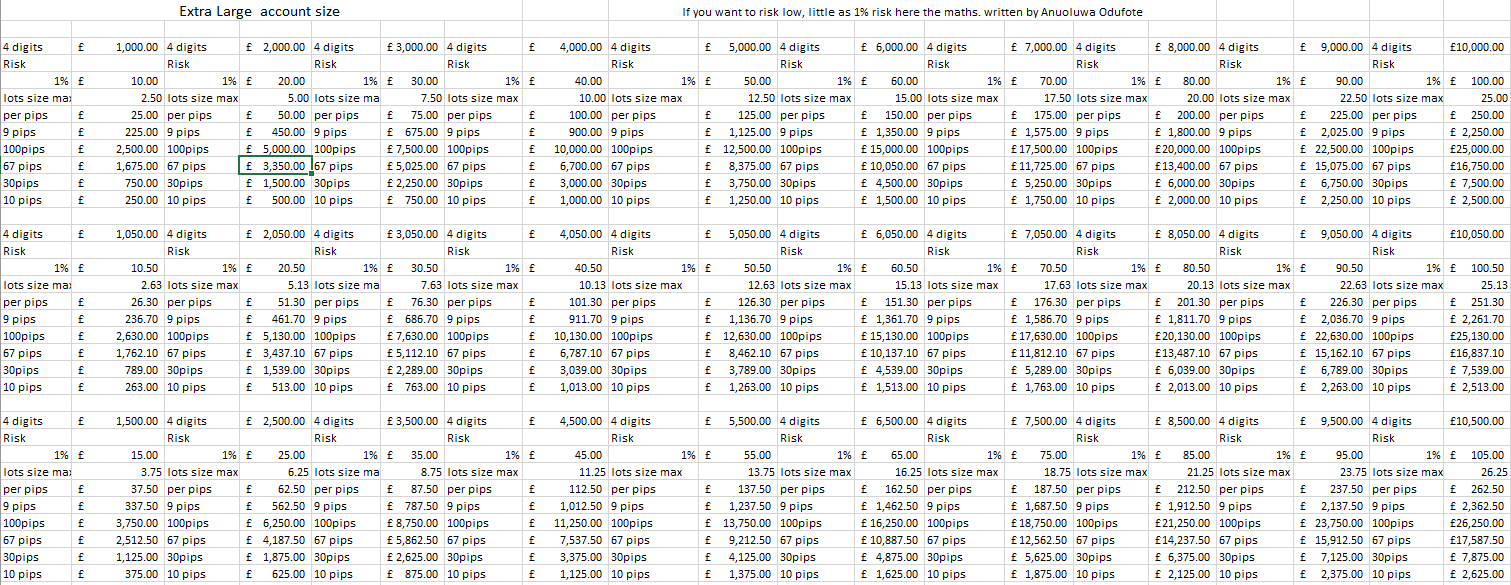

62507511 Dimimu Odufote

Risk management 101

(Please notes: Risk to rewards, losing streak rule book and Compounding ideas are not involved in this topic )

This is a simple guide on how to work out the money and treat it as a business. feel free to add your thoughts.

It is about Extral large account users here are the safety tips. If you wanted to risk more you simply change the %.

(Please notes: Risk to rewards, losing streak rule book and Compounding ideas are not involved in this topic )

This is a simple guide on how to work out the money and treat it as a business. feel free to add your thoughts.

It is about Extral large account users here are the safety tips. If you wanted to risk more you simply change the %.

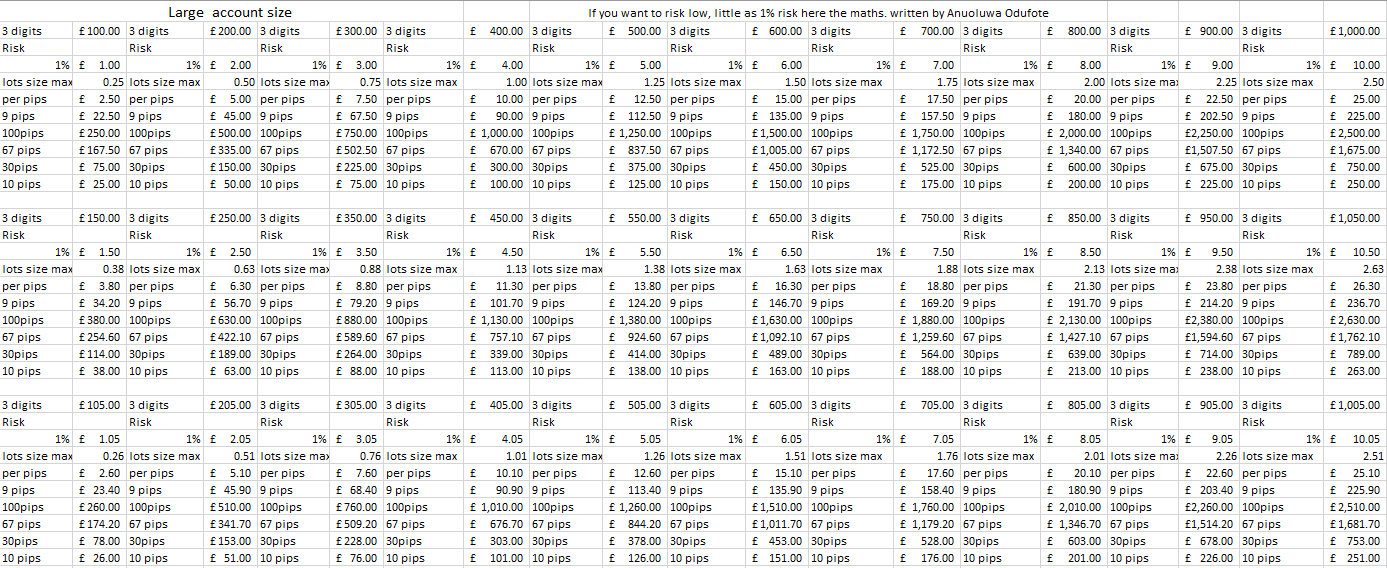

62507511 Dimimu Odufote

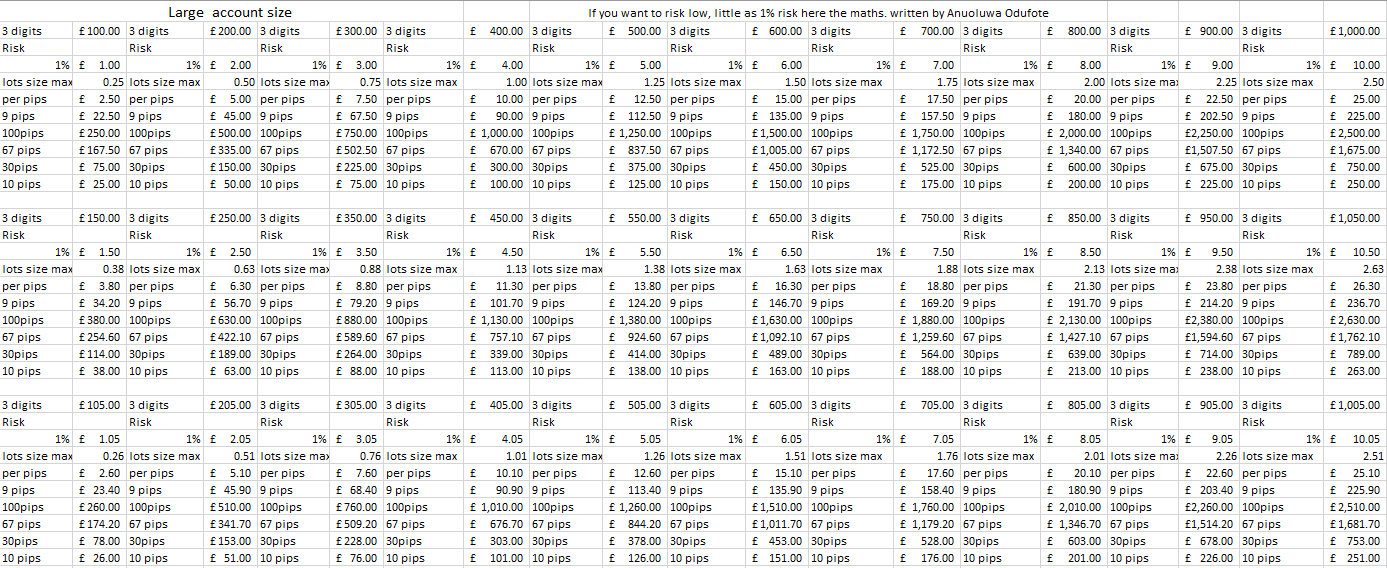

Risk management 101

(Please notes: Risk to rewards, losing streak rule book and Compounding ideas are not involved in this topic )

This is a simple guide on how to work out the money and treat it as a business. feel free to add your thoughts.

It is about large account users here are safety tips. If you wanted to risk more you simply change the %.

(Please notes: Risk to rewards, losing streak rule book and Compounding ideas are not involved in this topic )

This is a simple guide on how to work out the money and treat it as a business. feel free to add your thoughts.

It is about large account users here are safety tips. If you wanted to risk more you simply change the %.

62507511 Dimimu Odufote

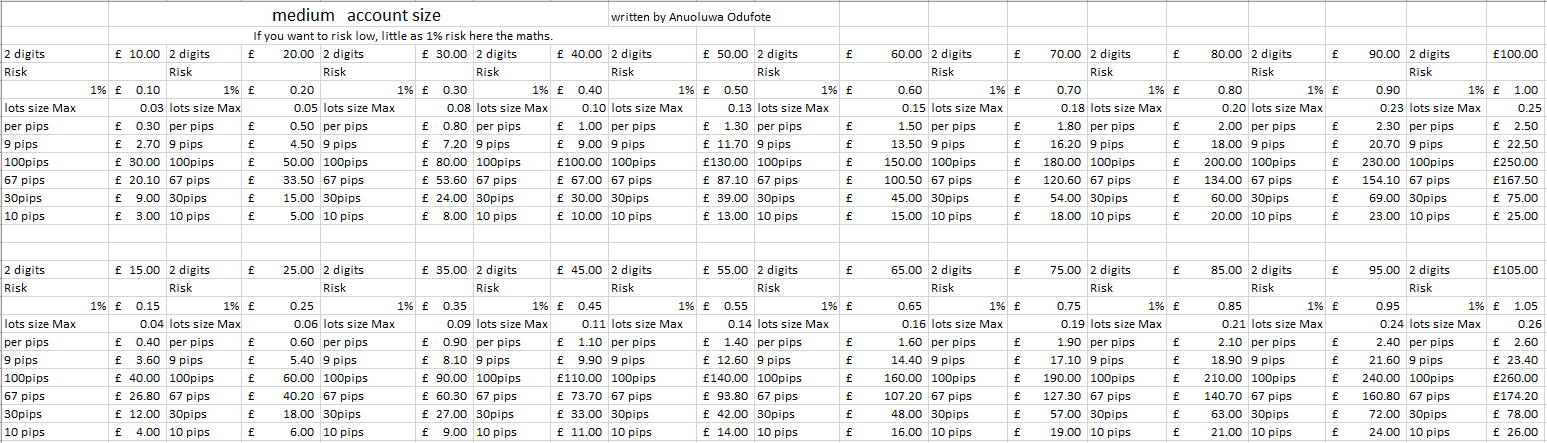

Risk management 101

(Please notes: Risk to rewards, losing streak rule book and Compounding ideas are not involved in this topic )

This is a simple guide on how to work out the money and treat it as a business. feel free to add your thoughts.

It is about Medium account users here are safety tips. If you wanted to risk more you simply change the %.

(Please notes: Risk to rewards, losing streak rule book and Compounding ideas are not involved in this topic )

This is a simple guide on how to work out the money and treat it as a business. feel free to add your thoughts.

It is about Medium account users here are safety tips. If you wanted to risk more you simply change the %.

62507511 Dimimu Odufote

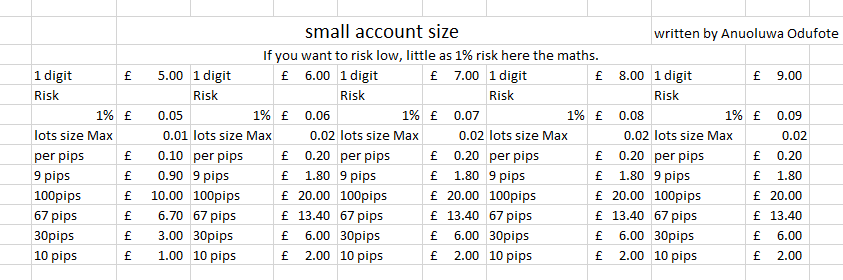

Risk management 101

(Please notes: Risk to rewards, losing streak rule book and Compounding ideas are not involved in this topic )

This is a simple guide on how to work out the money and treat it as a business. feel free to add your thoughts.

It is about small account users here are safety tips. If you wanted to risk more you simply change the %.

(Please notes: Risk to rewards, losing streak rule book and Compounding ideas are not involved in this topic )

This is a simple guide on how to work out the money and treat it as a business. feel free to add your thoughts.

It is about small account users here are safety tips. If you wanted to risk more you simply change the %.

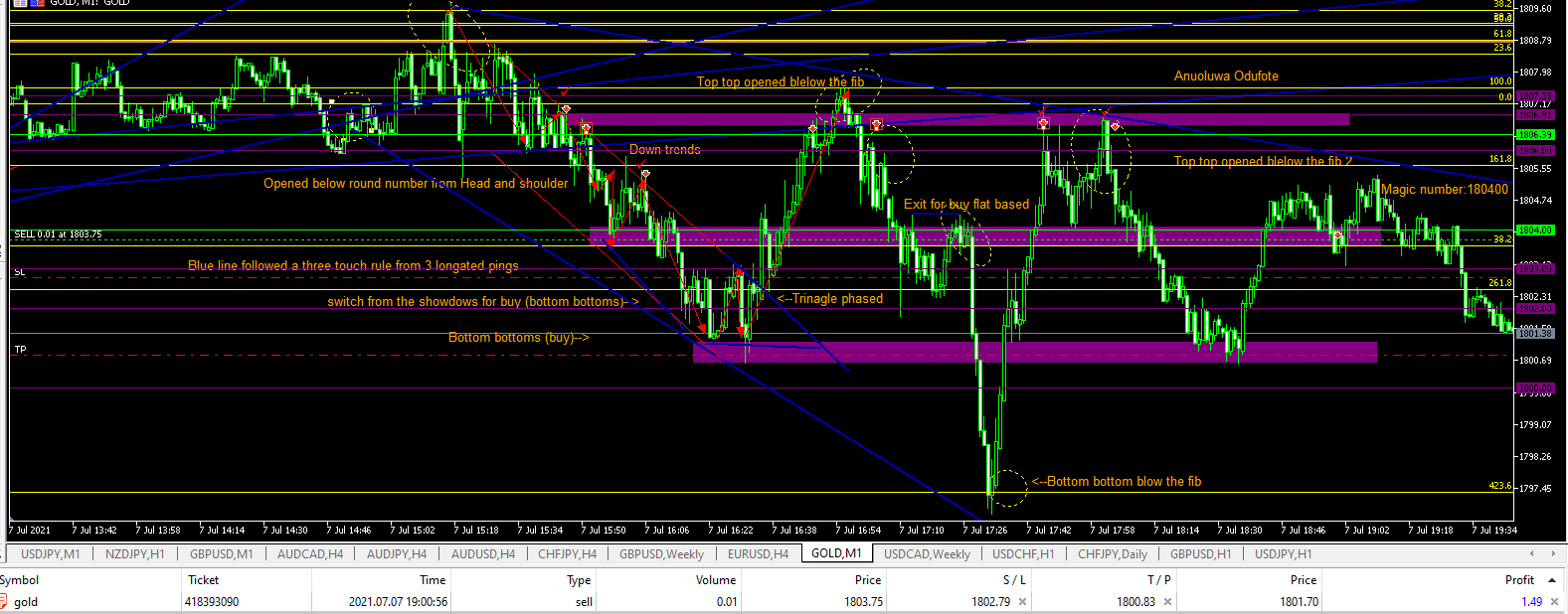

62507511 Dimimu Odufote

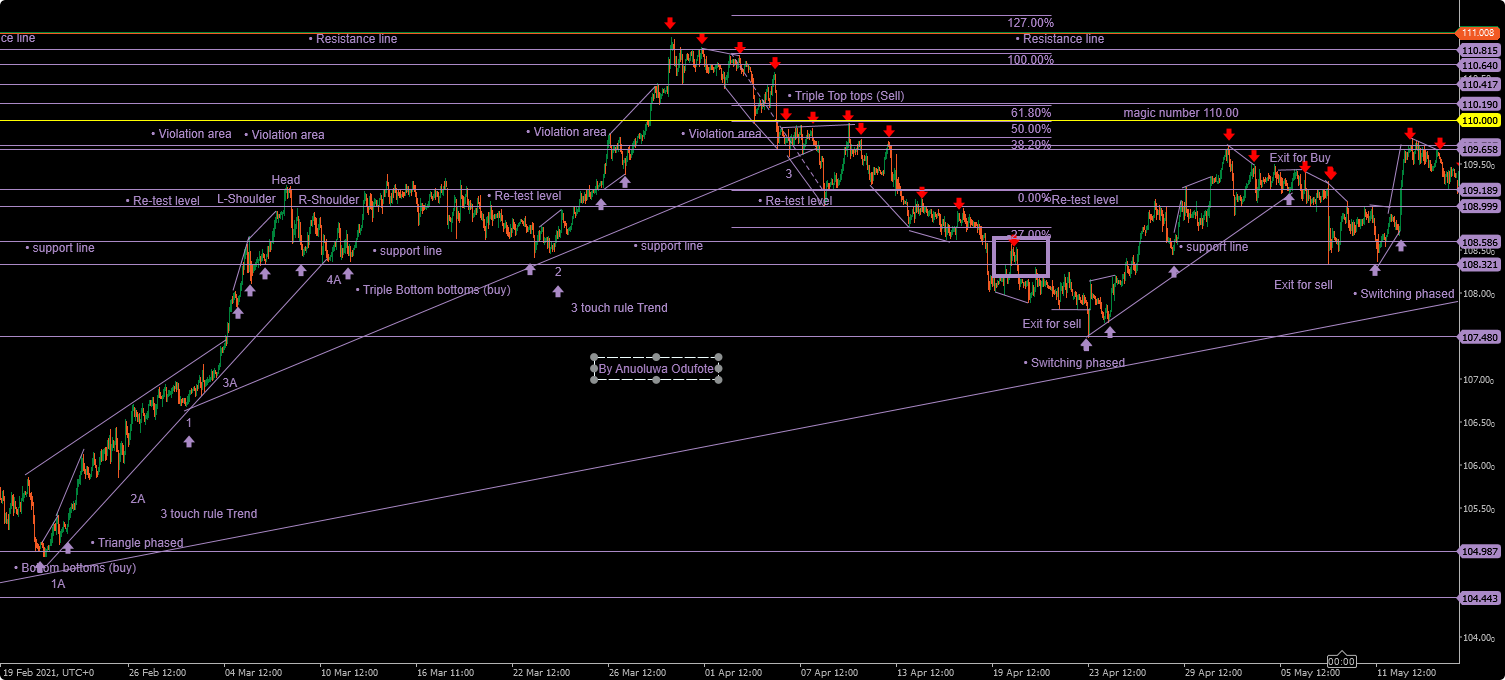

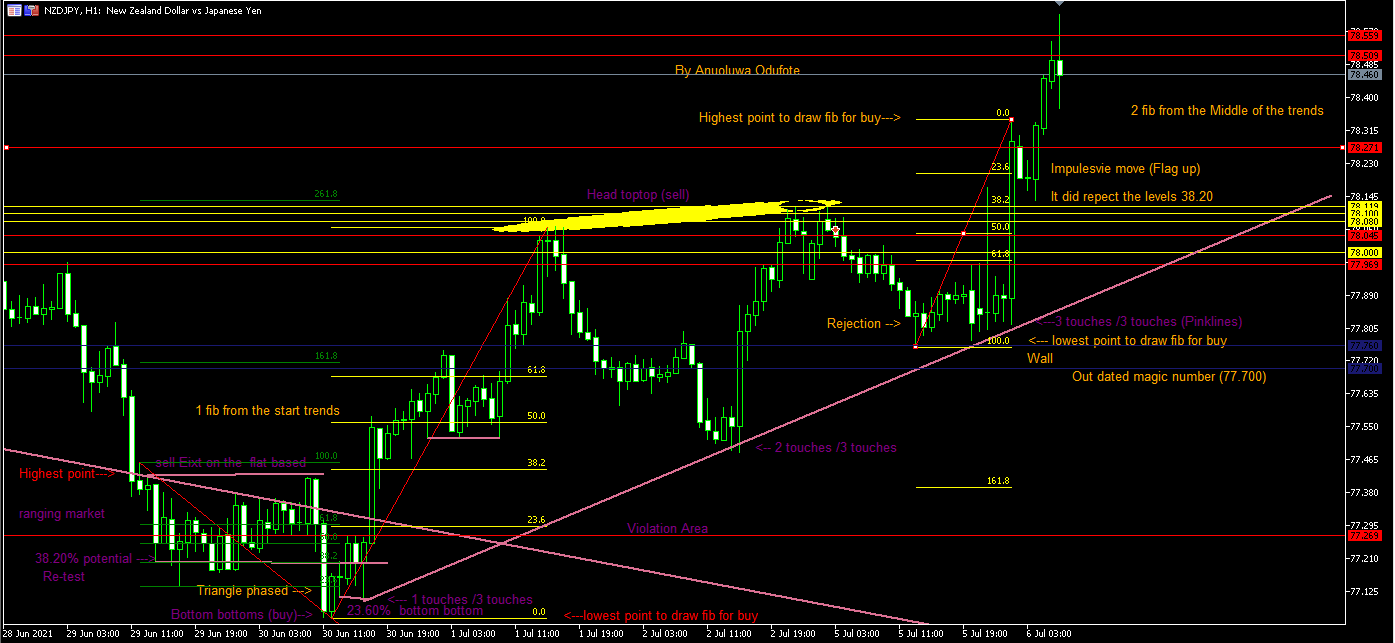

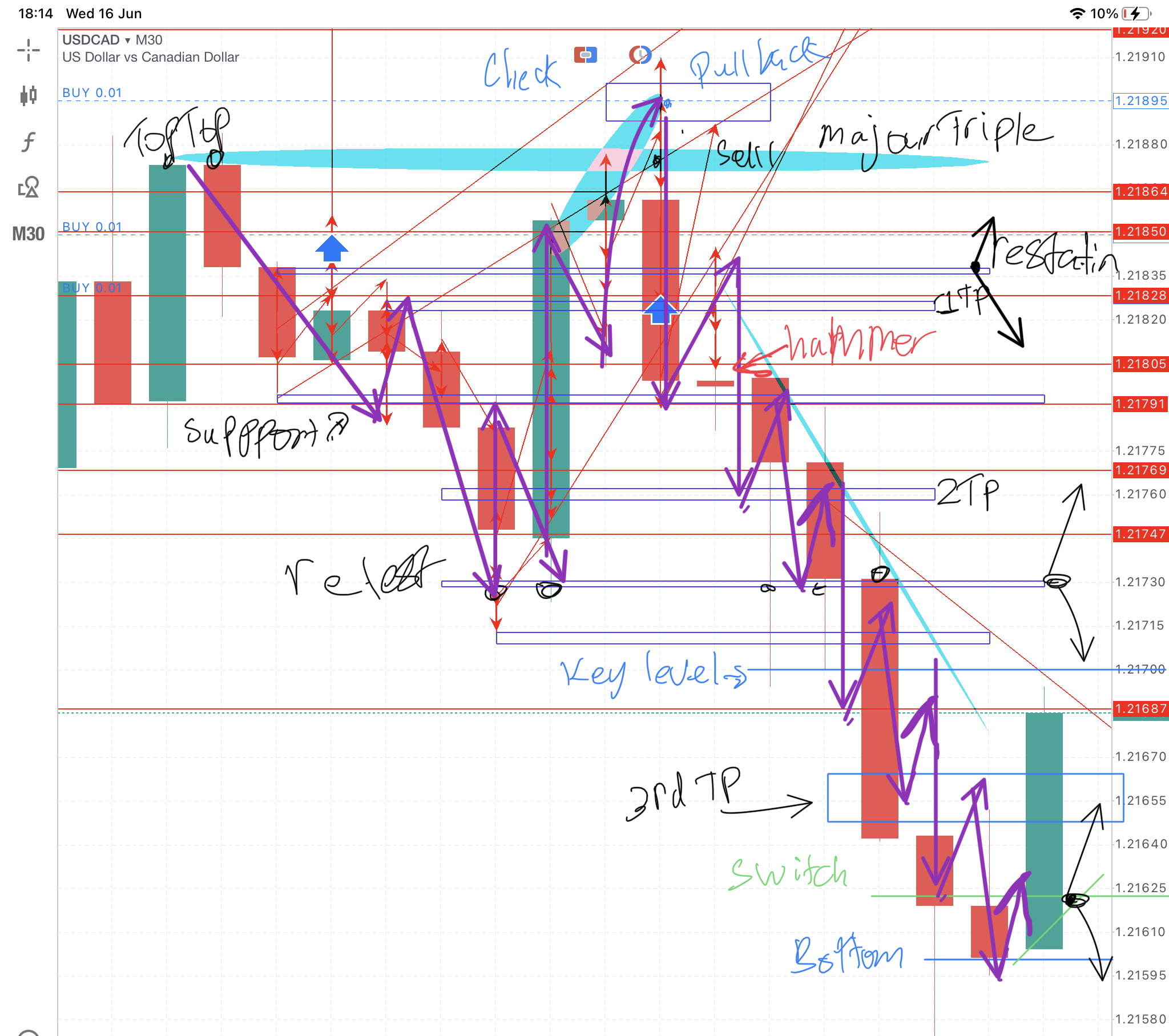

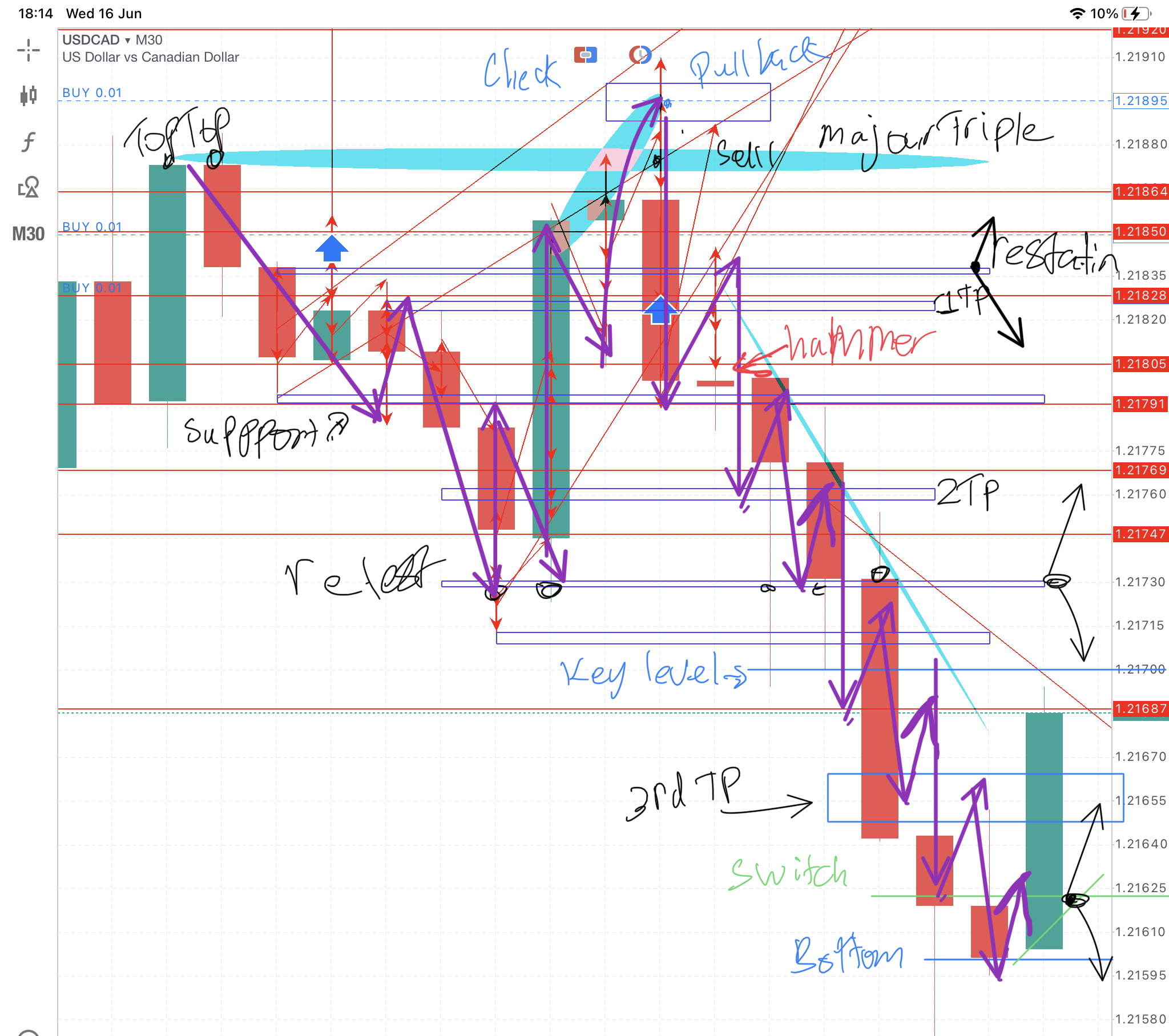

New skill, I am working on to Lock My trades and using combine skill of reading the chart, Round numbers, magic numbers and fib. Sorry guys, if there are many lines. I was working on prediction skill for my home work.

62507511 Dimimu Odufote

Thinking to protect yourself?

Risk management 101

(Please notes: Risk to rewards, losing streak rule book and Compounding ideas are not involved in this topic )

This is a simple guide on how to work out the money and treat it as a business. feel free to add your thoughts.

Let say person A has an account size of £13.87

1% risk = 13.87 x1%= £0.14

0.14 risk /4= 0.035

round it up = 0.04 max trades size = sngle trades

e.g 4 lots= £40 per pips. to win 9pips= 4 lots = £40 *9 =£360 (Standard lots)

e.g 0.4 lots = £4.00 per pips. To win 9 pips= 0.4 lots=£4*9 = £36 (mini lots)

e.g 0.04 lots = £0.40 per pips. To win 9pips= 0.04 lots =£0.40*9 = £0.36 (Micro lot)

e.g 0.04 lots = £0.40 per pips. To win 10pips= 0.04 lots =£0.40*10 = £4.0(Micro lot)

e.g 0.04 lots = £0.40 per pips. To win 30pips= 0.04 lots =£0.40*30 = £12.0(Micro lot) (max)

e.g 0.04 lots = £0.40 per pips. To win 100pips= 0.04 lots =£0.40*100 = £40.0(Micro lot)

£13.87+£12=£25.87 win / lost will be: £1.87

e.g 0.03 lots = £0.30 per pips. To win 9pips= 0.03 lots =£0.30*9 = £0.36 (Micro lot)

e.g 0.03 lots = £0.30 per pips. To win 10pips= 0.03 lots =£0.30*10 = £3.0(Micro lot)

e.g 0.03 lots = £0.30 per pips. To win 40 pips= 0.03 lots =£0.30*40 = £12.0(Micro lot) (max)

£13.87+£12=£25.87 win / lost will be: £1.87

e.g 0.02 lots = £0.20 per pips. To win 9pips= 0.02 lots =£0.20*9 = £0.36 (Micro lot)

e.g 0.02 lots = £0.20 per pips. To win 10pips= 0.02 lots =£0.20*10 = £2.00(Micro lot)

e.g 0.02 lots = £0.20 per pips. To win 60pips= 0.02 lots =£0.20*60 =£12.00(Micro lot) (Max)

£13.87+£12=£25.87 win / lost will be: £1.87

e.g 0.01 lots = £0.10 per pips. To win 9pips= 0.01 lots =£0.10*9 = £0.36 (Micro lot)

e.g 0.01 lots = £0.10 per pips. To win 10pips= 0.01 lots =£0.10*10 = £1.0(Micro lot)

e.g 0.01 lots = £0.10 per pips. To win 120pips= 0.01 lots =£0.10*120 = £12.0(Micro lot)

£13.87+£12=£25.87 win / lost will be: £1.87

13.87 *0.01 (/100) =0.1387 room left (Micro lots) -This is better

13.87*0.10 (/10)= 1.387 room left (mini lots)

13.87*1.0 (/10)= 13.87 room left (Standard lots)

Key then less than 1 the whole number.

Remeber : round it up = 0.04 max trades size = To do Mix trades

Let say: its move in profit 9 pips

Trade 1 =lots size 0.02= £0.36 (Micro lot)

Trade 2=lots size 0.02= £0.36 (Micro lot)

Total lots sized = 0.04= £0.72 (miro lots)

my account = £13.87+£0.72=£14.59 or lost will be: £13.15

let say you let your profit run! mmmmm.

Let say: its move in profit 60 pips

Trade 1 = lots size 0.02=£12.00 (micro lots)

Trade 2 = lots size 0.02=£12.00 (micro lots)

Total lots sized = 0.04= £24.00 (miro lots)

my account = £13.87+£24.00=£37.87 or lost will be: £0.00 Please let me know if I missed anything out! I try my best to make it clear to everyone.

Risk management 101

(Please notes: Risk to rewards, losing streak rule book and Compounding ideas are not involved in this topic )

This is a simple guide on how to work out the money and treat it as a business. feel free to add your thoughts.

Let say person A has an account size of £13.87

1% risk = 13.87 x1%= £0.14

0.14 risk /4= 0.035

round it up = 0.04 max trades size = sngle trades

e.g 4 lots= £40 per pips. to win 9pips= 4 lots = £40 *9 =£360 (Standard lots)

e.g 0.4 lots = £4.00 per pips. To win 9 pips= 0.4 lots=£4*9 = £36 (mini lots)

e.g 0.04 lots = £0.40 per pips. To win 9pips= 0.04 lots =£0.40*9 = £0.36 (Micro lot)

e.g 0.04 lots = £0.40 per pips. To win 10pips= 0.04 lots =£0.40*10 = £4.0(Micro lot)

e.g 0.04 lots = £0.40 per pips. To win 30pips= 0.04 lots =£0.40*30 = £12.0(Micro lot) (max)

e.g 0.04 lots = £0.40 per pips. To win 100pips= 0.04 lots =£0.40*100 = £40.0(Micro lot)

£13.87+£12=£25.87 win / lost will be: £1.87

e.g 0.03 lots = £0.30 per pips. To win 9pips= 0.03 lots =£0.30*9 = £0.36 (Micro lot)

e.g 0.03 lots = £0.30 per pips. To win 10pips= 0.03 lots =£0.30*10 = £3.0(Micro lot)

e.g 0.03 lots = £0.30 per pips. To win 40 pips= 0.03 lots =£0.30*40 = £12.0(Micro lot) (max)

£13.87+£12=£25.87 win / lost will be: £1.87

e.g 0.02 lots = £0.20 per pips. To win 9pips= 0.02 lots =£0.20*9 = £0.36 (Micro lot)

e.g 0.02 lots = £0.20 per pips. To win 10pips= 0.02 lots =£0.20*10 = £2.00(Micro lot)

e.g 0.02 lots = £0.20 per pips. To win 60pips= 0.02 lots =£0.20*60 =£12.00(Micro lot) (Max)

£13.87+£12=£25.87 win / lost will be: £1.87

e.g 0.01 lots = £0.10 per pips. To win 9pips= 0.01 lots =£0.10*9 = £0.36 (Micro lot)

e.g 0.01 lots = £0.10 per pips. To win 10pips= 0.01 lots =£0.10*10 = £1.0(Micro lot)

e.g 0.01 lots = £0.10 per pips. To win 120pips= 0.01 lots =£0.10*120 = £12.0(Micro lot)

£13.87+£12=£25.87 win / lost will be: £1.87

13.87 *0.01 (/100) =0.1387 room left (Micro lots) -This is better

13.87*0.10 (/10)= 1.387 room left (mini lots)

13.87*1.0 (/10)= 13.87 room left (Standard lots)

Key then less than 1 the whole number.

Remeber : round it up = 0.04 max trades size = To do Mix trades

Let say: its move in profit 9 pips

Trade 1 =lots size 0.02= £0.36 (Micro lot)

Trade 2=lots size 0.02= £0.36 (Micro lot)

Total lots sized = 0.04= £0.72 (miro lots)

my account = £13.87+£0.72=£14.59 or lost will be: £13.15

let say you let your profit run! mmmmm.

Let say: its move in profit 60 pips

Trade 1 = lots size 0.02=£12.00 (micro lots)

Trade 2 = lots size 0.02=£12.00 (micro lots)

Total lots sized = 0.04= £24.00 (miro lots)

my account = £13.87+£24.00=£37.87 or lost will be: £0.00 Please let me know if I missed anything out! I try my best to make it clear to everyone.

62507511 Dimimu Odufote

Combined reading the chart and fib. i have shown arrows the names are displays.

Key words:

- You should know" Round number" and "Magic numbers"

- Have an understanding of 1 hour timeframe for inter-day trade

- You should know traders tool rule book " 3 touch move"

-You should know how to draw a fib

Hot zone:

--> Re-test

-->Support and resistant

---> violation area

Pending order search:

Top tops (means sell) or Bottom bottoms (Buy)

Key words:

- You should know" Round number" and "Magic numbers"

- Have an understanding of 1 hour timeframe for inter-day trade

- You should know traders tool rule book " 3 touch move"

-You should know how to draw a fib

Hot zone:

--> Re-test

-->Support and resistant

---> violation area

Pending order search:

Top tops (means sell) or Bottom bottoms (Buy)

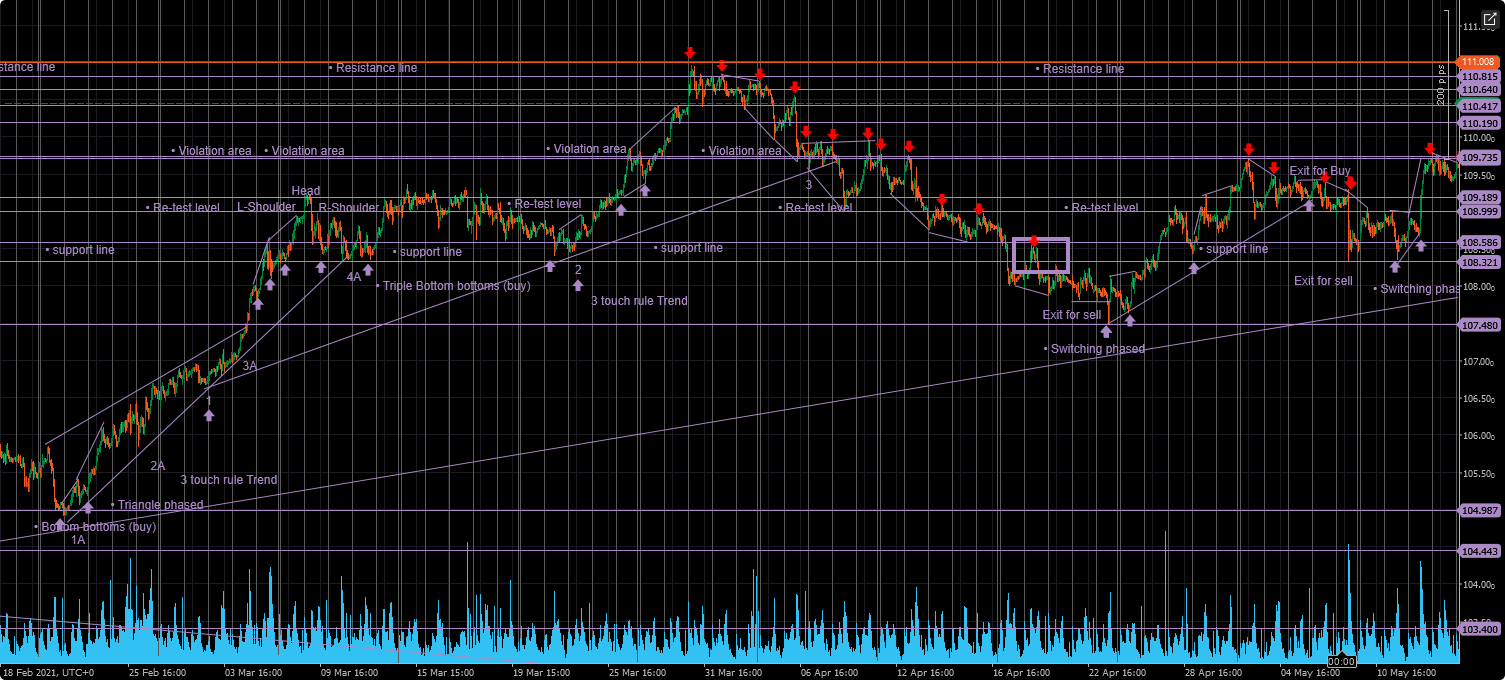

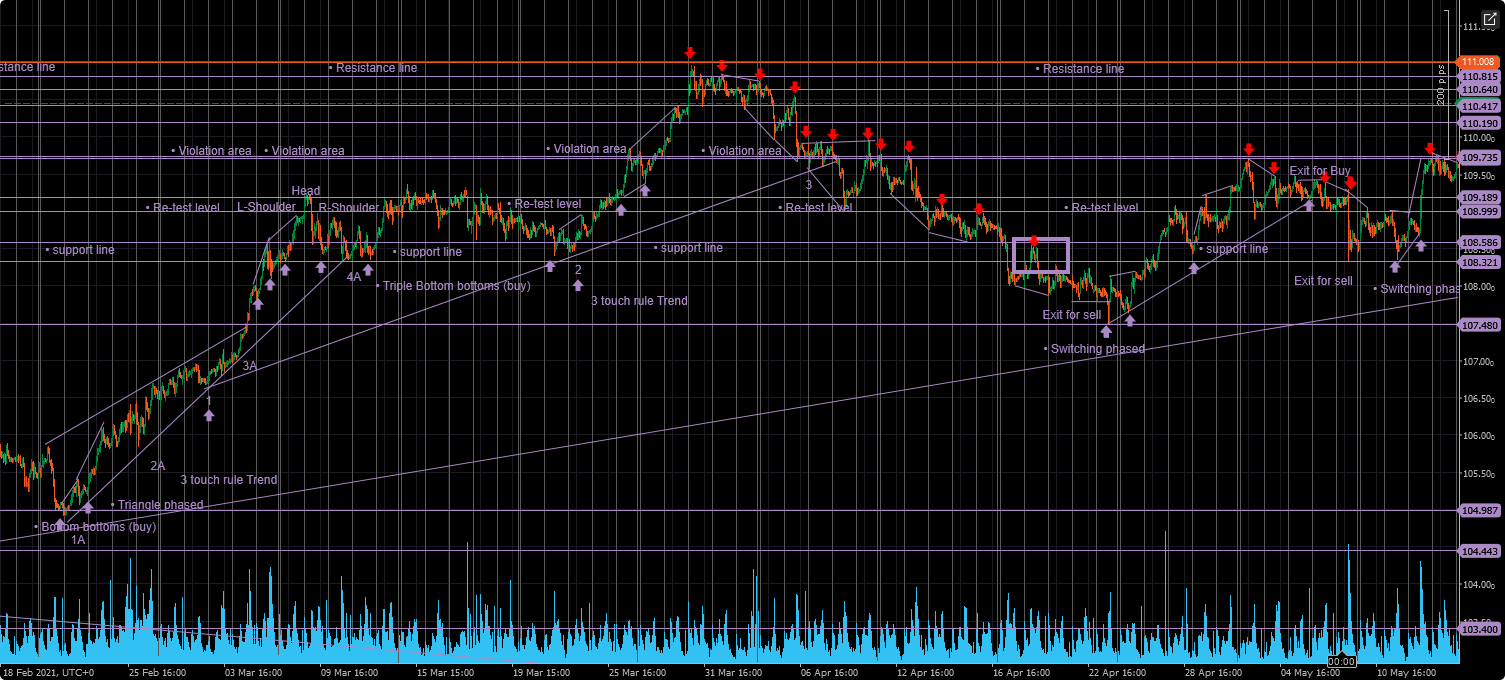

62507511 Dimimu Odufote

e.g As you can see "Divergence" and "Reading chart" follow suit. In the future, i will put fib.

1hour timeframe USDJPY.

1hour timeframe USDJPY.

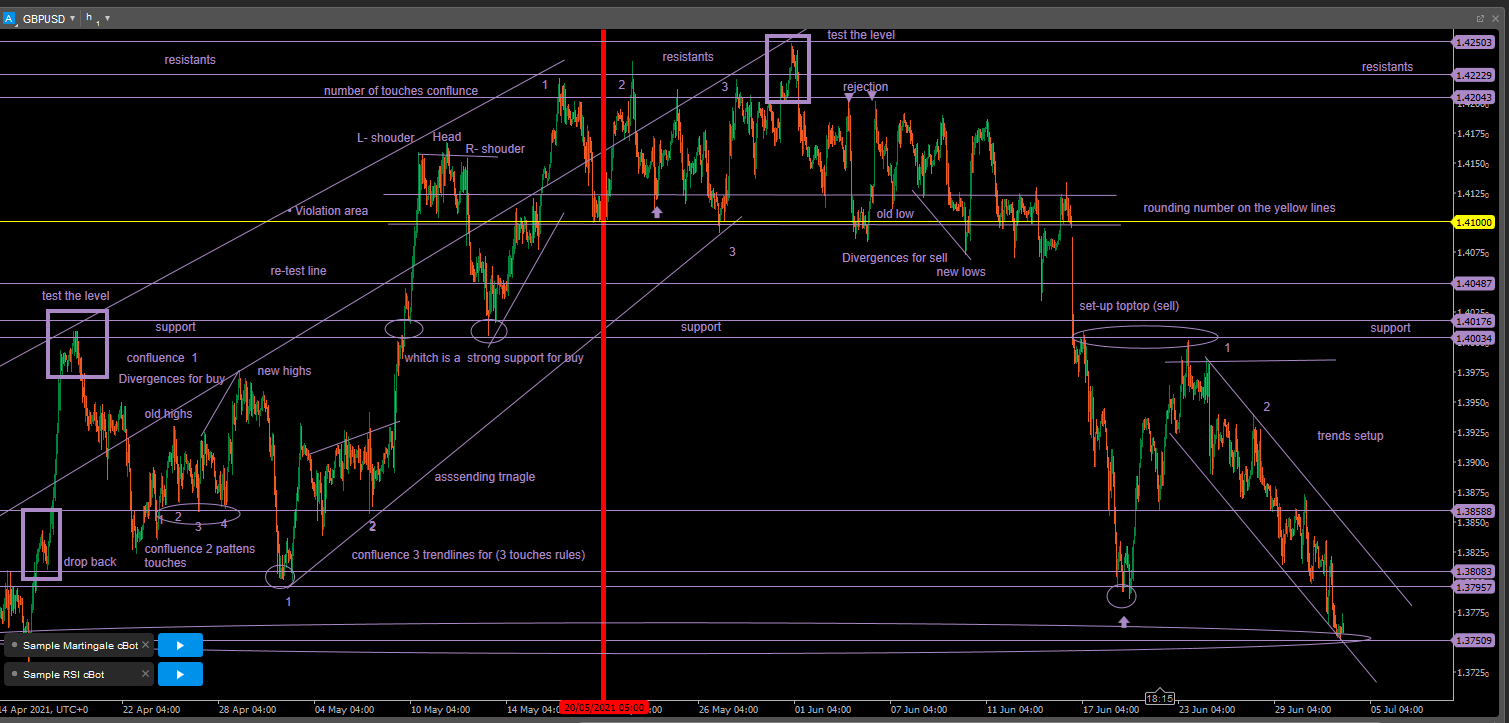

62507511 Dimimu Odufote

Divergence with fib

why:

spot reversals and continual trends.

This is a macro view for the entry signal.

This is a very useful tool book to use.

3 conditions for eixt the trades

If it doesn't respect the fib as a key level % ranges.

If it hit your stop lost

if I don't have many confluence to meet .eg it shows one confluence but not more this means it not worth trading. It needs to be two or more confluence to be able to trades.

I will update you more about how to use fib.

Thank you for reading this. (Please notes this is GBPUSD pair 1hour chart)

why:

spot reversals and continual trends.

This is a macro view for the entry signal.

This is a very useful tool book to use.

3 conditions for eixt the trades

If it doesn't respect the fib as a key level % ranges.

If it hit your stop lost

if I don't have many confluence to meet .eg it shows one confluence but not more this means it not worth trading. It needs to be two or more confluence to be able to trades.

I will update you more about how to use fib.

Thank you for reading this. (Please notes this is GBPUSD pair 1hour chart)

62507511 Dimimu Odufote

Confluence

It means to have two sets-up as you can see the chart:

why:

This will give you the confidence that it is safe to enter

so you can increase your odds of winning.

Keep in mind if you do not have Confluence or less than 1 set up do not add trades.

It means to have two sets-up as you can see the chart:

why:

This will give you the confidence that it is safe to enter

so you can increase your odds of winning.

Keep in mind if you do not have Confluence or less than 1 set up do not add trades.

62507511 Dimimu Odufote

Next is stock review:

Place your thought I will try my best to read your stock chart.

Place your thought I will try my best to read your stock chart.

62507511 Dimimu Odufote

Quiz Time:

Keywords:

• Triangle phased

• Top tops (sell)

• Ranging phased

• support line

• Resistance line

• Reject

• Shoulder-Head-Shoulder

• Re-test level

Keywords:

• Triangle phased

• Top tops (sell)

• Ranging phased

• support line

• Resistance line

• Reject

• Shoulder-Head-Shoulder

• Re-test level

62507511 Dimimu Odufote

Added topic Trader do list to sirvarl in the madness emotion and stay fit.

It is harsh truth this isn't that fun to losing money or taking out after 3 days. when i first started trading i wish i have someone told this before starting this: ---> Having the basic understanding of buy direction ( bluish ) and sell

62507511 Dimimu Odufote

Added topic Dark truth about Hammer in 4hour-frame

4 hour rules are really wierd but if you stick around to read this which will be clear. Let get right into it: fundamental basic you should know what is : pull back look like: Drop back: Fact about hammers: ---> shows a lots in

62507511 Dimimu Odufote

Day 2 forex trading IQ: I was shocked how the trend went up at 19:28. This afternoon it has all level up 23:26 as the liquid dried out but it has made a new time high on the Wednesday 16th of June.

I have placed 3 trades. I set my lowers trades Stop loss (Sl) above my key level, another one I bought on the key level which I have set my (Sl)on top the bodies of the candels and lastly, I set my stop loss at the head and shoulder on the Daily time frame.

I have placed 3 trades. I set my lowers trades Stop loss (Sl) above my key level, another one I bought on the key level which I have set my (Sl)on top the bodies of the candels and lastly, I set my stop loss at the head and shoulder on the Daily time frame.

: