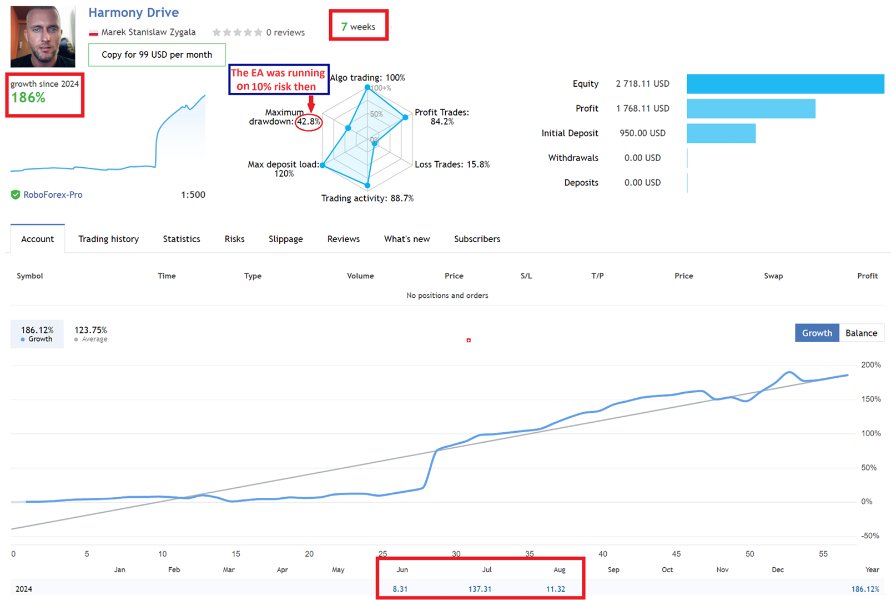

Harmony Drive

- Experts

- Marek Stanislaw Zygala

- Version: 6.91

- Updated: 12 December 2024

- Activations: 20

IMPORTANT: The price will gradually be increased so whatever you see right now is your opportunity to get the EA at a discounted price.

Harmony Drive is a sophisticated system operating on a carefully selected basket of the following symbols: USDJPY, CHFJPY, AUDUSD, USDCAD, USDCHF and NZDUSD. These pairs were strategically chosen for their diverse characteristics and market behaviors:

- Major pairs like USDJPY and USDCHF offer high liquidity and tight spreads, ideal for frequent trading

- Commodity-linked pairs such as AUDUSD and NZDUSD provide exposure to resource-rich economies, offering unique trading opportunities

- This combination ensures a balanced portfolio that can perform well in various market conditions

- The selected pairs represent different geographical regions and economic factors, enhancing diversification and reducing overall risk

- Multi-Symbol Strategy across 6 carefully selected currency pairs

- Advanced technical analysis using a combination of proven indicators

- Adaptive trading methodology customized for each pair

- Robust risk management with controlled risk per trade

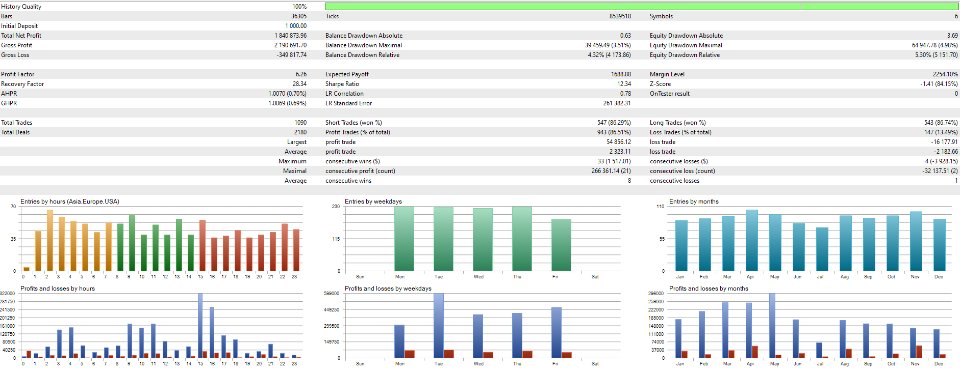

- Impressive win rate exceeding 80% for both long and short positions

- Active trading across all major market sessions

- Seasonal adaptability to capitalize on changing market conditions

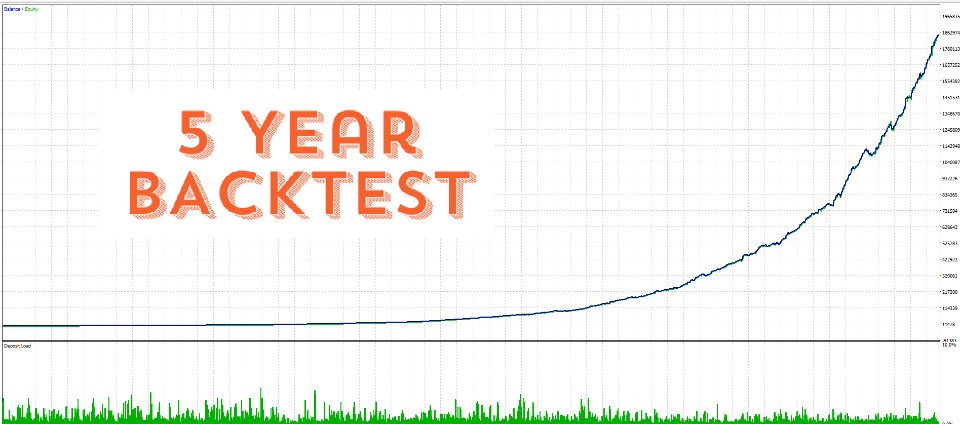

- Proven track record with steady equity growth and efficient drawdown recovery

How does the EA perform? Well, you can check the signal >>> HERE <<<

Harmony Drive is designed to cater to traders of all experience levels, with a primary focus on capital preservation. Its default settings prioritize safe and consistent trading. However, for those seeking to customize their approach, the EA offers a range of adjustable parameters. These include options to set maximum and minimum lot sizes, define profit targets in both fixed USD amounts and percentage of balance, and fine-tune ATR-based parameters. Additionally, Harmony Drive incorporates a high-impact news filter and allows for single trade restrictions per symbol, further enhancing its risk management capabilities. This combination of safety-first default settings and advanced customization options makes Harmony Drive a versatile and powerful trading solution, adaptable to various market conditions and individual trading styles, all while maintaining a strong emphasis on protecting your capital.

Strategies incorporated:- USDJPY: Bollinger Bands, Stochastic Oscillator, Fibonacci Retracement, Donchian Channel Strategy: Mean reversion with Bollinger Bands and stochastic signals, adaptive to different market conditions

- USDCHF: Stochastic Oscillator, MACD, RSI, Parabolic SAR; Strategy: Momentum-based strategy using stochastic and MACD signals, with risk management parameters and trade tracking

- AUDUSD: Moving Averages, RSI, Fibonacci Retracement, Keltner Channel; Strategy: Trend following with moving averages and retracement levels for entry/exit points, incorporating fundamental analysis

- NZDUSD: Moving Averages, MACD, Bollinger Bands, Donchian Channel; Strategy: Trend following with moving averages and volatility analysis, adaptive to different market conditions

- CHFJPY: Bollinger Bands, Stochastic Oscillator, Fibonacci Retracement, Parabolic SAR; Strategy: Mean reversion with Bollinger Bands and stochastic signals, incorporating sentiment analysis

Frequently Asked Questions:

Q: What chart is Drive Harmony to be run on?

A: It is designed to be run on USDJPY H1. IMPORTANT: Please attach Harmony Drive only to one chart - USDJPY H1 and all the other symbols will be traded automatically

A: Harmony Drive is equipped with advanced risk management tools and strategies designed to handle market volatility and protect your capital.

Outstanding EA and exceptional customer support! I recently purchased Harmony Drive and had some initial setup questions. Marek went above and beyond to help me optimize the EA's performance, even taking time to remotely assist with my VPS configuration. His dedication to ensuring customers get the best results is impressive. As a non-native English speaker, I especially appreciated his patience and clear communication. This level of post-purchase support is rare and valuable. Looking forward to using more of Marek's EAs in the future. Highly recommended!