MW Direction by Candle Body Analysis

- Indicators

- Martin Bittencourt

- Version: 1.8

- Updated: 1 June 2023

- Activations: 5

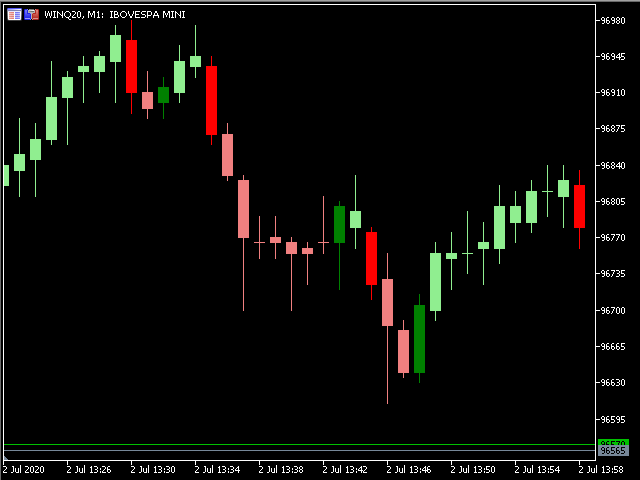

The Martinware™ Direction by Candle Body Analysis indicator is a direction indicator that shows the current asset direction, up or down, by checking if previous candle bodies' bases were respected or broken. It works similarly to a moving average, but it's more objective due to its lesser amount of configuration parameters.

The algorithm assumes the theory that although the highs and lows of candles have their value, it is the body that shows the conclusive market sentiment over that asset in the given period. Such sentiment includes not only the information of direction but also its strength. Thus, a breaking of a previous candle body indicates the market has decisively rejected the previous movement and is now going after creating a new one in the opposite direction.

This algorithm makes the DCBA indicator to behave similarly to a moving average: it indicates the start and direction of a new trend with a lagging factor that will inevitably result in some delayed entry and exit signals. Its advantage resides in being more objective, less subject to overoptimization and curve-fitting, and grounded on a sound reading of the market instead of a generic mathematical formula. The only input parameter required serves to filter excessively small candle bodies, a situation when two candles are considered instead of just one.

As with moving averages, it's recommended not to use this indicator alone, but combined with some filtering system.

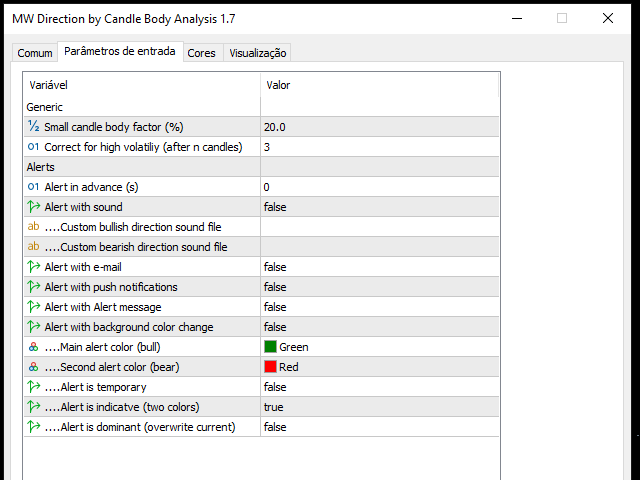

Input parameters:

Candle body factor: the percentage size of the body relative to its entirety used to determine if the body is smallCorrect for high volatility: the maximum number of candles a candle body will be considered. 0 means a body will be considered until brokenAlert in advance: check for signal n seconds before candle closeAlert with sound: informs if the alert should include playing a soundCustom buy sound: name of the custom buy sound file to be used instead of the default. It must be inside a folder named "Sounds", this one inside the "Files" folder in the Terminal's MQL5 directory tree.Custom sell sound: name of the custom sell sound file to be used instead of the defaultAlert with e-mail: enable sending an e-mail when a new signal is producedAlert with Alert message: informs if the alert should include showing an Alert messageAlert with background color change: informs if the alert should include temporarily changing the chart's background-colorAlarm color: the color to be used