Bate Hedging Indicator MT5

- Indicators

- Zhao Yang Li

- Version: 2.0

- Activations: 5

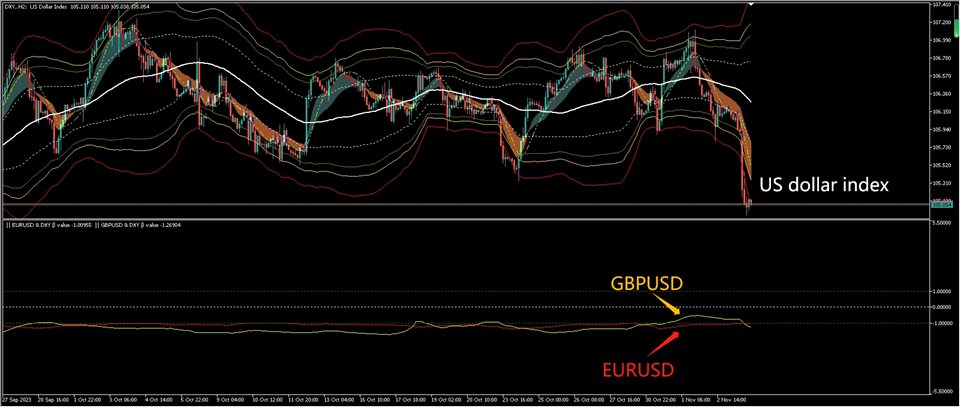

The Beta index, also known as the Beta indicator, is one of the key reference indicators for hedging institutions.

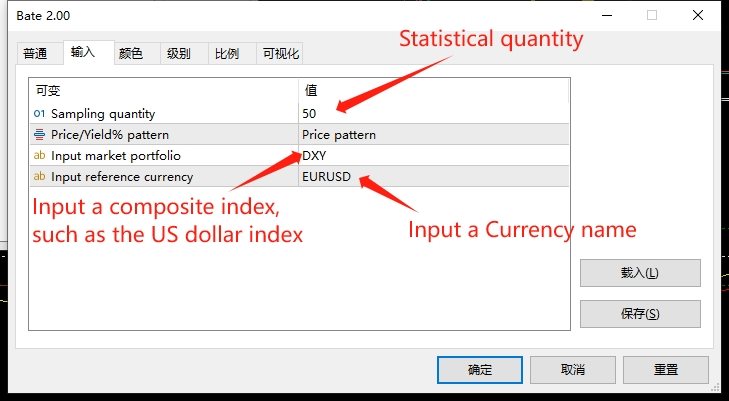

It allows you to measure the relative risk of individual assets, such as currencies and commodities, in comparison to market portfolios, cross-currency pairs, the U.S. dollar index, and stock indices. By understanding how your assets perform in relation to market benchmarks, you will have a clearer understanding of your investment risk.

Key Features:

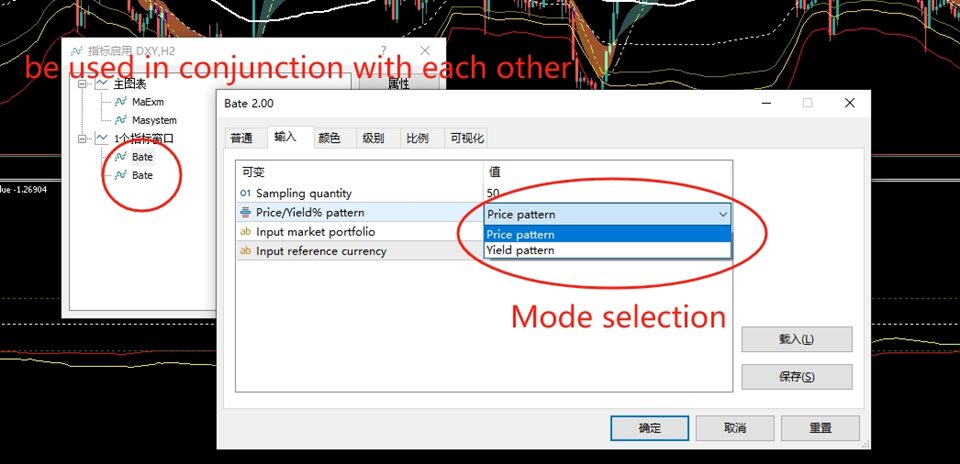

Accurate Risk Assessment: The Beta index provides a precise evaluation of an asset's risk relative to the broader market, aiding in making informed investment decisions. Diversification Strategies: Utilize this index to optimize your investment portfolio and explore diversification opportunities across various asset categories. Suitable for Multi-Currency Hedging: Investors involved in multi-currency hedging can consider this index as a vital reference point. Real-time Insights: Stay informed with real-time data analysis for timely decision-making.

By incorporating the Beta index into your trading toolkit, you can unlock the power of data and risk analysis. Start making wiser choices and reduce unnecessary exposure to risks in your portfolio.

β = 1: If β is equal to 1, it indicates that the asset's price fluctuations are in line with the overall market, suggesting that the asset's risk is comparable to the market.

β > 1: If β is greater than 1, it signifies that the asset's price fluctuations are larger than those of the overall market, typically implying higher risk for the asset.

β < 1: If β is less than 1, it indicates that the asset's price fluctuations are smaller than those of the overall market, suggesting a relatively lower risk for the asset.

β = 0: If β is equal to 0, it means that the asset's price fluctuations are unrelated to market movements, indicating that the asset's price changes are not influenced by market fluctuations.

You can use the Beta index values for weighted operations in multi-currency hedging scenarios.